coinbase

Fairshake discloses $78m crypto donation war chest

Published

6 months agoon

By

admin

Crypto leaders and Silicon Valley giants have boosted Fairshake’s funds for the U.S. 2026 mid-term election cycle, even as America prepares to decide its next president.

The crypto super PAC Fairshake has raised $78 million from blockchain supporters and businesses for mid-term lobbying in 2026, according to CNBC.

U.S. mid-term elections, held two years into a president’s term, determine many congressional seats, potentially favoring digital asset regulations. Coinbase and Andreessen Horowitz are among the backers funding pro-crypto candidates in Congress.

America’s largest centralized crypto exchange, Coinbase, pledged to donate $25 million. Earlier, crypto.news reported that a16z crypto committed $23 million to Fairshake, as announced by managing partner Chris Dixon.

Crypto industry firms and blockchain-friendly companies have contributed a total of $170 million to Fairshake, a super PAC founded by over a dozen entities. Fairshake’s numbers, along with other crypto-aligned PACs, made up nearly 50% of corporate donations for the 2024 general elections.

A16z, Coinbase, Jump Crypto, and Ripple donated most of Fairshake’s $170 million crypto lobbying war chest this cycle. Fairshake has spent around $135 million, targeting legislators and state policymakers.

Long-term crypto lobbying commitments floated on hours before the final voting between Republican Donald Trump and Democrat Kamala Harris for president. On prediction platforms like Polymarket, Trump had a higher winning probability at 57.9% against Kamala’s 42.3%. But national polls implied a tight race between the rivals.

Presidential election results may be announced on Nov. 5. However, protracted vote counting could cause delays. Polymarket’s presidential contract crossed $3.1 billion volume as traders placed stoppage time wagers.

The largest presidential prediction market will resolve when the Associated Press, Fox, and CNBC all declare a single winner. If not, Polymarket’s betting pool would remain open until the inauguration in January.

Source link

You may like

Massive Altcoin Rallies Imminent Amid Surging Global Liquidity, According to Analyst TechDev

Bitcoin ‘breaking out’ as it retakes $87K after early April slump

Kling 2.0 Review: State of the Art AI Video Quality

Could this sports memecoin replicate Dogecoin’s early success?

‘Dire Picture’ for BTC Miners as Revenue Flatlines Near Record Low

Dogecoin Traders Celebrate DOGE Day with $0.20 Price Prediction In Focus

Altcoins

Helium (HNT) Jumps After SEC Dismisses Lawsuit Against Team Behind the Decentralized Wireless Network

Published

1 week agoon

April 13, 2025By

admin

A Solana (SOL)-based decentralized wireless network crypto project is skyrocketing after the U.S. Securities and Exchange Commission (SEC) dismissed its lawsuit against the protocol.

In a new thread on the social media platform X, the development team behind Helium (HNT) says that the regulatory agency has dropped its lawsuit against the crypto platform, which alleged that they violated securities laws.

According to a press release, Helium developer Nova Labs agreed to pay the SEC $200,000 to settle the accusation without admitting to any wrongdoing.

News of the dismissal caused HNT to rally as it went from a low of $2.62 on April 10th to a peak of $3.03 just a day later. It has since retraced and is trading for $2.96, a 9.9% increase during the last 24 hours.

The SEC, which originally filed the lawsuit in January, had accused Nova Labs of distributing unregistered securities.

“The SEC has agreed to dismiss its unregistered securities claims with prejudice. Helium Hotspots and the distribution of HNT, MOBILE, and IOT through the Helium Network are not securities. It also means that the SEC cannot bring these charges against Helium again.”

In a recent blog post, Helium says the dismissal of the case is a “landmark outcome” for the digital assets industry and DePIN (Decentralized Physical Infrastructure Networks) technology, which tokenizes real-world infrastructure.

“This landmark outcome is a pivotal turning point for the Helium community and the entire crypto industry, removing legal uncertainty for DePIN projects that use crypto incentives to build real-world infrastructure.

With the dismissal of the SEC’s unregistered securities claims with prejudice, the outcome establishes that selling hardware and distributing tokens for network growth does not automatically make them securities in the eyes of the SEC.”

This marks another lawsuit dropped by the SEC against crypto giants this year after President Donald Trump took office. Other dissolved cases include ones against the crypto exchanges Kraken and Coinbase, retail trading giant Robinhood, non-fungible token (NFT) marketplace OpenSea, and crypto wallet developer MetaMask.

Follow us on X, Facebook and Telegram

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

bybit

NFT industry in trouble as activity slows, market collapses

Published

2 weeks agoon

April 6, 2025By

admin

As the crypto market prepares for turbulence amid the tariff wars, the NFT market seems to be in a worse position.

Trading volumes are declining and marketplaces shutting down.

The once-hyped world of non-fungible tokens, which analysts once boldly projected could balloon to over $264 billion by 2032, now seems to be limping along. Weekly trading volumes have been falling like dominoes for weeks, scaring off capital and dragging the market back to levels not seen since its explosive 2020 debut.

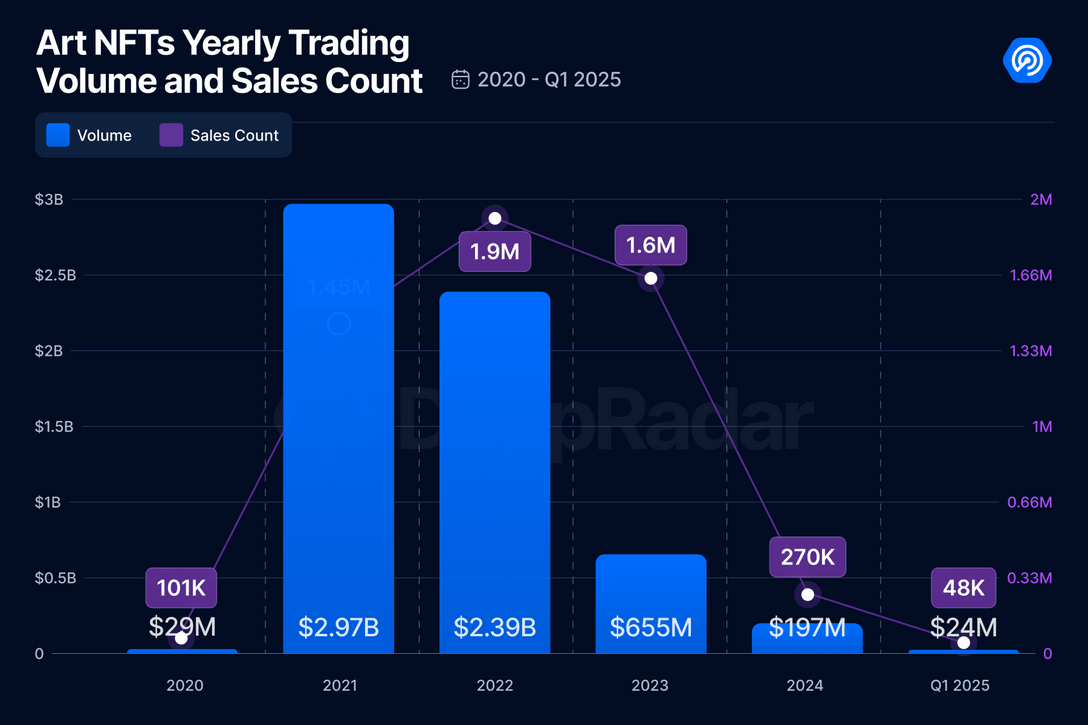

Blockchain analytics firm DappRadar shows that trading volumes in 2021 were riding high, hitting nearly $3 billion.

Fast-forward to the first quarter of 2025. That figure has nosedived 93% to just $23.8 million as “active traders have vanished,” blockchain analyst Sara Gherghelas noted.

“This rapid growth coincided with global shifts driven by the COVID-19 pandemic, accelerating the adoption of digital platforms and pushing artists to explore innovative methods of engaging with their audiences. However, three years later, the hype around Art NFTs has significantly decreased.”

Sara Gherghelas

The data backs her up. In 2024, trading volume dropped nearly 20% from the year prior, while total sales declined 18%. As Gherghelas put it in her 2025 research, it was “one of the worst-performing years since 2020.”

Still speculative assets

In an interview with crypto.news, OutsetPR’s legal officer Alice Frei implied that regulation is still a mess as “governments are still undecided on how to classify NFTs.”

In the U.S., they’re often treated like securities, meaning platforms must walk a legal tightrope. In the U.K., they’re seen more like collectibles under intellectual property law.

“These are examples of leading countries with clear cryptocurrency regulations; in many other countries, the situation is even more uncertain. This lack of regulatory clarity creates an environment that is ripe for fraud and erodes investor confidence. Until there is more consistency, NFT adoption will remain stagnant.”

Alice Frei

Frei also highlighted a deeper issue: beyond the worlds of cryptocurrency and gaming, NFTs are still “trying to prove that they offer real value.”

“In theory, they could revolutionize several industries — think concert tickets that prevent scalping, digital IDs for online verification, or property deeds stored on the blockchain. But in practice, most NFTs are still largely speculative assets.”

Alice Frei

Speaking of gaming, where NFTs have the most potential for mainstream use, their adoption is also struggling, Frei pointed out, recalling that Ubisoft’s Project Quartz, an attempt to integrate NFTs into AAA games, was met with “resistance from players, forcing the company to shut it down.”

Frei notes that gamers are “hesitant about digital assets that feel more like currency than a genuine addition to their experience.”

Revolving door

If the data wasn’t already bleak, March brought more bad news: a string of marketplace shutdowns added fuel to the fire. Among them, South Korean tech giant LG shut down its LG Art Lab, which was launched just three years ago at the height of the NFT mania. The company didn’t share detailed reasons, only saying that “it is the right time to shift our focus and explore new opportunities.”

Just a week later, X2Y2 — a former OpenSea rival that once boasted $5.6 billion in lifetime volume — also ceased its operations, citing a “90% shrinkage of NFT trading volume from its peak in 2021” and struggles to remain competitive in the space.

Then came Bybit. The crypto exchange, still reeling from a $1.46 billion theft linked to North Korea-affiliated hackers, quietly closed its platform.

Emily Bao, head of web3 at Bybit, said the decision would allow the company to “enhance the overall user experience while concentrating on the next generation of blockchain-powered solutions.”

Amid the wave of closures, Frei says the NFT market now “feels like a revolving door.”

“Take Bored Ape Yacht Club, for example – once the pinnacle of NFT status, its prices have dramatically dropped. At the peak, a single Bored Ape sold for $400,000, but now some are barely fetching $50,000. The problem lies in the fact that many NFT projects rely on hype rather than actual utility. If people cannot see long-term value, they are unlikely to return.”

Alice Frei

Last hope

Coinbase, too, seems to be pulling back. While it hasn’t officially shut down its NFT platform, all signs suggest it’s shifting focus. During an earnings call in early 2023, President and COO Emilie Choi indicated that the company sees “medium and long-term opportunities” in NFTs. But its real focus seems to be behind Base, its layer-2 blockchain network.

Coinbase declined to comment on its position as NFT activity continues to decline, despite multiple requests from crypto.news.

The OutsetPR legal officer thinks that with the market’s current trajectory, smaller platforms are unlikely to weather the storm. “Smaller platforms will continue to shut down, leaving only a few dominant players like OpenSea and Blur,” she said.

She explained that the shift is being driven by two major forces. First, tighter regulations are on the horizon, which will likely bring an end to the “Wild West days of NFTs.” Second, the gaming sector may offer NFTs a lifeline—but it’s still a narrow one. As Frei puts it, gaming may be NFTs’ “last hope,” though developers will still need to avoid “pay-to-win mechanics that could turn players away.”

“The hype is over. If NFTs are to survive, they will need to prove that they offer more than just expensive pictures on the blockchain,” Frei concluded.

Source link

Bitcoin ETF

Bitwise Debuts Option Income ETFs On Bitcoin Treasury Stocks: MSTR, MARA, COIN

Published

2 weeks agoon

April 5, 2025By

admin

Bitwise has introduced three new ETFs that provide yield-seeking investors with exposure to leading Bitcoin treasury companies, using a covered call strategy designed to capitalize on equity volatility while preserving Bitcoin-linked upside.

The funds include:

- $IMST, tracking Strategy (formerly MicroStrategy, ticker: MSTR), which currently holds 528,185 BTC.

- $IMRA, focused on MARA Holdings (MARA), a top-tier Bitcoin miner with 47,600 BTC in treasury.

- $ICOI, offering exposure to Coinbase (COIN), which holds 9,480 BTC and serves as a key on-ramp for institutional and retail Bitcoin adoption.

Each ETF employs an actively managed options overlay, writing out-of-the-money calls on the underlying equity while maintaining a long position. This approach is designed to deliver monthly income distributions—particularly attractive in today’s high-volatility environment—while retaining meaningful upside exposure to Bitcoin-linked companies.

While none of the funds directly hold Bitcoin, all three underlying equities are deeply intertwined with Bitcoin’s performance and trajectory. Strategy and Marathon are among the most prominent corporate holders of BTC, while Coinbase continues to serve as critical infrastructure for the broader ecosystem.

New Tools for Bitcoin-Aligned Capital Allocation

For corporate treasurers and institutional allocators who view Bitcoin as a long-term strategic asset, these new products represent a compelling way to gain indirect exposure while generating yield—especially in balance sheets that can’t yet directly hold BTC.

The rise of equity-based strategies like this is part of a broader shift. More public companies are actively integrating Bitcoin into their financial models, whether through direct holdings or through services and operations tied to Bitcoin mining, custody, or exchange infrastructure.

What Bitwise is offering is not just exposure, but a way to monetize volatility—something that Bitcoin-native companies experience more than most. Whether it’s MSTR stock reacting to Bitcoin’s price swings, MARA stock tracking mining difficulty and rewards, or Coinbase stock responding to changes in trading volume and regulatory sentiment, these equities are increasingly used as BTC proxies by sophisticated investors.

In recent months, institutional interest in Bitcoin ETFs, mining stocks, and companies with Bitcoin treasuries has intensified, and tools like IMST, IMRA, and ICOI provide a new angle on that demand. For companies already on a Bitcoin treasury path—or considering one—this evolution in capital markets infrastructure is notable.

What This Signals for Bitcoin Treasury Strategy

The launch of these ETFs reflects how Bitcoin is no longer just a spot asset—it’s now embedded in public equity strategy, yield generation, and portfolio construction.

Covered call structures won’t be right for every investor or treasury, but the signal is clear: the market is maturing around the idea that Bitcoin isn’t just to be held—it can be actively managed, structured, and monetized in new ways.

These new ETFs won’t replace direct holdings on a corporate balance sheet. But they may complement them—or offer a first step for firms exploring how to position around Bitcoin while still meeting traditional risk, yield, and reporting mandates.

Disclaimer: This content was written on behalf of Bitcoin For Corporations. This article is intended solely for informational purposes and should not be interpreted as an invitation or solicitation to acquire, purchase, or subscribe for securities.

Source link

Massive Altcoin Rallies Imminent Amid Surging Global Liquidity, According to Analyst TechDev

Bitcoin ‘breaking out’ as it retakes $87K after early April slump

Kling 2.0 Review: State of the Art AI Video Quality

Could this sports memecoin replicate Dogecoin’s early success?

‘Dire Picture’ for BTC Miners as Revenue Flatlines Near Record Low

Dogecoin Traders Celebrate DOGE Day with $0.20 Price Prediction In Focus

Bitcoin’s Largest Holders Are Stacking Again — What It Means for the Market

Bitcoin prepares for launch from $85K, BNB, HYPE, TAO and RNDR could follow

US Markets Will Crash if President Trump Forces Fed Chair Jerome Powell Out, Warns Senator Elizabeth Warren

Dogecoin supporters are 72% long — do they know something we don’t?

ConstitutionDAO But for the Apocalypse: Solana NFT Project Aims to Buy Nuclear Bunker

What’s Up With BTC, XRP, ETH?

XRP, Bitcoin Resemble a Compressed Spring Poised for a Significant Move as Key Volatility Indicator Mirrors 2024 Patterns

Bitcoin up 33% since 2024 halving as institutions disrupt cycle

Solana Price Surges Toward $140 — Here’s The Resistance Level To Watch

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Crypto’s Big Trump Gamble Is Risky

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

I’m Grateful for Trump’s Embrace of Bitcoin

Trending

24/7 Cryptocurrency News5 months ago

24/7 Cryptocurrency News5 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin3 months ago

Bitcoin3 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Ripple Price1 month ago

Ripple Price1 month ago3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin6 months ago

Bitcoin6 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Opinion6 months ago

Opinion6 months agoCrypto’s Big Trump Gamble Is Risky

Altcoins3 months ago

Altcoins3 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin5 months ago

Bitcoin5 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals