Technology

Crypto Crystal Ball 2025: Could Ethereum Updates Finally Bring Mass Adoption?

Published

3 months agoon

By

admin

As we enter 2025, many questions hover over crypto—and not just those about prices and regulation. The underlying technology powering some of the industry’s most popular tools is also poised to change in the new year, and those shifts could have major implications for users.

For our annual Crypto Crystal Ball series, we’re taking a hard look at the narratives likely to shape the coming year, and how they’re likely to impact you.

Following a look at how much political capital Donald Trump may be willing to spend on the crypto industry’s top priorities, here’s how an upcoming tech upgrade to Ethereum could finally pave the way to crypto going mainstream at a consumer level.

For years, the crypto industry has prayed for the arrival of mass adoption. But time and again, on-chain products and experiences have failed to attract as many users as their Web2 rivals.

A key update to Ethereum, penciled for February, could change that—by making on-chain apps much, much easier to use for everyday consumers.

David Silverman, senior vice president of strategic business initiatives at Ethereum scaling project Polygon, told Decrypt that during the 2021 crypto bull market, millions of people were interested in exploring on-chain apps—but the tech wasn’t ready. Come the looming 2025 bull cycle (knock on wood), Silverman says crypto products will finally be up to snuff.

“This next cycle, if we do see a mass inflow of interest, we will be able to show a proper example of what we think the Web3 future is,” Silverman said, “as opposed to just glimmers of hope.”

Why? Developers say Ethereum’s upcoming Pectra upgrade will eliminate barriers that have previously made on-chain apps a headache. Goodbye gas fees and special wallets for navigating smart contracts; hello signing transactions with FaceID—and surfing some on-chain apps without having to sign any transactions at all.

One key innovation in Pectra will grant smart wallet functionality to the types of basic wallets issued by mainstream companies like Coinbase and MetaMask. Come February, users of those wallets will be able to pay gas fees on Ethereum and all L2s with any crypto of their choosing, including stablecoins. They will also be able to sign for transactions with universal tools like Apple’s FaceID and TouchID.

Those effortless signing mechanisms will now also be capable of enabling “much more complicated on-chain interactions with a single click,” Mark Tyneway, the co-founder of Ethereum layer-2 network Optimism, told Decrypt.

Take session keys, for example. Previously impossible, session keys will soon allow ordinary crypto users to navigate a site or app for hours while completing dozens of secure on-chain interactions—all without the user knowing what’s happening on the backend.

“You could put the entire Instagram experience on-chain without it feeling like it,” Tyneway told Decrypt. “It’s going to unlock a massive wave of innovation.”

Polygon’s Silverman says Pectra will soon allow many crypto app developers to create seamless experiences where gas fees are sponsored and transaction signings are abstracted away—leaving products that look and feel like leading Web2 apps, but offer distinctive Web3 perks.

“Crypto UX is about to level up,” Silverman said. “This is the unlock.”

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.

Source link

You may like

German Regulator BaFin Identifies ‘Deficiencies’ in Ethena’s USDe Stablecoin, Orders Immediate Issuance Halt

Q&A with DELV’s Charles St. Louis

Bitcoin Futures Data Shows Bullish Long/Short Ratio – Details

TRUMP, PI Network, Wormhole Analysis

Insider at Major US Bank Quietly Drains $180,000 From Two Customers’ Accounts, Alleges Department of Justice

Bitcoin ‘in position’ for first key RSI breakout in 6 months at $85K

Technology

Filmmakers Bet on Web3 to Fix Hollywood Film Financing

Published

1 week agoon

March 16, 2025By

admin

Cutter Hodierne knew the odds were against him. As an independent filmmaker trying to secure funding for “Cold Wallet,” a crypto thriller about a heist gone wrong, he faced the usual hurdles—hesitant investors, an unpredictable industry, and a financing system that favored big studios over fresh voices.

“In Hollywood’s centralized model, breaking in is difficult,” he said. “You never know if you met the right person, if your script was overlooked, or if your work is truly considered.”

So instead of taking the traditional route, he turned to the decentralized film industry. Often referred to as Film3, it leverages blockchain technology, community voting, and cryptocurrency to fund movies, and television series. Unlike the traditional Hollywood system, which relies on centralized studios, agents, and intermediaries, Film3 lets filmmakers connect directly with their audiences and financing.

Hodierne put 10 minutes of his film up on the Decentralized Pictures website for review, where a community of producers, writers, investors, and film buffs got a look at his sizzle reel. In exchange for reviewing the clip, they earned $FILM, Decentralized Pictures’ token, which the studio says is “fuel for the platform. Users can stake them on their favorite projects, use them to pay others to review their own submissions (as a rewards pool), or simply purchase entry vouchers to pay for application fees for various creative financing rewards.”

One reviewer in particular was especially struck by the clip: “Steven Soderbergh, the king of the heist genre, gave us his blessing,” said Hodierne.

Soderbergh invested in the film, and Decentralized Pictures followed on with a grant, giving “Cold Wallet” enough money to make Hodierne’s movie. Now screening as a “Steven Soderbergh Presents” project, the movie is at select theaters and available for rent or purchase on Apple and Amazon Prime Video, and has garnered respectable reviews.

“Hopefully, it connects with viewers,” Hodierne said. “What excites me most is that you can rent and buy it on-chain with crypto—it’s highly appropriate.”

It’s another big step in the journey of the dominant studios in the Film3 movement, Decentralized Pictures and Gala Films, which have more than 60 movies and TV series in the works.

“We’re building the studio of the future,” said Decentralized Pictures co-founder Roman Coppola, a member of the Coppola filmmaking family. “At our company, American Zoetrope, and in my dad’s work, we value community and a cafe culture where people come together, share ideas, and compare notes.”

Coppola and others pointed out that just as important as community participation is the decentralized funding model that can support filmmakers, particularly those with distinctive voices and meaningful stories to tell, by allowing them to bypass industry hierarchies.

“The term we’ve been using—DeFiFi, decentralized film finance—represents a shift in film funding,” Stacy Spikes, co-founder of movie subscription platform MoviePass said during an interview with Decrypt at ETH Denver. “Distribution companies will still be needed to push films into the marketplace, but until now, back-end participation wasn’t possible. With smart contracts, it is.”

The idea is already gaining traction. In 2024, Film3 made history when actress Mena Suvari earned a Primetime Emmy nomination for her role in “RZR,” a sci-fi series created by David Bianchi’s Exertion3 Films in collaboration with the blockchain-powered streaming platform Gala Film.

Spikes likened the potential of decentralized filmmaking to past independent and genre film movements.

“If you go with the community—particularly black and brown communities or genre films—Web3 is a great place to tap into,” Spikes said. “I feel that people who were hesitant to invest will now be more likely to do so because they know they’ll get their money back.”

Hodierne also noted that by eliminating distributors and sales agents, all proceeds go directly to the filmmakers and Decentralized Pictures, allowing them to reinvest in independent artists and future projects.

“As a filmmaker, I’ve seen how centralized and fickle the industry is. This shift is a big deal, especially as streaming platforms pay artists less while struggling themselves,” he said. “It’s an exciting convergence for films, and for ‘Cold Wallet,’ a crypto thriller, this feels like the perfect first step in opening that door.”

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.

Source link

Disclosure: The views and opinions expressed here belong solely to the author and do not represent the views and opinions of crypto.news’ editorial.

One of the most intriguing aspects of crypto is its sense of anonymity. Bitcoin (BTC), for example, was created in 2008 by an unknown figure using the pseudonym Satoshi Nakamoto, and to this day, the true identity of its inventor remains unknown. The veil of anonymity has allowed users to create distinct identities through wallet addresses, adding an extra layer of privacy and discretion to transactions.

This concept of openness and universal access is one of the core promises of digital currencies, allowing anyone with internet access to engage, regardless of their financial history or background. However, even though the ethos of crypto promotes inclusivity, the reality hasn’t always reflected this.

The early days of crypto were defined by the archetype “crypto bros,” referring to a specific demographic of young, tech-savvy men who influenced the industry’s direction. Their influence extended to the design of projects, development of key protocols, and framing of the culture surrounding digital assets.

However, as the industry matured and evolved, efforts were made to reflect and include more female voices. This shift helped address the imbalance between gender representation, bringing new perspectives into the industry.

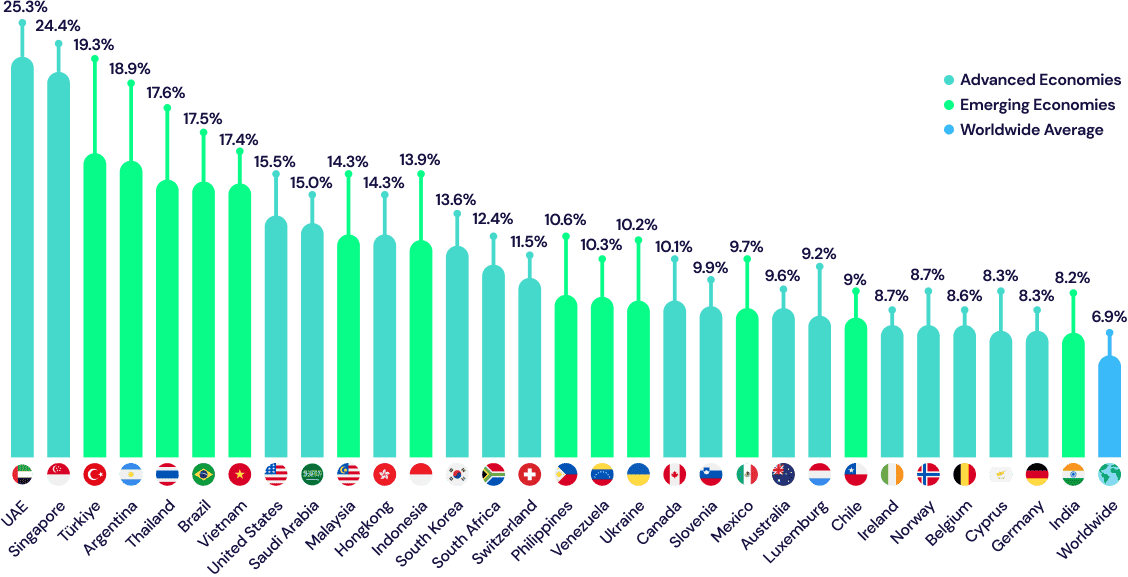

A 2024 study revealed that over 560 million cryptocurrency owners exist globally, with 61 percent identifying as male and 39 percent as female. This marks an increase from the previous year, when the global total was 420 million, with 37 percent of owners being female, signaling a positive shift.

In response to this trend, organizations have emerged to address crypto’s gender imbalances. Conferences and events once primarily targeted toward the male-dominated demographic have changed to allow women to step into the space and take the lead.

The Association for Women in Cryptocurrency, or AWC, for example, was founded in 2022 as a platform for women looking to enhance their knowledge and education in crypto. Led by Amanda Wick, AWC hosts various events, like webinars and in-person meetups, where women can learn from industry experts and connect with mentors who can guide them and help them discover new career opportunities.

Recently, Binance shared that it will offer global programs exclusively for women through its Binance Academy platform in honor of International Women’s Day. The events will be held across five continents at 11 venues to help women ease their way into the industry.

While women have made significant strides in the DeFi space, now accounting for 40 percent of Binance’s workforce, leadership positions have been predominantly held by men. Despite this, several women have established themselves as leaders in the space.

Perianne Boring, for instance, is the founder and CEO of the blockchain advocacy group The Digital Chamber, working alongside Congress and the government to promote and regulate blockchain technology. Her leadership role has made her an advocate for adopting blockchain technologies, as she has become a well-known voice in the space discussing the future of finance. In December, President Trump also considered Boring as a potential CFTC chair.

Another established female leader in the space is Joanna Liang, the founding partner of Jsquare, a tech-focused investment firm specializing in blockchain and web3. With a previous background as CIO at Digital Finance Group (DFG), a global Venture Capital firm focusing on crypto projects, Liang recently launched Jsquare’s latest fund, the Pioneer Fund. The fund has successfully raised $50 million in capital, making its first investment in the startup MinionLabs. The fund will focus on emerging technologies in the crypto space, including PayFi, real-world assets (RWAs), and consumer apps.

Laura Shin is also a prominent name in crypto and is recognized as one of the first mainstream media reporters to cover cryptocurrency full-time. She is the author of the book, ‘The Cryptopians: Idealism, Greed, Lies, and the Making of the First Big Cryptocurrency Craze,’ and the host of the podcast Unchained. Laura has shared her expertise at events such as TEDx San Francisco and the International Monetary Fund.

Over the past 16 years, women have been instrumental in helping legitimize crypto assets throughout the financial landscape. Their contributions have spanned various sectors in the ecosystem, helping shift the narrative around crypto from a niche, speculative asset to a more widely recognized and accepted financial tool.

Source link

Technology

Solana May Soon Get a Major Change—Here’s Why Builders Are Butting Heads Over SIMD-0228

Published

2 weeks agoon

March 7, 2025By

admin

A new Solana proposal aims to change the frequency at which new tokens are generated on the prominent blockchain—and the suggested changes are generating serious debate ahead of the imminent vote.

The proposal, also known as SIMD-0228, looks to move from fixed-rate token emissions to a programmatic, “market-based emission” schedule that is based on staking participation rate.

In other words, instead of decreasing Solana inflation based on a fixed, time-based schedule, SIMD-0228 proposes that Solana inflation dynamically changes based on network activity.

“The [current] mechanism is not aware of network activity, nor does it incorporate that to determine the emission rate. Simply put, it’s ‘dumb emissions,’” reads the proposal. “Given Solana’s thriving economic activity, it makes sense to evolve the network’s monetary policy with ‘smart emissions.’”

The proposal’s authors—Multicoin Capital’s Tushar Jain and Vishal Kankani, and Max Resnick, lead economist at Solana-focused R&D firm Anza—believe that so-called smart emissions would benefit the network and stakers by reducing inflation, spurring DeFi usage, reducing sell pressure, and improving the narrative around its existing inflation.

Notable Solana builders and personalities, including Solana Labs co-founder Anatoly Yakovenko, have signaled support for the proposal as well.

“The counter arguments to 228 are pretty bad because the cost of inflation is something on the order of […] $1-2 billion per year,” Yakovenko posted on X (formerly Twitter).

The counter arguments to 228 are pretty bad because the cost of inflation is something on the order of (global average income tax rate * inflation). Or $1-$2 BILLION per year.

1) small validators will lose out

Yes. That’s probably going to happen. It doesn’t cost $1 BILLION…

— toly

(@aeyakovenko) March 7, 2025

Helius Labs CEO Mert Mumtaz added that the “strongest argument for 228 is that it incentivizes and speeds up the timeline towards a network centered on real economic value.” That line of thinking was echoed by Placeholder VC partner Chris Burniske as well.

“I’m in favor of SIMD-228,” Burniske said on X. “In the long run, real yield comes from what the demand-side leaks to the supply-side, and inflation is just a bootstrapping mechanism to get to that place.”

But not all of the Solana community is ready to accept the proposal, which has been modified in the last two months based on feedback. As the proposal inches closer to a vote, some builders have taken aim at elements they believe will negatively impact the ecosystem.

One such dissenting opinion comes from SolBlaze.org, a Solana network validator that will have the option to vote on the proposal.

SIMD-0228 aims to add a dynamic element to staking rewards issuance with the goal of lowering inflation, citing alternate mechanisms such as MEV rewards which can compensate for decreased inflationary rewards. Sounds good in theory? Let me explain why it’s a terrible idea.

2/27

—

SolBlaze.org | Stake with us! (@solblaze_org) March 6, 2025

The validator added that the goal of lowering inflation “sounds good in theory,” but is a “terrible idea,” citing that SIMD-0228 will “drastically decrease” the amount of Solana tokens staked. Given that view, they believe it will threaten decentralization and the security of the network while impacting Solana’s DeFi protocols, which rely on staking rewards.

“DeFi is what powers Solana adoption, and regular users should care about that if they want Solana to succeed,” a SolBlaze representative told Decrypt when asked why the average Solana participant should care about SIMD-0228.

Others, including Solana Foundation President Lily Liu, have spoken out against the proposal.

“[SIMD-0228] is too, too half-baked,” posted Liu. She signaled support for fixed rates, which she called “not dumb and arbitrary,” citing that predictability is valuable in capital markets.

228 is too, too half-baked

Here’s my TLDR:

1/ Negative impact on SOL the asset during a critical period of growth

Blockchains are networks; they also have a native asset. The network and asset subecosystems are interdependent. Changing network parameters can be good for…

— Lily Liu (@calilyliu) March 6, 2025

“No on the proposal before us,” she said, instead suggesting an extension so the proposal can be adjusted to incorporate other features.

Voting on SIMD-0228 is expected to start Friday evening during Solana Epoch 753, which is estimated to arrive around 8:30pm ET according to timetracking from Solscan. SolBlaze expects a “close vote” and is using the remaining hours to whip up support against the bill.

“Since it needs two-thirds of the vote to pass,” they told Decrypt, “there’s still a chance that enough people can come together to stop the proposal.”

Edited by Andrew Hayward

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.

Source link

German Regulator BaFin Identifies ‘Deficiencies’ in Ethena’s USDe Stablecoin, Orders Immediate Issuance Halt

Q&A with DELV’s Charles St. Louis

Bitcoin Futures Data Shows Bullish Long/Short Ratio – Details

TRUMP, PI Network, Wormhole Analysis

Insider at Major US Bank Quietly Drains $180,000 From Two Customers’ Accounts, Alleges Department of Justice

Bitcoin ‘in position’ for first key RSI breakout in 6 months at $85K

Beyond Strategy: 11 More Publicly Traded Companies That Are Stockpiling Bitcoin

Crypto stocks mirror market-wide slump in Bitcoin, altcoins

Fidelity Files for OnChain U.S. Treasury Fund, Joining the Asset Tokenization Race

Analyst Predict XRP Price Could Hit $77 in This Bull Cycle

Jupiter Price Action Signals Breakdown—$0.41 Target In Play

Sonic unveils high-yield algorithmic stablecoin, reigniting Terra-Luna ‘PTSD’

Ethereum Altcoin Explodes 68% After Korea’s Second-Biggest Crypto Exchange Announces Trading Support

Time for XRP to hit new highs after SEC case over? IntelMarkets could rattle the market

Swedish Film ‘Watch the Skies’ Set for US Release With AI ‘Visual Dubbing’

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Crypto’s Big Trump Gamble Is Risky

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

Trump’s Coin Is About As Revolutionary As OneCoin

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Is $200,000 a Realistic Bitcoin Price Target for This Cycle?

Trending

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin2 months ago

Bitcoin2 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News2 months ago

24/7 Cryptocurrency News2 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Bitcoin4 months ago

Bitcoin4 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Altcoins2 months ago

Altcoins2 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Price analysis5 months ago

Price analysis5 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x