Bitcoin

Fed Minutes Confirm QT Is Ending

Published

2 months agoon

By

admin

On Tuesday, February 19, the Federal Reserve released their meeting minutes, revealing that central bankers are considering an end—or at least a significant slowdown—to quantitative tightening (QT). The document states: “Several participants suggest halting or slowing balance sheet reduction pending debt ceiling resolution.”

These remarks have fueled optimism among Bitcoin experts who view the potential end of QT as a bullish signal. Many see it as a precursor to greater liquidity entering financial markets, a condition that has historically benefited risk assets like cryptocurrencies.

The newly published minutes confirm that certain Fed officials are worried about the interaction between ongoing balance sheet reduction and the looming debt ceiling debate. The possibility of large-scale US Treasury issuance once the debt ceiling is resolved appears to be a key driver behind calls to pause or halt QT.

Related Reading

No explicit shift to quantitative easing (QE) was announced, but the acknowledgment that balance sheet reduction might be curtailed has been enough to stoke speculation in digital asset circles. The minutes must be unanimously approved by the Federal Open Market Committee (FOMC), further suggesting an intentional message from policymakers.

Implications For Bitcoin

Renowned market commentator and host of the On the Margin podcast, Felix Jauvin, took to X to emphasize the significance of the Fed’s signaling, writing: “There it is, QT coming to an end this spring. Reminder that every FOMC member has to unanimously approve these minutes, this is intentional.”

While Jauvin underscores the unanimity behind these minutes, he stops short of predicting an immediate shift toward QE. Instead, he points to a specific chain of events that the Fed seems to be navigating.

The Fed has already reduced the pace of balance sheet runoff by half compared to its initial rate. Jauvin also notes that as the reverse repo facility (RRP) nears zero and the Fed reaches its target reserve level of roughly 3% of GDP, an end to QT becomes more likely.

Related Reading

Moreover, concerns loom over the Treasury General Account (TGA) potentially being rebuilt once the debt ceiling is resolved, leading to sizable bill issuance which could lead to interim disruptions in funding markets.

Therefore, rather than pivot to QE, Jauvin believes the Fed could pursue a temporary Supplementary Leverage Ratio (SLR) exemption, allowing commercial banks to absorb additional government debt. “They are very very very very far from any sort of formal QE. Instead, it’s more likely they pursue an SLR exemption allowing commercial banks to be the marginal buyer of debt,” Jauvin predicts.

A formal return to QE, Jauvin concludes, would only materialize if financial and economic conditions deteriorate significantly, including a major collapse in risk assets and a drop in rates to near zero. In response to an X user asking if ending QT is bullish without necessarily indicating an immediate move to QE, Jauvin offered a succinct explanation:

“Therefore think for the current liquidity backdrop it is marginally improving in that we will have the possible sequence of TGA drawdown into QT ending into potentially SLR exemption, and that’ll be it for now. QE shouldn’t even be in the current vocabulary of discourse as it stands.”

Renowned crypto analyst Pentoshi agrees, highlighting a previously published forecast: “QT coming to an end… My guess, QT ends by start of Q3. With all that’s taking place currently Trump will likely end up forcing it. Was correct on QT guess in Nov 21. Let’s see.”

He cited how the conclusion of quantitative easing in late 2021 coincided with the end of the crypto bull run. Now, market watchers are keenly observing whether the inverse—a potential termination of QT—could spark renewed momentum for Bitcoin and other digital assets.

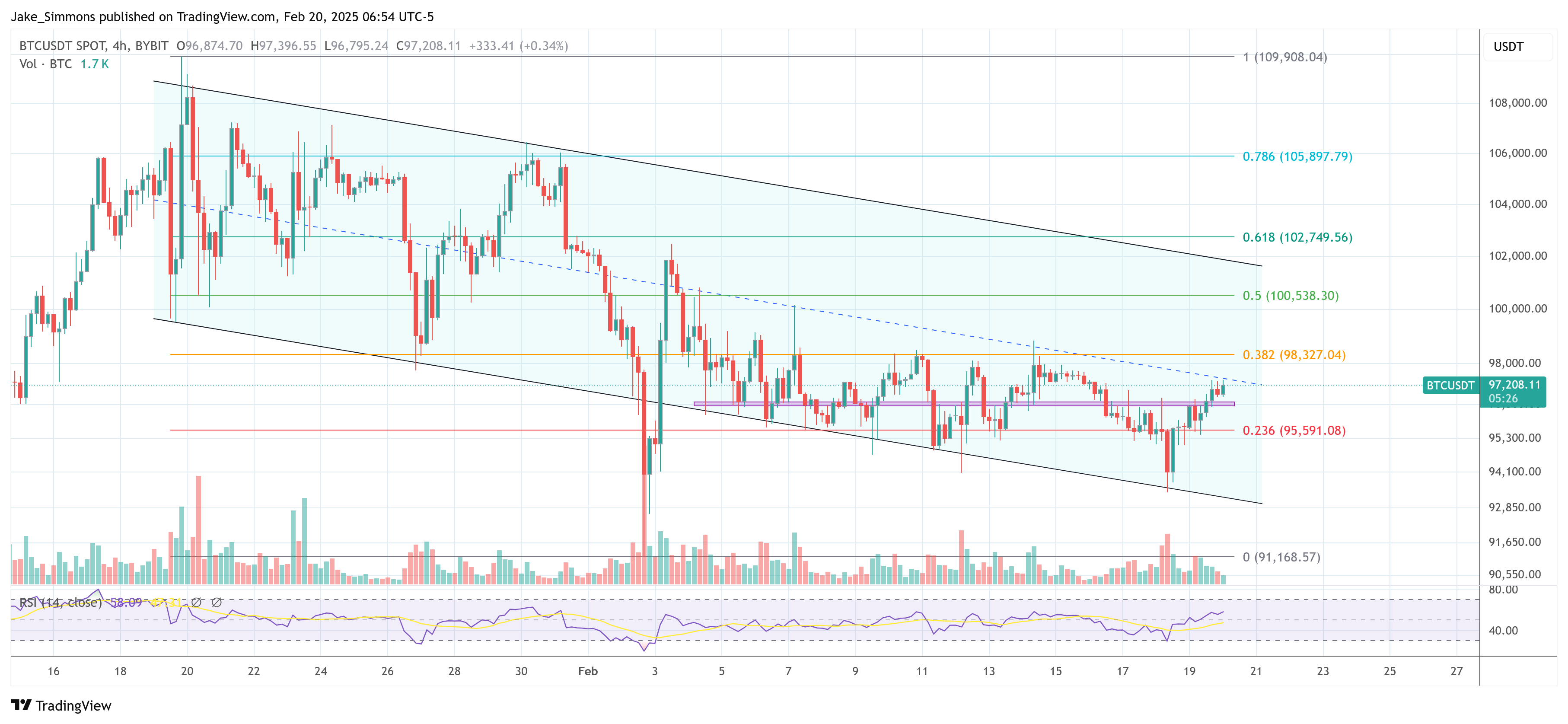

At press time, BTC traded at $97,208.

Featured image created with DALL.E, chart from TradingView.com

Source link

You may like

Crypto Trader Unveils Best-Case Scenario for Bitcoin To Avoid 2021-Style Market Meltdown

Bitcoin ETFs post $172m in weekly outflows amid market bloodbath

Trump Ally Bill Ackman Calls for 90-Day Pause on US Tariffs as Crypto Sinks

Ethereum price Tags $1,500 As Global Stock Market Crash Triggers Circuit Breakers

Bitcoin Trades Above $79K as Asia Markets React to Trump Tariffs

Memecoin platform Pump.fun brings livestream feature back to 5% of users

Bitcoin

Crypto Trader Unveils Best-Case Scenario for Bitcoin To Avoid 2021-Style Market Meltdown

Published

10 minutes agoon

April 7, 2025By

admin

A crypto strategist known for making timely Bitcoin calls says he sees a path for BTC to remain in bull territory, amid surging bearish momentum.

In a new strategy session, pseudonymous trader Cheds tells his 49,800 YouTube subscribers that Bitcoin bears have had the upper hand ever since BTC broke below its crucial support level at $90,000.

According to Cheds, Bitcoin bulls must now defend BTC’s next line of support to avoid a potential repeat of the 2021 market collapse.

“I still remain in the camp that we still have the momentum overhang from losing [$90,000] support, and it’s very likely we’re going to continue down and tag $72,000. And that’s my base case…

I just think it’s most likely we’re going to tag the prior range. What we want to see in Bitcoin is we want to see it hold the SMA (simple moving average) 50… We know that’s important because that was something that played a big role in the 2021 top when the price started to lose that [SMA] 50. We don’t want to see that happen.”

In December 2021, Bitcoin went below the SMA50 and lost about 66% of its value, melting down from $48,000 to $16,000 in less than a year.

On how Bitcoin can potentially avoid witnessing a similar fate, Cheds says,

“You can do that with a nice wick… A nice wick below the Bollinger Band and a recovery, like an intraweek recovery would be nice, where we close back up above the SMA50, we tag and test and hold this prior level ($72,000), then we can continue with the trend, the more high time frame trend which is bullish…

So the best case for me would be a very quick test and recovery, like a V recovery, an overreaction move. Something like we had perhaps [in August 2024], the dip below and the recovery, so we could test the prior range without losing the MA50. That would be the best case in my view.”

A wick is a thin line that extends above or below a candlestick’s body. In the trader’s best-case scenario, a lower wick would suggest tremendous buying pressure.

At time of writing, Bitcoin is trading for $75,795, down over 7% on the day.

Follow us on X, Facebook and Telegram

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

Bitcoin

Bitcoin ETFs post $172m in weekly outflows amid market bloodbath

Published

15 minutes agoon

April 7, 2025By

admin

Spot Bitcoin exchange-traded funds in the U.S. recorded a negative week once again amid escalating trade tensions following President Donald Trump’s announcement of new tariffs, dubbed ‘Liberation Day’ duties.

According to data from SoSoValue, the 12 spot Bitcoin ETFs reported $172.89 million in net outflows over the past week, snapping a two-week inflow streak that drew in nearly $941 million into the funds.

Notably, these ETFs experienced outflows on four of the five days between March 31 and April 4. Monday saw $71.07 million in outflows, followed by $157.64 million on Tuesday, $99.86 million on Thursday, and $64.88 million on Friday. The only positive day was Wednesday, with $220.76 million in inflows.

The majority of outflows came from Grayscale GBTC, which lost $95.5 million over last week, followed by WisdomTree’s BTCW with $44.6 million per Faside data. Additionally, outflows came from IBIT, BITB, ARKB, and HODL funds that saw $35.5 million, $24.1 million, $22.2 million, and $4.9 million in net redemption, respectively.

However, it wasn’t entirely a bearish week across the board, as Grayscale’s spot Bitcoin Trust, Franklin Templeton’s EZBC, and Fidelity’s FBTC still saw combined inflows of $61.8 million. The remaining BTC ETFs remained flat over the five days.

The drop in investor demand wasn’t limited to Bitcoin ETFs. Ethereum ETFs recorded $49.93 million in outflows last week, marking six straight weeks of withdrawals totaling over $795 million.

These outflows come as Bitcoin posted its worst first-quarter performance since 2018, and investor sentiment weakened due to Trump’s new tariff plans, starting with a flat 10% on all imports and higher rates for certain key trading partners, raising fears of a new global trade war.

At press time, the crypto market was down nearly 10% over the past day. Bitcoin had dropped 9.3%, falling below the $76,500 mark, a level BitMEX co-founder Arthur Hayes previously warned must be held to avoid deeper losses.

Source link

Bitcoin

Bitcoin Price On The Verge Of Explosive 15% Breakout As Analyst Spots Triangle Formation

Published

6 hours agoon

April 7, 2025By

admin

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bitcoin’s price is reaching a pivotal moment as it coils within a tightening triangle pattern that could soon resolve in a dramatic breakout. The ongoing consolidation around $80,000 to $85,000 is part of a classic technical setup that can cause strong directional moves in the market.

Notably, this triangle pattern was shared in an analysis on social media platform X by crypto analyst Ali Martinez, where he advised traders to keep a close eye on Bitcoin’s next breakout move.

Related Reading

The current pattern hints at a possible 15% swing in either direction, and with Bitcoin now hovering around $83,000, the stakes are high.

Triangle Pattern Forms As Bitcoin Compresses Between Lower Highs, Higher Lows

Martinez’s highlight of a triangle formation examines Bitcoin’s price action since March 7, when it briefly crashed from $91,000 until it broke below $80,000. The ensuing recovery above $80,000 eventually led to the Bitcoin price creating a lower high at $87,000 before correcting again.

Since then, Bitcoin’s price action has been highlighted by the formation of lower highs, higher lows, and an increasingly tightening range, all of which are classic parts of a triangle pattern formation.

Bitcoin is currently trading right in the heart of this tightening range. The 4-hour timeframe chart shows the upper trendline of the triangle, which caps the price at nearly $86,000, while the lower trendline provides support at around $82,000. These levels have effectively boxed in Bitcoin’s price over the past few weeks, and any clean breakout beyond these boundaries could define the cryptocurrency’s direction in the near term.

Image From X: @ali_charts

Analyst Predicts 15% Move, Warns Traders To Watch Closely

Martinez’s analysis points to a significant price shift once Bitcoin breaks out of the triangle. “#Bitcoin $BTC is consolidating within a triangle pattern, setting the stage for a potential 15% move. Watch closely for a breakout!” he wrote on X. The warning carries weight, especially for short-term traders and those managing leveraged positions.

If Bitcoin breaks above the $86,000 resistance line, it could spark a rally toward $90,000 or higher and usher in a renewed wave of bullish momentum. On the other side, a break below the $82,000 support could lead to a quick drop toward the $70,000 level, a scenario that would deal a harsh blow to bullish market sentiment and delay the hopes for predictions of new all-time highs.

Related Reading

Although a downward move to $70,000 would be brutal, its possibility cannot be ruled out, with the bull score currently at a low level of 10. Most investors are positioning for a bullish outcome and a return above $100,000, but analysis of buy zones shows that Bitcoin must break past $85,470 and $92,950 convincingly before this can happen.

At the time of writing, Bitcoin was trading at $83,070.

Featured image from Fortune, chart from TradingView

Source link

Crypto Trader Unveils Best-Case Scenario for Bitcoin To Avoid 2021-Style Market Meltdown

Bitcoin ETFs post $172m in weekly outflows amid market bloodbath

Trump Ally Bill Ackman Calls for 90-Day Pause on US Tariffs as Crypto Sinks

Ethereum price Tags $1,500 As Global Stock Market Crash Triggers Circuit Breakers

Bitcoin Trades Above $79K as Asia Markets React to Trump Tariffs

Memecoin platform Pump.fun brings livestream feature back to 5% of users

Bitcoin Price On The Verge Of Explosive 15% Breakout As Analyst Spots Triangle Formation

Strategy CEO Makes The Case For Corporate Bitcoin Adoption In MIT Keynote

Hackers Hammer Android and iPhone Users As Bank Account Attacks Surge 258% in One Year: Kaspersky

Cryptocurrencies to watch this week: Aptos, XRP, Solana

This Week in Crypto Games: ‘Off the Grid’ Token Live, Logan Paul ‘CryptoZoo’ Lawsuit Continues

Crypto Liquidations hit $600M as BTC Plunges Below $80K First Time in 25-days

Bitcoin (BTC) Price Posts Worst Q1 in a Decade, Raising Questions About Where the Cycle Stands

Stablecoins are the best way to ensure US dollar dominance — Web3 CEO

Chainlink (LINK) Targets Rebound To $19 — But Only If This Key Support Holds

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Crypto’s Big Trump Gamble Is Risky

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Trump’s Coin Is About As Revolutionary As OneCoin

I’m Grateful for Trump’s Embrace of Bitcoin

Trending

24/7 Cryptocurrency News5 months ago

24/7 Cryptocurrency News5 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin3 months ago

Bitcoin3 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Altcoins2 months ago

Altcoins2 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin5 months ago

Bitcoin5 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Price analysis5 months ago

Price analysis5 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x