Analyst

Ethereum Price Crash Incoming? Tron’s Justin Sun Unstakes $209 Million ETH From Lido Finance

Published

3 months agoon

By

admin

The Ethereum price could face some turbulence, as Justin Sun, the founder of Tron (TRX), has unstaked a whopping $209 million from Lido Finance, a liquid decentralized staking platform for Ethereum. Compared to top cryptocurrencies like Bitcoin (BTC) and Dogecoin (DOGE), the Ethereum price has had a relatively muted performance, skyrocketing to $4,000 before consolidating and struggling to move higher. With the possibility of more sell-offs, Ethereum could see its price crashing down if Sun decides to dump more coins.

Justin Sun Dumps ETH

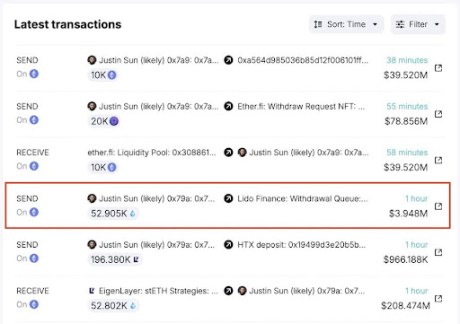

New reports from Spot On Chain, an AI-driven crypto platform, revealed that Sun recently applied to withdraw a staggering 52,905 ETH tokens worth about $209 million from Lido Finance. According to the on-chain data, this massive withdrawal was part of the ETH stash Sun allegedly accumulated between February and August 2024.

Spot On Chain has revealed that the total amount of Ethereum Sun bought within this period amounted to 392,474 ETH tokens, valued at $1.19 billion. All of these tokens were purchased via three wallet addresses at an average price of $3,027. Presently, the total profit the Tron founder has acquired since his purchase is up to $349 million, representing a 29% increase from its purchasing price.

Interestingly, on October 24, Sun had unstaked a massive 80,251 ETH tokens, worth over $131 million, from Lido Finance. Four days later, he transferred the entire amount to Binance, the world’s largest crypto exchange. This notable move took place just before the price of Ethereum had dropped sharply by 5% in mid-October, which could have resulted in a loss for Sun.

Unsurprisingly, this is not the first time Sun has dumped Ethereum. Spot On Chain revealed earlier this month that the Tron Founder had been cashing in his Ethereum holdings during the market rally.

In November, Sun deposited 19,000 ETH worth $60.83 million to HTX, a crypto exchange. Additionally, he transferred 29,920 ETH valued at $119.7 million to HTX again after its price surpassed $4,000 over the past week. These are just a few transactions the Tron founder has made with ETH over the past month.

Given Sun’s history of large-scale asset movements, further sell-offs could impact the already fragile Ethereum market. Nevertheless, the lingering question remains whether the Tron founder will continue his Ethereum dumping spree.

Ethereum Price Crash Ahead?

While Sun has not publicly commented on his recent large-scale Ethereum withdrawals, the size and timing of these transactions could pose a problem for the altcoin’s future trajectory. Historically, large ETH liquidations have triggered a price crash due to increasing selling pressures.

Related Reading

With the price of Ethereum still unstable and aiming for a stronger upward rally, further large-scale ETH dumps could exacerbate market volatility, especially if other investors or whales follow suit. For now, the price of Ethereum seems to be performing well, recording a more than 7% increase in the last seven days and a 28% surge over the past month, according to CoinMarketCap.

Featured image created with Dall.E, chart from Tradingview.com

Source link

You may like

CryptoQuant CEO Sounds The Alarm

South Korea Dismisses Establishing Strategic Bitcoin Reserve

TokenPicks Launches Reward System to Incentivize Crypto Education

Ethereum leadership now eyes Solana-style growth, Dragonfly’s Qureshi says

SEC’s Uyeda Signals Possible Revisions to Crypto Custody Rule

Mubarak Meme Coin Trader Turns $232 Into $1.1 Million, Here’s How

Analyst

Bitcoin Price Retests Support Line After Crash Below $95,000, Here’s The Next Target

Published

3 months agoon

December 28, 2024By

admin

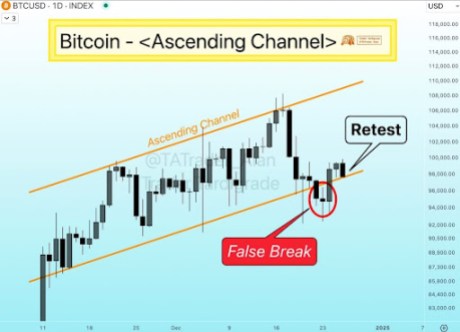

The Bitcoin price has struggled to reclaim previous price highs above $100,000, with bearish sentiment dominating the market. Currently, the Bitcoin price is retesting the support line of an Ascending Channel after crashing below $95,000. A crypto analyst has predicted that if it can hold this key support level, it could stage a recovery and skyrocket to its next bullish target, aligning with the upper resistance line of the channel.

Bitcoin Price Retest Support Line; New Target In Sight

In a chart illustrating Bitcoin’s price movement within an Ascending Channel, Trader Tardigrade, a crypto analyst on X (formerly Twitter), revealed that the cryptocurrency has temporarily declined below the lower support line on the channel. The analyst labeled this decline a “False Break,” highlighting that the Ascending Channel remains intact despite the drop.

Related Reading

As indicated by the red circle in the price chart, the False Break suggests that Bitcoin’s brief move below the support level was short-lived and does not confirm the continuation of its previous downtrend. Trader Tardigrade noted that after Bitcoin’s False break, the cryptocurrency quickly moved back into the Ascending Channel to reclaim the lower support line.

Interestingly, Bitcoin’s drop below the False break comes as the pioneer cryptocurrency experienced a sharp price crash below $95,000. Lately, the flagship cryptocurrency has been under significantly bearish pressure, recording notable declines as market volatility intensifies.

Despite this bearish performance, Trader Tardigrade has disclosed that Bitcoin is now retesting the channel’s support line again, aiming to break above and trigger a price reversal. The analyst predicts that if Bitcoin can hold this support line, it will likely continue moving upwards within the channel.

Consequently, the analyst has forecasted that Bitcoin’s next price target would be the upper resistance line of the Ascending Channel. Looking at the price chart, the channel points upwards towards a range between $110,000 and $112,000.

If Bitcoin can successfully recover toward the upper resistance line, it could signal the continuation of a bullish trend within the Ascending Channel. Additionally, a breakout above the resistance line could further validate the bullish momentum, setting up a stage for Bitcoin to potentially target higher price levels and possibly retest its all-time high.

Related Reading

Analyst Says Bitcoin Could Crash To $87,000

Bitcoin is currently in a downward trend, experiencing severe price declines despite analysts’ optimistic projections of a price surge. According to crypto analyst Titan of Crypto, the Bitcoin price could see another decline, with the support level at $87,000 being the next target.

However, according to the analyst, a drop to this price low could bring “maximum pain” to both short—and long-term investors. Nevertheless, Titan of Crypto believes this severe price decline could also present a strong foundation for Bitcoin’s next price rally.

He emphasized that price movements are rarely linear, highlighting the crypto market’s inherent unpredictability and volatility. Despite Bitcoin’s bearish behavior, Titan of Crypto confidently predicts that a price rally to $110,000 is inevitable.

Featured image created with Dall.E, chart from Tradingview.com

Source link

Analyst

Here Are The Major Bitcoin Support Levels To Watch As Bulls Push For $100,000 Again

Published

3 months agoon

December 26, 2024By

admin

Crypto analyst Trade PSH has revealed the major Bitcoin support levels to watch out for as BTC bulls push for a rally to the psychological $100,000 level. The analyst also mentioned what price levels Bitcoin could reach in the short term as it breaks above $100,000.

Bitcoin Support Levels To Watch Out For As Bulls Push For $100,000

In a TradingView post, Trade PSH stated that the local maximum is $99,450 as bulls are repeatedly trying to push the price above $100,000. The crypto analyst also mentioned that the nearest key support zone comes in between $95,000 and $96,600. This aligns with a recent Bitcoinist report that highlighted the $96,000 level as a crucial support zone.

Related Reading

While the Bitcoin price is moving above this support zone, Trade PSH stated that the primary scenario is continued growth for the flagship crypto. If Bitcoin maintains an uptrend and eventually breaks above the psychological $100,000 level, the crypto analyst predicts that the intermediate growth target is between $102,000 and $102,757.

Based on the current price action, the analyst suggested that Bitcoin could rally to $108,366. This would mark a new all-time high (ATH) for the flagship crypto, as its current ATH is $108,268. Meanwhile, Trade PSH mentioned that a drop below $94,300 would invalidate this trade setup.

The analyst’s accompanying chart showed that the Bitcoin price could break above $100,000 and reach these short-term targets before the year ends. While that remains to be seen, it is worth mentioning that January 2025 provides a bullish outlook for the flagship crypto.

Pro-crypto Donald Trump is set to take office on January 20, which could lead to the creation of the Strategic Bitcoin Reserve. Historically, Bitcoin also enjoyed a price recovery in January 2021 of the last bull run. As such, history could repeat itself again.

BTC Is Heading Higher

In an X post, crypto analyst Titan of Crypto also provided a bullish outlook for the Bitcoin price, stating that the flagship crypto is heading higher. His accompanying chart showed that Bitcoin could rally to as high as $158,000 by May 2025. The chart also showed a price target above $220,000, suggesting that the flagship crypto could rally even higher.

Related Reading

Titan of Crypto alluded to a bullish pennant, which he suggested was still in play for the Bitcoin price. This massive bull pennant is forming in the monthly timeframe, and if it plays out, the crypto analyst is confident that Bitcoin will enjoy a parabolic rally to this price target.

At the time of writing, the Bitcoin price is trading at around $98,100, down in the last 24 hours, according to data from CoinMarketCap.

Featured image created with Dall.E, chart from Tradingview.com

Source link

ADA

Possible Deep Correction Could Push Cardano Price To $0.43, Here’s How

Published

3 months agoon

December 26, 2024By

admin

The Cardano price action has continued to stall below the $1 mark in light of corrections in the past seven days. This correction, which played out across the entire crypto industry, saw Cardano break below the $1 mark again on December 18%.

Although the broader trend suggests a possible move on the weekly timeframe towards a new all-time high (ATH), recent technical analysis on TradingView has opened up the possibility for a continued correction towards $0.43 before another strong upward move.

Current Price Movements Highlight Resistance And Cooling Period

According to technical analysis of the Cardano (ADA) price action on the weekly candlestick timeframe, the cryptocurrency has encountered notable resistance around the $1.2046 mark. This resistance has emerged after Cardano’s remarkable 205% surge from $0.4322 in late October to $1.32 in late November.

Related Reading

Interestingly, this remarkable price surge saw Cardano form significant lows that serve as support levels for the price. Furthermore, the rally ended up with Cardano entering the overbought zone on the Relative Strength Index (RSI) indicator. The rally culminated in the Cardano price peaking at 82.87 on the RSI, but it has since retraced into a cooling/corrective period where buying pressure is consolidating at the time of writing.

Cardano’s consolidation has opened up outlooks as to its next direction, with substantial buying volumes observed in recent trading sessions.

Deep Correction Could Test Critical Support At $0.43

While the long-term outlook remains bullish, the analysis highlights the scenario of a deep correction that could send the Cardano price falling further in the short term. With this in mind, the analyst points to support levels that ADA may revisit in the event of a deeper correction. The first key level at $0.7683 has already proven its significance, acting as a reactionary zone in recent price movements.

Related Reading

Below this, $0.4322 stands as the ultimate support for the current bullish leg. What this means is that ADA has to hold above the $0.43 support level in order for a bullish trajectory to remain valid. Failure to hold above $0.43 is likely to cascade into more price declines at this point and a change into bearish outlook.

The analyst also identifies $0.3166 and $0.2427 as primary supports. These levels are Cardano’s lowest support during the previous bear market and are considered less likely to be breached in case of a longer-term decline.

Despite the potential for a deep correction, Cardano’s recent market behavior and buying trends suggest a promising long-term outlook. At the time of writing, ADA is trading at $0.912 and has increased by 2% in the past 24 hours. Once the current resistance at $1.2046 is cleared, ADA is well-positioned to challenge its $3.09 all-time high and possibly establish new highs in the current cycle.

Featured image created with Dall.E, chart from Tradingview.com

Source link

CryptoQuant CEO Sounds The Alarm

South Korea Dismisses Establishing Strategic Bitcoin Reserve

TokenPicks Launches Reward System to Incentivize Crypto Education

Ethereum leadership now eyes Solana-style growth, Dragonfly’s Qureshi says

SEC’s Uyeda Signals Possible Revisions to Crypto Custody Rule

Mubarak Meme Coin Trader Turns $232 Into $1.1 Million, Here’s How

Solana Protected Gender Identity Before Panning It in Anti-Queer Ad

Musk says he found ‘magic money computers’ printing money ‘out of thin air’

XRP To Triple Digits? Analyst Confident In $100 Price Goal

What Are They And What Do They Do?

Trader Predicts Crypto Rallies Amid Expectations of Fed Monetary Policy Shift – But There’s a Catch

Solana’s 5th birthday highlights explosive growth and trading activity: Mercuryo

Trump, Associates Net $390 Million Payday From World Liberty Token Sale

Bitcoin Price Eyes $200,000 Breakout If This History Aligns

Gold-Backed Tokens Outperform as ‘Bond King’ Gundlach Sees Precious Metal Hit $4,000

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Crypto’s Big Trump Gamble Is Risky

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

Trump’s Coin Is About As Revolutionary As OneCoin

Is $200,000 a Realistic Bitcoin Price Target for This Cycle?

Ripple Vs. SEC, Shiba Inu, US Elections Steal Spotlight

Trending

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin2 months ago

Bitcoin2 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News2 months ago

24/7 Cryptocurrency News2 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin4 months ago

Bitcoin4 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Altcoins2 months ago

Altcoins2 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin4 months ago

Bitcoin4 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Opinion4 months ago

Opinion4 months agoCrypto’s Big Trump Gamble Is Risky

Price analysis4 months ago

Price analysis4 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x