Bitcoin price

Crypto to Buy the Dip Now for 2X Gains in 2025

Published

4 months agoon

By

admin

The cryptocurrency market experienced fluctuations with Bitcoin price dropping sharply to $92,000, after reaching its new all-time high of $103,000. The value of the global crypto market has declined by 1.97% settling at 3.6 trillion, with BTC rebounding. Amid this volatility, wise investors understand that buying dips can yield maximum long-term returns. As we approach 2025, now is the time to consider projects promising substantial growth. Bitcoin (BTC), Minotaurus (MTAUR), XRP, and Hedera (HBAR) pause as crypto to buy dip now.

Crypto to Buy to Dip for Maximum Gains in 2025

Here are cryptocurrencies to consider investing in for their unique potential to yield 2x returns or more in the year ahead.

1. Bitcoin (BTC): Crypto to Buy Dip as it Reclaims Its Throne

Bitcoin, the leading cryptocurrency, recently surpassed the challenging $100K mark, hitting a peak of $103,900 before falling back to $92,000 in a turbulent trading period. Nonetheless, BTC recovered and is presently being traded at approximately $98,257.

Why Buy BTC Now?

- Significant recovery capability: The dip to $90,500 was short-lived, demonstrating Bitcoin’s strength as it stays close to its record high.

- Market confidence: Bitcoin’s performance highlight its role as the premier store of value and a hedge against inflation.

- 2025 forecast: Experts anticipate that Bitcoin may exceed $150K by 2025, driven by rising institutional interest and heightened scarcity from the approaching halving event.

Investing in Bitcoin during this downturn provides a solid basis for portfolio expansion, with 2X returns being a feasible expectation by 2025.

2. Minotaurus (MTAUR): The Hidden GameFi Gem

Minotaurus (MTAUR), priced at just $0.00006002 USDT per token during its presale, is creating waves as an undervalued gem with massive upside potential. The gaming token is geared toward explosive growth upon its listing. The Minotaurus project is not just about hype; it combines strong fundamentals with genuine utility within the game.

With the support of a rapidly growing community and increasing attention from thought leaders in the crypto space, the presale presents an opportunity for substantial benefits. For those looking to capitalize on early pricing, now is the time to get involved before the token hits exchanges and prices climb further.

Why Buy MTAUR Now?

- Massive ROI potential: Minotaurus is set to list at $0.00020 USDT, translating to a projected growth of over 234%.

- Community buzz: A robust community and social media excitement are driving early adoption.

- Incentives: Referral and vesting bonuses, along with a $100K USDT giveaway, make early investment particularly attractive.

Minotaurus offers high-risk, high-yield potential, ideal for buyers looking for early-stage cryptocurrencies, and diversify their portfolios with a speculative play.

3. XRP: Reclaiming Its Glory

Ripple’s XRP has experienced significant fluctuations, recently hitting a six-year peak of $2.90 before adjusting to $2.31. Even with a slight decline of 5.03%, XRP appears on our crypto to buy list due to its long-term positive perspective.

Why Buy XRP Now?

- DeFi and institutional applications: Ripple’s emphasis on cross-border transactions and institutional acceptance positions it as a strong candidate for future expansion.

- Regulatory transparency: The anticipated positive outcomes in its legal dispute with the SEC have enhanced investor trust.

- Analysts prediction: XRP price is forecasted to claim its all-time high of $3.30 it achieved in 2018, potentially rise to $10 by the year 2025.

- This decline presents a prime chance to buy XRP at a lower price, with the possibility of significant profits as the market rebounds.

4. Hedera (HBAR): The Enterprise Blockchain Leader

Hedera has excelled remarkably, with its price increasing more than 487% in the last month. At present, HBAR is trading at $0.2847 indicating potential for additional growth.

Why Buy HBAR Now?

- Technical momentum: Indicators like the RSI and MACD indicate ongoing upward momentum, aiming for a target price of $0.3 in the near term.

- Institutional trust: Collaborations with large companies and the possible endorsement of an HBAR ETF are boosting hope.

- 2025 forecast: As enterprise-grade solutions and DeFi continue to gain traction, HBAR is set to emerge as a significant contender in the blockchain arena.

HBAR is a cryptocurrency to buy now, for its strong fundamentals and positive technical indicators, rendering it essential for any crypto portfolio aiming at growth.

Final Thoughts

Bitcoin, Minotaurus, XRP, and Hedera offer unique opportunities for substantial gains in the year 2025. From the dominance of BTC, to speculative charm of Minotaurus, institutional embrace of XRP, and Hedera’s business-oriented approach, these crypto to buy present various investment approaches. By buying dips now, you can benefit from the fluctuations in the market, setting yourself for potential 2x profits or more in the coming year.

Purchasing the dip now enables you to take advantage of the market’s fluctuations and set yourself up for possible 2X profits or greater in the upcoming year. Nonetheless, always perform your own research and evaluate your risk tolerance prior to investing.

Frequently Asked Questions (FAQs)

Bitcoin’s strong rebound to $97K after its $100K milestone shows potential for further gains, making it a solid long-term choice.

Priced low during its presale, Minotaurus offers ~234% growth potential, along with referral and vesting bonuses to early adopters.

XRP’s institutional adoption and HBAR’s ETF filing prospects highlight their strong fundamentals and potential for explosive growth.

Coingape Staff

CoinGape comprises an experienced team of native content writers and editors working round the clock to cover news globally and present news as a fact rather than an opinion. CoinGape writers and reporters contributed to this article.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

You may like

As Bitcoin Mining Companies Slump, Tether Loads Up on Bitdeer

Can XRP Price Hit $20? Federal Reserve Hints US Banks Can Use XRP

Kyrgyzstan President Brings CBDC a Step Closer to Reality

Manta founder details attempted Zoom hack by Lazarus that used very real ‘legit faces’

Ethereum Price Fights for Momentum—Traders Watch Key Resistance

Corporate Bitcoin Holdings Hit Record High In Q1 2025 As Public Companies Accelerate Accumulation

Bitcoin

How Expanding Global Liquidity Could Drive Bitcoin Price To New All-Time Highs

Published

2 days agoon

April 16, 2025By

admin

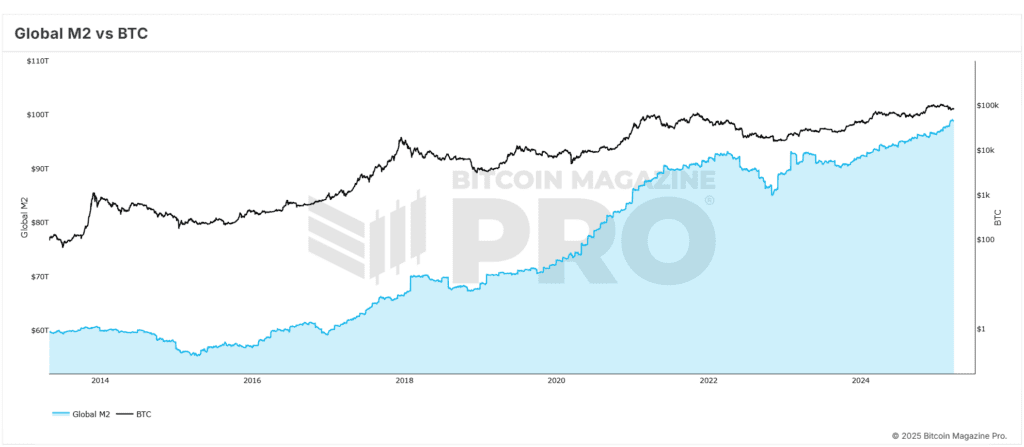

Bitcoin’s price trajectory is once again capturing headlines, and this time the catalyst appears to be global liquidity trends reshaping investor sentiment. In a recent comprehensive breakdown, Matt Crosby, Lead Analyst at Bitcoin Magazine Pro, presents compelling evidence tying the digital asset’s renewed bullish momentum to the expanding global M2 money supply. His insights not only illuminate the future of Bitcoin price but also anchor its macroeconomic relevance in a broader financial context.

Bitcoin Price and Global Liquidity: A High-Impact Correlation

Crosby highlights a remarkable and consistent correlation—often exceeding 84%—between Bitcoin price and global M2 liquidity levels. As liquidity increases across the global economy, Bitcoin price typically responds with upward movement, although with a noticeable delay. Historical data supports the observation of a 56–60 day lag between monetary expansion and Bitcoin price increases.

This insight has recently proven accurate, as Bitcoin price rebounded from lows of $75,000 to above $85,000. This trend closely aligns with the forecasted recovery that Crosby and his team had outlined based on macro indicators, validating the strength and reliability of the correlation driving Bitcoin price upward.

Why the 2-Month Delay Impacts Bitcoin Price

The two-month delay in market response is a critical observation for understanding Bitcoin price movements. Crosby emphasizes that monetary policy and liquidity injections do not immediately affect speculative assets like BTC. Instead, there is an incubation period, typically around two months, during which liquidity filters through financial systems and begins to influence Bitcoin price.

Crosby has optimized this correlation through various backtests, adjusting timeframes and offsets. Their findings indicate that a 60-day delay yields the most predictive accuracy across both short-term (1-year) and extended (4-year) historical Bitcoin price action. This lag provides a strategic advantage to investors who monitor macro trends to anticipate Bitcoin price surges.

S&P 500 and Its Influence on Bitcoin Price Trends

Adding further credibility to the thesis, Crosby extends his analysis to traditional equity markets. The S&P 500 exhibits an even stronger all-time correlation of approximately 92% with global liquidity. This correlation strengthens the argument that monetary expansion is a significant driver not just for Bitcoin price, but also for broader risk-on asset classes.

By comparing liquidity trends with multiple indices, Crosby demonstrates that Bitcoin price is not an anomaly but part of a broader systemic pattern. When liquidity rises, equities and digital assets alike tend to benefit, making M2 supply an essential indicator for timing Bitcoin price movements.

Forecasting Bitcoin Price to $108,000 by June 2025

To build a forward-looking perspective, Crosby employs historical fractals from previous bull markets to project future Bitcoin price movements. When these patterns are overlaid with current macro data, the model points to a scenario where Bitcoin price could retest and potentially surpass its all-time highs, targeting $108,000 by June 2025.

This optimistic projection for Bitcoin price hinges on the assumption that global liquidity continues its upward trajectory. The Federal Reserve’s recent statements suggest that further monetary stimulus could be deployed if market stability falters—another tailwind for Bitcoin price growth.

The Rate of Expansion Affects Bitcoin Price

While rising liquidity levels are significant, Crosby stresses the importance of monitoring the rate of liquidity expansion to predict Bitcoin price trends. The year-on-year M2 growth rate offers a more nuanced view of macroeconomic momentum. Although liquidity has generally increased, the pace of expansion had slowed temporarily before resuming an upward trend in recent months.

This trend is strikingly similar to conditions observed in early 2017, just before Bitcoin price entered an exponential growth phase. The parallels reinforce Crosby’s bullish outlook on Bitcoin price and emphasize the importance of dynamic, rather than static, macro analysis.

Final Thoughts: Preparing for the Next Bitcoin Price Phase

While potential risks such as a global recession or a significant equity market correction persist, current macro indicators point toward a favorable environment for Bitcoin price. Crosby’s data-driven approach offers investors a strategic lens to interpret and navigate the market.

For those looking to make informed decisions in a volatile environment, these insights provide actionable intelligence grounded in economic fundamentals to capitalize on Bitcoin price opportunities.

For more deep-dive research, technical indicators, real-time market alerts, and access to a growing community of analysts, visit BitcoinMagazinePro.com.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment decisions.

Source link

Bitcoin

Bitcoin Price Eyes Bullish Continuation—Is $90K Within Reach?

Published

3 days agoon

April 15, 2025By

admin

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bitcoin price started a fresh increase above the $83,500 zone. BTC is now consolidating gains and might attempt to clear the $85,500 resistance.

- Bitcoin started a fresh increase above the $83,500 zone.

- The price is trading above $83,000 and the 100 hourly Simple moving average.

- There is a connecting bullish trend line forming with support at $84,200 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair could start another increase if it clears the $85,500 zone.

Bitcoin Price Eyes More Gains

Bitcoin price started a fresh increase above the $82,500 zone. BTC formed a base and gained pace for a move above the $83,000 and $83,500 resistance levels.

The bulls pumped the price above the $84,500 resistance. A high was formed at $85,850 and the price recently started a downside correction. There was a move below the $84,000 support. The price dipped below the 23.6% Fib retracement level of the upward move from the $78,600 swing low to the $85,850 high.

However, the bulls were active near the $83,000 zone and the price recovered losses. Bitcoin price is now trading above $83,500 and the 100 hourly Simple moving average. There is also a connecting bullish trend line forming with support at $84,200 on the hourly chart of the BTC/USD pair.

On the upside, immediate resistance is near the $85,000 level. The first key resistance is near the $85,500 level. The next key resistance could be $86,200. A close above the $86,200 resistance might send the price further higher. In the stated case, the price could rise and test the $87,500 resistance level. Any more gains might send the price toward the $88,000 level.

Another Rejection In BTC?

If Bitcoin fails to rise above the $85,500 resistance zone, it could start another decline. Immediate support on the downside is near the $84,200 level and the trend line. The first major support is near the $83,200 level.

The next support is now near the $82,200 zone and the 50% Fib retracement level of the upward move from the $78,600 swing low to the $85,850 high. Any more losses might send the price toward the $81,500 support in the near term. The main support sits at $80,800.

Technical indicators:

Hourly MACD – The MACD is now gaining pace in the bullish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now above the 50 level.

Major Support Levels – $84,200, followed by $83,500.

Major Resistance Levels – $85,500 and $85,850.

Source link

Bitcoin

Bitcoin Compressing Between Key Levels, Is $74K Or $91K Next?

Published

6 days agoon

April 12, 2025By

admin

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

As Bitcoin (BTC) recovers from its five-month low, the cryptocurrency attempts to reclaim the $84,000 resistance. Some market watchers suggest that more volatility could be around the counter, as the price is compressing between two key levels.

Related Reading

Bitcoin Retests 4-Month Downtrend Line

Over the past week, Bitcoin has been trading between the $74,000-$84,000 price range following the recent tariff war-related volatility. After hitting a one-week high of $84,720, the flagship crypto hit a five-month low of $74,773, driven by this week’s market correction.

Amid this performance, the cryptocurrency risked a 13.7% drop to the $69,000 support, as it generally needs a daily close above the $78,500 level for a potential short-term rebound. However, BTC’s price has surged 13.5% since Monday’s lows and attempted to reclaim the $84,000 resistance.

The market recovery was fueled by US President Donald Trump’s 90-day pause on the trade tariffs for over 75 nations, which saw the crypto market and stock prices jump 6%-10% in an hour this Wednesday.

Nonetheless, the tariffs-driven rally slowed Thursday, with Bitcoin retracing nearly 5% to the $79,000 support. Analyst Alex Clay asserted that despite the bullish rally, BTC’s price needed to reclaim the broken $80,000 support and break through the descending 4-month resistance as its short-term structure continued looking bearish.

During BTC’s 7% surge in the past 24 hours, the analyst highlighted the key support zone held, invalidating his bearish scenario. However, a breakout and reclaim confirmation of the $84,000 remained crucial for BTC’s price.

BTC Preparing For More Volatility?

Analyst Rekt Capital pointed out that Bitcoin successfully retested the $78,500 support, but its price was rejected from the 4-month downtrend resistance. Therefore, the flagship crypto’s price is now compressing between these two levels, which usually “precedes volatility.”

The analyst also noted that BTC is “developing yet another Higher Low on the RSI while forming Lower Lows on the price.” During this cycle, the cryptocurrency has formed multiple bullish RSI divergences in the daily chart, each preceding a reversal to the levels.

Bitcoin’s Daily RSI equaled 2022 Bear Market RSI levels (RSI=23.93) when price crashed into the high $70,000s. The only lower Daily RSI in this cycle was back in August 2023 (RSI=18.28). Throughout this cycle, each visit into sub-25 RSI resulted in a trend reversal to the upside over time.

Related Reading

Meanwhile, crypto analyst Ali Martinez suggested that BTC could see a retrace back to the $74,000 support zone. He observed that Bitcoin’s movements within its weekly range display a W-shape to the upper boundary, and its price action seemed to be forming an M-shape after Thursday’s retrace and Friday’s jump, which eyes the range’s lower boundary.

On the contrary, the analyst also highlighted Bitcoin’s Friday performance, affirming that it “is slicing through key resistance at $82,360.” Notably, BTC’s price then jumped toward the $84,000 barrier, hitting a daily high of $84,220 before retracing to the $83,500 mark. According to Martinez, “A sustained breakout could open the door to $91,500.”

As of this writing, Bitcoin trades at $83,640, a 1% decline in the weekly timeframe.

Featured Image from Unsplash.com, Chart from TradingView.com

Source link

As Bitcoin Mining Companies Slump, Tether Loads Up on Bitdeer

Can XRP Price Hit $20? Federal Reserve Hints US Banks Can Use XRP

Kyrgyzstan President Brings CBDC a Step Closer to Reality

Manta founder details attempted Zoom hack by Lazarus that used very real ‘legit faces’

Ethereum Price Fights for Momentum—Traders Watch Key Resistance

Corporate Bitcoin Holdings Hit Record High In Q1 2025 As Public Companies Accelerate Accumulation

‘Big Short’ Investor Steve Eisman Derisks, Says Stock Market Volatility Will Be Here for a While

Dow drops over 500 points as UnitedHealth tanks, Fed tensions weigh on markets

Gold Is Still the Safe-Haven King, While Bitcoin Loses Out: JP Morgan

Dogecoin Price Breakout in view as Analyst Predicts $5.6 high

Bitcoin (BTC) Price in Standstill at $85K as Trump Increases Pressure on Fed’s Powell

Ripple acquisition Hidden Road secures FINRA registration

Ethereum Whales Offload 143,000 ETH In One Week – More Selling Ahead?

How Do We Protect Bitcoin From Quantum Computers? Not With A Joke

OKX Goes Live In The US After Setting Up New Headquarters in San Jose, California

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Crypto’s Big Trump Gamble Is Risky

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

I’m Grateful for Trump’s Embrace of Bitcoin

Trending

24/7 Cryptocurrency News5 months ago

24/7 Cryptocurrency News5 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin3 months ago

Bitcoin3 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Ripple Price4 weeks ago

Ripple Price4 weeks ago3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Altcoins3 months ago

Altcoins3 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin5 months ago

Bitcoin5 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

✓ Share: