Ethereum

Hamster Kombat enjoys triple-digit boost from six days ago

Published

6 months agoon

By

admin

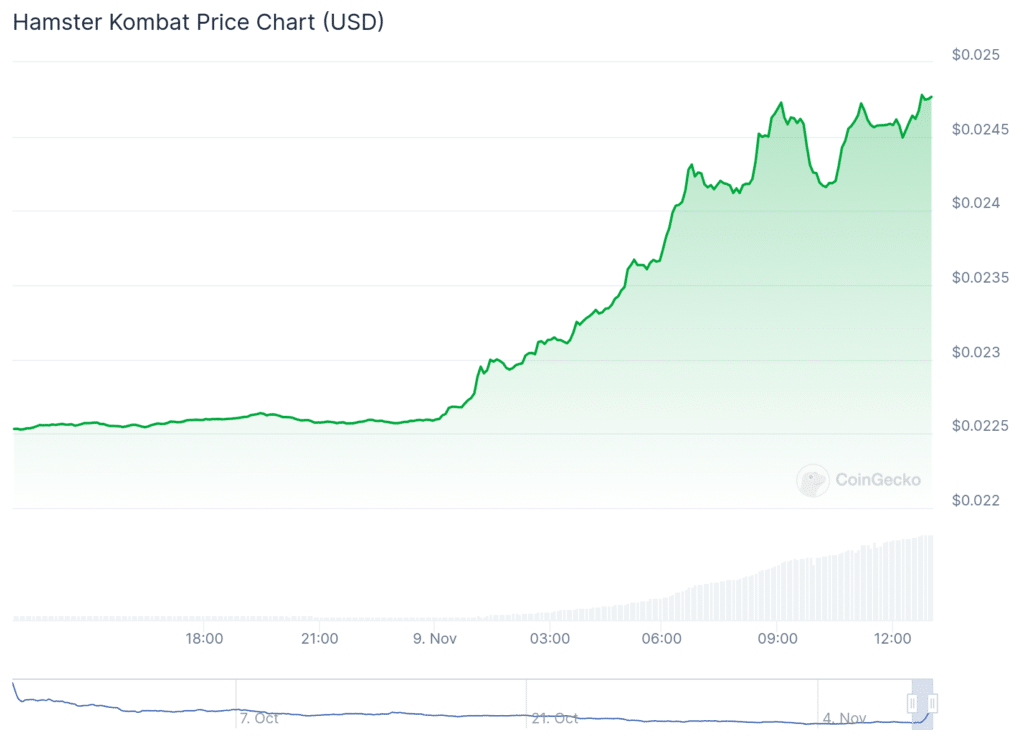

Hamster Kombat is up over 110% from its all-time low price of $0.002263 six days ago.

At last check Saturday, Hamster Kombat (HMSTR) was among the top-three trending coins on CoinGecko, up by almost 88%.

Its fully diluted valuation currently hovers at around $475.6 million. See below.

What is Hamster Kombat?

The creators of Hamster Kombat remain anonymous — a common choice in the crypto sector.

Based on a game launched via Telegram, Hamster Kombat meshes gaming with blockchain technology, allowing players to earn in-game HMSTR tokens.

Players can tap on digital hamsters to gain rewards. They can then be upgraded and use the coins to access special game features.

Hamster Kombat also uses non-fungible tokens, or NFTs, and is set to integrate TON blockchain wallets for storing and converting earned tokens.

The recent activity around the meme coin comes as crypto.news reported that Hamster Kombat’s recent chart pattern indicated that a comeback was imminent, despite the coin wallowing in a deep bear market.

Bongo Cat enjoys a brand-new beat

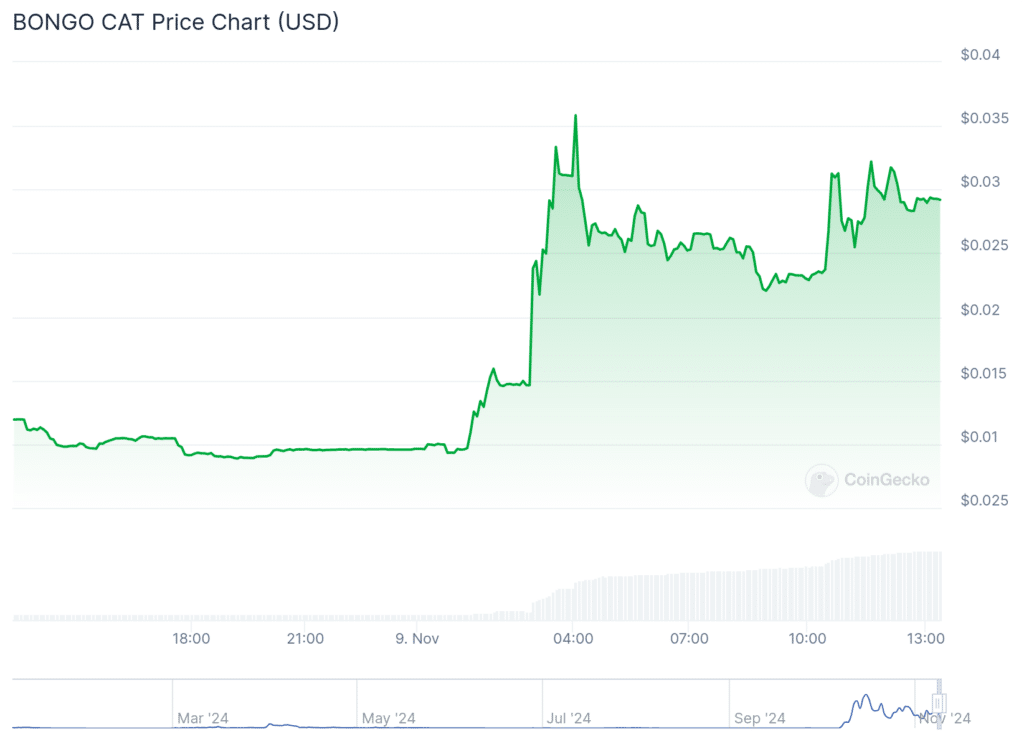

Bongo Cat (BONGO) is a meme coin inspired by an internet meme and video featuring a cat playing the bongos.

It has gained attention in the cryptocurrency community, combining meme culture with blockchain technology. As of now:

Bongo Cat is priced at approximately $0.02922 and is currently up 150% at last check on Saturday — the largest-gaining digital asset on CoinGecko.

This blend of meme and finance illustrates the ongoing trend of meme coins capturing both speculative interest and community-driven support in the crypto market.

LMEOW purrs in Thailand

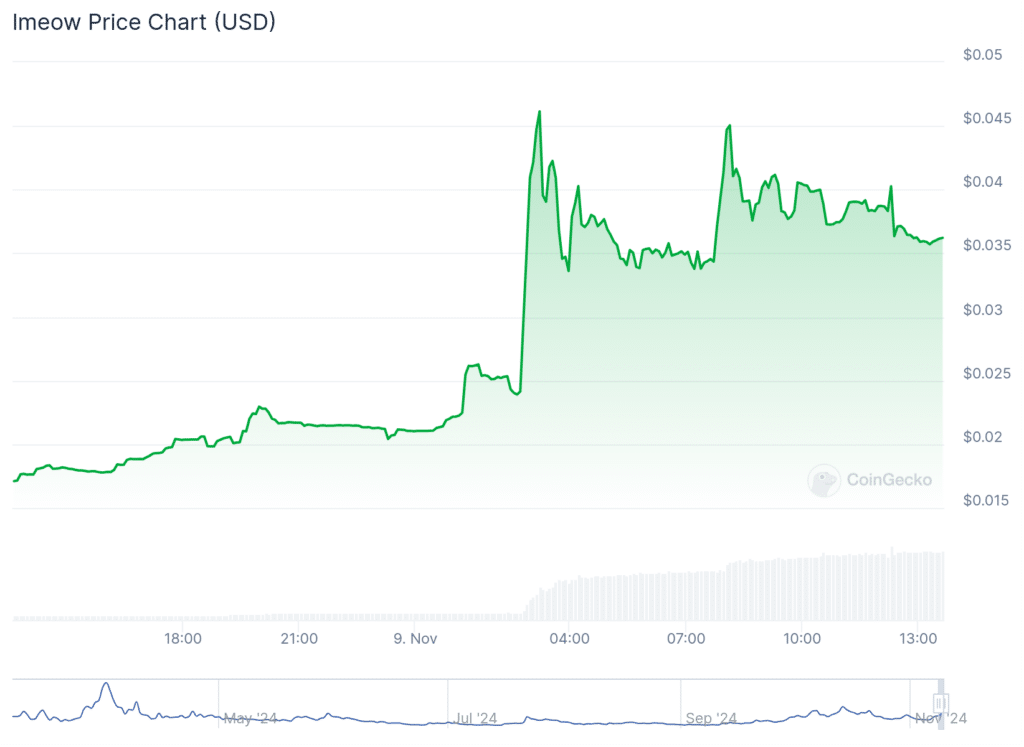

Lmeow (LMEOW) jumped triple-digits on Saturday, coinciding with hype and promotion at Thailand Blockchain Week 2024.

The event, which aims to elevate Thailand into a new era of financial technology, is currently taking place Saturday and Sunday.

Lmeow has a fully diluted valuation of $34.8 million.

The cat-themed tokens can be traded on decentralized exchanges and centralized crypto exchanges, including Uniswap V2 (Ethereum), where the most active trading pair

LMEOW currently has a trading volume of more than $6 million in the last 24 hours.

Source link

You may like

Crypto Investors Sue Nike, Accuse Apparel Giant of Rug Pull After Abrupt Closure of Metaverse Business: Report

Top cryptocurrencies to watch: Pi Network, XRP, Sui

This Week in Crypto Games: Ubisoft’s ‘Might & Magic’, ‘Peaky Blinders’ in Development

Why Arbitrum-Nvidia Partnership Collapsed – And What It Means for Web3

Tariff Carnage Starting to Fulfill BTC’s ‘Store of Value’ Promise

The cost of innovation — Regulations are Web3’s greatest asset

ETH Price

5 Cardano Rivals to Watch as Founder Predicts Ethereum Will Die by 2040

Published

19 hours agoon

April 27, 2025By

admin

Cardano rivals like Avalanche, Solana, Polkadot, NEAR, and Algorand are gaining market share as Ethereum faces scalability challenges.

Cardano (ADA) Tops $0.70 as Founder Predicts Ethereum Collapse

Cardano (ADA) recorded a weekly gain of 12.2%, closing above $0.70 on April 26 — its highest since February 2025.

The move follows public remarks by Cardano founder Charles Hoskinson, who stated during a CNBC interview that Ethereum’s scalability and governance limitations are likely to undermine the network within the next 15 years.

Hoskinson, an original co-founder of Ethereum, highlighted issues around layer-2 reliance, decentralization trade-offs, and ecosystem fragmentation as critical vulnerabilities.

“Without fundamental reform, Ethereum risks disintegration by 2040,” Hoskinson said, citing longstanding market concerns regarding the network’s technical roadmap.

Ethereum’s transition toward rollups and modular scaling, including recent updates such as Dencun, has not eliminated bottlenecks related to cost and throughput.

These factors has seen Cardano rivals like Solana, Avalanche and a handful of others gain ground on Ethereum in recent weeks.

Cardano Rivals to Watch if Ethereum Collapses by 2040

Notably, Charles Hoskinson founding member of Ethereum before exiting to found Cardano. Hence its unsuprisingly that his prediction of Ethereum’s collapse weighs heavy on market sentiment.

If Ethereum continues to lose market share, Avalanche, Solana, Polkadot, NEAR Protocol, and Algorand are some 5 Cardano rivals to watch in the months ahead, based on recent price trends, ETF filings and institutional demand for these assets.

Avalanche (AVAX)

Avalanche’s high transaction throughput, customisable subnets, and enterprise integrations strengthen its case as a scalable smart-contract platform.

Solana (SOL)

Solana ETF applications by Franklin Templeton, Grayscale, and VanEck remain under SEC evaluation, with decision deadlines in October 2025 according to Bloomberg chief ETF analyst Eric Balchunas.

Solana’s fast transactions through-put and growing decentralized finance (DeFi) traction continues to drive institutional and developer interest.

Polkadot (DOT)

NEAR Protocol (NEAR)

Algorand (ALGO)

In summary:

Hoskinson’s assessment of Ethereum’s future emphasizes growing concerns surround the long-term viability of the pioneer smart-contract blockchain network. Despite a leadership shuffle at the Ethereum Foundation in early March 2025, key on-chain benchmarks like scalability, governance, and decentralization resilience remain clouded under pesimism.

As regulatory clarity improves and technological differentiation widens, Cardano rivals like platforms like Avalanche, Solana, Polkadot, NEAR, and Algorand, able to meet those demands are expected to gain market share.

Frequently Asked Questions (FAQs)

Hoskinson predicts Ethereum’s scalability, governance issues, and reliance on layer-2 solutions will undermine its viability within 15 years.

Avalanche, Solana, Polkadot, NEAR Protocol, and Algorand are top contenders to gain market share if Ethereum collapses by 2040.

ETF filings forAvalanche, Solana, Polkadot, NEAR, and Algorand signal growing institutional interest and acceptance, which could drive prices higher.

ibrahim

Crypto analyst covering derivatives markets, macro trends, technical analysis, and DeFi. His works feature in-depth market insights, price forecasts, and institutional-grade research on digital assets.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

ETH

Ethereum Price Overtakes Solana and XRP After $164 Million Staking Deposits in 4 Days

Published

1 day agoon

April 26, 2025By

admin

Ethereum price surged 12% in four days, overtaking Solana and XRP as Trump’s policy shift boosted risk appetite across global markets.

Ethereum’s Undervalued Status Powers Late Rally Over SOL and XRP

Ethereum price broke above $1,825 on April 25, marking its highest level in 50 days.

Despite a sluggish start to the week, ETH now posts a 12% gain on the weekly timeframe, overtaking top Layer-1 rivals Solana (SOL) and XRP.

A major driver of Ethereum’s late rally was its undervalued status.

At the start of the week, ETH struggled for traction, consolidating below $1,600 for a 14-day stretch between April 9 and April 23.

While ETH remained stuck under the $1,620 resistance, Bitcoin (BTC), XRP, and Solana had already broken major psychological barriers—$90,000, $2.20, and $150 respectively—earlier in the week.

However, after former U.S. President Donald Trump softened his stance on tariffs and pressured the Federal Reserve for rate cuts, global market sentiment flipped positive.

Investors sitting on sidelined capital viewed ETH as undervalued relative to the broader market.Rapid inflows pushed Ethereum price from $1,600 on April 22 to $1,825 by Saturday, April 26—a 12% surge in just four days.

Ethereum’s late rally now places it ahead of Solana and XRP in weekly performance, with the latter two posting 5.3% and 6.9% gains, respectively, according to CoinGecko data as of April 26.

Bullish Investors Stake 91,000 ETH Amid Rumors of Institutional Migration From Ethereum to Solana

Trends observed on the Ethereum 2.0 staking network further affirm the narrative that investors piled into ETH following Trump’s tariff rollback hints earlier this week.

According to official Beacon Chain data, Ethereum has witnessed a consistent flow of new deposits since April 22.

As seen on Beaconcha.in, total ETH staked stood at 34,055,790 on April 22.

Following Trump’s announcement of a call with Chinese President Xi Jinping, deposits steadily climbed, reaching 34,146,222 ETH at press time on April 26.

This reflects an increase of 90,432 ETH—equivalent to approximately $164 million at current market prices.

Increased staking typically impacts asset prices positively for two key reasons: First, it reduces the circulating supply of tradable ETH on exchanges, tightening liquidity during periods of strong demand.

This supply shock helped ETH outpace rivals SOL and XRP on the weekly timeframe, despite its slow start.

Second, rising staking participation signals continued confidence among Ethereum’s core developers and large investors in the network’s long-term viability.

Such moves often encourage neutral traders and new entrants to take long positions.

Additionally, Ethereum staking enforces time constraints on liquidity.

According to validator platform Figment.io, withdrawals from the Beacon Chain can take up to nine days.

This lock-up period means the $164 million in new staking deposits will not be available for instant sell-offs, helping to establish strong short-term support for ETH even if broader market sentiment softens next week.

Ethereum Price Forecast Today: ETH Eyes $1,950 if Momentum Holds Above $1,800

Ethereum price is hovering above $1,802 at press time on April 26, as bulls look to set a strong bullish cluster above the key psychological $1,800 level.

The Keltner Channel indicator shows ETH rebounding from near the lower band at $1,511, with ETH price action now targeting the midline resistance at $1,928.

Volume Delta confirms bullish momentum, printing a positive 47,260 ETH on the latest session, the highest in two weeks.

The Relative Strength Index (RSI) has bounced sharply from oversold territory at 31.74 to 39.58, suggesting strengthening bullish divergence.

Ethereum price forecast today suggests a continuation toward $1,928 if buyers maintain dominance.

A daily close above $1,850 would validate a trend shift toward the Keltner Channel midline, with $1,950 emerging as the next major resistance.

Conversely, failure to hold $1,800 could expose ETH to renewed selling pressure, with immediate downside risk to $1,700 where prior consolidation occurred.

However, considering the improving Etheruem market volume dynamics and RSI recovery, odds now slightly favor a bullish continuation into early May.

Frequently Asked Questions (FAQs)

Ethereum surged 12% after Trump’s softer tariff stance boosted market sentiment and $164 million flowed into ETH staking.

Staking reduces ETH’s tradable supply, tightening liquidity during demand surges, and signals long-term investor confidence in the network.

Ethereum faces resistance at $1,850 and $1,928, with a potential breakout opening a path toward $1,950 in early May.

ibrahim

Crypto analyst covering derivatives markets, macro trends, technical analysis, and DeFi. His works feature in-depth market insights, price forecasts, and institutional-grade research on digital assets.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

ETH

Ethereum Attempts First Major Horizontal Reclaim In Months – Can Bulls Hold the Line?

Published

2 days agoon

April 25, 2025By

admin

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Ethereum is trading above $1,700 after a volatile few weeks, with bulls now trying to reclaim higher levels and flip resistance into support. Despite lingering macroeconomic tensions and the ongoing trade standoff between the US and China, markets are beginning to price in optimism as investors anticipate progress in negotiations. This renewed sentiment has lifted risk assets like ETH, which is showing early signs of a potential breakout.

Related Reading

Analysts are closely watching Ethereum’s current price action, which suggests a possible shift in trend. Top analyst Daan shared a technical view on X, highlighting that ETH is attempting to retake its previous horizontal support around $1,750. If successful, this would mark the first time in months that Ethereum reclaims a key support level after previously rejecting it and setting lower lows.

As Ethereum fights to regain lost ground, all eyes are on this critical level. A breakout here could lead to a renewed surge across the altcoin market, reinforcing growing speculation that the worst of the correction may already be behind us.

Ethereum Bulls Attempt to Shift Market Structure

Ethereum has rallied impressively, gaining over 32% from its local low of $1,383. This recovery has brought ETH to a critical price level, where bulls must hold and build momentum to break the broader downtrend that has defined much of 2024. A sustained move above current levels could mark a long-awaited shift in market structure, providing confidence that Ethereum is ready to trend higher over the medium term.

However, broader macroeconomic forces continue to weigh heavily on investor sentiment. Ongoing trade tensions between the United States and China remain unresolved, with each new tariff threat adding further strain on global supply chains. These geopolitical pressures threaten to limit risk appetite, and any further escalation could stall Ethereum’s recovery. On the flip side, a diplomatic breakthrough could trigger a strong shift in investor positioning across all risk assets, including crypto.

In the meantime, Ethereum must defend current levels to keep bullish momentum intact. Daan’s analysis highlighted that ETH is currently testing the $1,750 level, which previously acted as key support. If Ethereum can reclaim this horizontal zone, it would mark the first time in months that ETH retakes rather than rejects a critical level. Daan emphasized that daily closes above $1,750 are ideal and would confirm strength, potentially opening the door for a larger breakout.

Related Reading

ETH Price Holds Key Levels, Bulls Must Reclaim $2K Soon

Ethereum is currently trading at $1,770, maintaining strength above the 4-hour 200 EMA—a key short-term indicator that has historically acted as both resistance and support during critical trend shifts. Bulls have managed to defend this level over the past few sessions, signaling growing confidence and momentum as Ethereum attempts to recover from its recent downtrend.

Holding above the $1,700 zone is now essential to avoid triggering another wave of selling. This level has become the new battleground for bulls and bears, and continued consolidation above it may lay the groundwork for a broader rally. The next major objective is a decisive reclaim of the $2,000 level. A breakout above this threshold would mark a strong shift in sentiment and could trigger additional upside as sidelined buyers re-enter the market.

Related Reading

However, caution remains warranted. A failure to hold current support would invalidate the recovery narrative and open the door to further losses. If Ethereum breaks below $1,700 with volume, it could revisit the $1,500 level, which has acted as a historical demand zone. That would reinforce a longer-term bearish structure and delay any hopes of a full-scale recovery.

Featured image from Dall-E, chart from TradingView

Source link

Crypto Investors Sue Nike, Accuse Apparel Giant of Rug Pull After Abrupt Closure of Metaverse Business: Report

Top cryptocurrencies to watch: Pi Network, XRP, Sui

This Week in Crypto Games: Ubisoft’s ‘Might & Magic’, ‘Peaky Blinders’ in Development

Why Arbitrum-Nvidia Partnership Collapsed – And What It Means for Web3

Tariff Carnage Starting to Fulfill BTC’s ‘Store of Value’ Promise

The cost of innovation — Regulations are Web3’s greatest asset

Best Crypto to Buy as Derivatives Exchange CME Set to Launch XRP Futures

Metaplanet Buys Additional ¥1.92 Billion Worth Of Bitcoin

Here Are Four Signs the Stock Market Has Bottomed, According to Fundstrat’s Tom Lee

Bitcoin dips below $94,000 as ETFs record $3b weekly inflow

Bitcoin Post-Halving Price Performance Is the Worst on Record. Why?

Expert Predicts Start Date For Pi Network Price Pump

GameFi Tokens Show Signs of Life After Gala Games, White House Tie-Up

Bitcoin trades at ‘40% discount’ as spot BTC ETF buying soars to $3B in one week

Bitcoin Continues To Flow Out Of Major Exchanges — Supply Squeeze Soon?

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Crypto’s Big Trump Gamble Is Risky

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

I’m Grateful for Trump’s Embrace of Bitcoin

Trending

24/7 Cryptocurrency News6 months ago

24/7 Cryptocurrency News6 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin3 months ago

Bitcoin3 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Ripple Price1 month ago

Ripple Price1 month ago3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin6 months ago

Bitcoin6 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Opinion6 months ago

Opinion6 months agoCrypto’s Big Trump Gamble Is Risky

Bitcoin5 months ago

Bitcoin5 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Altcoins3 months ago

Altcoins3 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

✓ Share: