Bitcoin

Ether (ETH) ETF Inflows Hit Record, Bitcoin ETF Inflows Soar as BTC Price Eyes $90K

Published

5 months agoon

By

admin

“Assets in the US spot bitcoin ETFs are now up to $84b, which is 2/3 of the way to what gold ETFs have, all the sudden there’s a decent shot they surpass gold before their first birthday (we predicted it would take 3-4yrs),” Eric Balchunas, a senior analyst at Bloomberg, said in a post on X.

Source link

You may like

Solana Retests Bearish Breakout Zone – $65 Target Still In Play?

How Expanding Global Liquidity Could Drive Bitcoin Price To New All-Time Highs

Apple Delists 14 Crypto Apps in South Korea Including KuCoin and MEXC Exchanges Amid Regulatory Crackdown

Athens Exchange Group eyes first onchain order book via Sui

Futureverse Acquires Candy Digital, Taps DC Comics and Netflix IP to Boost Metaverse Strategy

Court Grants Ripple And SEC’s Joint Motion To Suspend Appeal

Bitcoin

How Expanding Global Liquidity Could Drive Bitcoin Price To New All-Time Highs

Published

54 minutes agoon

April 16, 2025By

admin

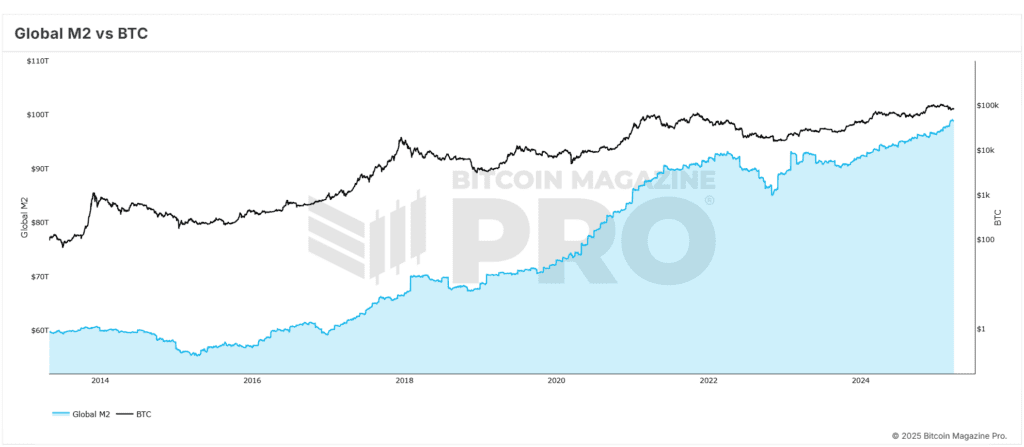

Bitcoin’s price trajectory is once again capturing headlines, and this time the catalyst appears to be global liquidity trends reshaping investor sentiment. In a recent comprehensive breakdown, Matt Crosby, Lead Analyst at Bitcoin Magazine Pro, presents compelling evidence tying the digital asset’s renewed bullish momentum to the expanding global M2 money supply. His insights not only illuminate the future of Bitcoin price but also anchor its macroeconomic relevance in a broader financial context.

Bitcoin Price and Global Liquidity: A High-Impact Correlation

Crosby highlights a remarkable and consistent correlation—often exceeding 84%—between Bitcoin price and global M2 liquidity levels. As liquidity increases across the global economy, Bitcoin price typically responds with upward movement, although with a noticeable delay. Historical data supports the observation of a 56–60 day lag between monetary expansion and Bitcoin price increases.

This insight has recently proven accurate, as Bitcoin price rebounded from lows of $75,000 to above $85,000. This trend closely aligns with the forecasted recovery that Crosby and his team had outlined based on macro indicators, validating the strength and reliability of the correlation driving Bitcoin price upward.

Why the 2-Month Delay Impacts Bitcoin Price

The two-month delay in market response is a critical observation for understanding Bitcoin price movements. Crosby emphasizes that monetary policy and liquidity injections do not immediately affect speculative assets like BTC. Instead, there is an incubation period, typically around two months, during which liquidity filters through financial systems and begins to influence Bitcoin price.

Crosby has optimized this correlation through various backtests, adjusting timeframes and offsets. Their findings indicate that a 60-day delay yields the most predictive accuracy across both short-term (1-year) and extended (4-year) historical Bitcoin price action. This lag provides a strategic advantage to investors who monitor macro trends to anticipate Bitcoin price surges.

S&P 500 and Its Influence on Bitcoin Price Trends

Adding further credibility to the thesis, Crosby extends his analysis to traditional equity markets. The S&P 500 exhibits an even stronger all-time correlation of approximately 92% with global liquidity. This correlation strengthens the argument that monetary expansion is a significant driver not just for Bitcoin price, but also for broader risk-on asset classes.

By comparing liquidity trends with multiple indices, Crosby demonstrates that Bitcoin price is not an anomaly but part of a broader systemic pattern. When liquidity rises, equities and digital assets alike tend to benefit, making M2 supply an essential indicator for timing Bitcoin price movements.

Forecasting Bitcoin Price to $108,000 by June 2025

To build a forward-looking perspective, Crosby employs historical fractals from previous bull markets to project future Bitcoin price movements. When these patterns are overlaid with current macro data, the model points to a scenario where Bitcoin price could retest and potentially surpass its all-time highs, targeting $108,000 by June 2025.

This optimistic projection for Bitcoin price hinges on the assumption that global liquidity continues its upward trajectory. The Federal Reserve’s recent statements suggest that further monetary stimulus could be deployed if market stability falters—another tailwind for Bitcoin price growth.

The Rate of Expansion Affects Bitcoin Price

While rising liquidity levels are significant, Crosby stresses the importance of monitoring the rate of liquidity expansion to predict Bitcoin price trends. The year-on-year M2 growth rate offers a more nuanced view of macroeconomic momentum. Although liquidity has generally increased, the pace of expansion had slowed temporarily before resuming an upward trend in recent months.

This trend is strikingly similar to conditions observed in early 2017, just before Bitcoin price entered an exponential growth phase. The parallels reinforce Crosby’s bullish outlook on Bitcoin price and emphasize the importance of dynamic, rather than static, macro analysis.

Final Thoughts: Preparing for the Next Bitcoin Price Phase

While potential risks such as a global recession or a significant equity market correction persist, current macro indicators point toward a favorable environment for Bitcoin price. Crosby’s data-driven approach offers investors a strategic lens to interpret and navigate the market.

For those looking to make informed decisions in a volatile environment, these insights provide actionable intelligence grounded in economic fundamentals to capitalize on Bitcoin price opportunities.

For more deep-dive research, technical indicators, real-time market alerts, and access to a growing community of analysts, visit BitcoinMagazinePro.com.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment decisions.

Source link

Bitcoin: The Inverse of Clown World by Knut Svanholm and Luke de Wolf, Lemniscate Media, 175 pages, $25.00.

This is a book review from The Mining Issue of Bitcoin Magazine Print. Get your copy here.

—

There is a similarity across the Bitcoin books published this [last] summer: They’re all about self-improvement and spiritual development. As a community, we seem to have moved on from writing about what money is, what it used to be, or how it operates in the modern world — or the specific ways in which bitcoin differs.

Instead, we’re now writing and thinking about life with bitcoin. Bitcoin has a culture, its virtues and values push its users in certain directions. [Aleks] Svetski writes about classical virtues and how they let us live well on a bitcoin standard. Mekhail writes about how to raise kids with intention and a long-term, orange, focus. In Bitcoin: The Inverse of Clown World, Knut Svanholm and his podcast sidekick Luke de Wolf gives us “a journey of introspection and self-improvement” (page 11). This “is a book about you” (page 13); not that different from how [George] Mekhail thinks about parenting.

It’s an unbelievably entertaining and powerful book, with plenty of food for thought about the insanities of our world. The chapter headings are slick, the chapters themselves digestible and relatable. If a measure of a book is how often I laugh, pull out my highlighter, or incessantly send quotes to friends, then Inverse of Clown World receives excellent marks. It’s the perfect combination of light, relaxed reading and hard-hitting punch — sprinkled with a whole jar of humor.

The allure of Inverse is to see that all the madness in the world — political grandstanding, gender dysphoria, the broad moral, fiscal, and political decay — call out for an explanation. Why is it happening? How did it come to this? It seems so obviously irrelevant and so obviously stupid.

Svanholm and de Wolf have an answer, which “is more straightforward than you might think. When the money stops working, everything becomes political and a farce” (page 51). Shockingly, the book’s main suggestion is that moral and political collapse is downstream of the money.

Hurling us straight off the deep end, the opening chapter is praxeology — that arcane, philosophical foundation for all Austrian economics. We then venture from the highest echelons of academic economics and mathematics to popular culture interpretations of Christopher Nolan’s The Dark Knight, to observations of reciprocal altruism in nature and its counterpart in human internet affairs. High and low, indeed.

Some dozen pages in, it feels like reading a textbook-like description of markets and the stylized economic hypothetical known as the prisoner’s dilemma. The authors draw important conclusions from the modern debate about that game-theoretical exercise: “[economist Robert] Axelrod’s findings emphasized the importance of being friendly and forgiving, but also appropriately retaliatory” (page 19). “The balance between self-interest and cooperative behavior is crucial in the game of life, where decisions shape futures” (page 21).

What that has to do with Clown World is a little unclear, and indeed we must wait some fifty pages to get an inkling of what precisely the authors mean by the label. Then again, if you’ve read Svanholm before or listened to the Bitcoin Infinity Show at all — or, you know, not been cave-bound for the last decade-plus — you have a pretty good idea.

Several descriptions are broad-stroke, which is understandable when you try to capture something roughly meaning “everything stupid”. It’s the desire for free lunches (page 41). It’s where “pleasing bureaucrats becomes increasingly profitable, while providing as much value as possible to your fellow man becomes increasingly futile” (page 50). Clown World directly follows from a political money, “which makes people focus on totally arbitrary issues” (page 65); indeed, most so-called societal problems aren’t even problems. Clown World is equality-focused (page 101). In contrast, Bitcoin is fair, honest, and meritocratic. At the very end of the book, we learn that “Clown World is a byproduct of people not taking responsibility”. From that definition it quickly follows, via self-reflection and better “mental software”, that “Taking responsibility for your actions is the only thing that can make the whole damn circus disappear” (page 163):

”Success in the Bitcoin world comes from providing value to your fellow human beings, not mass theft or political manipulation. Everything Divided by 21 Million equals the inverse of Clown World.”

There is no doubt in my mind that Clown World is indeed disappearing, pulling away its most ardent proponents and last, bitter beneficiaries kicking and screaming. Messrs Svanholm and de Wolf think something similar:

”things such as Bitcoin ATMs will look as ridiculous as phone booths in the not-too-distant future. […] it’s not only the ATMs that will fall into obsolescence. Everything in the Jurassic fiat currency world is on the brink of extinction. Are you a dinosaur or a human being?”

Between the ridiculing of wokeness and climate change worries, we get plenty of advice about screening out noise and guarding one’s time and mind. We get personal chapters about Knut running through the rainy slush of Gothenburg, Sweden, as well as unbelievably lengthy adventures in the Einsteinian spacetime and astrophysics. The far-fetched relevance to Clown World (“our attention also shapes our realities”, page 113) could have been reached without this much extravagance.

We get musings on creativity, stoicism, and what the relationship is between freedom and responsibility. Indeed, “whatever small step you take to increase your personal freedom footprint increases the total level of freedom dioxide in the atmosphere” (page 133).

Why should you read this book at all? It’s simple, really: It’s Knut, it’s funny, and at times it’s pretty inspiring.

Selected quotes:

- “When people know enough about Bitcoin to have stopped worrying about their financial future, they usually care less about how others perceive their words and actions and more about honesty and integrity” (page 53).

- “In a world where correct pronoun assignments, teenaged weather activists, the big game last night, Taylor Swift’s latest boyfriend, and a mostly harmless flu are headline news, it’s easy to see that some force is trying to avert our eyes from the men behind the curtain” (pages 24-25)

- “Clownish political ideas have existed for as long as politics itself. They come in many ways, shapes, and forms, and it can be hard to see their ridiculousness when living among them” (page 36)

Final nugget:

“You’re an absolute winner if you have one more Satoshi this year than last. Zoom out and be patient. Sell your chairs, slay your heroes, and take responsibility for your actions” (page 63).

Disclaimer: Opinions expressed are entirely the author’s and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Source link

Bitcoin

Bitcoin Indicator Flashing Bullish for First Time in 18 Weeks, Says Analyst Who Called May 2021 Crypto Collapse

Published

19 hours agoon

April 16, 2025By

admin

A crypto analyst who nailed the 2021 Bitcoin market meltdown says that a BTC indicator is suddenly flashing bullish.

Pseudonymous analyst Dave the Wave tells his 149,300 followers on the social media platform X that Bitcoin’s weekly logarithmic moving average convergence divergence (LMACD) histogram indicator is starting to strengthen, signaling a possible rally.

The LMACD histogram indicator is designed to signal changes in an asset’s trend, strength and momentum. Shrinking bars on the histogram suggest that an asset’s trend momentum is weakening. In Bitcoin’s case, the histogram’s declining red bars may indicate that a market reversal is in sight.

Says Dave the Wave,

“Bull markets climb a wall of worry. First strengthening histogram on the weekly BTC chart in 18 weeks/4.5 months. Weekly MACD itself has not been below the zero-line, in bear territory, since Feb 2023, i.e.; an ongoing bull market. People drop the ball when they ignore the technicals.”

Next up, he looks at the BTC/gold ratio, which is the value of Bitcoin relative to the price of gold. Based on the trader’s chart, he appears to suggest that the BTC/gold ratio may have topped out, indicating that Bitcoin may soon outperform gold.

Lastly, Dave the Wave shares a chart that shows BTC has been out of the “buy zone” of his logarithmic growth curve (LGC) since it was last trading around $40,000.

The LGC aims to forecast Bitcoin’s market cycle highs and lows while filtering out short-term volatility.

“Back when BTC was half the price that was the last time it hit the LGC ‘buy zone.’”

Bitcoin is trading for $84,459 at time of writing, flat on the day.

Follow us on X, Facebook and Telegram

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

Solana Retests Bearish Breakout Zone – $65 Target Still In Play?

How Expanding Global Liquidity Could Drive Bitcoin Price To New All-Time Highs

Apple Delists 14 Crypto Apps in South Korea Including KuCoin and MEXC Exchanges Amid Regulatory Crackdown

Athens Exchange Group eyes first onchain order book via Sui

Futureverse Acquires Candy Digital, Taps DC Comics and Netflix IP to Boost Metaverse Strategy

Court Grants Ripple And SEC’s Joint Motion To Suspend Appeal

AVAX Falls 2.1% as Nearly All Assets Trade Lower

What is a VTuber, and how do you become one in 2025?

Top Expert’s Update Sets $10 Target

How Academia Interacts With The Bitcoin Ecosystem

AB DAO and Bitget Launch Dual Reward Campaign, Distributing $2.6M Worth of $AB Globally

AI crypto tokens at risk as Nvidia faces restrictions on China exports

Coinbase Urges Australia to Vote for Crypto Progress in May

How High Would Pi Network Price Go If Pi Coin Adopts Transparency to Avoid Mantra Pitfalls

XRP’s ‘Rising Wedge’ Breakdown Puts Focus on $1.6 Price Support

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Crypto’s Big Trump Gamble Is Risky

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

I’m Grateful for Trump’s Embrace of Bitcoin

Trending

24/7 Cryptocurrency News5 months ago

24/7 Cryptocurrency News5 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin3 months ago

Bitcoin3 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Bitcoin5 months ago

Bitcoin5 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Altcoins3 months ago

Altcoins3 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Price analysis5 months ago

Price analysis5 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x