FTX

Embattled FTX Co-Founder Gary Wang Is Building US Authorities a Tool To Track Illicit Activity on Crypto Exchanges

Published

6 months agoon

By

admin

FTX co-founder and former CTO Gary Wang continues to work with US authorities after giving his testimony at the trial of his college roommate and ex-colleague, Sam Bankman-Fried.

Wang is among the FTX executives who were charged following the collapse of the FTX crypto exchange. He pleaded guilty to four criminal counts in December 2022.

In a sentencing memorandum filed on November 6th, Wang’s lawyers ask the court to consider how their client cooperated with the government and extended assistance beyond the prosecution of Bankman-Fried.

“Gary has made himself available to testify at two other trials in this district. He has met with the Government and Federal Bureau of Investigation (FBI) special agents to assist efforts to use FTX’s database to advance other pending investigations.”

The lawyers say that Wang also worked with US authorities to develop tools that can potentially mitigate the risks of financial fraud.

“In a further, extraordinary step, Gary has worked with the Government to design and build a new software tool to detect potential financial fraud in public markets and, at prosecutors’ direction, is currently developing a separate tool focused on identifying illicit activity on crypto exchanges.”

The court document, which was submitted ahead of Wang’s sentencing on November 20th, is asking the court to spare the 31-year-old from prison time.

“A custodial sentence would fail to account for his relative culpability and exceptional cooperation, and unnecessarily disrupt his ability to further assist the Government and continue contributing to his family and the wider world.”

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

You may like

Bitcoin Price (BTC) Retakes $95K Level After Early U.S. Decline

A New Risk For The Industry?

Justin Sun Bets Big On JUST Token, Sees 100x Potential

Worldcoin price prediction | What’s next for WLD price?

Bitcoin Is About To Begin Outperforming Gold, Says InvestAnswers – Here’s His Timeline

Bloomberg Analyst Confirms No Set Launch Date for ProShares XRP ETFs

Bankruptcy

FTX to Begin $11.4B Creditor Payouts in May After Years-Long Bankruptcy Battle

Published

1 month agoon

March 29, 2025By

admin

FTX, the collapsed cryptocurrency exchange once helmed by Sam Bankman-Fried, plans to begin paying its main creditors at the end of May, Bloomberg reported based on court proceedings in Delaware this week.

The company has gathered $11.4 billion in cash to distribute to thousands of parties affected by its 2022 bankruptcy, with the first payments to major creditors set for May 30.

These include institutional investors and firms that held crypto on FTX’s platform. Smaller creditors with claims below the $50,000 mark have already begun receiving distributions.

FTX’s collapse left a financial crater and a trail of frustrated creditors—many of whom expected to be repaid in crypto, not dollars. Since the bankruptcy, the price of bitcoin has more than quadrupled, intensifying frustrations among those waiting for their assets back.

The task of unwinding FTX’s balance sheet has been slowed by a large number of claims, many of them reportedly questionable. Andrew Dietderich, a bankruptcy attorney for the firm, told the court that FTX has received “27 quintillion” claims, Blloomberg reported, many of which are duplicates or outright fraudulent.

Interest payments are compounding the urgency. While FTX earns only a modest return on its cash, legitimate creditors are entitled to 9% interest annually on unpaid claims. The longer it takes to pay, the more the company could owe.

Read more: Nearly All FTX Creditors Will Get 118% of Their Funds Back in Cash, Estate Says in New Plan

Source link

crypto liquidations

US court permits Three Arrows Capital to expand claim against FTX, rejects FTX’s objections

Published

2 months agoon

March 14, 2025By

admin

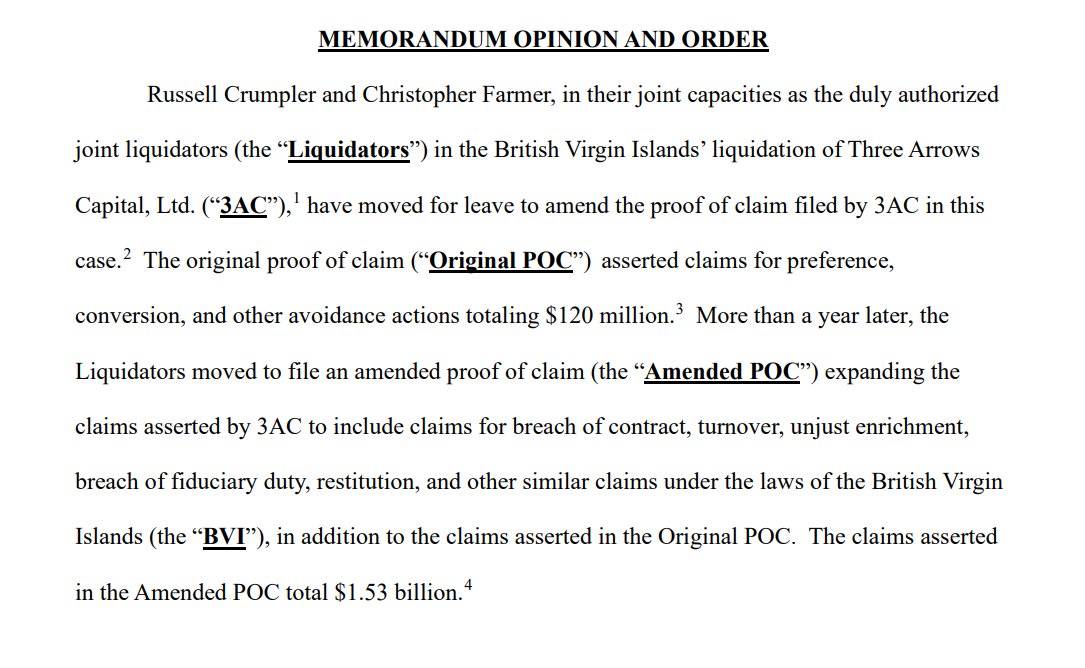

A U.S. bankruptcy court has allowed the liquidators of the defunct crypto hedge fund Three Arrows Capital to substantially increase its claim against the collapsed crypto exchange FTX from $120 million to $1.53 billion.

In a March 13 ruling by the US Bankruptcy Court for the District of Delaware, the judge ruled that FTX is to pay out $1.53 billion to Three Arrows Capital, increasing the claim from the original $120 million filed in June 2023. FTX objected to the decision, arguing it was too late and would slow down their bankruptcy process. However, the judge sided with 3AC’s liquidators, opining that they had provided sufficient notice of their claim. The judge determined that the delay in filing the larger claim was mainly due to FTX not promptly sharing relevant records with 3AC’s liquidators. 3AC liquidators needed that information to properly assess and detail their claim.

The 3AC’s liquidators are claiming that FTX held $1.53 billion in 3AC’s assets, which were then liquidated to pay off 3AC’s debts. Furthermore, 3AC liquidators argued that those transactions were avoidable and that FTX didn’t provide the information that would’ve uncovered the liquidation.

Both 3AC and FTX were once major players in the crypto world, but both are no defunct. Three Arrows Capital was one of the largest crypto hedge funds that collapsed in June 2022 due to forced liquidation of overleveraged positions in Bitcoin (BTC), Ethereum (ETH), and other altcoins. They filed for bankruptcy in July 2022. Its liquidators are now trying to recover funds by selling their remaining assets and through various lawsuits, most notably against FTX and Terraform Labs to repay its creditors.

FTX crypto exchange declared bankruptcy in Nov. 2022 and has also seen been trying to recoup funds through various lawsuits, including one against Binance and Changpeng Zhao. FTX recently started their repayment process facilitated through BitGo and Kraken exchanges.

Source link

FTX

Kraken is gearing up for the next round of FTX payouts, including claims about $50K

Published

2 months agoon

March 6, 2025By

admin

Kraken confirmed it will begin the next round of FTX payouts on May 30, covering claims both below and above $50,000.

According to FTX creditor representative Sunil’s recent post on X, Kraken has begun sending emails to FTX users, confirming that the next round of FTX payout distribution will take place on May 30. This distribution, which marks the second round of FTX repayments, will cover claims both below and above $50,000.

FTX Claims Distribution

Distributor: Kraken@krakenfx has started sending out emails

to FTX customers confirming theNext FTX distribution

30th May 2025Claims <$50k and Claims> $50k

are included in this distribution pic.twitter.com/nVjF4YPI94— Sunil (FTX Creditor Champion) (@sunil_trades) March 6, 2025

The now defunct crypto exchange FTX announced on Feb. 7 that initial distributions to holders of allowed claims in the Plan’s Convenience Classes would begin on Feb. 18, with repayments facilitated through BitGo and Kraken. Kraken even provided trading fee credits alongside the payouts to avoid profiting from the distribution process.

The first repayment round, which started on Feb.18, covered approved Convenience Class claims valued at $50,000 or less. Small claimants will receive full repayment plus post-petition interest of 9% per annum by April 11. Larger claimants (with claims valued above $50,000), including institutional investors and VC firms, have been not been issued any repayments as of yet.

Complex legal disputes and asset recovery efforts have delayed the distribution to larger investors. But with the next repayment round slated for May 30, larger investors will start receiving their funds (+9% interest accrued per annum), with roughly $16 billion earmarked for total distributions.

FTX, once valued at $32 billion, collapsed in Nov. 2022 after it was revealed that Alameda Research had misused customer funds to cover its own losses. A wave of withdrawal requests followed, but FTX could not meet them. The exchange halted withdrawals and filed for bankruptcy. FTX’s founder, Sam Bankman-Fried, was convicted on fraud and conspiracy charges in Nov. 2023. Other former executives, including Caroline Ellison and Gary Wang, pleaded guilty and cooperated with authorities. John J. Ray III took over as CEO in Nov. 2022 and has led efforts to locate and recover FTX’s lost assets through lawsuits, real estate purchases, and liquidations of FTX’s remaining assets.

Source link

Bitcoin Price (BTC) Retakes $95K Level After Early U.S. Decline

A New Risk For The Industry?

Justin Sun Bets Big On JUST Token, Sees 100x Potential

Worldcoin price prediction | What’s next for WLD price?

Bitcoin Is About To Begin Outperforming Gold, Says InvestAnswers – Here’s His Timeline

Bloomberg Analyst Confirms No Set Launch Date for ProShares XRP ETFs

What is Base? The Ethereum Layer-2 Network Launched by Coinbase

Loopscale hacker in talks to return stolen crypto

Bitcoin (BTC) Yield Platform Coming From Coinbase (COIN), Aspen Digital

The Emerging Market For State Services Via Citizen X

XRP Price Shoots For 20% Surge To $2.51 Amid Pullback To Breakout Zone

Stocks edge higher ahead of big earnings week

Here’s How Bitcoin Could Boost Demand for US Treasuries, According to Macro Guru Luke Gromen

Experts Predict US Recession in 2025 if Trump-China Trade War Tariffs Stay

Monero Jumps 51% After ‘Suspicious Transfer’ of $333M in Bitcoin

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Crypto’s Big Trump Gamble Is Risky

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

I’m Grateful for Trump’s Embrace of Bitcoin

Trending

24/7 Cryptocurrency News6 months ago

24/7 Cryptocurrency News6 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin3 months ago

Bitcoin3 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Ripple Price1 month ago

Ripple Price1 month ago3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin6 months ago

Bitcoin6 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Opinion6 months ago

Opinion6 months agoCrypto’s Big Trump Gamble Is Risky

Bitcoin6 months ago

Bitcoin6 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Bitcoin3 months ago

Bitcoin3 months agoThe Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines