Technology

Crypto and AI Hardware That Turned Heads in 2024

Published

4 months agoon

By

admin

From pocket AI assistants to humanoid robots, this year’s hardware innovations showcase the growing convergence of artificial intelligence, crypto, and consumer tech.

Despite concerns that the AI boom could lead to more toxic waste materials by 2030, more and more products are being introduced. The hardware landscape has transformed dramatically, with companies large and small rushing to bring AI out of the cloud and into consumers’ hands.

Meanwhile, crypto hardware continues to cater to its users, with manufacturers learning hard lessons about pricing and practicality.

This year’s standout products paint a picture of an industry in transition, where success hinges not just on technological innovation but also the sweet spot between a product’s capability and accessibility.

In no particular order, we’ve rounded up seven devices that captured attention in 2024—and in some cases, redefined their categories entirely.

Rabbit R1

In a year dominated by AI hardware launches, the Rabbit R1 emerged as a standout or even a front-runner. Priced at an accessible $199, this pocket-sized AI assistant has earned praise for delivering where others stumbled.

The device’s “Large Action Model” technology allows it to control other apps with impressive speed—most responses come within 1.5 to 2 seconds, according to tech reviewer Lewis Hilsenteger of Unbox Therapy.

“What the hardware represents is an opportunity to get people excited in a new input method, which is no longer touch-based and no longer app-based,” Hilsenteger noted in his video review.

The R1’s success shows some contrast to more expensive competitors, suggesting that in the nascent AI hardware market, affordability and practicality could trump premium positioning.

Humane AI Pin

If the Rabbit R1 represents AI hardware’s potential, then the Humane AI Pin serves as a cautionary tale about the perils of overpromising and under-delivering. Despite backing from tech industry luminaries and a sleek design, the $699 device—plus a $24 monthly subscription—faced brutal reviews following its launch.

“Should you buy this thing? That one’s easy. Nope. Nuh-uh. No way,” wrote David Pierce in The Verge‘s scathing review. Critics pointed to slow performance, limited functionality, and a constant need for internet connectivity.

The pin’s reception has become a learning moment for the industry, highlighting the gap between AI’s promise and its current practical limitations.

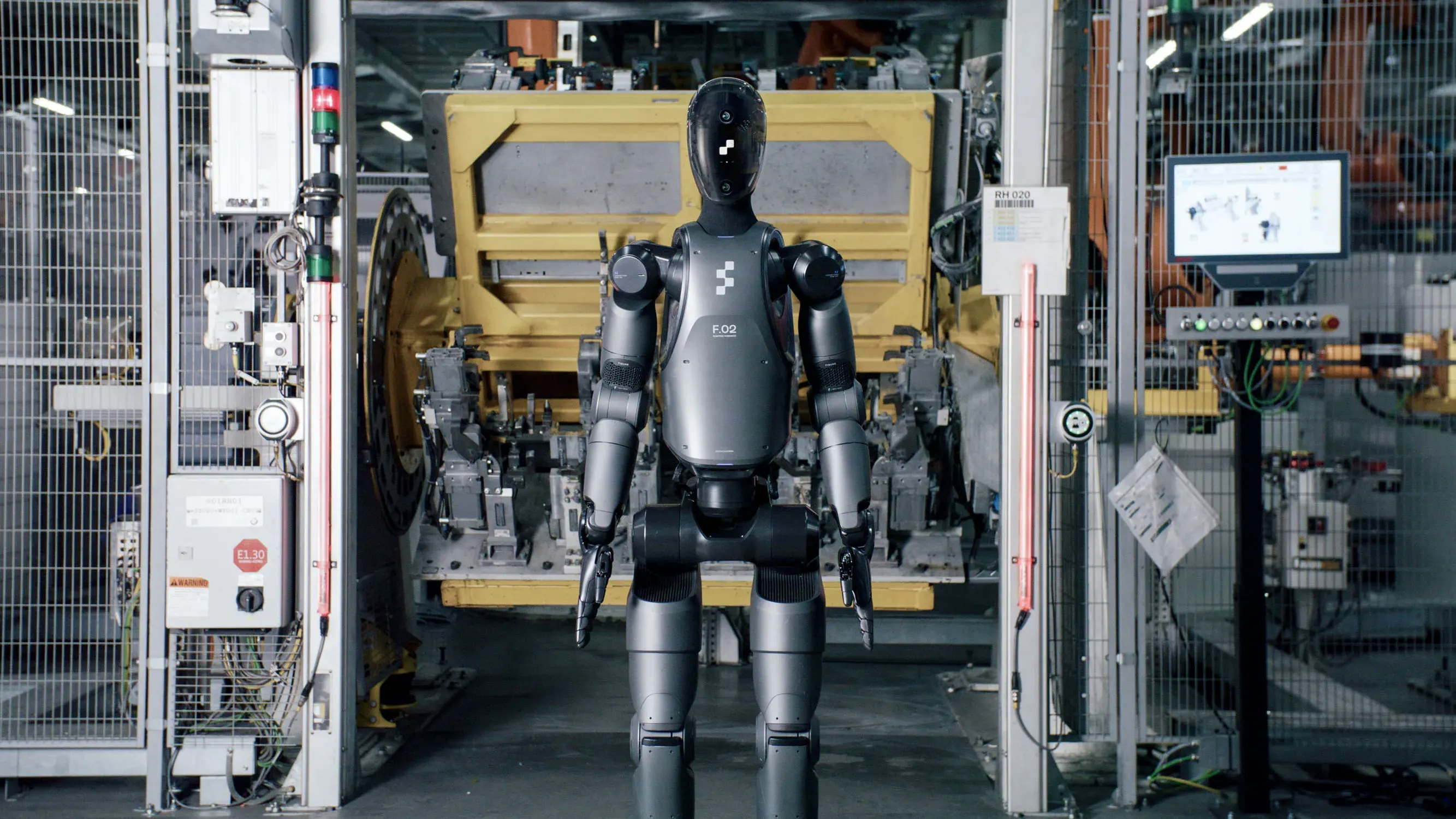

Figure 02 Humanoid Robot

While consumer AI grabbed headlines, Figure AI quietly advanced the state of the art in humanoid robotics with its Figure 02. The robot’s enhanced AI system and improved computer vision are powered by six AI-enabled RGB cameras, alongside other advancements in hardware.

The company’s partnership with OpenAI brings advanced language and visual processing capabilities to the platform.

“These robots can eliminate the need for unsafe and undesirable jobs—ultimately allowing us to live happier, more purposeful lives,” said Figure AI founder Brett Adcock.

With a $2.6 billion valuation and backing from tech giants like Microsoft and Nvidia, Figure 02 signals that the age of practical humanoid robots might be closer than we think.

Solana Seeker

Following the unexpected success of its Saga smartphone, Solana Mobile is doubling down with the Seeker. Revealed this year and set to release in 2025, the $500 device has already secured 140,000 pre-orders, suggesting a strong market appetite for crypto-native mobile devices.

The Seeker promises significant improvements over its predecessor, including upgraded cameras (108-megapixel and 32-megapixel sensors), enhanced battery life, and what Solana Mobile General Manager Emmett Hollyer calls “a meaningful step up” in processing power.

“Of course, it will be a rewards magnet,” Hollyer told Decrypt, referencing the airdrop appeal that helped the Saga sell out in late 2023. “But it also is going to open some one-of-a-kind experience doors that I think will be new to Seeker versus Saga.”

BitBoy One Gaming Handheld

Bridging the worlds of retro gaming and crypto, the BitBoy One represents a novel approach to hardware wallets. This $500 device combines gaming capabilities with Bitcoin storage and DePIN mining features, wrapped in a nostalgic, Game Boy-inspired design.

While its processing power limits it to PlayStation-era games and earlier, the device’s multi-functionality could appeal to crypto enthusiasts looking for more engagement than traditional hardware wallets offer.

We also wrote about other crypto gaming handhelds that made waves this year, and the burgeoning space looks exciting as 2025 approaches. The BitBoy One recently started shipping, and Decrypt is currently testing it out—stay tuned for more coverage in the new year.

Nakamoto Chronograph

Luxury watchmaker Franck Muller’s limited edition Nakamoto Chronograph brings high-end horology to the crypto world. We didn’t write about this timepiece, but one of Decrypt’s writers had the chance to try it on at Token2049 in Singapore earlier this year.

Limited to just 100 pieces, the carbon fiber timepiece features the manufacturer’s signature Vanguard shape and sophisticated Swiss automatic movement. Inside its 45mm case, the Chronograph showcases Muller’s signature craftsmanship with its FM 0800 Swiss automatic movement, which provides a 42-hour power reserve. The watch is also water-resistant to 30 meters.

The carbon fiber construction and scratch-resistant sapphire crystal protect the intricate mechanics, while the black alligator leather strap and double-fold clasp provide the elegance required for a true collector’s piece.

“Satoshi Nakamoto ingeniously intertwined technical, economic, and legal complexities to design Bitcoin,” the watchmaker said, comparing the Bitcoin creator to Muller’s propensity for “timeless” symbols of elegance and innovation.

The watch’s tribute to Bitcoin’s anonymous creator extends beyond its name, with design elements referencing blockchain technology and crypto culture.

While its price point—valued at a whopping $54,600—places it firmly in the luxury category, the Chronograph represents the growing mainstream acceptance of crypto culture in more traditional domains.

AirMoney Degn

As decentralized physical infrastructure networks or DePINs gained traction this year, some projects were quick to capitalize on the trend: AirMoney’s Degn device comes in claiming to be the first hardware wallet specifically designed for this emerging ecosystem.

The device combines traditional wallet security with active network participation features, including built-in node operation capabilities and physical controls for trading. The project positions its device as “purpose-built” for crypto engagement, similar to how a Kindle is explicitly designed for reading.

Its most striking feature is its physical interface: a tactile knob for adjusting trading leverage, and OLED buttons that provide haptic feedback during transactions. The design philosophy prioritizes tangible interaction with digital assets, marking a departure from the purely screen-based interfaces common to most crypto hardware.

This focused approach could set a new standard for crypto hardware, moving beyond simple storage to more active ecosystem participation.

Edited by Sebastian Sinclair and Andrew Hayward

Generally Intelligent Newsletter

A weekly AI journey narrated by Gen, a generative AI model.

Source link

You may like

Free Solana Game Pass NFT Offers Access and Crypto Rewards

3 Altcoins to Buy as Trump Eyes Crypto-Friendly Kevin Warsh as Next Fed Chair

Filecoin (FIL) Gains 3.7% as Index Trades Higher

Quantum computers likely to reveal if Satoshi is alive — Adam Back

Bitcoin In Peril? Expert Warns Of China’s Alleged Scheme To Crash BTC To $40,000

Crypto Privacy Legalized? Tornado Cash And Samourai Cases Suggest Uncertainty Remains

cross-border payments

Boosting growth in the tokenized credit market

Published

7 hours agoon

April 18, 2025By

admin

Disclosure: The views and opinions expressed here belong solely to the author and do not represent the views and opinions of crypto.news’ editorial.

Over the past decade, the tokenized credit market has soared to new heights. The industry, which converts traditional credit products, such as loans, bonds, or other debt instruments, into digital tokens that exist on a blockchain, has helped to democratize the world of investment for more participants, with each token issued representing a fraction of the underlying credit asset. This fractionalisation allows the token to be easily traded, transferred, and managed on decentralised platforms.

To date, $10 billion in tokenized bonds have been issued by leading institutions, including the World Bank and the City of Lugano. The market’s growing popularity stems from the significant benefits it offers—enhanced liquidity, transparency, and accessibility. Investors can now buy and sell portions of loans or bonds, making these traditionally illiquid assets more flexible and tradable. Blockchain’s transparent, immutable ledger ensures that all transactions are secure and verifiable in real time, reducing fraud and increasing trust. Additionally, tokenized credit products open the door to a broader pool of investors by lowering entry barriers, allowing even small-scale participants to invest in assets that were once limited to large institutional players. As more financial institutions and platforms adopt tokenization, this market is expected to expand, transforming how credit products are issued, traded, and managed.

Yet despite this advancement, the growth of the tokenised credit market is still constrained by one critical issue: return on investment. Decentralized finance lending currently offers lower yields when compared to traditional lending markets, especially in the current high-interest rate environment.

This can be solved by providing funding for cross-border payments as it is an ideal use case to expand the tokenized credit market and unlock higher yields, offering consistent cash flows and a natural fit for blockchain’s speed and cost-efficiency.

The core challenges: Low yields and volatility

The total allocation of the tokenized credit market remains relatively small compared to the size of the multi-trillion-dollar global bond market. The limited allocation is largely due to challenges in liquidity, investor hesitancy concerning yields, and regulatory uncertainty.

Concerning returns, the tokenised credit market currently offers an average yield of around 9.65% on $10 billion of tokenised credit assets. While this might seem attractive compared to traditional bond yields, tractional private credit markets saw average yields of 12% from 2018 to 2023, leading many investors to still view DeFi as volatile and uncertain. Therefore, to unlock further growth, it is critical that the industry addresses yield-related issues and enhances investor confidence in the pioneering asset class.

Institutional investors demand not just high yields but also stability and predictability. In traditional credit markets, low volatility and reliable income streams are key drivers of investment flows, whereas the DeFi sector is still seen as nascent and volatile. The ecosystem needs to prove that it can generate attractive, risk-adjusted returns for both institutional and retail investors. This means improving the robustness of the platforms and expanding the range of available asset classes, such as into payments.

Increasing yields to boost growth

To drive greater adoption and attract more capital into tokenised credit markets, several strategies are necessary to make yields more attractive:

- Enhance liquidity. One of the key factors limiting yield attractiveness is liquidity, as tokenized assets must have deeper secondary markets to allow investors to exit positions easily without significantly affecting prices. This can be achieved by expanding the number of platforms that offer trading of tokenized debt assets, and increasing institutional participation can help create the necessary liquidity for more stable returns.

- Broaden asset classes. The tokenized credit market is currently focused on a narrow range of assets, such as mortgages and corporate bonds. However, to make yields more appealing, the market needs to diversify into other asset classes. Tokenizing revenue-generating assets like payments, real estate, and infrastructure projects could provide higher yields and open up new opportunities for investors who are seeking different risk-return profiles.

- Leverage stable asset classes. Integrating more stable, low-risk asset classes into the DeFi ecosystem could help balance the risk-reward equation. For example, tokenized government bonds or investment-grade corporate debt could offer lower but more stable yields, which may be attractive to institutional investors or pension funds looking for secure, long-term returns.

Finding new asset classes for tokenization

To ensure sustained growth in the tokenized credit market, new asset classes must be explored. The current landscape focuses heavily on fixed-income instruments, but there are untapped opportunities in sectors including real estate, intellectual property rights, royalties, and even carbon credits.

However, the payments industry presents the best asset class for the expansion of the tokenized credit market. Playing a fundamental role in all global commerce, the payments industry handles extremely high transaction volumes with largely consistent returns. Cross-border payments are of particular interest; each provider must maintain sufficient liquidity in each jurisdiction in which it operates to provide fast and low-cost transactions, forming a significant burden for aspiring founders and scaling payment companies.

This burden creates huge inefficiencies and locks up capital that could otherwise be invested or otherwise used more productively elsewhere. The tokenized credit market offers an effective solution to this problem, lending to cross-border payment companies to enable them to operate pre-funded accounts in more jurisdictions, reaching a market untapped by traditional lenders due to high perceived risks and archaic due diligence processes. Utilising on-chain collateral for loans and offering highly flexible lines of credit, the tokenised credit market can go where the traditional private lending market never could, gaining access to a key source of transaction volume and higher yields.

The future of tokenized credit markets

As the tokenised credit market continues to evolve, funding payments companies stand out as an important asset class that can generate higher yields and attract more capital, enabling the tokenised credit market to take the next step in its growth.

To ensure the broader DeFi ecosystem thrives, the sector must focus on enhancing liquidity, stabilising yields, and diversifying into new asset classes, be that the payments industry or any other sector with high demand for flexible, on-chain liquidity.

Mouloukou Sanoh

Mouloukou Sanoh is an experienced investor and operator, with private equity and investment banking in his arsenal. He co-founded Cassava, Africa’s largest web3 platform, and led key investments at Adaverse, Cardano’s venture arm. He was on Forbes 30 Under 30 2023.

Source link

Technology

Now On Sale For $70,000: The World’s First Factory Ready Open-Source Humanoid Robot

Published

2 days agoon

April 16, 2025By

admin

Hugging Face is stepping into the world of humanoid robotics with Reachy 2, a $70,000 AI-powered robot designed and built by its latest acquisition, Pollen Robotics.

“So excited to start selling Reachy 2 this week, the first open-source humanoid robot!” Hugging Face co-founder Clément Delangue tweeted. “It’s expensive but already in use at Cornell, Carnegie Mellon & major AI labs for robotics research and education.”

While open-source robots are not new, Reachy 2 is the first manufactured, commercially available, open-source humanoid robot.

“Reachy 2 is a versatile, expressive, and open robotic platform designed to explore the future of human-robot interaction, assistive robotics, and AI-driven behaviors,” Hugging Face claims. The robot has a “humanoid upper body” and includes stereo vision, microphones, a speaker, and lidar.

Each of the robot’s arms has seven degrees of freedom, allowing it to move in seven independent directions, mimicking the flexibility of a human arm.

“Whether you want to build an expressive assistant, a teleoperated avatar, or a robot that learns from demonstration, Reachy 2 gives you the tools to make it happen,” the company said.

Reachy 2’s launch comes as Hugging Face, an AI company and platform best known for its open-source machine learning tools, expands into robotics. In November, the company said it was developing small language models for “Next Stage Robotics.”

Reachy 2 was developed by Pollen Robotics, a Bordeaux, France-based company founded in 2016. Pollen Robotics introduced the original Reachy in 2020.

It runs on Robot Operating System 2 (ROS 2) and Hugging Face’s LeRobotHF framework and is accessible via a Python-based software interface.

Beyond its technical specs, Delangue clarified who Reachy 2 is—and isn’t—intended for.

“It’s not a consumer robot,” he said. “It’s an AI lab robot so quite different.”

On Monday, Hugging Face announced that it had acquired Pollen Robotics for an undisclosed amount.

In a separate post on X, the company laid out its broader ambitions for Reachy 2 and the future of open-source robotics.

“We believe robotics could be the next interface for AI—and it should be open, affordable, and hackable,” the company said. “Our vision: a future where everyone from the community can build and control their own robot companions instead of relying on closed, expensive black boxes.”

While Reachy 2 is currently aimed at research institutions, Hugging Face’s investment in humanoid robotics suggests that the machines could play a larger role in the evolution of open-source AI.

Edited by Sebastian Sinclair

Generally Intelligent Newsletter

A weekly AI journey narrated by Gen, a generative AI model.

Source link

Disclosure: The views and opinions expressed here belong solely to the author and do not represent the views and opinions of crypto.news’ editorial.

Chinese companies are leading the AI arms race. Chinese politician and computer scientist Lou Qinjian said as much, recently commending DeepSeek for their accomplishments: “DeepSeek adheres to an open-source approach and promotes the widespread application of AI technology globally, which contributes Chinese wisdom to the world,” he said.

“Through the rise of companies like DeepSeek, we can see the innovation and inclusiveness of China’s technological development.”

In February, at the Artificial Intelligence Action Summit in Paris, US Vice President JD Vance made clear where the Trump Administration stands on artificial intelligence. He said that, first and foremost, the Trump administration will ensure that American AI technology remains “the gold standard” worldwide and that US companies remain the partner of choice for international companies and foreign countries.

The Vice President argued that excessive regulation in the AI sector would kill the nascent industry, and that the administration would encourage pro-AI growth policies. “And I’d like to see that deregulatory flavor, making its way into a lot of the conversations at this conference,” he said. Vance also made it clear that AI should be free of ideological bias and that “American AI will not be co-opted into a tool for authoritarian censorship.”

Finally, the Trump administration will safeguard a pro-worker growth path for AI so it can create jobs in the United States. Vance also brought up the notion of foreign adversaries weaponizing AI software to rewrite history, surveil users, and censorship. As Vance stated:

“This is hardly new, of course, as they do with other tech. Some authoritarian regimes have stolen and used AI to strengthen their military intelligence and surveillance capabilities, capture personal data, and create propaganda to undermine other nations’ national security.”

He warned conference attendees against partnering with such regimes. “From CCTV to 5G equipment, we’re all familiar with cheap tech in the marketplace that’s been heavily subsidized and exported by authoritarian regimes,” he said. “But as I know, and I think some of us in this room have learned from experience, partnering with them means chaining your nation to an authoritarian master that seeks to infiltrate, dig in, and seize your information infrastructure.”

Under the hood of DeepSeek

DeepSeek shocked global markets in January with low-cost models that made it seem like US companies were now behind in the AI arms race. The AI lowered the costs of developing reliable AIs, proving itself to be a powerful and cost-efficient open-source language model.

It changed the way we view how much capital and computational resources are needed to develop AI. Researchers across the Western world are now left playing catch-up, studying DeepSeek’s technical advances and social implications.

There are clear benefits to DeepSeek. For instance, startups without the deep pockets of Google and OpenAI can now compete in the AI sector. AI models can do more with less in the post-DeekSeep world. The company claims it took a mere $6 million using 2,000 Nvidia H800 graphics processing units (GPUs) versus the $80 million to $100 million cost of GPT-4 and the 16,000 H100 GPUs needed for Meta’s LLaMA 3.

The Hangzhou-based startup’s AI model employs reasoning capabilities that allow smaller models, whereas other AIs have had to employ larger models. It also uses reinforcement learning, eliminating the need for supervised fine-tuning. Moreover, DeepSeek’s multi-head latent attention (MHLA) mechanism decreases memory usage to 5%, down from 13%, in earlier AI methods.

DeepSeek raises privacy concerns and questions regarding data-sourcing and copyright. DeepSeek is open-weighted, not open source. Open source models share the full source code and data, and open weight models share trained weights but not the code. Therefore, the exact source code used to train the models is not available.

Due to DeepSeek’s open weight model, it is unknown what its sources are. This seems to be the way most AI companies operate. DeepSeek made public its R1 training and open weight models, which will allow other AI developers to copy and build on the model, but not its sources.

DeepSeek and geopolitics

A race for AI dominance between China and the US has come into focus, while Russian capabilities on the matter remain a secret. Sberbank—Russia’s largest state-owned bank—has revealed its intentions to collaborate with Chinese researchers on AI projects. Russia and China, which share what they call a “no limits” strategic partnership, have long talked about AI cooperation—including in military applications—but little is publicly known about its depth or scope.

Sberbank, under CEO German Gref, once a Soviet-style former state savings bank burdened by onerous bureaucracy, is today one of Russia’s leading players in artificial intelligence. It released its GigaChat model in 2023. “Sberbank has many scientists. Through them, we plan to conduct joint research projects with researchers from China,” Sberbank First Deputy CEO Alexander Vedyakhin told Reuters.

As the AI arms race heats up, the benefits of open source innovation come to the forefront. Little flowers bursting through the concrete all around the world, coming up with cool tech that is open-sourced and decentralized.

Manouk Termaaten

Manouk Termaaten is the founder and CEO of Vertical Studio AI.

Source link

Free Solana Game Pass NFT Offers Access and Crypto Rewards

3 Altcoins to Buy as Trump Eyes Crypto-Friendly Kevin Warsh as Next Fed Chair

Filecoin (FIL) Gains 3.7% as Index Trades Higher

Quantum computers likely to reveal if Satoshi is alive — Adam Back

Bitcoin In Peril? Expert Warns Of China’s Alleged Scheme To Crash BTC To $40,000

Crypto Privacy Legalized? Tornado Cash And Samourai Cases Suggest Uncertainty Remains

Trader Says Altcoin That’s Ripped 222% in a Month Still Has Room To Run, Updates Outlook on SOL-Based Memecoin

Boosting growth in the tokenized credit market

As Bitcoin Mining Companies Slump, Tether Loads Up on Bitdeer

Can XRP Price Hit $20? Federal Reserve Hints US Banks Can Use XRP

Kyrgyzstan President Brings CBDC a Step Closer to Reality

Manta founder details attempted Zoom hack by Lazarus that used very real ‘legit faces’

Ethereum Price Fights for Momentum—Traders Watch Key Resistance

Corporate Bitcoin Holdings Hit Record High In Q1 2025 As Public Companies Accelerate Accumulation

‘Big Short’ Investor Steve Eisman Derisks, Says Stock Market Volatility Will Be Here for a While

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Crypto’s Big Trump Gamble Is Risky

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

I’m Grateful for Trump’s Embrace of Bitcoin

Trending

24/7 Cryptocurrency News5 months ago

24/7 Cryptocurrency News5 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin3 months ago

Bitcoin3 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Ripple Price1 month ago

Ripple Price1 month ago3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Altcoins3 months ago

Altcoins3 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin5 months ago

Bitcoin5 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals