bull market

How Trump’s Promises Could Influence BTC $250k forecast

Published

6 months agoon

By

admin

As analysts predict Bitcoin could reach $250K, how might Trump’s promises influence this potential? What should you be watching for in the coming months?

Trump triumphs

Donald Trump is back in the Oval Office, officially winning the 2024 U.S. presidential election as the 47th president. After a high-energy election night celebration at Mar-a-Lago with guests including Elon Musk and Robert F. Kennedy Jr., digital asset markets surged in response.

Bitcoin (BTC) rocketed past $75,000, reaching a fresh all-time high, while crypto-linked stocks like Coinbase and MicroStrategy saw strong after-hours gains.

For crypto supporters, Trump’ win signals more than just another GOP presidency, especially as he has made bold commitments to protect crypto, a notable departure from the past, when Trump’ stance on digital assets was anything but warm.

Moreover, with Trump’ Republican allies securing a Senate majority, the path is now open for the policies he hinted at throughout his campaign—policies that could reshape the future of crypto in both the U.S. and globally.

So, what promises has he made, and what should we expect from his term? Let’s find out.

Trump’s promises to the crypto industry

Bold vision for a national crypto stockpile

One of Trump’ biggest promises to the crypto world is to create what he calls a “strategic national crypto stockpile.” In simple terms, Trump aims to prevent the government from auctioning off seized Bitcoin, instead holding onto it as a national asset.

Trump believes that, just as countries hold reserves of gold or oil, the U.S. should secure a portion of Bitcoin to hedge against future financial uncertainties.

Currently, the U.S. government often auctions off Bitcoin seized from criminal cases, such as after the Bitfinex hack, but Trump has suggested putting a halt to these sales.

This promise is crucial, given that the U.S. Marshals Service has regularly auctioned Bitcoin holdings, sometimes causing temporary market dips. Earlier this year, Germany’s sale of hundreds of millions in seized Bitcoin led to similar price swings.

While Trump hasn’t provided a concrete plan for how this reserve would be managed, some view it as a step toward positioning the U.S. as a global crypto leader.

Creating a strategic Bitcoin reserve

One of Trump’ more intriguing promises is to establish a “strategic Bitcoin reserve” for the U.S. His idea is to retain Bitcoin seized from criminal activities, rather than auctioning it off, to gradually build a substantial national Bitcoin reserve.

This proposal gained further traction when Senator Cynthia Lummis introduced a bill to create a “Bitcoin strategic reserve,” aiming to accumulate one million BTC over five years as a hedge against the national debt.

If realized, this reserve could signal a shift in the U.S. approach to crypto, positioning Bitcoin as a strategic asset on par with gold or foreign currency reserves.

Promise to fire SEC Chair Gary Gensler “on day one”

Trump has also set his sights on the U.S. Securities and Exchange Commission, pledging to fire its current chair, Gary Gensler, on his first day in office.

Appointed by President Joe Biden, Gensler has led an aggressive crackdown on the crypto industry, initiating over 100 enforcement actions against crypto companies for alleged securities violations since he

Gensler’ stance — that much of the crypto industry falls under SEC jurisdiction — has sparked frustration among industry players, who argue they need clearer guidelines, not constant lawsuits.

However, Trump’ promise may not be as straightforward to execute. While the president can appoint the SEC chair, dismissing one requires valid grounds, like neglect or inefficiency, due to the SEC’ independent status.

Legal experts caution that firing Gensler “on day one” could prompt a lengthy review and may not happen as swiftly as Trump suggests.

Still, if Trump does manage to appoint a new SEC chair, it could mark a shift toward more crypto-friendly policies — though how much freedom the new leadership would truly have remains uncertain.

A national push for Bitcoin mining

Another bold promise from Trump is his call to ensure that all remaining Bitcoin is mined within the U.S. He envisions Bitcoin mining as “Made in the USA,” aiming to establish America as a global hub for the industry.

This vision was echoed during a private Mar-a-Lago meeting with key figures in U.S. crypto mining, including executives from major companies like Riot Platforms, Marathon Digital, and Core Scientific.

Trump’ goal aligns with his broader agenda of “energy dominance” for the U.S., believing that Bitcoin mining could boost energy production and decrease reliance on foreign energy sources.

However, the path to this goal is challenging. Bitcoin mining is decentralized by nature, relying on thousands of miners across the globe. Centralizing it within one country would contradict the decentralized ethos on which Bitcoin was built.

Moreover, about 90% of Bitcoin’ total supply has already been mined, leaving only a small yet symbolically significant portion — around 10% — that Trump hopes to bring under U.S. control.

Stopping the central bank digital currency development

Trump has also pledged to block any progress toward a central bank digital currency in the U.S. He made his stance clear: “There will never be a CBDC while I’m president”, citing that CBDCs pose a potential threat to financial privacy.

Unlike decentralized cryptocurrencies like Bitcoin, a CBDC would be fully controlled by the government, potentially allowing for extensive surveillance of citizens’ transactions.

Trump’ position aligns with other Republican leaders, such as Ron DeSantis, who recently signed a bill in Florida to limit CBDC use within the state.

Opposition to CBDCs is also building in Congress. Representative Tom Emmer introduced the CBDC Anti-Surveillance State Act, aiming to prevent the Federal Reserve from issuing a CBDC without congressional approval.

The right to self-custody

Trump has also pledged to enshrine self-custody rights for crypto users into federal law, reinforcing the principle that “not your keys, not your coins” should be protected by the U.S. government.

Self-custody allows crypto holders to manage their private keys independently, ensuring they fully control their digital assets without relying on third parties like exchanges.

This promise aligns with recent legislative efforts by Republican Senator Ted Budd, who introduced the Keep Your Coins Act in 2023. The bill aims to safeguard Americans’ ability to transact with self-hosted crypto wallets, making it harder for regulators to impose restrictions on self-custody.

However, the proposal has sparked debate. Critics argue that self-custody could enable bad actors to evade anti-money laundering regulations, a concern highlighted by Senator Elizabeth Warren’ 2022 Digital Asset Anti-Money Laundering Act, which advocates for tighter controls.

While the crypto community largely views self-custody as an essential right, questions remain about how such laws might affect the balance between personal freedom and regulatory oversight.

A crypto-friendly advisory council

One of Trump’ more structural promises is to establish a dedicated “crypto advisory council” to guide his administration’s approach to crypto policy.

The goal of this council would be to create clear, industry-friendly regulations that support crypto growth rather than stifle it.

As Trump puts it, he wants “the rules to be written by people who love your industry, not hate it,” ensuring that crypto policies reflect a deep understanding of the industry’s needs and challenges.

Many industry insiders have voiced concerns that current regulations lack clarity, making it difficult for companies to operate within legal boundaries.

However, setting up such a council presents its own challenges, such as ensuring a diversity of perspectives and maintaining unbiased oversight.

Commuting Ross Ulbricht’s sentence

In a more controversial promise, Trump has vowed to commute the sentence of Ross Ulbricht, founder of the Silk Road marketplace.

Ulbricht, a first-time nonviolent offender, received a double life sentence plus 40 years without parole—a punishment many view as excessively harsh. Silk Road, the darknet marketplace he created, facilitated the trade of illegal goods, from drugs to weapons, with Bitcoin as the primary currency.

Ulbricht’ case has become a rallying point within the crypto and libertarian communities, where advocates argue that his sentence was disproportionate to the nature of his crime.

Critics, however, contend that his involvement in Silk Road fueled illegal activities and harmed individuals, making any consideration of leniency a sensitive issue.

What to expect from Trump’s crypto term

Recent tweets from crypto analysts reflect a mood of optimism as Trump’ presidency begins.

Michaël van de Poppe, a prominent crypto analyst, describes the current state of crypto as the end of the “longest and heaviest Altcoin bear market.”

He suggests we’re on the brink of a new “Dot.com bubble in Crypto,” hinting that this cycle could “go way higher than we all expect.”

If this outlook proves accurate, Trump’ pro-crypto stance could pave the way for a strong market rebound, benefiting from a more supportive regulatory environment.

Meanwhile, technical analyst Gert van Lagen forecasts that Bitcoin is on its “final ascent,” with a target of $250,000 by February next year.

#Bitcoin – The Final Ascent

The Bull awakens, strong and clear,

Two-fifty K expected this year!

From shadows past, it’s set to soar,

With fortune close, and fate in store.In August the 10-2Y yield spread’s turned its tide,

A warning sign we can’t abide.

For history… pic.twitter.com/4UGeBEl7rE— Gert van Lagen (@GertvanLagen) November 6, 2024

He points to the recent reversal of the 10-2 yield curve — a classic precursor to recessions — as a sign that economic conditions could fuel a BTC rally.

For now, the industry watches to see if Trump’s bold promises can translate into action. If he delivers, the U.S. could emerge as a leader in crypto adoption, creating jobs and establishing financial alternatives that could leave a lasting mark on the entire crypto space.

Source link

You may like

Tariff Carnage Starting to Fulfill BTC’s ‘Store of Value’ Promise

The cost of innovation — Regulations are Web3’s greatest asset

Best Crypto to Buy as Derivatives Exchange CME Set to Launch XRP Futures

Metaplanet Buys Additional ¥1.92 Billion Worth Of Bitcoin

Here Are Four Signs the Stock Market Has Bottomed, According to Fundstrat’s Tom Lee

Bitcoin dips below $94,000 as ETFs record $3b weekly inflow

Disclosure: The views and opinions expressed here belong solely to the author and do not represent the views and opinions of crypto.news’ editorial.

Although some believe that crypto PR and communications efforts should slow down when the markets are cooling off, it couldn’t be further from the truth. Sure, during crypto winters, product development teams huddle together to work on building their solutions—and that’s great—but these are also the ideal times for brand building.

Indeed, when the market is going through a crypto slowdown, the strategic brands are seizing the opportunity to strengthen credibility while everyone else is hibernating. And when the market inevitably heats up, this strategy will position such players ahead of the competition.

Now, not all might agree with this point of view, arguing that pushing PR during a downturn is tone-deaf. Others might see slow market communications as unnecessary noise when product development should be the only priority. But visibility isn’t vanity—it’s strategy, and it’s easier to get noticed in calmer markets.

Slower news, hungrier journalists

As the movements in the crypto market slow down, so does everything else that relates to it, including newsrooms. In other words, journalists have more space (and patience) for stories that go beyond mere price action. There are no big stories of exploding digital assets. Bitcoin (BTC) is nowhere near reaching a new all-time high, and altcoins are taking the cue from the industry’s number one, sleeping it off themselves.

Thus, when the hype and the noise in the crypto sphere die down, media outlets are on the lookout for stories worth telling. In such moments, true innovation and strong projects get their chance to shine and get real editorial interest, instead of getting lost among drama-driven headlines.

Small news can be perceived as newsworthy in a bear market

Here’s a secret—during a bull run, not even a $10 million funding round might turn heads. It’s just too common when there’s money flowing everywhere across the board. To illustrate, an insider source at a crypto media powerhouse once said that their “funding news coverage threshold is a minimum of $10 million, with exceptions.”

This might sound counterintuitive at first, but in a more bearish market sentiment, that same outlet might just be interested in a mere $5 million, or even a $1.4 million seed round, like the one recently raised by crypto payment hub Lyzi to expand its Tezos-based service.

In other words, Lyzi has just told the world that it’s there and constantly working on building its product. Arguably, in a period of market pessimism, it would be one hell of a smart and well-timed PR move, and the best part—the likes of CoinDesk might pick it up.

Pick up the mic when no one else is talking

Providing expert commentary when the industry goes silent becomes even more valuable. Journalists still seek third-party sources and insights, and this is your chance to establish yourself as an authoritative figure in the sector, to whom journalists will come back when the bull market returns.

This means that when it’s all quiet on the crypto front and a journalist comes knocking at your door, be ready. Hiring a good PR firm that will lead you, shape your story, and provide the stage is certainly the right move, but it’s up to you to step up with confidence and claim the spotlight.

Execution still matters

With this in mind, don’t mindlessly drop news just for the sake of it. Be strategic about timing, like holidays, conferences, and other major events that might overshadow your news, as well as the tone—this isn’t the time to brag but display resilience and value.

Also, use the time of market bearishness to build your reputation and flesh out your digital footprint through earned media placements in trusted crypto outlets. Potential users, partners, and investors will look you up online, so make sure they have good things to read about you—that’s your PR working in the background.

The real bottom line

All things considered, crypto PR in times of market stagnation and bearish sentiment is not so much about creating hype as it is about demonstrating real substance. It’s about crafting a narrative that portrays you as the crypto player who can weather the blizzard, better positioning your brand.

So, the next time you’re considering staying silent during a crypto downturn, think again. You might miss out on the best PR opportunities of the cycle, as at this time, you could get more attention than usual.

Don’t wait for the bull to charge—make your mark when the field is clear.

Afik Rechler

Afik Rechler is the co-founder and co-CEO of Chainstory, a results-driven crypto PR agency. He specializes in crypto communications and search-driven content marketing. Afik has been in the crypto industry since late 2016, helping blockchain businesses meet their marketing and communications goals.

Source link

24/7 Cryptocurrency News

CryptoQuant CEO Explains Why Bitcoin Bull Market is Over Now

Published

3 weeks agoon

April 5, 2025By

admin

CryptoQuant CEO Ki Young Ju avers that the Bitcoin bull market is over as prices hover around the $82K mark. The expert hinges his theory for Bitcoin price on key technicals, analyzing the relationship between Realized Cap, Market Cap, and selling pressure to reach his conclusions.

Expert Gives Reason Why The Bitcoin Bull Market Is Over

According to an analysis on X, Ki Young Ju reveals that Bitcoin is firmly in bear market territory to the dismay of investors. The CryptoQuant CEO surmised in his analysis that the curtain has fallen for the Bitcoin bull market giving reasons.

In his analysis, Ju bases his prediction on the interplay between Bitcoin’s Realized Cap and the asset’s market capitalization. Realized market cap measures Bitcoin’s value using the price at which each BTC held in wallets was transferred. On the other hand, the market cap measures value by multiplying the circulating BTC supply with current prices.

The CryptoQuant CEO notes that market capitalization alone is not the best way to track the Bitcoin Bull Market. According to Ju, when there is low selling pressure in the markets, small Bitcoin purchases often send the market capitalization to new highs. Ju notes that Strategy has ridden the tailwind of low selling pressure to grow the paper value of their BTC holdings.

Conversely, when sell pressure is high, sizeable purchases are unable to send Bitcoin price on a rally. Strategy’s purchase of 22,048 BTC for $1.92 billion did not trigger a rally like its previous acquisition.

Onchain data indicates that Bitcoin’s Realized Cap is rising but market capitalization continues its decline, an indicator of bearish sentiments. Ju notes that fresh capital is flooding the markets but prices are not responding, signaling the end of the bitcoin bull market.

“When even large capital can’t push prices upward, it’s a bear,” said Ju.

Bitcoin Price Flashes Bearish Signals

Despite glowing fundamentals and large acquisitions, on-chain indicators are underwhelming for the top cryptocurrency. Bitcoin price is consolidating within a bearish pennant, a signal for even lower prices. However, a small bump has triggered speculation of a potential Bitcoin price decoupling from S&P500.

Crypto Sat says a short-term drop to $80K is in play for Bitcoin with prices standing at $82,950. However, Ju has even grimmer predictions for BTC, noting that a near-term rally is unlikely for the asset. The CryptoQuant CEO notes that it will take the asset up to six months to drag itself out of the bear market.

“Sell pressure could ease anytime, but historically, real reversals take at least six months,” said Ju.

Despite the dour sentiments, US Treasury Secretary Scott Bessent has praised BTC as a store of value comparing it with gold.

Aliyu Pokima

Aliyu Pokima is a seasoned cryptocurrency and emerging technologies journalist with a knack for covering needle-moving stories in the space. Aliyu delivers breaking news stories, regulatory updates, and insightful analysis with depth and precision. When he’s not poring over charts or following leads, Aliyu enjoys playing the bass guitar, lifting weights and running marathons.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

Following a sharp multi-week selloff that dragged Bitcoin from above $100,000 to below $80,000, the recent price bounce has traders debating whether the Bitcoin bull market is truly back on track or if this is merely a bear market rally before the next macro leg higher.

Bitcoin’s Local Bottom or Bull Market Pause?

Bitcoin’s latest correction was deep enough to rattle confidence, but shallow enough to maintain macro trend structure. Price seems to have set a local bottom between $76K–$77K, and several reliable metrics are beginning to solidify the local lows and point towards further upside.

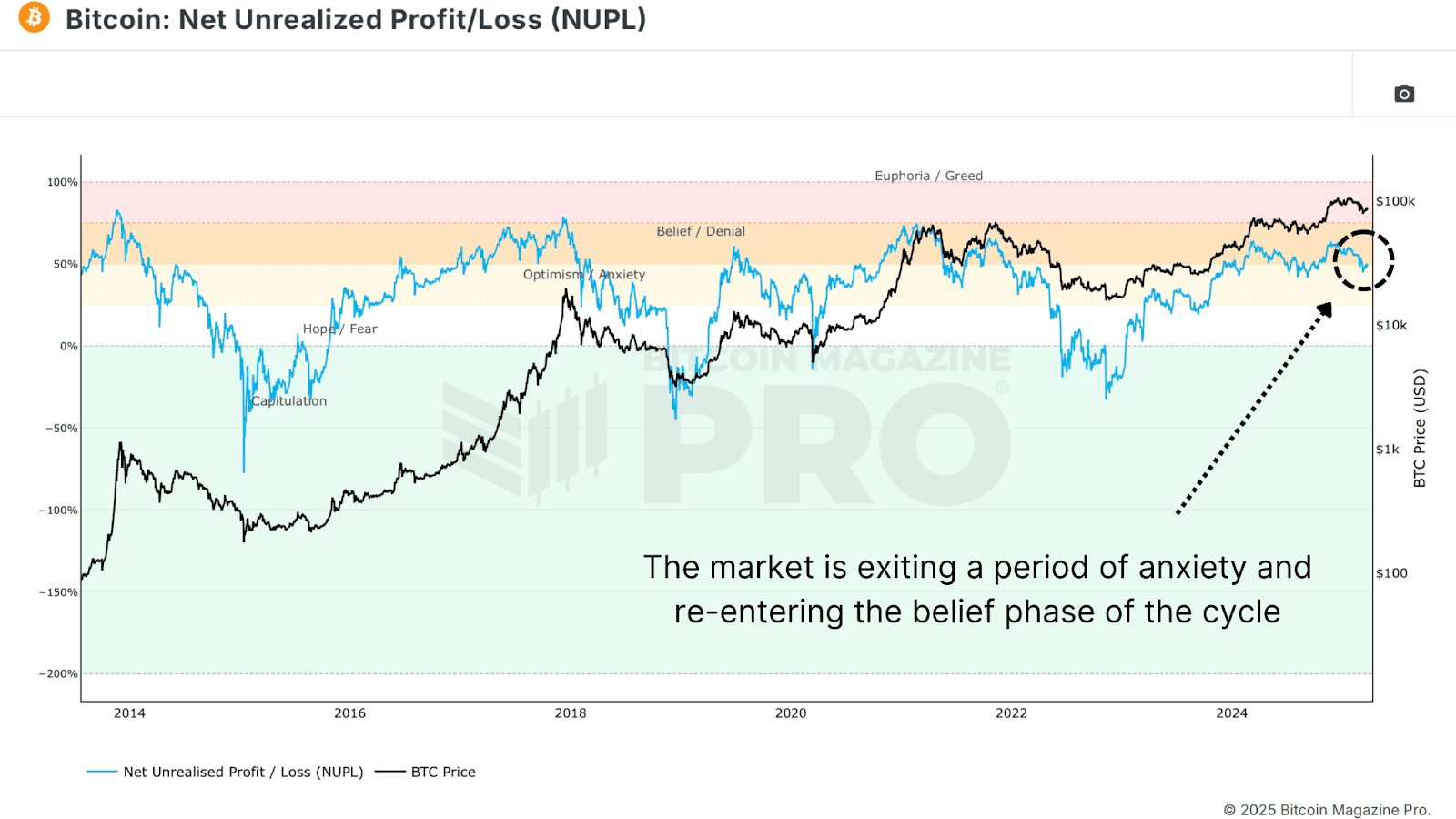

The Net Unrealized Profit and Loss (NUPL) is one of the most reliable sentiment gauges across Bitcoin cycles. As price fell, NUPL dropped into “Anxiety” territory, but following the rebound, NUPL has now reclaimed the “Belief” zone, a critical sentiment transition historically seen at macro higher lows.

The Value Days Destroyed (VDD) Multiple weighs BTC spending by both coin age and transaction size, and compares the data to a previous yearly average, giving insight into long term holder behavior. Current readings have reset to low levels, suggesting that large, aged coins are not being moved. This is a clear signal of conviction from smart money. Similar dynamics preceded major price rallies in both the 2016/17 and 2020/21 bull cycles.

Bitcoin Long-Term Holders Boost Bull Market

We’re also now seeing the Long Term Holder Supply beginning to climb. After profit-taking above $100K, long-term participants are now re-accumulating at lower levels. Historically, these phases of accumulation have set the foundation for supply squeezes and subsequent parabolic price action.

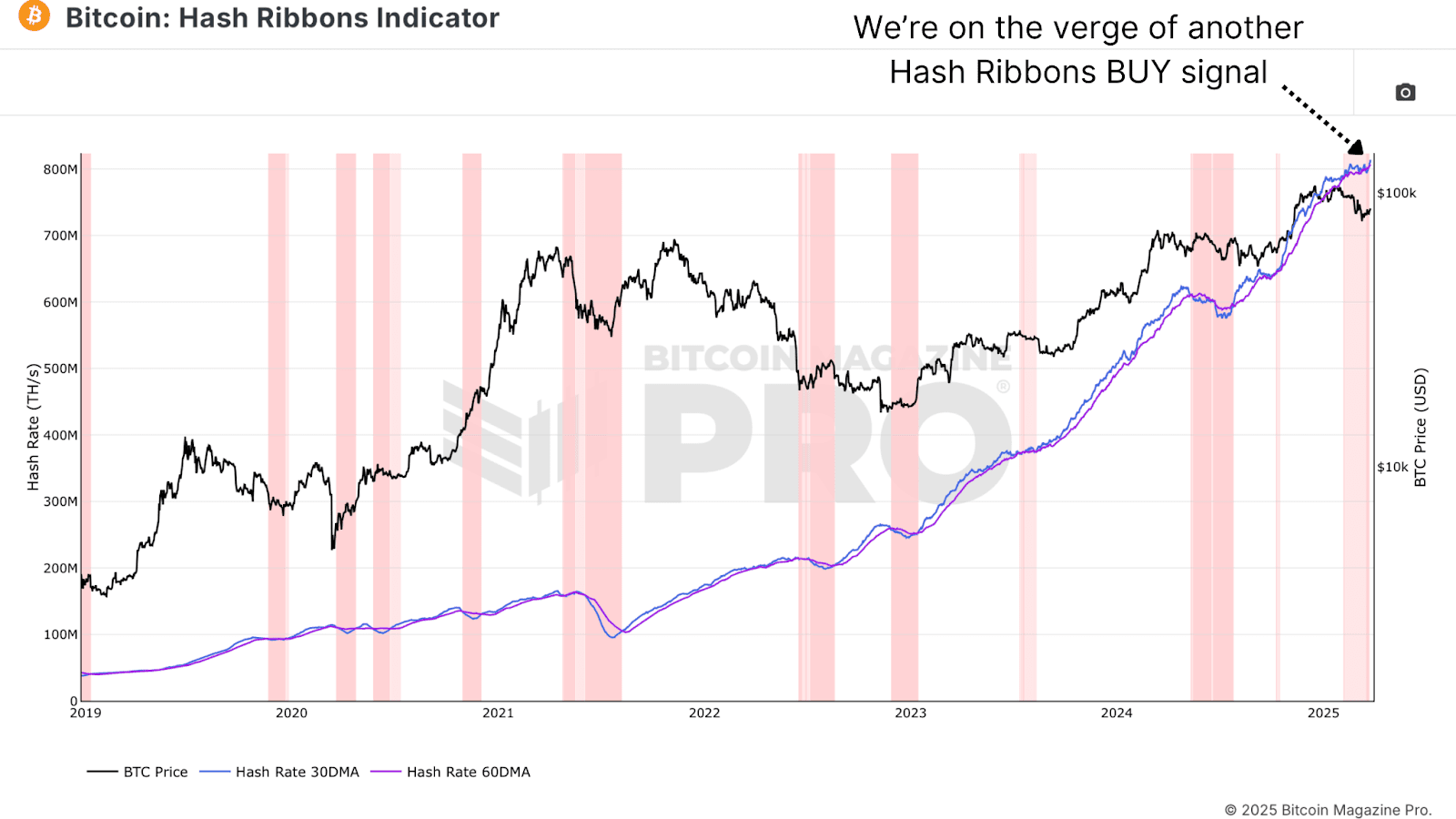

Bitcoin Hash Ribbons Signal Bull Market Cross

The Hash Ribbons Indicator has just completed a bullish crossover, where the short-term hash rate trend moves above the longer-term average. This signal has historically aligned with bottoms and trend reversals. Given that miner behavior tends to reflect profitability expectations, this cross suggests miners are now confident in higher prices ahead.

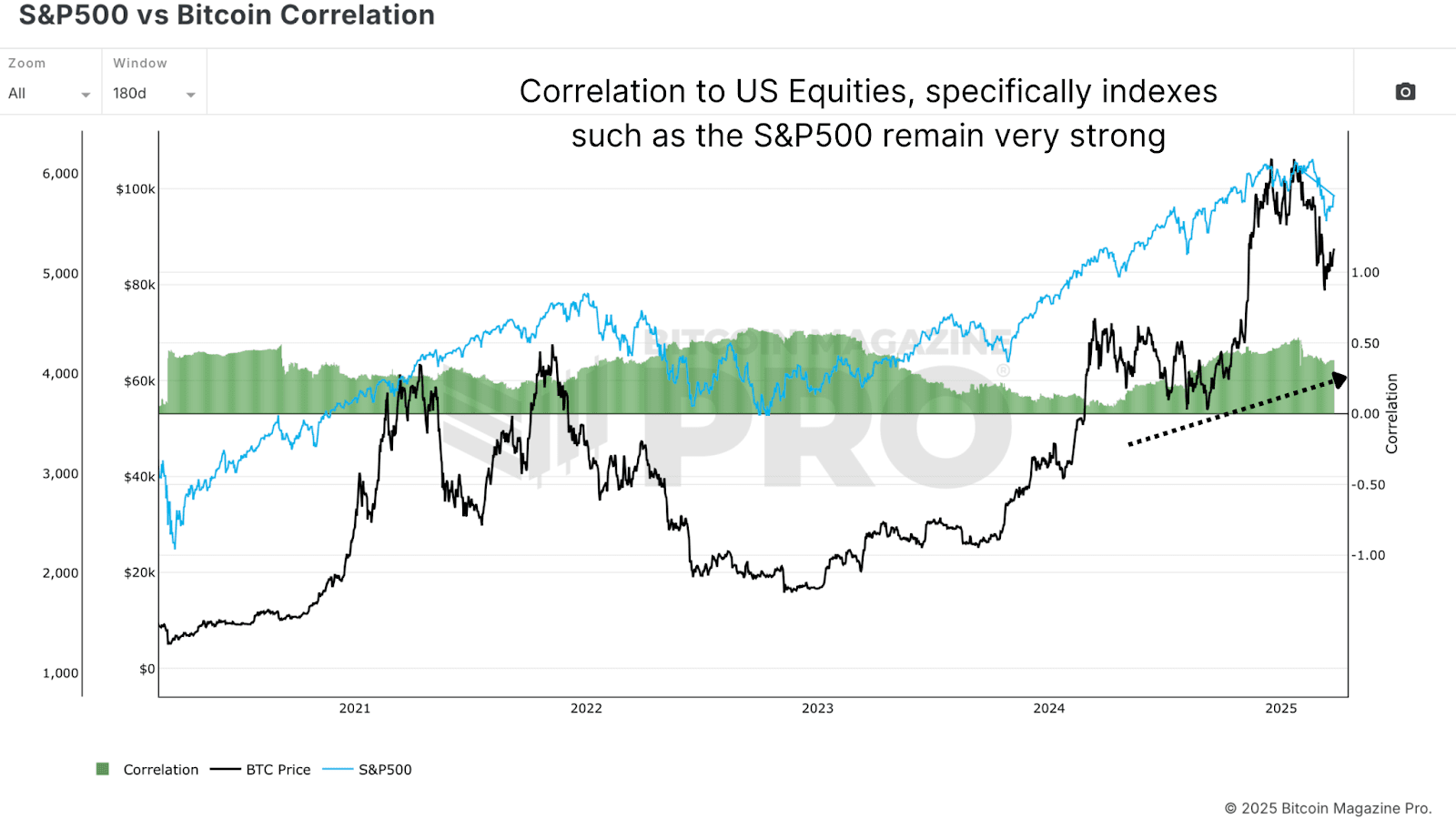

Bitcoin Bull Market Tied to Stocks

Despite bullish on-chain data, Bitcoin remains closely tied to macro liquidity trends and equity markets, particularly the S&P 500. As long as that correlation holds, BTC will be partially at the mercy of global monetary policy, risk sentiment, and liquidity flows. While rate cut expectations have helped risk assets bounce, any sharp reversal could cause renewed choppiness for Bitcoin.

Bitcoin Bull Market Outlook

From a data-driven perspective, Bitcoin looks increasingly well-positioned for a sustained continuation of its bull cycle. On-chain metrics paint a compelling picture of resilience for the Bitcoin bull market. The Net Unrealized Profit and Loss (NUPL) has shifted from “Anxiety” during the dip to the “Belief” zone after the rebound—a transition often seen at macro higher lows. Similarly, the Value Days Destroyed (VDD) Multiple has reset to levels signaling conviction among long-term holders, echoing patterns before Bitcoin’s rallies in 2016/17 and 2020/21. These metrics point to structural strength, bolstered by long-term holders aggressively accumulating supply below $80,000.

Further supporting this, the Hash Ribbons indicator’s recent bullish crossover reflects growing miner confidence in Bitcoin’s profitability, a reliable sign of trend reversals historically. This accumulation phase suggests the Bitcoin bull market may be gearing up for a supply squeeze, a dynamic that has fueled parabolic moves before. The data collectively highlights resilience, not weakness, as long-term holders seize the dip as an opportunity. Yet, this strength hinges on more than just on-chain signals—external factors will play a critical role in what comes next.

However, macro conditions still warrant caution, as the Bitcoin bull market doesn’t operate in isolation. Bull markets take time to build momentum, often needing steady accumulation and favorable conditions to ignite the next leg higher. While the local bottom between $76K–$77K seems to hold, the path forward won’t likely feature vertical candles of peak euphoria yet. Bitcoin’s tie to the S&P 500 and global liquidity trends means volatility could emerge from shifts in monetary policy or risk sentiment.

For example, while rate cut expectations have lifted risk assets, an abrupt reversal—perhaps from inflation spikes or geopolitical shocks—could test Bitcoin’s stability. Thus, even with on-chain data signaling a robust setup, the next phase of the Bitcoin bull market will likely unfold in measured steps. Traders anticipating a return to six-figure prices will need patience as the market builds its foundation.

If you’re interested in more in-depth analysis and real-time data, consider checking out Bitcoin Magazine Pro for valuable insights into the Bitcoin market.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment decisions.

Source link

Tariff Carnage Starting to Fulfill BTC’s ‘Store of Value’ Promise

The cost of innovation — Regulations are Web3’s greatest asset

Best Crypto to Buy as Derivatives Exchange CME Set to Launch XRP Futures

Metaplanet Buys Additional ¥1.92 Billion Worth Of Bitcoin

Here Are Four Signs the Stock Market Has Bottomed, According to Fundstrat’s Tom Lee

Bitcoin dips below $94,000 as ETFs record $3b weekly inflow

Bitcoin Post-Halving Price Performance Is the Worst on Record. Why?

Expert Predicts Start Date For Pi Network Price Pump

GameFi Tokens Show Signs of Life After Gala Games, White House Tie-Up

Bitcoin trades at ‘40% discount’ as spot BTC ETF buying soars to $3B in one week

Bitcoin Continues To Flow Out Of Major Exchanges — Supply Squeeze Soon?

BlackRock’s Bitcoin ETF Sees $643 Million Inflows

DePIN Altcoin Outpaces Crypto Market and Skyrockets by Nearly 44% Following High-Profile Exchange Listing

Solaxy, BTC bull token, and Pepeto gaining momentum as leading 2025 presale tokens

Australian Radio Station Used AI DJ For Months Before Being Discovered

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Crypto’s Big Trump Gamble Is Risky

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

I’m Grateful for Trump’s Embrace of Bitcoin

Trending

24/7 Cryptocurrency News6 months ago

24/7 Cryptocurrency News6 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin3 months ago

Bitcoin3 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Ripple Price1 month ago

Ripple Price1 month ago3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin6 months ago

Bitcoin6 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Opinion6 months ago

Opinion6 months agoCrypto’s Big Trump Gamble Is Risky

Altcoins3 months ago

Altcoins3 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin5 months ago

Bitcoin5 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

✓ Share: