Markets

Ethereum ETFs Are Thriving Amid ‘Overdue Excitement’ and Rising Optimism: Analysts

Published

5 months agoon

By

admin

Ethereum ETFs are riding a wave of post-election momentum, reversing a tide of billions of dollars in outflows that had dampened investor enthusiasm when launched this summer.

Cumulative net inflows for spot Ethereum ETFs flipped positive Tuesday, hitting $94 million, according to SoSo Value data. Representing the total amount of money that nine investment products for Ethereum have taken in so far, the figure had climbed to $238 million on Thursday.

When spot Ethereum ETFs debuted in July, the initial picture was ugly. The Grayscale Ethereum Trust (ETHE) saw $1.7 billion worth of outflows in its first five trading days, bleeding cash as the price of Ethereum dropped as low as $3,400, according to SoSo Value data.

Analysts attributed ETHE’s sizable streak of outflows to the product’s relatively high expense ratio, making it more costly to hold than alternatives. Not long after, the crypto market dipped amid macro jitters and an unwinding yen “carry trade” that caught global markets off guard.

“The launch of the spot Ethereum ETFs came at an awkward time,” Matt Mena, a research analyst at 21Shares, told Decrypt. “But now the optimism has come back in full force.”

While investors pulled $3.2 million from spot Ethereum ETFs on Thursday, the previous six days represented a record-setting span. Ramping up on Election Day, investors allocated $796 million to the products, notching their longest and largest stretch of inflows on record.

Investors appear to be more comfortable with Ethereum following Donald Trump’s White House victory, Mena said, pointing to hopes of a pro-crypto administration under the president-elect. At the same time, he said crypto-friendly members of Congress should “also encourage more builders to develop applications on top of the Ethereum network” amid a new tone on Capitol Hill.

“As the U.S. ushers in a more favorable regulatory administration, TradFi institutions and retail crypto traders alike feel more secure about the promise and resilience of digital assets,” Plume CEO Chris Yin told Decrypt. “We are beginning to see overdue excitement.”

Expectations of favorable crypto policy and regulation are driving excitement around Ethereum, according to FalconX Head of Research David Lawant. For example, he told Decrypt a regulatory framework for stablecoins would validate one of Ethereum’s use cases.

With spot Bitcoin ETFs seeing billions of dollars of inflows since Trump’s win, however, he told Decrypt that the recent wave of inflows for Ethereum ETFs is also likely part of a spillover effect among institutional and retail investors.

“There’s going to be people who will start looking around and seeing what is out there in this industry besides just Bitcoin,” Lawant said. “And the first thing that we’ll probably bump into is Ethereum, the only other crypto asset that has a spot ETF approved right now.”

Lawant added that there’s a degree of reflexivity likely impacting flows. As Ethereum’s price rises, investors are more likely to pay attention to the ETFs and potentially allocate to them, he said.

On Election Day, the price of Ethereum clocked in around $2,400. While its price had jumped 41% to $3,400 by Tuesday, it’s since retraced back down to around $3,100.

Overall, ETHE outflows have overshadowed the launch of spot Ethereum ETFs, but their launch has been pretty successful when looking past that one fund, Lawant said. BlackRock’s Bitcoin ETF has pulled in $1.7 billion just on its own, while seven others have collectively attracted $1.8 billion.

“It’s important to keep in mind that $3.5 billion dollars for ETFs that launched less than four months ago is not a bad number at all,” he said.

Edited by Andrew Hayward

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.

Source link

You may like

Solana Retests Bearish Breakout Zone – $65 Target Still In Play?

How Expanding Global Liquidity Could Drive Bitcoin Price To New All-Time Highs

Apple Delists 14 Crypto Apps in South Korea Including KuCoin and MEXC Exchanges Amid Regulatory Crackdown

Athens Exchange Group eyes first onchain order book via Sui

Futureverse Acquires Candy Digital, Taps DC Comics and Netflix IP to Boost Metaverse Strategy

Court Grants Ripple And SEC’s Joint Motion To Suspend Appeal

Bitcoin

How Expanding Global Liquidity Could Drive Bitcoin Price To New All-Time Highs

Published

1 hour agoon

April 16, 2025By

admin

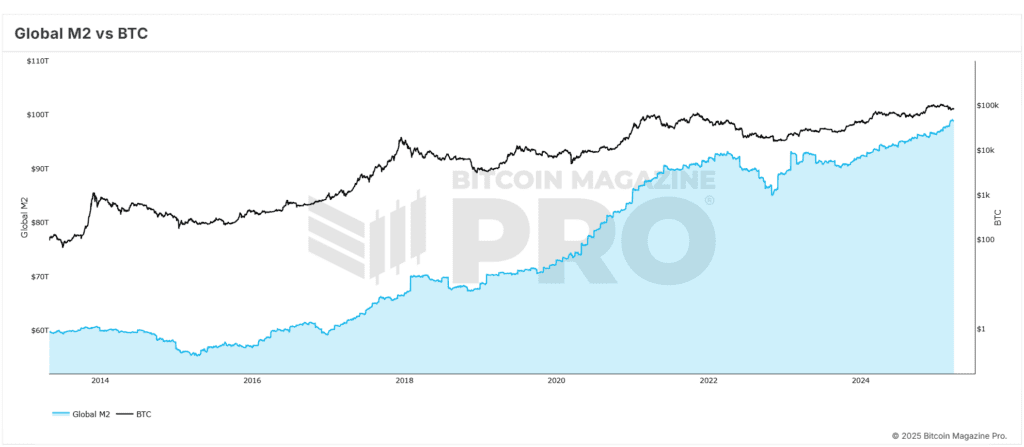

Bitcoin’s price trajectory is once again capturing headlines, and this time the catalyst appears to be global liquidity trends reshaping investor sentiment. In a recent comprehensive breakdown, Matt Crosby, Lead Analyst at Bitcoin Magazine Pro, presents compelling evidence tying the digital asset’s renewed bullish momentum to the expanding global M2 money supply. His insights not only illuminate the future of Bitcoin price but also anchor its macroeconomic relevance in a broader financial context.

Bitcoin Price and Global Liquidity: A High-Impact Correlation

Crosby highlights a remarkable and consistent correlation—often exceeding 84%—between Bitcoin price and global M2 liquidity levels. As liquidity increases across the global economy, Bitcoin price typically responds with upward movement, although with a noticeable delay. Historical data supports the observation of a 56–60 day lag between monetary expansion and Bitcoin price increases.

This insight has recently proven accurate, as Bitcoin price rebounded from lows of $75,000 to above $85,000. This trend closely aligns with the forecasted recovery that Crosby and his team had outlined based on macro indicators, validating the strength and reliability of the correlation driving Bitcoin price upward.

Why the 2-Month Delay Impacts Bitcoin Price

The two-month delay in market response is a critical observation for understanding Bitcoin price movements. Crosby emphasizes that monetary policy and liquidity injections do not immediately affect speculative assets like BTC. Instead, there is an incubation period, typically around two months, during which liquidity filters through financial systems and begins to influence Bitcoin price.

Crosby has optimized this correlation through various backtests, adjusting timeframes and offsets. Their findings indicate that a 60-day delay yields the most predictive accuracy across both short-term (1-year) and extended (4-year) historical Bitcoin price action. This lag provides a strategic advantage to investors who monitor macro trends to anticipate Bitcoin price surges.

S&P 500 and Its Influence on Bitcoin Price Trends

Adding further credibility to the thesis, Crosby extends his analysis to traditional equity markets. The S&P 500 exhibits an even stronger all-time correlation of approximately 92% with global liquidity. This correlation strengthens the argument that monetary expansion is a significant driver not just for Bitcoin price, but also for broader risk-on asset classes.

By comparing liquidity trends with multiple indices, Crosby demonstrates that Bitcoin price is not an anomaly but part of a broader systemic pattern. When liquidity rises, equities and digital assets alike tend to benefit, making M2 supply an essential indicator for timing Bitcoin price movements.

Forecasting Bitcoin Price to $108,000 by June 2025

To build a forward-looking perspective, Crosby employs historical fractals from previous bull markets to project future Bitcoin price movements. When these patterns are overlaid with current macro data, the model points to a scenario where Bitcoin price could retest and potentially surpass its all-time highs, targeting $108,000 by June 2025.

This optimistic projection for Bitcoin price hinges on the assumption that global liquidity continues its upward trajectory. The Federal Reserve’s recent statements suggest that further monetary stimulus could be deployed if market stability falters—another tailwind for Bitcoin price growth.

The Rate of Expansion Affects Bitcoin Price

While rising liquidity levels are significant, Crosby stresses the importance of monitoring the rate of liquidity expansion to predict Bitcoin price trends. The year-on-year M2 growth rate offers a more nuanced view of macroeconomic momentum. Although liquidity has generally increased, the pace of expansion had slowed temporarily before resuming an upward trend in recent months.

This trend is strikingly similar to conditions observed in early 2017, just before Bitcoin price entered an exponential growth phase. The parallels reinforce Crosby’s bullish outlook on Bitcoin price and emphasize the importance of dynamic, rather than static, macro analysis.

Final Thoughts: Preparing for the Next Bitcoin Price Phase

While potential risks such as a global recession or a significant equity market correction persist, current macro indicators point toward a favorable environment for Bitcoin price. Crosby’s data-driven approach offers investors a strategic lens to interpret and navigate the market.

For those looking to make informed decisions in a volatile environment, these insights provide actionable intelligence grounded in economic fundamentals to capitalize on Bitcoin price opportunities.

For more deep-dive research, technical indicators, real-time market alerts, and access to a growing community of analysts, visit BitcoinMagazinePro.com.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment decisions.

Source link

Markets

XRP’s ‘Rising Wedge’ Breakdown Puts Focus on $1.6 Price Support

Published

15 hours agoon

April 16, 2025By

admin

Payments-focused XRP’s immediate prospects look bleak, with its price chart flashing a “rising wedge” breakdown.

A rising wedge comprises two converging trendlines that connect higher lows and higher highs. This convergence suggests that upward momentum is weakening. When the price moves below the lower trendline, it signals a shift to a bearish trend.

XRP dived out of its rising wedge pattern during Wednesday’s early Asian hours, suggesting that the attempted recovery from the April 7 lows near $1.60 has likely lost momentum, allowing sellers to regain control.

According to technical analysis theory, analysts should identify the starting point of the rising wedge as the initial support level following the breakdown, which means XRP can now fall back to $1.60. The cryptocurrency has also fallen below the Ichimoku Cloud, a momentum indicator, on the hourly chart, reinforcing the bearish outlook indicated by the rising wedge breakdown.

Tuesday’s high of $2.18 is the level for bulls to beat to invalidate the bearish outlook.

Source link

The U.S. dollar index remains under pressure as Donald Trump’s tariffs push investors to other currencies.

The DXY index was trading at $99.95 on Tuesday, down by 9.20% from its highest level this year. It has also been hovering at its lowest point since July 2023, and a death cross it formed points to more downside in the coming months.

The US dollar index could crash further

More technical signals show that the U.S. dollar index has further downside potential. It has formed an inverse cup and shoulders pattern whose depth is about 9%. Measuring the same distance from the lower side of the cup points to further downside to $91.

Further, a key survey of institutional investors shows that most of them are bearish on the currency as the trade war continues. Sixty-one percent of respondents in Bank of America’s Global Fund Manager Survey see the greenback falling in the next 12 months. This is the most bearish these fund managers have been since 2006.

These investors are concerned about Trump’s policies and their economic impact. The most urgent fear is tariffs, which analysts expect will affect the economy. Many fund managers believe the U.S. will sink into a recession this year.

While Trump has walked back some tariffs, those on China remain at uncomfortable levels. Most Chinese goods flowing to the United States will receive a 145% tariff, affecting goods worth hundreds of billions of dollars. On Tuesday, Beijing announced that it would block Boeing purchases by its airlines.

Further, the U.S. dollar index has dropped as Congress negotiates Trump’s funding bill, which includes $4.5 trillion in tax cuts.

A falling US dollar could benefit Bitcoin and most altcoins

A deteriorating US dollar index could benefit Bitcoin (BTC) and altcoins for three reasons. First, most of these coins are traded in Tether, a stablecoin backed by the U.S. dollar. As such, a weakening greenback makes Bitcoin and these altcoins more affordable.

Second, the ongoing dollar weakness is likely due to concerns about the American economy and the impact of tariffs. As such, there is a likelihood that the Federal Reserve will intervene and slash interest rates. Some Fed officials, like Christopher Waller and Susan Collins, have confirmed that the bank is ready to act in the event of a recession.

Third, Bitcoin and altcoins could benefit as the U.S. dollar index falls because they are often considered safe havens. While Bitcoin’s price has dropped this year, it has performed better than the stock market.

Source link

Solana Retests Bearish Breakout Zone – $65 Target Still In Play?

How Expanding Global Liquidity Could Drive Bitcoin Price To New All-Time Highs

Apple Delists 14 Crypto Apps in South Korea Including KuCoin and MEXC Exchanges Amid Regulatory Crackdown

Athens Exchange Group eyes first onchain order book via Sui

Futureverse Acquires Candy Digital, Taps DC Comics and Netflix IP to Boost Metaverse Strategy

Court Grants Ripple And SEC’s Joint Motion To Suspend Appeal

AVAX Falls 2.1% as Nearly All Assets Trade Lower

What is a VTuber, and how do you become one in 2025?

Top Expert’s Update Sets $10 Target

How Academia Interacts With The Bitcoin Ecosystem

AB DAO and Bitget Launch Dual Reward Campaign, Distributing $2.6M Worth of $AB Globally

AI crypto tokens at risk as Nvidia faces restrictions on China exports

Coinbase Urges Australia to Vote for Crypto Progress in May

How High Would Pi Network Price Go If Pi Coin Adopts Transparency to Avoid Mantra Pitfalls

XRP’s ‘Rising Wedge’ Breakdown Puts Focus on $1.6 Price Support

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Crypto’s Big Trump Gamble Is Risky

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

I’m Grateful for Trump’s Embrace of Bitcoin

Trending

24/7 Cryptocurrency News5 months ago

24/7 Cryptocurrency News5 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin3 months ago

Bitcoin3 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Bitcoin5 months ago

Bitcoin5 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Altcoins3 months ago

Altcoins3 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Price analysis5 months ago

Price analysis5 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x