blackrock

Crypto whales: Friends or foes?

Published

3 months agoon

By

admin

The closing weeks of 2024 saw vintage crypto wallets waking and moving tens and hundreds of tokens to exchanges or other addresses. Public curiosity is by far not the only impact of such transactions. Let’s see how the whale transactions influence the market and why not everyone is happy about them.

The whales’ transactions Christmas rampage

On Dec. 25, 2024, the Bitcoin wallet that was kept untouched for nearly 14 years moved 20.55 BTC to another address. During the years in the wallet, these coins gained over $2 million in value. The same day, a different wallet released 210 BTC after ten years of inactivity. This BTC stash grew by $20 million while being hodled.

Two days later, someone moved 1,940 ETH from the pre-mine address to Coinbase. These ether tokens were dormant from the launch of the Ethereum network. The following days saw other huge transactions involving long-time sleepers.

For instance, on Dec. 29 it was reported that someone sent 7,000 BTC from the address that was inactive for seven years to several different addresses, splitting the sum into seven 1,000 BTC outputs.

This chad held on to 7,000 BTC for 7 years, hodled from 62M$ to 663M$, the funds haven’t been sold they just split them into 1,000 BTC addresses.https://t.co/1FhOHUjUOH

— Sani | TimechainIndex.com (@SaniExp) December 29, 2024

Reporters share the opinion that these bitcoins weren’t sold; they just moved to other wallets. In seven years, the 7k BTC stash value grew by several hundred million dollars. On the same day, the address that had been silent since 2014 sent 357.4 BTC to other addresses.

When whales hold

As of Dec. 30, 2024, there are four wallets holding nearly 650k BTC, which is over 3% of the total supply. All of these addresses are the cold wallets of the crypto exchanges. According to the Bitinfocharts tool, less than 100 Bitcoin addresses hold around 15% of the entire supply; many of these addresses probably belong to individuals. If they decide to move their millions worth of crypto coins, it may trigger a bearish reversal even in the uptrend.

When whales hold their crypto, they decrease its liquidity. Just think of billions worth of cryptocurrency that has not moved for years! Almost half of all bitcoins are held in wallets that have between 100 and 10,000 bitcoins on the balance. This group of whales impacts liquidity and value the most. Many of them haven’t moved crypto for years, sometimes over 10 consecutive years, effectively keeping large amounts of crypto out of the market.

When whales sell

When whales get rid of their crypto, they signal other investors that someone who held millions worth of the asset in question decided that the asset isn’t worth it anymore. And everyone sees it!

The whales’ transactions don’t go unnoticed, as thanks to the Bitcoin network’s transparency, these addresses are known, listed, and monitored. Each massive transaction makes headlines and triggers much talk on the Internet. Some people, especially those who don’t follow the trading/investment strategy or even don’t have one, fall for emotions and start to panic. When many people panic simultaneously, they may flip the market or increase the price volatility – not necessarily for a long period, but still. The whales who don’t want to cause disturbance dump their crypto gradually.

Most transactions described in the previous chapter seemingly have one goal–the owners move crypto from the legacy Pay-to-Public-Key-Hash (P2PKH) addresses to modern wallets that provide better privacy and security. They cannot be attributed to so-called “whale dumping” that serves as a bearish signal.

Alleged market manipulations

On Dec. 27, 2024, the “Rich Dad Poor Dad” author, Robert Kiyosaki, took to X to accuse the BlackRock CEO Larry Fink of dumping Bitcoin. According to Kiyosaki, BlackRock is “suppressing Bitcoin price, so the whales can buy Bitcoin at under $100k.”

Larry Fink dumping Bitcoin. VIVEK warned Larry Fink of BLACK ROCK is a Marxist. Vivek warned Fink & Black Rock are Share Holder Capitalist not Stake Holder Caplitist. Share Holder Capitalists are Marxist….like Klaus Schwab who state: “Someday you’ll own nothing and you’ll be…

— Robert Kiyosaki (@theRealKiyosaki) December 27, 2024

Although we don’t have evidence to support or dispute Kiyosaki’s claim, we must admit that institutions and individuals holding large amounts of crypto are often subjected to such claims. The alleged market manipulation conducted by Tether is one of the best-known cases. The battle for the truth continues as of December 2024.

Why would someone accuse whales of intentional price manipulations? First off, whales really can impact the prices. Whales may sell a large amount of BTC, sending the price down, re-buy what was sold during retracement at a discounted price, and enjoy profit made out of the price differences. Other tactics available for whales include rug pulls and wash trading.

Ripple Labs admitted having used trading bots in the past. However, it doesn’t outrightly agree with the accusations of using them to manipulate the XRP price.

Crypto whales: friends or foes?

Just like the natural whales in the oceans, crypto whales are not friends or foes. Rather, they are large bodies minding their own business. If we know how they impact the market when they spend crypto, we can react to the whale alerts accordingly and avoid trouble. The only exception is the whales consciously manipulating the prices. However, the same means, namely, preparedness and caution, may save us from them too.

Source link

You may like

Circle to Launch USDC in Japan With SBI Partnership

Is Ethena Price At Risk? Trump’s World Liberty Financial Sells 184K ENA Sparking Concerns

XRP Price Consolidates—Breakout Incoming or More Choppy Moves?

Massive Bitcoin whale buys $200M in BTC, another wakes up after 8 years

Whales Abruptly Deposit Ethereum Altcoin to Binance and OKX, Causing Price To Plummet 50%: On-Chain Data

HK Asia Holdings Becomes First In China To Adopt Bitcoin Treasury

Bitcoin spot ETF

BlackRock to allocate up to 2% of model portfolio to IBIT Bitcoin ETF

Published

4 weeks agoon

February 28, 2025By

admin

BlackRock, the world’s largest asset manager with over $10 trillion in assets under management, is incorporating Bitcoin into its own model portfolio.

According to a Bloomberg report on Feb. 28, the asset manager will allocate 1% to 2% of its Bitcoin (BTC) exchange-traded fund to target model investment portfolios. These allocations, sourced from the BlackRock iShares Bitcoin Trust ETF under the ticker IBIT, will be directed toward the company’s portfolios that include alternative investments.

In the investment world, model portfolios are pre-structured funds designed to offer ready-made strategies. They provide managed investment strategies that invest in fund shares and are marketed to financial advisors.

Model portfolios have seen significant growth across the market, driven in part by rising interest in digital assets and crypto exchange-traded products.

BlackRock’s IBIT is currently a $48 billion spot Bitcoin ETF, holding 576,046 bitcoins, which accounts for about 2.9% of the total Bitcoin market share. According to Bloomberg, BlackRock plans to allocate 1% to 2% of IBIT into its $150 billion model portfolio.

Although this $150 billion pool represents a small portion of BlackRock’s overall model portfolio business, the inclusion of IBIT could significantly boost demand for the spot Bitcoin ETF.

Michael Gates, lead portfolio manager for target allocation ETF models at BlackRock, reiterated the company’s confidence in Bitcoin as an investment.

“We believe Bitcoin has long-term investment merit and can potentially provide unique and additive sources of diversification to portfolios,” Gates said in a note to investors on Feb. 27.

The U.S. Securities and Exchange Commission approved IBIT and several other spot Bitcoin ETFs in January 2024. BlackRock, Fidelity Investments, WisdomTree, and VanEck were among the firms that received regulatory approval for the listing and trading of Bitcoin ETFs.

Investor demand for these funds helped push Bitcoin’s price above $69,000 in March 2024. Later, heightened interest amid the U.S. election cycle propelled Bitcoin to an all-time high above $109,000.

However, a sell-off has since driven BTC down to $79,000, with significant outflows from spot ETFs, including IBIT, in the past week.

Source link

barclays

Banking Giant Barclays Owns $136,834,631 Worth of BlackRock’s Bitcoin Exchange-Traded Fund

Published

1 month agoon

February 15, 2025By

admin

The multinational banking giant Barclays holds nearly $137 million worth of BlackRock’s iShares Bitcoin exchange-traded fund (ETF).

The London-headquartered bank disclosed it holds 2,473,064 shares of BlackRock’s IBIT fund in a recent quarterly filing submitted to the U.S. Securities and Exchange Commission (SEC).

IBIT, the largest Bitcoin (BTC) ETF in terms of assets under management (AUM), is priced at $55.33 at time of writing, meaning Barclays’ holdings are worth around $136.8 million.

Barclays also recently disclosed in a 2024 annual report that the United Kingdom’s Financial Conduct Authority (FCA) is probing the bank over potential anti-money laundering rule violations.

Explains the firm,

“The FCA’s investigation focuses primarily on the historical oversight and management of certain customers with heightened risk. Barclays has been cooperating with the investigation.”

Barclays has shown an interest in the blockchain and digital asset space for years. In 2024, the bank teamed up with other financial institutions and the industry body UK Finance to participate in a tokenized deposits pilot project.

And back in 2022, reports emerged that Barclays planned to buy a multimillion-dollar stake in Copper, a European crypto firm aiming to provide a secure infrastructure for institutions looking to invest in digital assets. That same year, the bank also backed Elwood Technologies, a crypto infrastructure and market data platform founded by billionaire Alan Howard.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

Bitcoin

Nasdaq Proposes In-Kind Redemptions for BlackRock’s Bitcoin ETF

Published

1 month agoon

February 10, 2025By

admin

Nasdaq has submitted a groundbreaking proposal to the U.S. Securities and Exchange Commission (SEC) that could transform the operational framework of Bitcoin exchange-traded funds (ETFs). The proposal, focused on BlackRock’s iShares Bitcoin Trust (IBIT), seeks to introduce “in-kind” bitcoin redemptions, offering a streamlined and cost-effective alternative to the current cash redemption process.

JUST IN: BlackRock files to allow in-kind creations and redemptions for its spot Bitcoin ETF! pic.twitter.com/SSigX4utRG

— Bitcoin Magazine (@BitcoinMagazine) January 24, 2025

What Are In-Kind Redemptions?

Under the proposed system, institutional players known as authorized participants (APs) – responsible for creating and redeeming ETF shares – could opt to exchange ETF shares directly for bitcoin rather than cash. This innovation eliminates the need to sell bitcoin to generate cash for redemptions, simplifying the process while cutting operational costs.

While this option would only be available to institutional participants and not retail investors, experts suggest that the improved efficiency could indirectly benefit everyday investors. By reducing operational hurdles, in-kind redemptions have the potential to make Bitcoin ETFs more streamlined and cost-efficient for all market participants.

Related: BlackRock CEO Larry Fink Forecasts $700K Bitcoin Price Amid Inflation Worries

Why the Change?

The cash redemption model, implemented in January 2024 when spot Bitcoin ETFs were first approved by the SEC, was designed to keep financial institutions and brokers from handling bitcoin directly. This approach prioritized regulatory simplicity during the nascent stages of Bitcoin ETFs.

However, the rapid growth of the Bitcoin ETF market has created new opportunities to improve its infrastructure. With evolving regulations and a more mature digital asset ecosystem, Nasdaq and BlackRock now see a pathway to adopt a more efficient in-kind redemption model.

Benefits of In-Kind Redemptions

- Operational Efficiency:

- Reduces the complexity and number of steps in the redemption process.

- Streamlines ETF operations, saving both time and costs.

- Tax Advantages:

- Avoiding the sale of bitcoin minimizes capital gains distributions, making ETFs more tax-efficient for institutional investors.

- Market Stability:

- Reduces sell pressure on bitcoin during redemptions, potentially stabilizing the asset’s price.

Regulatory and Market Context

Nasdaq’s proposal coincides with significant regulatory developments under the pro-Bitcoin Trump administration. Recent policy shifts, such as the repeal of Staff Accounting Bulletin 121 (SAB 121), have paved the way for broader cryptocurrency adoption. The removal of SAB 121 eliminated barriers that previously discouraged banks from offering cryptocurrency custody services, creating a more favorable environment for innovations like Nasdaq’s in-kind redemption model.

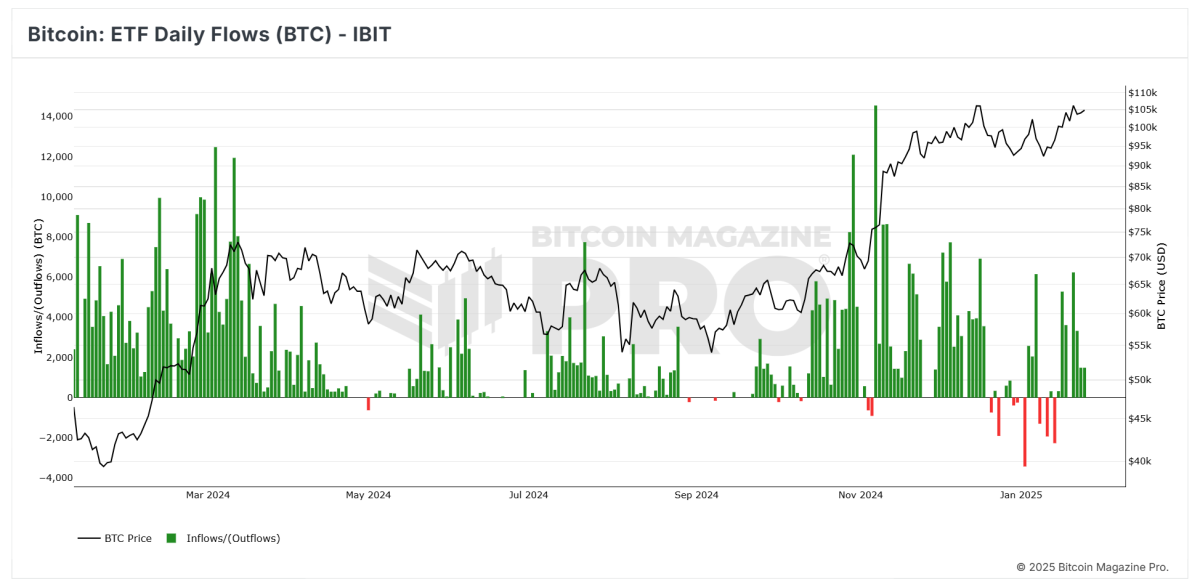

BlackRock’s Bitcoin ETF: A Market Leader

Since its 2024 launch, BlackRock’s iShares Bitcoin ETF has emerged as a market leader, with over $60 billion in inflows. The fund’s consistent growth highlights institutional demand for Bitcoin investment products. Innovations like Nasdaq’s in-kind redemption model could further enhance IBIT’s appeal to institutional investors.

Note the consistent upward trend of green candles, reflecting strong and steady inflows.

Related: What Bitcoin Price History Predicts for February 2025

Conclusion

Nasdaq’s proposal to introduce in-kind redemptions for BlackRock’s Bitcoin ETF represents a pivotal moment for the Bitcoin ETF market. By simplifying redemption processes, offering tax efficiencies, and reducing sell pressure on bitcoin, the model stands to significantly enhance the appeal and performance of Bitcoin ETFs for institutional investors.

As the Bitcoin ETF market matures and regulatory support continues to grow, innovations like this are poised to drive further adoption. If approved, Nasdaq’s proposal could mark a critical step forward, solidifying Bitcoin ETFs as a cornerstone of institutional digital asset investment while indirectly benefiting retail participants.

With a favorable regulatory climate and growing institutional interest, the future of Bitcoin ETFs looks brighter than ever.

Source link

Circle to Launch USDC in Japan With SBI Partnership

Is Ethena Price At Risk? Trump’s World Liberty Financial Sells 184K ENA Sparking Concerns

XRP Price Consolidates—Breakout Incoming or More Choppy Moves?

Massive Bitcoin whale buys $200M in BTC, another wakes up after 8 years

Whales Abruptly Deposit Ethereum Altcoin to Binance and OKX, Causing Price To Plummet 50%: On-Chain Data

HK Asia Holdings Becomes First In China To Adopt Bitcoin Treasury

Ancient Mystery or Modern Hoax? Experts Debunk Giza Pyramid Claims

Kaspa price prediction | Is Kaspa a good investment?

World Liberty Financial-Labeled Tokens Spark Speculation of Trump-Backed Project’s Stablecoin Launch

Brad Garlinghouse Discusses Ripple’s Future, Crypto Legislation & Blockchain Technology As Lawsuit Ends

Analyst Sets Dogecoin Next Target As Ascending Triangle Forms

Crypto exchange Kraken exploring $1B raise ahead of IPO: Report

Bitcoin and Stock Market Rally Hard as White House Narrows Scope of Tariffs

Tabit Insurance Raises $40 Million Bitcoin-Funded Insurance Facility

Strategy’s Bitcoin Holdings Cross 500,000 BTC After Stock Sales

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Crypto’s Big Trump Gamble Is Risky

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

Trump’s Coin Is About As Revolutionary As OneCoin

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Is $200,000 a Realistic Bitcoin Price Target for This Cycle?

Trending

24/7 Cryptocurrency News5 months ago

24/7 Cryptocurrency News5 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin2 months ago

Bitcoin2 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News2 months ago

24/7 Cryptocurrency News2 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Bitcoin4 months ago

Bitcoin4 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Altcoins2 months ago

Altcoins2 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Price analysis5 months ago

Price analysis5 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x