doge

Dogecoin Ready To Hit $1 – Price Struggles To Break Above Major Resistance

Published

5 months agoon

By

admin

Dogecoin (DOGE) is currently trading below a key resistance level, signaling the potential for a bullish breakout. However, the price has struggled to surpass this critical barrier, creating uncertainty about the next major move. For Dogecoin to achieve new highs and rekindle investor enthusiasm, breaking this resistance is essential.

Top crypto analyst Scofield recently shared a detailed technical analysis on X, highlighting Dogecoin’s readiness to test the psychological $1 mark. According to Scofield, DOGE’s recent price action shows consolidation near resistance, which often precedes a decisive move. He emphasized that a breakout above this level could ignite a rally, pushing the price toward its long-awaited milestone.

Related Reading

Despite this optimism, traders should approach with caution. The struggle to clear resistance indicates that the market may require stronger buying pressure or a catalyst to trigger the next leg up. If Dogecoin fails to break through, it risks a retrace to lower levels, potentially dampening current bullish sentiment.

As the broader market shows signs of recovery, Dogecoin remains a focal point for investors seeking high-growth opportunities. The coming days will likely determine whether DOGE can reclaim its momentum and make a serious run toward the $1 level.

Dogecoin Pushes Above Key Levels

Dogecoin has surged past critical supply levels, positioning itself for a potential rally that could push prices significantly higher. Currently, DOGE is eyeing the last major resistance zone that must be breached to confirm the start of a new bullish cycle. This level represents a decisive point, and a successful breakout would likely attract substantial buying pressure.

Top analyst Scofield, known for his accurate technical predictions, recently shared insights on X regarding Dogecoin’s current setup. His analysis highlights a bullish triangle pattern forming on DOGE’s chart, a structure often indicative of an imminent breakout. According to Scofield, the pattern’s apex suggests that Dogecoin is nearing a decisive move, with the psychological $1 mark set as the next major target if the breakout materializes.

Scofield’s technical analysis underscores key support levels that DOGE has successfully defended, reinforcing the asset’s bullish potential. The triangle pattern also reflects reduced selling pressure, aligning with growing optimism among traders. However, Scofield cautions that any failure to break above the resistance could lead to a retest of lower levels, delaying the anticipated rally.

Related Reading

As Dogecoin captures increasing attention in the crypto market, all eyes remain on this pivotal resistance zone. Breaking above it would signal a renewed bullish momentum, setting the stage for DOGE to test and potentially surpass the $1 milestone.

Technical Details: DOGE Ready To Rally Again

Dogecoin is at $0.426 following an 18% surge to test local supply at $0.43. This critical resistance level has proven challenging for DOGE, as the price has struggled to break above it for over two weeks. Despite the recent upward momentum, the market remains cautious, with analysts highlighting the significance of a decisive breakout above $0.43.

A successful push past this resistance could set the stage for a massive rally, attracting renewed interest from both retail and institutional investors. Historically, such breakouts in Dogecoin’s price action have triggered significant upward movements, making this level a key focus for market participants. However, the inability to breach $0.43 could lead to further consolidation below this level, frustrating bullish sentiment.

Related Reading

Adding to the uncertainty is the risk of a potential correction. If DOGE fails to maintain its current levels or faces increased selling pressure, it could revisit lower price points, possibly retesting supports around $0.38 or lower. Analysts emphasize the need for patience, as Dogecoin’s next major move will likely hinge on breaking the $0.43 resistance. For now, DOGE’s trajectory remains uncertain, but the potential for a breakout keeps it on the radar of traders and investors alike.

Featured image from DALL-E, chart from TradingView

Source link

You may like

Apple Delists 14 Crypto Apps in South Korea Including KuCoin and MEXC Exchanges Amid Regulatory Crackdown

Athens Exchange Group eyes first onchain order book via Sui

Futureverse Acquires Candy Digital, Taps DC Comics and Netflix IP to Boost Metaverse Strategy

Court Grants Ripple And SEC’s Joint Motion To Suspend Appeal

AVAX Falls 2.1% as Nearly All Assets Trade Lower

What is a VTuber, and how do you become one in 2025?

doge

Dogecoin Whales Buy 800 Million DOGE in 48 Hours – Smart Money Or Bull Trap?

Published

24 hours agoon

April 15, 2025By

admin

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Dogecoin is showing signs of strength after weeks of volatility and market uncertainty. The meme-inspired cryptocurrency has held firm above crucial support levels and is now pushing toward a potential recovery rally. After reclaiming the $0.15 mark, bulls are looking to build momentum, with the $0.17 level emerging as the next major resistance to break. A successful move above this threshold could confirm a broader trend reversal and reignite bullish sentiment across the meme coin sector.

Related Reading

Supporting this outlook, recent on-chain data from Santiment shows that Dogecoin whales have been highly active—accumulating over 800 million DOGE in the last 48 hours. This surge in whale buying activity adds weight to the bullish thesis, suggesting that larger players are positioning for a move higher. The renewed accumulation, paired with improving technical conditions, has sparked optimism among traders and investors who believe Dogecoin could be gearing up for its next leg upward.

Still, caution remains, as global macroeconomic tensions continue to create unpredictable conditions across the financial markets. For Dogecoin to confirm a recovery rally, bulls must hold current levels and push through near-term resistance in the coming sessions.

Dogecoin Faces Crucial Resistance As Whale Accumulation Builds

Dogecoin is now at a pivotal point, trading just below key resistance levels after a strong rebound from recent lows. As broader market conditions improve and global tensions—especially around trade and tariffs—begin to cool, analysts are turning their attention to assets like DOGE that have lagged in performance but now show signs of potential upside. The meme coin has managed to reclaim the $0.15 mark, but to validate a broader recovery rally, bulls must push beyond the $0.17–$0.18 zone in the days ahead.

Momentum indicators are beginning to flip bullish, and some market watchers suggest that Dogecoin could be preparing for a breakout. However, sentiment remains mixed, with others pointing to the possibility of a continuation of the downtrend, particularly if resistance holds or macroeconomic conditions deteriorate. Despite this uncertainty, on-chain data paints a more optimistic picture.

Top analyst Ali Martinez shared insights on X, revealing that Dogecoin whales have accumulated over 800 million DOGE in the last 48 hours. This level of accumulation by large holders suggests renewed confidence in the asset’s short-term potential. Historically, such whale activity has often preceded strong price moves in DOGE.

For bulls to take control, Dogecoin must break above near-term resistance and sustain momentum amid a still-volatile environment. A failure to do so could see the asset slip back into consolidation or even retest previous lows. The coming week will be critical for determining whether DOGE’s next move is a breakout or another pullback.

Related Reading

DOGE Price Holds $0.16 As Bulls Aim for Breakout

Dogecoin is trading at $0.16 after failing to reclaim the 4-hour 200 Moving Average (MA) near $0.168, a level that has acted as strong short-term resistance. Despite recent bullish momentum across the crypto market, DOGE bulls are struggling to regain control. The $0.15 level now serves as critical support. If Dogecoin holds this area, there’s a strong chance it could push higher in the coming sessions.

A successful break above $0.17 would be significant, potentially opening the door to a rally toward $0.20, a level not seen since early April. However, price rejection and continued weakness around $0.168 suggest that sellers are still active, and bulls need to reclaim this moving average to build momentum.

Related Reading

If DOGE loses the $0.15 mark, downside risk increases sharply. A drop to $0.13—or even lower—is likely as bearish pressure could intensify in a volatile market. Investors will be watching closely for a clear move in either direction, as Dogecoin sits at a key inflection point. Volume and on-chain data, including recent whale accumulation, suggest potential, but confirmation must come through price action above immediate resistance.

Featured image from Dall-E, chart from TradingView

Source link

doge

Dogecoin Follows This Blueprint, Says Crypto Analyst

Published

2 days agoon

April 14, 2025By

admin

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

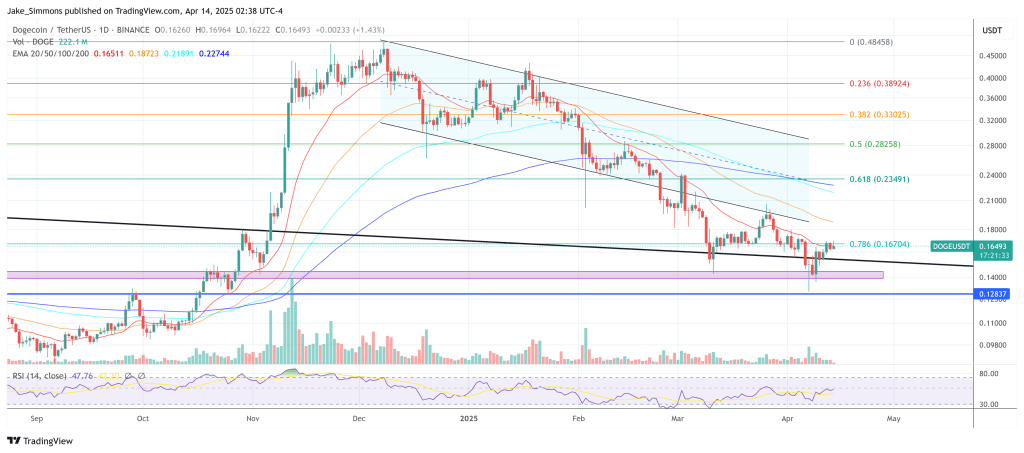

Dogecoin’s price action continues to honor the technical “blueprint” laid out by crypto analyst Kevin (@Kev_Capital_TA), who reaffirmed on Sunday that his strategic roadmap from March 22 remains intact. The weekly chart reveals an extended descending channel drawn with multiple yellow trend lines that originated in 2021 and constricted price action throughout 2022.

Within that formation, the most critical horizontal threshold appears to be $0.139, labeled on the chart as the “Last line in the sand” and described by Kevin as essential for preserving bullish market structure. He notes that maintaining durable weekly closes above this zone is paramount for further upside, while a decisive break beneath $0.139 would nullify the bullish thesis.

Dogecoin Follows The Blueprint

Dogecoin’s retracement from highs near $0.45 earlier this year has so far been contained by a confluence of support channels and Fibonacci retracement levels. According to Kevin’s chart, the primary Fib levels span from roughly $0.049 at the lower bound (0% Fib) to around $2.268 at the 1.414 extension.

Related Reading

Closer inspection shows intermediate Fibonacci markers at $0.090 (0.236), $0.138 (0.382), $0.190 (0.50), $0.262 (0.618), $0.413 (0.786), $0.542 (0.88), $0.738 (1.0), $0.934 (1.0866), and $1.543 (1.272). Since the price is hovering near $0.16–$0.17 at press time, Dogecoin has remained above the 0.382 retracement near $0.138, reinforcing Kevin’s argument that the risk-reward ratio at this level appears “absolutely phenomenal.”

Kevin’s March 22 update describes the confluence of several higher time frame indicators, including the Weekly Stochastic RSI, the 3-Day MACD, and the 2-Week Stochastic RSI, all of which he sees nearing full resets. He cites the previous weekly demand candle, which formed just above $0.139, as a key sign that buyers are stepping in to defend what he calls “the Last line of bull market support.”

The Weekly Stoch RSI on his chart is already situated at low levels, while the 3-Day MACD and 2-Week Stoch RSI appear roughly a month away from bottoming out. According to Kevin, these technical resets should serve as a springboard for Dogecoin’s next significant upward move, provided that Bitcoin, which he believes must hold above $70K in his scenario, remains stable enough to support broader market strength.

Related Reading

On Sunday, Kevin reminded his audience that this strategy, first made public on March 22, is going “exactly according to plan,” given Dogecoin’s confirmed bounce around the $0.139 region and the ongoing drift toward oversold conditions in multiple momentum gauges. He disclosed that his Patreon trading portfolio holds an average entry at $0.15 for this swing and noted that a swift rejection of sub-$0.139 weekly closes, coupled with the bullish stance of the higher time frame indicators, corroborates his confidence in Dogecoin’s recovery potential.

While he acknowledges that “lots of work” still needs to be done for Dogecoin to reclaim loftier levels near the 0.618 Fib around $0.262 or even the 0.786 Fib at $0.413, Kevin maintains that his initial thesis stands as long as the meme-inspired asset preserves its foothold above $0.139. For him, the risk of a breakdown is well-defined if the pivotal support gives way, but should the level persist, he sees the upside potential extending far beyond the current range. As of now, Dogecoin’s price continues to cling to that all-important line in the sand, keeping Kevin’s bullish blueprint very much alive.

At press time, DOGE traded at $0.16493.

Featured image created with DALL.E, chart from TradingView.com

Source link

doge

Dogecoin Bull Div Plays Out, Analyst Maps Next Price Targets

Published

6 days agoon

April 10, 2025By

admin

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

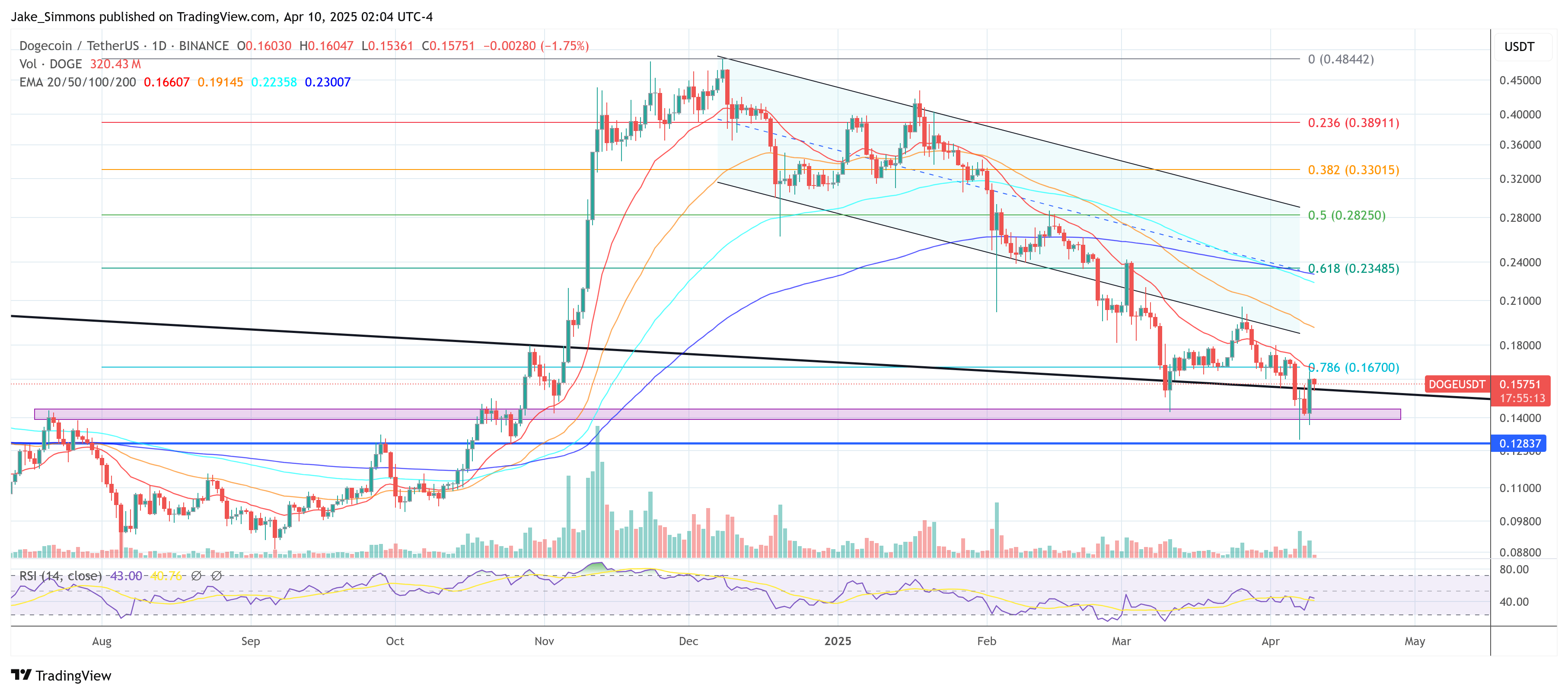

Dogecoin’s momentum has shifted dramatically following macroeconomic developments and a series of strong technical signals, according to crypto chartist Kevin (@Kev_Capital_TA). Yesterday, the broader crypto market surged after President Donald Trump announced a 90-day pause on tariffs for 75 countries, while raising China’s tariffs to 125%.

Bullish Momentum For Dogecoin

The news sent Bitcoin above the $80,000 threshold and catapulted several major altcoins, including Dogecoin, higher. “Daily Bullish divergence on Dogecoin starting to play here,” Kevin writes in his latest update, while cautioning that “obviously macro news has most to do with this, but nonetheless the charts were giving us hints ahead of time that the opportunity was not guaranteed but there.”

In the hours following the tariff announcement, Dogecoin rallied by approximately 13%, strengthening signs of a bullish divergence Kevin first flagged two days earlier. “Dogecoin came down once again to test the bull market structure ‘lines in the sand’ and somehow even though it cleanly broke through earlier in the day was able to recover and close the daily candle slightly above this support level,” he explained.

Related Reading

Kevin noted the parallel between Dogecoin’s bullish divergence and that of Bitcoin on the daily time frame, suggesting that renewed optimism for DOGE may be tied, in part, to the leading cryptocurrency’s resilience above its own pivotal support.

Kevin’s outlook is rooted in a multi-week assessment of Dogecoin’s technical posture. At the end of March, he pointed to a “weekly demand candle” and the ‘Last line of bull market support.” He emphasized how crucial it remains for Dogecoin to hold above the 0.139 mark. “It will continue to be absolutely vital that Dogecoin hold this level while it resets higher time frame indicators like the 3 Day MACD, Weekly Stoch RSI and 2W Stoch RSI all of which are getting very close to being fully reset,” he said.

DOGE Price Targets

He also described the potential upside for Dogecoin as “phenomenal” relative to the risk of losing that $0.139 threshold for multiple weekly closes. The chart’s Fibonacci retracement and extension levels suggest potential technical targets for Dogecoin that remain relevant for traders seeking directional cues.

Related Reading

These levels begin with the 0.236 at $0.09038, the 0.382 at $0.13827, the 0.5 at $0.19039, the 0.618 at $0.26216, the 0.65 at $0.28529, and the 0.70 at $0.3310. Higher up, the 0.786 reads $0.41339, the 0.88 is $0.54210, the 1.0 level marks $0.73839, and the 1.0866 is $0.93377.

Further on the extension side, the 1.272 stands at $1.54348, and the 1.414 appears at $2.26813. The analyst underscored that “as long as BTC holds these levels and does not lose $70K then I absolutely love this spot on DOGE,” highlighting how the broader market’s trajectory could shape Dogecoin’s path along these technical markers.

However, the coming days will reveal whether Dogecoin can build on the momentum that emerged amid the tariff-related market surge—and whether the well-worn phrase “the trend is your friend” will keep Dogecoin enthusiasts in a bullish mindset.

At press time, DOGE traded at $0.15751.

Featured image created with DALL.E, chart from TradingView.com

Source link

Apple Delists 14 Crypto Apps in South Korea Including KuCoin and MEXC Exchanges Amid Regulatory Crackdown

Athens Exchange Group eyes first onchain order book via Sui

Futureverse Acquires Candy Digital, Taps DC Comics and Netflix IP to Boost Metaverse Strategy

Court Grants Ripple And SEC’s Joint Motion To Suspend Appeal

AVAX Falls 2.1% as Nearly All Assets Trade Lower

What is a VTuber, and how do you become one in 2025?

Top Expert’s Update Sets $10 Target

How Academia Interacts With The Bitcoin Ecosystem

AB DAO and Bitget Launch Dual Reward Campaign, Distributing $2.6M Worth of $AB Globally

AI crypto tokens at risk as Nvidia faces restrictions on China exports

Coinbase Urges Australia to Vote for Crypto Progress in May

How High Would Pi Network Price Go If Pi Coin Adopts Transparency to Avoid Mantra Pitfalls

XRP’s ‘Rising Wedge’ Breakdown Puts Focus on $1.6 Price Support

China selling seized crypto to top up coffers as economy slows: Report

Ethereum Price Dips Again—Time to Panic or Opportunity to Buy?

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Crypto’s Big Trump Gamble Is Risky

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

Has The Bitcoin Price Already Peaked?

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

I’m Grateful for Trump’s Embrace of Bitcoin

Trending

24/7 Cryptocurrency News5 months ago

24/7 Cryptocurrency News5 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin3 months ago

Bitcoin3 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Altcoins3 months ago

Altcoins3 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin5 months ago

Bitcoin5 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Price analysis5 months ago

Price analysis5 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x