ETH

Genesis-Era Ethereum Whale Sends $171,780,000 Worth of ETH to Kraken in 2024: Report

Published

3 months agoon

By

admin

A crypto whale that participated in the initial coin offering (ICO) of Ethereum has reportedly been spotted sending nine figures worth of ETH to the crypto exchange Kraken this year.

Citing data from on-chain analyst Ember, Wu Blockchain reports that after another transfer of 3,370 ETH to Kraken over the weekend, a whale connected to Ethereum’s genesis block has sent a total of 48,687 ETH worth $171.78 million to the exchange in 2024 with an average transfer price of $3,528.

Meanwhile, Ember says that the deep-pocketed investor collected 200,000 ETH from the genesis block in 2015. Ember also thinks that the Ethereum whale will soon run out of ETH to unload.

“However, after eight years of continuous sales, his ETH has been almost sold out. Currently, there are only 7,594 ETH ($25.72 million) left, and it will be cleared in one-two more sales.”

Blockchain tracking firm Lookonchain also recently spotted an Ethereum genesis wallet waking up after almost a decade of inactivity to transfer a small amount of ETH to a new address.

“An Ethereum ICO participant woke up after 9.4 years of dormancy and transferred 0.01 ETH to a new wallet.

The participant received 1,940 ETH (ICO cost was $601, now worth $6.56 million) at [Ethereum’s genesis].”

At time of writing, Ethereum is trading at $3,356, up about 1,082,480% from its ICO price of $0.31.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: DALLE3

Source link

You may like

Elizabeth Warren Calls Stablecoin Bill a Trump and Musk ‘Grift’

Crypto scammers nabbed in India for $700k fraud posing as a Japanese exchange

BTC in Stasis Below $88K as Trump Suggests Bigger Tariffs on EU, Canada

Dogecoin Price Eyes 10x Breakout After Elon Musk Ghibli Anime

XRP Price Rejected at Resistance—Are Bears Taking Control?

OpenAI expects to 3X revenue in 2025 but Chinese AI firms are heating up

Across Protocol

Ethereum Altcoin Explodes 68% After Korea’s Second-Biggest Crypto Exchange Announces Trading Support

Published

4 days agoon

March 23, 2025By

admin

An Ethereum (ETH)-based altcoin is skyrocketing after gaining support from South Korea’s second-largest crypto exchange.

In a new announcement, crypto trading platform Bithumb says that it is now supporting the interoperable cross-chain bridge Across Protocol (ACX), triggering rallies for the digital asset.

News of the event caused ACX to surge, as it went from a March 21st low of $0.275 to a peak of $0.462 just a few hours later, a rise of nearly 68%. It has since retraced and is trading for $0.319 at time of writing, a 10% gain during the last 24 hours.

In its whitepaper, Across Protocol says it is the only cross-chain platform powered by intents.

Explains Across Protocol,

“Intents introduce a third party, a relayer (alternatively named filler, or solver), that does the job of delivering assets / executing user transactions quickly. An intent is a type of order where a user specifies an outcome instead of an execution path.

In practice, intents manifest as a combination of a cross-chain limit order and an action to execute, all encoded within a standardized order structure. Relayers compete on cost and speed to fill these orders, which can include on-chain actions as well as assets. Relayers deliver very quickly, without any messages.

From the user’s perspective, interoperability is solved. Their desired outcome is achieved.”

Follow us on X, Facebook and Telegram

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

ETH

Investors Withdraw 360,000 Ethereum From Exchanges In Just 48 Hours – Accumulation Trend?

Published

6 days agoon

March 21, 2025By

admin

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Ethereum has experienced a much-needed surge above the $2,000 level, a key psychological and technical mark that bulls have struggled to reclaim since March 10. This breakout sparked optimism in the market, but the momentum was short-lived, as ETH quickly pulled back below the level and was unable to confirm a solid hold. Analysts widely agree that a strong and sustained move above $2,000 is critical for Ethereum to initiate a broader recovery rally.

Related Reading

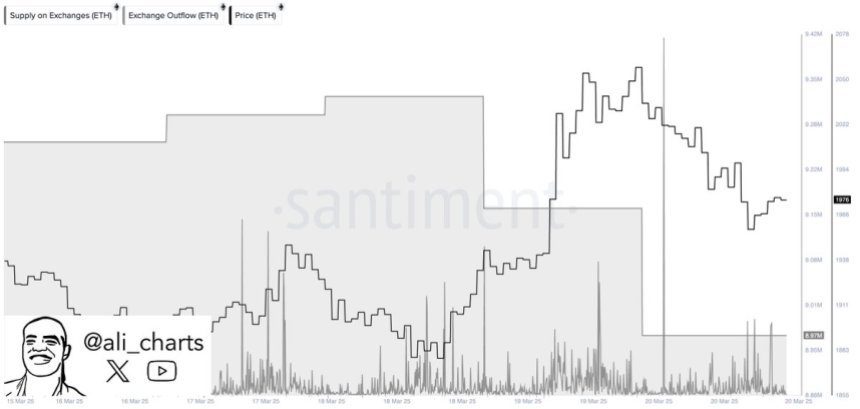

Despite the hesitation at resistance, on-chain data shows signs of growing investor confidence. According to Santiment, investors have withdrawn over 360,000 ETH from centralized exchanges in the last 48 hours. This shift is often interpreted as a bullish signal, suggesting that large holders are moving their assets to private wallets, possibly in anticipation of higher prices.

Meanwhile, the broader macroeconomic landscape continues to apply pressure. Trade war tensions and unpredictable policy decisions from the U.S. government have weighed heavily on both crypto and traditional markets, intensifying volatility and investor uncertainty. Still, Ethereum’s latest exchange outflows hint at a potential trend shift — one that could favor accumulation and set the stage for the next major move, provided bulls can reclaim and hold above the $2K threshold.

Ethereum Faces Critical Test Amid Exchange Outflows

Ethereum has lost over 57% of its value since mid-December, falling from a high of around $4,100 to recent lows near $1,750. This sharp correction has created a challenging environment for bulls, who have repeatedly failed to reclaim and hold higher price levels.

Now, the $2,000 mark stands as a psychological and technical battlefield. If Ethereum can firmly establish support above this level, it could provide the foundation for a recovery rally. However, a failure to do so would likely result in further downside and reinforce the bearish trend.

Related Reading

The current market landscape struggles with uncertainty. On one side, continued macroeconomic headwinds—rising trade tensions, inflation concerns, and policy shifts from the U.S. government—have weakened investor confidence and driven volatility across risk assets. On the other hand, there are signs of potential recovery and accumulation.

Top crypto analyst Ali Martinez shared data from Santiment, revealing that investors have withdrawn over 360,000 ETH from centralized exchanges in the past 48 hours. Historically, large-scale withdrawals are considered a bullish signal, as they suggest investors are moving assets into cold storage for long-term holding rather than preparing to sell.

This move could indicate growing confidence among large holders and signal the early stages of a new accumulation phase—provided Ethereum can hold above $2,000.

Price Holds Steady Below $2,000

Ethereum is currently trading at $1,960 after briefly attempting to reclaim the $2,000 mark in yesterday’s session. The psychological and technical resistance at $2,000 remains a crucial barrier that bulls must overcome to shift market momentum in their favor. Despite a small bounce from recent lows, Ethereum has struggled to gain traction amid persistent market uncertainty.

Bulls need to push ETH above $2,000 and reclaim higher levels such as $2,150 and $2,300 to confirm the beginning of a recovery phase. A sustained move above these levels would not only signal a potential trend reversal but could also attract sidelined investors back into the market. Until that happens, Ethereum remains vulnerable to continued downside pressure.

Related Reading

If bulls fail to break above the $2,000 resistance in the coming sessions, Ethereum could lose support at current levels and revisit lower demand zones around $1,850 or even $1,750. With the broader crypto market still under the influence of macroeconomic volatility and weak sentiment, the coming days are likely to be pivotal for ETH’s short-term direction. A decisive move either above or below this key range will likely set the tone for the next major price action.

Featured image from Dall-E, chart from TradingView

Source link

Altcoins

Justin Sun Stakes $100,000,000 Worth of Ethereum Amid Calls for ‘Tron Meme Season’

Published

7 days agoon

March 20, 2025By

admin

Tron (TRX) founder Justin Sun has staked $100 million worth of Ethereum (ETH), according to the blockchain analytics platform Arkham.

Arkham notes that Sun’s staked ETH will yield $3 million worth of Ethereum per year in passive income.

In addition to staking ETH, Sun also teased that Tron’s native asset, TRX, would soon be available on the Ethereum competitor Solana (SOL).

Sun, a polarizing figure in the crypto community, says it is currently “Tron meme szn [season].” He also notes that the issuance of top stablecoin USDT on Tron recently reached a new all-time high of $64.7 billion.

The U.S. Securities and Exchange Commission (SEC) recently paused its civil case against Sun. According to recent court filings, the Tron founder and the regulatory agency jointly asked United States District Judge Edgardo Ramos if they could “move to stay [the] case to allow the parties to explore a potential resolution.” Ramos granted the application a day later.

In 2023, the SEC accused Sun – who went on to invest millions of dollars into President Donald Trump’s decentralized finance platform World Liberty Financial – and his crypto firms of fraud, selling unregistered securities and manipulating the price of the digital asset TRX via wash trading.

TRX, a layer-1 asset, is trading at $0.23 at time of writing. The 10th-ranked crypto asset by market cap is down nearly 1% in the past day but up nearly 3% in the past week.

ETH is trading at $2,033 at time of writing. The second-ranked crypto asset by market cap is up nearly 7% in the past 24 hours and more than 8% in the past seven days.

Follow us on X, Facebook and Telegram

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Design Projects

Source link

Elizabeth Warren Calls Stablecoin Bill a Trump and Musk ‘Grift’

Crypto scammers nabbed in India for $700k fraud posing as a Japanese exchange

BTC in Stasis Below $88K as Trump Suggests Bigger Tariffs on EU, Canada

Dogecoin Price Eyes 10x Breakout After Elon Musk Ghibli Anime

XRP Price Rejected at Resistance—Are Bears Taking Control?

OpenAI expects to 3X revenue in 2025 but Chinese AI firms are heating up

‘Chart Is Still Broken’ – Crypto Analyst Predicts Sustained Downtrend for Altcoins Until This Takes Place

GameStop Announces $1.3 Billion Fundraising Plan To Purchase Bitcoin

Wyoming Governor Backs Away From State’s Failed Bitcoin Reserve Push

Priced at $0.20, this Solana competitor could be the next crypto to 20x

Why Are We Still Under the SEC’s Gun?

Expert Predicts XRP ETF Approval Is Only A ‘Matter Of Time’ As Approval Odds Soar

Analyst Unveils Extended XRP Price Target To $44, Reveals When To Take Profits

Would GameStop buying Bitcoin help BTC price hit $200K?

New SEC Chair Paul Atkins Holds $6,000,000 in Crypto-Related Investments – Here’s His Portfolio: Report

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Crypto’s Big Trump Gamble Is Risky

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

Trump’s Coin Is About As Revolutionary As OneCoin

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Is $200,000 a Realistic Bitcoin Price Target for This Cycle?

Trending

24/7 Cryptocurrency News5 months ago

24/7 Cryptocurrency News5 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin2 months ago

Bitcoin2 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Altcoins2 months ago

Altcoins2 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin4 months ago

Bitcoin4 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Price analysis5 months ago

Price analysis5 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x