SOL

Here’s Where Support & Resistance Lies For Solana, Based On On-Chain Data

Published

2 days agoon

By

admin

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

The analytics firm Glassnode has revealed the Solana price levels that could be important to watch, based on on-chain accumulation data.

Solana Cost Basis Distribution Reveals Where Supply Is Most Concentrated

In a new post on X, Glassnode has discussed about the UTXO Realized Price Distribution (URPD) of Solana. The URPD is an indicator that basically tells us about how much of the SOL supply was purchased at which price levels. Naturally, the metric uses the last transaction price of any token in circulation as its cost basis.

Related Reading

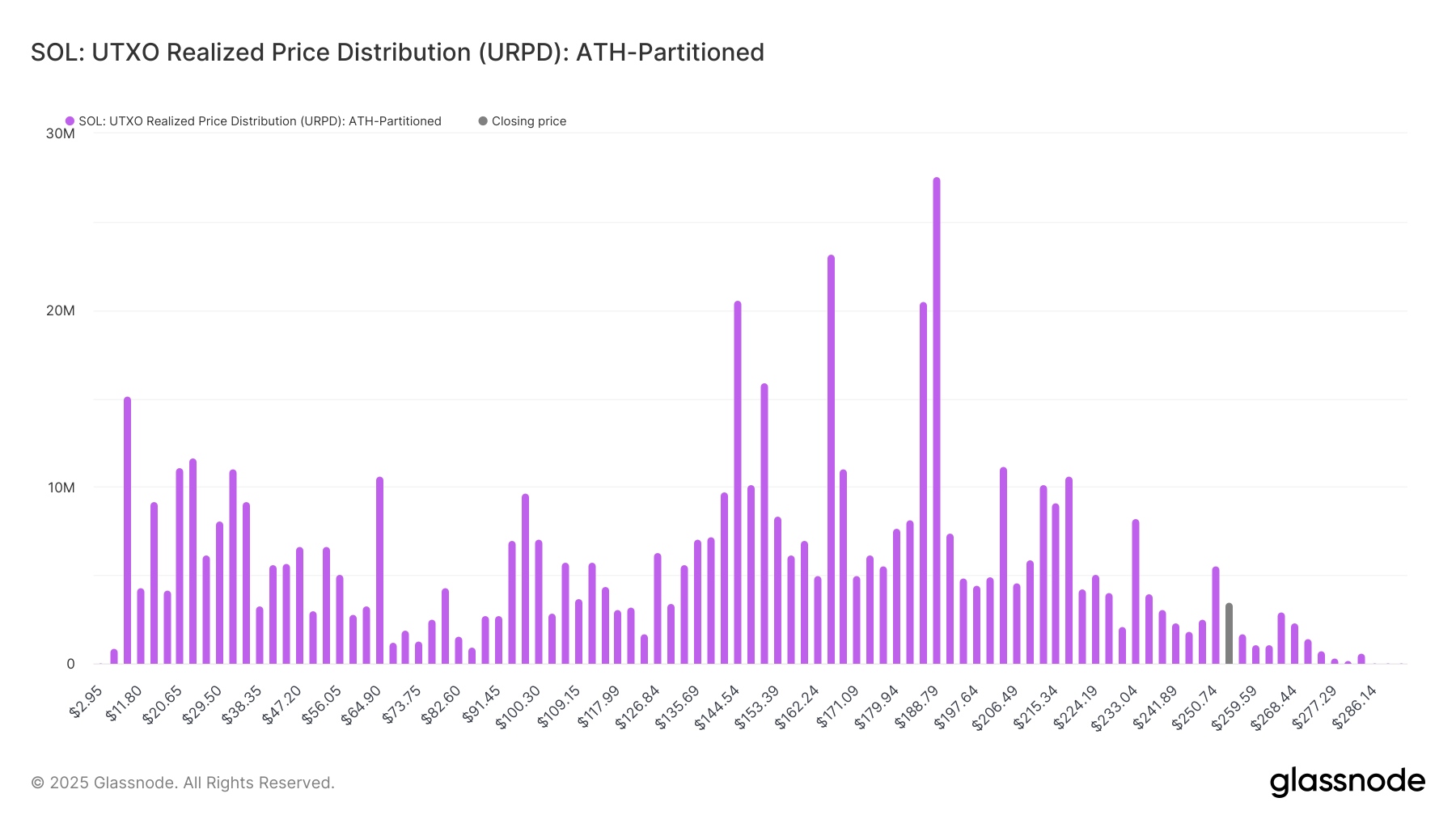

First, here is how the URPD looked when the cryptocurrency set its new all-time high (ATH) back in January:

From the graph, it’s apparent that a few price levels like $144 stood out in terms of the amount of supply that they hosted. At the price levels closer to the new ATH, however, supply was quite thin, meaning not many coins changed hands there.

In on-chain analysis, the potential of any level to act as support or resistance is measured in terms of the amount of supply that it hosts. This means that levels that have a large cluster around them on the URPD are the ones of importance to the asset.

As for why this is so, the answer lies in investor psychology: holders are sensitive to retests of their cost basis. Whenever the price touches a large cost basis cluster, the investors who are holding these coins may respond by making some panic moves.

These moves can tend toward buying if the retest is happening from above, as investors may want to defend their profit-loss boundary. In retests happening from below, however, the traders could react by selling instead, as they may seek to exit at their break-even.

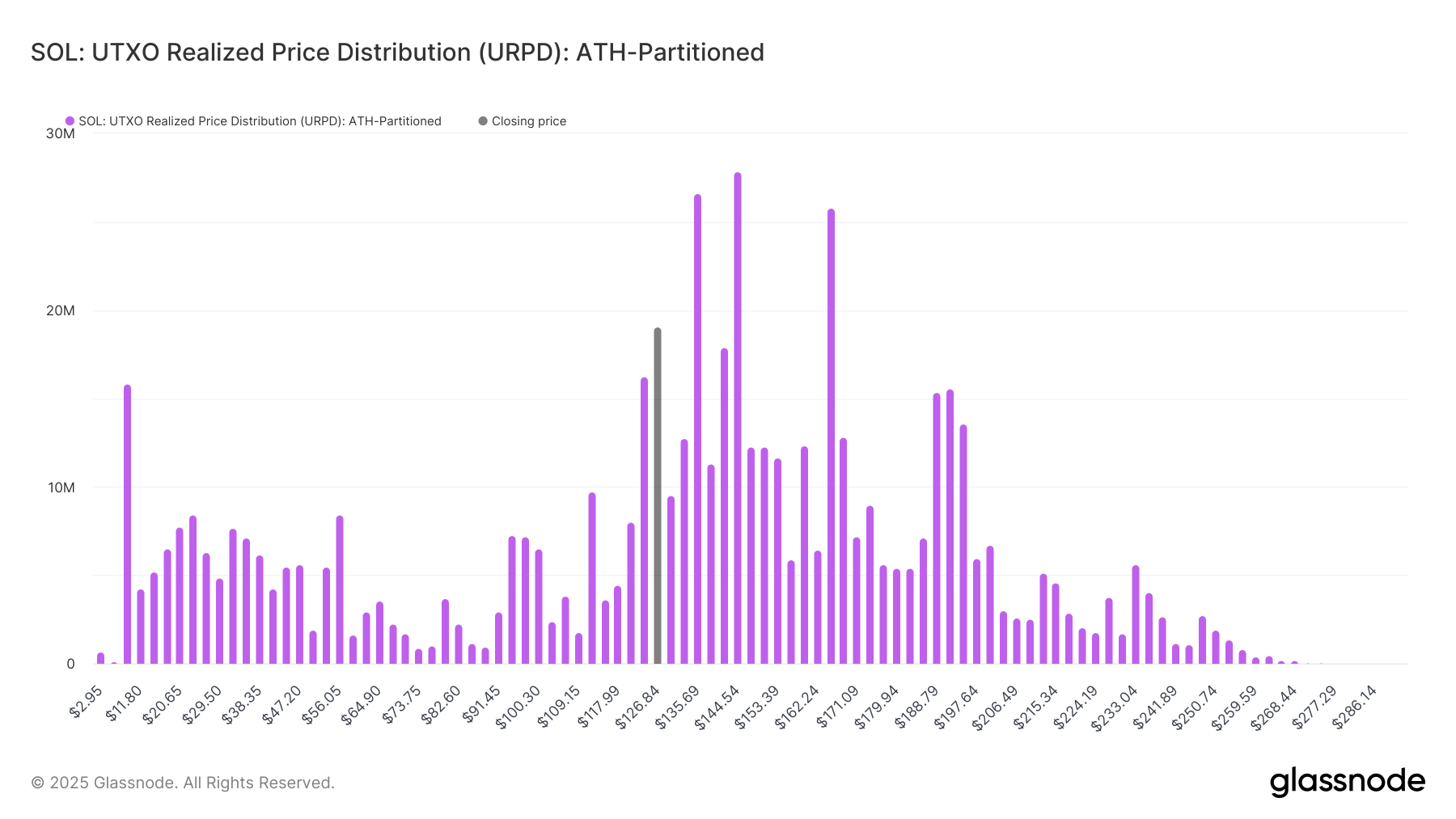

When SOL reached its ATH, there was a lack of support nearby. This may be why the asset ended up falling into the cluster that did carry a significant amount of supply. Below is a chart that shows how the URPD has changed following the price drawdown.

From the graph, it’s visible that if SOL continues its downtrend, it may have to end up relying on the freshly grown $112 level. In January, this level hosted the cost basis of 4 million tokens, but today, the figure has grown to 9.7 million, equivalent to 1.67% of the entire supply.

Beyond this level, Glassnode notes, “$94, $97, and $100 collectively hold nearly 21M SOL (3.5% of supply).” In the scenario that these support levels fail, Solana may find itself in trouble, as there aren’t any major supply clusters until $53.

Related Reading

In terms of the levels above, the $135 and $144 levels stand out, as they hold the acquisition level of 26.6 million and 27 million coins, respectively. These levels could act as major obstacles in SOL’s recovery.

SOL Price

Solana has jumped more than 5% over the last 24 hours to recover to the $130 level.

Featured image from Shutterstock.com, Glassnode.com, chart from TradingView.com

Source link

You may like

This Week in Bitcoin: Volatility Rises as ETFs Rebound and SEC Gives OK to Mining

Will ETH ETF Net Outflow Exceed $20 Million?

Will new US SEC rules bring crypto companies onshore?

Net Taker Volume on Binance Hits Yearly High Amid Bitcoin Price Consolidation

Eric Trump Joins Metaplanet’s Board Of Advisers

Bitcoin Primed for Major Moves As Macroeconomic Conditions Ease, Says Analyst Jamie Coutts – Here’s His Outlook

doge

Trader Issues Urgent XRP Alert, Says the Top-Five Altcoin at Risk of Sharp Correction – Here’s His Target

Published

2 days agoon

March 21, 2025By

admin

Cryptocurrency trader Ali Martinez says a payments-focused altcoin must stay above a key price level to avoid a steep corrective move.

Martinez tells his 133,500 followers on the social media platform X that if XRP (XRP) falls below $2, it risks witnessing a deeper drawdown due to a lack of consolidation below the price level.

“XRP testing the waters! Below $2, a gap with no significant support could pull it to $1.60.”

Based on a chart citing on-chain data from blockchain analytics platform Glassnode, it appears that there’s an “air gap” between $2 and $1.60, indicating a weak foundation for XRP around that price zone.

XRP is trading at $2.56 at time of writing.

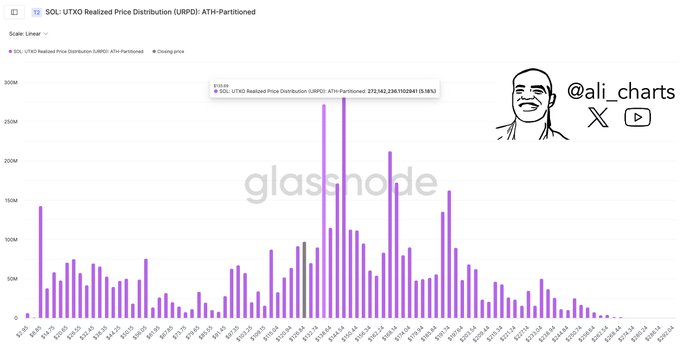

Next up is the layer-1 protocol Solana (SOL). According to Martinez, SOL is facing a “big test” at a resistance level a few percentage points above the current price.

“$135 stands as the most important resistance.”

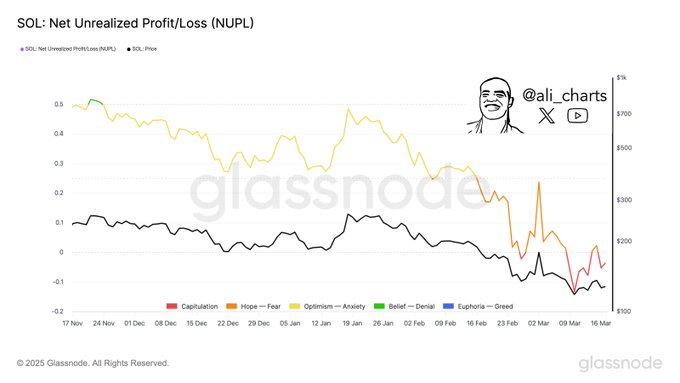

The widely followed analyst further says that investors in the sixth-largest crypto asset by market cap are capitulating based on the altcoin’s net unrealized profit/loss metric (NUPL), an on-chain indicator that measures whether accumulators of a coin are in a state of profit or loss.

Based on the trader’s chart, SOL’s NUPL is hovering below the zero line, indicating that investors are witnessing losses and in the midst of capitulation.

Solana is trading at $132 at time of writing, down by around 55% from the all-time high price of $293 reached January 20th.

Looking at the top memecoin Dogecoin (DOGE), Martinez says that the altcoin has recorded significant demand in a week.

“Whale alert! Over 110 million Dogecoin bought up in a week. Big players are betting on a breakout.”

Dogecoin is trading at $0.173 at time of writing.

Follow us on X, Facebook and Telegram

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

Altcoins

XRP Potentially Set for Massive Price Collapse As Bearish Technical Setup Forms, According to Crypto Trader

Published

4 days agoon

March 19, 2025By

admin

A closely followed crypto analyst and trader is warning that the payments token XRP is at risk of a massive collapse.

In a new post, crypto trader Ali Martinez tells his 133,300 followers on the social media platform X that XRP may be forming a bearish head-and-shoulders pattern (H&S) on the daily chart.

A head-and-shoulders pattern typically suggests that an asset is losing momentum and could reverse its uptrend if the price breaks below the structure’s support.

“XRP is shaping up a head-and-shoulders on the weekly chart. It spotlights the $2 support. Holding it is crucial.”

Looking at the trader’s chart, he seems to predict that XRP will fall to $1.255 if crypto bears shatter support at $2.

XRP is trading for $2.38 at time of writing, up 2.3% in the last 24 hours.

Next up, the analyst suggests Solana (SOL) may soar to the upper bound of an ascending channel after respecting the pattern’s diagonal support around $126.

An ascending channel is traditionally seen as a bullish pattern, indicating that an asset is printing higher highs and higher lows.

“Solana set to bounce? Eyeing a climb from the channel’s base to the upper resistance at $140.”

Solana is trading for $129 at time of writing, up 1% in the last 24 hours.

Lastly, the trader says the smart contract project Qtum (QTUM) may be gearing up for a huge corrective move if it moves below a key support level that has remained intact since November 2022.

“QTUM could be on the verge of a breakout! Keep an eye on the $1.88 support level.”

Based on the trader’s chart, he appears to predict that QTUM may plunge to as low as $0.63.

QTUM is trading for $2.23 at time of writing, up 4.2% in the last 24 hours.

Follow us on X, Facebook and Telegram

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

Bitcoin

Trader Predicts Crypto Rallies Amid Expectations of Fed Monetary Policy Shift – But There’s a Catch

Published

5 days agoon

March 18, 2025By

admin

A widely followed crypto analyst is predicting higher prices for crypto assets as he expects the Federal Reserve to end its anti-inflation monetary policies.

In a new thread, the pseudonymous crypto analyst Pentoshi tells his 861,300 followers on the social media platform X that we are close to seeing the end of quantitative tightening (QT), which are policies that reduce the Fed’s balance sheet and lowers the supply of money in circulation.

The trader cites data from the decentralized prediction platform Polymarket, which shows that 100% of users believe that the Fed will end QT by May of this year.

The cessation of QT is typically seen as bullish for risk assets like Bitcoin (BTC) and altcoins as the move signals the end of tight monetary conditions.

However, Pentoshi warns investors to be “cautiously optimistic” as both the S&P 500 and top crypto assets have seen growth over the last few years that appears unsustainable.

“I think we are getting close to [the] end of QT with Polymarket now pricing in odds as a sure thing whereas before they were much lower odds. As previously stated, it does seem Trump would end up forcing it. I don’t think QT automatically means it’s easy mode.

I think that mode is clearly gone overall in the way people think about it (2017/2021). While prices are much lower, I think it’s best to be cautiously optimistic. Many things are down significantly and there hopefully will be some decent mean reversion. Markets in general have rallied hard. And assets were likely a bit overvalued before.

SPX going 25% back to back years was going to have low growth or negative this year as it wasn’t a sustainable pace. BTC went from $16,000 to $108,000, SOL [from] $8 to $300. Cautiously optimistic. [Be] patient for any time capitulation, as often, following big trends, we eventually get longer sideways periods and less volatility as the market finds balance.”

While Pentoshi is flipping tactically bullish on stocks and crypto, he warns investors that any rally will likely be short-lived.

“I think any up currently will be a lower high. People underestimate the time aspect.”

At time of writing, Bitcoin is trading for $83,248.

Follow us on X, Facebook and Telegram

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

This Week in Bitcoin: Volatility Rises as ETFs Rebound and SEC Gives OK to Mining

Will ETH ETF Net Outflow Exceed $20 Million?

The SEC Resets Its Crypto Relationship

Will new US SEC rules bring crypto companies onshore?

Net Taker Volume on Binance Hits Yearly High Amid Bitcoin Price Consolidation

Eric Trump Joins Metaplanet’s Board Of Advisers

Bitcoin Primed for Major Moves As Macroeconomic Conditions Ease, Says Analyst Jamie Coutts – Here’s His Outlook

Themes ETFs exec on new 2X Coinbase fund: ‘We believe as the Bitcoin tide rises, it will lift all crypto boats’

Ethena’s USDe Stablecoin Sales Blocked by German Regulator Over ‘Serious Deficiencies’

Is Ethena Price At Risk? Market Maker Offloads $10M ENA Raising Concerns

Coinbase Could Be Near Multi-Billion Dollar Deal for Deribit: Bloomberg

Tether eyes Big Four firm for its first full financial audit: Report

Why Current ‘Boredom Phase’ Could Trigger Epic Rally

US Treasury Removes Tornado Cash From OFAC Sanctions List

21,899 Bank Customers Affected As US Lender Suffers Cybersecurity Breach, Hacker Taps Social Security Numbers and Other Sensitive Information

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Crypto’s Big Trump Gamble Is Risky

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

Trump’s Coin Is About As Revolutionary As OneCoin

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Is $200,000 a Realistic Bitcoin Price Target for This Cycle?

Trending

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin2 months ago

Bitcoin2 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News2 months ago

24/7 Cryptocurrency News2 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Bitcoin4 months ago

Bitcoin4 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Altcoins2 months ago

Altcoins2 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Price analysis5 months ago

Price analysis5 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x