CryptoQuant

How the crypto market react?

Published

2 months agoon

By

admin

Bank of America states the U.S. economy is headed for instability as Donald Trump enters office, despite the strong employment and retail sales data being disseminated. This has brought renewed focus on the future of the crypto market. Will it thrive?

According to reports by Jinshi, Bank of America said on Jan. 20. that employment data, retail sales, and core inflation are holding strong, with core inflation at 3.2%. However, this number for inflation is above the mark, which means the Fed has no room to cut rates any further.

In December 2024, the Fed cut rates by 25 basis points, following a 25 basis point cut in November and a 50 basis point reduction in September. Fed Chair Jerome Powell stated in December meeting that no further rate cuts will occur unless economic data improves.

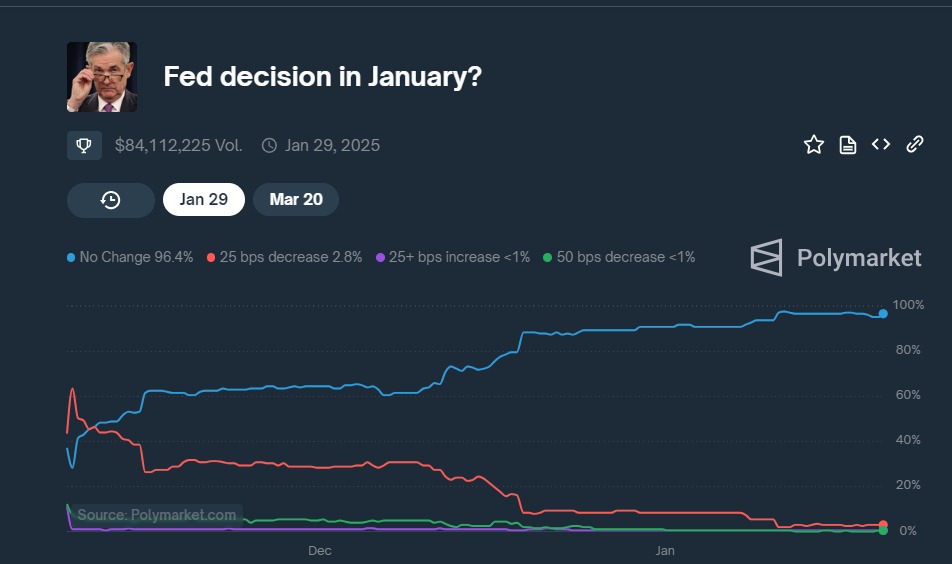

The sentiment against additional rate cuts is further reflected in Polymarket votes, where over 96% of bettors believe there will be no rate cut in January.

Now, Bank of America believes that with the oncoming presidency and, with it, the Trump 2.0 policies, there may be extreme security and fiscal uncertainty, and it could affect economic managers differently.

Trump’s Protectionist policies

Protectionist policies are government actions, i.e., tariffs or taxes on imports and trade restrictions, undertaken to protect local industries from foreign competitors.

During Donald Trump’s first term, these had quite an impact on the stock market. For instance, tariffs on Chinese goods and steel helped U.S. manufacturers with reduced competition. Still, they raised costs for companies that relied on imports, like carmakers and high-tech companies, as reported by the Tax Foundation in May 2024. Such continuously affected market ups and downs, especially during the trade war with China.

Reuters further reported that the same now could return via Trump’s reemergence with a 60% tariff on Chinese products, affecting the economy; this will raise prices and provide uncertainty to investors in the global market.

What is in for the crypto market?

The course of crypto’s future will largely depend on the interplay between Trump’s policies and Fed’s decisions. While protectionist policies generally exert their effects on traditional financial markets through inflation, supply chain disruptions, and investor sentiment, they will have a spillover effect on crypto markets.

Protectionist measures usually raise the costs of goods and services, which are typically passed on to consumers by companies.

For example, should inflation remain elevated, Bitcoin (BTC), often viewed as an inflation hedge, is likely to continue gaining traction, especially as the president has been heavily supportive on Bitcoin Reserve. Further, if the Fed does not cut rates to curb inflation, crypto might gain popularity as a store of value.

While many analysts are positive about a Bitcoin Reserve in the making, some within the crypto market are also voting against it. As of Jan. 20, Polymarket voters are only 57% confident that a Bitcoin Reserve would be created within the next 100 days.

Throughout history, whenever the United States perceived a threat to its dominance in the global economy, gold prices surged, and debates around the gold standard gained traction.

In the late 1990s, Peter Schiff championed gold as the true form of money, much like today’s…

— Ki Young Ju (@ki_young_ju) December 28, 2024

Moreover, Trump’s crypto-friendly policies may also pave the way for institutional adoption of cryptocurrencies by supporting pro-crypto laws, potentially curbing litigation against crypto exchanges that the SEC had imposed under the Biden government.

All in all, while the protectionist policies could hike prices for some imports of tech goods, slowing the development of blockchain, Trump’s pro-crypto stance would offset some of this through its promotion of the growth of the sector.

Source link

You may like

Bitcoin’s Road To $1M? Expect A ‘Dip Then Rip,’ Bitwise CIO Says

How Bitcoin ETFs And Mining Innovations Are Reshaping BTC Price Cycles

Bitcoin Hoarder Metaplanet Issues Fresh Bonds To Increase Holdings to 3,200 BTC

Pi Network coin to $10? 4 catalysts that may make it possible

XRP Jumps as Ripple CEO Brad Garlinghouse Says SEC ‘Case Has Ended’

3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

Bitcoin

Bitcoin’s Downtrend Continues, But Analyst Predicts $180K Target—Is It Possible?

Published

1 week agoon

March 11, 2025By

admin

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bitcoin has continued its downward trend despite briefly surging to $94,000 last week, a move that had initially fueled investor optimism. Since hitting that level, the cryptocurrency has steadily declined, now trading below $80,000 as of today.

While the short-term price action suggests a bearish outlook, some analysts remain confident about Bitcoin’s potential for long-term growth.

Bitcoin’s Price Outlook: $180K Within Reach?

One of CryptoQuant’s contributors to the QuickTake platform, ibrahimcosar, recently shared his perspective on Bitcoin’s price trajectory, offering a bold prediction for its next all-time high (ATH).

In his latest analysis, the analyst reiterated his long-term expectation that Bitcoin could reach $180,000 by 2026, citing historical price cycles and institutional projections that align with his forecast.

According to Ibrahim, Bitcoin’s price movements over the past year have followed a familiar pattern seen in previous bull cycles. The analyst pointed out that major financial institutions have recently begun making similar long-term projections, validating his earlier forecasts.

While Bitcoin currently trades below $80,000, he believes that the asset has the potential to more than double in value within the next two years.

If Bitcoin follows historical patterns, the $150K–$200K range could be achieved in the upcoming bull cycle. The analyst emphasized that investors who enter the market at current levels could see over 100% returns, provided Bitcoin reaches its predicted target by 2026.

However, he also noted that timing the market correctly is crucial, as buying at key support levels has historically presented the most favorable opportunities for long-term gains. Ibrahim wrote:

In summary, those investing in Bitcoin at these levels have the potential to gain over 100% in dollar terms without even waiting a year. Buying in the right regions and at the right times can present significant opportunities.

Short-Term Market Trends and Buying Opportunities

While long-term projections remain bullish, Bitcoin’s short-term price action continues to fluctuate. Another CryptoQuant analyst, BilalHuseynov, provided insights into open interest (OI) trends, which may indicate whether this is a favorable time to buy Bitcoin.

According to BilalHuseynov, the 7-day change in open interest has entered a “deleveraging” phase, a signal that has historically aligned with potential buying opportunities.

Related Reading

The last time this occurred was in August 2024, when Bitcoin was trading between $58,000 and $60,000 before rallying to an all-time high of $106K. If historical trends repeat, the current market conditions could set the stage for a similar recovery. The CryptoQuant analyst noted:

When the OI ratio’s change for 7 days down to the section, that means we can define the time to buy. Since August 2024, we have been observing one of the deepest areas in the Crypto Market. To remember, at this time (2024 Aug), Bitcoin’s price was around 58 – 60k. After that, the price goes up to ~106k.

Featured image created with DALL-E, Chart from TradingView

Source link

bybit

Bybit Ethereum (ETH) Reserves Steadily Recovering Following Massive Hack, According to CryptoQuant

Published

3 weeks agoon

February 24, 2025By

admin

Market intelligence platform CryptoQuant says that the Ethereum (ETH) reserves of Bybit are recuperating after the crypto exchange was hacked to the tune of $1.4 billion.

In a new thread on the social media platform X, Julio Moreno – CryptoQuant’s head of research – says that Bybit is seeing inflows worth over $390 million in ETH.

“Bybit’s ETH reserves are slowly recovering. The exchange has experienced positive net flows of 139,000 ETH since the hack.”

Previous reports indicate that the Singapore-based exchange suffered the biggest exploit in the digital assets industry when a bad actor took control of its ETH cold wallet, which stores keys offline.

According to recent data from the blockchain tracker Lookonchain, Bybit’s rapid recovery of ETH is being aided by other digital asset firms as well as crypto whales.

“Since being hacked, Bybit has received 145,879 ETH ($390 million) in loans and deposits. Whales withdrew 47,800 ETH ($127.56 million) from Binance to Bybit as loans.

Bitget transferred 40,000 ETH ($106 million) to Bybit as loans. Whale ‘0x3275’ transferred 20,000 ETH ($53.7 million) to Bybit as loans.

[The crypto exchange] MEXC transferred 12,652 stETH ($33.74 million) to Bybit as loans.

Whale ‘0xd7CF’” bought 15,427 ETH ($42.2 million) from CEXs (centralized exchanges) and DEXs (decentralized exchanges), then deposited it to Bybit.

A wallet suspected to be Fenbushi Capital deposited 10,000 ETH ($27 million) to Bybit.”

Furthermore, Lookonchain finds that Bybit itself purchased $197 million ETH via over-the-counter transactions.

Ethereum is trading for $2,808 at time of writing, a 1.5% increase during the last 24 hours.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: DALLE3

Source link

CryptoQuant

Ethereum Price Could Still Reclaim $4,000 Based On This Bullish Divergence

Published

4 weeks agoon

February 22, 2025By

admin

Opeyemi is a proficient writer and enthusiast in the exciting and unique cryptocurrency realm. While the digital asset industry was not his first choice, he has remained absolutely drawn since making a foray into the space over two years. Now, Opeyemi takes pride in creating unique pieces unraveling the complexities of blockchain technology and sharing insights on the latest trends in the world of cryptocurrencies.

Opeyemi savors his attraction to the crypto market, which explains why he spends the better parts of his day looking through different price charts. “Looking” is a rather simple way to describe analyzing and interpreting various price patterns and chart formations. However, it appears that is not Opeyemi’s favorite part – in fact, far from it.

Being able to connect what happens on a price chart to on-chain movements and blockchain activities is what keeps Opeyemi ticking. “This emphasizes the intricacies of blockchain technology and the cryptocurrency market,” he would say. Most importantly, Opeyemi thinks of any market insights as the gospel, while recognizing that he is only a messenger.

When he is not clicking away at his keyboard, Opeyemi is most definitely listening to music, playing games, reading a book, or scrolling through X. He likes to think he is not loyal to a particular genre of music, which can be true on many days. However, the fast-rising Afrobeats genre is a staple in Opeyemi’s Spotify Daily Mix.

Meanwhile, Opeyemi is a voracious reader who enjoys a wide category of books – ranging from science fiction, fantasy, and historical, to even romance. He believes that authors like George R. R. Martin and J. K.

Rowling are the greatest of all time when it comes to putting pen to paper. Opeyemi believes his reading of the Harry Potter series twice is proof of that.

Indeed, Opeyemi enjoys spending most of his time within the four walls of his home. However, he also sometimes finds solace in the company of his friends at a bar, a restaurant, or even on a stroll. In essence, Opeyemi’s ambivert (haha! been searching for an opportunity to use the word to describe myself) nature makes him a social chameleon who is able to quickly adapt to different settings.

Opeyemi recognizes the need to constantly develop oneself in order to stay afloat in a competitive and ever-evolving market like crypto. For this reason, he is always in learning mode, ready to pick up the slightest lesson from every situation. Opeyemi is efficient and likes to deliver all that is required of him in time – he believes that “whatever is worth doing at all is worth doing well.” Hence, you will always find him striving to be better.

Ultimately, Opeyemi is a good writer and an even better person who is trying to shed light on an exciting world phenomenon – cryptocurrency. He goes to bed every day with a smile of satisfaction on his face, knowing that he has done his bit of the holy assignment – spreading the crypto gospel to the rest of the world.

Source link

Bitcoin’s Road To $1M? Expect A ‘Dip Then Rip,’ Bitwise CIO Says

How Bitcoin ETFs And Mining Innovations Are Reshaping BTC Price Cycles

Bitcoin Hoarder Metaplanet Issues Fresh Bonds To Increase Holdings to 3,200 BTC

Pi Network coin to $10? 4 catalysts that may make it possible

XRP Jumps as Ripple CEO Brad Garlinghouse Says SEC ‘Case Has Ended’

3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

Index Rises 3.4% as All Assets Trade Higher

Sophisticated crypto address poisoning scams drain $1.2M in March

Dogecoin Shark & Whale Population Rises—Price Turnaround Incoming?

ECB Prepping The Ground For Digital Euro Launch

One Indicator Could Soon Signal New Bitcoin Breakout, According to Crypto Analyst

BMT crypto soars nearly 30% a day after Binance listing

EOS Token Spikes 30% as Network Rebrands to ‘Vaulta’

Why Is Tron Price Up 7% Today?

Lessons from the Bybit Hack

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Crypto’s Big Trump Gamble Is Risky

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

Trump’s Coin Is About As Revolutionary As OneCoin

Is $200,000 a Realistic Bitcoin Price Target for This Cycle?

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Trending

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin2 months ago

Bitcoin2 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News2 months ago

24/7 Cryptocurrency News2 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin4 months ago

Bitcoin4 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Altcoins2 months ago

Altcoins2 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin4 months ago

Bitcoin4 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Opinion4 months ago

Opinion4 months agoCrypto’s Big Trump Gamble Is Risky

Price analysis4 months ago

Price analysis4 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x