Bitcoin adoption

Fidelity Investments Director Shares Bitcoin’s Adoption and Valuation Models

Published

5 months agoon

By

admin

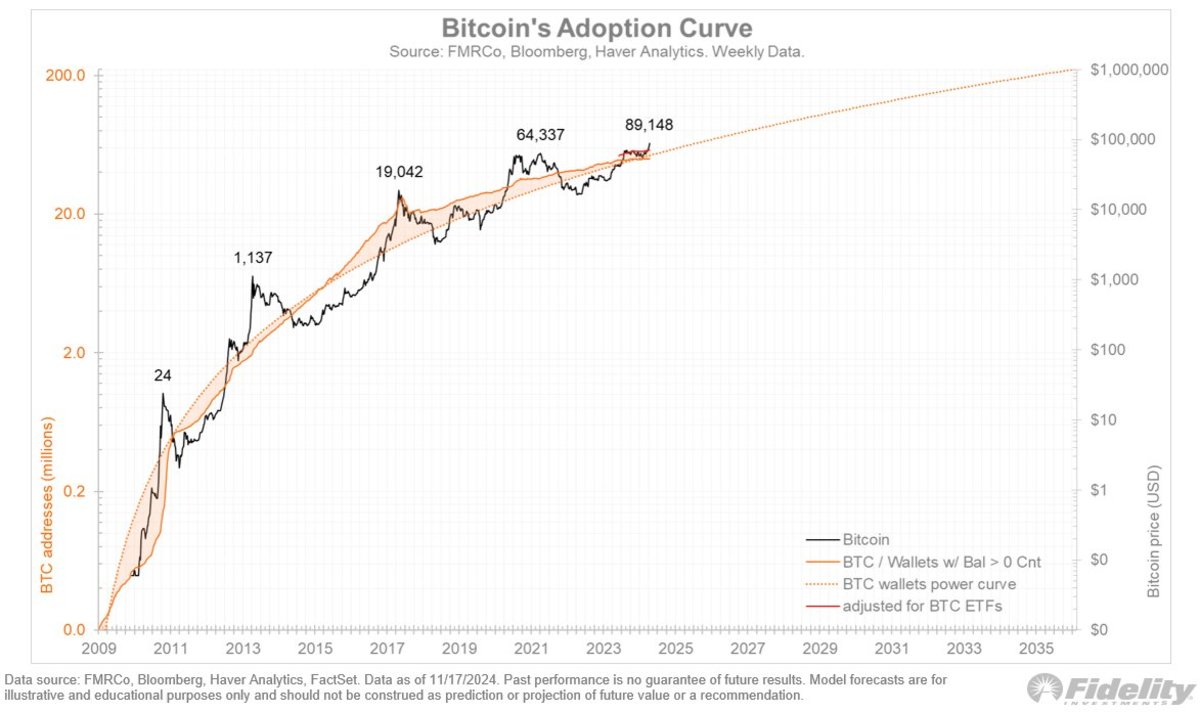

Fidelity Investments’ Director of Global Macro, Jurrien Timmer, continues to provide insightful frameworks for understanding Bitcoin’s valuation and growth. In a recent update, Timmer shared his take on Bitcoin’s adoption and value trajectories, illustrated by detailed charts that reflect both historical trends and hypothetical scenarios.

Timmer’s models aim to simplify Bitcoin’s complex growth dynamics, bridging the gap between network adoption and valuation. “While the supply is known, the demand is not,” he stated, emphasizing the critical role of adoption curves and macroeconomic variables such as real rates and monetary policy.

Adoption Curves: Slowing But Consistent Growth

Despite a slowdown in Bitcoin’s network growth, as measured by the number of wallets with a non-zero balance, Timmer noted that the trend still aligns with the steep power curve shown in his updated adoption chart. While the internet adoption curve has a gentler slope, Bitcoin’s adoption trajectory remains steeper, signifying its rapid but maturing growth.

Importantly, Timmer highlighted a key limitation in the measurement of wallet growth: the understated wallet/address count due to Bitcoin ETFs, which consolidate holdings into just a few wallets. “It’s very likely that the wallet/address count is understated,” he said, pointing out that ETFs obscure the broader distribution of Bitcoin adoption.

Monetary Policy Meets Adoption Dynamics

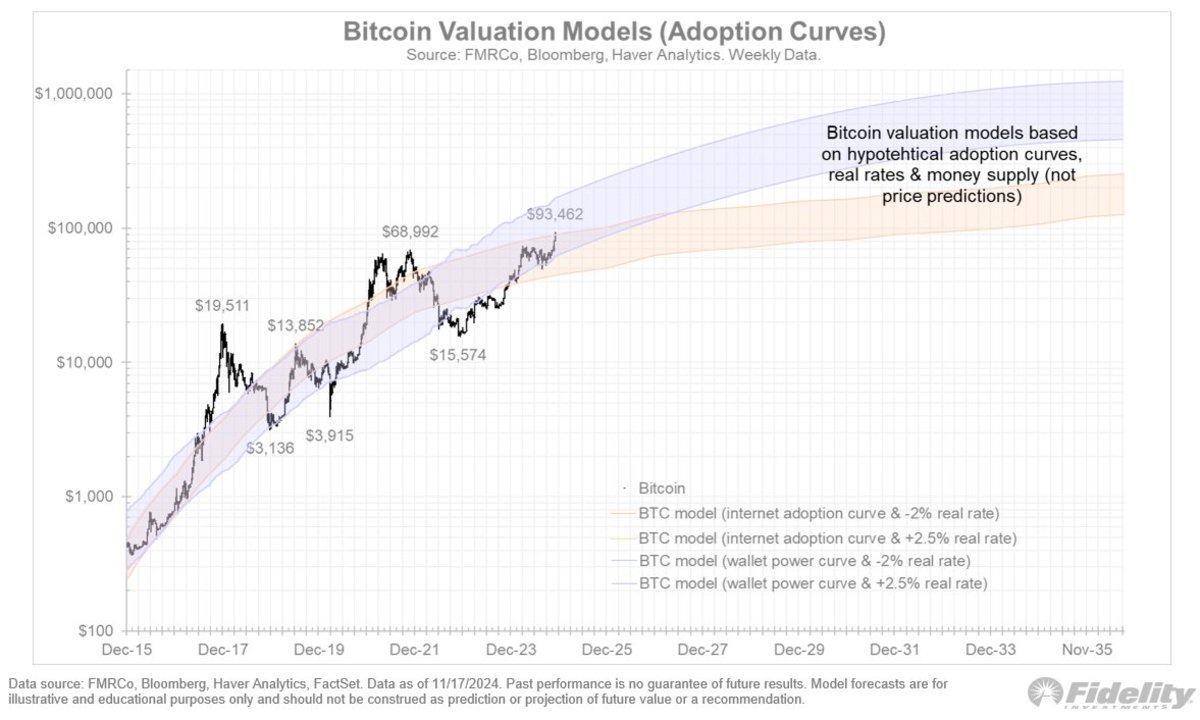

Building on his previous models, Timmer added a new layer to his valuation framework by incorporating money supply growth alongside real interest rates. The updated charts compare two hypothetical paths for Bitcoin’s valuation: one driven by adoption curves and real rates, and another that includes monetary inflation as a factor.

“Again, these are not predictions,” Timmer clarified, “but merely attempts at visualizing the use case on the basis of adoption, real rates, and monetary inflation.” This layered approach underscores how external macroeconomic forces, like monetary policy, could influence Bitcoin’s adoption and valuation.

Why This Matters

Timmer’s updated models reinforce Bitcoin’s position as a maturing financial asset. By combining historical S-curves, Metcalfe’s Law, and macroeconomic factors, he offers a comprehensive view of Bitcoin’s unique blend of network utility and monetary features. His work highlights the importance of adoption in driving Bitcoin’s value, while also demonstrating how real-world monetary conditions could shape its future.

For Bitcoin proponents and skeptics alike, Timmer’s insights serve as a valuable framework for understanding the asset’s dual nature as both a network and a form of money. The inclusion of monetary inflation in his models further underscores Bitcoin’s potential as a hedge against fiat currency debasement.

The Road Ahead

As Bitcoin continues to evolve, Timmer’s models provide a critical lens for tracking its development. Whether it’s the flattening of the adoption curve or the interplay between monetary policy and valuation, his analysis underscores the asset’s growing complexity—and its enduring relevance in the financial world.

For investors, analysts, and enthusiasts, these insights are a reminder of Bitcoin’s transformative potential, even as its growth curve matures.

Source link

You may like

Solana Retests Bearish Breakout Zone – $65 Target Still In Play?

How Expanding Global Liquidity Could Drive Bitcoin Price To New All-Time Highs

Apple Delists 14 Crypto Apps in South Korea Including KuCoin and MEXC Exchanges Amid Regulatory Crackdown

Athens Exchange Group eyes first onchain order book via Sui

Futureverse Acquires Candy Digital, Taps DC Comics and Netflix IP to Boost Metaverse Strategy

Court Grants Ripple And SEC’s Joint Motion To Suspend Appeal

As bitcoin moves into the mainstream of American life, people from every background and corner of the planet are contributing to its historic rise. In the spirit of the age, the bitcoin industry is largely a meritocracy. It is the quality of contributions—rather than any singular identity—that drives bitcoin forward.

March is recognized as International Women’s Month, a tradition rooted in early-20th century labor and suffrage movements. It provides an occasion to reflect on the role of women in bitcoin. Rather than focusing on the experience of being a woman in a technical field, this article spotlights the real contributions and leadership from individuals who happen to be women but who have each, in their own right, helped shape the bitcoin ecosystem.

Whether they come from legal, financial, or technical backgrounds, individuals with strong foundational skills often transition naturally into the bitcoin industry. Much of bitcoin’s growth can be credited to those able to distill complex technical concepts into accessible language. Women are excelling in this role, using skills in marketing, community organizing, and storytelling to broaden understanding and trust in bitcoin. It’s one thing to code or invest in bitcoin, but quite another to convey its principles effectively to the uninitiated. As more people demonstrate real skill in bridging that knowledge gap—through podcasts, workshops, or online content—bitcoin’s base of educated users expands exponentially.

“Women can be powerful communicators and community builders, finding ways to distill complex topics into easily understandable and relatable bites,” says Kelley Weaver, CEO of Melrose PR & Founder of Bitwire. “Since bitcoin fundamentally grows through network effects, this is essential! I’ve seen firsthand how women’s approaches to explaining bitcoin can reach people who might otherwise be intimidated. Approachability is essential for bitcoin’s long-term success.”

In recent years, bitcoin ownership among women has risen significantly. One survey showed that women’s share of digital asset ownership jumped from 29% to 34% in a single quarter. While these numbers vary depending on the source, there’s a clear upward trend. If finance was once perceived as a male-dominated space, that narrative is shifting—particularly for a technology-driven asset like bitcoin, which democratizes participation by removing traditional gatekeepers.

“Across ‘Main Street’ America and the world… decentralized networks of female leaders can be a catalyst for financial education and increasing understanding about the transformative nature of bitcoin,” says Cleve Mesidor, Executive Director of Blockchain Foundation. “Particularly because of scarcity, most individuals will never own even a fraction of bitcoin, which is why women cannot afford to be late adopters.”

Mesidor points to a key dynamic: informal, community-driven networks excel at spreading education. Because bitcoin can be learned and shared peer-to-peer, it finds fertile ground in the natural social structures that women have historically led, such as book clubs, parent associations, and charitable groups. Such networks become informal “nodes” of adoption, where knowledge flows more freely than it might in a top-down environment.

In the past, popular culture often portrayed men as the family financiers while women managed daily household tasks. Yet a recent study revealed that about 84% of women say they are responsible for their family’s finances, from paying bills to setting budgets to overseeing savings and debt obligations. Perhaps more remarkable is that almost all women in couples (94%) report being actively involved in shaping household financial decisions. Many women effectively act as Chief Financial Officers for their families, handling budgeting, strategic planning, and long-term goal setting.

As bitcoin continues to gain traction worldwide, it is increasingly one of the tools under consideration, especially for those who like to plan with a low-time-preference mindset. Bitcoin’s design fits neatly with the mindset that prudent financial planners rely upon. Its limited supply and disinflationary monetary policy reward disciplined saving. As families look for ways to preserve purchasing power, it is natural to add bitcoin in the mix. Whether it’s a small allocation every month or a larger diversification strategy, bitcoin attracts those seeking reliability over the long run.

“For long-term investments, bitcoin is a top choice. While short-term fluctuations are inevitable, its overall trajectory shows a clear path toward growth and stability.” says Frieda Bobay, co-founder of Bitcoin Sports Network. “I never plan to sell my bitcoin; instead, I view it like real estate—an asset I can borrow against while it continues to grow in value.”

While it’s easy to over-generalize, data does suggest that women, on average, tend to adopt disciplined approaches to money management. They trade less frequently in stock markets, are more likely to stick to a plan, and often do deeper research before making an investment. One of bitcoin’s most emblematic qualities is its alignment with low-time-preference thinking: favoring long-term wealth building over short-term speculation. Studies have shown that women are often methodical, patient, and focus on fundamentals rather than jumping in and out of markets. This mindset leads to outperformance in traditional investment contexts.

“A common misconception is that bitcoin is ‘too expensive’—in reality, this is a matter of unit bias,” says Hailey Lennon, General Counsel at Fold. “Many people don’t realize you can own fractions of a bitcoin, and by that measure, it’s still incredibly early and relatively cheap when you compare it to traditional assets. If women empower themselves with the basic knowledge of how bitcoin works, they’ll see that we’re just at the beginning of its potential, making it a compelling opportunity rather than an exclusive, high-priced investment.”

Lennon’s perspective highlights a key barrier for new entrants: bitcoin’s per-coin price might intimidate some, but the option to purchase fractions (satoshis) lowers that barrier significantly. That’s often an eye-opener for people new to bitcoin—especially those who excel in careful, long-term budget allocation. By embracing the possibility of stacking small amounts, methodically and regularly, one can build a meaningful position over time.

Weaver agrees: “Slow and steady wins the race! My personal strategy is to DCA, or “dollar cost average” meaning that I purchase small amounts daily. This spreads out risk. I ultimately think it’s more risky to NOT own bitcoin in the long term, but I also recognize that it’s incredibly volatile. I always say in the short term it may never be a good time to buy bitcoin but in the long term it’s ALWAYS a good idea to buy bitcoin.”

Another reason for the surge in interest among women is that bitcoin, as a universal asset, offers financial independence and sovereignty. This resonates strongly with individuals who value autonomy. “Bitcoin is the pathway to financial sovereignty. It removes traditional gatekeepers and allows for independent wealth management without intermediaries,” says Evie Phillips, Founder of Creeds Collective & Founding Board Member of Crypto Connect, now Eve Wealth. “The blockchain’s immutability means assets can’t be frozen or seized—this is specifically valuable in relational situations and regions where women face financial restrictions. Bitcoin doesn’t have geographic limitations, making global transactions seamless, and that opens up a flood of opportunities that aren’t available through centralized financial systems.” Phillips’s point highlights bitcoin’s advantages in personal control over assets. The economy is fundamentally transforming, and many are drawn to the reliability of an asset that exists beyond the reach of institutions.

The novelty of bitcoin can be intimidating, especially because the mainstream media frequently associates it with scams and hype-driven speculative bubbles. Thought leaders in bitcoin address this by pointing to the facts of the technology. “The more I learn about bitcoin, the more I trust this trustless financial system,” says Weaver. “The network has had zero downtime since it launched in 2009 and has never been hacked. Over the course of bitcoin’s history, the price has risen and fallen, but consistently trends upward in the long term.”

Bitcoin is a protocol, and using it does not require trust in any central authority. Yet it thrives on trust, education, and consensus among people. This is why communicators matter so much. “I often see women’s entire perspective shift when they recognize bitcoin’s potential—not just as an investment, but as a vehicle for financial empowerment,” says Megan Nilsson, host of the Crypto Megan Podcast. “By leveraging their ability to build networks, drive education, and advocate for broader adoption, women can play a leading role in shaping the future of bitcoin and decentralized finance… Bitcoin has fundamentally redefined the concept of financial independence. It has leveled the playing field, offering financial tools that were once only available to accredited investors. It eliminates reliance on centralized systems, providing individuals with true ownership and control over their wealth.”

In the coming years, the world economy, and society itself, will be reshaped by the convergence of transformative technologies including AI, robotics, and space travel, all underwritten and financed with bitcoin. It’s no wonder that as families, institutions, and communities discover bitcoin’s utility, so many of those leading the charge are women. They do so not because they want to check a box, but because the technology itself demands the best talent available. In celebrating the achievements of women this month, we also celebrate bitcoin’s potential to reshape our collective future. It is a global experiment buoyed by those who see beyond the hype and dedicate themselves to building, teaching, and expanding the Bitcoin Network for future generations.

This is a guest post by Dave Birnbaum. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Source link

24/7 Cryptocurrency News

Semler Scientific Achieves 99.3% BTC Yield Boosting Holdings To Over 2,300 BTC

Published

3 months agoon

January 13, 2025By

admin

Semler Scientific, Inc., a medical technology company focused on combating chronic diseases, has expanded its Bitcoin holdings significantly. The company recently acquired 237 BTC, bringing its total reserves to 2,321 Bitcoin. This move reflects Semler’s ongoing strategy of increasing its cryptocurrency treasury to enhance shareholder value.

Semler Scientific Boosts Bitcoin Holdings to 2,321 BTC with 99.3% BTC Yield

In a recent statement, Semler Scientific confirmed acquiring 237 Bitcoin between December 16, 2024, and January 10, 2025. The acquisition was made at an average price of $98,267 per Bitcoin, including fees. These purchases added $23.3 million worth of Bitcoin to its reserves, which now total 2,321 BTC.

The company stated its total Bitcoin investment amounts to $191.9 million. Semler’s strategy focuses on using Bitcoin as a treasury asset to drive long-term growth and shareholder value.

Additionally, Semler Scientific funded its Bitcoin acquisitions through an at-the-market (ATM) offering and operational cash flow. As of January 10, 2025, the company had generated $121.8 million in gross proceeds under its ATM sales agreement with Cantor Fitzgerald.

The ATM program, which was expanded by $50 million in December 2024, enables the company to issue additional shares for strategic investments. This financing model underpins Semler Scientific’s continued ability to grow its Bitcoin holdings.

Interestingly, institutional Bitcoin adoption has risen with Michael Saylor’s MicroStrategy announcing another massive purchase of 2,530 BTC today, worth $243 million. This brings its total holdings to 450,000 BTC, acquired for $28.2 billion. Despite the move, MSTR stock declined after Bitcoin’s price dropped below key support levels.

Bitcoin Adoption and Key Performance Indicators

Since adopting its Bitcoin treasury strategy in July 2024, Semler Scientific has monitored its performance through a key performance indicator (KPI) known as BTC Yield. From July 2024 to January 2025, the company achieved a 99.3% BTC Yield, reflecting the effectiveness of its treasury management.

Bitcoin adoption remains integral to Semler Scientific’s financial strategy. The company has consistently emphasized its focus on increasing Bitcoin reserves.

Semler Scientific remains committed to its Bitcoin strategy, with plans to continue acquiring Bitcoin through proceeds from its ATM program and cash flow.

BTC Price Action

Meanwhile, Bitcoin’s 24-hour price action shows a 3.34% drop, falling from $94,820 to $91,700. Trading volume surged by 193.09%, reaching $58.6 billion, as the market cap stands at $1.81 trillion. BTC struggles to hold key support amid market volatility.

A recent report by CoinGape highlighted the reasons behind today’s drop in Bitcoin price. The decline is attributed to a strong jobs market diminishing hopes for rate cuts, technical exhaustion following Bitcoin’s rally to $100K, and profit-taking ahead of President-elect Donald Trump’s inauguration. Key support remains at $90,804.

Ronny Mugendi

Ronny Mugendi is a seasoned crypto journalist with four years of professional experience, having contributed significantly to various media outlets on cryptocurrency trends and technologies. With over 4000 published articles across various media outlets, he aims to inform, educate and introduce more people to the Blockchain and DeFi world. Outside of his journalism career, Ronny enjoys the thrill of bike riding, exploring new trails and landscapes.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

24/7 Cryptocurrency News

Why Tim Draper Sees BTC as the ‘Next Netflix’?

Published

3 months agoon

January 7, 2025By

admin

Bitcoin’s exponential growth in 2024 brought all the attention to this digital asset. Interestingly, BTC’s achievement led Tim Draper to compare it to the popular streaming site Netflix, a pioneer in the multi-media industry. He presented a metaphorical connection between the two, depicting why Bitcoin is the next Netflix. Let’s explore Draper’s reasoning behind the comparison between the two and what it means for the potential of the crypto industry.

The Netflix Disruption

Netflix has become the mainstream media platform, beating its competitors by a large margin and attaining a $380 billion valuation. Interestingly, the same company was on the brink of bankruptcy in 2010 and was just a CD rental business before. However, it rose and developed from a movie retail business to an online blockbuster media and entertainment platform. Some even call it a real-life example of technological disruption or Netflix disruption, as it changed how people consume media.

Somewhere, there is a big similarity between the rental industry and the TradeFi industry, which is also getting left behind with digital assets, especially Bitcoin, the new mode of payments based on decentralization. The way Netflix left behind its competitors, which failed to rise with new technology and trends, BTC is likely to do the same with third-party controlled, slow, and expensive traditional transactions.

Its growth, where one Bitcoin is priced at $101.5k per coin with a market cap of nearly $2 T, reveals its high adoption rate. This is especially true as the soon-to-be 47th US president, Donald Trump, promised to make the US the crypto capital involving BTC. Based on this, the famous venture capitalist Tim Draper presented a Bitcoin vs. Netflix analysis, drawing a parallelism between Netflix and Bitcoin’s growth.

Tim Draper Bitcoin Prediction on Why BTC Could Be the ‘Next Netflix’

Tim Draper presents a very interesting key point, hinting at Bitcoin’s dominance among traditional financial systems like Netflix in the media. With the growing adoption of this digital asset and tech giants like Elon Musk, Michael Saylor, Robert Kiyosaki, and many others seeing Bitcoin as the future, much more dominance could be seen.

“Next Netflix vs. blockbuster moments to come is the Bitcoin vs Banks,” outlines Draper, boldly asserting that Bitcoin’s trajectory mirrors Netflix’s disruption.

Although Tim Draper’s Bitcoin Vs. Netflix post did not clearly explain, but his few words were enough to conclude the parallelism between these two. Both, Netflix and Bitcoin are disruptive technologies, grabbing global adoption and mainstream acceptance. More importantly, BTC has already set its foot strong in the financial market, but there is much more to come. Analysts’ Bitcoin price prediction sees it achieving $225k in 2025 alone and much more in the upcoming years.

Michael Saylor and many other industry leaders believe that Bitcoin is the US debt’s solution and that this digital asset would disrupt traditional banking institutions. This belief could become more prominent with Donald Trump’s presidency.

Eventually, all this would make Bitcoin the pioneer of the financial industry. More importantly, as Tim Draper sees, BTC is the next Netflix for the TradeFi and banking sectors. However, this is not new Bitcoin news. Draper’s months-old Bitcoin price prediction that this asset per token will hit $3M evaluations describes his ideology, as he believes BTC is the currency of the future.

Conclusion

Tim Draper provided more than just a catchy analogy by calling Bitcoin the next Netflix of the financial sector. Netflix shaped the future of the media and entertainment industry, and BTC would shape the future of the financial industry with its exponential growth, global adoption, and overcoming the TradeFI, which is slow, complicated, and controlled by institutions and government. Draper’s analysis of Bitcoin Vs. Netflix depicts the future of financial freedom and a tech-driven financial system, where one token could grab a price of $3M, far away from any asset’s value.

Pooja Khardia

With a deep-seated passion for reading and five years of experience in content writing, Pooja is now focused on crafting trending content about cryptocurrency market.

As a dedicated crypto journalist, Pooja is constantly seeking out trending topics and informative statistics to create compelling pieces for crypto enthusiasts. Staying abreast of the latest trends and advancements in the field is an integral part of her daily routine, fueling a commitment to delivering timely and insightful coverage

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

Solana Retests Bearish Breakout Zone – $65 Target Still In Play?

How Expanding Global Liquidity Could Drive Bitcoin Price To New All-Time Highs

Apple Delists 14 Crypto Apps in South Korea Including KuCoin and MEXC Exchanges Amid Regulatory Crackdown

Athens Exchange Group eyes first onchain order book via Sui

Futureverse Acquires Candy Digital, Taps DC Comics and Netflix IP to Boost Metaverse Strategy

Court Grants Ripple And SEC’s Joint Motion To Suspend Appeal

AVAX Falls 2.1% as Nearly All Assets Trade Lower

What is a VTuber, and how do you become one in 2025?

Top Expert’s Update Sets $10 Target

How Academia Interacts With The Bitcoin Ecosystem

AB DAO and Bitget Launch Dual Reward Campaign, Distributing $2.6M Worth of $AB Globally

AI crypto tokens at risk as Nvidia faces restrictions on China exports

Coinbase Urges Australia to Vote for Crypto Progress in May

How High Would Pi Network Price Go If Pi Coin Adopts Transparency to Avoid Mantra Pitfalls

XRP’s ‘Rising Wedge’ Breakdown Puts Focus on $1.6 Price Support

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Crypto’s Big Trump Gamble Is Risky

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

I’m Grateful for Trump’s Embrace of Bitcoin

Trending

24/7 Cryptocurrency News5 months ago

24/7 Cryptocurrency News5 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin3 months ago

Bitcoin3 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Bitcoin5 months ago

Bitcoin5 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Altcoins3 months ago

Altcoins3 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Price analysis5 months ago

Price analysis5 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x

✓ Share: