Bitcoin

Grayscale Investments Launches Bitcoin Miners ETF

Published

3 months agoon

By

admin

Grayscale Investments LLC has officially launched the Grayscale Bitcoin Miners ETF (MNRS), providing investors with a unique opportunity to gain exposure to the Bitcoin mining industry. This ETF is designed for those who want to invest in Bitcoin miners without directly purchasing Bitcoin itself, making it an attractive option for traditional investors looking to diversify their portfolios.

Introducing the Grayscale Bitcoin Miners ETF ($MNRS)

, offering investors targeted, pure-play exposure to Bitcoin Miners and the Bitcoin Mining Industry, available directly in your investment account. Learn more below. Brokerage fees and other expenses may still apply.

— Grayscale (@Grayscale) January 30, 2025

Key Takeaways

- Grayscale’s Bitcoin Miners ETF (MNRS) targets companies involved in Bitcoin mining and related services.

- The ETF is listed on NYSE Arca and tracks the Indxx Bitcoin Miners Index.

- Investors can gain exposure to the Bitcoin mining ecosystem without direct investment in BTC.

Overview Of The ETF

The Grayscale Bitcoin Miners ETF aims to provide targeted exposure to companies that derive a significant portion of their revenue from Bitcoin mining activities. This includes firms that offer mining infrastructure, hardware, and software services. The ETF is particularly appealing to investors who may not be ready to invest directly in Bitcoin but still want to participate in the growing market.

Investment Strategy

The ETF will not invest directly in Bitcoin or other digital assets. Instead, it focuses on companies that support the Bitcoin network’s operations. The Indxx Bitcoin Miners Index, which the ETF tracks, includes major players in the mining sector, such as:

- MARA Holdings – 16.65%

- Riot Platforms – 11.92%

- Core Scientific – 9.2%

- CleanSpark – lower weight

- Iren – lower weight

These companies are crucial for maintaining the security and integrity of the Bitcoin network, positioning them for potential growth as Bitcoin adoption increases.

Related: Nasdaq Proposes In-Kind Redemptions for BlackRock’s Bitcoin ETF

Market Context

The launch of the Grayscale Bitcoin Miners ETF comes at a time when the market is experiencing significant fluctuations. Despite Bitcoin’s impressive performance in 2024, with a return of 113%, many publicly traded mining companies have struggled to keep pace. Some have reported declines of up to 84% in their stock prices, highlighting the volatility and risks associated with the mining sector.

Future Prospects

Grayscale’s Global Head of ETFs, David LaValle, emphasized the importance of Bitcoin miners, stating, “Bitcoin miners, the backbone of the network, are well-positioned for significant growth as Bitcoin adoption and usage increases.” This sentiment reflects the broader trend of institutional interest in Bitcoin-related investments, as more traditional investors seek to diversify their portfolios with innovative financial products.

Related: Is $200,000 a Realistic Bitcoin Price Target for This Cycle?

Conclusion

The Grayscale Bitcoin Miners ETF represents a significant step forward in making Bitcoin investments more accessible to a wider audience. By focusing on the mining sector, Grayscale is tapping into a critical component of the Bitcoin ecosystem, offering investors a way to engage with the market without the complexities of direct Bitcoin ownership. As the demand for Bitcoin continues to grow, the ETF could serve as a valuable tool for investors looking to capitalize on the evolving landscape of digital assets.

Source link

You may like

Strategy Boosts Bitcoin Holdings Above $47 Billion With Latest Buy

Coinbase CLO Reveals New Details on SEC’s Ethereum 2.0 Investigation Documents

NEAR Gains 11.7%, Leading Index Higher Over Weekend

Bitget’s $12B VOXEL frenzy fizzled fast, but questions remain

BNB Springs Back From $531 With Unshaken Bullish Conviction

This tiny altcoin could see 50x gains before BTC hits 100k

Bitcoin

Bitcoin Entering Phase of Parabolic Expansion After Successfully Breaking Downtrend: Crypto Analyst

Published

7 hours agoon

April 21, 2025By

admin

A closely followed crypto analyst says that Bitcoin (BTC) has successfully broken a downtrend with strong price action.

The pseudonymous analyst known as Rekt Capital tells his 543,000 followers on the social media platform X that BTC has successfully broken a diagonal resistance and flipped it into support after staying above $85,000.

“Bitcoin hasn’t just broken the Downtrend and successfully retested it as support for the first time since Downtrend formation

But Bitcoin has also been able to sustainably maintain above the Downtrend for a period of several consecutive days now.”

Rekt Capital also says that BTC is likely in the first corrective stage of the “Banana zone,” or a phase of parabolic expansion for Bitcoin after breaking last cycle’s highs.

The analyst suggests that BTC will soon soar to new all-time highs before entering a new corrective phase and a final launch to its bull market peak.

“Technically, we should be seeing parabolic upside, but instead we’re getting [consolidation]. The ‘Banana Zone’ is a term of endearment for the parabolic phase of the cycle when it comes to Bitcoin’s price action whenever it breaks beyond old all-time highs into new all-time highs.

What happens with Bitcoin’s price action when it breaks to new all-time highs is, yes, we do see a parabolic ascension to those new all-time highs but sometimes when we break to new all-time highs, it can get a little bit bumpy, so it tends to be bumpy in and around the old all-time high region and it tends to be also bumpy once we’ve rallied to new all-time highs…

What that means is we’re going to see additional upside, so that gets us into the corrective phase two. We tend to see at least two corrective periods in price discovery.”

At time of writing, BTC is trading at $87,523.

Follow us on X, Facebook and Telegram

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

24/7 Cryptocurrency News

Metaplanet Acquires 330 BTC For $28.2 Million

Published

13 hours agoon

April 21, 2025By

admin

Metaplanet has increased the size of its Bitcoin (BTC) holdings by 330 in a bulk purchase valued at $28.2 million. The latest acquisition brings the Japanese company’s holdings closer to the 5,000 BTC mark amid impressive YTD yields.

Metaplanet Buys 330 BTC For Nearly $30 Million

Tokyo-based Metaplanet has announced the addition of 330 BTC to its growing Bitcoin holdings. According to a post on X by Metaplanet CEO Simon Gerovich, the Japanese-based company splurged $28.2 million on the purchase.

Gerovich’s announcement reveals that Metaplanet spent an average of $85,605 for each BTC in its latest acquisition. At the moment, Metaplanet’s total BTC holding stands at an impressive 4,855 BTC valued at nearly $500 million.

Since the start of the year, Metaplanet says its acquisition spree has seen it rack up a BTC yield of 119.3% YTD.

“Metaplanet has acquired 330 BTC for $28.2 million at $85,605 per bitcoin and has achieved BTC Yield of 119.3% YTD 2025,” said Gerovich.

THIS IS A DEVELOPING STORY….

Aliyu Pokima

Aliyu Pokima is a seasoned cryptocurrency and emerging technologies journalist with a knack for covering needle-moving stories in the space. Aliyu delivers breaking news stories, regulatory updates, and insightful analysis with depth and precision. When he’s not poring over charts or following leads, Aliyu enjoys playing the bass guitar, lifting weights and running marathons.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

Altcoins

Massive Altcoin Rallies Imminent Amid Surging Global Liquidity, According to Analyst TechDev

Published

15 hours agoon

April 21, 2025By

admin

A closely followed crypto strategist and trader believes that the time for altcoins to shine is close at hand.

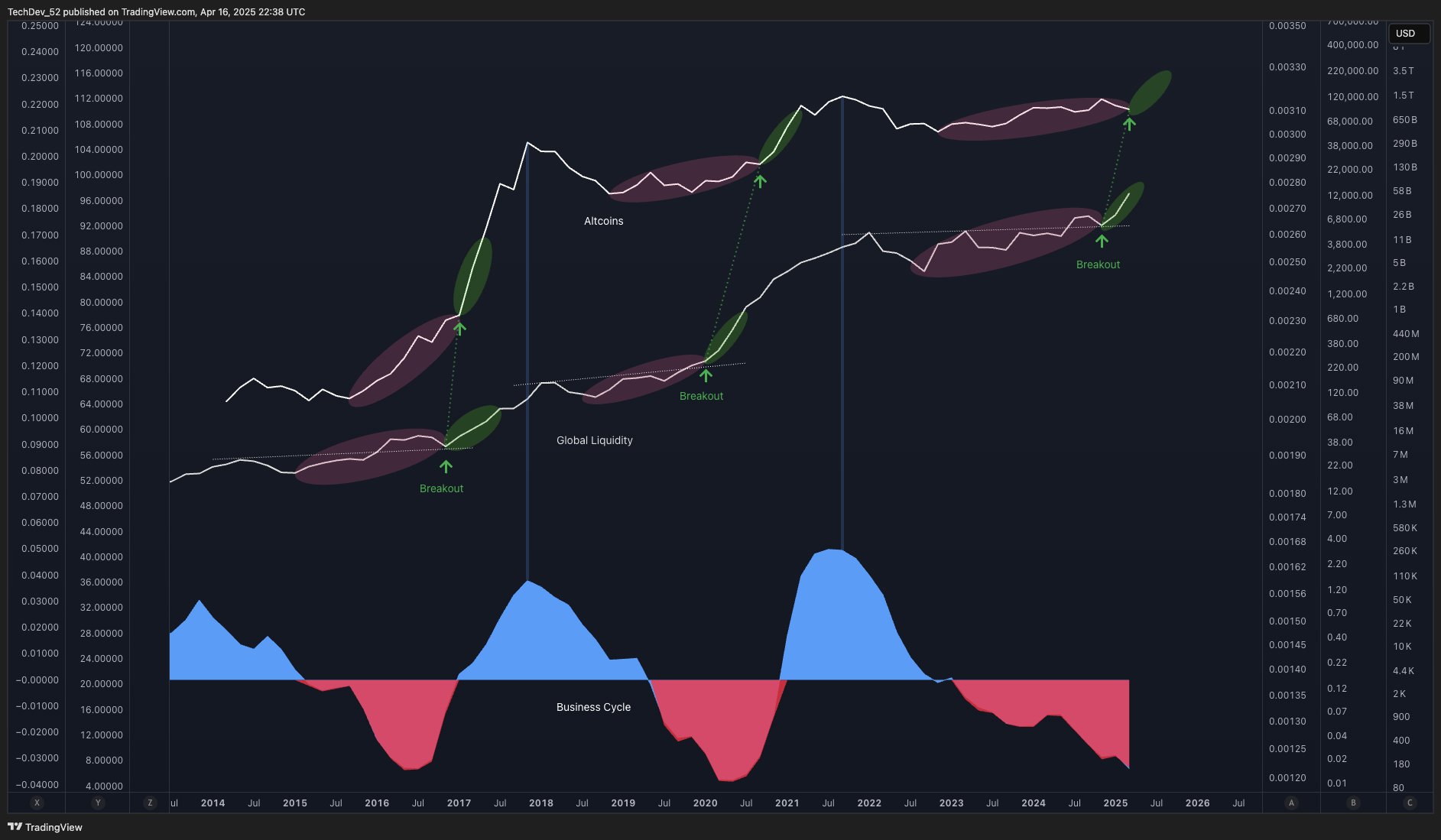

Pseudonymous analyst TechDev tells his 520,200 followers on the social media platform X that two macroeconomic factors are flashing bullish for altcoins based on historical precedent.

The trader shares a chart suggesting that altcoins tend to explode whenever global liquidity surges and the business cycle bottoms out.

Global liquidity refers to the amount of money sloshing in the world’s financial system, while the business cycle tracks the rise and fall of economic activity over time.

Says TechDev,

“Altcoins don’t run until liquidity breaks out. It’s time.”

Based on the trader’s chart, he appears to suggest that altcoins have sparked steep rallies in 2016 and 2020 following a business cycle bottom and a global liquidity breakout.

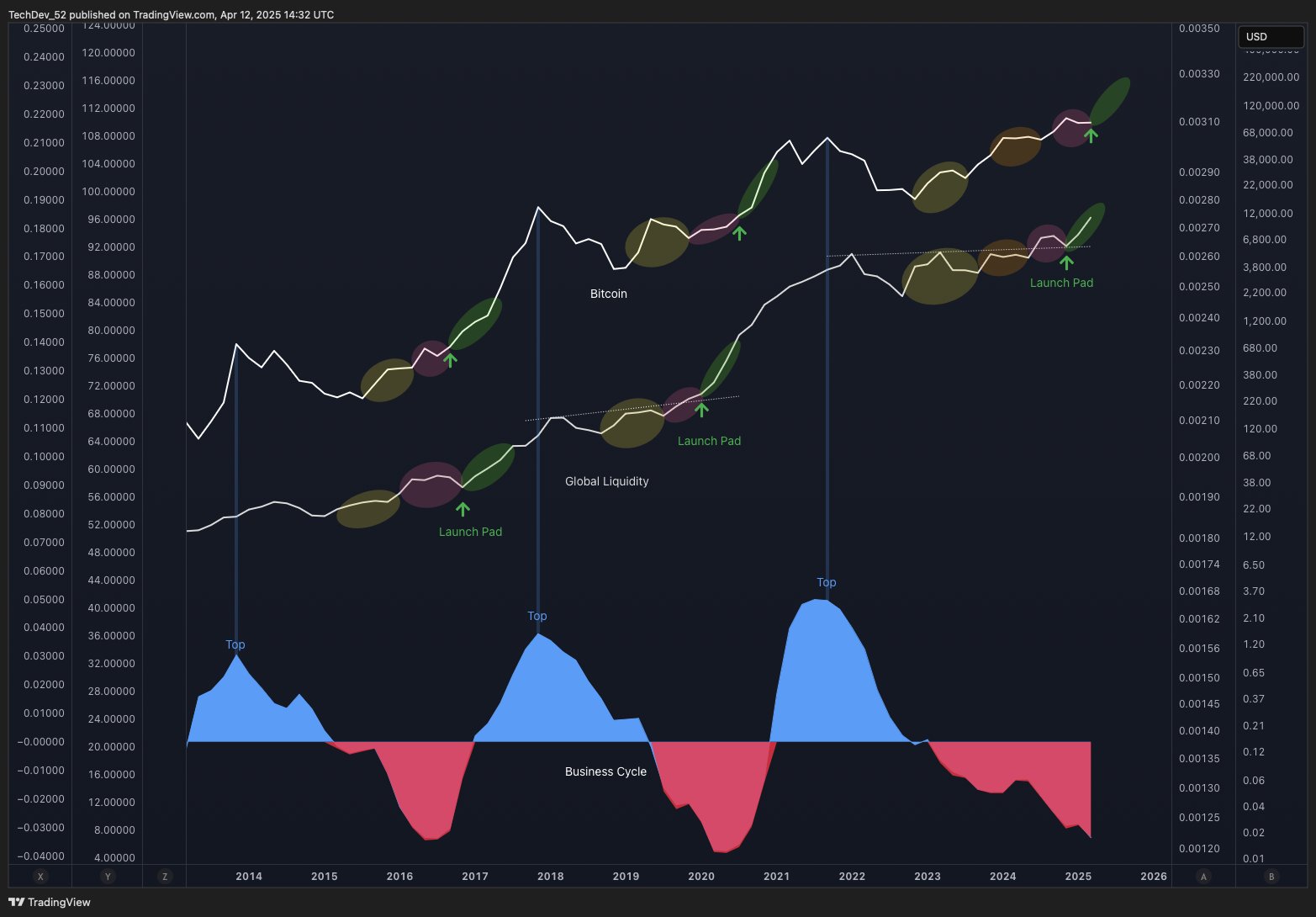

Turning to Bitcoin (BTC), the trader predicts that the crypto king will also rally due to the bullish alignment of the two macro factors.

“Are you ready?”

Zooming in on BTC, the trader predicts that Bitcoin will hit a massive price target this cycle after breaking out from a cup-and-handle pattern, which is typically viewed as a bullish continuation structure, indicating that buyers are stepping in without waiting for the asset to drop to its price lows.

“After all the rigorous analysis, will be amusing if it ends up this simple…”

Looking at the trader’s chart, he seems to predict that BTC can surge to as high as $500,000 by 2026.

At time of writing, Bitcoin is worth $85,165.

Follow us on X, Facebook and Telegram

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Tithi Luadthong/Natalia Siiatovskaia

Source link

Strategy Boosts Bitcoin Holdings Above $47 Billion With Latest Buy

Coinbase CLO Reveals New Details on SEC’s Ethereum 2.0 Investigation Documents

NEAR Gains 11.7%, Leading Index Higher Over Weekend

Bitget’s $12B VOXEL frenzy fizzled fast, but questions remain

BNB Springs Back From $531 With Unshaken Bullish Conviction

This tiny altcoin could see 50x gains before BTC hits 100k

Bitcoin Entering Phase of Parabolic Expansion After Successfully Breaking Downtrend: Crypto Analyst

Here’s Why You Should Hold At Least 10K Pi Coin Before 2025 Ends

This Week in Crypto Games: Solana Game Pass, ‘Ponzi’ Games Pop, SEC and CyberKongz

Cointelegraph Bitcoin & Ethereum Blockchain News

Bybit’s CEO Ben Zhou Says Nearly 28% Funds From $1.4B Hack Have Gone Dark

Solana’s Meatbags announces NFT sale to buy Cold War bunker

XRP Bulls Defend $2.00—Is a Fresh Price Surge Loading?

Metaplanet Acquires 330 BTC For $28.2 Million

Massive Altcoin Rallies Imminent Amid Surging Global Liquidity, According to Analyst TechDev

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Crypto’s Big Trump Gamble Is Risky

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

I’m Grateful for Trump’s Embrace of Bitcoin

Trending

24/7 Cryptocurrency News5 months ago

24/7 Cryptocurrency News5 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin3 months ago

Bitcoin3 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Ripple Price1 month ago

Ripple Price1 month ago3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin6 months ago

Bitcoin6 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Opinion6 months ago

Opinion6 months agoCrypto’s Big Trump Gamble Is Risky

Altcoins3 months ago

Altcoins3 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin5 months ago

Bitcoin5 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

✓ Share: