Guides

How to Use & Store Bitcoin Safely

Published

5 months agoon

By

admin

Ever since its 2009 development by the mysterious Satoshi Nakamoto, Bitcoin has become foundational to the cryptocurrency and fintech landscape. As the first decentralized cryptocurrency, Bitcoin has driven significant growth in blockchain technology, becoming the most visible and widely adopted coin on the market. With the ability to conduct seamless transactions on the blockchain, Bitcoin has been adopted as legal tender in some countries and embraced worldwide for a variety of uses.

Today, Bitcoin is used by people globally for various services. Notably, Bitcoin has gained adoption not only as legal currency in El Salvador but also for every day transactions—whether trading a pizza from Papa John’s or depositing funds at online casinos and sports betting websites.

Bitcoin’s value lies in its enhanced privacy, cryptographic security, and the development of encrypted wallets that ensure safe transactions on a global scale. Let’s dive into how Bitcoin works, how to use it, and the best ways to keep it secure:

What is Bitcoin (BTC) & How Does it Work?

Despite being around for more than a decade, newcomers may still wonder, “what is bitcoin?” Simply put, Bitcoin is a decentralized digital currency that operates independently of any central bank. Instead of relying on a traditional financial institution, Bitcoin transactions are verified by networked computers through a process known as mining, which involves solving complex mathematical problems. Once mined, Bitcoin can be transferred directly to others or used for purchases with bitcoin-accepting vendors, with each transaction recorded on a public ledger—the blockchain.

This decentralized, peer-to-peer system ensures that all Bitcoin transactions are transparent yet pseudonymous. Even though each transaction is publicly available on the blockchain, the identities of the transacting parties can remain private.

How to Use Bitcoin Online

Before first buying and using bitcoin, you will need to set up a wallet in which to store it. Here’s a simple guide to start using Bitcoin:

Set Up a Wallet: Choose a secure Bitcoin wallet for your needs. You’ll need both a public key (like an account number) for receiving funds and a private key (like a password) for authorizing transactions. Many hot wallets and cold wallets are available, each with its pros and cons for different users.

Find Vendors that Accept Bitcoin: Many online services and products now accept Bitcoin, although some may only accept other cryptocurrencies. Once you’ve found a vendor, you can use your wallet to send Bitcoin directly for goods or services.

Send Bitcoin to Other Users: Bitcoin transfers are similar to traditional bank transfers, though they remain independent of banks. Ask the recipient for their wallet address, then transfer funds directly to their wallet.

How to Store Bitcoin Safely

When using Bitcoin, securing your funds is critical. Here are key wallet types and best practices for safe Bitcoin storage:

Hot Wallets: These are digital wallets connected to the internet, such as mobile or web apps. Hot wallets are convenient for frequent transactions but are more vulnerable to cyber threats. When using hot wallets, consider diversifying to reduce risk.

Cold Wallets: Cold wallets, like hardware wallets, are offline storage solutions, ideal for long-term holdings. These wallets are disconnected from the internet, making them less accessible to potential hackers. While they’re more secure, they can be less convenient for immediate transactions.

Seed Phrases and Private Keys: When you set up a wallet, you’ll often receive a seed phrase—a recovery phrase that enables you to restore your funds if you lose access to your wallet. It’s essential to keep both your seed phrase and private key secure and offline. The public key can be shared with anyone for receiving Bitcoin, but the private key must remain private to ensure the safety of your funds.

Why You Should Use Bitcoin

There are many reasons why people choose to use Bitcoin, and here are some of the most popular benefits:

- Privacy and Decentralization: Bitcoin’s independence from central banks and financial institutions allows users to make private, pseudonymous transactions. This feature makes it an appealing choice for those looking to protect their financial privacy.

- Global Payment Solution: Bitcoin allows users to conduct transactions across borders without worrying about exchange fees. You’ll only need to pay a small transaction fee on crypto exchanges, with no need to exchange fiat currencies like dollars to euros.

- Wider Acceptance: With increased adoption, Bitcoin is now accepted by a growing number of companies and online platforms. Whether it’s for gaming on sites like Stake.com or making everyday purchases, Bitcoin’s utility continues to expand.

Bitcoin: The Future of Finance

Bitcoin offers a decentralized, secure method of conducting transactions that emphasizes user control, privacy, and a simplified financial process. As Bitcoin continues to grow in use and adoption, learning how to use and store it safely has never been more critical. Following these best practices can help you protect your assets and enjoy the benefits of this revolutionary digital currency.

Source link

You may like

Gold Is Still the Safe-Haven King, While Bitcoin Loses Out: JP Morgan

Dogecoin Price Breakout in view as Analyst Predicts $5.6 high

Bitcoin (BTC) Price in Standstill at $85K as Trump Increases Pressure on Fed’s Powell

Ripple acquisition Hidden Road secures FINRA registration

Ethereum Whales Offload 143,000 ETH In One Week – More Selling Ahead?

How Do We Protect Bitcoin From Quantum Computers? Not With A Joke

Bitcoin Payments

How Local Businesses Can Use Bitcoin For Payments

Published

2 months agoon

February 24, 2025By

admin

I. Introduction

Bitcoin is often praised as a long-term savings technology, but its role as a medium of exchange is just as important—especially for businesses. From local cafés to large corporations, more merchants are considering bitcoin as a payment option, drawn by its low fees, fast transactions, and ability to reach a global, young and tech savvy customer base.

This guide explores how local businesses can start accepting bitcoin, covering both the immediate benefits and long-term strategic advantages. As digital payments evolve, understanding Bitcoin’s potential isn’t just an option—it’s becoming essential for businesses looking to stay ahead.

II. Benefits of Accepting Bitcoin for Small Businesses

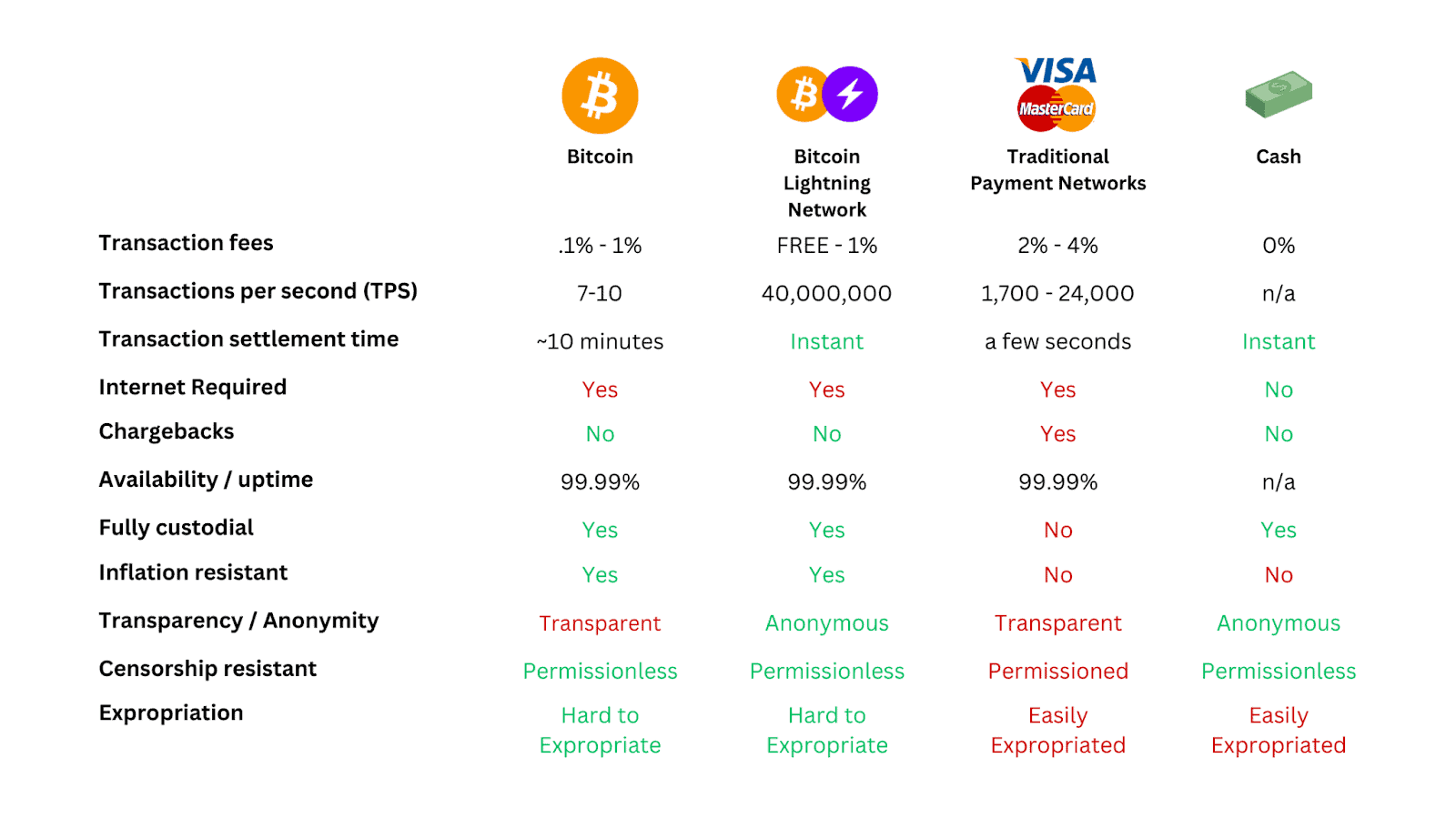

There are three main reasons for a small business to accept bitcoin:

- Grow revenue from energetic, tech-savvy, and potentially hugely loyal customers. Bitcoiners are often delighted to pay and tip in bitcoin, and they regularly travel far and wide just to visit and support local businesses that accept bitcoin.

- Save on fees: Fees for bitcoin payments are low and paid by the customers, so merchants can save 2-3% in credit card fees by simply accepting payments on one of Bitcoin’s second layers (e.g., Lightning or Liquid).

- Preserve value: Bitcoin serves as a long-term solution to inflation, preserving the value of earnings due to its fixed supply. While the bitcoin price is volatile in the short term, over a number of years this volatility has been up more than down, driving the price higher.

Some other benefits include:

- Banks are not needed: Bitcoin provides a global, decentralized banking solution, enabling secure and affordable transactions for everyone, anywhere, anytime.

- Instant settlement — no risk of chargebacks: On Bitcoin, settlements are final, which means that charges cannot be reversed. Online commerce now comes with guarantees for the business.

- Greater flexibility: Accepting bitcoin provides greater flexibility if and when the traditional payment system falters. Furthermore, many bitcoin payment tools allow the merchant the option to invoice in dollars and receive either bitcoin or dollars.

- Environmental benefits: Contrary to popular belief, Bitcoin is a net positive for the environment as the process of mining enhances energy companies’ efficiency and empowers the growth of renewables. As the industry leans towards sustainable energy sources, the carbon footprint of Bitcoin transactions is set to decrease.

III. Implementing Bitcoin in Business Operations

Every business, whether a cozy corner café or a sprawling enterprise, has its own unique needs when it comes to accepting payments. For that reason, it’s essential to understand how bitcoin could fit into your specific business: A café might find it perfectly suitable to use a simple mobile Bitcoin wallet for transactions, but larger businesses (or those seeking a polished and professional approach) might opt for a more comprehensive integration. Whatever your business size or aspirations, this guide is tailored to provide insights and steps to seamlessly incorporate bitcoin payments.

Step 1: Learn about Bitcoin

Before we dive in, it’s important to learn about Bitcoin and why it should become a vital part of your business. It’s more than just another payment method; it’s a groundbreaking new currency and a powerful monetary network. Adopting Bitcoin won’t just expand your payment alternatives but could also lower operational expenses.

The Bitcoin network is the world’s most secure computer network. It’s an unchangeable, censorship-resistant, immutable, global network of value which is beyond the purview of governments and conventional banking systems. Furthermore, it boasts a limited supply of twenty-one million coins — each divisible into smaller units, marking the advent of a genuinely limited and robust currency. Notably, bitcoin is a bearer asset, which means that those who hold bitcoin possess the actual asset, not just a debt or an IOU as is the case with fiat bank accounts.

Read more >> What is Bitcoin & Why Does it Have Value

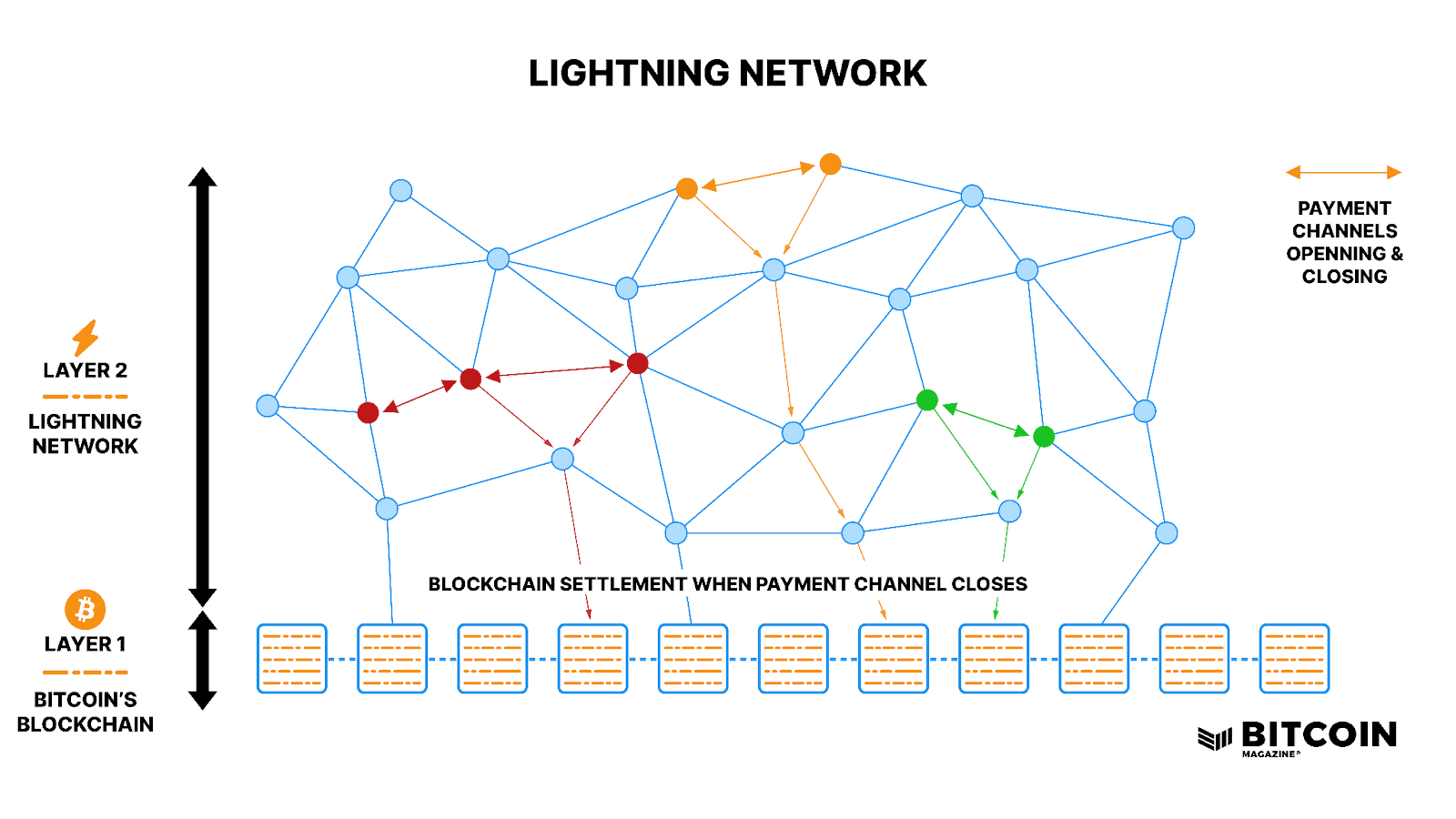

Step 2: Understand Transaction Layers

Layer 1 (High security and settlement in minutes)

Bitcoin’s base layer is a triple-entry ledger accounting system (timestamp server) where transactions are timestamped, irreversible, publicly verifiable, and secured by nodes and hash power. This makes it the most secure financial settlement network ever created.

With settlement roughly every 10 minutes, Layer 1 is best suited for high-value transactions where instant finality isn’t required—such as buying a car, settling invoices, or large business payments.

Layer 2 (Medium security, with settlement in seconds)

The Lightning Network enables near-instant bitcoin transactions without compromising the security of the base layer. Operating as a second-layer protocol, it allows users to transact off-chain while remaining secured by Bitcoin’s triple-entry accounting system. When a channel is opened, funds are locked into the base chain, and from that point, transactions occur off-chain as state updates between channel participants—similar to an abacus keeping track of balances. The base chain remains unaware of these transactions until a channel is closed, at which point the net result is settled on-chain. With settlement speeds faster than Visa or Mastercard, Lightning is ideal for everyday payments in cafés, retail shops, and beyond.

Now that we understand the layers, let’s talk about wallets.

Step 3: Choose a Bitcoin Wallet

Accepting Bitcoin without proper security measures is counterproductive. Wallets function as digital safes for bitcoin, ensuring its security and facilitating transactions by generating Bitcoin addresses.

Businesses transacting in Bitcoin should prioritize self-custody. While some might consider entrusting their bitcoin to third parties, it’s important to be aware of the associated risks. Should a third party mismanage your bitcoin or become insolvent, your business will lose its bitcoin; bitcoin held with a third party isn’t your bitcoin.

Instead of relying on third parties, businesses should use a cryptographically secure Bitcoin wallet. Various wallets support both transaction layers, capable of generating unique Bitcoin addresses for transactions on either layer.

Businesses should store bitcoin for the long term in a layer-1 hardware wallet or a multisig wallet. Sending bitcoin from a Lightning software wallet to a Bitcoin hardware wallet is relatively straightforward. We recommend keeping less than a month’s worth of bitcoin in a Lightning or hot wallet.

- Hardware Wallets are available for layer 1 only. They are typically small hardware devices similar in size and form to a USB drive. They only connect to the internet when connected via USB or Bluetooth, therefore they are considerably more secure.

- Multisig Wallets are a specialized type of Bitcoin wallet that necessitates the approval of multiple private keys for transactions. These keys can be distributed among senior staff members and directors. For instance, in a 2-of-3 or 3-of-5 setup, the bitcoin can only be transferred if two out of three (or three out of five) keys authorize the transaction. This security measure ensures that no single individual has unilateral control over the stored bitcoin.

Step 4: Point of Sale (POS) Payment Solutions

When deciding on a payment solution for Bitcoin transactions, you should determine if a simple wallet is adequate or if it’s necessary to use a specialized payment app.

Option 1: Use a Basic Lightning wallet

Lightning wallets are primarily designed for personal use and not for commercial transactions. That said, some provide a light-touch POS solution and as such serve as an introductory tool for businesses to familiarize themselves with bitcoin payments.

To proceed, simply download a Lightning wallet from the Android or App Store.

- Wallet of Satoshi, a well-known Bitcoin Lightning wallet, introduced a point-of-sale system in 2023. It’s a simple and convenient wallet to use, making it accessible to almost any user. However, Wallet of Satoshi is a custodial wallet, so the company holds the private keys on behalf of its users, meaning you don’t have full control of your bitcoin while it’s on the app. If your intention is to utilize the Lightning network for more extensive transactions beyond small tips or the occasional $1 bitcoin purchases, opting for a non-custodial Lightning network wallet is a more prudent choice. (WoS is not available in the USA.)

- Blink, another well-known Bitcoin wallet (formerly known as “Bitcoin Beach Wallet”) has merchant features that make it easy and flexible for businesses to receive payments over Lightning and on-chain, including LN address, a Lightning cash register, and a printable pay code. Payments can be received in bitcoin and stablesats (a proxy for USD). Finally, transactions can be exported via a CSV file for record keeping.

We recommend upgrading from simple Lightning wallets should the amount of bitcoin received begin to grow, as basic wallets introduce a number of minor challenges that are easily overcome with a more customized solution.

Option 2: Use a Bitcoin Point-of-Sale app

Specialized payment apps should be the preferred solution for local businesses as they provide a plethora of features necessary to run a business.

- Labeling: Without labels, payments are received without any descriptive context, creating unnecessary accounting challenges.

Transaction with labeling: “2023-08-24: Coffee – Latte – $3 – Invoice #12345”

Transaction without labeling: 2023-08-24 – XYZ123 – $3”

- Address reuse: If a merchant consistently uses a single wallet address for transactions, savvy customers can trace that address on the open Bitcoin network and view the total funds received. To maintain privacy it’s advisable not to reuse addresses, which specialized payment apps can help with.

Note: While payment processors don’t address the risks associated with zero-confirmation transactions, the Lightning network does. Accepting payments without network confirmations, known as “zeroconf,” can lead to potential double-spending issues.

All that’s required is a mobile phone loaded with one of the following apps, which can be downloaded from the Google Play Store or the App Store.

- Breez requires nothing more than a cell phone and is instantly operable as a non-custodial Lightning POS terminal. Retailers can easily add items in the app, create a manager password, print a receipt, and send funds out to an on-chain address if needed.

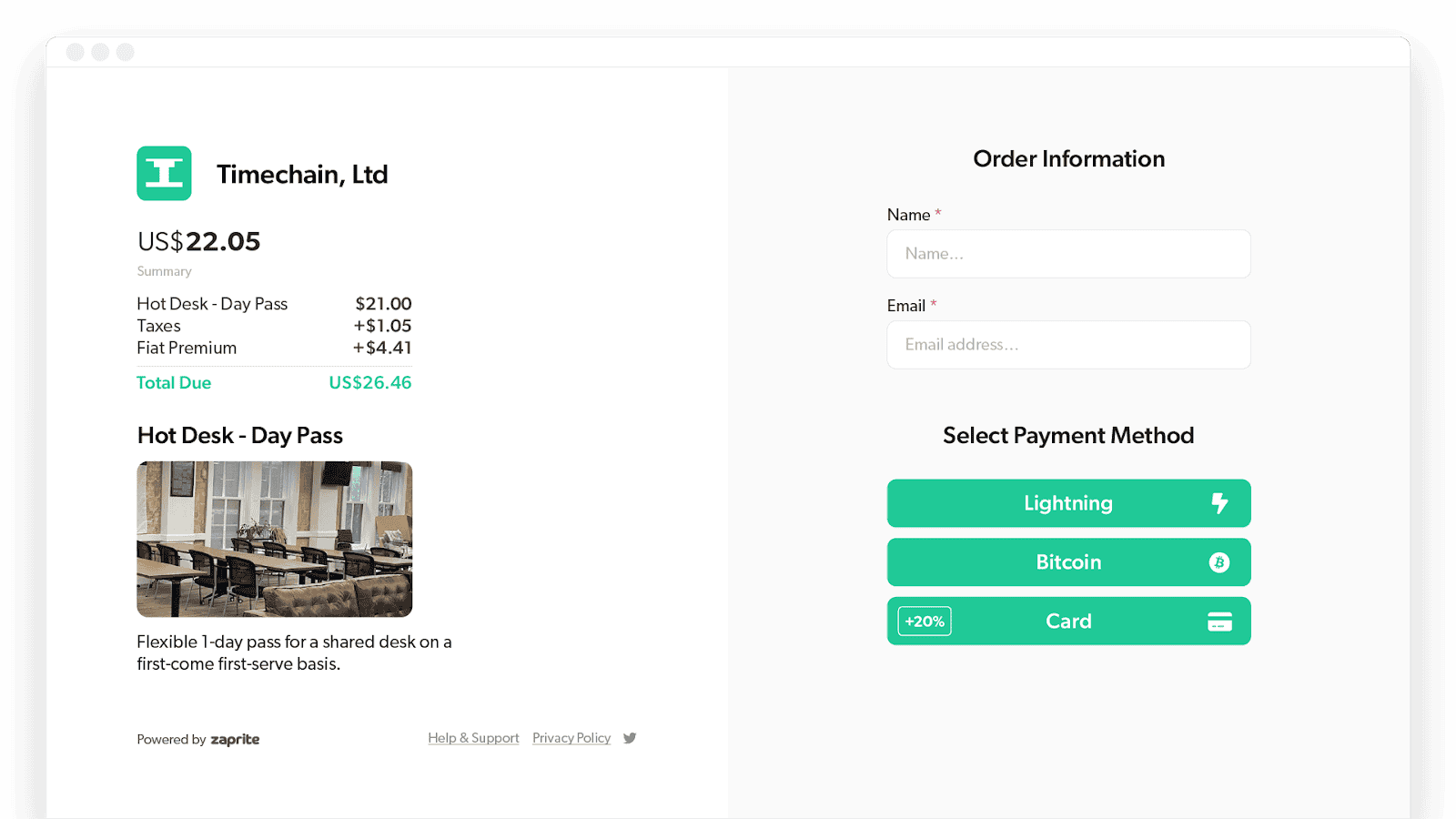

- Zaprite offers a POS-like experience, allowing merchants to accept bitcoin payments in person with ease. Service-based merchants can set up tip pages, enabling customers to leave gratuities in bitcoin. Fiat payments are accepted by connecting payment gateways such as Stripe.

- Coinos is a user-friendly Bitcoin web wallet designed for both individuals and merchants. It emphasizes non-custodial solutions, allowing users to maintain full control over their funds with the flexibility to withdraw anytime. It caters to merchants seeking efficient retail transactions.

- Opago allows small merchants around the world to accept bitcoin in a fast, easy, and secure way by giving access to the Lightning network in their own custom POS terminals. Opago provides a merchant dashboard that details all transactions and provides a rather useful tax reporting feature — particularly for EU merchants. The fee is 1% for all transactions processed through the POS terminals, which cost €99 to buy.

- Bitcoin Suisse Pay is an easy-to-set-up, KYC-free solution. Business owners have the option to choose to instantly receive bitcoin in their preferred Bitcoin wallet or to auto-convert bitcoin to euro and receive the payments the following day in the selected bank account. Each account has one primary device and any number of “receive only” devices, which is suitable for business owners to allow employees to receive payments on their phones, without being able to access the funds. Watch their 90-second promotional video.

- Coin Corner: Checkout offers a simple Bitcoin payment solution. With CoinCorner Checkout, businesses can accept bitcoin payments in-store, online, or via email invoicing. Fees are just 1% and when accepting bitcoin, merchants can either hold BTC or convert instantly to EUR which removes any risk of price volatility. Although CoinCorner can hold bitcoin on behalf of businesses, they do allow recurring Lightning payments to the merchant’s personal wallet should they wish to take custody.

- In VoltPay, merchants can set a tip, but the customer doesn’t get to choose. You can create an inventory of products within the app, which can be useful for a small café with a limited number of products. All payment invoices are visible in the invoices tab. The app can export a spreadsheet of transactions and withdraw bitcoin to a wallet manually.

- Flash is a streamlined Bitcoin point-of-sale solution that leverages the Lightning network for rapid, secure, and cost-effective transactions. The app features a user-friendly interface that generates detailed, labeled invoices while safeguarding privacy by avoiding address reuse.

These setups can be enhanced by using a dedicated phone embedded in an NFC-enabled POS terminal, loaded with any of the necessary apps listed above. These terminals are better than using just a phone, as the customer can see clearly where to tap their phone or Bolt Card to pay for a transaction.

Option 3: Use an enterprise POS solution

- IBEX Pay specializes in offering enterprise payment solutions over the Lightning network. IBEX Pay allows retailers to assign specific wallet addresses, currencies, and terminals with different branches. Each branch can then use the associated IBEX Pay app to receive payments. IBEX Pay allows retailers to determine whether they wish to receive the payment entirely in bitcoin, dollars, or a mix of both.

- BTCPay Server is a self-hosted, open-source cryptocurrency payment processor designed for businesses. It emphasizes security, privacy, and censorship resistance, allowing businesses to accept bitcoin payments with zero fees and without relying on third-party services. The platform offers essential built-in apps, including a POS app for physical stores and invoicing tools for smoother bookkeeping. While it integrates with e-commerce platforms, its primary value for retail businesses lies in its direct payment processing capabilities and native wallet management. The onus is on the operator to manage the liquidity of channels (in and out) in order to make and receive payments.

- OpenNode provides a comprehensive Bitcoin payment solution tailored for businesses. It facilitates lightning-fast, low-cost Bitcoin transactions through its robust API, e-commerce plugins, and hosted payment pages. Merchants can accept Bitcoin payments and opt for automatic conversion to receive local currencies like EUR, GBP, and USD. OpenNode ensures instant settlements via the Lightning network and offers protection against price fluctuations by allowing automatic bitcoin-to-fiat conversions. Additionally, the platform emphasizes security, eliminating concerns of fraud and chargebacks, and promotes global reach with its cross-border payment capabilities.

Option 4: Are legacy POS solutions available?

Most legacy point-of-sale (POS) systems do not yet support native Bitcoin payments, as traditional payment processors remain heavily tied to the fiat banking system. However, some providers are beginning to experiment with Bitcoin integration, recognizing the growing demand from businesses and consumers.

As demand increases, more traditional POS providers will likely integrate Bitcoin payments, but for now, merchants must use workarounds or hybrid setups to accept Bitcoin while still using their existing systems.

Step 5: How to Process a Transaction

A. Brick and Mortar Payments

Whether you’ve opted for a simple Lightning wallet, or a POS app, the process to accept payments is more or less the same.

1. Customer places an order: When a customer orders a coffee or any other item, tally the total cost in your local currency as you would for any other transaction.

2. Generate a Bitcoin invoice: Using your payment app, put in the total dollar amount of the order. The app will automatically convert this amount into its equivalent in bitcoin or satoshis (fractions of a Bitcoin) based on the current exchange rate.

3. Display the payment prompt: Once the invoice is generated, your app will display a QR code or activate an NFC instance for the customer to scan or tap with their phone.

4. Customer initiates payment: The customer will open their Lightning-enabled wallet app on their phone. They will then either:

a. Scan the QR code displayed on your device, or

b. Tap their phone against yours if both devices support NFC.

c. Alternatively, if the customer has a Bold Card (Bitcoin NFC card), they can tap that against your device.

5. Payment verification: Once scanned or tapped, the customer’s wallet app will display the payment details, including the amount in bitcoin/satoshis and the merchant information (i.e., your café). The customer should verify that the amount and details are correct.

6. Customer approves the transaction: After verifying the payment details, the customer will be prompted to confirm and accept the transaction on their app. They’ll click or tap the “Accept” or “Confirm” button.

7. Transaction confirmation: Your payment app will instantly receive the payment and notify you of a successful transaction. The Lightning network ensures that this process is quick, often within seconds.

B. Invoicing

Zaprite, CoinCorner Checkout, and Bitcoin Suisse Pay are services that allow anyone to create customized invoices that can be paid with bitcoin or even a bank transfer. The beauty of using such solutions is that the invoice can be issued in dollars, paid in dollars, and still be received in bitcoin. They need not ever know that bitcoin is being transacted; the payer need not even know the payee received bitcoin.

C. E-commerce Integration

For businesses with an online presence, integrating bitcoin payments can be seamless with solutions like Zaprite, BTCPay Server, OpenNode, Flash, CoinCorner Checkout, or Bitcoin Suisse Pay.

Shopify also supports Bitcoin payments through third-party integrations like BTCPay Server, and OpenNode. Merchants using Shopify can easily add these payment processors to their stores, allowing customers to pay in Bitcoin while keeping checkout smooth and familiar.

Step 8: Educate Staff and Stakeholders

Like any new technology or system adopted by a business, proficiency is critical to leverage its full potential and ensure seamless integration into existing workflows. Stakeholders need to learn about Bitcoin, so as to not make uninformed or rash decisions about the business and its Bitcoin implementation.

Meanwhile, staff members are at the forefront of daily operations, and their ability to manage Bitcoin transactions effectively will directly impact customer satisfaction and the company’s reputation. Simply put, adequate knowledge safeguards the company’s assets, maintains trust with its clientele, and guarantees that the decision to adopt bitcoin yields the desired advantages. Further, using a solution like Bitwage or CashApp, your staff can be paid in bitcoin, which may lead them to view the company as forward-thinking and progressive in nature. It may also give them the sense of having a vested interest in the business and value their work more.

Step 9: Accounting and Tax Considerations

It’s critical to be aware of the tax implications and accounting requirements when dealing with bitcoin. Regularly consulting a financial advisor or accountant familiar with cryptocurrency can ensure compliance and proper reporting. In the USA, the Financial Accounting Standards Board (FASB) has allowed fair value accounting from 2024. So businesses based in the USA can mark their treasury up or down on their books accordingly.

In most jurisdictions, taxation only applies when the asset is being sold. So a reasonable goal for most small businesses could be (at least in the early stages) to stack a small percentage of bitcoin that will appreciate in value over time. It’s important to keep a record of transactions so that capital gains can be calculated accurately in due course.

Should a business have tight cash flows, then it would be useful to keep the volume of bitcoin received low, which can be done by setting up the payment app to receive payments mostly in dollars.

Disclaimer: This article, including any advice and information contained herein, is provided for general informational purposes only and should not be construed as tax advice. Bitcoin Magazine and the author are not offering tax advice to readers. Tax laws and regulations are complex and subject to change, which can materially impact investment results. Readers should consult their own tax advisor or accountant to understand the tax implications of their investments and financial decisions.

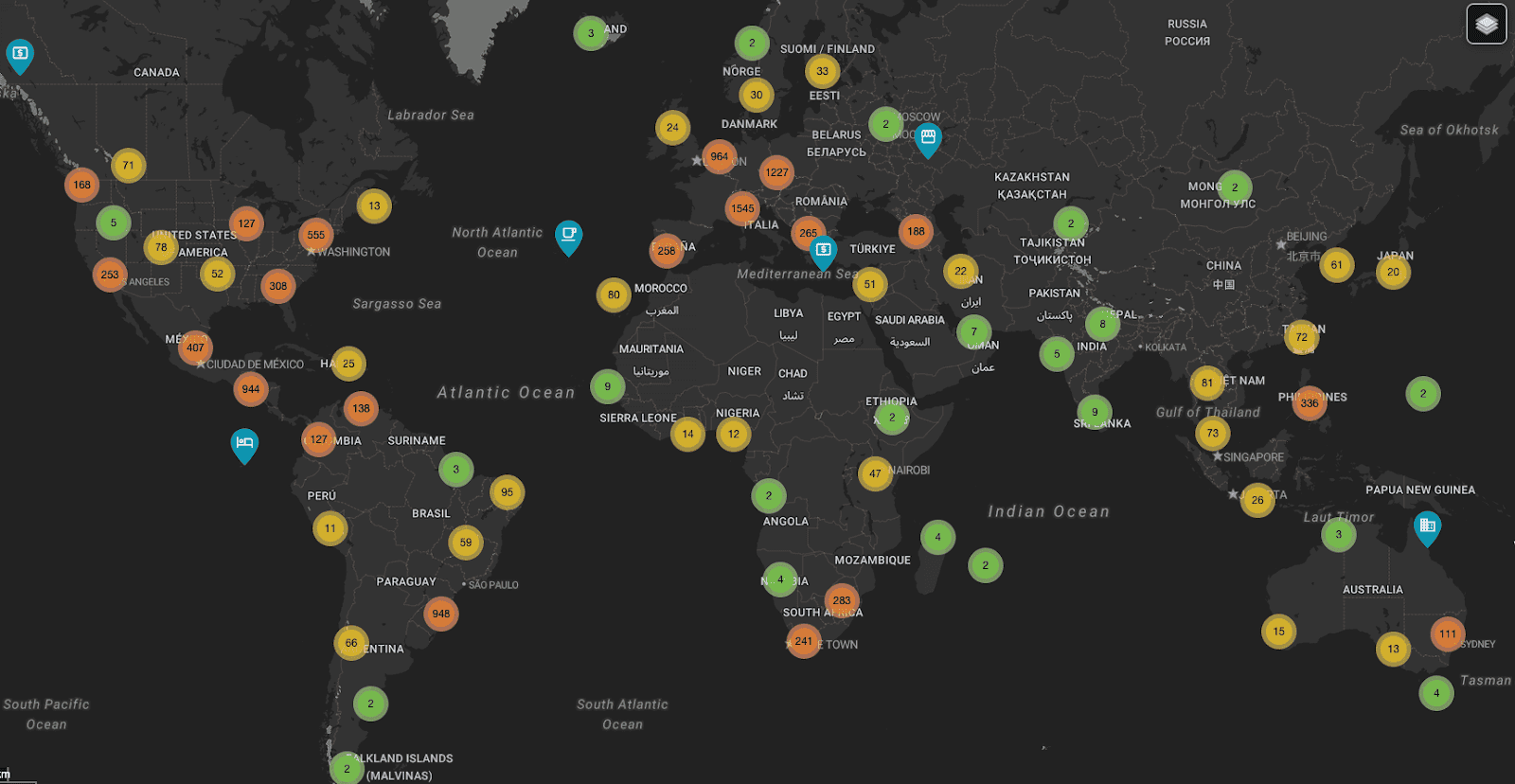

Step 10: Bitcoin Accepted Here

Let everyone know you accept bitcoin. At the very least, display a sticker or sign at the checkout to signify that bitcoin is a valid payment method. Additionally, placing a sign on your shop’s window or exterior wall can attract the attention of passers by, especially Bitcoiners.

Collaborate with local Bitcoin enthusiasts and join Bitcoin meetups to promote your services within the local Bitcoin community. Consider contacting local bloggers and/or media to create a local PR campaign, which would inform the broader community about this alternative payment option. Making payments in bitcoin more attractive than dollars would also be hugely advantageous to businesses, assuming the margins are not already too thin. A business that can build bitcoin reserves should benefit greatly from its long-term appreciation.

The above image is a snapshot of BTC Map, 2024.

Of course, you should add your business listing to Satmap and BTC Map, so that your business is noticeable to potential visitors from around the world.

IV. Challenges and Considerations

Bitcoin is young: Bitcoin is still in its nascent stages. Drawing parallels to the early days of business websites, it should be considered an addition to traditional payment systems, not a replacement. The benefit of accepting bitcoin early is better than having a business website in the ’90s. By receiving bitcoin and adding it to your company’s treasury, your business benefits from its price appreciation relative to traditional currencies. Companies like Newegg, Starbucks, Microsoft, Bed & Beyond, Tesla and much more recognize the benefits and accept payments.

POS hardware solutions like Clover, Toast, and Square will integrate bitcoin in due course, if they haven’t already done so. Until then, the onus is upon small businesses to learn about bitcoin and implement a solid solution for their business.

Price volatility: Bitcoin’s price can be volatile. However, with strategies like immediate conversion or fund splitting, businesses can mitigate potential risks.

Security protocols: Adopting best practices for securing bitcoin assets and transactions is crucial to prevent potential breaches.

Regulatory landscape and taxation: Staying updated with regulations and tax laws is essential to ensuring compliance. In most jurisdictions the taxing authorities treat bitcoin as an investment subject to capital gains tax. We recommend talking to your accountant or tax advisor on how tax would be applied to any bitcoin you receive.

Source link

Encryption

How To Use PGP For Enhanced Privacy And Powerful OPSEC

Published

2 months agoon

February 23, 2025By

admin

In today’s world of constant surveillance and daily data breaches, it’s never been more important to take control of your own privacy. Whether you’re protecting your emails, securing sensitive files, or just trying to keep nosy governments and cybercriminals at bay, one of the most effective tools at your disposal is PGP (Pretty Good Privacy). For anyone dealing with bitcoin or any kind of sensitive information, PGP isn’t just useful—it’s essential.

In this article, we’ll dive deep into what PGP is, why you need it, and most importantly, how you can start using it today. By the end, you’ll not only understand PGP but also be ready to use it like a pro.

Why Should You Use PGP?

You might be asking yourself, “Why should I use PGP? I don’t have anything to hide.” But that’s missing the point entirely. Privacy isn’t about hiding things you’re ashamed of—it’s about protecting yourself from those who would misuse your information.

Let’s take a look at some of the key reasons why you should consider using PGP:

1. Emails Aren’t as Private as You Think

The U.S. Supreme Court has ruled that emails are private, but the reality is far from reassuring. In practice, emails are often weakly protected, and encryption is the only way to ensure that your communications remain private. Imagine your email “security” as a door locked with a cheeto instead of a proper deadbolt—technically locked, but not actually secure.

PGP fixes this by encrypting your emails, ensuring only the intended recipient can decrypt and read them.

2. Protect Yourself From Hackers and Cybercriminals

Cybercrime is at an all-time high. Hackers constantly look for ways to access private communications, personal data, and even financial records. PGP can safeguard your communication about transactions, wallets, and passwords from prying eyes. Even if you’re not dealing with bitcoin, cybercriminals can leverage your personal details in identity theft or blackmail.

3. Keep Your Personal and Professional Life Separate

Whether it’s workplace politics or family drama, you probably don’t want certain people snooping through your private messages. PGP ensures that sensitive information—be it personal or professional—remains private and secure, protecting you from prying eyes.

4. Freedom from Government Surveillance

One of the strongest reasons to use PGP is to protect yourself from government surveillance, as revealed by Edward Snowden and Julian Assange. Snowden’s 2013 leaks exposed how agencies like the NSA collect massive amounts of data on everyone—not just criminals—by tapping into tech giants like Google and Facebook. PRISM and other programs made it clear that no one’s data was safe from government eyes.

Julian Assange’s work with WikiLeaks further highlighted how governments use private information against citizens without their knowledge, sparking global concerns over privacy rights. The idea that “if you have nothing to hide, you have nothing to fear” is flawed. As Snowden famously said, “Saying you don’t care about privacy because you have nothing to hide is like saying you don’t care about free speech because you have nothing to say.”

5. Privacy Is Not a Crime

One of the most common arguments against using encryption tools like PGP is, “Why bother if you’re not doing anything illegal?” But this thinking is dangerous. You shouldn’t have to give up your privacy just because you’re following the law. Privacy is a fundamental human right, and it protects you from a host of dangers—like intrusive governments, malicious hackers, or even people in your own social circle who would use your private information against you.

How Does PGP Work?

Now that you understand PGP’s importance, let’s get into how it actually works. The magic of PGP lies in its use of public-key cryptography, a sophisticated form of encryption that allows secure communication between two parties without them having to share a private key beforehand.

Here’s how it works in simple terms:

- Public and Private Keys: When you set up PGP, you generate a pair of keys—a public key and a private key. These two keys are mathematically linked, but while the public key can be shared with anyone, the private key is kept secret and known only to you.

- The public key is used by others to encrypt messages that are sent to you.

- The private key is used by you to decrypt those messages.

- Encryption: When someone wants to send you an encrypted message, they use your public key to lock the message. Once the message is encrypted, it can only be unlocked by your private key, ensuring that only you (and no one else) can read it.

- Digital Signatures: PGP also provides a system for verifying the identity of the person sending a message. This is done through digital signatures. When you send a message, PGP creates a unique signature using your private key. The recipient can then check this signature against your public key to verify that the message is really from you and hasn’t been altered in transit.

A Real-World Example of PGP Use

Imagine you’re a journalist covering a controversial topic (or any topic that’s not government “approved”), and you’re communicating with a confidential source. You don’t want your emails intercepted by hackers or government agencies. By using PGP, you can send encrypted emails to your source, ensuring that only they can read your messages. Additionally, your source can use PGP to send encrypted replies, keeping both sides of the conversation private.

This is precisely the kind of privacy protection that whistleblowers like Edward Snowden have relied on to expose government wrongdoing without fear of immediate detection.

How to Get Started with PGP

Alright, enough theory. Let’s talk about how you can actually start using PGP. There are a few different tools out there that allow you to use PGP, but we’ll focus on two options: Keybase and Kleopatra. Both are great, but they cater to different users.

1. Keybase.io: The User-Friendly Option

If you’re new to PGP and want something simple, Keybase.io is the way to go. It’s a free, easy-to-use platform that integrates PGP encryption with a sleek interface, making it accessible for beginners. Plus, it works on all major platforms—Windows, Mac, iPhone, Android, and Linux—so you can use it no matter what device you’re on.

Here’s how to set it up:

- Go to Keybase.io and download the version that fits your device.

- Install the software and create an account.

- Choose a username (this can be anything, so feel free to go anonymous if that’s your style).

- Skip adding your phone number and email if you want to maximize privacy.

- Set up your public and private keys through Keybase. It’s a seamless process that the software handles for you.

Now you’re ready to encrypt your emails, messages, and files with ease. You can also use Keybase to verify identities through digital signatures, ensuring that any encrypted message you receive really came from the person it says it did.

Pros of Keybase:

- It’s pretty easy to use.

- It works on all major platforms.

- Key management and identity verification are simple to use.

Cons of Keybase:

- Keybase was acquired by Zoom, which does raise some privacy concerns. Zoom has been criticized for its connections to China and its checkered history with security and privacy issues. While Keybase remains a solid tool, you might want to consider these concerns if you’re extra cautious about your privacy.

2. Kleopatra: The Power User’s Tool

For those who want more control over their encryption, Kleopatra (part of the Gpg4win suite) is an excellent option. While it’s a bit more complex than Keybase, it gives you more granular control over your encryption and is perfect for advanced users.

Setting up Kleopatra is straightforward but requires a bit more manual configuration. Here’s a basic guide to get started:

- Download the Gpg4win suite from Gpg4win.org.

- Install the software and follow the prompts to generate your public and private keys.

- Kleopatra also offers key management, making it easier to import and export keys for your contacts.

- You’ll need to manually integrate PGP encryption into your email client, but the security benefits are well worth the effort.

Pros of Kleopatra:

- More control over your encryption settings.

- Great for power users who want higher customization.

- Built-in key management system.

Cons of Kleopatra:

- Not as user-friendly as Keybase.

- No mobile support, so it’s best for desktop use.

Why You Should Start Using PGP

PGP isn’t just a tool for technologists or privacy fanatics—it’s for anyone who values their freedom and security in a world where everything is increasingly monitored and vulnerable to attack. With government surveillance at all-time highs and cybercriminals becoming more sophisticated by the day, protecting your communications is no longer optional.

By using PGP, you can take control of your privacy, secure your personal and professional communications, and protect yourself from anyone who might want to use your information against you. Whether you’re a journalist, a bitcoin user, or just someone who values privacy, PGP is a powerful, time-tested tool that should be part of your everyday digital toolkit.

So, what are you waiting for? Take the plunge, set up PGP, and start enjoying the peace of mind that comes with knowing your communications are safe from prying eyes. Privacy isn’t a crime—it’s your right.

Source link

Guides

Maximizing Bitcoin Accumulation – Beyond the Benchmark

Published

5 months agoon

November 27, 2024By

admin

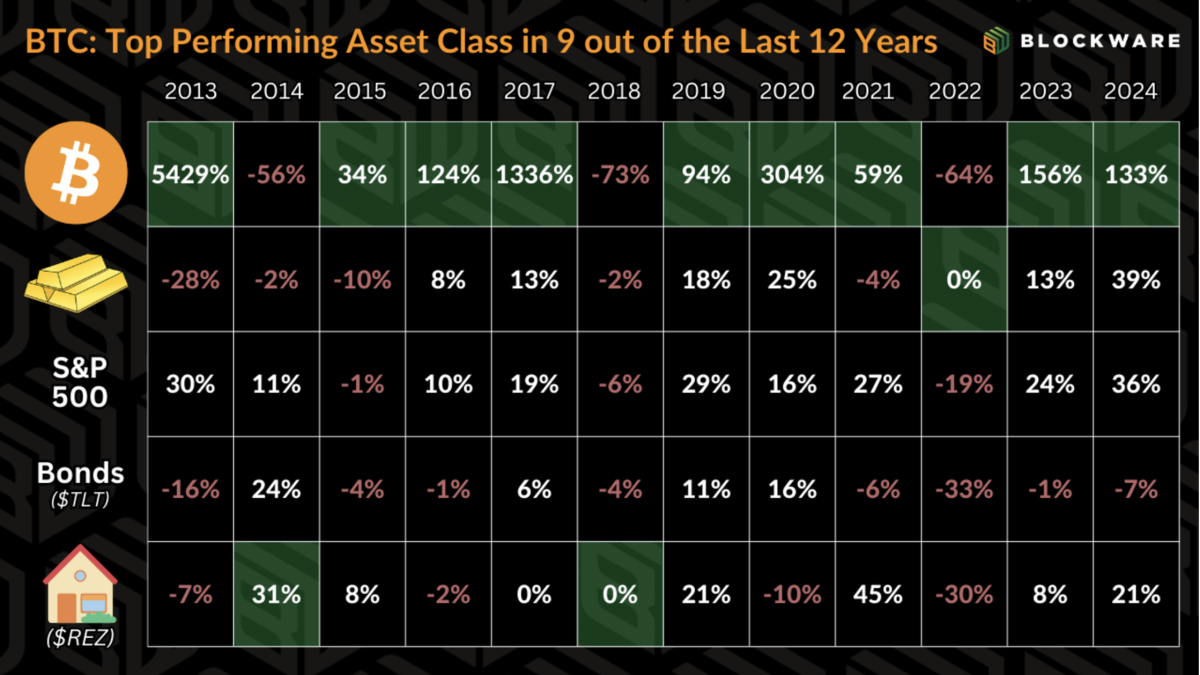

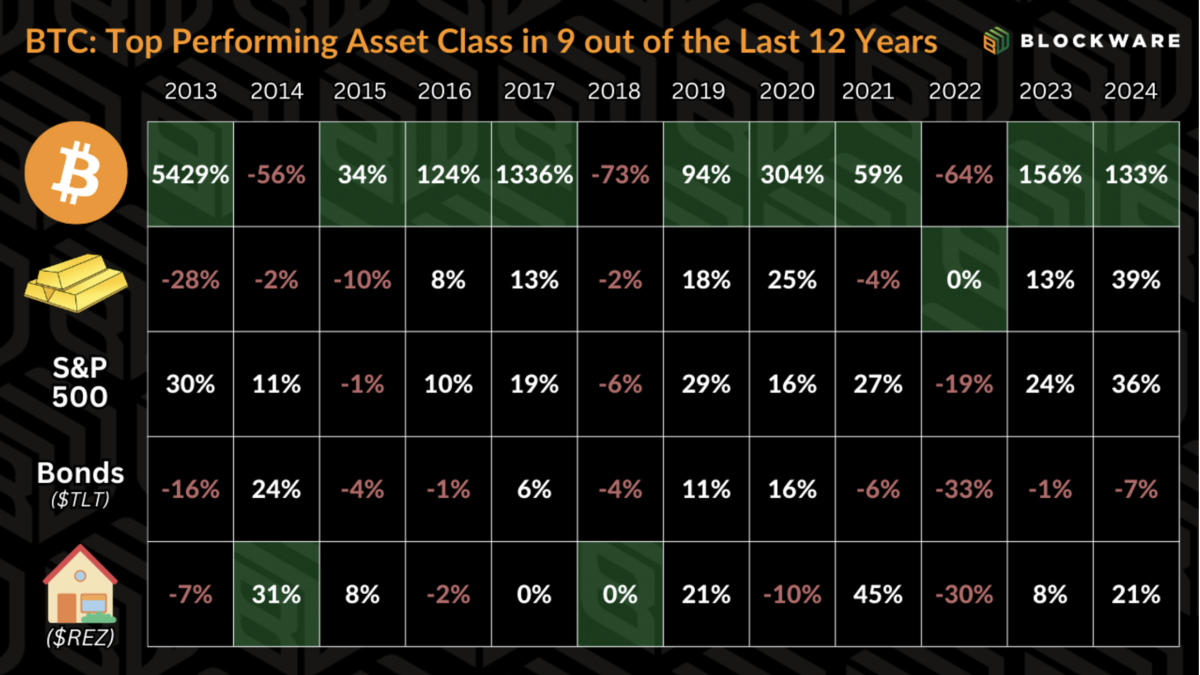

Bitcoin has consistently outperformed all major asset classes over the past decade, solidifying its role as the benchmark for digital asset investors. For those committed to Bitcoin’s long-term vision, the ultimate financial goal often shifts from acquiring more dollars to maximizing their Bitcoin holdings.

Bitcoin is the Hurdle Rate

Bitcoin is to digital assets what treasury bonds are to the legacy financial system—a foundational benchmark. While no investment is without risk, Bitcoin held in self-custody eliminates counterparty risk, dilution risk, and other systemic risks common in traditional finance.

With BTC outperforming every other asset class in 9 of the past 12 years (by orders of magnitude), it’s no surprise that it has usurped treasury bonds as the “risk free rate” in the minds of many investors – especially those knowledgeable about monetary history and thus the appeal of Bitcoin’s verifiable scarcity.

Another way to phrase this would be that the financial objective of digital asset investors is to acquire more BTC rather than acquire more dollars. All investments or spending are viewed through the lens of BTC being the opportunity cost.

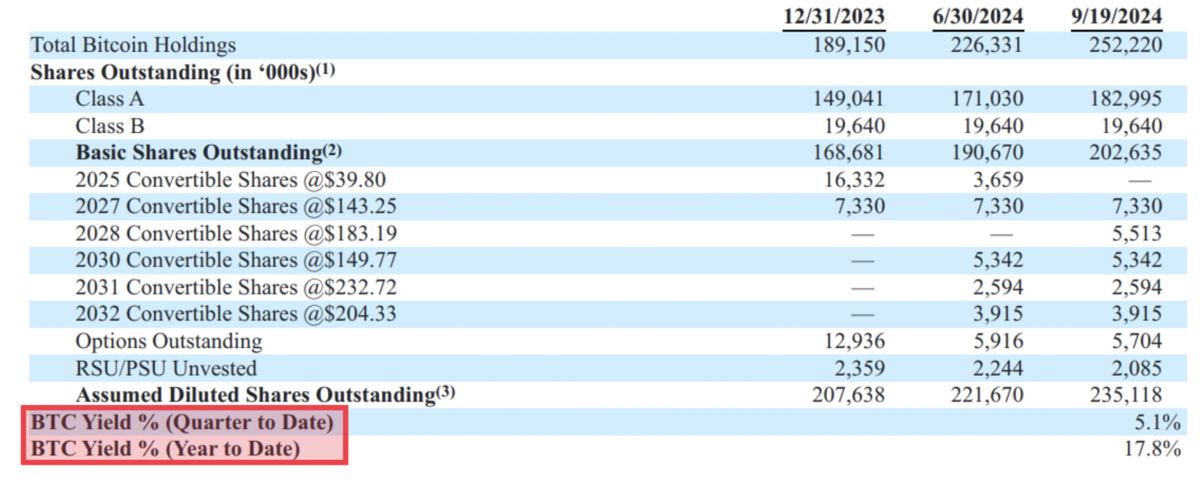

MicroStrategy has demonstrated what this looks like in the corporate world with their new KPI: BTC Yield. To quote from their September 20th, 8-K form: “The Company uses BTC Yield as a KPI to help assess the performance of its strategy of acquiring bitcoin in a manner the Company believes is accretive to shareholders.” MicroStrategy has taken full advantage of the tools available to them as a multi-billion dollar public company: access to low interest rate debt and the ability to issue new shares. This KPI shows that they are acquiring more BTC per outstanding share despite the fact that they are engaging in the traditionally dilutive activity of new share issuance.

Mission accomplished: they are acquiring more bitcoin.

But MicroStrategy has an advantage that the average fund manager or retail investor does not: they are a publicly traded company with the ability to tap into capital markets at little to no relative cost. Individual holders are unable to issue shares into the public market in order to raise capital and acquire BTC. Nor can we issue convertible notes and borrow dollars at a near zero % interest rate.

So that begs the question: how can we accumulate more bitcoin? How can we have a positive ‘BTC Yield’?

Bitcoin Mining

Bitcoin miners acquire BTC by contributing computational power to the Bitcoin network, and receiving a greater amount of BTC than what it costs in electricity to operate their machine(s). Now this is easier said than done. The Bitcoin protocol enforces a predetermined supply schedule using “difficulty adjustments” – meaning that more computational power dedicated towards Bitcoin mining results in the finite block rewards getting split up into smaller pieces.

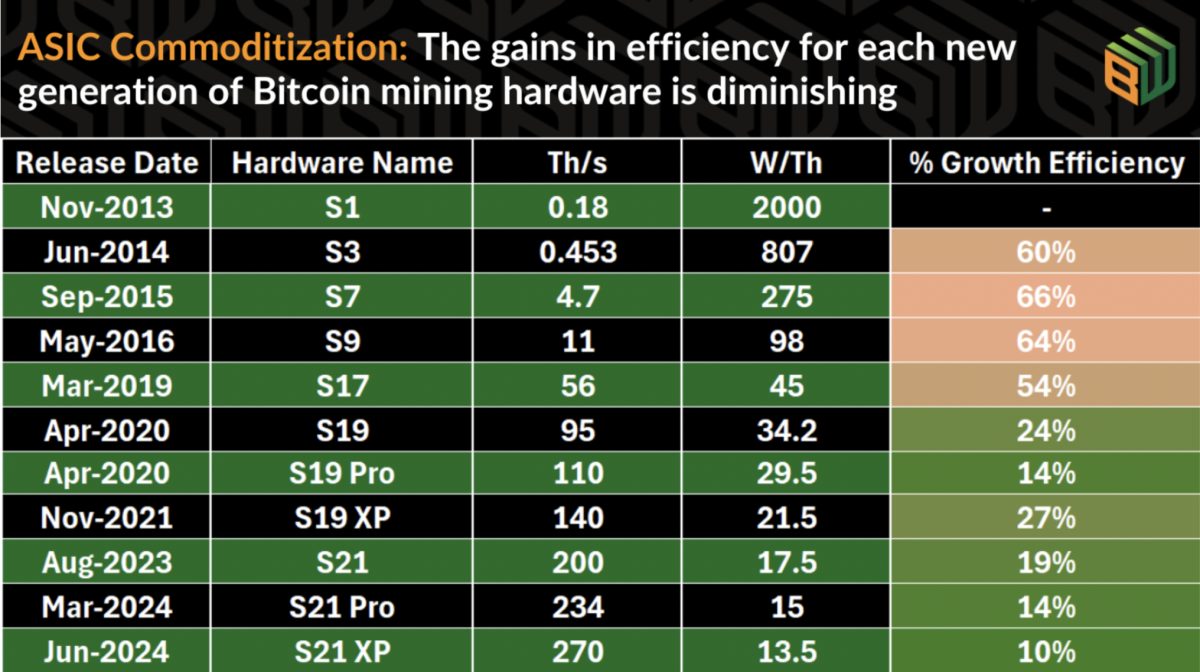

The most effective Bitcoin miners are those that maximize their computational power while minimizing their operational costs. This is accomplished by acquiring the latest, most-efficient Bitcoin mining hardware, and operating with the lowest possible electricity rate.

Under current market conditions (as of 11/21/2024), 1 bitcoin has a price of ~$98,000. However, an Antminer S21 Pro mining with an electricity rate of $0.078/kWh is able to produce 1 BTC for ~$40,000 in electricity. This is an operating margin of nearly 145%. A business is typically considered to have “healthy profit margins” if they are in the 5-10% range – mining beats this easily. This is in spite of the fact that as of the April 2024 Bitcoin halving, they earn half as much BTC per unit of compute.

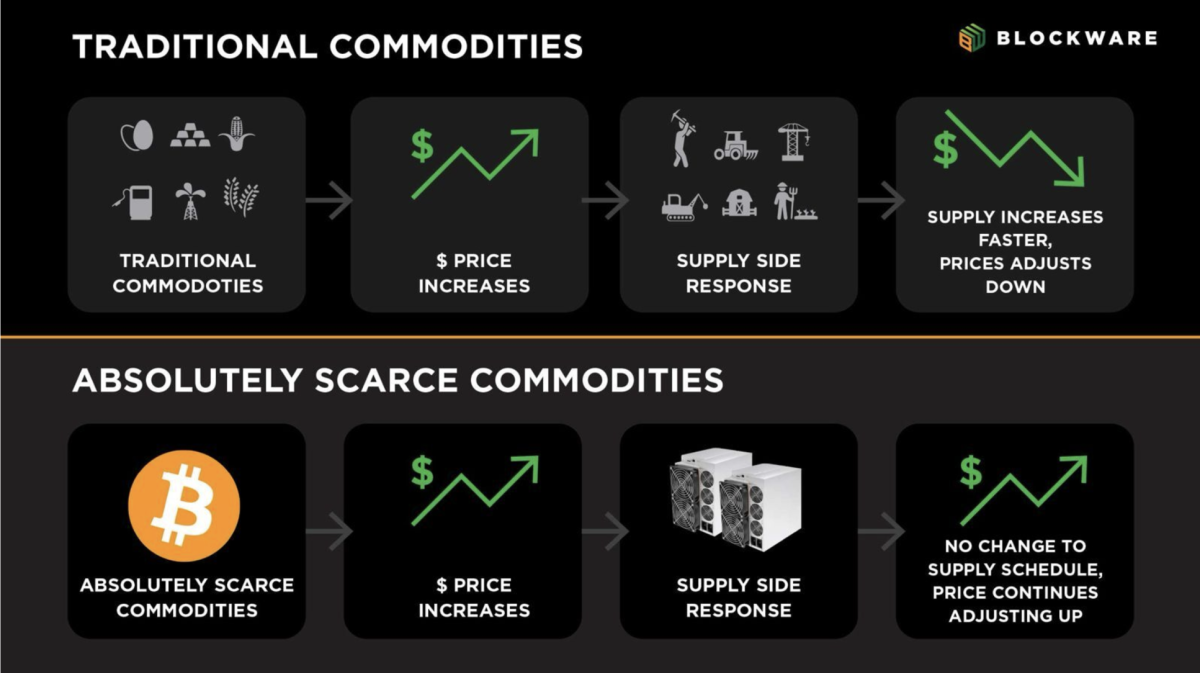

Price Growth Outpacing Difficulty Growth

The price of a financial asset – specifically bitcoin – is set at the margin. This means that the asset’s price is determined by the most recent transactions between buyers and sellers. In other words, the price reflects what the last buyer is willing to pay and what the last seller is willing to accept.

This, in part, is what enables BTC’s notoriously volatile price action. A lack of sellers at price X means buyers must bid the price higher than X in order to find the next marginal seller. Inversely, a lack of buyers at price X means a seller must lower their ask to find the next marginal buyer. BTC can quickly move up or down based on a lack of sellers or buyers in a specific range.

Consequently, the velocity at which the Bitcoin price can move is much higher than that of network mining difficulty. Substantial growth in network mining difficulty is not achieved by marginal bid/ask spreads, it is achieved by the culmination of ASIC manufacturing, energy production, and mining infrastructure development. There is not shortcutting the time and human capital necessary to increase the total computational power on the Bitcoin network.

This dynamic is what creates opportunities for Bitcoin miners to accumulate vast amounts of bitcoin.

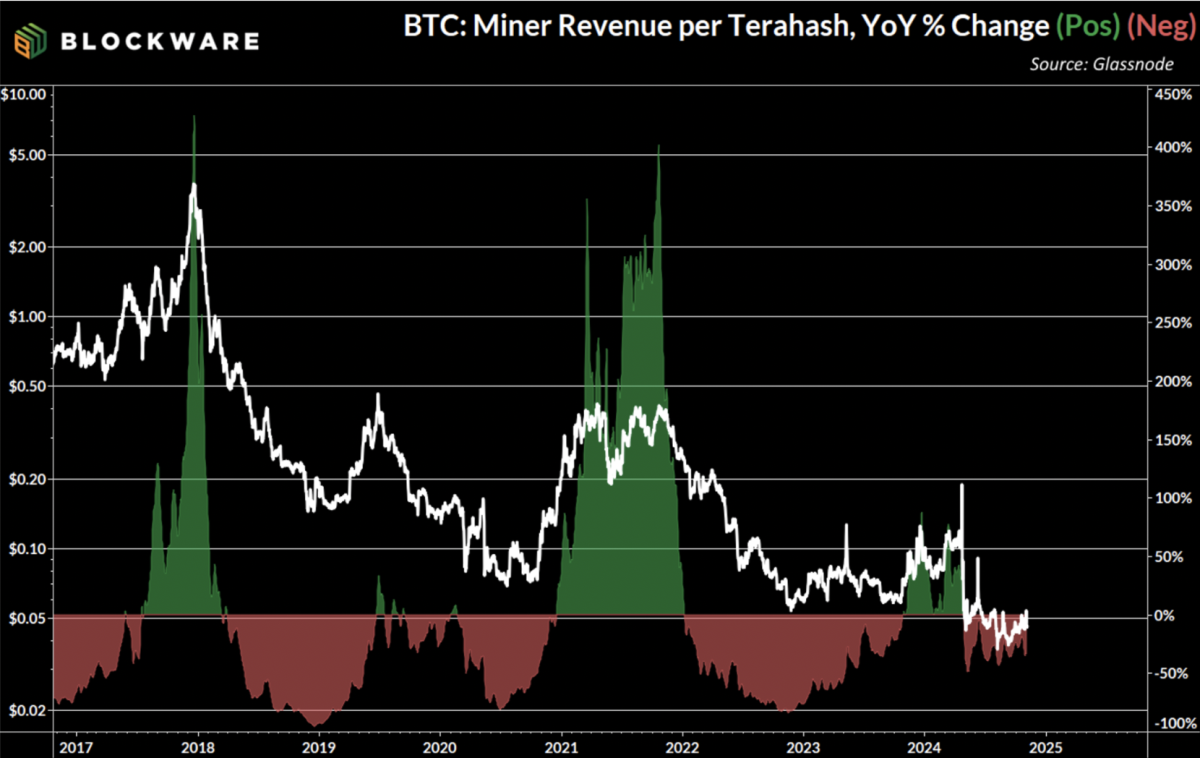

The chart here illustrates the explosive growth of Bitcoin mining profitability that takes place during bull markets. “Hashprice” measures the amount of revenue that Bitcoin miners earn per unit of compute on a daily basis. On a year-over-year basis, hashprice has increased by more than 300% at the height of each bitcoin mining cycle. This means that miners have had their profit margins more than triple in a 12-month span.

Over the long-run this metric trends down as more entities begin mining bitcoin, miners upgrade to more powerful & efficient machines, and the block subsidy is cut in half every four years. However, during bull markets, the combination of the forces that are a positive catalyst for mining difficulty (and thus net-negative for mining profitability) pale in comparison to the rapid growth in the price of bitcoin.

Price Volatility in Bitcoin Mining Hardware

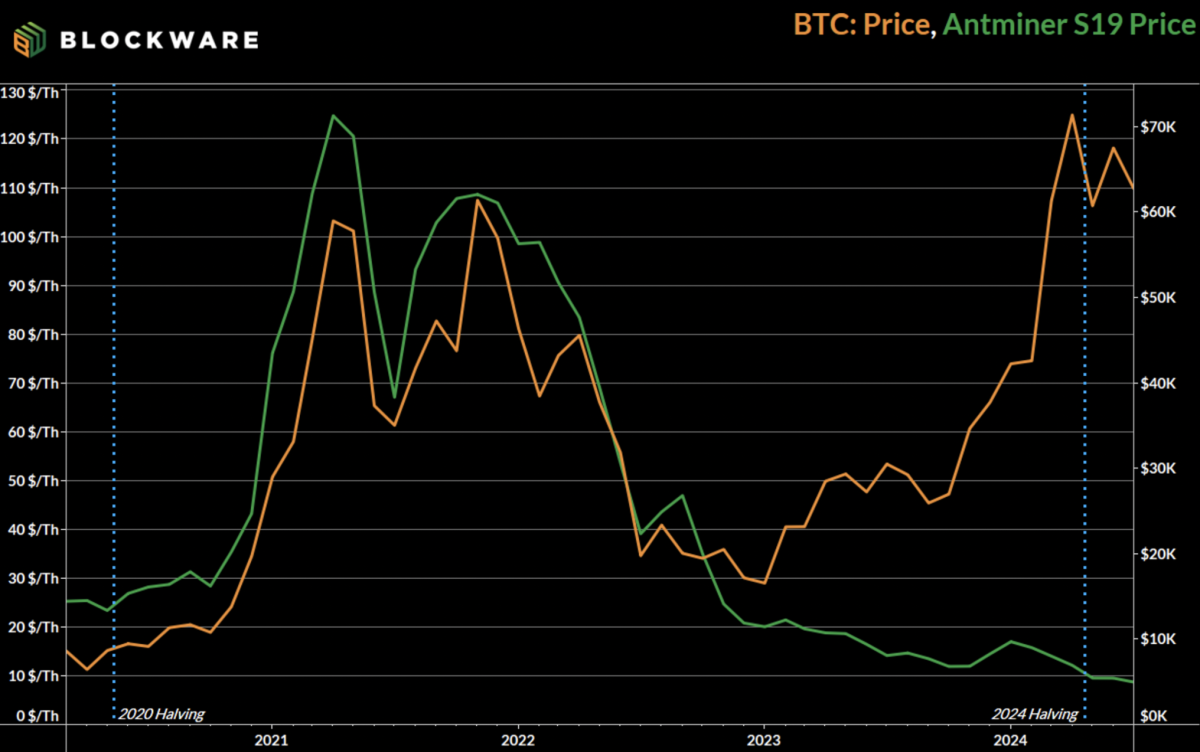

In addition to wider profit margins during bull markets, Bitcoin miners have the simultaneous benefit of the fact that ASIC prices tend to move in tandem with the Bitcoin price. During the 2020 – 2024 cycle, the Antminer S19 (most efficient ASIC at the time) began trading at ~$24/T. By November 2021 – when the BTC price was peaking – they began trading for north of $120/T.

Bitcoin mining hardware retaining resale value is becoming increasingly the case with each new generation of hardware. In the early days of Bitcoin mining, technological advancements were swift and forceful – to the point that new ASICs would make older models obsolete overnight. However, the marginal gains of new ASICs have diminished to the point that older models are able to remain competitive for multiple years after release.

Since the S19 was launched in 2020 and retains a non-zero market price today, it is reasonable to expect that the S21 line of machines will be able to retain value for even longer. This gives miners a significant leg-up when it comes to accumulating bitcoin, because the upfront cost of purchasing machines is no longer “sunk”. Their machines have a price, one that is correlated to bitcoin, and there is a resource available to get liquidity.

Blockware Marketplace

Blockware developed this platform to enable any investor – institutional or retail – the opportunity to gain direct exposure to Bitcoin mining. Users of the marketplace are able to purchase Bitcoin mining rigs that are hosted at one of Blockware’s tier 1 data centers and have access to industrial power prices. These machines are online already, eliminating lengthy lead times that have historically caused some miners to miss out on those key months in the cycle in which price is outpacing network difficulty.

Moreover, this platform is built by Bitcoiners, for Bitcoiners. Which means that machines are purchased using Bitcoin as the medium of exchange, and mining rewards are never held by Blockware – they are sent directly to the users own wallet.

Lastly, this provides miners with the aforementioned opportunity, but not obligation, to sell their machines at any time and price. This enables miners to capitalize on volatility in ASIC prices, recoup the cost of their machines, and accumulate more BTC faster than they would with a traditional “pure play” approach.

This innovation removes the obstacles that have historically made hosted mining difficult, enabling miners to concentrate on the mission: accumulating more Bitcoin.

For institutional investors looking for bulk pricing on mining hardware, contact the Blockware team directly.

Source link

Gold Is Still the Safe-Haven King, While Bitcoin Loses Out: JP Morgan

Dogecoin Price Breakout in view as Analyst Predicts $5.6 high

Bitcoin (BTC) Price in Standstill at $85K as Trump Increases Pressure on Fed’s Powell

Ripple acquisition Hidden Road secures FINRA registration

Ethereum Whales Offload 143,000 ETH In One Week – More Selling Ahead?

How Do We Protect Bitcoin From Quantum Computers? Not With A Joke

OKX Goes Live In The US After Setting Up New Headquarters in San Jose, California

Stanford’s AI research lab to use Theta EdgeCloud for LLM model studies

Central African Republic Solana Meme Coin Jumps as President Fuels Rumors of Revival

Will Shiba Inu Price 3x?

Bitcoin Cash (BCH) Gains 4.2%, Leading Index Higher

Bybit shuts down four more Web3 services after axing NFT marketplace

Aptos To Continue Moving In ‘No Man’s Land’ – Can It Reclaim $5?

The Premier Developer-Centric Bitcoin Event Returns To Austin

Hints of Long-Term Crypto Bear Market Showing Up, According to Coinbase Analyst

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

Crypto’s Big Trump Gamble Is Risky

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

I’m Grateful for Trump’s Embrace of Bitcoin

Trending

24/7 Cryptocurrency News5 months ago

24/7 Cryptocurrency News5 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin3 months ago

Bitcoin3 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Ripple Price4 weeks ago

Ripple Price4 weeks ago3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Altcoins3 months ago

Altcoins3 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin5 months ago

Bitcoin5 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals