glassnode

Glassnode Finds XRP Is Retail’s Top Pick This Cycle

Published

2 weeks agoon

By

admin

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

On-chain data analytics firm Glassnode has identified an intriguing shift in retail investor preference, spotlighting XRP as a focal point of speculative interest. The findings, which come from Glassnode’s newly published report titled “Rippling Away,” reveal that while Bitcoin market indicators edge closer to a bearish zone, XRP has seen remarkable inflows of capital and user activity—albeit with signs of waning momentum.

According to Glassnode’s report, Bitcoin has been consolidating between the $76,000 and $87,000 price range. Indicators such as the Realized Profit/Loss Ratio are showing “signs of near-term seller exhaustion but not yet a renewal of sustained bullish momentum.”

Furthermore, a longer-term on-chain “Death-Cross” suggests the market’s current weakness could persist for some time. “Supply in loss remains elevated at 4.7M BTC,” the report states, underlining the depth of investor stress. These conditions, as Glassnode notes, paint a picture of “deepening bearish conditions” for the leading cryptocurrency.

Retail Flocks To XRP

In contrast to Bitcoin’s cautionary signals, Glassnode points to XRP as a proxy for heightened retail speculation this cycle. The report highlights: “For this cycle in particular, Ripple (XRP) has been a preferred asset for trade amongst retail investors, and studying its behavior can, therefore, serve as a proxy for measuring retail speculative demand.”

Related Reading

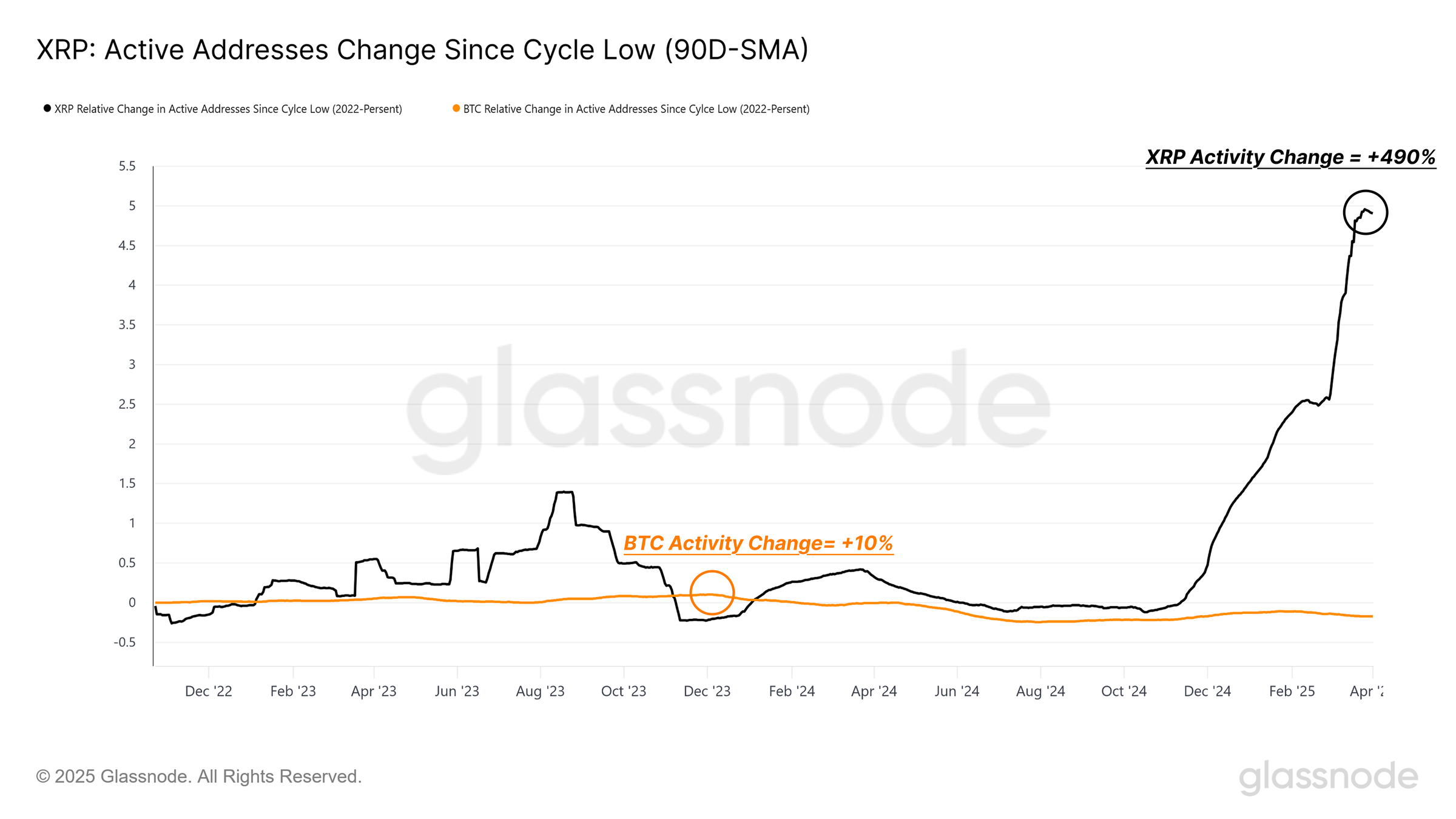

From the 2022 cycle low, XRP’s daily active addresses have “jumped by +490%” on a quarterly average basis, while Bitcoin’s rose by only 10%. This sharp divergence underscores the retail community’s enthusiasm for XRP, which Glassnode views as indicative of broader speculative appetite in the market.

The enthusiasm for XRP translated into a near-doubling of its Realized Cap—leaping from $30.1 billion to $64.2 billion during its rally from December 2024 to early 2025. Glassnode estimates that approximately $30 billion of this new capital came in over the last six months, pointing to a fresh wave of market participants.

Alongside the short surge in capital flows, there’s been a rapid concentration of wealth in the hands of new investors,” the report explains. However, Glassnode also warns: “When viewed together with the heavy retail participation, this sharp uplift in new holders raises caution signs.”

Related Reading

Glassnode warns that these new investors are vulnerable to downside volatility, especially as XRP’s cost basis becomes more top-heavy. Thus, despite initial excitement, the report notes a cooling of speculative interest since late February 2025.

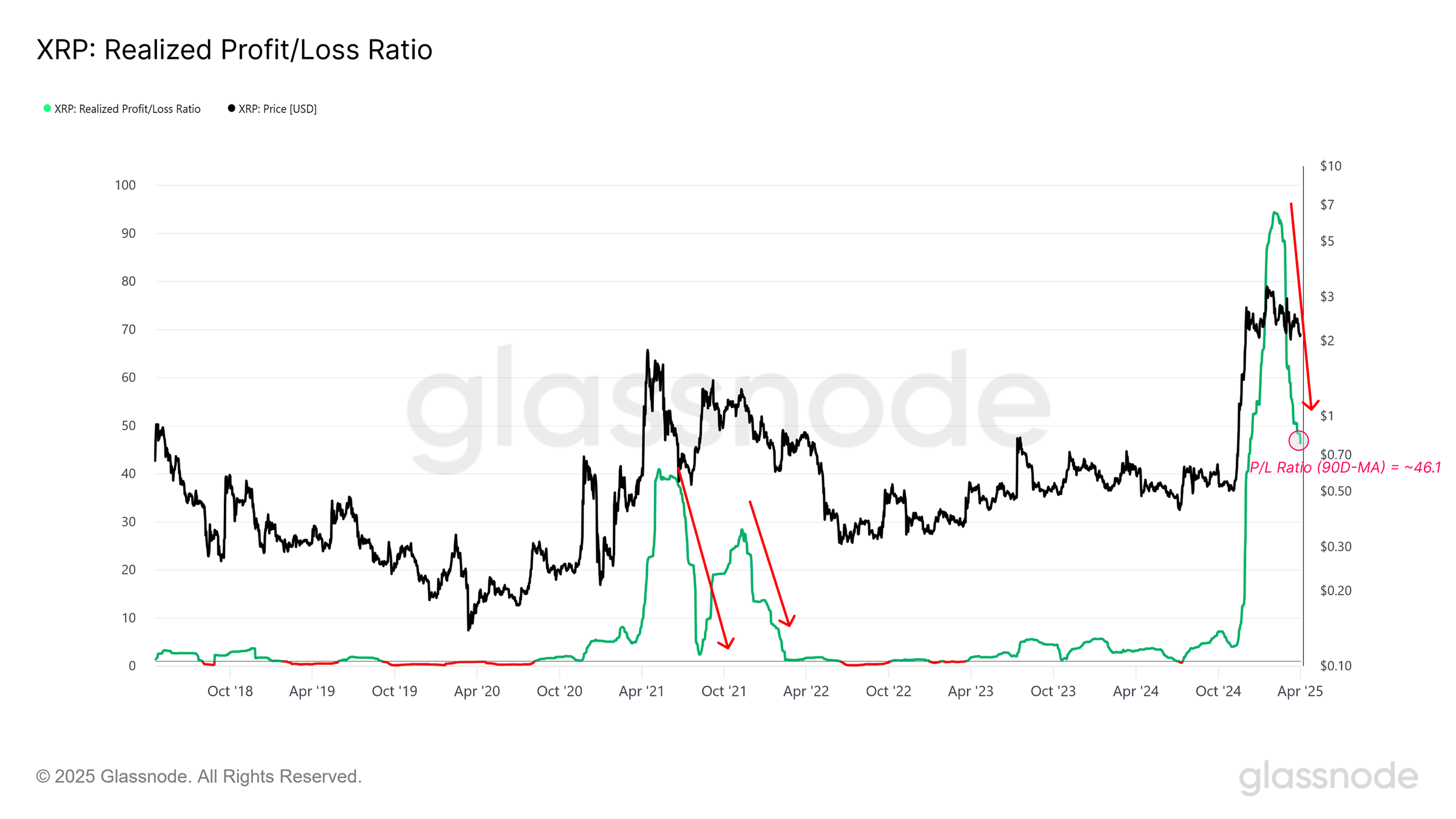

Glassnode’s Realized Loss/Profit Ratio for XRP has declined steadily since January 2025, suggesting a slip in profitability and “waning confidence.” This might reflect a more fragile market structure, where large swaths of relatively new holders face mounting paper losses.

“The XRP market is showing signs of a top-heavy structure, with many investors caught on a relatively high-cost basis,” the report adds. This fragility in XRP’s positioning could also imply broader caution for retail-driven altcoin markets.

Overall, Glassnode’s latest research underscores the dichotomy in today’s digital asset landscape. While Bitcoin’s drift below $80,000 spurred increased losses for long-term holders, XRP’s meteoric rise and subsequent slowdown depict a market driven by short-term retail enthusiasm that may be approaching saturation.

“For more speculative assets like XRP, demand may have already peaked,” the report concludes, “suggesting caution may be warranted until signs of a robust recovery start to emerge.”

At press time, XRP traded at $2.00.

Featured image created with DALL.E, chart from TradingView.com

Source link

You may like

Top Expert’s Update Sets $10 Target

How Academia Interacts With The Bitcoin Ecosystem

AB DAO and Bitget Launch Dual Reward Campaign, Distributing $2.6M Worth of $AB Globally

AI crypto tokens at risk as Nvidia faces restrictions on China exports

Coinbase Urges Australia to Vote for Crypto Progress in May

How High Would Pi Network Price Go If Pi Coin Adopts Transparency to Avoid Mantra Pitfalls

24/7 Cryptocurrency News

Arthur Hayes Predicts 70% Bitcoin Dominance as BTC Whales Hit Peak Accumulation

Published

1 week agoon

April 7, 2025By

admin

Bitcoin bull and former BitMEX CEO Arthur Hayes has shared that Bitcoin’s dominance in the cryptocurrency market will continue to rise.

Hayes revealed in a recent tweet that he has been avoiding altcoin investments despite their decreasing prices.

Arthur Hayes Predicts Bitcoin Dominance Increase

Arthur Hayes has taken a clear stance on the current market situation. He is actively adding to his Bitcoin position while avoiding altcoin investments. Hayes also spoke about a potential interest rate cut in the U.S. and explained how it could happen in one of his recent tweets.

In his recent tweet, the former BitMEX CEO stated: “Been nibbling on $BTC all day, and shall continue. Shitcoins are getting in our strike zone but I think #bitcoin dominance keeps zooming towards 70%.”

Been nibbling on $BTC all day, and shall continue. Shitcoins are getting in our strike zone but I think #bitcoin dominance keeps zooming towards 70%. So we are not gorging at the shitcoin supermarket. Remember, money printing is the only answer they have.

— Arthur Hayes (@CryptoHayes) April 7, 2025

Arthur Hayes specifically pointed to monetary policy as the driving factor behind his bullish Bitcoin outlook. He added: “So we are not gorging at the shitcoin supermarket. Remember, money printing is the only answer they have.” This comment suggests Hayes believes central bank policies will continue to favor Bitcoin as a hedge against inflation and currency devaluation.

The 70% dominance target is a substantial increase from Bitcoin’s current market share. Such a shift would imply major capital flows from altcoins back into Bitcoin.

Whale Accumulation Reaches Peak Levels

On-chain analytics firm Glassnode has identified a pattern of Bitcoin accumulation among the largest holders. According to their data, Bitcoin whales holding more than 10,000 BTC reached a nearly perfect accumulation score of approximately 1.0 at the month’s turn. This means that there is intense buying activity over a 15-day period.

Whales holding >10K $BTC briefly hit a perfect accumulation score (~1.0) at the turn of the month, reflecting intense 15-day buying. The score has since eased to ~0.65, still signaling steady accumulation.

Meanwhile, cohorts from <1 $BTC up to 100 $BTC have intensified their… https://t.co/cEo3F7Paid pic.twitter.com/7udA7G8nSM— glassnode (@glassnode) April 7, 2025

While this peak accumulation score has since moderated to around 0.65, it still shows continued steady buying from these major market participants. This level of whale accumulation stands in stark contrast to the behavior of smaller Bitcoin holders.

Glassnode noted: “Meanwhile, cohorts from <1 $BTC up to 100 $BTC have intensified their distribution, all trending toward 0.1–0.2. A clear and widening divergence between small and large holders.”

This difference in behavior between large and small holders often precedes major market movements. Historically, periods where whales accumulate while retail sells have preceded bullish phases in the Bitcoin market cycle.

Bitcoin Establishes support at $74,000

Bitcoin price appears to have established a support level around $74,000, according to data shared by Glassnode. Their analysis comes at a time when Bitcoin and altcoins have lost double-digit value in the last 24 hours.

The data shows this price point aligns with “the first major supply cluster below $80K – over 50K $BTC at $74.2K.” This supply zone is primarily composed of investors who were active in the market for approximately five months.

The strength of this support level will be important for Bitcoin’s short-term price action as the market moves through its current volatility. If this support holds, it could be a foundation for a potential recovery toward previous highs.

OKX partner Ted has highlighted a key technical level that could decide Bitcoin’s next directional move. “BTC is trying to reclaim the weekly 50-EMA level. This has acted as a bull/bear line for BTC,” Ted noted on X.

$BTC is trying to reclaim the weekly 50-EMA level.

This has acted as a bull/bear line for BTC.

If BTC fails to reclaim it, expect a correction towards $69K-$70K (2021 highs), and even the $67K (Saylor average entry) level could be retested.

In case BTC reclaims this level, a… pic.twitter.com/CtsyZ7q3FH

— Ted (@TedPillows) April 7, 2025

According to his analysis, failure to reclaim this moving average could trigger further downside. He mentioned potential correction targets at “$69K-$70K (2021 highs) and even the $67K (Saylor average entry) level.” Conversely, successfully reclaiming the 50-EMA could spark a “relief rally.”

Ted’s analysis also comes at a time when the crypto liquidations breached $600 million and Bitcoin fell below the important $80,000 level.

Vignesh Karunanidhi

Vignesh Karunanidhi is a seasoned crypto journalist with nearly 7 years of experience in the cryptocurrency industry. He has contributed to numerous publications, including WatcherGuru, BeInCrypto, Milkroad, and authored over 10,000 articles

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

chainlink

Support Or Resistance? Chainlink (LINK) Investor Data Suggests Key Price Zones

Published

3 weeks agoon

March 29, 2025By

admin

Semilore Faleti is a cryptocurrency writer specialized in the field of journalism and content creation. While he started out writing on several subjects, Semilore soon found a knack for cracking down on the complexities and intricacies in the intriguing world of blockchains and cryptocurrency.

Semilore is drawn to the efficiency of digital assets in terms of storing, and transferring value. He is a staunch advocate for the adoption of cryptocurrency as he believes it can improve the digitalization and transparency of the existing financial systems.

In two years of active crypto writing, Semilore has covered multiple aspects of the digital asset space including blockchains, decentralized finance (DeFi), staking, non-fungible tokens (NFT), regulations and network upgrades among others.

In his early years, Semilore honed his skills as a content writer, curating educational articles that catered to a wide audience. His pieces were particularly valuable for individuals new to the crypto space, offering insightful explanations that demystified the world of digital currencies.

Semilore also curated pieces for veteran crypto users ensuring they were up to date with the latest blockchains, decentralized applications and network updates. This foundation in educational writing has continued to inform his work, ensuring that his current work remains accessible, accurate and informative.

Currently at NewsBTC, Semilore is dedicated to reporting the latest news on cryptocurrency price action, on-chain developments and whale activity. He also covers the latest token analysis and price predictions by top market experts thus providing readers with potentially insightful and actionable information.

Through his meticulous research and engaging writing style, Semilore strives to establish himself as a trusted source in the crypto journalism field to inform and educate his audience on the latest trends and developments in the rapidly evolving world of digital assets.

Outside his work, Semilore possesses other passions like all individuals. He is a big music fan with an interest in almost every genre. He can be described as a “music nomad” always ready to listen to new artists and explore new trends.

Semilore Faleti is also a strong advocate for social justice, preaching fairness, inclusivity, and equity. He actively promotes the engagement of issues centred around systemic inequalities and all forms of discrimination.

He also promotes political participation by all persons at all levels. He believes active contribution to governmental systems and policies is the fastest and most effective way to bring about permanent positive change in any society.

In conclusion, Semilore Faleti exemplifies the convergence of expertise, passion, and advocacy in the world of crypto journalism. He is a rare individual whose work in documenting the evolution of cryptocurrency will remain relevant for years to come.

His dedication to demystifying digital assets and advocating for their adoption, combined with his commitment to social justice and political engagement, positions him as a dynamic and influential voice in the industry.

Whether through his meticulous reporting at NewsBTC or his fervent promotion of fairness and equity, Semilore continues to inform, educate, and inspire his audience, striving for a more transparent and inclusive financial future.

Source link

Bitcoin

Bitcoin Long-Term Holder Net Position Turns Green For The First Time In 2025

Published

4 weeks agoon

March 20, 2025By

adminReason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

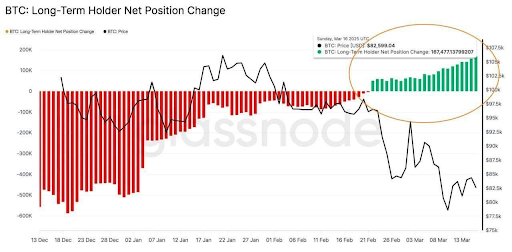

Bitcoin’s long-term holders have resumed accumulation in what is a notable shift in investor sentiment despite the turbulence that has gripped the market in recent weeks. Particularly, data from on-chain analytics platform Glassnode shows that the “BTC: Long-term holder net position change” metric has flipped positive for the first time this year. This suggests that long-term Bitcoin investors are capitalizing on market conditions to add significant amounts of BTC to their holdings.

Long-Term Holders Add 167,000 BTC Amid March Crash

Earlier this month, Bitcoin’s price plunged from above $90,000 to around $80,000 during a rapid sell-off. This price stunned many traders and triggered a continuous wave of liquidations among short-term investors. Yet despite this steep correction, long-term holders treated the sub-$90,000 levels as a buying opportunity rather than a reason to capitulate.

Related Reading

In other words, coins are moving into wallets that haven’t spent their BTC in a long time, which is a notable reversal after starting 2025 with a negative net position change. This marks the first net accumulation by these “HODLers” in 2025. Glassnode’s Long-Term Holder Net Position Change metric, which had been in the red, flipped “green” as long-term investors aggressively accumulated through the downturn.

On-chain data shows that this flip to green has seen long-term holders increase their net Bitcoin holdings by more than 167,000 BTC in the past month. This notable influx is valued at nearly $14 billion. In short, the cohort of seasoned holders began scooping up cheap BTC while short-term sentiment was at its bleakest.

Is A Bitcoin Price Recovery Brewing?

The timing of this flip from red selloff to green accumulation among long-term holders is striking, considering what the Bitcoin price went through in the past two weeks. This data suggests that a large part of the Bitcoin crash was caused by panic-selling among short-term holders. This behavior aligns with past market cycles between August and September 2024, where long-term holders accumulated aggressively during a price dip.

Related Reading

Interestingly, Glassnode’s long-term holder metric isn’t the only one pointing to positive Bitcoin sentiment among large holders. After weeks of uncertainty, Bitcoin exchange-traded funds (ETFs) have started seeing net inflows again. On March 17, spot Bitcoin ETFs collectively drew in about $274.6 million, the largest single-day inflow in 28 days and a clear signal of renewed investor interest.

The very next day brought another wave of fresh capital, with roughly $209 million pouring into Bitcoin funds on March 18. In fact, this three-day streak represents the first sustained run of positive inflows since February 18, a period during which Bitcoin funds have experienced consecutive days of outflows.

At the time of writing, Bitcoin is trading at $83,500.

Featured image from Unsplash, chart from Tradingview.com

Source link

Top Expert’s Update Sets $10 Target

How Academia Interacts With The Bitcoin Ecosystem

AB DAO and Bitget Launch Dual Reward Campaign, Distributing $2.6M Worth of $AB Globally

AI crypto tokens at risk as Nvidia faces restrictions on China exports

Coinbase Urges Australia to Vote for Crypto Progress in May

How High Would Pi Network Price Go If Pi Coin Adopts Transparency to Avoid Mantra Pitfalls

XRP’s ‘Rising Wedge’ Breakdown Puts Focus on $1.6 Price Support

China selling seized crypto to top up coffers as economy slows: Report

Ethereum Price Dips Again—Time to Panic or Opportunity to Buy?

The Inverse Of Clown World”

Bitcoin Indicator Flashing Bullish for First Time in 18 Weeks, Says Analyst Who Called May 2021 Crypto Collapse

3iQ and Figment to launch North America’s first Solana staking ETF

Bitcoin Miners Are Selling More BTC to Make Ends Meet: CryptoQuant

5 Biggest Ripple (XRP) Price Predictions for April 2025

Tokenization Firm Securitize Acquires MG Stover’s Digital Asset Fund Administration Unit

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Crypto’s Big Trump Gamble Is Risky

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

I’m Grateful for Trump’s Embrace of Bitcoin

Trending

24/7 Cryptocurrency News5 months ago

24/7 Cryptocurrency News5 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin3 months ago

Bitcoin3 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Altcoins3 months ago

Altcoins3 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin5 months ago

Bitcoin5 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Price analysis5 months ago

Price analysis5 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x

✓ Share: