24/7 Cryptocurrency News

Fed Chair Jerome Powell Compares Bitcoin To Gold

Published

5 months agoon

By

admin

Federal Reserve Chairman Jerome Powell has broken silence on the broad comparison between Bitcoin, Gold and the US Dollar. Speaking at the Dealbook Summit, he revealed that Bitcoin is a speculative asset that has a closer correlation to Gold rather than the US Dollar.

Settling the Bitcoin Versus Gold Feud

The Fed Chair shared his take on this analogy while speaking with CNBC’s Andrew Ross Sorkin. His statements directly address Bitcoin proponents who believe the coin could displace the US Dollar. Rather than the tag it along USD, Jerome Powell said BTC’s major competitor is gold and not the greenback.

This statement is stirring a debate in the broader market on what this means for the strategic Bitcoin reserve plan President-elect Donald Trump is nursing.

This is a developing story, please check back for updates!!!

Godfrey Benjamin

Benjamin Godfrey is a blockchain enthusiast and journalists who relish writing about the real life applications of blockchain technology and innovations to drive general acceptance and worldwide integration of the emerging technology. His desires to educate people about cryptocurrencies inspires his contributions to renowned blockchain based media and sites. Benjamin Godfrey is a lover of sports and agriculture.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

You may like

‘Rich Dad, Poor Dad’ author calls for $1 million BTC by 2035

Chainlink Price Continues To Hover Around $12.5 — Levels To Watch

What Bitcoin Indicators Predict For Q3 2025?

$13,600,000 To Be Handed To Residents in Major US County As Leaders Approve Massive One-Time Payments for Households

Solana could end crypto market limbo rally, eyes $150

Evening Workouts Could Be Disrupting Your Sleep, New Study Finds

24/7 Cryptocurrency News

Robert Kiyosaki Reveals Timeline For Bitcoin Price To Hit $1M

Published

16 hours agoon

April 19, 2025By

admin

Robert Kiyosaki has once again stolen the spotlight with his recent bold prediction that the Bitcoin price will soar past $1 million. Besides, the Rich Dad Poor Dad also said that the Gold price will hit $30K while the Silver price will attain $3,000 per coin in the same time frame. Notably, this comes as he reiterates his prediction of a “GREATER DEPRESSION” for the US.

Robert Kiyosaki Predicts Bitcoin Price To $1M Amid Crash Woes

In a recent post on X, the Rich Dad Poor Dad author painted a grim picture of America’s financial future. He warned that soaring credit card debt, climbing unemployment, and dwindling pensions signal the early stages of a devastating economic crisis. According to him, the “biggest stock market crash in history” is unfolding right now.

However, amid this, he reiterated his previous advice while saying that Bitcoin price is poised to hit $1 million by 2035. Simultaneously, he also remained optimistic about precious metals like gold and silver amid the macroeconomic woes.

Kiyosaki Urges Taking Action

Meanwhile, Kiyosaki emphasized he had long warned about this crash in several books, including Rich Dad’s Prophecy, Fake, and Who Stole My Pension. He said those who listened to his advice are now better off. But, he worries for those who dismissed it.

“People who heeded my warnings are doing well today. I am concerned for those who did not.” Kiyosaki shared, urging individuals to still take action. He believes that investing in gold, silver, or even a portion of Bitcoin today could be life-changing.

He stressed, “It’s not too late, if you take action.” According to Kiyosaki, hesitation and negative self-talk are what keep people poor. He pointed out that even small investments, like a few ounces of gold or half a Bitcoin, could help individuals escape poverty after the economic storm passes.

Why Bitcoin Price May Hit $1M? Kiyosaki Reveals

Robert Kiyosaki’s belief that the Bitcoin price will reach $1 million by 2035 isn’t just a wild guess. It’s based on his deep mistrust of government-backed currencies and the collapsing traditional financial system. He explained that the US is drowning in debt and losing economic strength. At the same time, he sees decentralized assets like BTC as the new store of value.

Meanwhile, he added that the rich are already preparing, while the middle class and poor are left vulnerable. “This coming Great Depression will cause millions to be poor and a few who take action, may enjoy great wealth and freedom,” he warned.

Notably, the Rich Dad Poor Dad author has long warned of a “financial disaster”, which he thinks could be due to the government’s inefficiency. Also, Kiyosaki has been actively supporting Bitcoin, gold, and silver during the economic turmoil, deeming these as safer havens.

What’s Next For BTC?

BTC price today was up nearly 1% and exchanged hands at $85,071 while its one-day volume fell 38% to $13.07 billion. Notably, Bitcoin price has hovered between $84K and $85K over the last 24 hours, accompanied by a soaring Futures Open Interest of over 5%.

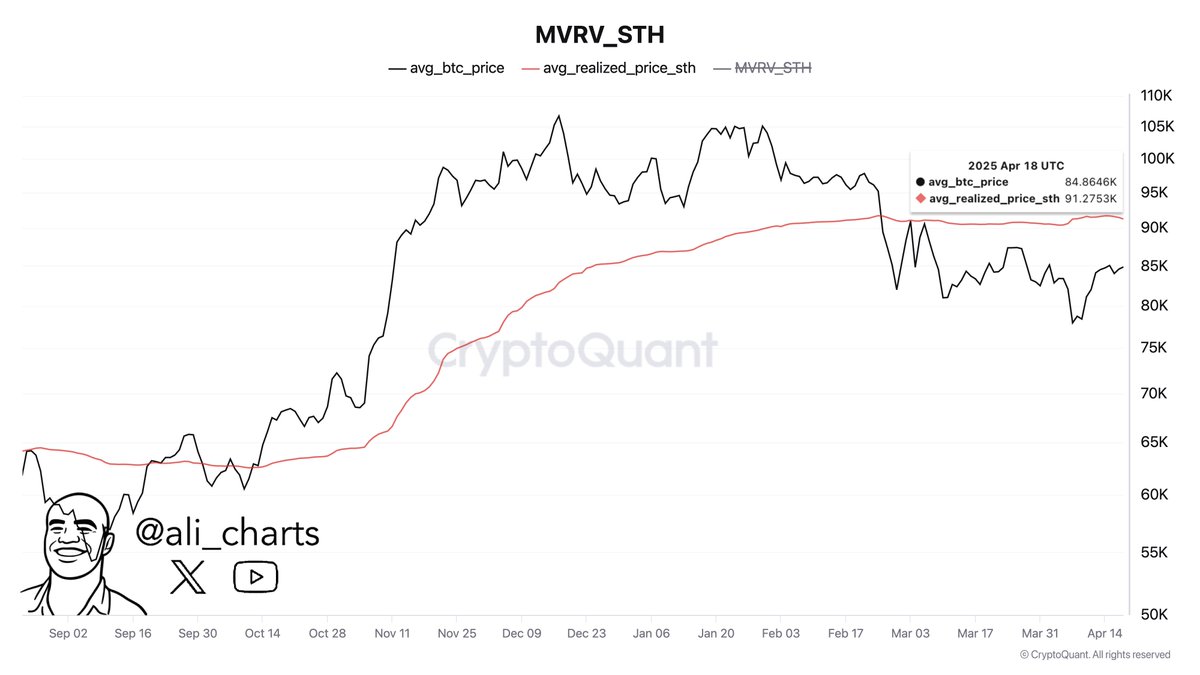

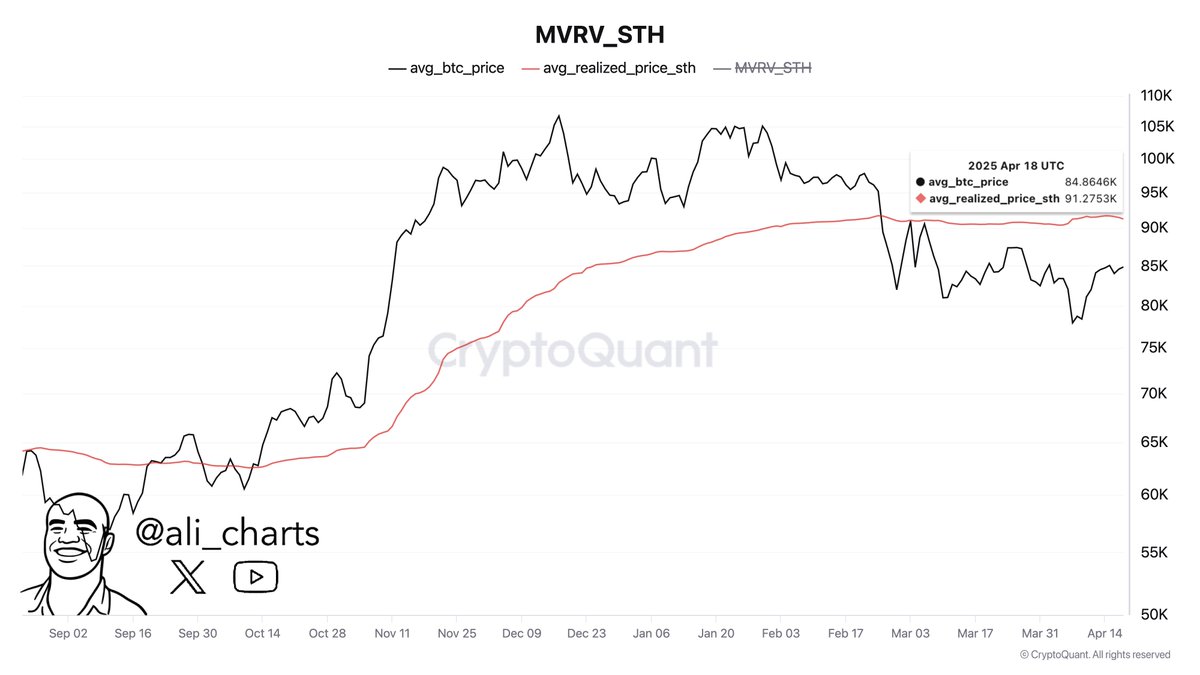

Notably, the market participants are keeping close track as BTC continues to trade within a tight range, sparking speculation about its next major move. Amid this, analyst Ali Martinez has shed light on the current state of the market, highlighting key price levels that could determine Bitcoin’s future trajectory.

According to Martinez, a breakout above $86,000 or a breakdown below $83,000 will likely define the next significant price shift. Looking further ahead, Martinez identifies $91,275 as a crucial resistance level, aligning with the short-term holder realized price.

A surge past this point could signal a renewed bullish trend, while failure to break through may lead to continued consolidation. Besides, a recent BTC price prediction also showed that the flagship crypto might hover the $90K in the coming weeks.

Rupam Roy

Rupam is a seasoned professional with three years of experience in the financial market, where he has developed a reputation as a meticulous research analyst and insightful journalist. He thrives on exploring the dynamic nuances of the financial landscape. Currently serving as a sub-editor at Coingape, Rupam’s expertise extends beyond conventional boundaries. His role involves breaking stories, analyzing AI-related developments, providing real-time updates on the crypto market, and presenting insightful economic news.

Rupam’s career is characterized by a deep passion for unraveling the complexities of finance and delivering impactful stories that resonate with a diverse audience.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

24/7 Cryptocurrency News

Dogecoin Price Breakout in view as Analyst Predicts $5.6 high

Published

2 days agoon

April 17, 2025By

admin

A Dogecoin (DOGE) price breakout past its previous All-Time High (ATH) price is gradually becoming possible amid the current market setup. While still tied in a long-drawn consolidation, a potential breakout is ahead for the memecoin, according to predictions from market analysts.

Dogecoin Price and Open Interest Outlook

As of this writing, DOGE’s price has changed hands for $0.1569, which has increased by 3.3% in the past 24 hours. This price trend is a testament to how resilient the DOGE price is, having traded at a low spot value of $0.1532. The memecoin has traded at a very close range during this period.

The current DOGE outlook shows a bullish trend in the futures market as showcased by Open Interest data. Data from Coinglass pegs the total Dogecoin committed to the futures market at 9.87 billion DOGE. This was valued at $1.54 billion and has skyrocketed by more than 5% in 24 hours.

Top crypto exchanges like Binance, OKX, and Bybit saw the highest DOGE open interest record. While the price traded at a relatively close range, the open interest commitment proves that traders with leverage are betting on the asset.

DOGE Price to $5.6?

Optimism trails Dogecoin, despite its spot value now trading down 78.71% from its ATH of $0.7376. Market analyst Dogedog told his more than 58,600 followers on X that the price of DOGE is heading to $5.6.

#Dogecoin heading to $5.60.

Breaking falling wedges. pic.twitter.com/XH7bwI7am4

— dogegod (@_dogegod_) April 17, 2025

While Dogegod did not provide a timeline or much context for his prediction, he highlighted how the memecoin breaks falling wedges. The analyst is not alone in his projection for the coin, as an earlier DOGE price analysis, Ali Martinez, predicted a $0.29 rally for the asset in the near term.

Although this price trend is not unrealistic, the broader market slowdown may serve as a bottleneck. Key performance metrics already tipped the Dogecoin price in line for a short-term breakout. With trading volume up 6% to more than $586 million as of writing, retail interest in the coin has further skyrocketed.

Dogecoin remains the lead among altcoins being considered for an exchange-traded fund (ETF) product. As reported earlier by CoinGape, 21Shares filed for a spot Dogecoin ETF, the latest asset manager to make the move. The belief is that an approval can usher in institutional funds, which can help fuel the coin’s price growth.

Godfrey Benjamin

Benjamin Godfrey is a blockchain enthusiast and journalists who relish writing about the real life applications of blockchain technology and innovations to drive general acceptance and worldwide integration of the emerging technology. His desires to educate people about cryptocurrencies inspires his contributions to renowned blockchain based media and sites. Benjamin Godfrey is a lover of sports and agriculture.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

24/7 Cryptocurrency News

Here’s What to Expect From TOWNS Token Price at Launch?

Published

3 days agoon

April 17, 2025By

admin

Towns, an on-chain decentralized messaging platform, is launching its native TOWNS token with an airdrop in 2025. The Towns association with the Base blockchain network has made it popular among crypto investors. Many are awaiting this token launch, especially as the platform raised $35.5M in funding backed by a16z, Coinbase Ventures, and others. In this blog, let us discuss the key details around the TOWNS token launch and potential price.

Towns Airdrop, Token Listing Date & Other Details

The TOWNS token launch with an airdrop is set to happen in Q2 2025 (before June). It will have a total supply of 10 billion, and 57% is allocated to the community. The remaining 35% is allocated to the team and investors, and 8% to initial node operators and delegators.

Interestingly, 10% (1 billion) is allocated for the airdrop going live before June. Notably, the listing date, eligibility criteria, and the TOWNS token price have not yet been finalized. However, the community discussions reveal that it is among the most anticipated crypto airdrops in 2025.

How to Qualify for Towns Airdrop?

Since the eligibility criteria for this airdrop are still due, the interested users can follow the following steps to potentially qualify. This includes:

- Setting up Base wallet with at least $10 in ETH

- Signing up with Towns’ platform

- Creating a Town group chat

- Continuous engagement with the platform, including joining paid Towns

- Completing activities for rewards/ points

Although these steps do not necessarily make users eligible, these are common crypto airdrop requirements. Similarly, the PAWS airdrop is in motion, which was delayed due to last-minute eligibility changes. Investors must stay updated with the airdrop notifications.

What can you expect from the TOWNS Token Price at Launch?

Towns’ decentralized platform has gained a significant milestone, showing investors’ interest in the upcoming airdrop. It includes the 1 million+ membership purchases, 332,000+ group chats, and much more.

Based on the potential hype among investors (around launch), circulating supply, potential top crypto exchange listing, and similar launches, experts anticipate the TOWN token price to be between $0.025 and $0.05 at launch. However, this is just an anticipation and could go differently.

Frequently Asked Questions (FAQs)

The eligibility criteria are not out yet, but experts anticipate proper interaction with the platform, including creating a Town group chat is important to be eligible.

The token will be launched with a total supply of 1 billion, and 57% is allocated to the community, 35% to the team and investors, and 8% to initial node operators and delegators.

The team has not officially announced the launch price, but experts calculate it between $0.025 and $0.05.

Pooja Khardia

With a deep-seated passion for reading and five years of experience in content writing, Pooja is now focused on crafting trending content about cryptocurrency market.

As a dedicated crypto journalist, Pooja is constantly seeking out trending topics and informative statistics to create compelling pieces for crypto enthusiasts. Staying abreast of the latest trends and advancements in the field is an integral part of her daily routine, fueling a commitment to delivering timely and insightful coverage

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

Trump’s Official Memecoin Surges Despite Massive $320 Million Unlock in Thin Holiday Trading

‘Rich Dad, Poor Dad’ author calls for $1 million BTC by 2035

Chainlink Price Continues To Hover Around $12.5 — Levels To Watch

What Bitcoin Indicators Predict For Q3 2025?

$13,600,000 To Be Handed To Residents in Major US County As Leaders Approve Massive One-Time Payments for Households

Solana could end crypto market limbo rally, eyes $150

Evening Workouts Could Be Disrupting Your Sleep, New Study Finds

3 XRP Rivals to Buy as Analyst Says Ripple Is The “Biggest Meme Coin”

Unpacking the DOJ’s Crypto Enforcement Memo

Bitcoin can reach $138K in 3 months as macro odds see BTC price upside

Ethereum Trades At Bear Market Lows: Fundamentals Signal Major Undervaluation

Bitcoin Covenants: TXHASH And CHECKTXHASHVERIFY(BIP 346)

Bitcoin Could Rip by 137% in a ‘Perfect Scenario,’ According to Analyst Benjamin Cowen – Here’s His Outlook

AI flattens creativity. Blockchain is how we save it

Public Keys: Circle Goes Quiet, Miners Dump Bitcoin, and Semler Gets Bailed Out

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Crypto’s Big Trump Gamble Is Risky

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

I’m Grateful for Trump’s Embrace of Bitcoin

Trending

24/7 Cryptocurrency News5 months ago

24/7 Cryptocurrency News5 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin3 months ago

Bitcoin3 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Ripple Price1 month ago

Ripple Price1 month ago3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin6 months ago

Bitcoin6 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Opinion6 months ago

Opinion6 months agoCrypto’s Big Trump Gamble Is Risky

Altcoins3 months ago

Altcoins3 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin5 months ago

Bitcoin5 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

✓ Share: