Dogecoin

Ether (ETH) Could Be Hardest Hit by Impact of Trump Tariffs

Published

3 months agoon

By

admin

A fresh round of tariffs by U.S. president Donald Trump and lack of short term catalysts is inciting caution from market watchers, who believe Ethereum’s ether (ETH) may be particularly affected.

Trump on Sunday said he will introduce 25% tariffs on all steel and aluminium imports into the US, on top of existing duties, with reciprocal tariffs later in the week applicable to all countries.

The rhetoric and spike in inflation expectations could breed downside volatility with a key indicator that foresaged a move above $100,000 for bitcoin, when it traded under $70,000, turning bearish on Sunday.

Crypto majors remained little-changed in European afternoon hours Monday, with U.S. futures Dow and S&P 500 up 0.46% ahead of the New York open. Bitcoin, ether, XRP, Solana’s SOL and dogecoin (DOGE) were up under 1% in the past 24 hours, while BNB Chain’s BNB lost 4.5% after a Sunday rally.

Tariffs introduce economic uncertainty by potentially escalating trade wars, which can lead to market volatility — such events tend to impact bitcoin and the broader crypto market as investors tend to move away from risk assets to safer investments.

Some traders say ether could be further impacted as sentiment for crypto fades down, adding to an already tumultuous year for the asset which saw a widely-watched bitcoin-ether ratio drop to 2021, indicative of a fallout for ETH and preference for BTC.

A drop in ETH may further spell bad news for related beta bets such as memecoin dogecoin (DOGE) and Ethereum-based DeFi tokens, which tend to mirror the movements of the parent asset.

“The rise of BTC vs everything else is the most evident in comparison with ETH, which is seeing record short-interest and FUD with the 2nd largest token being down -23% YTD vs a +2.5% gain in BTC,” Augustine Fan, head of insights at SignalPlus, told CoinDesk in a Telegram message.

“At the risk of sounding like a broken record, but a lack of L1 catalysts and narrative leadership will likely continue to weigh on Ethereum in the foreseeable future,” Fan added.

“Ethereum has been hit particularly hard as ETH reversed its entire pump from late November last year, unwinding any gains to holders,” shared Nick Ruck, director at LVRG Research, in a Telegram message. Due to expectations of increased inflation, investors are betting on only one interest rate cut by the Federal Reserve this year, casting a grim outlook for risk assets including crypto.”

Meanwhile, traders at Singapore-based QCP Capital expect crypto markets to flip-flop in the coming weeks as Trump’s words continue to impact markets.

“A feedback loop is emerging—President Trump, highly sensitive to market reactions, is facing a market increasingly calling his bluff. This could embolden him further, adding another layer of volatility,” the firm said in a Monday broadcast message.

“BTC volatility now skews in favor of puts until April, reflecting a lack of upside catalysts,” it ended.

Source link

You may like

Crypto Investors Sue Nike, Accuse Apparel Giant of Rug Pull After Abrupt Closure of Metaverse Business: Report

Top cryptocurrencies to watch: Pi Network, XRP, Sui

This Week in Crypto Games: Ubisoft’s ‘Might & Magic’, ‘Peaky Blinders’ in Development

Why Arbitrum-Nvidia Partnership Collapsed – And What It Means for Web3

Tariff Carnage Starting to Fulfill BTC’s ‘Store of Value’ Promise

The cost of innovation — Regulations are Web3’s greatest asset

doge

Dogecoin Trader Who Nailed 300% Rally Says It’s About To Repeat

Published

5 days agoon

April 22, 2025By

admin

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

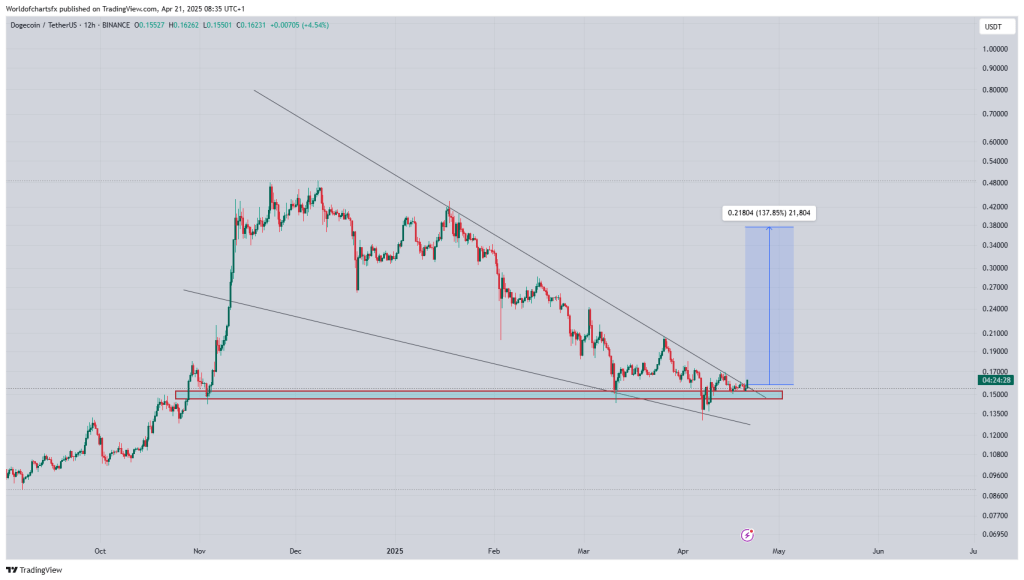

Dogecoin (DOGE) is once again breaking out of a textbook falling‑wedge formation, and the analyst who anticipated the memecoin’s last three‑fold explosion thinks the stage is set for an encore. “Breaking crucial area, expecting solid bullish wave in midterm,” World Of Charts (@WorldOfCharts1) told his X followers while sharing a 12‑hour Binance chart.

Major Dogecoin Upswing Incoming?

He referenced a post from April 13 where he predicted: “Doge: We caught this big move in Oct 2024, Dogecoin went more than 3×. Now again Doge [is] on [the] verge of massive breakout… expecting 3× from here.”

The chart shows five months of compression that began when DOGE topped at just under $0.48 in early December.

Since then, every rally has stalled beneath a descending resistance trendline, which now cuts through the mid‑$0.155 zone; parallel support currently tracks the $0.14 area after cushioning a pair of capitulation wicks in March and April. The price is now breaking out of the upper boundary for the first time in almost two weeks.

Related Reading

World Of Charts’ measured‑move overlay starts at the notional breakout above $0.17 and projects a vertical advance of $0.21804, implying a primary objective just shy of $0.39—a 138% gain from the trigger and within striking distance of the psychological $0.40 handle. If the setup delivers the same magnitude as last year’s wedge, the could ultimately test $0.65, completing a fresh three‑fold rally.

The time symmetry behind the call is hard to ignore: the current wedge has compressed for almost six months, mirroring the consolidation that preceded the October–December 2024 eruption from $0.11 to $0.48. Volume has thinned with each contraction cycle, a classic pre‑breakout signature, while momentum oscillators on lower time frames are beginning to tilt positive as spot reclaims its 50‑EMA.

Related Reading

Other analysts remain focused on Bitcoin’s grip over market beta. “If BTC breaks above $89K and shows conviction upwards I think Dogecoin gets back to $0.26 relatively quick,” cautions Kevin (@Kev_Capital_TA). “BTC holds the cards as always, especially with BTC dominance pushing higher and monetary policy still tight.” In his analysis, $0.26 represents the 0.618 Fibonacci retracement of the November–March slide, marking the first substantive hurdle even if DOGE clears wedge resistance.

From a pure chart‑based perspective, the battle lines are now sharply drawn. A decisive daily close above trendline and a successful retest would confirm the breakout, shift the red demand band into a springboard, and expose successive targets. Failure to punch through would keep price pinned inside the pattern, with any slip below $0.15 risking a slide toward structural support at $0.13 and, in extremis, the $0.11 pivot that launched last year’s parabolic ascent.

At press time, DOGE traded at $0.1641.

Featured image created with DALL.E, chart from TradingView.com

Source link

doge

Dogecoin Whales Buy 800 Million DOGE in 48 Hours – Smart Money Or Bull Trap?

Published

2 weeks agoon

April 15, 2025By

admin

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Dogecoin is showing signs of strength after weeks of volatility and market uncertainty. The meme-inspired cryptocurrency has held firm above crucial support levels and is now pushing toward a potential recovery rally. After reclaiming the $0.15 mark, bulls are looking to build momentum, with the $0.17 level emerging as the next major resistance to break. A successful move above this threshold could confirm a broader trend reversal and reignite bullish sentiment across the meme coin sector.

Related Reading

Supporting this outlook, recent on-chain data from Santiment shows that Dogecoin whales have been highly active—accumulating over 800 million DOGE in the last 48 hours. This surge in whale buying activity adds weight to the bullish thesis, suggesting that larger players are positioning for a move higher. The renewed accumulation, paired with improving technical conditions, has sparked optimism among traders and investors who believe Dogecoin could be gearing up for its next leg upward.

Still, caution remains, as global macroeconomic tensions continue to create unpredictable conditions across the financial markets. For Dogecoin to confirm a recovery rally, bulls must hold current levels and push through near-term resistance in the coming sessions.

Dogecoin Faces Crucial Resistance As Whale Accumulation Builds

Dogecoin is now at a pivotal point, trading just below key resistance levels after a strong rebound from recent lows. As broader market conditions improve and global tensions—especially around trade and tariffs—begin to cool, analysts are turning their attention to assets like DOGE that have lagged in performance but now show signs of potential upside. The meme coin has managed to reclaim the $0.15 mark, but to validate a broader recovery rally, bulls must push beyond the $0.17–$0.18 zone in the days ahead.

Momentum indicators are beginning to flip bullish, and some market watchers suggest that Dogecoin could be preparing for a breakout. However, sentiment remains mixed, with others pointing to the possibility of a continuation of the downtrend, particularly if resistance holds or macroeconomic conditions deteriorate. Despite this uncertainty, on-chain data paints a more optimistic picture.

Top analyst Ali Martinez shared insights on X, revealing that Dogecoin whales have accumulated over 800 million DOGE in the last 48 hours. This level of accumulation by large holders suggests renewed confidence in the asset’s short-term potential. Historically, such whale activity has often preceded strong price moves in DOGE.

For bulls to take control, Dogecoin must break above near-term resistance and sustain momentum amid a still-volatile environment. A failure to do so could see the asset slip back into consolidation or even retest previous lows. The coming week will be critical for determining whether DOGE’s next move is a breakout or another pullback.

Related Reading

DOGE Price Holds $0.16 As Bulls Aim for Breakout

Dogecoin is trading at $0.16 after failing to reclaim the 4-hour 200 Moving Average (MA) near $0.168, a level that has acted as strong short-term resistance. Despite recent bullish momentum across the crypto market, DOGE bulls are struggling to regain control. The $0.15 level now serves as critical support. If Dogecoin holds this area, there’s a strong chance it could push higher in the coming sessions.

A successful break above $0.17 would be significant, potentially opening the door to a rally toward $0.20, a level not seen since early April. However, price rejection and continued weakness around $0.168 suggest that sellers are still active, and bulls need to reclaim this moving average to build momentum.

Related Reading

If DOGE loses the $0.15 mark, downside risk increases sharply. A drop to $0.13—or even lower—is likely as bearish pressure could intensify in a volatile market. Investors will be watching closely for a clear move in either direction, as Dogecoin sits at a key inflection point. Volume and on-chain data, including recent whale accumulation, suggest potential, but confirmation must come through price action above immediate resistance.

Featured image from Dall-E, chart from TradingView

Source link

doge

Dogecoin Follows This Blueprint, Says Crypto Analyst

Published

2 weeks agoon

April 14, 2025By

admin

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

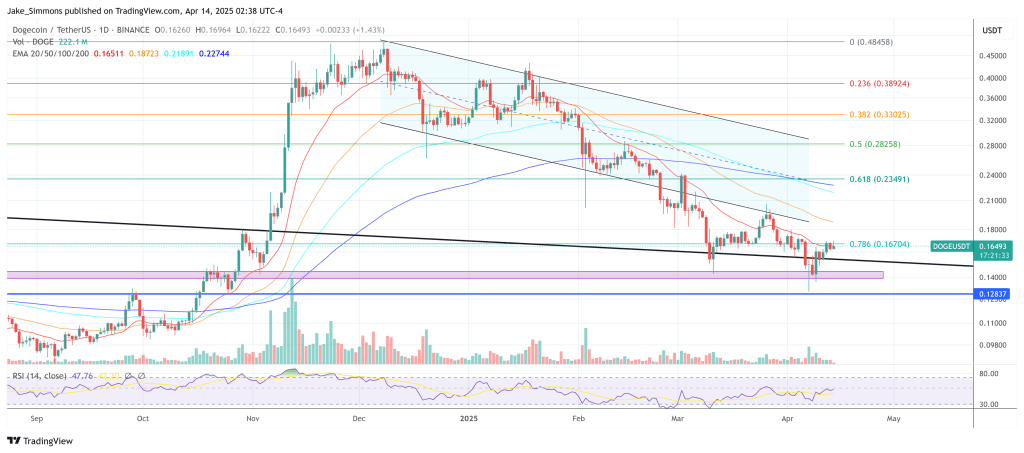

Dogecoin’s price action continues to honor the technical “blueprint” laid out by crypto analyst Kevin (@Kev_Capital_TA), who reaffirmed on Sunday that his strategic roadmap from March 22 remains intact. The weekly chart reveals an extended descending channel drawn with multiple yellow trend lines that originated in 2021 and constricted price action throughout 2022.

Within that formation, the most critical horizontal threshold appears to be $0.139, labeled on the chart as the “Last line in the sand” and described by Kevin as essential for preserving bullish market structure. He notes that maintaining durable weekly closes above this zone is paramount for further upside, while a decisive break beneath $0.139 would nullify the bullish thesis.

Dogecoin Follows The Blueprint

Dogecoin’s retracement from highs near $0.45 earlier this year has so far been contained by a confluence of support channels and Fibonacci retracement levels. According to Kevin’s chart, the primary Fib levels span from roughly $0.049 at the lower bound (0% Fib) to around $2.268 at the 1.414 extension.

Related Reading

Closer inspection shows intermediate Fibonacci markers at $0.090 (0.236), $0.138 (0.382), $0.190 (0.50), $0.262 (0.618), $0.413 (0.786), $0.542 (0.88), $0.738 (1.0), $0.934 (1.0866), and $1.543 (1.272). Since the price is hovering near $0.16–$0.17 at press time, Dogecoin has remained above the 0.382 retracement near $0.138, reinforcing Kevin’s argument that the risk-reward ratio at this level appears “absolutely phenomenal.”

Kevin’s March 22 update describes the confluence of several higher time frame indicators, including the Weekly Stochastic RSI, the 3-Day MACD, and the 2-Week Stochastic RSI, all of which he sees nearing full resets. He cites the previous weekly demand candle, which formed just above $0.139, as a key sign that buyers are stepping in to defend what he calls “the Last line of bull market support.”

The Weekly Stoch RSI on his chart is already situated at low levels, while the 3-Day MACD and 2-Week Stoch RSI appear roughly a month away from bottoming out. According to Kevin, these technical resets should serve as a springboard for Dogecoin’s next significant upward move, provided that Bitcoin, which he believes must hold above $70K in his scenario, remains stable enough to support broader market strength.

Related Reading

On Sunday, Kevin reminded his audience that this strategy, first made public on March 22, is going “exactly according to plan,” given Dogecoin’s confirmed bounce around the $0.139 region and the ongoing drift toward oversold conditions in multiple momentum gauges. He disclosed that his Patreon trading portfolio holds an average entry at $0.15 for this swing and noted that a swift rejection of sub-$0.139 weekly closes, coupled with the bullish stance of the higher time frame indicators, corroborates his confidence in Dogecoin’s recovery potential.

While he acknowledges that “lots of work” still needs to be done for Dogecoin to reclaim loftier levels near the 0.618 Fib around $0.262 or even the 0.786 Fib at $0.413, Kevin maintains that his initial thesis stands as long as the meme-inspired asset preserves its foothold above $0.139. For him, the risk of a breakdown is well-defined if the pivotal support gives way, but should the level persist, he sees the upside potential extending far beyond the current range. As of now, Dogecoin’s price continues to cling to that all-important line in the sand, keeping Kevin’s bullish blueprint very much alive.

At press time, DOGE traded at $0.16493.

Featured image created with DALL.E, chart from TradingView.com

Source link

Crypto Investors Sue Nike, Accuse Apparel Giant of Rug Pull After Abrupt Closure of Metaverse Business: Report

Top cryptocurrencies to watch: Pi Network, XRP, Sui

This Week in Crypto Games: Ubisoft’s ‘Might & Magic’, ‘Peaky Blinders’ in Development

Why Arbitrum-Nvidia Partnership Collapsed – And What It Means for Web3

Tariff Carnage Starting to Fulfill BTC’s ‘Store of Value’ Promise

The cost of innovation — Regulations are Web3’s greatest asset

Best Crypto to Buy as Derivatives Exchange CME Set to Launch XRP Futures

Metaplanet Buys Additional ¥1.92 Billion Worth Of Bitcoin

Here Are Four Signs the Stock Market Has Bottomed, According to Fundstrat’s Tom Lee

Bitcoin dips below $94,000 as ETFs record $3b weekly inflow

Bitcoin Post-Halving Price Performance Is the Worst on Record. Why?

Expert Predicts Start Date For Pi Network Price Pump

GameFi Tokens Show Signs of Life After Gala Games, White House Tie-Up

Bitcoin trades at ‘40% discount’ as spot BTC ETF buying soars to $3B in one week

Bitcoin Continues To Flow Out Of Major Exchanges — Supply Squeeze Soon?

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Crypto’s Big Trump Gamble Is Risky

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

I’m Grateful for Trump’s Embrace of Bitcoin

Trending

24/7 Cryptocurrency News6 months ago

24/7 Cryptocurrency News6 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin3 months ago

Bitcoin3 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Ripple Price1 month ago

Ripple Price1 month ago3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin6 months ago

Bitcoin6 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Opinion6 months ago

Opinion6 months agoCrypto’s Big Trump Gamble Is Risky

Bitcoin5 months ago

Bitcoin5 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Altcoins3 months ago

Altcoins3 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje