Gold

Gold ETF Inflows Hit Three-Year High as PAXG, XAUT Outperform Wider Crypto Market

Published

2 weeks agoon

By

admin

As traditional gold markets heat up, crypto investors are following suit—flocking to tokenized versions of the precious metal that offer both price exposure and digital flexibility.

Gold-backed cryptocurrencies like Paxos Gold (PAXG) and Tether Gold (XAUT) have risen 24.15% and 23.7% respectively year-to-date to new all-time highs above $3,300, roughly matching the performance of spot gold. Their prices have since receded slightly to $3,265 and $3,244, respectively.

While gold-backed cryptocurrencies surged so far this year, the wider cryptocurrency market has been in a downtrend. Bitcoin (BTC) has lost more than 11% of its value so far this year, while the wider crypto market has fallen by a little over 30%, based on the CoinDesk 20 (CD20) index.

The tokens, which are backed by physical gold and track its price, experienced a surge in value as investors sought refuge from the uncertainty induced by the escalating U.S.-China trade war.

The move echoes a broader return to gold as a safe-haven asset. Inflows into gold ETFs hit 226.5 tonnes in the first quarter of 2025, the highest level since early 2022, according to data from the World Gold Council. Nearly 60% of that demand came from North America.

Similarly, gold-backed cryptocurrencies saw net token minting of over $42.7 million in the first quarter of the year, according to data from RWA.xyz, helping along with gold’s price appreciation raise their total market capitalization near $1.4 billion.

Source link

You may like

Here’s How Bitcoin Could Boost Demand for US Treasuries, According to Macro Guru Luke Gromen

Experts Predict US Recession in 2025 if Trump-China Trade War Tariffs Stay

Monero Jumps 51% After ‘Suspicious Transfer’ of $333M in Bitcoin

ZachXBT flags suspicious $330M Bitcoin transfer triggering Monero surge

Monero’s XMR Rockets 40% as XRP Leads Crypto Majors Gains

The 5 top crypto loan platforms of 2025

Bitcoin

Bloomberg Analyst Predicts Massive but Historically ‘Normal’ Market Crashes for Bitcoin, Oil and Stock Market

Published

6 days agoon

April 22, 2025By

admin

Bloomberg commodity strategist Mike McGlone says that there’s a chance of a massive correction in US markets that could pummel the price of Bitcoin (BTC), oil and stocks.

In a post on the social media platform X, McGlone says the US has a “self-correcting mechanism” that may push back against President Trump’s tariff war, which could create market chaos.

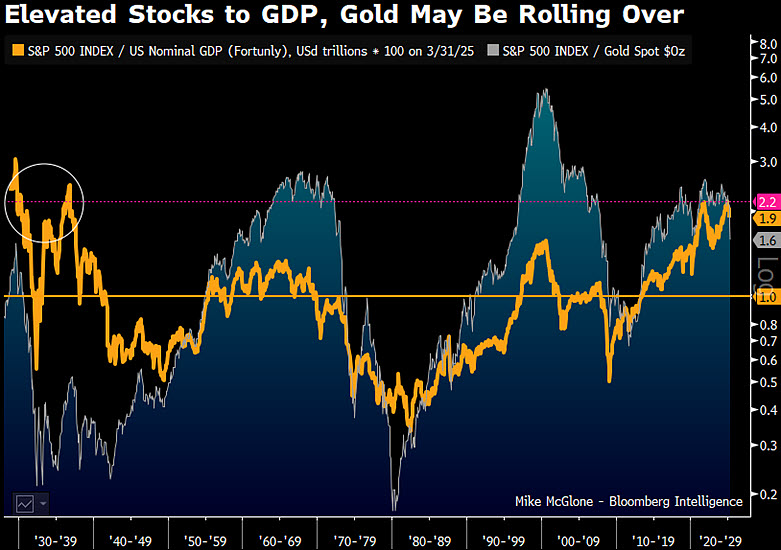

The analyst shares a chart suggesting that the S&P 500 vs. GDP ratio and the S&P 500 vs. gold ratio are both at elevated levels – a setup that has historically marked stock market crashes, such as in the 1930s, the late 1990s, and 2008.

Such an event, or “reversion,” could result in significant drops in stocks, Bitcoin oil, copper and bonds, according to McGlone.

“America’s self-correcting mechanism is unstoppable. If unprecedented tariffs and austerity don’t work, pushback will come in the next elections. If the great rebalance attempt works, it could reset world order underpinnings for the coming century.

The problem is that the discombobulation is coming with US stock market cap vs. GDP and the rest of the world, the highest in about 100 years.

My normal reversion base case:

– 50% drawdown in the US stock market

– $40 a barrel crude oil

– $3 per pound copper

– 3% US 10-year yield

– $10,000 Bitcoin, 90% drawdowns in most of the millions of cryptocurrencies

– $4,000 gold, the outlier due to not being simple reversion”

While McGlone’s predicted drawdowns appear severe, the analyst says that the magnitude of the potential downside moves is “normal” based on historical terms.

At time of writing, Bitcoin is trading for $87,529.

Follow us on X, Facebook and Telegram

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

Bitcoin

Gold Rush Or Bitcoin Boom? China Buys Big, BTC Price Follows

Published

7 days agoon

April 21, 2025By

admin

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

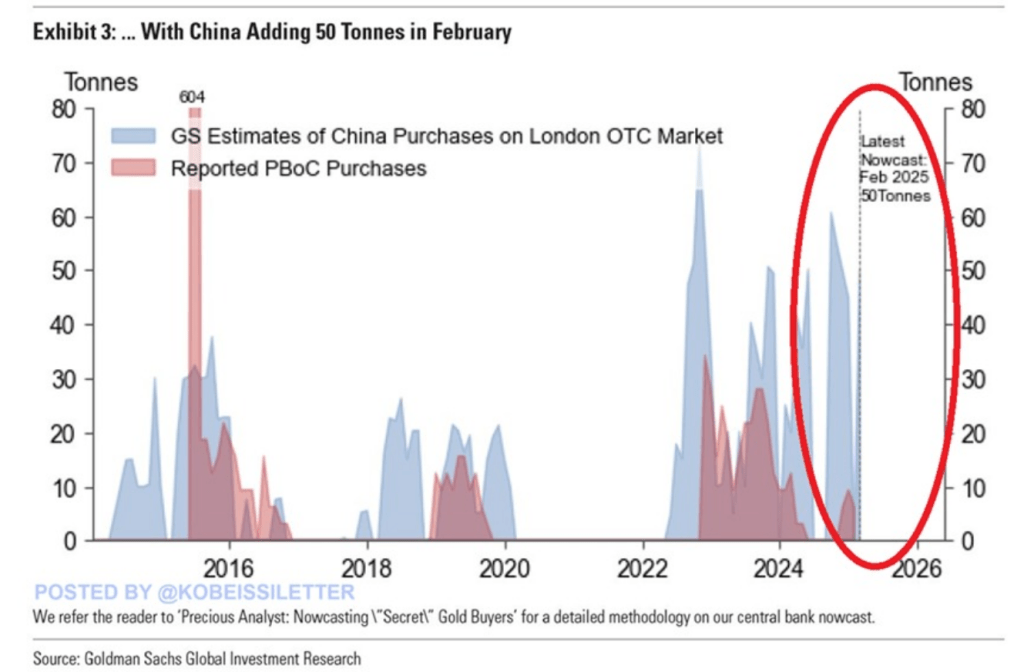

China has added five tonnes of gold to its reserves in under a month as part of an increasing aggressive purchase of the precious metal. Bitcoin continues to stand firm above the $87,000 level despite recent market fluctuations.

Related Reading

PBOC Gold Accumulation Up As Bitcoin Price Soars

According to the Kobeissi Letter in posting messages on X, the People’s Bank of China has been abruptly accumulating gold. It has acquired five tonnes over the last month. This has taken place amid uncertainty in global markets from the rift caused by persistent tensions in trade along US-China fronts.

Bitcoin traders seem to witness this, as the price of the crypto holds strong at $87,280, with scanty negative macronews in the background. Merely four days ago, cryptocurrencies fell back after US President Donald Trump proclaimed a 245% import tax on Chinese items. The quick recovery has surprised many market observers.

BREAKING: China’s central bank increased its gold holdings by 5 tonnes in March, posting their 5th consecutive monthly purchase.

This brings total China’s gold reserves to a record 2,292 tonnes.

Chinese gold holdings now reflect 6.5% of its total official reserve assets.… pic.twitter.com/LuwiBvnirn

— The Kobeissi Letter (@KobeissiLetter) April 20, 2025

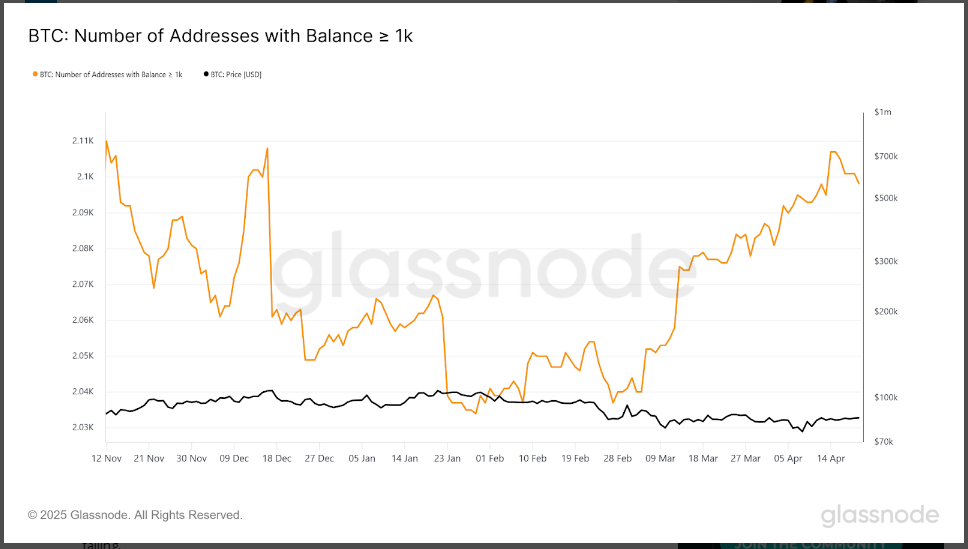

Whale Wallets Indicate Growing Appetite For Bitcoin

Statistics by Glassnode indicate a steep increase in addresses containing over 1,000 Bitcoin. More than 60 new “whale” wallets have entered the market since early March.

The number of such large Bitcoin addresses has increased from 2,030 in late February to 2,100 as of April 15, which is the highest in four months. The boost indicates large investors are purchasing more Bitcoin despite changing market conditions.

Others say the strength of Bitcoin lies in its increased popularity as an inflation hedge, akin to gold. This theory has become more widely accepted as China seems to be steering away from US dollar-denominated assets.

Gold Prices Hit New Records As Trade Tensions Mount

Prices of gold have surged to $3,401, up by close to $100 over only a week. The rise comes as institutions, dominated by China, raise their gold stockpiles.

The ongoing tariff war between the US and China has driven investors towards traditional safe-haven assets. Bitcoin is also seen to be gaining from this same trend, with some investors seeing it as a contemporary option for gold in times of uncertainty.

Mixed Signals From ETF Flows And Market Analysts

Not everything is rosy for Bitcoin. Reports disclose that nearly $5 billion has exited Bitcoin ETFs since their aggregate flow hit all-time highs. In spite of this outflow, Bitcoin’s price has remained extremely stable.

Related Reading

There are also contradictory reports regarding China’s position on Bitcoin. While there are rumors that China may be accumulating a Strategic Bitcoin Reserve, other reports say the nation sold 15,000 BTC on offshore exchanges.

The cryptocurrency’s ability to maintain its price despite these mixed signals has caught the attention of traders worldwide. As US-China economic tensions continue, investors are watching both gold and Bitcoin as potential safe havens in an increasingly unstable global market.

Featured image from GEPL Capital, chart from TradingView

Source link

Altcoins

Ethereum Price Suffers 77% Crash Against Bitcoin, On-Chain Deep Dive Reveals Reasons Why

Published

2 weeks agoon

April 13, 2025By

adminReason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Despite rolling out a large number of upgrades and innovations, the Ethereum price continues to lag behind Bitcoin (BTC) by a wide margin. Reports reveal that ETH has suffered a staggering 77% price crash against BTC — a decline likely fueled by a mix of technical, macro, and sentiment-driven factors. Notably, On-chain analytics platform, Santiment has now pinpointed and broken down the key reasons behind these price struggles.

Ethereum Price Nosedives Against Bitcoin

On April 11, Santiment released a detailed report on Ethereum, highlighting its almost four-year underperformance and the reasons behind it. Ethereum, once revered as the cryptocurrency most likely to dethrone Bitcoin, has recently suffered a brutal price decline when measured directly against BTC.

Related Reading

According to Santiment’s on-chain data, Ethereum has crashed by approximately 77% against Bitcoin since December 2021. While the dollar value of ETH hasn’t completely collapsed, especially compared to other altcoins, the long-term BTC/ETH ratio still paints a gruesome picture for Ethereum holders.

Notably, Ethereum has also failed to recover anywhere near its November 2021 all-time high of $4,760. In contrast, Bitcoin has surged ahead, reclaiming much of its market dominance and outpacing ETH across almost every timeframe.

This disparity has led many traders and former maximalists to compare ETH to a “shitcoin.” Even worse, various mid to low-cap altcoins have already outperformed Ethereum over the short, mid, and long-term timeframes, causing further embarrassment for the world’s second-largest cryptocurrency by market capitalization. Based on Santiment’s report, the ETH/BTC price ratio chart alone is enough to trigger doubt and uncertainty among long-term holders.

Behind The Scenes Of Ethereum Price Struggles

Beyond price action and market volatility, Santiment reveals that there are fundamental reasons for Ethereum’s sluggish performance over the years. Some of the major criticisms that analysts and traders have pinpointed include technical, sentimental, and regulatory issues.

Related Reading

Ironically, Ethereum’s Layer 2 solutions are one of the key drivers of its underperformance. L2 solutions like Arbitrum, Optimism, and zkSync are reportedly cannibalizing activity on the mainnet, taking investments from ETH while spreading investor attention thin.

Secondly, Ethereum seems to struggle with complex roadmaps and communication, which has led to investor confusion. Major updates like The Merge and Shanghai have been difficult for investors to comprehend, making ETH feel less accessible than BTC.

Thirdly, users remain frustrated by Ethereum’s relatively high gas fees and the slow rollout of key upgrades. This has pushed them toward more affordable and faster alternatives, significantly reducing adoption.

Another primary reason for Ethereum’s crash against Bitcoin is ongoing regulatory concerns. Unlike Bitcoin, which has a more established legal precedent, Ethereum faces constant uncertainty about whether it could be labeled a security.

Other points include ETH’s lack of investment appeal. While Bitcoin maintains the title as a stable digital gold, Ethereum appears to be caught in between, having no clear or attractive investment narrative. Moreover, newer blockchains like Solana and Cardano are also attracting a significant number of users with cheaper and faster solutions, ultimately pulling investments away from ETH.

The final reason Santiment has identified for Ethereum’s long-term price descent is rising selling pressure. Post-upgrade withdrawals of stakes ETHs have created steady sell-side pressure, limiting growth and momentum compared to Bitcoin.

Featured image from Unsplash, chart from Tradingview.com

Source link

Here’s How Bitcoin Could Boost Demand for US Treasuries, According to Macro Guru Luke Gromen

Experts Predict US Recession in 2025 if Trump-China Trade War Tariffs Stay

Monero Jumps 51% After ‘Suspicious Transfer’ of $333M in Bitcoin

ZachXBT flags suspicious $330M Bitcoin transfer triggering Monero surge

Monero’s XMR Rockets 40% as XRP Leads Crypto Majors Gains

The 5 top crypto loan platforms of 2025

XRP Price Shows Strength — Breakout Above Key Levels Possible?

Expert Reveals Why The Ethereum-To-Bitcoin Ratio Is Falling

Analyst Says Solana-Based Memecoin Going Much Higher, Sees PENGU Facing ‘True Test’ After April Surge

Nike sued for $5 million over its shutdown of NFT platform RTFKT

Biological Age vs. Chronological Age: Redefining Age in the Digital Era

TRUMP whale regrets sale, pays double to buy back meme coins

Stripe Tests New Stablecoin Project as $3.7T Market Looms

Falling Wedge Pattern Confirms $264 target

Dogecoin Confirms Daily Trend Reversal With Breakout, Retest, And New Uptrend

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Crypto’s Big Trump Gamble Is Risky

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

I’m Grateful for Trump’s Embrace of Bitcoin

Trending

24/7 Cryptocurrency News6 months ago

24/7 Cryptocurrency News6 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin3 months ago

Bitcoin3 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Ripple Price1 month ago

Ripple Price1 month ago3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin6 months ago

Bitcoin6 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Opinion6 months ago

Opinion6 months agoCrypto’s Big Trump Gamble Is Risky

Bitcoin6 months ago

Bitcoin6 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Bitcoin3 months ago

Bitcoin3 months agoThe Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines