Markets

Haliey Welch Releases HAWK Token

Published

4 months agoon

By

admin

Viral personality Haliey Welch has released her official token on the Solana blockchain, the latest in a long line of celebrity tokens floated on the network.

Welch went viral earlier this year after using a “hawk tuah” onomatopoeia to describe a sexual act. “Hawk Tuah” quickly became a phase used for memes across social platforms — making Welch an overnight sensation from a minimum wage worker who didn’t even have an Instagram account.

As often happens with memes, “hawk tuah” has found its way to the blockchain. Welch’s HAWK token went live on Solana-based exchanges at 22:00 UTC on Wednesday in partnership with overHere, a token launchpad.

Minutes after HAWK began trading, its market cap soared to $491 million — and then it dove below $100 million.

Welch previously distributed free tokens to her social media followers and supporters within the meme and NFT communities during a campaign held from Nov. 26 to Dec. 2.

A statement shared with CoinDesk said Welch can’t sell the HAWK tokens she got for one year and they will vest over three years.

“Who doesn’t love a good meme?” Welch said in a prepared statement. “Becoming part of meme culture interested me in the world of crypto, and I’ve learned so much along the way. Launching my own token feels like the perfect next step — not just to create something meaningful for my fans but also to protect my community from scammers.”

HAWK is supported by a foundation in the Cayman Islands through complete legal compliance in the U.S. with hired directors on staff. It has raised money from a group of private non-U.S. investors at a $34.5 million initial valuation.

Celebrity tokens became a short-lived rage within the Solana ecosystem earlier this year, with several niche and forgotten media artists releasing their tokens using Pump.Fun during a frenzied period in May.

Most tokens ended up falling 99% in the days, or even hours, afterward.

But Welch’s team says it is in it for the long run, hoping to build a community around the token and her fans in a bid to make it a successful project in the long term.

“Launching the $HAWK token creates a fun, secure and innovative way for Haliey to get even closer to her community,” Jonnie Forster, Welch’s manager, said in a statement. “It not only empowers her fans but also eliminates the confusion posed by scammers who are constantly releasing unauthorized coins without approvals of her name and likeness.”

Source link

You may like

‘Big Short’ Investor Steve Eisman Derisks, Says Stock Market Volatility Will Be Here for a While

Dow drops over 500 points as UnitedHealth tanks, Fed tensions weigh on markets

Gold Is Still the Safe-Haven King, While Bitcoin Loses Out: JP Morgan

Dogecoin Price Breakout in view as Analyst Predicts $5.6 high

Bitcoin (BTC) Price in Standstill at $85K as Trump Increases Pressure on Fed’s Powell

Ripple acquisition Hidden Road secures FINRA registration

Markets

Gold Is Still the Safe-Haven King, While Bitcoin Loses Out: JP Morgan

Published

2 hours agoon

April 17, 2025By

admin

Bitcoin‘s safe-haven narrative isn’t living up to its mythical status, according to JP Morgan, with investors instead preferring to put their cash into gold amid recent market volatility spurred by President Trump’s global trade war.

Analysts at the top investment bank said in a Thursday report that gold exchange-traded funds and futures are receiving most of the investment action, as speculators look for a safe bet.

Gold’s price has soared since last year, and this week hit a new high over $3,660. Bitcoin has dropped since it broke a new record in January. It has been trading sideways this month, and is more than 20% off its record high near $109,000, set on Jan. 20, the day of U.S. President Donald Trump’s inauguration.

Bitcoin in the past has correlated to the precious metal, and advocates describe the top cryptocurrency as “digital gold.” But the asset—which began trading in 2009—has in recent years correlated with U.S. equities, especially tech stocks.

“Bitcoin has failed to benefit from the safe haven flows that have been supporting gold in recent months,” the JP Morgan report said, noting that while investors have pumped money into gold ETFs, speculators have cashed out of the new American crypto ETFs.

Bitcoin ETFs in the U.S. briefly overtook their gold counterparts in December, thanks to the virtual coin’s price increase, before losing ground to them.

Trump’s November election helped boost crypto prices, as the Republican campaigned on helping the digital asset industry by ratcheting back regulations the industry deemed unfair.

But a combination of geopolitical uncertainty, President Trump’s aggressive tariffs, and fears of a recession have led investors to go to the ultimate safe-haven asset: gold.

Bitcoin was changing hands near $85,000 on Wednesday, roughly where it started in April, according to crypto data provider CoinGecko.

It has fared better than major equity indexes, which have lost ground this month with the S&P 500 and tech-heavy Nasdaq both off by about 6%.

Edited by James Rubin

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.

Source link

Bitcoin

Bitcoin (BTC) Price in Standstill at $85K as Trump Increases Pressure on Fed’s Powell

Published

4 hours agoon

April 17, 2025By

admin

Bitcoin (BTC) was treading water just below $85,000 late Thursday as tensions between U.S. President Donald Trump and Federal Reserve Chair Jerome Powell added another layer of uncertainty for investors.

Markets dipped on Wednesday after hawkish comments from Powell, who criticized Trump’s tariffs policy, saying that it would likely result in a slowing economy and rising prices — what economists call “stagflation.” In his remarks, Powell made clear his larger focus for now would be on prices, suggesting tighter Fed policy than otherwise thought.

Trump — who nominated the former investment banker and lawyer as Fed chair during his first term (Powell was given a second four-year term by President Biden) — has expressed his displeasure with Powell since retaking the White House. Powell, though, who is set to remain atop the central bank until May 2026, has repeatedly stated his determination to finish his term and suggested the president has no standing to fire him.

On Thursday, the WSJ reported that Trump has been privately discussing firing Powell for months, according to people familiar with the matter. Former Fed Governor Kevin Warsh is reportedly waiting in the wings as Powell’s replacement, but Warsh has lobbied the president not to move against the Fed chair, according to the story.

Joining Warsh in that warning is Treasury Secretary Scott Bessent, who said the move could roil already shaky U.S. markets as the central bank is supposed to be independent from political influences.

Odds of Trump removing Powell this year on the blockchain-based prediction market Polymarket rose to 19%, the highest reading since the contract’s late January launch.

Trump’s comments came on the back of the European Central Bank (ECB) cutting key interest rates for the seventh consecutive occasion on Thursday as it warned of a deteriorating growth outlook.

More pressure on markets came from the latest Philadelphia Fed manufacturing index, published Thursday morning, which showed a nosedive in activity this month, sinking to its lowest level (-26.4) in two years. Meanwhile, the prices paid index climbed to its highest reading since July 2022, adding to concerns about the Trump administration’s large-scale tariff policy pushing the U.S. economy into stagflation.

The S&P 500 and tech-heavy Nasdaq stock indexes traded mostly flat during the day.

A look at the crypto market showed BTC and Ethereum’s ETH up 0.8% over the past 24 hours. Most assets in the CoinDesk 20 Index traded higher during the day, with bitcoin cash (BCH), NEAR and AAVE leading gains.

How bitcoin traders position amid heightened fear on Wall Street ?

Bitcoin has stabilized between $83k and $86k with traders chasing bullish bets while still seeking downside protection.

On Deribit, traders are actively chasing calls at the 90k to $100k strikes expiring in May and June, the exchange said in a market update Thursday. The demand for calls indicates expectations for a continued price rally.

Some of these bullish bets have been funded by premiums collected by selling put options.

At the same time, there has been renewed interest in buying put options at $80k expiring this month, representing preparations for potential price declines. Buying a put option is akin to purchasing insurance against price slides.

The diverse two-way flow comes as the VIX, Wall Street’s fear gauge measuring the 30-day implied volatility, still remains well above its 50-day average, despite the pullback from recent highs above 50.

The VIX is warning that the macro situation is still unraveling rather than resolving, the exchange said on X.

Source link

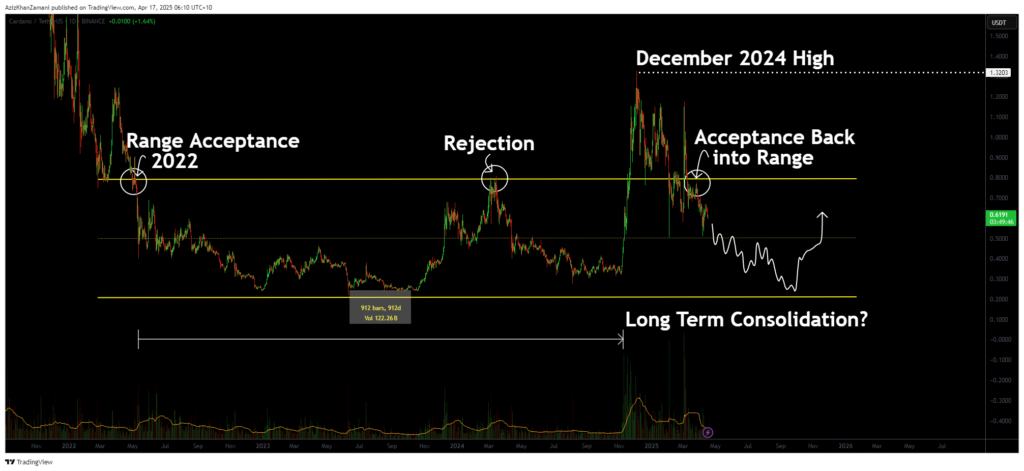

Cardano (ADA) has shown major structural developments as it re-enters a multi-year trading range. The recent price action suggests acceptance back within this long-term structure, with indicators pointing toward a potential move to the lower support region.

Cardano (ADA) has re-entered a significant trading range that has contained its price action for over three years. After a breakout in late 2024 that lacked volume strength, the asset has failed to sustain its highs and is now showing signs of weakness. For traders, this shift back into the range carries major implications for ADA’s medium- to long-term price trajectory.

Key points covered

- ADA has closed multiple candles back within a multi-year trading range, signaling true acceptance

- The 2024 breakout lacked volume confirmation, indicating a potential climactic top

- A move towards the lower support region is increasingly likely as ADA seeks true market value

After more than 912 days of trading within a well-defined range since 2022, ADA finally broke out in December 2024, setting a new high. However, this breakout lacked the critical component of follow-through volume. A sharp drop in volume immediately after the breakout signaled weakening momentum, suggesting a climactic top rather than a sustainable bullish trend.

Price action has since fallen back below the range high and closed multiple candles beneath it, a clear sign of acceptance back within the range. This is significant from a structural standpoint. Rather than consolidating above and building new support, ADA is now signaling a potential return to its value zone, likely toward the lower bound of the long-term range.

The volume profile reinforces this theory. The expansion to the December highs was not matched by sustained buyer interest. Instead, volume sharply tapered off, indicating that the breakout may have been speculative and not backed by conviction. In such cases, price often returns to equilibrium levels to reassess fair market value.

What to expect in the coming price action

With ADA now firmly back inside the long-term range, a slow grind toward the lower support region is increasingly probable. Traders should exercise patience, avoiding premature entries until there is either a confirmed trend reversal or a test of the lower boundary. The real opportunity may lie in ADA’s eventual consolidation and structure near the bottom of this historical range.

Source link

‘Big Short’ Investor Steve Eisman Derisks, Says Stock Market Volatility Will Be Here for a While

Dow drops over 500 points as UnitedHealth tanks, Fed tensions weigh on markets

Gold Is Still the Safe-Haven King, While Bitcoin Loses Out: JP Morgan

Dogecoin Price Breakout in view as Analyst Predicts $5.6 high

Bitcoin (BTC) Price in Standstill at $85K as Trump Increases Pressure on Fed’s Powell

Ripple acquisition Hidden Road secures FINRA registration

Ethereum Whales Offload 143,000 ETH In One Week – More Selling Ahead?

How Do We Protect Bitcoin From Quantum Computers? Not With A Joke

OKX Goes Live In The US After Setting Up New Headquarters in San Jose, California

Stanford’s AI research lab to use Theta EdgeCloud for LLM model studies

Central African Republic Solana Meme Coin Jumps as President Fuels Rumors of Revival

Will Shiba Inu Price 3x?

Bitcoin Cash (BCH) Gains 4.2%, Leading Index Higher

Bybit shuts down four more Web3 services after axing NFT marketplace

Aptos To Continue Moving In ‘No Man’s Land’ – Can It Reclaim $5?

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

Crypto’s Big Trump Gamble Is Risky

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

I’m Grateful for Trump’s Embrace of Bitcoin

Trending

24/7 Cryptocurrency News5 months ago

24/7 Cryptocurrency News5 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin3 months ago

Bitcoin3 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Ripple Price4 weeks ago

Ripple Price4 weeks ago3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Altcoins3 months ago

Altcoins3 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin5 months ago

Bitcoin5 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals