Ethereum

Fidelity Files for OnChain U.S. Treasury Fund, Joining the Asset Tokenization Race

Published

3 days agoon

By

admin

U.S.-based asset manager Fidelity Investments has filed paperwork to register a blockchain-based, tokenized version of its U.S. dollar money market fund, aiming to join the tokenized asset race.

According to a Friday filing to the U.S. Securities and Exchange Commission (SEC), the company seeks to register an “OnChain” share class of its Fidelity Treasury Digital Fund (FYHXX) and use blockchains as transfer agent. FYHXX holds cash and U.S. Treasury securities and was launched late last year.

The OnChain class of the fund currently uses the Ethereum (ETH) network, and the firm may expand to other blockchains in the future, the filing said. The registration is subject to regulatory approval, with the product expected to become effective on May 30.

The filing happened as global banks and asset managers increasingly put traditional financial instruments such as government bonds, credit, and funds on blockchain rails, a process often referred to as tokenization of real-world assets (RWAs). They do so to pursue operational and efficiency gains and faster, around-the-clock settlements.

Fidelity, with $5.8 trillion in assets under management, is the latest traditional financial heavyweight seeking to enter the fast-growing tokenized U.S. Treasuries space.

Blackrock (BLK), in partnership with digital asset firm Securitize, launched a similar tokenized T-bill fund last March called BUIDL and has become the market leader with nearly $1.5 billion of assets, rwa.xyz data shows.

Franklin Templeton’s fund, which was the first on-chain money market product, gathered $689 million in assets since its 2021 debut.

The entire tokenized U.S. Treasury market is currently worth $4.77 billion, growing almost 500% over the past year, per rwa.xyz.

Fidelity is also one of the largest issuers of spot bitcoin and ether exchange-traded funds (ETF) in the U.S., with its $16.5 billion FBTC and $780 million FETH, per SoSoValue data.

Source link

You may like

Analyst Unveils Extended XRP Price Target To $44, Reveals When To Take Profits

Would GameStop buying Bitcoin help BTC price hit $200K?

New SEC Chair Paul Atkins Holds $6,000,000 in Crypto-Related Investments – Here’s His Portfolio: Report

We’ve Turned A Generation Of Bitcoiners Into Digital Goldbugs

Solana DEX Raydium’s Pump.fun Alternative Is Going Live ‘Within a Week’

Google Cloud joins Injective as validator, expands Web3 tools

Ethereum

Ethereum ‘commoditized itself’ by shifting value to layer-2s, Standard Chartered says

Published

2 days agoon

March 25, 2025By

admin

Standard Chartered analysts say Ethereum is going through a “midlife crisis,” with ETH struggling to hold around $2,000.

Ethereum (ETH) has seemingly stuck in limbo as it’s giving away its value for free to layer-2 networks while struggling to keep investors interested. The world’s second-largest cryptocurrency by market capitalization has dropped 40% in the past three months, with Standard Chartered analysts now saying the network if facing “midlife crisis.”

In an interview with the Financial Times, Standard Chartered’s head of digital assets research Geoff Kendrick said the network “gave away value for free” as with layer-2 networks Ethereum has “essentially commoditized itself.”

Now, Ethereum is struggling with keeping its price from falling even further. As of press time, ETH is trading at around $2,054, after plunging to $1,813 earlier in March. Kaiko’s research analyst Adam McCarthy says the decline might be tied due to the fact that Ethereum “is just not interesting to most people.”

“It’s hard to get too excited about amazing feats of engineering when there [are] so many competing things now in the attention economy.”

Adam McCarthy

At the same time, Ethereum’s developers are struggling with internal disagreements, and user activity on the network hasn’t picked up, noted Carol Alexander, a finance professor at the University of Sussex. She added that the decentralized finance vision now feels “much further away now than a year ago” and that decision-making in the Ethereum community has become “a bit of a shambles.”

Ethereum’s direction has been under scrutiny lately as even former Ethereum Foundation engineer Harikrishnan Mulackal criticized the network’s governance, saying it suffers from a “lack of a clear and cohesive vision.”

Per Mulackal, without stronger leadership, Ethereum could stagnate, suggesting that the network should push for faster updates and ship “one hard fork each quarter.” Otherwise, he said, Ethereum risks reproducing “exactly the same result” as the past five years.

Source link

Across Protocol

Ethereum Altcoin Explodes 68% After Korea’s Second-Biggest Crypto Exchange Announces Trading Support

Published

3 days agoon

March 23, 2025By

admin

An Ethereum (ETH)-based altcoin is skyrocketing after gaining support from South Korea’s second-largest crypto exchange.

In a new announcement, crypto trading platform Bithumb says that it is now supporting the interoperable cross-chain bridge Across Protocol (ACX), triggering rallies for the digital asset.

News of the event caused ACX to surge, as it went from a March 21st low of $0.275 to a peak of $0.462 just a few hours later, a rise of nearly 68%. It has since retraced and is trading for $0.319 at time of writing, a 10% gain during the last 24 hours.

In its whitepaper, Across Protocol says it is the only cross-chain platform powered by intents.

Explains Across Protocol,

“Intents introduce a third party, a relayer (alternatively named filler, or solver), that does the job of delivering assets / executing user transactions quickly. An intent is a type of order where a user specifies an outcome instead of an execution path.

In practice, intents manifest as a combination of a cross-chain limit order and an action to execute, all encoded within a standardized order structure. Relayers compete on cost and speed to fill these orders, which can include on-chain actions as well as assets. Relayers deliver very quickly, without any messages.

From the user’s perspective, interoperability is solved. Their desired outcome is achieved.”

Follow us on X, Facebook and Telegram

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

ETH

Investors Withdraw 360,000 Ethereum From Exchanges In Just 48 Hours – Accumulation Trend?

Published

5 days agoon

March 21, 2025By

admin

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Ethereum has experienced a much-needed surge above the $2,000 level, a key psychological and technical mark that bulls have struggled to reclaim since March 10. This breakout sparked optimism in the market, but the momentum was short-lived, as ETH quickly pulled back below the level and was unable to confirm a solid hold. Analysts widely agree that a strong and sustained move above $2,000 is critical for Ethereum to initiate a broader recovery rally.

Related Reading

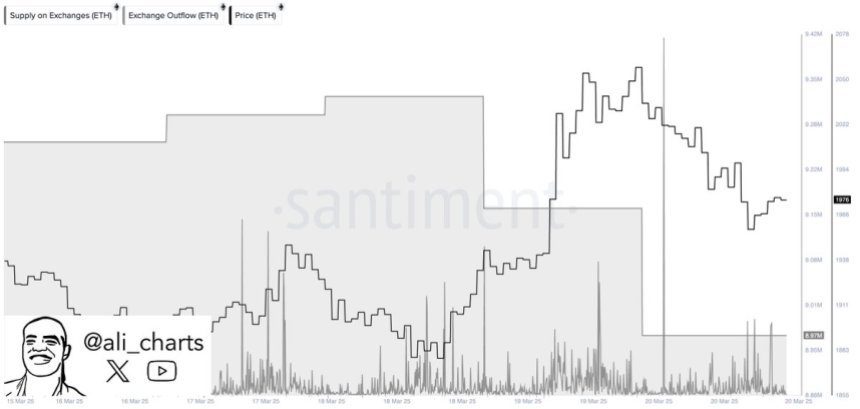

Despite the hesitation at resistance, on-chain data shows signs of growing investor confidence. According to Santiment, investors have withdrawn over 360,000 ETH from centralized exchanges in the last 48 hours. This shift is often interpreted as a bullish signal, suggesting that large holders are moving their assets to private wallets, possibly in anticipation of higher prices.

Meanwhile, the broader macroeconomic landscape continues to apply pressure. Trade war tensions and unpredictable policy decisions from the U.S. government have weighed heavily on both crypto and traditional markets, intensifying volatility and investor uncertainty. Still, Ethereum’s latest exchange outflows hint at a potential trend shift — one that could favor accumulation and set the stage for the next major move, provided bulls can reclaim and hold above the $2K threshold.

Ethereum Faces Critical Test Amid Exchange Outflows

Ethereum has lost over 57% of its value since mid-December, falling from a high of around $4,100 to recent lows near $1,750. This sharp correction has created a challenging environment for bulls, who have repeatedly failed to reclaim and hold higher price levels.

Now, the $2,000 mark stands as a psychological and technical battlefield. If Ethereum can firmly establish support above this level, it could provide the foundation for a recovery rally. However, a failure to do so would likely result in further downside and reinforce the bearish trend.

Related Reading

The current market landscape struggles with uncertainty. On one side, continued macroeconomic headwinds—rising trade tensions, inflation concerns, and policy shifts from the U.S. government—have weakened investor confidence and driven volatility across risk assets. On the other hand, there are signs of potential recovery and accumulation.

Top crypto analyst Ali Martinez shared data from Santiment, revealing that investors have withdrawn over 360,000 ETH from centralized exchanges in the past 48 hours. Historically, large-scale withdrawals are considered a bullish signal, as they suggest investors are moving assets into cold storage for long-term holding rather than preparing to sell.

This move could indicate growing confidence among large holders and signal the early stages of a new accumulation phase—provided Ethereum can hold above $2,000.

Price Holds Steady Below $2,000

Ethereum is currently trading at $1,960 after briefly attempting to reclaim the $2,000 mark in yesterday’s session. The psychological and technical resistance at $2,000 remains a crucial barrier that bulls must overcome to shift market momentum in their favor. Despite a small bounce from recent lows, Ethereum has struggled to gain traction amid persistent market uncertainty.

Bulls need to push ETH above $2,000 and reclaim higher levels such as $2,150 and $2,300 to confirm the beginning of a recovery phase. A sustained move above these levels would not only signal a potential trend reversal but could also attract sidelined investors back into the market. Until that happens, Ethereum remains vulnerable to continued downside pressure.

Related Reading

If bulls fail to break above the $2,000 resistance in the coming sessions, Ethereum could lose support at current levels and revisit lower demand zones around $1,850 or even $1,750. With the broader crypto market still under the influence of macroeconomic volatility and weak sentiment, the coming days are likely to be pivotal for ETH’s short-term direction. A decisive move either above or below this key range will likely set the tone for the next major price action.

Featured image from Dall-E, chart from TradingView

Source link

Analyst Unveils Extended XRP Price Target To $44, Reveals When To Take Profits

Would GameStop buying Bitcoin help BTC price hit $200K?

New SEC Chair Paul Atkins Holds $6,000,000 in Crypto-Related Investments – Here’s His Portfolio: Report

We’ve Turned A Generation Of Bitcoiners Into Digital Goldbugs

Solana DEX Raydium’s Pump.fun Alternative Is Going Live ‘Within a Week’

Google Cloud joins Injective as validator, expands Web3 tools

U.S. House Stablecoin Bill Poised to Go Public, Lawmaker Atop Crypto Panel Says

South Korea Urges Google To Block 17 Unregistered Crypto Exchanges

Bitcoin Rally To $95K? Market Greed Suggests It’s Possible

Polymarket faces scrutiny over $7M Ukraine mineral deal bet

Morgan Stanley Warns of Short-Lived Stock Market Rally, Says Equities To Print ‘Durable’ Low Later in the Year

Stablecoins Are The CBDCs

Ethereum Volatility Set to Surge in April as Derive Flags Bearish Sentiment Shift

Crusoe Energy sells Bitcoin mining arm to NYDIG, turns focus to AI

What Next For XRP, DOGE as Bitcoin Price Action Shows Bearish Double Top Formation

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Crypto’s Big Trump Gamble Is Risky

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

Trump’s Coin Is About As Revolutionary As OneCoin

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Is $200,000 a Realistic Bitcoin Price Target for This Cycle?

Trending

24/7 Cryptocurrency News5 months ago

24/7 Cryptocurrency News5 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin2 months ago

Bitcoin2 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Altcoins2 months ago

Altcoins2 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin4 months ago

Bitcoin4 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Price analysis5 months ago

Price analysis5 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x