Bitcoin

Donald Trump Vows to Propel Bitcoin to New Heights

Published

1 month agoon

By

admin

In a recent series of tweets, David Bailey, CEO of BTC Inc, shared highlights from a private conversation with President Donald Trump. Bailey revealed that Trump expressed unwavering support for the Bitcoin community. According to Bailey, the former president stated, “He’s with us 100%, we’re going to send things to much greater heights, and we’re going to outcompete China and other countries that want to take it from us.“

Just talked with @realDonaldTrump and thanked him for keeping his promises to our industry and to Ross. I asked him if he wanted to share a message with the Bitcoin community…

He said he’s with us 100%, we’re going to send Bitcoin to much greater heights, and we’re going to…

— David Bailey

$0.85mm/btc is the floor (@DavidFBailey) January 26, 2025

Bailey’s tweets sparked immediate interest and debate within the community. While many were enthusiastic about Trump’s purported endorsement, skeptics questioned the authenticity of the statements. One user’s comment, “Record the talk next time, because nobody I’m talking with believes these tweets,” captured the sentiments of some within the community.

Related: David Bailey Forecasts $1M Bitcoin Price During Trump Presidency

Bailey addressed these concerns head-on, emphasizing his respect for the privacy of the conversation. “I would never record a private conversation with the President and share it publicly to score points on the internet,” Bailey responded. This statement reaffirmed his commitment to ethical practices, even as it left some doubters unconvinced.

In the tweet’s comment section, another user raised a specific question about the Executive Order instructing the President’s Working Group on Digital Asset Markets to evaluate the potential creation of a national digital asset stockpile. The user highlighted concerns “over the possibility of shitcoins in the stockpile.”

Bailey’s response shed light on the scope of the conversation with Trump. “We talked for ~10 minutes. Covered a few topics. I don’t think he’s aware of the concern, and I didn’t raise it,” he noted.

Related: Trump Signs Executive Order to Explore a U.S. Strategic Bitcoin Reserve

Eight months ago, Bailey collaborated with the Trump campaign to develop their policy agenda on these matters. This collaboration was part of Bailey’s ongoing efforts to engage political leaders and shape policy discussions.

For the past month we have been working with the Trump campaign to develop their bitcoin and crypto policy agenda. We proposed a comprehensive executive order for President Trump to sign on day 1. I will be sharing those details soon. This week Trump took the first step, but…

— David Bailey

$0.85mm/btc is the floor (@DavidFBailey) May 11, 2024

This dialogue underscores the growing intersection between the community and politics, with these topics increasingly finding their place in national and global policy discussions. While Bailey’s exchange with Trump may not have resolved every concern within the community, it reflects a broader effort to engage influential figures on the future of these matters. As the community continues to advocate for its values, such conversations could play a pivotal role in shaping the direction of policy in the United States.

Source link

You may like

‘This Is a Good Sign’: Crypto Analyst Says Bitcoin at a Key Inflection Point, Unveils Breakout Targets for BTC

Meteora shares two proposals on MET token allocation

Trump Aides Look To Reform USAID With Blockchain For ‘Transparency’: Report

Ethereum Price Eyes 50% Drop Amid Heavy ETH Whale Profit Booking

Polymarket is Over 90% Accurate in Predicting World Events: Research

Bad news Bitcoin bulls, the long-hoped-for retail is already here: CryptoQuant

Bitcoin

‘This Is a Good Sign’: Crypto Analyst Says Bitcoin at a Key Inflection Point, Unveils Breakout Targets for BTC

Published

2 hours agoon

March 21, 2025By

admin

A widely followed analyst says Bitcoin (BTC) is showing signs of being on the verge of a massive breakout.

The analyst pseudonymously known as Credible Crypto tells his 462,900 followers on the social media platform X that Bitcoin may reclaim the $100,000 range if BTC can break through resistance around the $88,000 level.

“We’re at a key inflection point around this region, but since we went up to tag it BEFORE going down to range lows this is a good sign. It increases the odds that if we reject here but hold range lows [at around $78,000], the next move up will be expansion and a true breakout through not just this level but the original supply zone above in RED that we first rejected from. All eyes on this key zone for now.”

The analyst says Bitcoin’s dip to the $84,000 range after tagging $87,000 on Thursday keeps the flagship crypto asset on target to reclaim the $100,000 level.

“A perfect rejection so far.”

Bitcoin is trading for $84,427 at time of writing, down 1.5% in the last 24 hours.

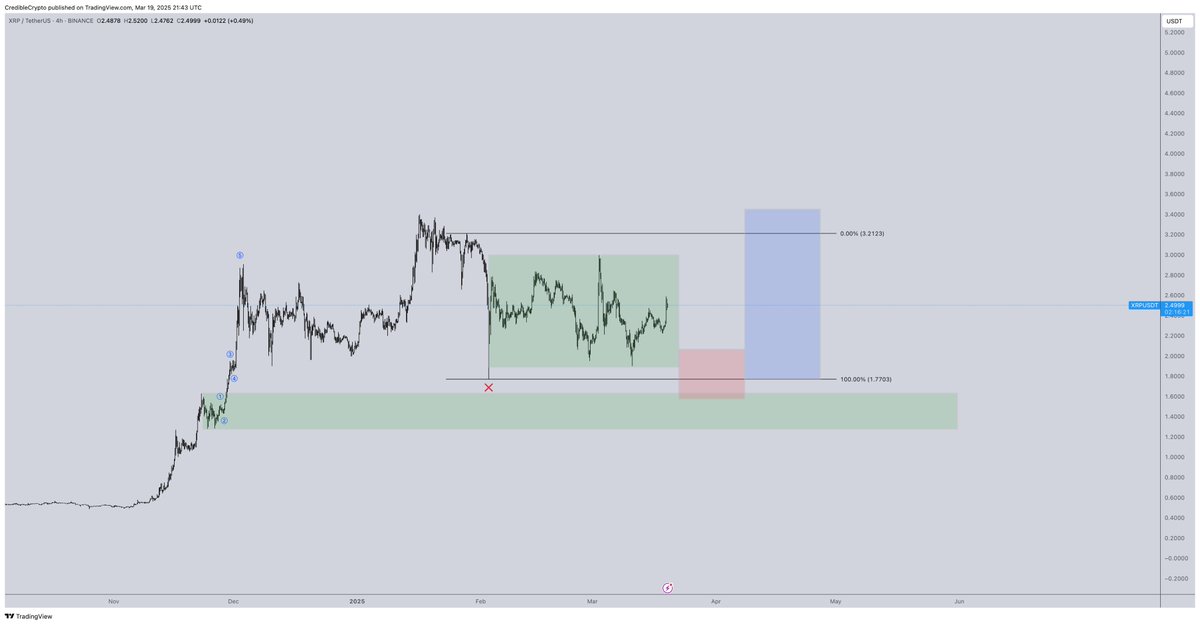

Next up, the analyst suggests payments token XRP may dip below $2.00 before rallying to its all-time high of about $3.40.

“This is still the game plan for XRP by the way. If we don’t get it, we don’t get it, and we ride spot to double digits regardless. But I’m not interested in jumping into fresh longs mid-range. Hoping people choose to fade this push so we get what would be a fantastic opportunity.”

XRP is trading for $2.45 at time of writing, down 1.7% in the last 24 hours.

Follow us on X, Facebook and Telegram

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

Bitcoin

Top 6 Important Fed Decisions To Know After SEC Drops Ripple Lawsuit Appeal

Published

8 hours agoon

March 21, 2025By

adminReason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

The crypto industry received a significant legal victory as Ripple CEO Brad Garlinghouse announced on March 19 that the U.S. Securities and Exchange Commission (SEC) had officially dropped its appeal against the company. The announcement came in a video posted on social media platform X, where Garlinghouse noted the regulatory agency’s decision to end its pursuit of further litigation.

Besides this interesting development, another major financial development has taken center stage in the crypto market in the past 24 hours; the outcome of the Federal Reserve’s latest meeting.

Fed Keeps Interest Rates Steady Amid Uncertainty

The outcome of the latest Fed meeting can be divided into six key decisions. First, the Federal Reserve opted to maintain interest rates at their current level, keeping the borrowing rate in a range between 4.25% and 4.5% for the second consecutive meeting. This decision is part of a continued pause in the Fed’s tightening cycle.

Related Reading

Secondly, the Fed noted that uncertainty surrounding the economy has increased, and third, the Fed’s updated projections were the shift in expectations for rate cuts in 2025. The median forecast suggests 50 basis points of cuts for the year, but a growing number of Fed officials are less convinced that rate reductions will be necessary. In December, only one official anticipated no rate cuts in 2025. However, there’s now a more divided outlook, and that number has now risen to four, as noted in a post on social media platform X by analysts at The Kobeissi Letter.

Beyond interest rates, the Fed revised its economic growth projections downward for 2025, suggesting that policymakers see slower expansion ahead. This adjustment comes alongside an increase in the Fed’s inflation forecast for the same period, reflecting concerns about price pressures persisting longer than previously anticipated. With inflation remaining a key focus, the central bank is treading carefully as it evaluates the right time to pivot toward a looser monetary stance.

Fourthly, the Fed announced that it would slow the pace of its balance sheet runoff beginning in April. This is alongside a sharp reduction in the Fed’s 2025 growth projections and a markup in their 2025 inflation forecast.

Implications For Crypto Markets And Digital Assets

For the crypto industry, the Fed’s decision to hold rates steady and its mixed messaging on future cuts introduce a dynamic situation to Bitcoin and others. The fact that the Fed is still concerned about inflation and economic uncertainty shows that the path to more accommodative policies regarding the crypto industry may not be as smooth.

Related Reading

However, if the Fed stays hesitant to cut rates and economic growth slows as projected, digital assets may face headwinds later in the year, which may slow down the predicted growth by crypto analysts.

Featured image from Unsplash, chart from Tradingview.com

Source link

As bitcoin moves into the mainstream of American life, people from every background and corner of the planet are contributing to its historic rise. In the spirit of the age, the bitcoin industry is largely a meritocracy. It is the quality of contributions—rather than any singular identity—that drives bitcoin forward.

March is recognized as International Women’s Month, a tradition rooted in early-20th century labor and suffrage movements. It provides an occasion to reflect on the role of women in bitcoin. Rather than focusing on the experience of being a woman in a technical field, this article spotlights the real contributions and leadership from individuals who happen to be women but who have each, in their own right, helped shape the bitcoin ecosystem.

Whether they come from legal, financial, or technical backgrounds, individuals with strong foundational skills often transition naturally into the bitcoin industry. Much of bitcoin’s growth can be credited to those able to distill complex technical concepts into accessible language. Women are excelling in this role, using skills in marketing, community organizing, and storytelling to broaden understanding and trust in bitcoin. It’s one thing to code or invest in bitcoin, but quite another to convey its principles effectively to the uninitiated. As more people demonstrate real skill in bridging that knowledge gap—through podcasts, workshops, or online content—bitcoin’s base of educated users expands exponentially.

“Women can be powerful communicators and community builders, finding ways to distill complex topics into easily understandable and relatable bites,” says Kelley Weaver, CEO of Melrose PR & Founder of Bitwire. “Since bitcoin fundamentally grows through network effects, this is essential! I’ve seen firsthand how women’s approaches to explaining bitcoin can reach people who might otherwise be intimidated. Approachability is essential for bitcoin’s long-term success.”

In recent years, bitcoin ownership among women has risen significantly. One survey showed that women’s share of digital asset ownership jumped from 29% to 34% in a single quarter. While these numbers vary depending on the source, there’s a clear upward trend. If finance was once perceived as a male-dominated space, that narrative is shifting—particularly for a technology-driven asset like bitcoin, which democratizes participation by removing traditional gatekeepers.

“Across ‘Main Street’ America and the world… decentralized networks of female leaders can be a catalyst for financial education and increasing understanding about the transformative nature of bitcoin,” says Cleve Mesidor, Executive Director of Blockchain Foundation. “Particularly because of scarcity, most individuals will never own even a fraction of bitcoin, which is why women cannot afford to be late adopters.”

Mesidor points to a key dynamic: informal, community-driven networks excel at spreading education. Because bitcoin can be learned and shared peer-to-peer, it finds fertile ground in the natural social structures that women have historically led, such as book clubs, parent associations, and charitable groups. Such networks become informal “nodes” of adoption, where knowledge flows more freely than it might in a top-down environment.

In the past, popular culture often portrayed men as the family financiers while women managed daily household tasks. Yet a recent study revealed that about 84% of women say they are responsible for their family’s finances, from paying bills to setting budgets to overseeing savings and debt obligations. Perhaps more remarkable is that almost all women in couples (94%) report being actively involved in shaping household financial decisions. Many women effectively act as Chief Financial Officers for their families, handling budgeting, strategic planning, and long-term goal setting.

As bitcoin continues to gain traction worldwide, it is increasingly one of the tools under consideration, especially for those who like to plan with a low-time-preference mindset. Bitcoin’s design fits neatly with the mindset that prudent financial planners rely upon. Its limited supply and disinflationary monetary policy reward disciplined saving. As families look for ways to preserve purchasing power, it is natural to add bitcoin in the mix. Whether it’s a small allocation every month or a larger diversification strategy, bitcoin attracts those seeking reliability over the long run.

“For long-term investments, bitcoin is a top choice. While short-term fluctuations are inevitable, its overall trajectory shows a clear path toward growth and stability.” says Frieda Bobay, co-founder of Bitcoin Sports Network. “I never plan to sell my bitcoin; instead, I view it like real estate—an asset I can borrow against while it continues to grow in value.”

While it’s easy to over-generalize, data does suggest that women, on average, tend to adopt disciplined approaches to money management. They trade less frequently in stock markets, are more likely to stick to a plan, and often do deeper research before making an investment. One of bitcoin’s most emblematic qualities is its alignment with low-time-preference thinking: favoring long-term wealth building over short-term speculation. Studies have shown that women are often methodical, patient, and focus on fundamentals rather than jumping in and out of markets. This mindset leads to outperformance in traditional investment contexts.

“A common misconception is that bitcoin is ‘too expensive’—in reality, this is a matter of unit bias,” says Hailey Lennon, General Counsel at Fold. “Many people don’t realize you can own fractions of a bitcoin, and by that measure, it’s still incredibly early and relatively cheap when you compare it to traditional assets. If women empower themselves with the basic knowledge of how bitcoin works, they’ll see that we’re just at the beginning of its potential, making it a compelling opportunity rather than an exclusive, high-priced investment.”

Lennon’s perspective highlights a key barrier for new entrants: bitcoin’s per-coin price might intimidate some, but the option to purchase fractions (satoshis) lowers that barrier significantly. That’s often an eye-opener for people new to bitcoin—especially those who excel in careful, long-term budget allocation. By embracing the possibility of stacking small amounts, methodically and regularly, one can build a meaningful position over time.

Weaver agrees: “Slow and steady wins the race! My personal strategy is to DCA, or “dollar cost average” meaning that I purchase small amounts daily. This spreads out risk. I ultimately think it’s more risky to NOT own bitcoin in the long term, but I also recognize that it’s incredibly volatile. I always say in the short term it may never be a good time to buy bitcoin but in the long term it’s ALWAYS a good idea to buy bitcoin.”

Another reason for the surge in interest among women is that bitcoin, as a universal asset, offers financial independence and sovereignty. This resonates strongly with individuals who value autonomy. “Bitcoin is the pathway to financial sovereignty. It removes traditional gatekeepers and allows for independent wealth management without intermediaries,” says Evie Phillips, Founder of Creeds Collective & Founding Board Member of Crypto Connect, now Eve Wealth. “The blockchain’s immutability means assets can’t be frozen or seized—this is specifically valuable in relational situations and regions where women face financial restrictions. Bitcoin doesn’t have geographic limitations, making global transactions seamless, and that opens up a flood of opportunities that aren’t available through centralized financial systems.” Phillips’s point highlights bitcoin’s advantages in personal control over assets. The economy is fundamentally transforming, and many are drawn to the reliability of an asset that exists beyond the reach of institutions.

The novelty of bitcoin can be intimidating, especially because the mainstream media frequently associates it with scams and hype-driven speculative bubbles. Thought leaders in bitcoin address this by pointing to the facts of the technology. “The more I learn about bitcoin, the more I trust this trustless financial system,” says Weaver. “The network has had zero downtime since it launched in 2009 and has never been hacked. Over the course of bitcoin’s history, the price has risen and fallen, but consistently trends upward in the long term.”

Bitcoin is a protocol, and using it does not require trust in any central authority. Yet it thrives on trust, education, and consensus among people. This is why communicators matter so much. “I often see women’s entire perspective shift when they recognize bitcoin’s potential—not just as an investment, but as a vehicle for financial empowerment,” says Megan Nilsson, host of the Crypto Megan Podcast. “By leveraging their ability to build networks, drive education, and advocate for broader adoption, women can play a leading role in shaping the future of bitcoin and decentralized finance… Bitcoin has fundamentally redefined the concept of financial independence. It has leveled the playing field, offering financial tools that were once only available to accredited investors. It eliminates reliance on centralized systems, providing individuals with true ownership and control over their wealth.”

In the coming years, the world economy, and society itself, will be reshaped by the convergence of transformative technologies including AI, robotics, and space travel, all underwritten and financed with bitcoin. It’s no wonder that as families, institutions, and communities discover bitcoin’s utility, so many of those leading the charge are women. They do so not because they want to check a box, but because the technology itself demands the best talent available. In celebrating the achievements of women this month, we also celebrate bitcoin’s potential to reshape our collective future. It is a global experiment buoyed by those who see beyond the hype and dedicate themselves to building, teaching, and expanding the Bitcoin Network for future generations.

This is a guest post by Dave Birnbaum. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Source link

‘This Is a Good Sign’: Crypto Analyst Says Bitcoin at a Key Inflection Point, Unveils Breakout Targets for BTC

Meteora shares two proposals on MET token allocation

Trump Aides Look To Reform USAID With Blockchain For ‘Transparency’: Report

Ethereum Price Eyes 50% Drop Amid Heavy ETH Whale Profit Booking

Polymarket is Over 90% Accurate in Predicting World Events: Research

Bad news Bitcoin bulls, the long-hoped-for retail is already here: CryptoQuant

Top 6 Important Fed Decisions To Know After SEC Drops Ripple Lawsuit Appeal

Leaders In Adoption And Innovation

Trader Issues Urgent XRP Alert, Says the Top-Five Altcoin at Risk of Sharp Correction – Here’s His Target

This coin could see a $10b market cap and double-digit price before SHIB gains its 2021 mojo

Can a Meme Coin Fund the Future of Scientific Research?

Analyst Confirms XRP Price Is Still On Path To $130

Proof-of-Work Crypto Mining Doesn’t Trigger Securities Laws, SEC Says

Crypto campaign donations are democracy at work — former Kraken exec

1 Million Bitcoin In New Whale Hands—A Mega BTC Rally On The Horizon?

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Crypto’s Big Trump Gamble Is Risky

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

Trump’s Coin Is About As Revolutionary As OneCoin

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Is $200,000 a Realistic Bitcoin Price Target for This Cycle?

Trending

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin2 months ago

Bitcoin2 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News2 months ago

24/7 Cryptocurrency News2 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Altcoins2 months ago

Altcoins2 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin4 months ago

Bitcoin4 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Price analysis5 months ago

Price analysis5 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x