Bitcoin

David Bailey Forecasts $1M Bitcoin Price During Trump Presidency

Published

2 months agoon

By

admin

In an in-depth discussion on the Hell Money Podcast, David Bailey, CEO of BTC Inc., shared insights into Bitcoin’s transformative potential, its geopolitical implications, and its role as a cornerstone of a new global economic framework.

“I see this happening so much faster than anyone can appreciate. Within 10 years, Bitcoin will become the reserve asset of the world.”

- 00:00 Intro

- 07:15 Bitcoin soft forks

- 11:00 Bitcoin vs. Crypto in US policy

- 19:20 How much political power does Bitcoin have?

- 23:50 Bitcoiners are politically homeless

- 26:20 Strategic Bitcoin Reserve

- 29:00 Bitcoin development and ossification

- 32:00 Separation of money and state

- 33:40 Raise your time preference

- 35:20 SBR as a way out of USD global reserve status

- 41:00 Will they eventually fight us?

- 43:00 Incentives as a political movement

- 46:30 What happens next?

- 49:15 Bitcoin Vegas & Inscribing Vegas 2025

The Political and Economic Power of Bitcoin

Bitcoin has evolved into a significant political and financial instrument. Its decentralized nature, immutable ledger, and finite supply make it an attractive alternative to traditional fiat currencies, particularly during periods of economic uncertainty. Bailey emphasizes that Bitcoin is no longer merely a speculative asset but has become a political force capable of influencing policy and elections.

“Within the next four years, Bitcoin will be the most widely held asset in the world. This isn’t a special one-off moment—it’s the changing of the guard of the world order.”

As Bitcoin gains adoption among individual investors, corporations, and governments, its ability to sway decisions in both the public and private sectors continues to grow. This makes Bitcoin a strategic tool for economic stability and a hedge against systemic risks such as inflation, currency devaluation, and geopolitical instability. Understanding this evolution is crucial for investors looking to align their strategies with Bitcoin’s increasing influence in global finance.

Strategic Bitcoin Reserve: A Game-Changer for Economies

Bailey highlights the concept of a Strategic Bitcoin Reserve (SBR) as a key driver in Bitcoin’s path to becoming a global reserve asset. If a major economy, such as the United States, were to adopt an SBR, it could trigger a domino effect, with other nations racing to establish their own reserves. This global competition could significantly accelerate Bitcoin’s transition from a speculative asset to a fundamental part of national and international financial strategies.

“If America gets an SBR, China gets an SBR. If America and China have an SBR, within 12 months every country on the planet will have an SBR. The game theory effects of us kicking this off, in my opinion, are like the biggest catalyst possible for hyperbitcoinization.”

An SBR offers governments the ability to hedge against inflation, protect their economies from devaluation, and diversify their reserves. Unlike gold, Bitcoin is easily transferable, highly divisible, and operates transparently on a decentralized network. For investors, national adoption of Bitcoin reserves signals long-term stability and growth potential, reinforcing the case for allocating a portion of portfolios to Bitcoin and related assets.

Orange-Pilling Trump: A Strategic Advocacy Moment

One of the most intriguing aspects of David Bailey’s efforts in advancing Bitcoin’s adoption was his strategic engagement with former President Donald Trump. Bailey discussed how Bitcoin advocates pitched Bitcoin to Trump as more than just a digital currency, emphasizing its economic and political advantages. By framing Bitcoin as a tool for strengthening American competitiveness and financial independence, Bailey and his team successfully captured Trump’s interest.

“We are within a couple of years of being the most powerful political faction in the United States. And not just the United States—there are bitcoiners embedded in power structures across the planet.”

Bailey’s team leveraged Bitcoin mining as a key entry point in their discussions, highlighting the economic benefits of Bitcoin mining operations in the United States, such as job creation and energy innovation. This approach aligned Bitcoin with Trump’s “America First” policies, presenting it as a way to bolster the nation’s energy independence and economic strength. These discussions laid the groundwork for a broader understanding of Bitcoin’s strategic value at the highest levels of government.

Governance and Innovation in Bitcoin

While Bitcoin’s decentralized nature is its greatest strength, it also presents challenges in governance and technological adaptability. Bailey underscores the importance of continuous innovation, particularly through mechanisms like soft forks, to ensure that Bitcoin remains scalable, secure, and competitive. Without these updates, the risk of ossification—where the network becomes resistant to necessary changes—could hinder Bitcoin’s evolution.

“Bitcoin gives governments a really elegant way out of the money-printing trap. They can print money, buy Bitcoin, and as the price of Bitcoin goes up, they’re still solvent. Later, they can peg their currency to Bitcoin.”

The Bitcoin community must navigate these governance complexities with a focus on collaboration and forward-looking solutions.

Hyperbitcoinization and the $1 Million Price Target

Bailey predicts that Bitcoin could reach a value of $1 million per coin within the next four years, driven by its growing adoption and the systemic challenges faced by traditional financial systems. This projection signifies more than just a price milestone—it represents a fundamental shift in the global economic order. Hyperbitcoinization, as Bailey describes it, involves Bitcoin becoming the default reserve currency, complementing or even replacing traditional fiat currencies.

“When we get to a million bucks, which I think can happen over the next four years—in my personal opinion, I think it’s possible—the Federal Reserve is, like, going to be completely impotent.”

This transition would have profound implications. Bitcoin’s decentralized nature would democratize access to financial systems, reduce reliance on central authorities, and promote greater economic inclusion. For investors, the journey toward hyperbitcoinization offers unparalleled opportunities as Bitcoin’s dual role as a store of value and medium of exchange becomes increasingly evident.

Related: Eric Trump Confident Bitcoin Price Will Hit $1 Million

Interview Key Takeaways

- Political Leverage: Bitcoin’s influence on policymaking and elections underscores its role as a hedge against political and economic risks.

- National Adoption Trends: The adoption of SBRs by major economies could catalyze global Bitcoin adoption, creating a favorable environment for long-term investment.

- Technological Resilience: Continuous innovation, including scalability solutions like the Lightning Network, is essential for sustaining Bitcoin’s growth and usability.

- Portfolio Diversification: Bitcoin’s uncorrelated performance relative to traditional assets makes it an attractive addition to diversified investment strategies.

- Economic Stability: In an era of rising inflation and monetary instability, Bitcoin provides a transparent, secure, and decentralized alternative to fiat currencies.

The Future of Bitcoin in the Global Economy

David Bailey’s insights provide a compelling vision of Bitcoin’s transformative potential, offering investors a clear opportunity to align their strategies with a rapidly evolving financial landscape. By understanding and leveraging Bitcoin’s role in fostering economic resilience and innovation, investors can position themselves to benefit from its adoption as a global reserve asset and a tool for long-term portfolio growth. As the world confronts challenges such as inflation, currency instability, and geopolitical uncertainty, Bitcoin emerges as a beacon of financial stability and innovation. For investors, the implications of Bitcoin’s growth extend far beyond speculative returns—it represents a strategic opportunity to participate in the evolution of the global financial system.

“It’s like, well, once that happens, then it’s not $1 million or $10 million. It’s like, it is the reserve asset of the world.”

In the coming decade, Bitcoin’s role as a stabilizing force and driver of innovation will become increasingly evident. Its seamless integration into national and corporate strategies, combined with its adaptability, positions Bitcoin as a cornerstone of future financial systems. Bailey’s vision challenges investors to consider the profound implications of a decentralized monetary system that prioritizes transparency, inclusion, and resilience.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment decisions.

Source link

You may like

Authorities Target Crypto Scammers Posing as Binance in Australia

Why Is Solana Price Up 6% Today?

Ripple CEO Confident of XRP Being Included in U.S. Strategic Reserve, Says IPO is 'Possible'

Bitnomial drops SEC lawsuit ahead of XRP futures launch in the US

BIGGER THAN ORDINALS. MORE THAN ART

Leading Shiba Inu Rival Flashing Bullish Signals Hinting at Price Reversal, According to Santiment

Bitcoin

Bitcoin Long-Term Holder Net Position Turns Green For The First Time In 2025

Published

5 hours agoon

March 20, 2025By

adminReason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

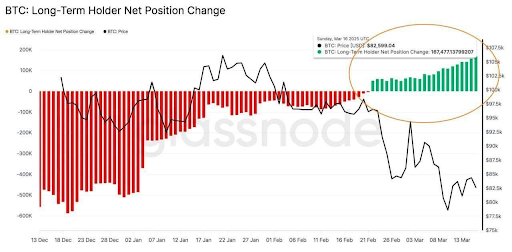

Bitcoin’s long-term holders have resumed accumulation in what is a notable shift in investor sentiment despite the turbulence that has gripped the market in recent weeks. Particularly, data from on-chain analytics platform Glassnode shows that the “BTC: Long-term holder net position change” metric has flipped positive for the first time this year. This suggests that long-term Bitcoin investors are capitalizing on market conditions to add significant amounts of BTC to their holdings.

Long-Term Holders Add 167,000 BTC Amid March Crash

Earlier this month, Bitcoin’s price plunged from above $90,000 to around $80,000 during a rapid sell-off. This price stunned many traders and triggered a continuous wave of liquidations among short-term investors. Yet despite this steep correction, long-term holders treated the sub-$90,000 levels as a buying opportunity rather than a reason to capitulate.

Related Reading

In other words, coins are moving into wallets that haven’t spent their BTC in a long time, which is a notable reversal after starting 2025 with a negative net position change. This marks the first net accumulation by these “HODLers” in 2025. Glassnode’s Long-Term Holder Net Position Change metric, which had been in the red, flipped “green” as long-term investors aggressively accumulated through the downturn.

On-chain data shows that this flip to green has seen long-term holders increase their net Bitcoin holdings by more than 167,000 BTC in the past month. This notable influx is valued at nearly $14 billion. In short, the cohort of seasoned holders began scooping up cheap BTC while short-term sentiment was at its bleakest.

Is A Bitcoin Price Recovery Brewing?

The timing of this flip from red selloff to green accumulation among long-term holders is striking, considering what the Bitcoin price went through in the past two weeks. This data suggests that a large part of the Bitcoin crash was caused by panic-selling among short-term holders. This behavior aligns with past market cycles between August and September 2024, where long-term holders accumulated aggressively during a price dip.

Related Reading

Interestingly, Glassnode’s long-term holder metric isn’t the only one pointing to positive Bitcoin sentiment among large holders. After weeks of uncertainty, Bitcoin exchange-traded funds (ETFs) have started seeing net inflows again. On March 17, spot Bitcoin ETFs collectively drew in about $274.6 million, the largest single-day inflow in 28 days and a clear signal of renewed investor interest.

The very next day brought another wave of fresh capital, with roughly $209 million pouring into Bitcoin funds on March 18. In fact, this three-day streak represents the first sustained run of positive inflows since February 18, a period during which Bitcoin funds have experienced consecutive days of outflows.

At the time of writing, Bitcoin is trading at $83,500.

Featured image from Unsplash, chart from Tradingview.com

Source link

Bitcoin

Bitcoin Price Eyes 90K rally at Blackrock-led ETFs Buy $512M BTC 3-Days before US Fed Decision

Published

9 hours agoon

March 19, 2025By

admin

Bitcoin price surged by 4% on Wednesday, hitting a 10-day peak . This rally follows three consecutive days of substantial Bitcoin ETF inflows, totaling $512 million. As BTC flirts with the critical $90,000 resistance level, investors are closely watching the impact of the Federal Reserve’s policy decision on global markets.

Bitcoin (BTC) Price Hits 10-Day Peak on Fed Rate Decision

Bitcoin (BTC) surged by 4% on Wednesday, reaching a 10-day high of $85,900 as the U.S. Federal Reserve’s decision to pause interest rate hikes aligned with investor expectations.

This bullish momentum follows three consecutive days of strong institutional inflows into Bitcoin ETFs, totalling $512 million. With BTC price facing critical resistance at $90,000, market participants are watching closely to see whether institutional demand and macroeconomic conditions will trigger more gains in the coming trading sessions.

ETF Inflows Surged $512M ahead of Fed Rate Decision

Since their introduction, Bitcoin ETFs have become a key gauge of institutional sentiment in the cryptocurrency market. After 3-week selling spree, Bitcoin ETFs have recored positive inflows over the past three trading days, according to SosoValue data

On Tuesday alone, Bitcoin ETFs saw $209 million in inflows, marking one of the strongest demand periods in weeks. The funds have accumulated over $512 million in Bitcoin purchases, underscoring strong demand from corporate and institutional investors.

Historically, such sustained inflows have often preceded significant price breakouts, suggesting that institutional investors swung bullish BTC’s short-term price prospects as markets priced in a 99% chance of a rate pause at the start of the week.

BTC Faces Key Resistance at $90,000 Amid Short Squeeze Pressure

Despite its recent gains, Bitcoin price is showing more upside potential. According to the latest derivatives data from Coinglass, over $290 million worth of BTC short positions were closed near the $85,000 level.

Short traders, who profit when prices decline, are making last-ditch efforts to defend their positions and avoid a wave of forced liquidations.

However, liquidation heatmaps suggest that BTC short liquidations at the $85,000 level may have weaken ed neighboring resistance zones. If Bitcoin sustains momentum and breaks above $90,000, it could trigger a cascading effect, forcing more short sellers to cover their positions and further driving up the price.

US Fed Rate Pause Boosts Risk Asset Appetite

The Federal Reserve’s decision to maintain interest rates at current levels has provided additional support for Bitcoin’s rally. A pause in rate hikes signals a more accommodative stance toward financial markets, which typically benefits risk assets such as cryptocurrencies.

Lower interest rates make traditional savings and fixed-income investments less attractive, prompting investors to seek higher returns in alternative assets like Bitcoin. If institutional investors interpret the Fed’s stance as a green light for continued Bitcoin accumulation, ETF inflows could remain strong, further reinforcing the bullish outlook.

Bitcoin Price Outlook: Path to $90K and Beyond?

With ETF inflows surging and macroeconomic conditions remaining favorable, Bitcoin price forecast signals appears well-positioned for a continued uptrend. However, to sustain its bullish momentum, BTC must overcome key resistance levels:

- $90,000 – A major psychological level that could trigger a new wave of buying or profit-taking.

- $92,500 – The next upside target if BTC breaks through $90K.

On the downside, strong support levels include:

- $85,000 – A key level where short liquidations have already been triggered.

- $82,500 – A potential retest zone if BTC faces rejection at $90,000.

The ongoing BTC price surge is fuelled by strong institutional demand and a favorable macroeconomic backdrop. With $512 million in ETF inflows and short sellers under pressure, BTC’s path to $90,000 looks increasingly viable. However, breaking through this critical resistance will be key in determining whether Bitcoin can extend its rally toward new all-time highs.

Frequently Asked Questions (FAQs)

Bitcoin’s recent price surge is fueled by strong ETF inflows, institutional demand, and macroeconomic factors like the Federal Reserve’s rate pause.

The $90,000 level represents a major psychological and technical barrier where large short positions could trigger a short squeeze or a pullback.

Bitcoin ETFs allow institutional investors to gain exposure to BTC, and significant inflows often drive price surges due to increased market confidence.

ibrahim

Crypto analyst covering derivatives markets, macro trends, technical analysis, and DeFi. His works feature in-depth market insights, price forecasts, and institutional-grade research on digital assets.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

Bitcoin

Bitcoin Reclaims $85k and Stocks Head Higher Despite Analysts Warning of Pain Ahead

Published

11 hours agoon

March 19, 2025By

admin

Crypto markets are experiencing a modest move to the upside following today’s Federal Open Market Committee (FOMC) meeting, in which the U.S. central bank left interest rates steady at 4.25%-4.50%

Bitcoin (BTC) has risen 4.5% in the last 24 hours and is now trading for $85,500, its highest point since March 9.

The CoinDesk 20 — an index of the top 20 cryptocurrencies by market capitalization except for stablecoins, memecoins and exchange coins — is up 6%. Ether (ETH) and solana (SOL) have both surged by 7%, while Ripple’s XRP token has risen 10% off the back of CEO Brad Garlinghouse’s announcement that the Securities and Exchange Commission (SEC) is planning to drop its case against the company.

Crypto stocks are also doing relatively well, especially bitcoin mining companies like Bitdeer (BTDR) and Core Scientific (CORZ), which are up 10% and 8% on the day, respectively. Bitdeer is likely buoyed from the technological progress it recently made in its ASIC manufacturing process, as well as from the news that stablecoin giant Tether was increasing its stake in the company to 21%.

Core Scientific, meanwhile, is potentially reaping the benefits of AI firm CoreWeave (Core Scientific’s main customer) filing for an initial public offering earlier in the month. Even so, both companies are down more than 61% and 53% since January and November respectively.

Federal Reserve Chair Jerome Powell said that tariff-related inflation was likely to be transitory and that recession risks remained low. And despite the market reacting positively to the meeting — Nasdaq, S&P 500 and Dow Jones all gained 1% or more — market commentators weren’t necessarily convinced.

“The word — ‘transitory’ — is back at the Federal Reserve as Chair Powell characterizes the price effects of tariffs as a one-off,” economist Mohamed A. El-Erian posted on X. “I would have thought that, particularly after the big policy mistake of earlier this decade and given all the current uncertainties, some Fed officials would show greater humility. It’s simply too early to say with any regress of confidence that the inflationary effects will be transitory.”

Gold continued to rise after surpassing the $3,000 mark on Tuesday and today hit a new record above $3,050. Callie Cox, chief market strategist at Ritholtz Wealth Management, said that the U.S. central bank was signaling that any additional rate cuts would likely happen at the cost of battering stocks. “The Fed is no longer comfortable gliding to neutral as we get closer to their inflation target. I think you can argue that the soft landing is over,” she posted.

Source link

Authorities Target Crypto Scammers Posing as Binance in Australia

Why Is Solana Price Up 6% Today?

Ripple CEO Confident of XRP Being Included in U.S. Strategic Reserve, Says IPO is 'Possible'

Bitnomial drops SEC lawsuit ahead of XRP futures launch in the US

Bitcoin Long-Term Holder Net Position Turns Green For The First Time In 2025

BIGGER THAN ORDINALS. MORE THAN ART

Leading Shiba Inu Rival Flashing Bullish Signals Hinting at Price Reversal, According to Santiment

Binance’s USDT pair with Turkish lira sees largest amplitude since 2024 after key Erdogan rival detained

Treasury Expands Financial Surveillance of Cash Transactions—What About Crypto?

Bitcoin Price Eyes 90K rally at Blackrock-led ETFs Buy $512M BTC 3-Days before US Fed Decision

Bitcoin Reclaims $85k and Stocks Head Higher Despite Analysts Warning of Pain Ahead

Trump to speak at Digital Asset Summit: Report

Bitcoin’s Road To $1M? Expect A ‘Dip Then Rip,’ Bitwise CIO Says

How Bitcoin ETFs And Mining Innovations Are Reshaping BTC Price Cycles

Bitcoin Hoarder Metaplanet Issues Fresh Bonds To Increase Holdings to 3,200 BTC

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Crypto’s Big Trump Gamble Is Risky

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

Trump’s Coin Is About As Revolutionary As OneCoin

Is $200,000 a Realistic Bitcoin Price Target for This Cycle?

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Trending

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin2 months ago

Bitcoin2 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News2 months ago

24/7 Cryptocurrency News2 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin4 months ago

Bitcoin4 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Altcoins2 months ago

Altcoins2 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin4 months ago

Bitcoin4 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Price analysis4 months ago

Price analysis4 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x

✓ Share: