Altcoins

Dogecoin Primed for a Price Rebound As Crypto Whales Accumulate DOGE, According to Analyst

Published

3 months agoon

By

admin

A popular crypto analyst says one technical signal suggests that top meme token Dogecoin (DOGE) could be primed for a bounce.

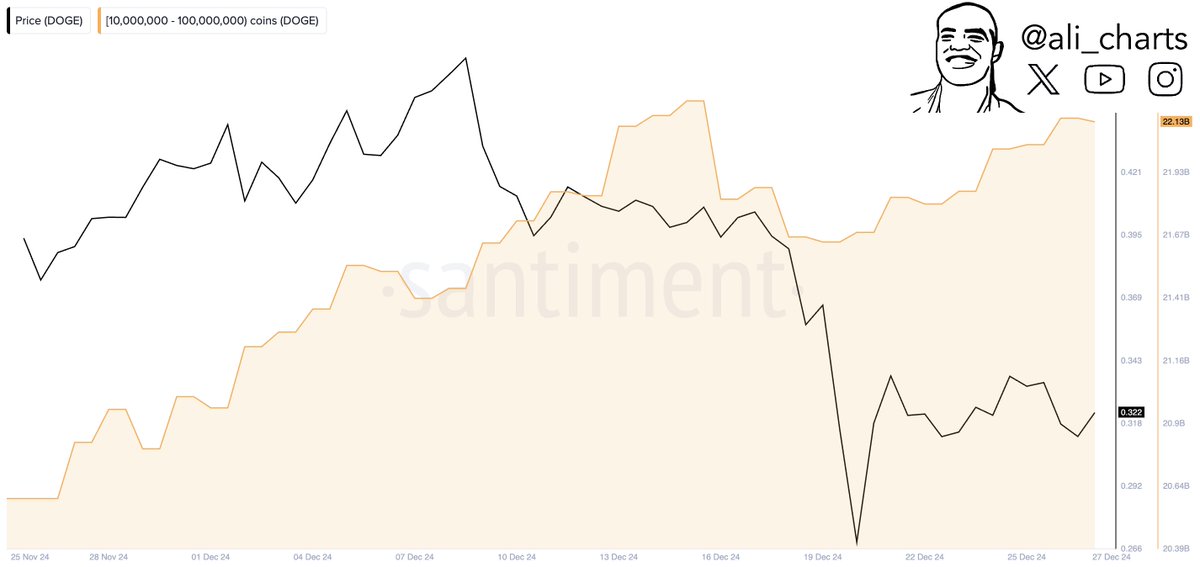

Ali Martinez tells his 104,600 followers on the social media platform X that the Tom DeMark (TD) Sequential Indicator presented a bullish signal for DOGE.

“The TD Sequential presents a buy signal on the Dogecoin DOGE four-hour chart, anticipating a price rebound!”

Traders use the TD Sequential Indicator to predict potential trend reversals for tokens based on the closing prices of their 13 previous bars or candles.

Martinez also notes that Dogecoin whales bought more than 90 million DOGE in the past two days.

DOGE is trading at $0.314 at time of writing, a fractional decrease in the past 24 hours.

Looking at Bitcoin (BTC), Martinez warns that traders should be worried if the top-ranked crypto asset by market cap drops below a certain price level.

“You don’t want BTC to dip below $92,730 – it’s essentially free-fall territory if that level breaks.”

Martinez suggests that below $92,730, the next on-chain support for BTC hovers at around $69,000 based on Glassnode’s UTXO (Unspent Transaction Output) Realized Price Distribution, a metric that shows the amount of Bitcoin that last moved within a specific price bucket.

But while Martinez is sounding the alarm about a potential pullback for BTC, he notes that a 20-30% correction represents “the most bullish thing that could happen to Bitcoin.”

Bitcoin is trading at $94,671 at time of writing.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

You may like

Elizabeth Warren Calls Stablecoin Bill a Trump and Musk ‘Grift’

Crypto scammers nabbed in India for $700k fraud posing as a Japanese exchange

BTC in Stasis Below $88K as Trump Suggests Bigger Tariffs on EU, Canada

Dogecoin Price Eyes 10x Breakout After Elon Musk Ghibli Anime

XRP Price Rejected at Resistance—Are Bears Taking Control?

OpenAI expects to 3X revenue in 2025 but Chinese AI firms are heating up

Altcoins

‘Chart Is Still Broken’ – Crypto Analyst Predicts Sustained Downtrend for Altcoins Until This Takes Place

Published

8 hours agoon

March 27, 2025By

admin

A seasoned crypto trader is warning that the current bounce in the altcoin market will likely be short-lived.

Pseudonymous analyst The Flow Horse tells his 266,500 followers on the social media platform X that he thinks crypto is still bearish and the latest rally will probably lead to another leg down.

According to the analyst, the current bounce has not changed the bearish market structure of crypto.

“Bearish still on the high time frame until proven otherwise.

I can’t see any reason why this isn’t a relief rally and markets won’t continue to suck the next few months.

Chart is still broken.”

Elaborating on his bearish stance on crypto, the trader says on the instant messaging platform Telegram that the downtrend will likely persist unless Bitcoin (BTC) flips a key price area into support.

“I think we are at the part where the correction can be, as I said the other day, one that is more through time than through price.

I will be looking at how FARTCOIN, HYPE, PEPE, ENA and BERA continue to trade.

Being that it is a Bitcoin dominance macro trend, there is no reason to assume that changes, and any success in alts is going to come down to if BTC can turn this $90,000-$93,000 level into support.”

At time of writing, Bitcoin is trading for $87,813.

Follow us on X, Facebook and Telegram

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: MIdjourney

Source link

Altcoins

Solana Rises As BlackRock Brings Its $1,700,000,000 Tokenized Treasury Fund to Ethereum Rival’s Chain

Published

2 days agoon

March 25, 2025By

admin

Solana (SOL) is green on the day on reports that BlackRock is moving its blockchain-based money market fund onto the Ethereum (ETH) competitor’s network.

Fortune reports that the world’s largest asset manager is adding its $1.7 billion BlackRock USD Institutional Digital Liquidity Fund (BUIDL) to the Solana blockchain.

Solana is trading for $145 at time of writing, up nearly 19% in the last week.

Launched a year ago, BUIDL uses traditional money market funds, which investors use to store cash in the near term and earn yield on it, combined with blockchain payment properties.

Solana is now the seventh blockchain compatible with the tokenized money market fund BUIDL, after its initial launch on Ethereum.

BlackRock’s technology partner, Securitize, says the fund is expected to exceed $2 billion in cash and Treasury bills by early April.

Says Michael Sonnenshein, COO at Securitize,

“We’re making [money market funds] unboring. We are advancing and leapfrogging some of the quote-unquote deficiencies that money markets may have in their traditional formats.”

One benefit BUIDL offers over traditional money market funds is 24/7 trading.

Says Lily Liu, president of the Solana Foundation,

“Our vision for why on-chain finance adds more value is because you can do more things with those assets on chain than you could if [they’re] sitting in your brokerage account.”

BUIDL is part of BlackRock’s long-term digital asset strategy, which includes its spot-Bitcoin (BTC) exchange-traded fund (ETF).

According to BlackRock CEO Larry Fink, the future of finance includes the “tokenization of every financial asset.”

Follow us on X, Facebook and Telegram

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: DALLE3

Source link

Altcoin

XRP Breakout On Hold? Financial Expert Reveals What’s Missing

Published

2 days agoon

March 25, 2025By

admin

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

XRP remains stuck around the $2 level, with experts issuing warnings of restricted near-term growth prospects. According to recent analysis, the digital currency is going through a phase of uncommon stability that has investors speculating about its next step.

Related Reading

Investor Sentiment Dampens Market Momentum

According to financial commentator Austin Hilton, millions of crypto traders have withdrawn from active participation. The market is stuck in neutral, as traders are simply waiting for a big event to set things into motion. The volumes of trade have been above $4 billion at peak levels, but the price itself remains virtually unchanged.

Summer Slowdown Impacts Crypto Trading

Analysts cite seasonal patterns as the major reason for XRP’s current behavior. Hilton describes how summer months usually experience lower trading volumes, with investors more inclined to engage in private activities than respond to market activity. This pattern might continue until July, possibly maintaining XRP’s price relatively stable.

A realistic XRP price prediction!

– Lets talk about the resistance levels for $XRP

– Also, discussed are the support levels that you need to know about

– What you need to know about your XRP holdings – so that you can navigate what is going on right now pic.twitter.com/h9kxG3a0Ex— Austin Hilton (@austinahilton) March 23, 2025

Price Barriers Create Market Challenges

Technical analysis indicates key price levels for XRP. Resistance levels are found at $2.61 and $2.81, while support levels are at $2.22 and $2.31. Experts caution that in the absence of heavy buy pressure, the cryptocurrency might not be able to overcome these levels. Currently, XRP is trading at $2.44, with a modest 0.04% gain over the last 24 hours.

XRP market cap currently at $141 billion. Chart: TradingView.com

Long-Term Outlook Remains Hopeful

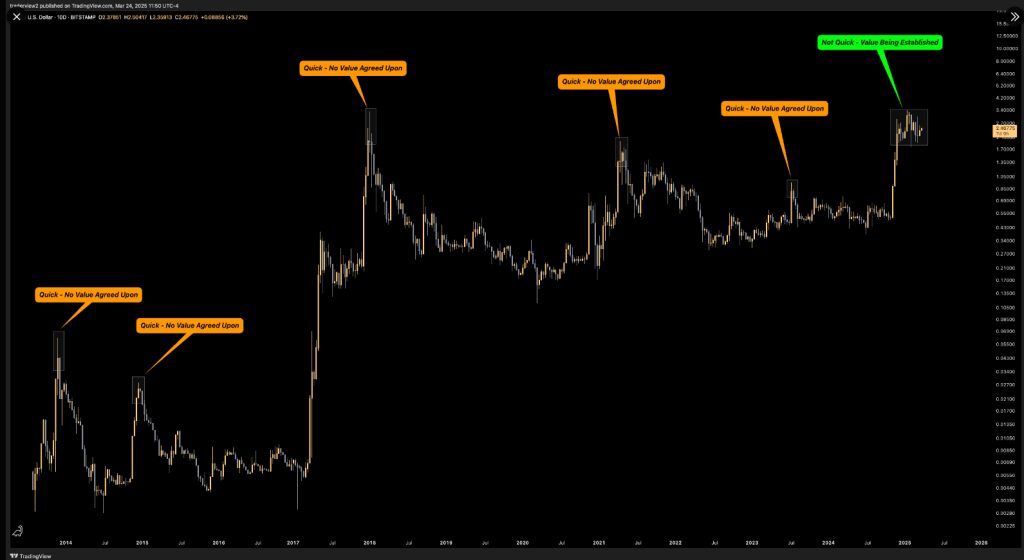

Despite current market challenges, some experts remain optimistic. Market analyst Dom suggests the current price consolidation might indicate a strong foundation for future growth. Unlike previous market cycles where XRP experienced rapid price spikes and drops, the current stability suggests a more measured approach.

There’s one reason I will be pretty surprised if $XRP does not go higher this year, read along –

Every time $XRP has historically put in a multi month or year top, it did it quickly (as shown below)

Essentially, it never showed any mid term acceptance at those higher… pic.twitter.com/RahjM2xHwz

— Dom (@traderview2) March 24, 2025

A number of possible catalysts are on the horizon, such as developments in XRP ETF products, continued action in the SEC vs. Ripple case, and possible reserve disclosures. As of yet, however, none of these events have caused major market activity.

Related Reading

Institutional investors remain quietly accumulating digital assets, creating yet another level of sophistication to the current market dynamics. Hilton advises not to anticipate extreme price increases in the near term, highlighting that there needs to be a major positive event for drastic change.

As the cryptocurrency market keeps growing, XRP investors are warned to keep close watch on the market conditions. The fourth quarter could see things pick up once again, but for the meantime, patience seems to be the main approach for those who possess the cryptocurrency.

Featured image from Gemini Imagen, chart from TradingView

Source link

Elizabeth Warren Calls Stablecoin Bill a Trump and Musk ‘Grift’

Crypto scammers nabbed in India for $700k fraud posing as a Japanese exchange

BTC in Stasis Below $88K as Trump Suggests Bigger Tariffs on EU, Canada

Dogecoin Price Eyes 10x Breakout After Elon Musk Ghibli Anime

XRP Price Rejected at Resistance—Are Bears Taking Control?

OpenAI expects to 3X revenue in 2025 but Chinese AI firms are heating up

‘Chart Is Still Broken’ – Crypto Analyst Predicts Sustained Downtrend for Altcoins Until This Takes Place

GameStop Announces $1.3 Billion Fundraising Plan To Purchase Bitcoin

Wyoming Governor Backs Away From State’s Failed Bitcoin Reserve Push

Priced at $0.20, this Solana competitor could be the next crypto to 20x

Why Are We Still Under the SEC’s Gun?

Expert Predicts XRP ETF Approval Is Only A ‘Matter Of Time’ As Approval Odds Soar

Analyst Unveils Extended XRP Price Target To $44, Reveals When To Take Profits

Would GameStop buying Bitcoin help BTC price hit $200K?

New SEC Chair Paul Atkins Holds $6,000,000 in Crypto-Related Investments – Here’s His Portfolio: Report

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Crypto’s Big Trump Gamble Is Risky

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

Trump’s Coin Is About As Revolutionary As OneCoin

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Is $200,000 a Realistic Bitcoin Price Target for This Cycle?

Trending

24/7 Cryptocurrency News5 months ago

24/7 Cryptocurrency News5 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin2 months ago

Bitcoin2 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Altcoins2 months ago

Altcoins2 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin4 months ago

Bitcoin4 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Price analysis5 months ago

Price analysis5 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x