elon musk

Here’s why Pepe coin price went parabolic

Published

4 months agoon

By

admin

Pepe coin price is ending 2024 on a high note as it surged by almost 20%, erasing some of the losses made this month.

Pepe (PEPE), the third-biggest meme coin, climbed to a high of $0.000022, its highest level since Dec. 18. The rebound came after Elon Musk, the wealthiest person in the world, updated his X profile picture to a Pepe-like image.

Musk, one of the most influential people globally, has over 234 million followers on X, close ties with Donald Trump, and a fortune of nearly half a trillion dollars.

His action could indicate growing interest in Pepe, similar to his previous engagement with Dogecoin (DOGE). Musk’s tweets about Dogecoin in 2020 preceded its public surge in 2021, helping DOGE become the largest meme coin with a market cap of over $47 billion.

Pepe has experienced remarkable growth since its inception in 2023, with its market cap soaring from near zero to a peak of over $10 billion earlier this month. The token has surged by nearly 1,500% in the past year, ranking it among the best-performing meme coins.

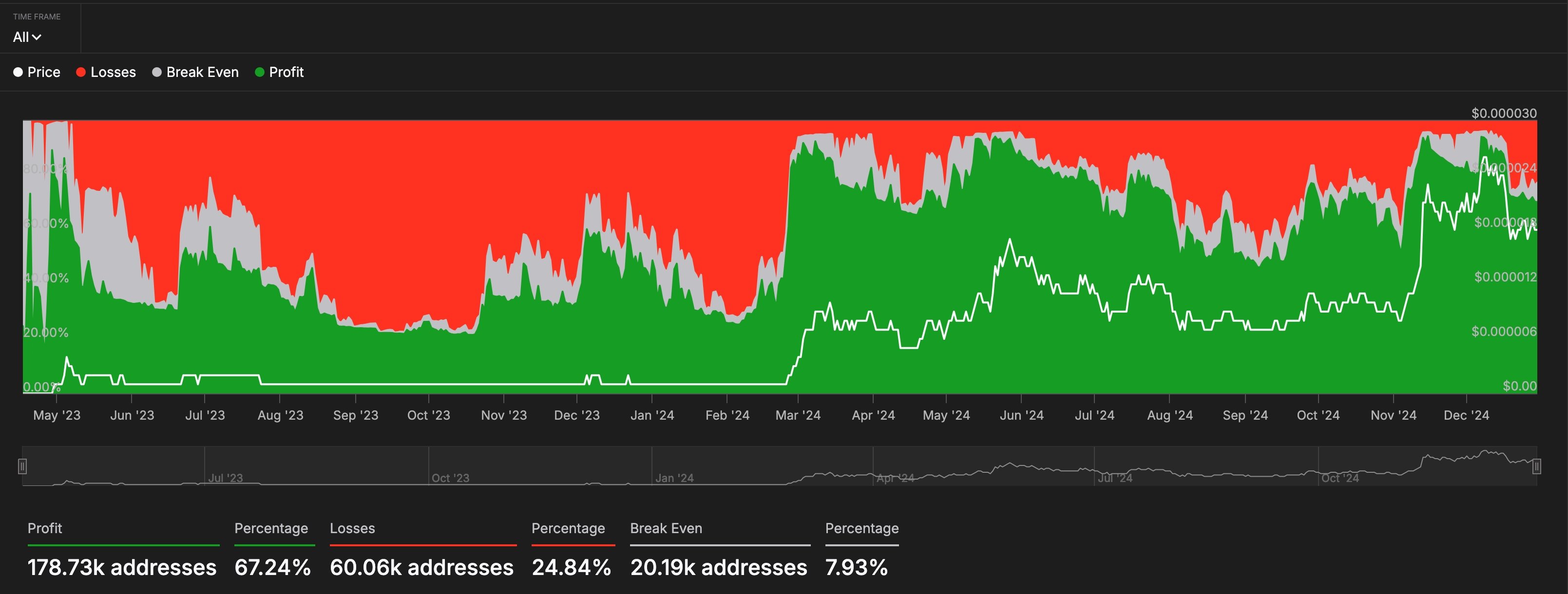

Pepe has created significant wealth for many investors. According to IntoTheBlock, 70% of all holders, or about 178,000 people, are in profit, while 24% have incurred losses. The remaining investors are at breakeven.

Pepe Coin price analysis

The daily chart shows that Pepe coin price peaked at $0.00002833 earlier this month before pulling back. It bottomed at $0.0000145, which coincides with the 50% Fibonacci Retracement point, and formed a hammer pattern. This pattern, characterized by a small body and a long lower shadow, is often a bullish signal.

Pepe has now climbed above the key resistance level of $0.00001950, its highest swing on Dec. 24. It is also trading above the 200-day and 100-day moving averages.

Given these bullish indicators, Pepe is likely to continue rising, with bulls targeting the year-to-date high of $0.00002833, which represents about a 33% upside from the current level. Potential catalysts for further gains include Donald Trump’s upcoming swearing-in and the expected FTX distributions. Some of the $16 billion from the distributions may be reinvested into cryptocurrencies, potentially boosting Pepe.

Source link

You may like

‘Big Short’ Investor Steve Eisman Derisks, Says Stock Market Volatility Will Be Here for a While

Dow drops over 500 points as UnitedHealth tanks, Fed tensions weigh on markets

Gold Is Still the Safe-Haven King, While Bitcoin Loses Out: JP Morgan

Dogecoin Price Breakout in view as Analyst Predicts $5.6 high

Bitcoin (BTC) Price in Standstill at $85K as Trump Increases Pressure on Fed’s Powell

Ripple acquisition Hidden Road secures FINRA registration

doge

Elon Musk, Dogecoin Proponent and U.S. Agency Figurehead, Says ‘No DOGE in D.O.G.E.’

Published

3 weeks agoon

March 31, 2025By

admin

Shaurya Malwa

Shaurya is the Co-Leader of the CoinDesk tokens and data team in Asia with a focus on crypto derivatives, DeFi, market microstructure, and protocol analysis.

Shaurya holds over $1,000 in BTC, ETH, SOL, AVAX, SUSHI, CRV, NEAR, YFI, YFII, SHIB, DOGE, USDT, USDC, BNB, MANA, MLN, LINK, XMR, ALGO, VET, CAKE, AAVE, COMP, ROOK, TRX, SNX, RUNE, FTM, ZIL, KSM, ENJ, CKB, JOE, GHST, PERP, BTRFLY, OHM, BANANA, ROME, BURGER, SPIRIT, and ORCA.

He provides over $1,000 to liquidity pools on Compound, Curve, SushiSwap, PancakeSwap, BurgerSwap, Orca, AnySwap, SpiritSwap, Rook Protocol, Yearn Finance, Synthetix, Harvest, Redacted Cartel, OlympusDAO, Rome, Trader Joe, and SUN.

Source link

Bitcoin

Trump pardons BitMEX, is ‘Bitcoin Jesus’ Roger Ver next?

Published

3 weeks agoon

March 30, 2025By

admin

Vitalik Buterin, Ross Ulbricht, and Tucker Carlson are among those urging President Donald Trump to pardon Roger Ver, aka Bitcoin Jesus.

Known as Bitcoin Jesus for his early advocacy of Bitcoin, Ver faces up to 109 years in prison on tax charges, including allegations of evading $48 million in taxes. Despite renouncing his U.S. citizenship in 2014 to avoid prosecution, Ver’s legal troubles resurfaced when he was arrested in Spain in 2024. But following the president’s earlier pardons of figures like Ulbricht and BitMEX co-founders, observers wonder whether Ver’s would catch a break. Is a pardon on the way, or will Ver’s legal troubles continue?

Read on for a closer look.

Crypto cronies

After Trump embraced cryptocurrency, many crypto leaders rallied to support him by donating funds to his inauguration and hobnobbing at galas.

Trump also , which industry brass celebrated.

In return, Trump signed an order to stockpile tokens and swiftly acted in favor of the industry. Under Trump-appointed SEC chair Mark Uyeda, investigations into several cryptocurrency companies, including Immutable, Crypto.com, Ripple, and Coinbase, were dismissed.

In a notable move on Thursday, March 27, Trump pardoned BitMEX co-founders Arthur Hayes, Benjamin Delo, and Samuel Reed, who had pleaded guilty to federal charges related to money laundering and regulatory violations. The trio was convicted for failing to implement anti-money laundering measures at BitMEX, which prosecutors had labeled a “money laundering platform.” Reed had also violated the Bank Secrecy Act and paid a $10 million fine. But under Trump, it seems all is forgiven.

This has sparked speculation on whether Ver, a prominent figure in the crypto world, could also receive the same courtesy.

Ver, a Silicon Valley native with a libertarian streak, was deeply involved in the early days of cryptocurrency, investing in companies like Kraken, Ripple, and Blockchain.com. In 2017, Ver hyped Bitcoin Cash (BCH) as more suitable for everyday payments.

Roger Ver was there for me when I was down and needed help. Now Roger needs our support.

No one should spend the rest of their life in prison over taxes. Let him pay the tax (if any) and be done with it. #FreeRoger pic.twitter.com/flP573hm0N

— Ross Ulbricht (@RealRossU) February 20, 2025

Ver’s past

In 2000, by the age of 20, Ver began to participate in libertarian party debates.

During these debates, he made critical statements about the agents of the Bureau of Alcohol, Tobacco, and Firearms, calling them “murderers” and referencing their involvement in the scandalous Waco Siege in which dozens of children were killed in a standoff between FBI and ATF agents and Branch Davidian cult followers. Ver didn’t know that ATF agents were present during these debates.

In the 2000s, Ver became involved in e-commerce. On top of tech enterprises, Ver was selling firecrackers on eBay. After selling unlicensed firecrackers in 2001, he was charged and spent 10 months in prison. The fact that he was locked in jail instead of being fined or notified about the necessity of obtaining a license led Ver to think that the case was politically motivated and that his criticism of ATF was the real reason behind his prosecution. Without fear of further persecution, Ver left the U.S. after his post-prison probation ended.

By 2011, Ver learned about Bitcoin and became one of its first investors. He also advocated for Bitcoin long before it went mainstream, with multi-million investments and national leaders talking about its importance for the future of their countries.

The key points of Ver’s advocacy for Bitcoin were the financial freedom of individuals and the stopping of government and banks from interfering in people’s lives.

The legal fight

Since February 2014, Ver has been a citizen of Saint Kitts and Nevis. He claims that he had to renounce his U.S. citizenship after long-lasting targeting from the U.S. government.

In April 2024, he was indicted and arrested in Spain on charges of U.S. tax evasion and mail fraud. Ver is accused of dodging $48 million in taxes after earning up to half a billion dollars through cryptocurrencies.

According to prosecutors, Ver failed to pay his “exit tax” on 131,000 BTC owned by his two companies when he left the U.S. and provided false info to the law firms filing Ver’s tax returns. Allegedly, he sold his bitcoins in 2017 without notifying the financial attorneys.

Ver clarifies that three charges of mail fraud (combined, punishable by 19 years behind bars) are based on the three letters with his tax returns he sent to the Internal Revenue Service (IRS).

Ver denies he committed crimes such as tax evasion and mail fraud. He insists he was doing his best to comply with the nascent Bitcoin taxation rules, and that his prosecution was politically motivated.

In December, he began his legal fight against the prosecution, denying all the charges. He filed a motion to dismiss charges, but the government rejected it in January.

Ver’s legal team challenged an exit tax as “an unconstitutional burden on the fundamental right to expatriate.” For people like Ver, who have substantial amounts of low-liquidity assets, the exit tax may be prohibitive. The government suggests Ver is a fugitive. He disagrees with this status as he doesn’t hide and didn’t commit crimes for which he is judged while living in the U.S.

On March 1, Ethereum’s Buterin published an X post arguing that the exit tax doesn’t exist in most other countries and called it the “tax-by-citizenship” and “extreme.”

In addition, Buterin mentioned that the IRS obtained some of the information by intimidating Ver’s lawyers. The Ethereum founder added:

“Genuine good faith mistakes should be treated by giving the actor the opportunity to pay back taxes if needed with interest and penalties, not with prosecution.”

Going to prison for the rest of your life over non-violent tax offenses is absurd. The case against Roger seems very politically motivated; like with @RealRossU, there have been plenty of people and corporations who have been accused of far worse and yet faced sentences far… https://t.co/7G3zDkn2F2

— vitalik.eth (@VitalikButerin) March 1, 2025

Will Bitcoin Jesus be pardoned?

Trump promised to pardon Ross Ulbricht if get elected. Ulbricht, the man behind the Silk Road marketplace charged for money laundering and drug trafficking, is an important figure in the history of Bitcoin as his marketplace drove Bitcoin’s adoption. After the inauguration, Trump indeed pardoned Ulbricht to much acclaim.

Soon, various crypto advocates began to urge Trump to pardon Roger Ver. On Jan. 21, 2025, following the pardon of Ross Ulbricht, an X influencer using the moniker Rothmus published a short post calling for the pardon of Ver to which Elon Musk replied: “will inquire.” This reply gave the community hope for the pardon of Bitcoin Jesus.

https://twitter.com/Rothmus/status/1881536312710402268

On March 17, Marla Maples, Trump’s ex-wife, took to X to share a touching video where people who met Ver tell their stories of his generosity.

It is not clear, though, if the POTUS paid attention to this post.

The hope for a pardon of Ver was seriously undermined on Jan. 26, when Elon Musk suddenly, via an X post, stated that Ver would not be pardoned because he gave up his U.S. citizenship.

Roger Ver gave up his US citizenship. No pardon for Ver. Membership has its privileges.

— Elon Musk (@elonmusk) January 26, 2025

The statement drew much criticism, as Musk is not an elected official and cannot decide who to pardon and who not to. He is, however, Trump’s advisor and was a major donor to his “MAGA” campaign.

More than that, the POTUS is not prohibited from pardoning non-U.S. citizens. Finally, many commented that Ver had to renounce his citizenship under pressure from ATF and a U.S. prison sentence.

I missed this tweet.

Another time I will publicly criticize Elon, hopefully for his own benefit. Because this is a terrible and wildly ignorant “hot take”.

1) You don’t need to be a citizen to get a pardon.

2) Ver was a citizen and specifically renounced his U.S. citizenship in…— Viva Frei (@thevivafrei) January 27, 2025

A few hours after Musk’s tweet, Ver took X to post a video in which he briefly explained why he was prosecuted and asked Trump for a pardon.

In the video, Ver stated that he is American and that renouncing his citizenship was one of the “hardest and saddest decisions [he] ever made.”

After Ulbricht, Hayes, Delo, and Reed received presidential pardons, others, including Angela McArdle, who currently serves as Chair of the national Libertarian Party, called for freeing Ver as well.

“Let’s pray Roger Ver is next!” she declared on Friday.

It remains to be seen whether Musk made skeptical comments over the possibility of Ver’s clemency on Trump’s behalf or if it was only his view of the situation.

At last check Saturday, Trump hasn’t commented on Ver’s situation.

Source link

Bitcoin

If gold isn’t there, we’re gonna be very upset

Published

2 months agoon

February 20, 2025By

admin

Elon Musk raised concerns about whether Fort Knox is still holding $425 billion worth of gold. The posts reignited an old conspiracy theory about gone gold and sparked discussion about the advantages of Bitcoin. Donald Trump said he will audit “the fabled Fort Knox.”

As a head of the Department of Government Efficiency Musk has been busy scrutinizing the government institutions lately. Fort Knox was another target for his daring eyes as Musk published an X post saying that “it would be cool to do a live video walkthrough of Fort Knox.”

Sen. Mike Lee fueled the discussion when he replied to Musk that despite being a senator, he was denied access to Fort Knox on multiple occasions without a proper cause. Musk replied that the American public was the true owner of gold stored in Fort Knox and asked if someone could confirm the gold was there.

Who is confirming that gold wasn’t stolen from Fort Knox?

Maybe it’s there, maybe it’s not.

That gold is owned by the American public! We want to know if it’s still there. https://t.co/aEBXK1CfD6

— Elon Musk (@elonmusk) February 17, 2025

The discussion continued with many expressing support for the idea of a public audit of the biggest gold reserve in the U.S. The Fort Knox reserve holds 147 troy ounces of gold, more than any other storage in the country.

Missing Fort Knox gold is an old conspiracy theory, infused by the extremely low level of the reserve’s transparency. It is hard to enter this storage even by the military base standards.

The inability to make sure gold is present in the depository raises questions about accountability and transparency standards revision.

Does Fort Knox undergo regular audits?

Regular audits take place. The U.S. government issues monthly reports that specify the amount of gold stored in every storage. The proponents of the missing gold theory don’t buy these reports and want to get evidence. However, the restrictive policies that don’t allow visitors to Fort Knox only make people more suspicious.

Probably, you saw a striking statement that Fort Knox hasn’t been audited for 50 years. That’s not far from the truth.

Indeed, the last public audit of Fort Knox took place on Sept. 24, 1974, when several congressmen and journalists were allowed in the depository. They entered the storage, inspected the gold, and took photos. The previous tone when Fort Knox had such an audit took place in 1943.

The press release dedicated to the 1974 visitation proclaimed that the event marked a change in the long-standing no-visitors policy. According to it, the Congressional inspection adhered to President Ford’s new policy of open doors. However, as we know today, the Fort Knox doors were closed shortly after the visit for the next 40+ years.

During the previous Donald Trump presidency, in 2017, then-Treasury Secretary Steven Mnuchin managed to obtain permission to visit the bullion depository accompanied by Kentucky elected officials. Unlike the 1974 inspection, this event was pretty private, with no media present.

Mnuchin received backlash for the inappropriate use of military aircraft to travel to Fort Knox, spending an additional $9k of the taxpayers’ money.

The fact that the visitation took place on the very day of the total solar eclipse, which Mnuchin observed from the roof of Fort Knox, which is situated close to the Path of Totality, one of the best points to look at the eclipse, raised additional criticism. The photos of him and his peers in front of golden bricks were published in 2018. This tour to Fort Knox hardly adheres to the criteria for audit.

The is no evidence that any portion of the Fort Knox gold is missing. However, the lack of transparency and clear accountability set a good climate for speculations and alternative solutions.

Bitcoin enters the discussion

Gold is often compared to Bitcoin, especially now, when national gold reserves are not such a hot topic as Bitcoin reserves. No wonder the inability to verify the consistency of the gold reserves draws discussions in the crypto community.

Whether Fort Knox gold is safe or not, Bitcoin is an asset that would not have raised any of these concerns, Bitcoin proponents say.

More and more experts claim Bitcoin is better than gold. In light of the Fort Knox case, Bitcoin showcases higher transparency and ease of user and transportation. It’s much easier to cross the border with $5 million worth of Bitcoin than gold or cash. More than that, the ownership of Bitcoin is verifiable by any person with a device connected to the Internet. The Fort Knox situation reminds us that we don’t have such a possibility with gold.

More than that, more traditional assets like Bitcoin ETFs or ETPs are as transparent as Bitcoin. Bradley Duke of Bitwise took to X to remind everyone why Bitcoin is much more trustworthy than gold. He said why trust when you can verify?

Don’t trust, verify.

For decades there hasn’t been an independent audit of the gold bullion kept at Fort Knox – the largest treasure ever amassed. Should the American people, who nominally own this treasure, just trust their successive governments?

At Bitwise, we believe that… pic.twitter.com/8DKSaY676n

— Bradley Duke (@BradleyDukeBTC) February 18, 2025

Bernstein analytics say the U.S. will need gold to buy Bitcoin

One of the reasons why Bitcoin maxis may be concerned by the possible lack of gold in the bullion depository is that at some point, the American government will start selling gold to acquire more Bitcoin.

According to Gautam Chhugani, an analyst from Bernstein, if a Strategic Bitcoin reserve is established, the Federal Reserve will have to search for funds to purchase Bitcoin. It may issue debt (which is opposite to the proclaimed goal of setting the Strategic Bitcoin reserve) or sell some of the gold reserves.

Musk’s concerns didn’t go unnoticed by the POTUS. On Feb. 20, Musk posted a clip with Trump saying they are going to inspect “the fabled Fort Knox to make sure the gold is there.” “If the gold isn’t there, we’re gonna be very upset,” Trump added, smiling.

Source link

‘Big Short’ Investor Steve Eisman Derisks, Says Stock Market Volatility Will Be Here for a While

Dow drops over 500 points as UnitedHealth tanks, Fed tensions weigh on markets

Gold Is Still the Safe-Haven King, While Bitcoin Loses Out: JP Morgan

Dogecoin Price Breakout in view as Analyst Predicts $5.6 high

Bitcoin (BTC) Price in Standstill at $85K as Trump Increases Pressure on Fed’s Powell

Ripple acquisition Hidden Road secures FINRA registration

Ethereum Whales Offload 143,000 ETH In One Week – More Selling Ahead?

How Do We Protect Bitcoin From Quantum Computers? Not With A Joke

OKX Goes Live In The US After Setting Up New Headquarters in San Jose, California

Stanford’s AI research lab to use Theta EdgeCloud for LLM model studies

Central African Republic Solana Meme Coin Jumps as President Fuels Rumors of Revival

Will Shiba Inu Price 3x?

Bitcoin Cash (BCH) Gains 4.2%, Leading Index Higher

Bybit shuts down four more Web3 services after axing NFT marketplace

Aptos To Continue Moving In ‘No Man’s Land’ – Can It Reclaim $5?

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

Crypto’s Big Trump Gamble Is Risky

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

I’m Grateful for Trump’s Embrace of Bitcoin

Trending

24/7 Cryptocurrency News5 months ago

24/7 Cryptocurrency News5 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin3 months ago

Bitcoin3 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Ripple Price4 weeks ago

Ripple Price4 weeks ago3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Altcoins3 months ago

Altcoins3 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin5 months ago

Bitcoin5 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals