Blockchain

Hong Kong’s crypto broker OSL adds support for TON into OTC services

Published

3 months agoon

By

admin

OSL Digital Securities has expanded its OTC offerings with the addition of Toncoin, boosting investor access to The Open Network’s native token.

Hong Kong‘s regulated crypto broker OSL Digital Securities has added Toncoin (TON) to its over-the-counter trading services, allowing professional investors to trade the token. The new offering is part of OSL’s strategy to expand its services and meet the growing demand for crypto in the region, the firm said in a Dec. 13 press release.

Effective immediately, eligible users can trade TON against USD, USDT, and HKD on OSL’s platform. The service also includes custodian services and fiat on/off-ramps for digital assets, the press release reads.

“We are committed to actively listening to our customers and strive to provide secure and easy access to quality tokens that enable them to capitalize on market opportunities and growth potential.”

Guoliang Hao, chief business officer of OSL

OSL’s decision to add TON to its OTC services comes after the TON blockchain secured multi-million dollar funding from Pantera Capital. As crypto.news reported in May, the Open Network allegedly secured over $250 million in funding from the Californian venture capital giant. At the time, Pantera Capital said it had decided to invest in TON as the platform “has the capacity to introduce crypto to the masses because it is used extensively within the Telegram network.”

In early December, reports revealed that Pantera Capital raised an additional $20 million to further invest in Toncoin, maintaining its support for the Telegram-linked blockchain. Other details of the funding, however, remain unclear.

Source link

You may like

CryptoQuant CEO Sounds The Alarm

South Korea Dismisses Establishing Strategic Bitcoin Reserve

TokenPicks Launches Reward System to Incentivize Crypto Education

Ethereum leadership now eyes Solana-style growth, Dragonfly’s Qureshi says

SEC’s Uyeda Signals Possible Revisions to Crypto Custody Rule

Mubarak Meme Coin Trader Turns $232 Into $1.1 Million, Here’s How

Blockchain

Solana Hits 400B Transactions, Nearly $1T in 5 Years

Published

1 day agoon

March 17, 2025By

admin

Solana, the layer-one blockchain platform, celebrated five years since the launch of its mainnet on March 16, 2020.

To celebrate the milestone, the network shared its accomplishments, which include more than 1,300 validators, nearly $1 trillion in trading volume, and over 408 billion total Solana transactions, in a post on its official X account.

https://twitter.com/solana/status/1901279678620749997?s=46&t=nznXkss3debX8JIhNzHmzw

Solana (SOL) was founded in 2017 by Anatoly Yakovenko with the goal of addressing the primary challenge facing blockchain technology. The network aims to strike the right balance between scalability, security, and decentralization.

When combined with proof-of-stake, Yakovenko’s proof-of-history system speeds up transaction processing. Solana has been able to grow while maintaining low costs as a result.

More than 254 million blocks have been generated by Solana since its mainnet went live in March 2020. Since then, the network has grown to be a major force in decentralized finance, with over $7 billion in total value locked in its protocols, according to DeFiLlama data.

Meanwhile, Solana’s stablecoin market has reached $11 billion, down from its peak of over $12.6 billion in February 2025. Similarly, its market cap, which once peaked at $127.5 billion, now stands at $65 billion.

Developer interest in Solana has also significantly increased. It surpassed Ethereum as the most popular blockchain for new developers in 2024. According to Electric Capital’s 2024 developer report, Solana attracted 7,625 new developers in the previous year, accounting for 19.5% of all new entrants in the market.

On Mar. 17, CME Group plans to introduce Solana futures contracts, subject to regulatory clearance. These futures, which are intended to assist investors in protecting themselves from price swings, indicate that Solana is becoming a more widely accepted asset in the cryptocurrency market.

Furthermore, Solana has been included in several exchange-traded funds applications, indicating its increasing mainstream acceptance and room for growth.

Source link

Altcoins

Layer-1 Project MultiversX Continues To Top the Crypto Gaming Sector in Terms of Development Activity: Santiment

Published

2 days agoon

March 16, 2025By

admin

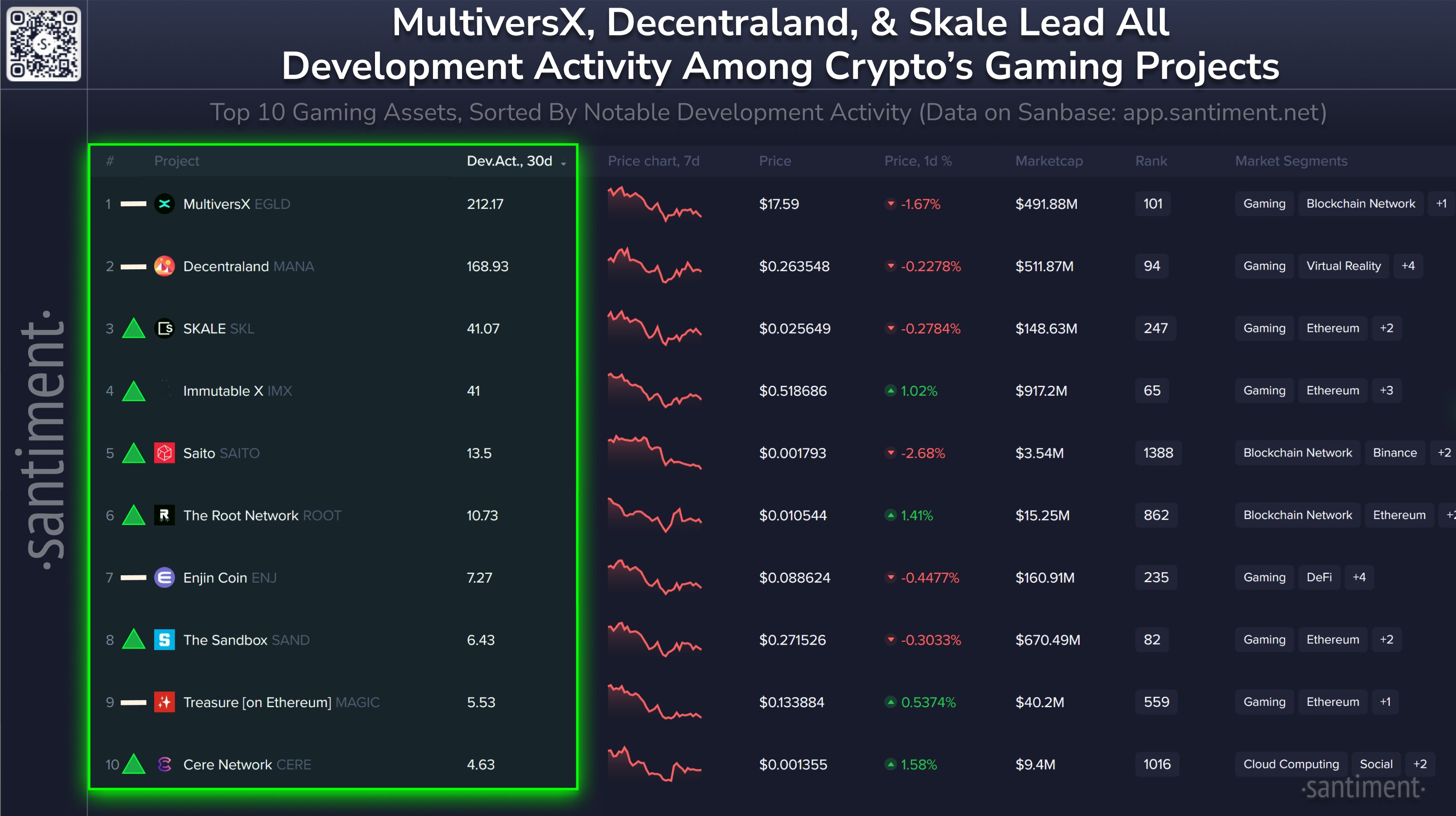

The layer-1 blockchain MultiversX (EGLD) continues to lead the digital asset gaming sector in the realm of development activity, according to the crypto analytics firm Santiment.

Santiment notes on the social media platform X that MultiversX, formerly known as Elrond, registered 212.17 notable GitHub events in the past 30 days.

The Ethereum (ETH)-based virtual reality platform Decentraland (MANA) ranks second, clocking 168.93 events, and the Ethereum layer-2 protocol Skale Network (SKL) is a distant third with 41.07.

MultiversX and Decentraland have occupied the number one and two spots in previous months as well, according to Santiment.

Santiment notes that it doesn’t count routine updates and uses a “better methodology” to collect data for GitHub events based on a “backtested process.”

The analytics firm has previously said that heavy development activity centered around a crypto project is a positive indication that could mean that the developers believe the protocol will be successful. It also indicates that the project is less likely to be an exit scam.

MultiversX is a distributed, proof-of-stake blockchain network that is decentralized via more than 3,500 nodes. The project aims to help developers build next-gen applications.

The project’s native token, EGLD, is trading at $18.10 at time of writing. The 139th-ranked crypto asset by market cap is up more than 3% in the past 24 hours.

Follow us on X, Facebook and Telegram

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

Blockchain

Crypto Fintech Giant MoonPay Continues Acquisition Spree With Purchase of Stablecoin Infrastructure Platform

Published

4 days agoon

March 14, 2025By

admin

The web3 infrastructure provider MoonPay just announced its acquisition of the stablecoin infrastructure developer Iron just months after purchasing crypto payments platform Helio.

In a statement, MoonPay says its new acquisition significantly expands its offerings with solutions that allow businesses to manage multi-currency treasuries, facilitate instant cross-border payments and generate new revenue through yield-bearing assets.

Says MoonPay’s co-founder and CEO, Ivan Soto-Wright,

“This acquisition is a strategic step forward, positioning MoonPay at the forefront of enterprise-grade stablecoin solutions. With Iron’s technology, we’re putting the power of instant, programmable payments into the hands of enterprises, fintechs, and global merchants.”

Iron co-founder and CTO Omid Aladini says that joining forces with MoonPay is also beneficial to the platform.

“Since we rolled out the Iron stablecoin API the interest has been absolutely phenomenal! But once part of MoonPay, we’ll be able to scale exponentially faster.

We’ve built a developer-first API experience to power apps, exchanges, institutions, DEXs, and PSPs around the world to move stablecoins across crypto ecosystems and fiat rails. It’s the foundational infrastructure for the future of money.”

MoonPay also acquired Helio in January. The Solana (SOL) crypto payment processor enables merchants and creators to accept cryptocurrencies such as Bitcoin (BTC), Ethereum (ETH) and SOL.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/duangphorn wiriya/INelson

Source link

CryptoQuant CEO Sounds The Alarm

South Korea Dismisses Establishing Strategic Bitcoin Reserve

TokenPicks Launches Reward System to Incentivize Crypto Education

Ethereum leadership now eyes Solana-style growth, Dragonfly’s Qureshi says

SEC’s Uyeda Signals Possible Revisions to Crypto Custody Rule

Mubarak Meme Coin Trader Turns $232 Into $1.1 Million, Here’s How

Solana Protected Gender Identity Before Panning It in Anti-Queer Ad

Musk says he found ‘magic money computers’ printing money ‘out of thin air’

XRP To Triple Digits? Analyst Confident In $100 Price Goal

What Are They And What Do They Do?

Trader Predicts Crypto Rallies Amid Expectations of Fed Monetary Policy Shift – But There’s a Catch

Solana’s 5th birthday highlights explosive growth and trading activity: Mercuryo

Trump, Associates Net $390 Million Payday From World Liberty Token Sale

Bitcoin Price Eyes $200,000 Breakout If This History Aligns

Gold-Backed Tokens Outperform as ‘Bond King’ Gundlach Sees Precious Metal Hit $4,000

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Crypto’s Big Trump Gamble Is Risky

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

Trump’s Coin Is About As Revolutionary As OneCoin

Is $200,000 a Realistic Bitcoin Price Target for This Cycle?

Ripple Vs. SEC, Shiba Inu, US Elections Steal Spotlight

Trending

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin2 months ago

Bitcoin2 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News2 months ago

24/7 Cryptocurrency News2 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin4 months ago

Bitcoin4 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Altcoins2 months ago

Altcoins2 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin4 months ago

Bitcoin4 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Opinion4 months ago

Opinion4 months agoCrypto’s Big Trump Gamble Is Risky

Price analysis4 months ago

Price analysis4 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x