Bitcoin

Historical On-Chain Metric Suggests Bitcoin (BTC) Has More Room To Run, According to Glassnode – Here’s Why

Published

1 month agoon

By

admin

Prominent on-chain analytics firm Glassnode believes that Bitcoin (BTC) has more room to run to the upside based on one on-chain indicator.

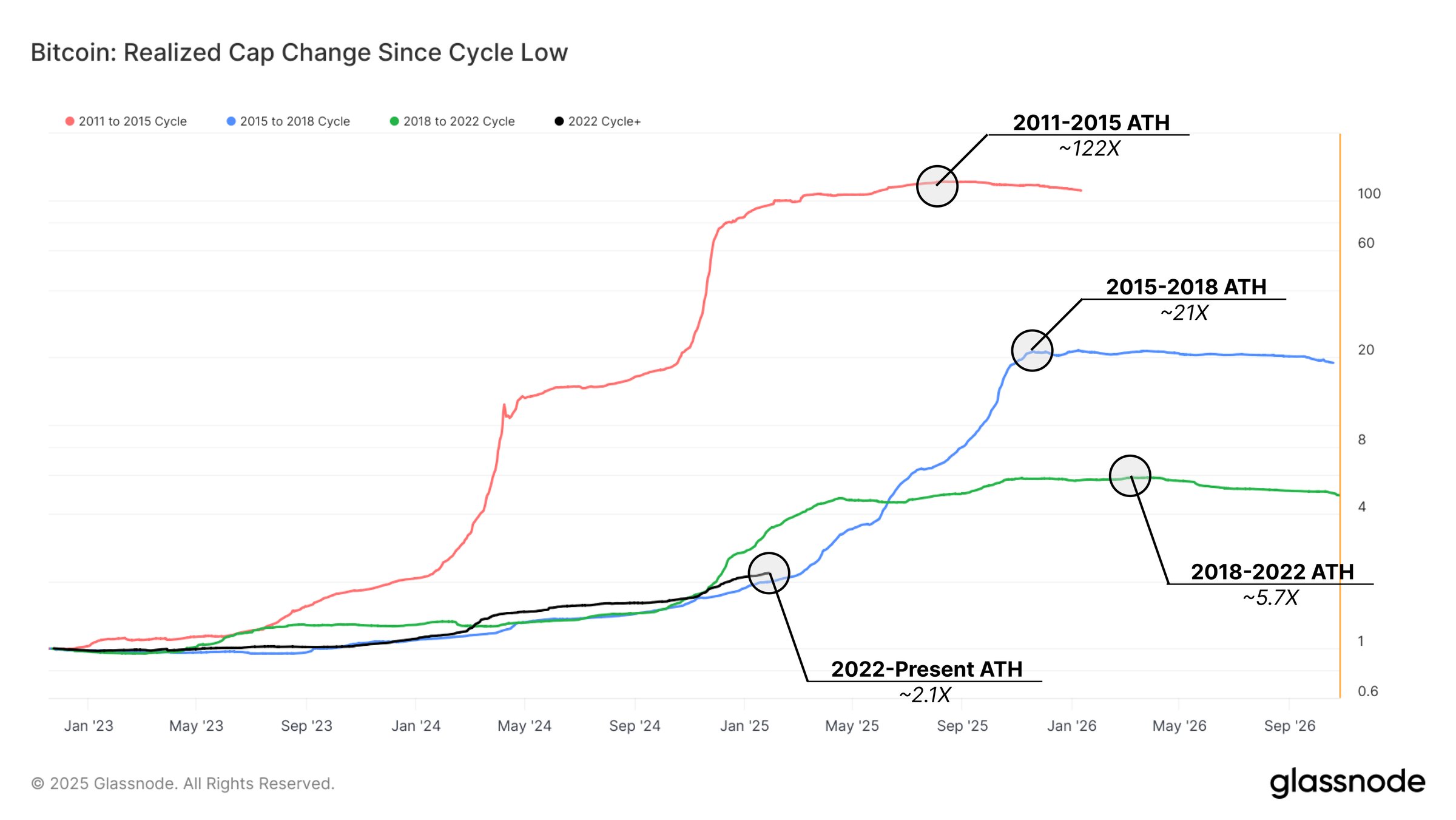

On the social media platform X, the analytics firm points to BTC’s Realized Cap, which records the price at which each coin was last moved and aims to gauge how many holders are in profit or at a loss.

Says Glassnode,

“Realized Cap tracks net capital inflows into Bitcoin, a key driver of bull markets. So far, it has grown 2.1x from the 2022 low – below the 5.7x peak of the last cycle. The typical euphoric phase sees a sharp acceleration, but this hasn’t fully materialized yet.”

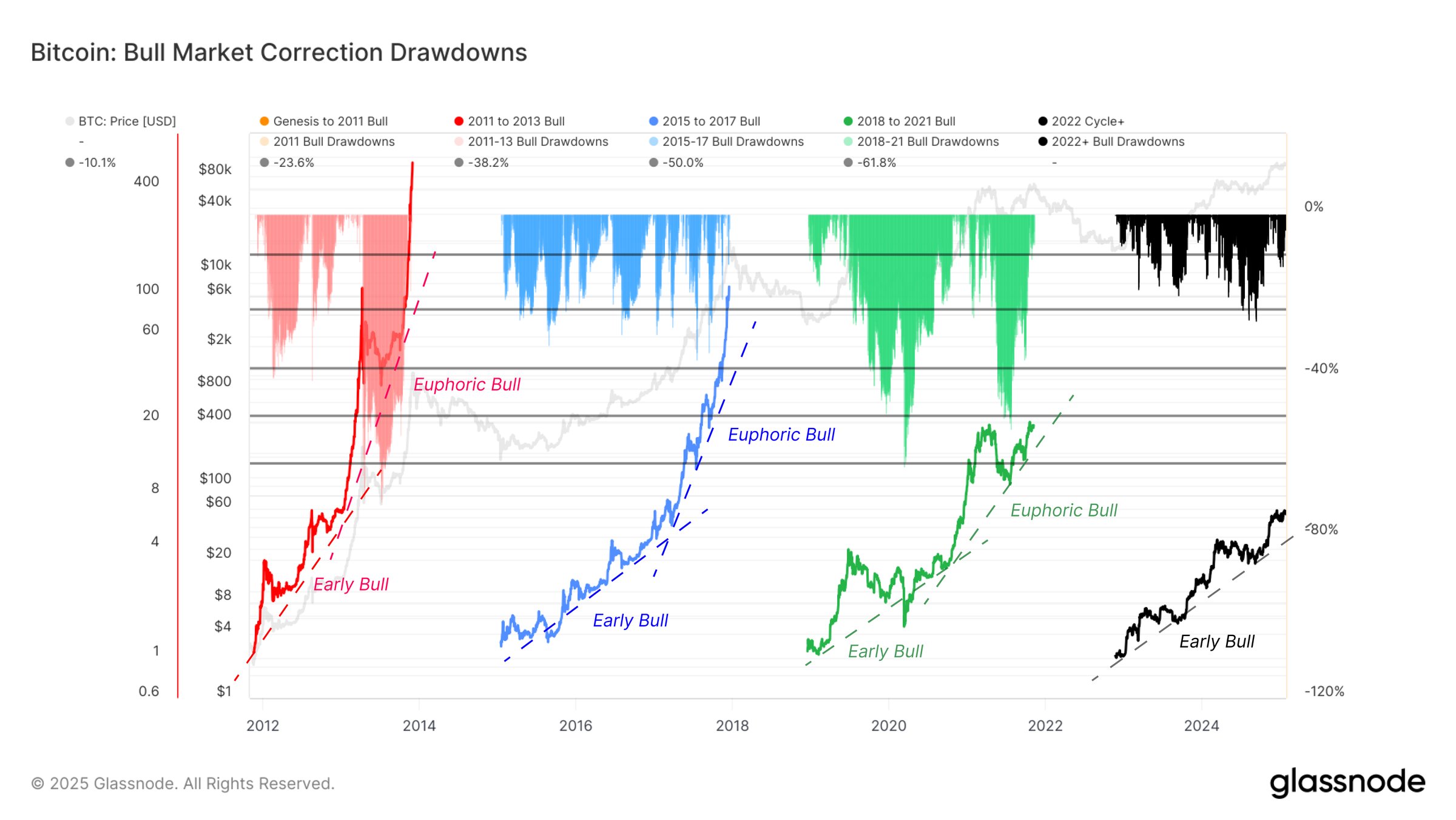

Glassnode also notes that Bitcoin’s current cycle appears to be following in the footsteps of its 2015-2018 bull run, which was largely driven by spot market investors.

“Despite a much larger market cap, pullbacks have rarely exceeded -25%, reflecting strong demand, ETF (exchange-traded fund) inflows, and Bitcoin’s role as a macro asset.”

The analytics firm says when new demand materializes, price action tends to accelerate in a “second euphoric phase.”

“Prior cycles saw explosive growth, though a 100x rally from the low – like in 2015 – is unlikely at today’s scale. If demand strengthens, there may still be room for further expansion.”

BTC is trading at $101,807 at time of writing. The top-ranked crypto asset by market cap is down more than 3.5% in the past 24 hours.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

You may like

VanEck Registers AVAX ETF in Delaware

Why is Ethereum (ETH) price down today?

Key Support Level At $74,000 Determines Bitcoin Bull Or Bear Future

Deutsche Boerse-backed Clearstream to offer custody for Bitcoin, Ethereum

Analyst Who Nailed End of 2021 Bull Market Says Bitcoin May Have Seen Worst of Correction – Here’s Why

Crypto & Stock Market Crash as US Recession Odds Hit 40%

Bitcoin

Key Support Level At $74,000 Determines Bitcoin Bull Or Bear Future

Published

4 hours agoon

March 11, 2025By

admin

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Since January 31, Bitcoin (BTC) has experienced a significant correction, with the leading cryptocurrency plummeting as much as 27.52%.

Currently valued around $79,000, Bitcoin’s price is precariously balanced above a crucial support level dubbed as “the magic line,” which is set at $74,000, pivotal in determining the market’s trajectory—bullish or bearish.

A Historical Buffer Against Bear Markets

In a recent social media post on X (formerly Twitter), market expert Doctor Profit emphasized that “the magic line” placed at $74,000 in his analysis is not just a number but a key indicator of market sentiment.

Related Reading

According to the expert, this line has historically acted as a buffer against bear market conditions. For instance, during the 2020 market correction, Bitcoin held above this support level until a bear market was confirmed. Doctor Profit asserts, “A massive correction, even 30-50%, does NOT mean a bear market.”

This market volatility is exacerbated by fears of a recession, driven in part by President Donald Trump’s aggressive tariff policies targeting countries like China, Canada, and Mexico.

These actions have ignited concerns over a potential trade war, further dampening investor sentiment and leading to a retreat from riskier assets, including cryptocurrencies.

However, BTC is not alone in this downtrend. Peers such as Ethereum (ETH), XRP, Solana (SOL), and Cardano (ADA), have also followed Bitcoin’s lead in this regard, experiencing 10%, 6%,5% and 6% drops respectively in the 24-hour time frame.

Optimal Bitcoin Entry Point Between $52,000 and $60,000?

In another recent post on social media platform X, Doctor Profit discussed a possible recession scenario, suggesting that the optimal entry point for investors might be between $52,000 and $60,000.

This forecast implies a troubling potential drop of another 34% from $79,000 towards the worst case scenario for BTC’s price at $52,000 if this occurs, heightening concerns among traders and investors alike.

Related Reading

Doctor Profit remains vigilant, monitoring not only Bitcoin’s movements but also the stock market’s influence on crypto prices. He has set his sights on a critical short position with a target profit level (TP1) aligning with the magic line.

“If Bitcoin bounces hard, I’ll re-enter,” the market expert stated. Doctor Profit concluded his analysis saying that “If it shows weakness, I’ll stay in cash and hunt for lower entries between $50,000 and $60,000.”

While finding at least a temporary foothold at the $79,460 mark, the largest digital asset, BTC, is down 14% in the past two weeks, reaching its lowest level since November 2024.

Featured image from DALL-E, chart from TradingView.com

Source link

Banking

Deutsche Boerse-backed Clearstream to offer custody for Bitcoin, Ethereum

Published

4 hours agoon

March 11, 2025By

admin

Clearstream plans to offer Bitcoin and Ether custody and settlement services to its 2,500 institutional clients starting April.

Clearstream, the central securities depository arm of Deutsche Börse Group, will launch cryptocurrency custody and settlement services for institutional clients starting April, Bloomberg reports, citing executive at the company. The Luxembourg-headquartered depository will initially support Bitcoin (BTC) and Ethereum (ETH), with plans to expand into other cryptocurrencies and services like staking, lending, and brokerage.

According to the report, Clearstream’s 2,500 clients will be able to access these services through their accounts with Clearstream Banking SA, while the offering itself will be facilitated by Crypto Finance, a majority-owned subsidiary acting as a sub-custodian.

Commenting on the launch, Jens Hachmeister, head of issuer services and new digital markets at Clearstream said that with the offering, the company is creating a “one-stop shop around custody, brokerage and settlement,” adding that this could extend to stablecoins and tokenized securities in the future.

Crypto Finance CEO Stijn Vander Straeten says there’s been “very high demand” for crypto from international banking clients, pointing out that firms typically spend up to €5 million to develop in-house crypto capabilities.

The move comes as major financial institutions expand their presence in the crypto space, supported by regulations like the E.U.’s Markets in Crypto-Assets, or MiCA framework, which took effect last year.

For instance, the second-largest Spanish financial institution by volume of assets, BBVA, is also set to roll out a new crypto trading service in Spain, allowing customers to buy and manage Bitcoin and Ethereum.

As crypto.news reported, customers in Spain will be able to manage their crypto transactions alongside their regular banking activities, the banks says. BBVA will use its own custody platform for cryptographic keys without relying on third-party providers.

Source link

Bitcoin

Analyst Who Nailed End of 2021 Bull Market Says Bitcoin May Have Seen Worst of Correction – Here’s Why

Published

6 hours agoon

March 11, 2025By

admin

A crypto strategist who accurately called the top of the 2021 Bitcoin bull market believes the worst of the current BTC collapse is now in the rearview mirror.

Pseudonymous analyst Dave the Wave tells his 148,800 followers on the social media platform X that Bitcoin is close to carving the price bottom of this correction.

According to the analyst, Bitcoin’s downside potential from current levels is limited based on several technical indicators.

“Thinking we’ve seen the worst of this BTC multi-month correction:

1] Multi-year diagonal support coming through

2] 0.38 Fibonacci retracement repeat

3] 0.5 Fibonacci retracement and resistance come support

4] Time Fibonacci through to the end of April

5] one-year moving average coming through.”

Traders use the Fibonacci extension tool to pinpoint potential reversal price areas based on the Fibonacci ratio. Looking at the trader’s chart, he seems to suggest that BTC will bottom out at $74,000 where three technical indicators are converging to act as support including the 0.5 Fibonacci level, the high time frame diagonal trendline and the one-year moving average.

At time of writing, Bitcoin is trading for $79,361.

While some prominent crypto strategists believe that the Bitcoin bull market is now over, Dave the Wave predicts that BTC will witness an over 2x gain after plunging to the $74,000 price level.

“BTC darkest before the dawn.”

Based on the trader’s chart, he appears to predict that Bitcoin will soar to a new all-time high of $160,000 before the end of the year.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

VanEck Registers AVAX ETF in Delaware

Why is Ethereum (ETH) price down today?

Key Support Level At $74,000 Determines Bitcoin Bull Or Bear Future

Deutsche Boerse-backed Clearstream to offer custody for Bitcoin, Ethereum

Analyst Who Nailed End of 2021 Bull Market Says Bitcoin May Have Seen Worst of Correction – Here’s Why

Crypto & Stock Market Crash as US Recession Odds Hit 40%

ChatGPT Maker OpenAI Inks $12B Deal With CoreWeave Ahead of Planned IPO

Mt. Gox makes second $900M+ move in a week as Bitcoin taps $76K

Bitcoin’s Downtrend Continues, But Analyst Predicts $180K Target—Is It Possible?

Why is Bitcoin price down 30% from its all time high?

Market Cap of Top Five Stablecoins Surges to New All-Time High of $204,700,000,000, According to Analyst

3 Top Factors That Can Fuel Massive Bitcoin Price Rebound

Rex Shares, Osprey Seek Movement ETF Approval as Ethereum Layer-2 Mainnet Launches

4 things must happen before Ethereum can reclaim $2,600

Recent SEC Guidance On Memecoins Suggests Broader Policy Change

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Crypto’s Big Trump Gamble Is Risky

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

A16z-backed Espresso announces mainnet launch of core product

Has The Bitcoin Price Already Peaked?

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

Trump’s Coin Is About As Revolutionary As OneCoin

Ripple Vs. SEC, Shiba Inu, US Elections Steal Spotlight

Is $200,000 a Realistic Bitcoin Price Target for This Cycle?

Trending

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin2 months ago

Bitcoin2 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News2 months ago

24/7 Cryptocurrency News2 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin4 months ago

Bitcoin4 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Bitcoin4 months ago

Bitcoin4 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Altcoins1 month ago

Altcoins1 month agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Opinion4 months ago

Opinion4 months agoCrypto’s Big Trump Gamble Is Risky

Price analysis4 months ago

Price analysis4 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x