Bitcoin mining

How Chinese Lending Firm Cango Became a Bitcoin Mining Powerhouse

Published

4 months agoon

By

admin

The bitcoin (BTC) mining industry was shaken up in the last months of 2024 by the sudden entrance of a new player: Cango (CANG), a Chinese firm that specializes in providing loans to automobile buyers.

Based in Shanghai and valued at $363 million on the stock market, Cango is in the process of acquiring 50 exahashes per second (EH/s) worth of mining power, meaning that the auto lending platform will become one of the largest bitcoin miners in the world once its entire fleet goes online.

“I guess it’s surprising for people in the [bitcoin mining] industry because nobody has ever heard of Cango before,” Juliet Ye, the company’s senior director of communications, told CoinDesk in an interview. “But the history of Cango is a history of adaptation. We’ve diversified into different areas at least two or three times [since the firm was established in 2010].”

Getting such a large bitcoin mining fleet isn’t cheap. Cango paid $256 million in cash for the first 32 EH/s worth of computing power, which it purchased from bitcoin mining machine manufacturer Bitmain. It will be issuing $144 million worth of shares for the remaining 18 EH/s, which it is acquiring from Golden TechGen — a firm owned by former Bitmain Chief Financial Officer Max Hua — as well as other undisclosed mining machine sellers. Once the transaction is settled, Golden TechGen and these other sellers will end up owning approximately 37.8% of Cango.

The diversification into bitcoin mining is already bearing fruit. Cango’s stock finished 2024 at $4.56, up more than 362% from the start of that year. Even better, Ye said, this new bitcoin mining strategy has catapulted Cango into the spotlight.

“It’s been really hard for us to gain traction around the company, as a small- to mid-cap listed Chinese firm in the U.S.,” Ye said. “All of a sudden, a lot of people are very much interested in Cango. The buzz around the company — we’ve never seen this before in the past.”

50 EH/s

Cango is more used to helping Chinese banks issue loans for people looking to buy cars. But the firm, which went public in 2018, was already diversifying its operations years before acquiring its bitcoin fleet.

Cango started facilitating car exports from China to other parts of the world and has invested in Li Auto, a Chinese electric vehicle manufacturer. Following that investment, Cango explored business opportunities in the renewable energy sector, including high-compute power projects related to AI, before venturing into on bitcoin mining.

“Bitcoin mining is a very good way to rebalance energy grids,” Ye said, referring to the fact that bitcoin miners can easily switch their rigs off and on again. Some jurisdictions, like Texas, take advantage of that ability by encouraging miners to operate in periods of low energy consumption, and paying them to shut down their machines when local demand surges, like during heatwaves or blizzards.

With Bitcoin’s hashrate now hovering at 823 EH/s, Cango will be providing roughly 6% of the total computing power behind Bitcoin once the firm’s 50 EH/s fully come online. For reference, MARA Holdings (MARA), the largest publicly traded miner in the world, owned a little over 47 EH/s worth of computing power as of November, per TheMinerMag data. CleanSpark (CLSK) and Riot Platforms (RIOT), the two next largest, stood at 32 EH/s and 26 EH/s respectively.

“The Bitcoin mining sector’s imperative for scaled operations was a pivotal consideration in our decision to enter this domain,” Cango’s management team told CoinDesk in an email.

“The current landscape is marked by industry consolidation, with larger-scale operations becoming increasingly dominant due to escalating mining difficulty and the necessity for state-of-the-art hardware.”

One major difference between Cango and other mining heavyweights is that Cango isn’t operating its own mining fleet right now. With machines spread out around the world — including in the U.S., Canada, Paraguay and Ethiopia — Cango is still relying heavily on Bitmain for facilities and infrastructure, and to make sure the sites run smoothly.

“Even though we enter the industry with a significant amount of computing power, we are still new here, and we need time to adapt to the norms, and get a better understanding of the tax situation and the rest of the market,” Ye said. “So at the beginning, we chose to work together with Bitmain and to use its operations teams.”

That situation is likely to change over time, Ye said, as Cango gains experience in the sector and seeks to make its bitcoin mining operations more economically efficient. Nurturing an in-house mining team would likely be cheaper than relying on Bitmain’s expertise in the long run.

As for what Cango plans to do with its growing bitcoin stash, that will depend on how the year unfolds, Ye said. “We don’t rule out the possibility of making some tactical reductions [to the bitcoin holdings] based on market conditions,” she said. Cango mined 363.9 BTC in November alone, a sum worth roughly $35 million at the time of writing.

Source link

You may like

Biological Age vs. Chronological Age: Redefining Age in the Digital Era

TRUMP whale regrets sale, pays double to buy back meme coins

Stripe Tests New Stablecoin Project as $3.7T Market Looms

Falling Wedge Pattern Confirms $264 target

Ethereum community members propose new fee structure for the app layer

Crypto Investors Sue Nike, Accuse Apparel Giant of Rug Pull After Abrupt Closure of Metaverse Business: Report

Bitcoin mining has come a long way since the days of GPUs and basement set ups. In that time, miners have advanced in countless ways. For example, ASICs are now the standard, not GPUs. Furthermore, enterprise grade players have entered the field, opening new frontiers and bringing with them the size and institutional recognition that opens the doors to otherwise unreachable places for smaller miners. Nowadays, the mining landscape is one where grid services, curtailment strategies, and energy market participation are no longer edge cases but core strategies. As the world around it has moved forward, there’s one question we keep hearing from miners: can PPLNS adapt?

Many miners, particularly those working closely with energy providers or integrating Demand Response mechanisms, have come to view PPLNS with suspicion. They worry that it penalizes downtime and rewards only uninterrupted hashrate—a bad deal for those who routinely curtail machines to support the grid or provide other services.

This fear isn’t baseless. It traces back to a pivotal moment in the mining industry’s recent past, one that apparently sealed the deal for many on PPLNS style payouts: the fallout between RIOT and Braiins Pool.

At the time, Braiins was using the Score payout system. Designed in 2011 by Slush himself, Score was engineered to solve the problem of pool hopping—when miners would jump between pools to exploit reward systems. There’s also been a misconception that Score is a PPLNS style payment system, but as Rosenfeld’s bible on pool payout systems describes, Score and PPLNS are distinctly different payout methods. The main difference is how they account for shares, specifically, Score implemented a rolling window with exponential decay function, this effectively made the lookback window very short. On the other hand, PPLNS is a family of payout systems with various types of fixed length lookback windows.

As shown on this archived website of how Score worked, you can see that after 90 minutes your hashrate had no more presence on the pool. This means that the moment a miner starts mining, their share of rewards fairly quickly reaches the fair value of the hashrate. On the other hand, when a miner stops mining, it drops equally fast, as shown on the gif below.

This might have worked well in the era of cowboys and hackers, but it was never designed with today’s complex mining environments in mind. Certainly not with Demand Response, where miners intentionally and profitably take machines offline to stabilize energy grids or bid into ancillary markets. To Score, that kind of behavior looks no different than a pool hopper—someone attempting to cheat the system.

So when RIOT left Braiins, citing concerns about payout mechanics, it sent a shockwave through the mining world. Due to the aforementioned misconception, Score system’s flaws got unfairly projected onto a broader category of payouts, PPLNS got caught in the fray, catching a stray bullet in the process, and the industry collectively threw the baby out with the bathwater.

But the mining world has changed, and it’s time for the phoenix to rise from his ashes.

SLICE: A Payout Mechanism for the 21st Century Grid

Enter SLICE, a modern, open-source Stratum-V2-ready payout system created by the DMND team. It’s an improvement and evolution of PPLNS, that rethinks how miners get paid, rewards are calculated, and —most importantly— how downtime is treated respect

to Score. All while preserving miner’s right to build their own block templates with SV2.

At its core, SLICE is about fairness and transparency. It preserves the foundational idea of PPLNS—paying miners in proportion to their actual contribution to solving blocks—while modernizing it for today’s decentralized mining landscape.

The key innovation lies in how SLICE structures reward calculation, and on how the lookback window works. Rather than treating the entire pool as a monolith, SLICE breaks time into smaller, dynamic “slices” of work to properly distribute the fee component. These slices represent batches of shares submitted over a specific period, where we control for the amount of fees in the mempool, and compare and score different job templates for the financial value they represent. When a block is found, SLICE distributes the block subsidy and transaction fees separately. The subsidy is allocated proportionally by hashrate, while the fees are distributed based on hashrate and financial value.

This is particularly relevant in a world where miners can choose their own transaction sets. Some miners may prioritize high-fee MEV-style bundles; others may exclude certain types of transactions for ideological, political or technical reasons. SLICE ensures that, within each slice, miners are rewarded according to both the quantity and quality of their work—without punishing them for downtime or strategic energy decisions. For those curious to learn more, this article can prove helpful.

Demand Response Without Penalty

What makes SLICE especially attractive for miners participating in Demand Response or curtailment programs is that it doesn’t penalize you for being offline.

That’s because SLICE doesn’t decay your payout just because you took a break. Your shares remain in the PPLNS window—the rolling window of recent work that is eligible for payouts—as long as they’re recent enough. In this way, each share is treated independently, and is expected to get 8 payouts, since SLICE uses an 8-block rolling window, each valid share remains eligible for payout across the next 8 blocks on average. This means that regardless of how big or small the pool is, you will never have the abysmal luck of eating up bad luck days without a block, disconnecting, having the pool find a block, and not get paid.

That means miners can power down during peak demand hours, support their regional grid, and still collect their fair cut from blocks found after they resume operations, most importantly, even while they’re offline, if their shares are still in the window. In other words, if the pool has a streak of bad luck, and then the miner is called to perform demand response and shuts off, even if the pool finds a block during their down time, that miner will get paid their fair share for all the time they were online. That’s because each share generated during that time will be active and getting paid for 8 blocks on average.

This is not a workaround. This is the feature. It makes SLICE fully compatible with modern energy strategies that require flexibility, whether you’re participating in frequency regulation markets, ramping down during grid emergencies, or simply optimizing for off-peak pricing.

For example, let’s say that a miner is mining at a pool, and the pool hasn’t found that day’s block yet. This means that the pool hasn’t found the block yet, and thus the miners hasn’t gotten paid for that day yet. Now, the miner shuts off to provide ancillary services during peak summer load for a few hours, during that time, the pool finds the block. In a Score based pool, the miner would not see a single Sat of that after 90 minutes, when the decay has had full effect. But even if the pool found a block 30 minutes later, due to the exponential decay, the miner would barely see anything. On the other hand, the miner would have all of the shares they mined over the day receive a payment, since each share receives on average 8 payments. Thus, the miner would benefit in the good times, and not be penalized in the bad times.

Payment Transparency and Auditability

Furthermore, SLICE doesn’t just modernize payout fairness—it does so in a way that minimizes trust in the pool operator. Every slice is fully auditable. Each share is tracked, indexed, and publicly verifiable by any miner, so miners can independently verify their share of the block reward. There’s no black box, no “trust me bro.”

And if the pool operator attempts to cheat—say, by injecting fake shares to dilute payouts—miners can challenge the integrity of the slice. The Job Declaration extension to Stratum V2, which SLICE relies on, includes mechanisms for publishing share data, verifying Merkle roots, and ensuring that each share corresponds to real computational work.

For miners who care about decentralization, SLICE isn’t just a payment scheme—it’s an accountability tool.

From Defensive to Strategic

The shift from Score to SLICE represents more than a technical upgrade. It’s a mental shift. Mining pools no longer need to defend against bad actors by penalizing everyone. Instead, they can structure payouts in a way that reflects reality: that miners are sophisticated participants working not only in the Bitcoin blockchain, but also the energy ecosystem.

With SLICE, PPLNS stops being a liability and becomes a strategic advantage. It enables better revenue capture, more transparency and auditability, and smoother integration with grid services.

And in a world where uptime is optional, but fairness is non-negotiable, that’s exactly what enterprise-grade miners need, a strategic pool partner that pushes forward and innovates, bringing the future today and enabling miners to make more money with the same hardware.

This is a guest post by General Kenobi. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Source link

Bitcoin

‘Dire Picture’ for BTC Miners as Revenue Flatlines Near Record Low

Published

1 week agoon

April 20, 2025By

admin

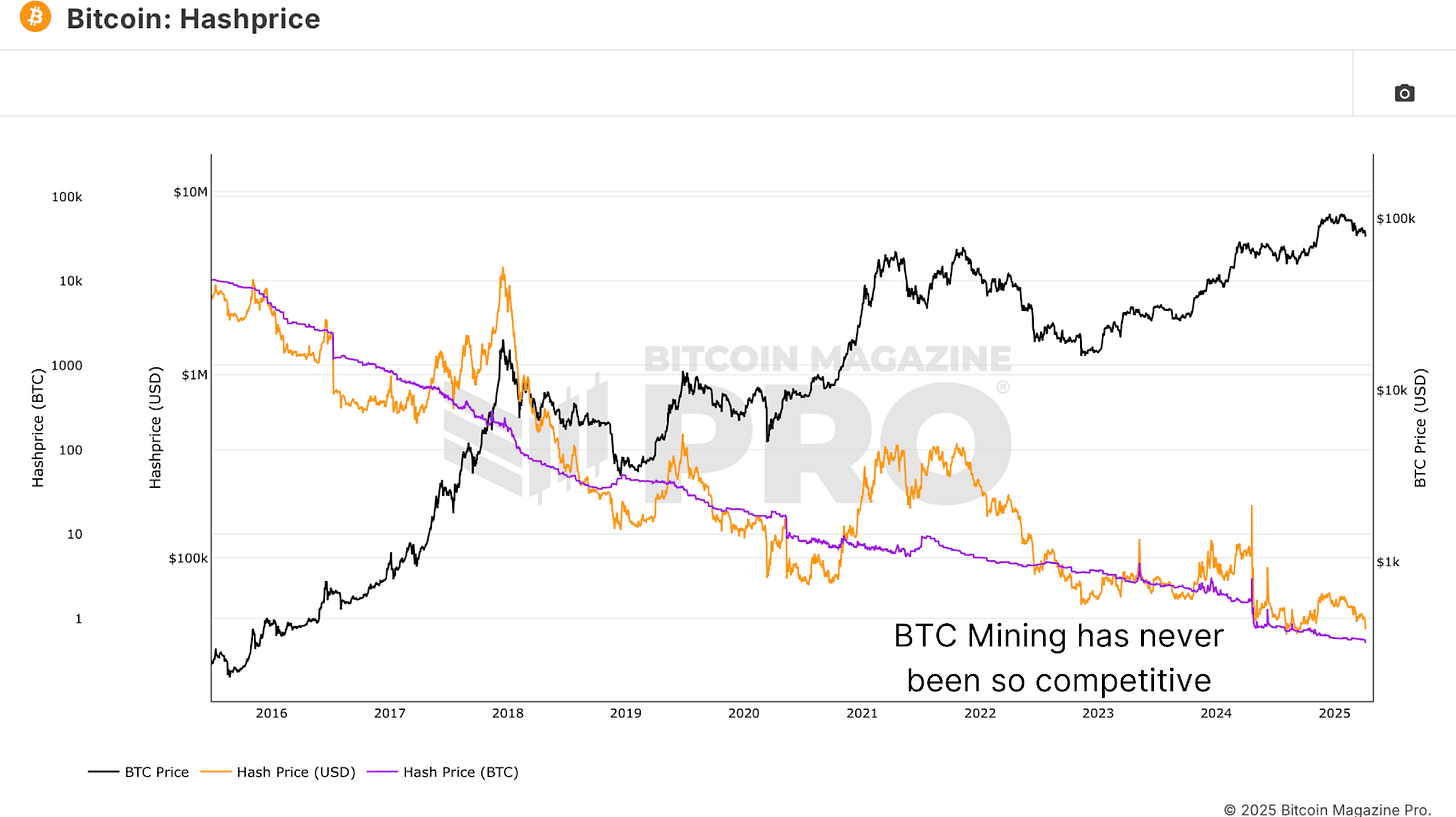

Hashprice, a key metric used to gauge miner revenue, is currently hovering near a five-year low, according to HashRate Index—a stark reminder of how difficult the mining business has become.

In simple terms, the metric is the income miners can expect per unit of computing power, denoted by per petahash (PH/s). It can be denominated in U.S. dollars or BTC, although it’s most commonly quoted in USD for practical comparison.

At present, hashprice sits at $44.00 PH/s, only slightly above its August 2024 low, when bitcoin reached $49,000 amid the yen carry trade unwind. Currently, bitcoin is trading around $84,000.

Despite the higher BTC price, miner revenue is dwindling, which paints a dire picture of the mining industry as a whole after the recent halving event cut the rewards by half. Rising competition, higher mining difficulty, lower transaction revenue, and spiking energy costs have added more pressure to the revenue.

However, it’s not all bad. At around $44.00 PH/s levels, depending on what type of mining machines miners are using, miners can still be near or at breakeven, although far from 2021’s mining bull run.

Looking ahead, deteriorating market conditions, stagnant bitcoin prices, and geopolitical uncertainty, such as potential tariffs affecting mining operations, could create further headwinds for the industry.

This is reflected in the performance of the Valkyrie Bitcoin Miners ETF (WGMI), which is down 50% year-to-date while BTC fell about 10%, underscoring the challenging environment facing the mining sector.

It makes sense that miners are increasingly pivoting into other revenue streams, such as reallocating computing power for artificial intelligence.

Read more: Bitcoin Mining Stocks Plunge as Revenue Craters Amid Market Carnage

Source link

With all the current bearish sentiment and macroeconomic uncertainty swirling around both Bitcoin and the broader global economy, it might come as a surprise to see miners as bullish as ever. In this article, we’ll unpack the data that suggests Bitcoin miners are not just staying the course, they’re accelerating, doubling down at a time when many are pulling back. What exactly do they know that the broader market might be missing?

For a more in-depth look into this topic, check out a recent YouTube video here:

Why Bitcoin Miners Are Doubling Down Right Now

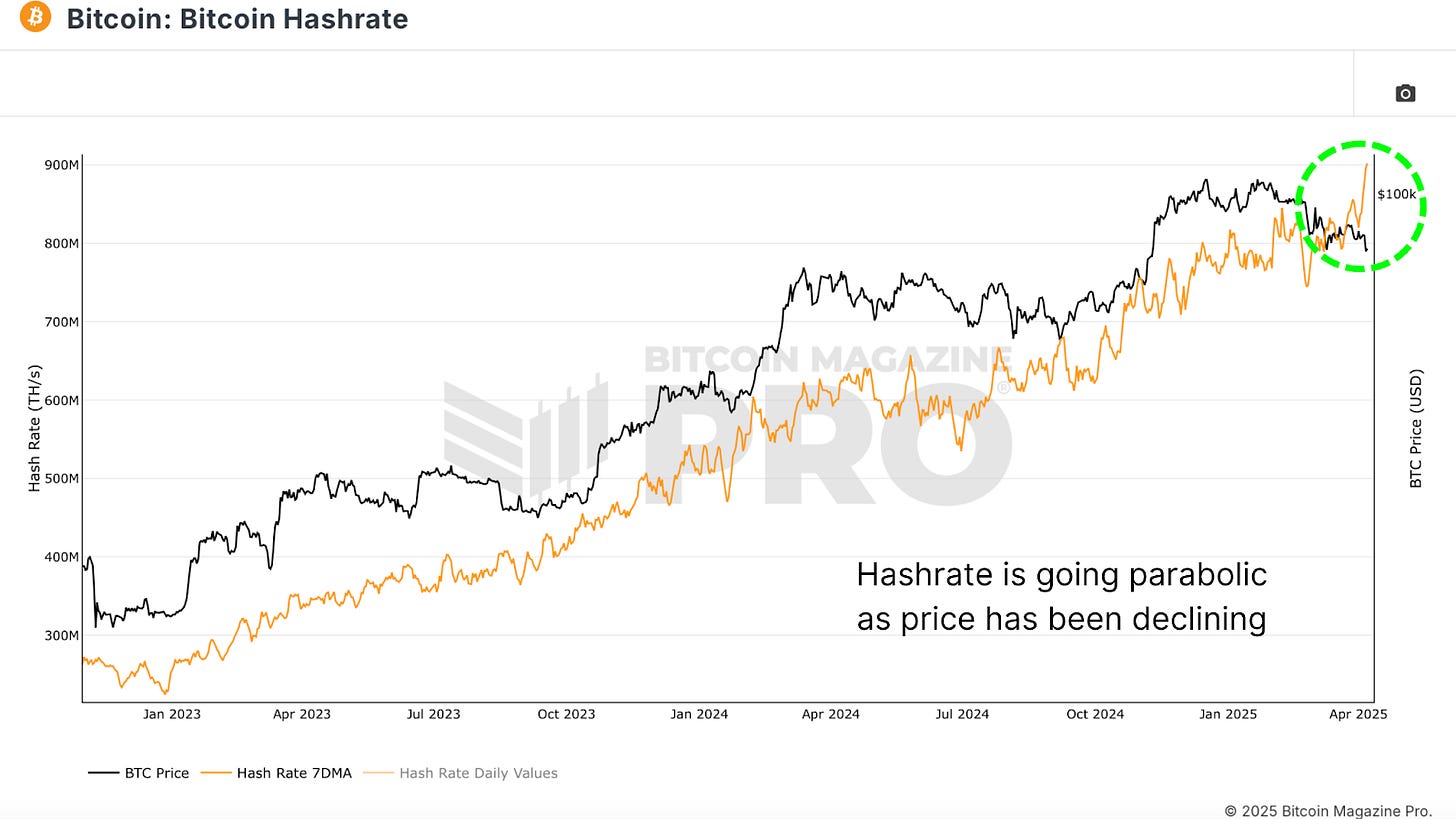

Bitcoin Hash Rate Going Parabolic

Despite Bitcoin’s recent price underperformance, the Bitcoin Hashrate has been going absolutely vertical, breaking all-time highs with seemingly no regard for macro headwinds or sluggish price action. Typically, hash rate is tightly correlated with BTC price; when price drops sharply or remains stagnant, hash rate tends to plateau or decline due to economic pressure on miners.

Yet now, in the face of heightened global tariffs, economic slowdown, and a consolidating BTC price, hash rate is accelerating. Historically, this level of divergence between hash rate and price has been rare and often significant.

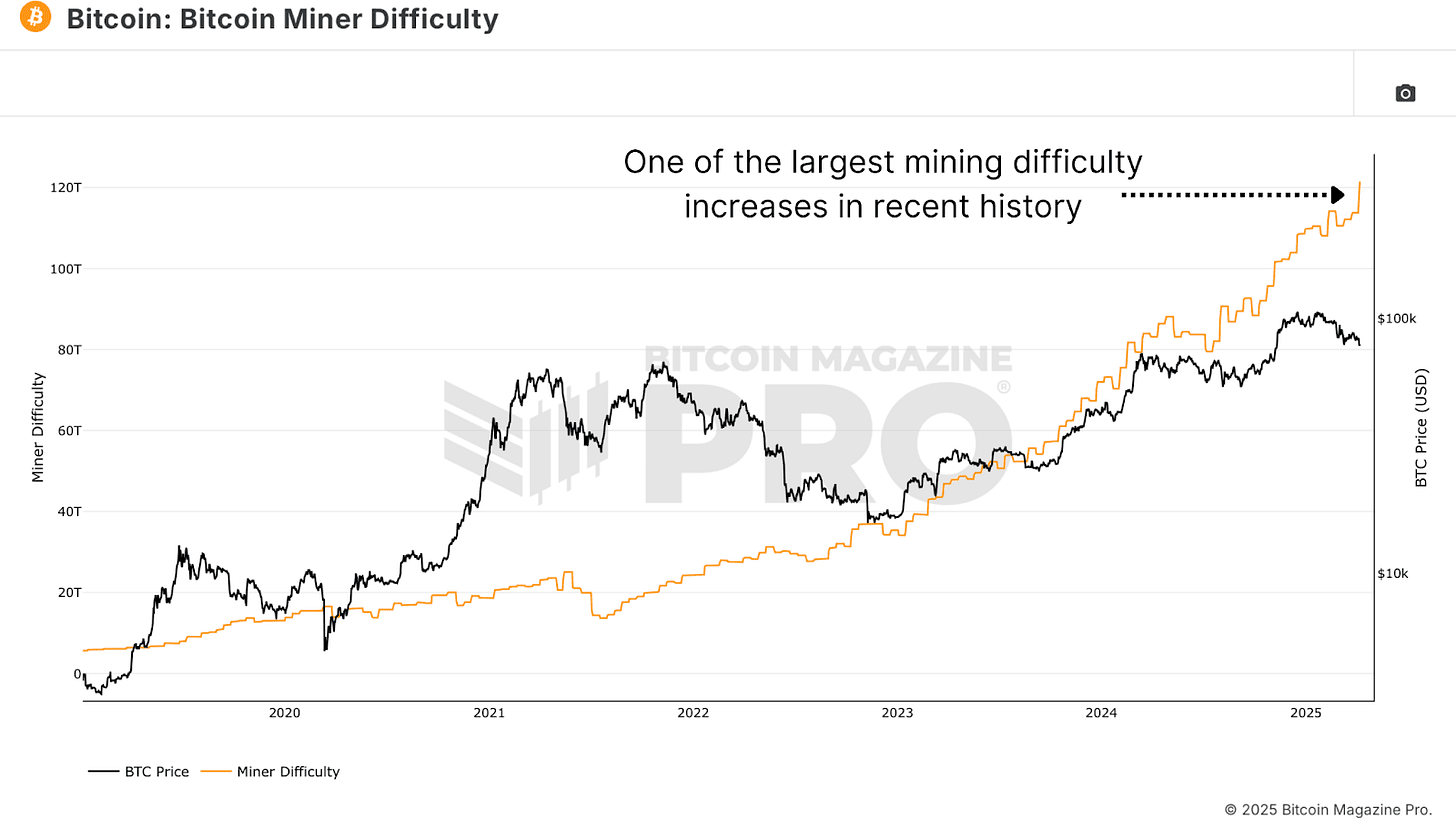

Bitcoin Miner Difficulty, a close cousin to hash rate, just saw one of its largest single adjustments upward in history. This metric, which auto-adjusts to keep Bitcoin’s block timing consistent, only increases when more computational power floods the network. A difficulty spike of this magnitude, especially when paired with poor price performance, is nearly unprecedented.

Again, this suggests that miners are investing heavily in infrastructure and resources, even when BTC price does not appear to support the decision in the short term.

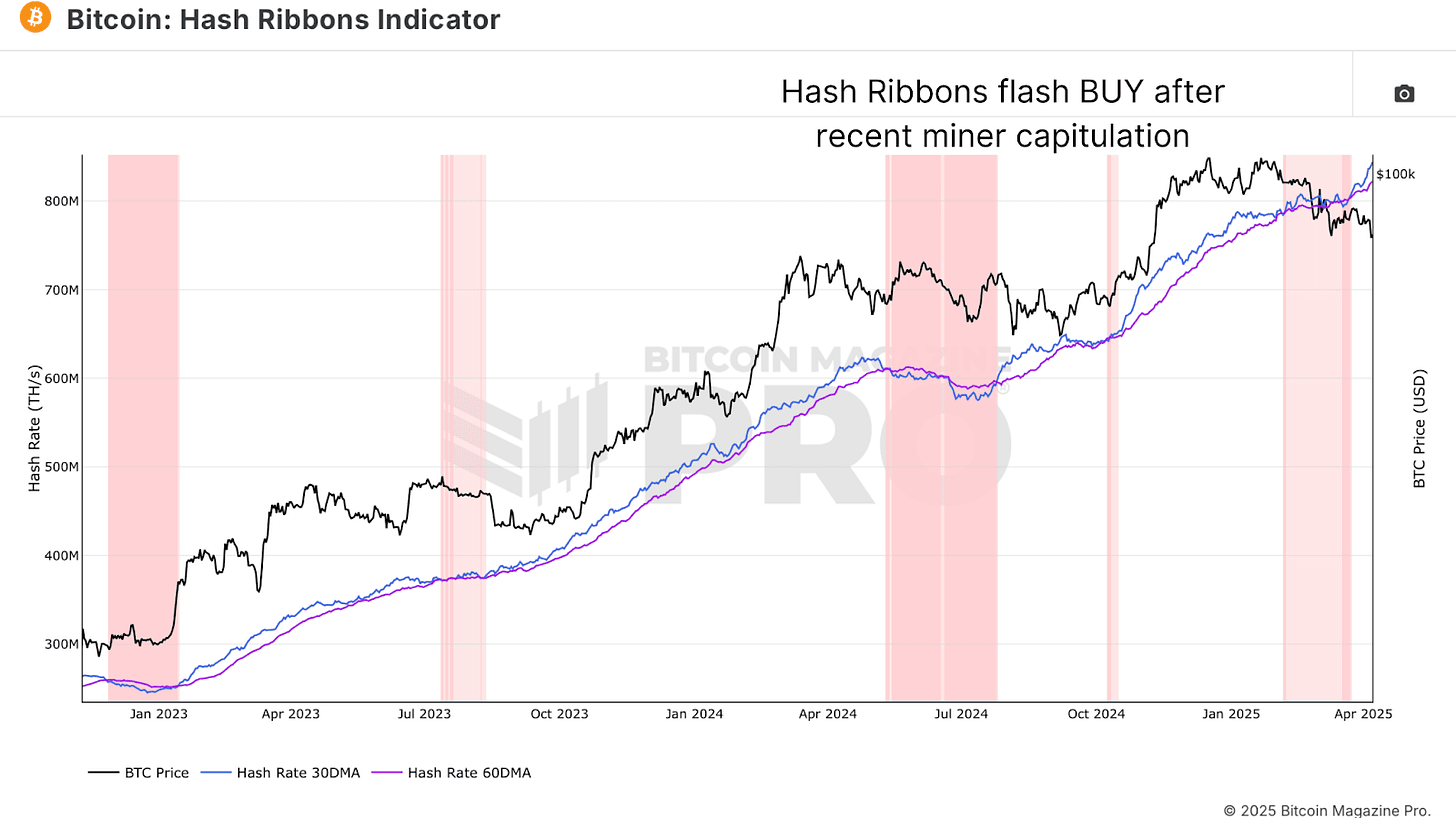

Adding further intrigue, the Hash Ribbons Indicator, a blend of short and long-term hash rate moving averages, recently flashed a classic Bitcoin buy signal.

When the 30-day moving average (blue line) crosses back above the 60-day (purple line), it signals the end of miner capitulation and the beginning of renewed miner strength. Visually, the background of the chart shifts from red to white when this crossover occurs. This has often marked powerful inflection points for BTC price.

What’s striking this time around is how aggressively the 30-day moving average is surging away from the 60-day. This is not just a modest recovery, it’s a statement from miners that they are betting heavily on the future.

The Tariff Factor

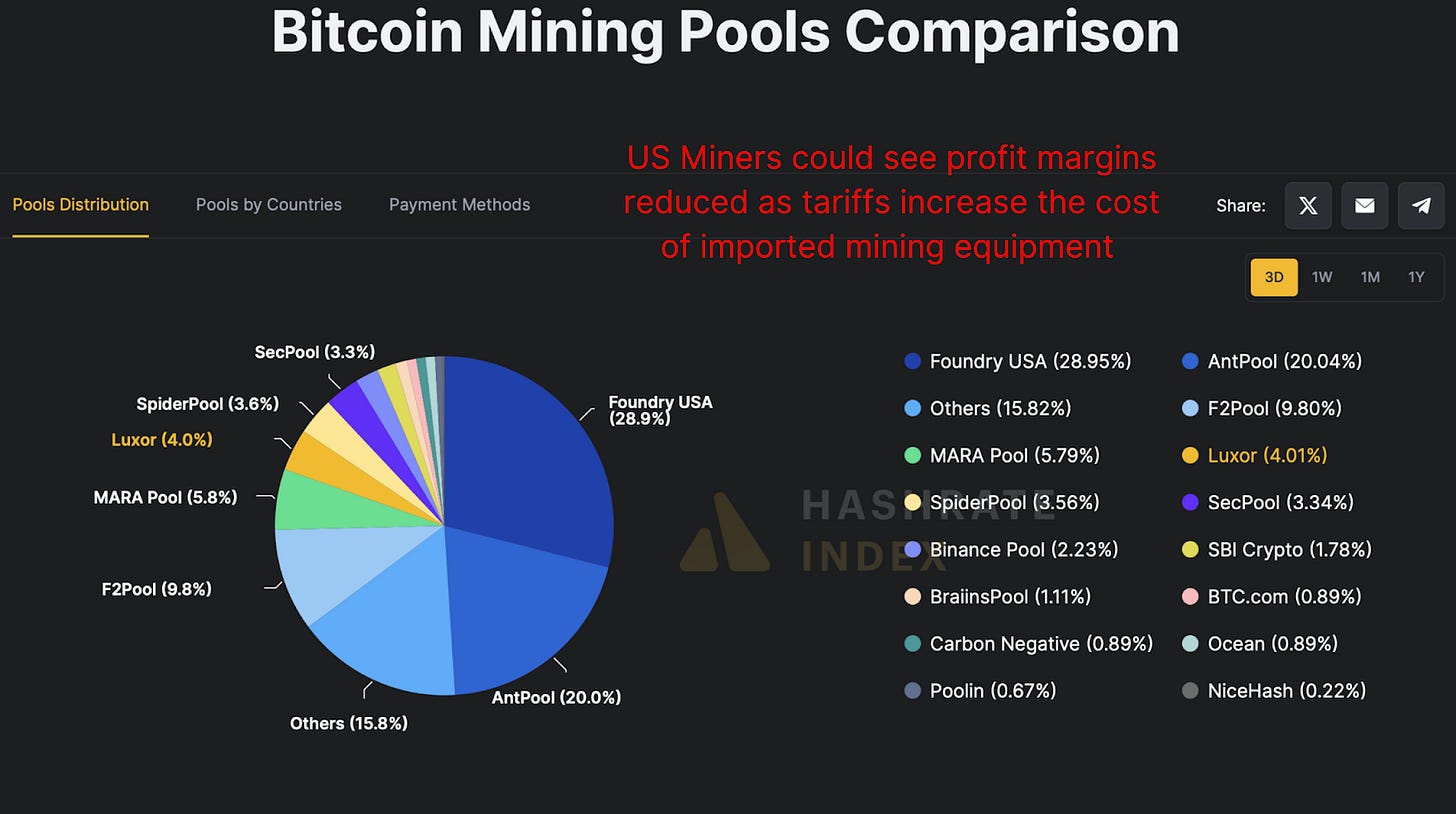

So, what’s fueling this miner frenzy? One plausible explanation is that miners, especially U.S.-based ones, are trying to front-run the impact of looming tariffs. Bitmain, the dominant producer of mining equipment, is now in the crosshairs of trade policies that could see equipment prices surge by 30–50%, potentially to even over 100%!

Given that over 40% of Bitcoin’s hash rate is controlled by U.S.-based pools like Foundry USA, Mara Pool, and Luxor, any cost increase would drastically reduce profit margins. Miners may be aggressively scaling now while hardware is still (relatively) cheap and available.

Bitcoin Miners Keep Mining

Hashprice, the BTC-denominated revenue per terahash of computational power, is at historical lows. In other words, it’s never been less profitable in BTC terms to operate a Bitcoin miner on a per-terahash basis. Typically, we see hash price increase toward the tail-end of bear markets, as competition fades and weaker players exit the space.

But that’s not happening here. Despite terrible profitability, miners are not only staying online, they’re deploying more hash power. This could imply one of two things; either miners are racing against deteriorating margins to front-load BTC accumulation, or, more optimistically, they have strong conviction in Bitcoin’s future profitability and are buying the dip aggressively.

Bitcoin Miners Conclusion

So, what’s really happening? Either miners are desperately front-running hardware costs, or, more likely, they’re signaling one of the strongest collective votes of confidence in the future of Bitcoin we’ve seen in recent memory. We’ll continue tracking these metrics in future updates to see whether this miner conviction is proven right.

If you’re interested in more in-depth analysis and real-time data, consider checking out Bitcoin Magazine Pro for valuable insights into the Bitcoin market.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment decisions.

Source link

Biological Age vs. Chronological Age: Redefining Age in the Digital Era

TRUMP whale regrets sale, pays double to buy back meme coins

Stripe Tests New Stablecoin Project as $3.7T Market Looms

Falling Wedge Pattern Confirms $264 target

Dogecoin Confirms Daily Trend Reversal With Breakout, Retest, And New Uptrend

Ethereum community members propose new fee structure for the app layer

Crypto Investors Sue Nike, Accuse Apparel Giant of Rug Pull After Abrupt Closure of Metaverse Business: Report

Top cryptocurrencies to watch: Pi Network, XRP, Sui

This Week in Crypto Games: Ubisoft’s ‘Might & Magic’, ‘Peaky Blinders’ in Development

Why Arbitrum-Nvidia Partnership Collapsed – And What It Means for Web3

Tariff Carnage Starting to Fulfill BTC’s ‘Store of Value’ Promise

The cost of innovation — Regulations are Web3’s greatest asset

Best Crypto to Buy as Derivatives Exchange CME Set to Launch XRP Futures

Metaplanet Buys Additional ¥1.92 Billion Worth Of Bitcoin

Here Are Four Signs the Stock Market Has Bottomed, According to Fundstrat’s Tom Lee

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Crypto’s Big Trump Gamble Is Risky

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

I’m Grateful for Trump’s Embrace of Bitcoin

Trending

24/7 Cryptocurrency News6 months ago

24/7 Cryptocurrency News6 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin3 months ago

Bitcoin3 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Ripple Price1 month ago

Ripple Price1 month ago3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin6 months ago

Bitcoin6 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Opinion6 months ago

Opinion6 months agoCrypto’s Big Trump Gamble Is Risky

Bitcoin5 months ago

Bitcoin5 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Altcoins3 months ago

Altcoins3 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje