Donald Trump

Eric Trump Joins Metaplanet’s Board Of Advisers

Published

2 days agoon

By

admin

Metaplanet, Japan’s largest corporate bitcoin holder, has appointed Eric Trump to its newly formed strategic board of advisers. The move aims to advance Metaplanet’s bitcoin adoption mission as bitcoin gains mainstream traction.

Metaplanet announced the move on Friday, stating that Trump’s expertise and passion for bitcoin will help drive the company’s goals. As the son of U.S. President Donald Trump, Eric Trump has emerged as an influential voice supporting the growth bitcoin and the crypto industry.

JUST IN:

Japanese public company Metaplanet appoints Eric Trump as a strategic advisor to help drive Bitcoin adoption. pic.twitter.com/9UnAFzF5Ty

— Bitcoin Magazine (@BitcoinMagazine) March 21, 2025

The advisory board will also include other high-profile figures yet to be named, according to Metaplanet. The focus will be bringing together leaders in business, politics and technology to further bitcoin’s acceptance globally.

Metaplanet Representative Director Simon Gerovich welcomed Trump’s appointment, emphasizing his business acumen and enthusiasm for the bitcoin community. Gerovich said, “His business expertise and passion for BTC will help drive our mission forward as we continue building one of the world’s leading Bitcoin Treasury Companies.”

The Tokyo-based company has aggressively accumulated bitcoin reserves, now holding over 3,200 BTC worth approximately $267 million. Earlier in March, Metaplanet purchased 150 additional bitcoins at a value of $12.5 million.

Established in 1999, Metaplanet has shifted its focus to bitcoin investment and advocacy. The company trades on the Tokyo Stock Exchange and was previously known as Red Planet Japan.

Eric Trump has increasingly backed bitcoin and cryptos. He is involved with World Liberty Financial, a Trump family’s crypto venture. His father, Donald Trump, recently signed an executive order to launch a strategic bitcoin reserve.

With bitcoin going mainstream, Metaplanet is betting on crypto-friendly advisers like Trump to drive institutional adoption. Major corporations adding bitcoin to reserves could accelerate acceptance and solidify bitcoin as a sound corporate asset.

Source link

You may like

Crypto exchange Kraken exploring $1B raise ahead of IPO: Report

Bitcoin and Stock Market Rally Hard as White House Narrows Scope of Tariffs

Tabit Insurance Raises $40 Million Bitcoin-Funded Insurance Facility

Strategy’s Bitcoin Holdings Cross 500,000 BTC After Stock Sales

PwC Italy, SKChain to launch self-sovereign EU digital ID

PwC Italy, SKChain Advisors to Build Blockchain-Based EU Digital Identity Product

Bitcoin

Bitcoin and Stock Market Rally Hard as White House Narrows Scope of Tariffs

Published

2 hours agoon

March 24, 2025By

admin

Digital assets and equities are soaring on the weekly open amid renewed optimism stemming from the White House taking a softer tone on tariffs.

While tariff threats initially sparked one of the worst stock market drawdowns in recent memory, reports are now suggesting that President Trump’s aggressive trade negotiations may be in the process of a smooth resolution.

Citing “US officials familiar with the matter,” Bloomberg reports that Trump’s reciprocal tariffs may be more targeted than initially anticipated, with some countries being exempt, and some sector-specific levies being delayed by the White House.

The Wall Street Journal reported similar information.

All major stock indices opened the week well into the green, while Bitcoin (BTC) is up 3% on the day and is now up 15% from its 2025 low near $76,500.

Said Tobin Marcus of Wolfe Research in a note seen by CNBC,

“Omitting the sectoral tariffs from the April 2nd package significantly reduces both its aggregate scale and the maximum rate on targeted sectors, given that all of Trump’s tariffs to date have been designed to stack… The ceiling for reciprocal tariffs on April 2 remains dramatic, and we still expect a negative market reaction, but the scale won’t be as severe and the sectoral impacts won’t be as concentrated.”

However, in a post on Truth Social, President Trump announced that “secondary tariffs” would be placed on Venezuela and any country that purchases oil and/or gas from the country. Trump cited numerous reasons, including “the fact that Venezuela has purposefully and deceitfully sent to the United States, undercover, tens of thousands of high level, and other, criminals, many of whom are murderers and people of a very violent nature.”

At time of writing, BTC is trading at $88,013.

Follow us on X, Facebook and Telegram

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: DALLE3

Source link

crypto

Crypto Braces For April 2 — The Most Crucial Day Of The Year

Published

8 hours agoon

March 24, 2025By

admin

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

The crypto market is on high alert ahead of April 2, a date some analysts are calling “the biggest event of the year by an order of magnitude.” Macro economist Alex Krüger (@krugermacro), warns that President Donald Trump’s upcoming announcement of new reciprocal tariffs could deliver a seismic jolt to global markets — including crypto.

Why April 2 Is Massive For Crypto

In a post shared on X, Krüger describes the looming announcement, which the president has dubbed “Liberation Day,” as “10x more important than any FOMC” meeting: “April 2nd is similar to election night. It is the biggest event of the year by an order of magnitude. 10x more important than any FOMC, which is a lot. And anything can happen.”

According to Krüger, Trump might choose one of several paths: “Trump could go soft, in which case markets would rally fast and furiously. Or could go half-way, adding uncertainty on timelines, in which case markets would take out the stops of all longs and shorts. Or go all out, in which case markets could easily crash another 10% to 15%, fast.“

Related Reading

Krüger also suggests that “the US economy is still strong, but will highly likely slow down due to tariffs regardless of the path Trump chooses.” Nevertheless, he notes that many economists have already factored in a sharp year-end slowdown. He stresses that April 2 could mark the peak of market anxiety, aligning with the arrival of US Tax Day just two weeks later. “Either way, you all want to be prepared and ready to act on ‘Liberation Day.’ It will be big.”

Trump’s “Liberation Day” announcement will reportedly focus on “reciprocal tariffs” targeting specific countries or blocs deemed to maintain unfair trade barriers. Although this strategy appears “more targeted than the barrage he has occasionally threatened,” officials familiar with the matter believe it could still prove far-reaching.

President Trump has repeatedly signaled that these tariffs would be significant. Citing trade disparities with nations such as the European Union, Mexico, Japan, South Korea, Canada, India, and China, he asserts the US has been treated unfairly for too long. In remarks from the Oval Office, he declared: “April 2nd is going to be liberation day for America. We’ve been ripped off by every country in the world, friend and foe.”

Worst Case Scenario

Aides and allies suggest that while some countries may be excluded, Trump is looking for immediate impact. Tariff rates could take effect right away, adding to market fears of spiraling retaliation. In this case, Krüger says: “In worst case scenario sh*t would hit the fan then tariffs would start coming off as Trump negotiates hard in the following month, in which case peak negativity would hit around week 2 of April, which would coincide with US Tax Day.”

Related Reading

Senior officials, including National Economic Council Director Kevin Hassett and Treasury Secretary Scott Bessent, have indicated that the administration is focusing on a “dirty 15” group of countries where tariff and non-tariff barriers are allegedly most egregious. Hassett recently remarked, “It’s not everybody that cheats us on trade, it’s just a few countries, and those countries are going to be seeing some tariffs.”

For the crypto market, global macroeconomic events have increasingly played a pivotal role in price action in recent weeks. The April 2 “Liberation Day” announcement arrives at a time when digital asset traders already face headwinds from monetary policy shifts and a slowing global economy. Krüger believes that if the tariffs come in softer than expected, “markets would rally fast and furiously.” On the other hand, a maximalist tariff approach could deliver a significant shock, potentially denting cryptocurrencies.

At press time, the total crypto market cap stood at $2.81 trillion.

Featured image from iStock, chart from TradingView.com

Source link

Altcoins have been attracting investor attention this weekend, with Bitcoin and Ethereum prices stagnating around $85,000 and $2,000, respectively, since Friday. Prominent crypto analysts have published data insights showing investors are increasingly rotating capital toward altcoins after recent U.S. macroeconomic updates.

Analysts Predict Altcoin Season as Fed Rate Pause Triggers Risk-On Appetite

The altcoin market had a rough start to March 2025 when U.S. President Donald Trump announced new tariffs on Canada and Mexico. However, the macroeconomic landscape has since improved. The Trump administration made adjustments to the tariffs, while U.S. CPI and PPI data indicated that inflation risks from the tariffs were overestimated.

This shift in sentiment was further reinforced after the latest Federal Open Market Committee (FOMC) meeting on Wednesday, where the U.S. Federal Reserve announced a pause in interest rate hikes.

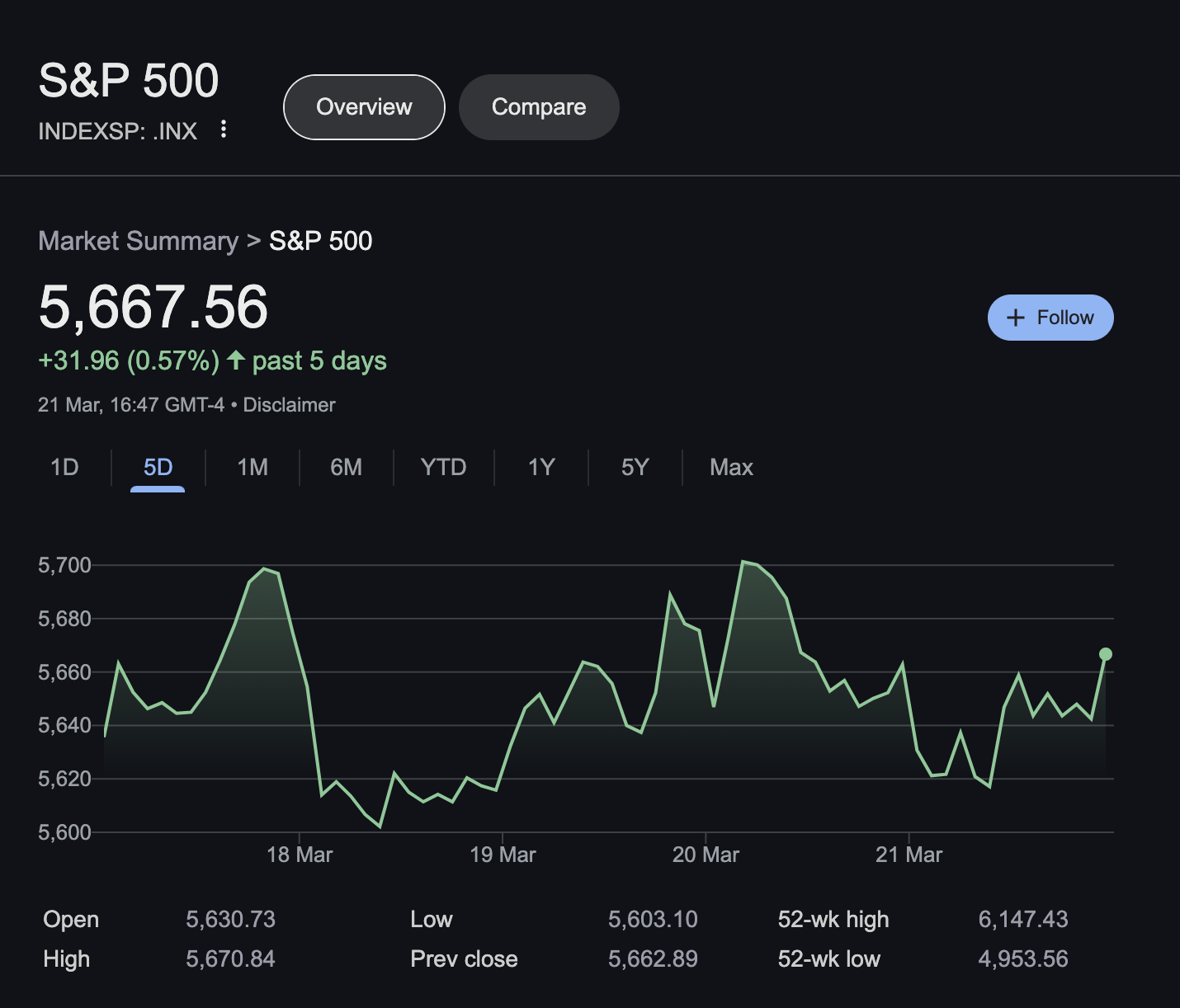

Traditional finance (TradFi) investors reacted by moving capital out of safe-haven assets like gold and into stocks, pushing the S&P 500 up by 31.7 points last week.

Crypto markets appear to be following suit, with traders increasingly rotating funds from Bitcoin and Ethereum into altcoins.

Crypto Analysts Signal Imminent Altcoin Breakout

Adding to the growing optimism around altcoins, two major crypto analysts took to social media to highlight technical indicators pointing to an incoming “Alt Season”—a market phase where altcoins significantly outperform Bitcoin.

“2025 #ALTSEASON starts in less than 3 days now,” alongside a chart illustrating past cycles of altcoin dominance relative to Bitcoin.

Crypto analyst Sensei (@SenseiBR_btc) made a bold declaration, March 21, 2025 ,

The accompanying chart showed clear historical patterns where altcoins surged against Bitcoin, with a third major rally seemingly about to begin.

In response, OBI Real Estate (@Obirealestate) weighed in on the discussion, adding, “Markets are buzzing, timing will be everything.”

Key Takeaways: Why This Weekend Matters for Altcoins

Capital Rotation: With Bitcoin and Ethereum trading sideways, traders are diverting funds toward altcoins, anticipating stronger returns.

Macro Trends: Improved inflation outlook and the Fed’s rate pause have boosted risk-on sentiment across global markets.

Technical Indicators: Historical charts from top analysts suggest that the long-awaited Alt Season could be days away from starting.

As traders look ahead, this weekend may present a critical window of opportunity to accumulate promising altcoins before a broader market breakout.

3 Top Trending Altcoins to Watch in the Week Ahead

Bitcoin (BTC) has surged past the $85,000 mark, signaling strong market sentiment despite a slight 0.9% decline in global crypto market cap over the past 24 hours. While BTC’s resilience suggests growing confidence, a look at broader market trends reveals that large-cap altcoins remain stagnant, while smaller-cap assets are seeing significant moves.

Ethereum (ETH) remains subdued at $2,000, showing only a 0.5% gain in 24 hours. Similarly, Cardano (ADA) and Binance Coin (BNB) also moved sideways, conslidating at the $0.70, $620 respectively, while Solana (SOL), trading at $132 leads the top 10 assets with a 2.4% gain.

However a closer look at the Coinmarketcap above shows low-cap altcoins, are attracting significant search traffic, a move that could attract further capital inflows in the coming trading seesions.

1. Trump Memecoin (Official Trump) – Political optimism fuels rally

The Trump-themed memecoin is trading at $11.81, up 5.9% in the last 24 hours, making it one of the most notable gainers. This rally alligns with improved sentiment surrounding recent U.S. policy discussions and Trump’s appearance at the Blockwork’s Digital Assets Summit, last week.

With increasing political relevance and heightened social media buzz, this token is one to watch closely. A break above key resistance levels in the coming days could drive further gains.

2. Pi Network (PI) – Struggling to Break $1, But Buzz is Growing

Last week, PI endured major sell-offs as the network migration trigger mixed reactions among investors. However, Pi Network is now flashing recovery signals. At press time on Sunday, March 23, PI network price is facing strong resistance at the $1 mark, struggling to establish a breakout. However, with the token has become one of the most discussed assets in the last 24 hours, investor interest is evident.

If buying pressure continues and $1 resistance caves, a significant breakout could follow, making this an asset to monitor for a potential price explosion.

3. Wormhole (W) – Cross-Chain Demand Fuels Buying Activity

Ethereum’s native cross-chain bridge token, Wormhole (W) price, has surged 23.9%, driven by increased demand as investors rotate funds across chains.

The boost in market optimism, combined with the Fed’s recent decision to pause interest rate hikes, has further supported capital flows into decentralized finance (DeFi).

With more activity on cross-chain protocols, Wormhole’s demand could continue to rise, making it a strong candidate for further upside in the days ahead.

In Summary:

While Bitcoin’s dominance remains strong above $85,000, altcoins, particularly low-cap assets, are gaining momentum. The surge in Trump memecoin, Pi Network’s rising popularity, and Wormhole’s DeFi-driven gains all signal that the altcoin market could be gearing up for major moves. Traders should watch for key breakout levels as these assets continue to gain traction

Frequently Asked Questions (FAQs)

Altcoin Season refers to a market phase where altcoins outperform Bitcoin, often driven by capital rotation and favorable macroeconomic conditions.

Analysts predict an Altcoin Season due to Bitcoin’s stagnation, improving inflation data, and the Federal Reserve’s decision to pause rate hikes.

Trump memecoin, Pi Network, and Wormhole are gaining traction due to political sentiment, technical setups, and cross-chain DeFi demand.

ibrahim

Crypto analyst covering derivatives markets, macro trends, technical analysis, and DeFi. His works feature in-depth market insights, price forecasts, and institutional-grade research on digital assets.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

Crypto exchange Kraken exploring $1B raise ahead of IPO: Report

Bitcoin and Stock Market Rally Hard as White House Narrows Scope of Tariffs

Tabit Insurance Raises $40 Million Bitcoin-Funded Insurance Facility

Strategy’s Bitcoin Holdings Cross 500,000 BTC After Stock Sales

PwC Italy, SKChain to launch self-sovereign EU digital ID

PwC Italy, SKChain Advisors to Build Blockchain-Based EU Digital Identity Product

Bitcoin Price Set To Explode as Global Liquidity Z Score Flashes Buy Signal

Crypto Braces For April 2 — The Most Crucial Day Of The Year

DYDX shoots up 10% as buybacks get a quarter of protocol revenue

$7,000,000 Up for Grabs As Feds Tell Crypto Fraud Victims To Come Recover Their Money

Berachain rolls out next phase of proof-of-liquidity system

White House to Scale Back Tariffs, Bitcoin Gains on Eased Economic Jitters

More is Less: Feature Fatigue is Driving Web3 Users Away

Trump-Linked WLFI Snaps Up 3.54M MNT After Last Week’s Hard Fork

Tokenized US gold could ultimately benefit Bitcoin: NYDIG

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Crypto’s Big Trump Gamble Is Risky

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

Trump’s Coin Is About As Revolutionary As OneCoin

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Is $200,000 a Realistic Bitcoin Price Target for This Cycle?

Trending

24/7 Cryptocurrency News5 months ago

24/7 Cryptocurrency News5 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin2 months ago

Bitcoin2 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News2 months ago

24/7 Cryptocurrency News2 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Bitcoin4 months ago

Bitcoin4 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Altcoins2 months ago

Altcoins2 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Price analysis5 months ago

Price analysis5 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x

✓ Share: