Doge price

Dogecoin Price Eyes $1 Boom, Mirroring Iconic 2021 Bull Run

Published

5 months agoon

By

admin

Dogecoin price, a leading meme-based altcoin, has surged recently, riding the ongoing crypto bull market wave. The digital asset defied broader trends with BTC hovering above $100k, steadily climbing and drawing attention for its impressive rally desspite slight market corrections. Analysts suggest Dogecoin’s upward momentum could mirror its 2021 performance, eyeing an ambitious $1 milestone if bullish mounts pressure.

Dogecoin Price Eyes $1 Breakout, Mirroring Historic 2021 Bull Frenzy

The crypto expert recently highlighted Dogecoin’s potential for a significant price surge, likening its current pattern to the 2021 bull run. The analyst identified the emergence of a “first breakout candle” as a key indicator of explosive growth. The same pattern has reappeared, sparking speculation that Dogecoin could surpass its previous $1 target and reach new heights in this cycle.

Notably, the analyst dismissed the $1 price target as outdated, referencing manipulation allegations during the 2021 rally that hindered progress. Instead, the expert predicts Dogecoin price could achieve levels between $4.20 and $6.90 this cycle, driven by renewed market momentum. This optimistic outlook underscores Dogecoin’s potential to repeat history with an even greater rally.

Crypto analysts has highlighted a significant bullish pattern for Dogecoin, indicating potential upward momentum. According to their technical analysis, a bullish pennant formation has emerged on the 6-hour timeframe, signaling a possible breakout.

The analyst predicts that Dogecoin could experience a 30% to 40% price surge as this pattern unfolds. Bullish pennants often suggest a continuation of an upward trend following a brief period of consolidation.

The upcoming Congressional address on U.S. economic policy and Elon Musk’s influence intrigue Dogecoin’s outlook. Meanwhile, the rise of meme coins like PEPE and SHIB could bolster DOGE’s momentum, hitting $1 soon

Dogecoin Technical Analysis: DOGE Poised for Major Bullish Breakout

The DOGE price has surged by 20% in the past week. At the time of writing, the meme coin is trading at $0.45, with a 5% surge indicating a bullish trend.

The Dogecoin price forecast is gaining traction, hovering above $0.45, sparking optimism for another rally. If bullish sentiment continues, a potential surge to $0.73, matching its previous all-time high.a breakthrough above $1, similar to its 2021 performance, may be possible. However, bearish pressure could trigger a correction to $0.40 or even $0.35.

The Moving Average Convergence Divergence (MACD) indicates bullish momentum on the 4-hour chart. The MACD line is currently hovering above the signal line. The increasing histogram bars indicate growing buying interest.

Dogecoin’s recent momentum showcases its potential to surpass historic highs, fueled by bullish patterns and growing market optimism. With continued support, the meme coin could achieve remarkable price milestones.

Frequently Asked Questions (FAQs)

Similar bullish patterns hint at a repeat or surpassing of 2021 highs.

Elon Musk’s influence adds bullish sentiment and intrigue to DOGE’s momentum.

Analysts predict DOGE could surpass $1, aiming for $4.20-$6.90.

Coingape Staff

CoinGape comprises an experienced team of native content writers and editors working round the clock to cover news globally and present news as a fact rather than an opinion. CoinGape writers and reporters contributed to this article.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

You may like

This Week in Crypto Games: Ubisoft’s ‘Might & Magic’, ‘Peaky Blinders’ in Development

Why Arbitrum-Nvidia Partnership Collapsed – And What It Means for Web3

Tariff Carnage Starting to Fulfill BTC’s ‘Store of Value’ Promise

The cost of innovation — Regulations are Web3’s greatest asset

Best Crypto to Buy as Derivatives Exchange CME Set to Launch XRP Futures

Metaplanet Buys Additional ¥1.92 Billion Worth Of Bitcoin

doge

Dogecoin Trader Who Nailed 300% Rally Says It’s About To Repeat

Published

5 days agoon

April 22, 2025By

admin

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

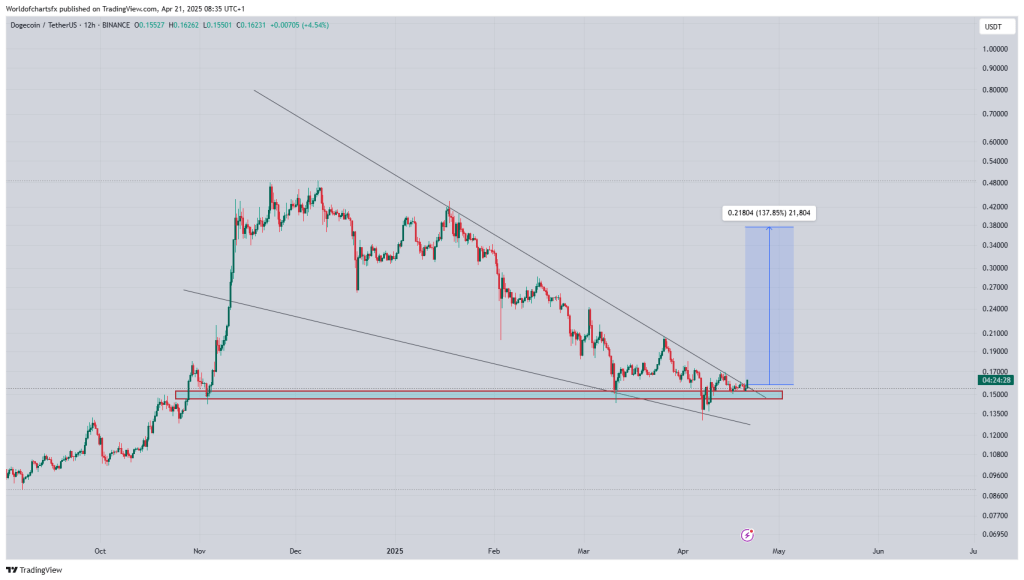

Dogecoin (DOGE) is once again breaking out of a textbook falling‑wedge formation, and the analyst who anticipated the memecoin’s last three‑fold explosion thinks the stage is set for an encore. “Breaking crucial area, expecting solid bullish wave in midterm,” World Of Charts (@WorldOfCharts1) told his X followers while sharing a 12‑hour Binance chart.

Major Dogecoin Upswing Incoming?

He referenced a post from April 13 where he predicted: “Doge: We caught this big move in Oct 2024, Dogecoin went more than 3×. Now again Doge [is] on [the] verge of massive breakout… expecting 3× from here.”

The chart shows five months of compression that began when DOGE topped at just under $0.48 in early December.

Since then, every rally has stalled beneath a descending resistance trendline, which now cuts through the mid‑$0.155 zone; parallel support currently tracks the $0.14 area after cushioning a pair of capitulation wicks in March and April. The price is now breaking out of the upper boundary for the first time in almost two weeks.

Related Reading

World Of Charts’ measured‑move overlay starts at the notional breakout above $0.17 and projects a vertical advance of $0.21804, implying a primary objective just shy of $0.39—a 138% gain from the trigger and within striking distance of the psychological $0.40 handle. If the setup delivers the same magnitude as last year’s wedge, the could ultimately test $0.65, completing a fresh three‑fold rally.

The time symmetry behind the call is hard to ignore: the current wedge has compressed for almost six months, mirroring the consolidation that preceded the October–December 2024 eruption from $0.11 to $0.48. Volume has thinned with each contraction cycle, a classic pre‑breakout signature, while momentum oscillators on lower time frames are beginning to tilt positive as spot reclaims its 50‑EMA.

Related Reading

Other analysts remain focused on Bitcoin’s grip over market beta. “If BTC breaks above $89K and shows conviction upwards I think Dogecoin gets back to $0.26 relatively quick,” cautions Kevin (@Kev_Capital_TA). “BTC holds the cards as always, especially with BTC dominance pushing higher and monetary policy still tight.” In his analysis, $0.26 represents the 0.618 Fibonacci retracement of the November–March slide, marking the first substantive hurdle even if DOGE clears wedge resistance.

From a pure chart‑based perspective, the battle lines are now sharply drawn. A decisive daily close above trendline and a successful retest would confirm the breakout, shift the red demand band into a springboard, and expose successive targets. Failure to punch through would keep price pinned inside the pattern, with any slip below $0.15 risking a slide toward structural support at $0.13 and, in extremis, the $0.11 pivot that launched last year’s parabolic ascent.

At press time, DOGE traded at $0.1641.

Featured image created with DALL.E, chart from TradingView.com

Source link

doge

Dogecoin Follows This Blueprint, Says Crypto Analyst

Published

2 weeks agoon

April 14, 2025By

admin

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

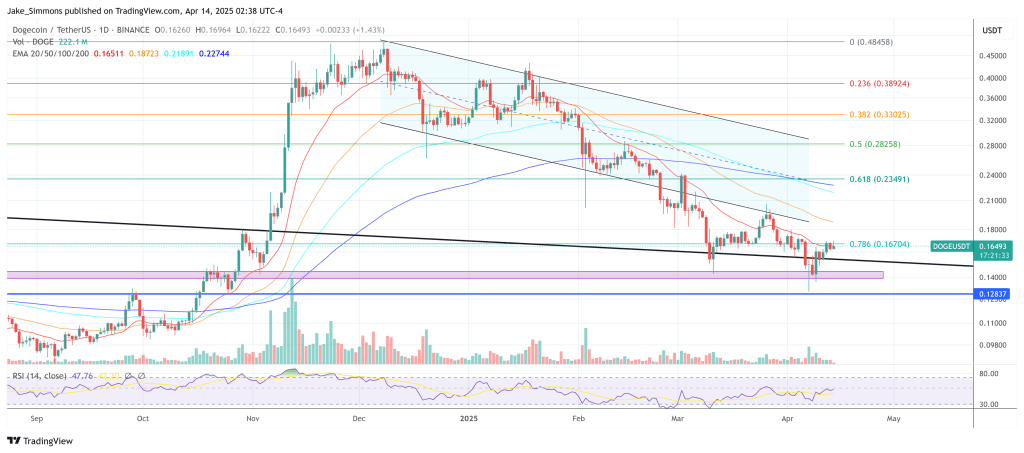

Dogecoin’s price action continues to honor the technical “blueprint” laid out by crypto analyst Kevin (@Kev_Capital_TA), who reaffirmed on Sunday that his strategic roadmap from March 22 remains intact. The weekly chart reveals an extended descending channel drawn with multiple yellow trend lines that originated in 2021 and constricted price action throughout 2022.

Within that formation, the most critical horizontal threshold appears to be $0.139, labeled on the chart as the “Last line in the sand” and described by Kevin as essential for preserving bullish market structure. He notes that maintaining durable weekly closes above this zone is paramount for further upside, while a decisive break beneath $0.139 would nullify the bullish thesis.

Dogecoin Follows The Blueprint

Dogecoin’s retracement from highs near $0.45 earlier this year has so far been contained by a confluence of support channels and Fibonacci retracement levels. According to Kevin’s chart, the primary Fib levels span from roughly $0.049 at the lower bound (0% Fib) to around $2.268 at the 1.414 extension.

Related Reading

Closer inspection shows intermediate Fibonacci markers at $0.090 (0.236), $0.138 (0.382), $0.190 (0.50), $0.262 (0.618), $0.413 (0.786), $0.542 (0.88), $0.738 (1.0), $0.934 (1.0866), and $1.543 (1.272). Since the price is hovering near $0.16–$0.17 at press time, Dogecoin has remained above the 0.382 retracement near $0.138, reinforcing Kevin’s argument that the risk-reward ratio at this level appears “absolutely phenomenal.”

Kevin’s March 22 update describes the confluence of several higher time frame indicators, including the Weekly Stochastic RSI, the 3-Day MACD, and the 2-Week Stochastic RSI, all of which he sees nearing full resets. He cites the previous weekly demand candle, which formed just above $0.139, as a key sign that buyers are stepping in to defend what he calls “the Last line of bull market support.”

The Weekly Stoch RSI on his chart is already situated at low levels, while the 3-Day MACD and 2-Week Stoch RSI appear roughly a month away from bottoming out. According to Kevin, these technical resets should serve as a springboard for Dogecoin’s next significant upward move, provided that Bitcoin, which he believes must hold above $70K in his scenario, remains stable enough to support broader market strength.

Related Reading

On Sunday, Kevin reminded his audience that this strategy, first made public on March 22, is going “exactly according to plan,” given Dogecoin’s confirmed bounce around the $0.139 region and the ongoing drift toward oversold conditions in multiple momentum gauges. He disclosed that his Patreon trading portfolio holds an average entry at $0.15 for this swing and noted that a swift rejection of sub-$0.139 weekly closes, coupled with the bullish stance of the higher time frame indicators, corroborates his confidence in Dogecoin’s recovery potential.

While he acknowledges that “lots of work” still needs to be done for Dogecoin to reclaim loftier levels near the 0.618 Fib around $0.262 or even the 0.786 Fib at $0.413, Kevin maintains that his initial thesis stands as long as the meme-inspired asset preserves its foothold above $0.139. For him, the risk of a breakdown is well-defined if the pivotal support gives way, but should the level persist, he sees the upside potential extending far beyond the current range. As of now, Dogecoin’s price continues to cling to that all-important line in the sand, keeping Kevin’s bullish blueprint very much alive.

At press time, DOGE traded at $0.16493.

Featured image created with DALL.E, chart from TradingView.com

Source link

doge

Dogecoin Bull Div Plays Out, Analyst Maps Next Price Targets

Published

2 weeks agoon

April 10, 2025By

admin

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

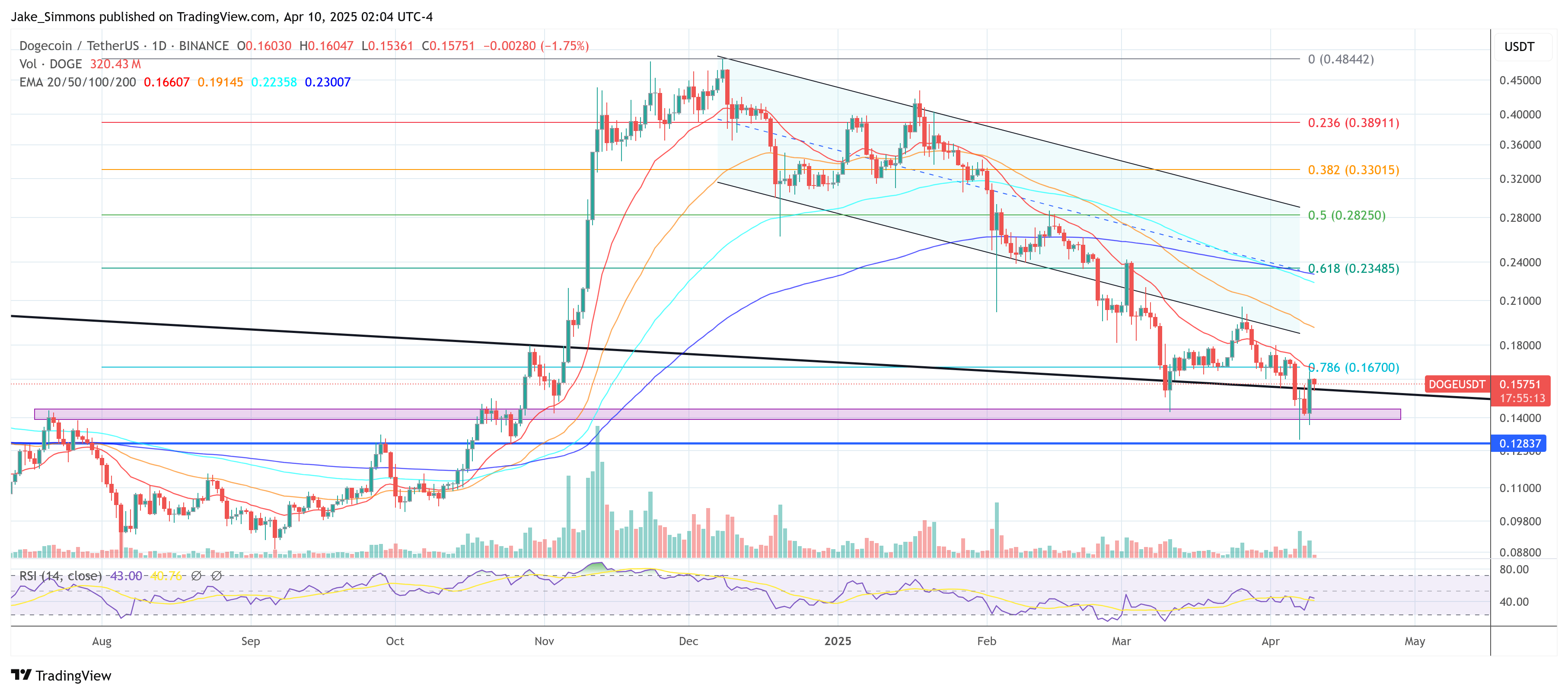

Dogecoin’s momentum has shifted dramatically following macroeconomic developments and a series of strong technical signals, according to crypto chartist Kevin (@Kev_Capital_TA). Yesterday, the broader crypto market surged after President Donald Trump announced a 90-day pause on tariffs for 75 countries, while raising China’s tariffs to 125%.

Bullish Momentum For Dogecoin

The news sent Bitcoin above the $80,000 threshold and catapulted several major altcoins, including Dogecoin, higher. “Daily Bullish divergence on Dogecoin starting to play here,” Kevin writes in his latest update, while cautioning that “obviously macro news has most to do with this, but nonetheless the charts were giving us hints ahead of time that the opportunity was not guaranteed but there.”

In the hours following the tariff announcement, Dogecoin rallied by approximately 13%, strengthening signs of a bullish divergence Kevin first flagged two days earlier. “Dogecoin came down once again to test the bull market structure ‘lines in the sand’ and somehow even though it cleanly broke through earlier in the day was able to recover and close the daily candle slightly above this support level,” he explained.

Related Reading

Kevin noted the parallel between Dogecoin’s bullish divergence and that of Bitcoin on the daily time frame, suggesting that renewed optimism for DOGE may be tied, in part, to the leading cryptocurrency’s resilience above its own pivotal support.

Kevin’s outlook is rooted in a multi-week assessment of Dogecoin’s technical posture. At the end of March, he pointed to a “weekly demand candle” and the ‘Last line of bull market support.” He emphasized how crucial it remains for Dogecoin to hold above the 0.139 mark. “It will continue to be absolutely vital that Dogecoin hold this level while it resets higher time frame indicators like the 3 Day MACD, Weekly Stoch RSI and 2W Stoch RSI all of which are getting very close to being fully reset,” he said.

DOGE Price Targets

He also described the potential upside for Dogecoin as “phenomenal” relative to the risk of losing that $0.139 threshold for multiple weekly closes. The chart’s Fibonacci retracement and extension levels suggest potential technical targets for Dogecoin that remain relevant for traders seeking directional cues.

Related Reading

These levels begin with the 0.236 at $0.09038, the 0.382 at $0.13827, the 0.5 at $0.19039, the 0.618 at $0.26216, the 0.65 at $0.28529, and the 0.70 at $0.3310. Higher up, the 0.786 reads $0.41339, the 0.88 is $0.54210, the 1.0 level marks $0.73839, and the 1.0866 is $0.93377.

Further on the extension side, the 1.272 stands at $1.54348, and the 1.414 appears at $2.26813. The analyst underscored that “as long as BTC holds these levels and does not lose $70K then I absolutely love this spot on DOGE,” highlighting how the broader market’s trajectory could shape Dogecoin’s path along these technical markers.

However, the coming days will reveal whether Dogecoin can build on the momentum that emerged amid the tariff-related market surge—and whether the well-worn phrase “the trend is your friend” will keep Dogecoin enthusiasts in a bullish mindset.

At press time, DOGE traded at $0.15751.

Featured image created with DALL.E, chart from TradingView.com

Source link

This Week in Crypto Games: Ubisoft’s ‘Might & Magic’, ‘Peaky Blinders’ in Development

Why Arbitrum-Nvidia Partnership Collapsed – And What It Means for Web3

Tariff Carnage Starting to Fulfill BTC’s ‘Store of Value’ Promise

The cost of innovation — Regulations are Web3’s greatest asset

Best Crypto to Buy as Derivatives Exchange CME Set to Launch XRP Futures

Metaplanet Buys Additional ¥1.92 Billion Worth Of Bitcoin

Here Are Four Signs the Stock Market Has Bottomed, According to Fundstrat’s Tom Lee

Bitcoin dips below $94,000 as ETFs record $3b weekly inflow

Bitcoin Post-Halving Price Performance Is the Worst on Record. Why?

Expert Predicts Start Date For Pi Network Price Pump

GameFi Tokens Show Signs of Life After Gala Games, White House Tie-Up

Bitcoin trades at ‘40% discount’ as spot BTC ETF buying soars to $3B in one week

Bitcoin Continues To Flow Out Of Major Exchanges — Supply Squeeze Soon?

BlackRock’s Bitcoin ETF Sees $643 Million Inflows

DePIN Altcoin Outpaces Crypto Market and Skyrockets by Nearly 44% Following High-Profile Exchange Listing

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Crypto’s Big Trump Gamble Is Risky

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

I’m Grateful for Trump’s Embrace of Bitcoin

Trending

24/7 Cryptocurrency News6 months ago

24/7 Cryptocurrency News6 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin3 months ago

Bitcoin3 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Ripple Price1 month ago

Ripple Price1 month ago3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin6 months ago

Bitcoin6 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Opinion6 months ago

Opinion6 months agoCrypto’s Big Trump Gamble Is Risky

Bitcoin5 months ago

Bitcoin5 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Altcoins3 months ago

Altcoins3 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

✓ Share: