Price analysis

How Will TRUMP Inauguration impact SHIB ?

Published

2 months agoon

By

admin

Shiba Inu price plummeted 5% to hit $0.000022 on Sunday, January 19 as traders reacted to Donald Trump’s memecoin launch hours before the US Presidential Inauguration. Memecoin sector performance trends suggest SHIB price could be at risk of further downside.

Shiba Inu (SHIB) Market Cap Declines $700m as traders react to Trump Token Launch

Shiba Inu (SHIB) faced intense selling pressure on January 19, dropping 5% to $0.000022 as its market cap shed over $700 million. This decline coincided with Donald Trump’s memecoin debut, with the $TRUMP token surging 131% in 24 hours and claiming a $12.5 billion valuation.

The sudden interest in Trump-linked tokens has disrupted the memecoin sector, prompting traders to pivot from established assets to trendier entrants.

According to Coingecko data, memecoin market grew by 1.4% overall, reaching $130 billion in total capitalization, but legacy tokens such as Dogecoin (DOGE), Pepe (PEPE), and SHIB all posted losses.

This divergence signals a shift in market dynamics, as investors favor new, narrative-driven tokens.

While DOGE fell 0.5% and PEPE dropped 5.8%, the $TRUMP token saw unprecedented transaction volumes, attracting millions of dollars in speculative capital within hours.

Trump-linked tokens, including $MAGA and $TRUMP, now dominate market discussions, leading gainers by triple-digit percentages. This shift has introduced volatility across legacy tokens, with SHIB bearing the brunt of the sell-off.

Despite broader market growth, the current SHIB price decline reflects waning trader confidence, as funds flow to newer assets promising quicker returns. If this trend persists, legacy memecoins such as SHIB, DOGE and PEPE remain at risk of losing more market share.

Shiba Inu price forecast: Bears in Control as $0.000020 Support Wobbles

Shiba Inu price forecast chart currently paints a neutral outlook, with bulls struggling to hold the $0.000021 support level after an 11% pullback.

As the daily time frame candlestick breaches the midline of the Bollinger Bands (BB) at $0.00002242, this position signals that bears are testing a critical support zone. If this level fails to hold, SHIB risks accelerating losses toward the psychological support at $0.00001800.

More so, the Relative Strength Index (RSI) at 45.52 trends below the neutral 50 mark, signaling weakened bullish momentum. A further decline in RSI could confirm continuation of the bearish trend. However, the narrowing BB bands hint at reduced volatility, suggesting potential stabilization near current levels.

For a bullish scenario, a decisive reclaim of the $0.00002242 midline could pivot sentiment, targeting $0.00002470, the upper BB. This move requires increased trading volume and a positive RSI divergence. Until decisive signals emerge, SHIB’s short-term trajectory leans cautiously bearish.

Frequently Asked Questions (FAQs)

The price fell due to intense selling pressure linked to Donald Trump’s memecoin launch, which shifted market focus.

Key support levels are $0.000021 and $0.000020. Breaching these could trigger a decline to $0.000018.

A recovery is possible if SHIB reclaims the $0.00002242 Bollinger Bands midline and sees increased trading volume.

ibrahim

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

You may like

Crypto Braces For April 2 — The Most Crucial Day Of The Year

DYDX shoots up 10% as buybacks get a quarter of protocol revenue

$7,000,000 Up for Grabs As Feds Tell Crypto Fraud Victims To Come Recover Their Money

Berachain rolls out next phase of proof-of-liquidity system

White House to Scale Back Tariffs, Bitcoin Gains on Eased Economic Jitters

More is Less: Feature Fatigue is Driving Web3 Users Away

Bitcoin

$90K Target Ahead as BTC Options Volume nears $800M

Published

11 hours agoon

March 24, 2025By

admin

Bitcoin’s price rose 2.6% on Sunday, March 23, crossing the $86,000 mark after a three-day consolidation around $84,000. With growing market optimism following the recent Fed rate pause, speculative BTC traders deployed increased leverage over the weekend. Will BTC advance above $90,000, or will it reverse to $80,000 in the week ahead?

Bitcoin (BTC) Retakes $85,500 After Three-Day Consolidation

After a prolonged consolidation phase, Bitcoin (BTC) made a major recovery bounce on Sunday. Following Trump’s appearance at Blockworks’ Digital Asset Summit, many short-term traders opted to take profits on their BTC holdings.

Despite the decline, Bitcoin continues to find buyers, as the recent U.S. Fed rate pause announced on Wednesday prompted macro-sensitive capital to flow toward risky assets.

Bullish tailwinds from the Fed rate pause counteracted the downward pressure from profit-taking, leading to a three-day stalemate at the $84,000 level since Thursday.

However, as sell-side pressure subsided, BTC price recorded a major breakout above $86,000 on Sunday, March 23. The chart above shows how BTC rose 2.6%, hitting a daily peak of $85,600.

BTC Options Volume nears $800M as Whales Return After Fed Rate Pause

Bitcoin price demonstrated remarkable resilience consolidating around $84,000 over the past three days, as macro-sensitive institutional investors reassess their stance on U.S. economic policies.

Earlier this month, fears of inflationary pressure from Trump’s proposed tariffs triggered a cautious retreat from risk assets, including Bitcoin. However, with recent CPI and PPI reports showing inflation cooling and the Federal Reserve opting to pause rate hikes, large investors appear to be re-entering the market.

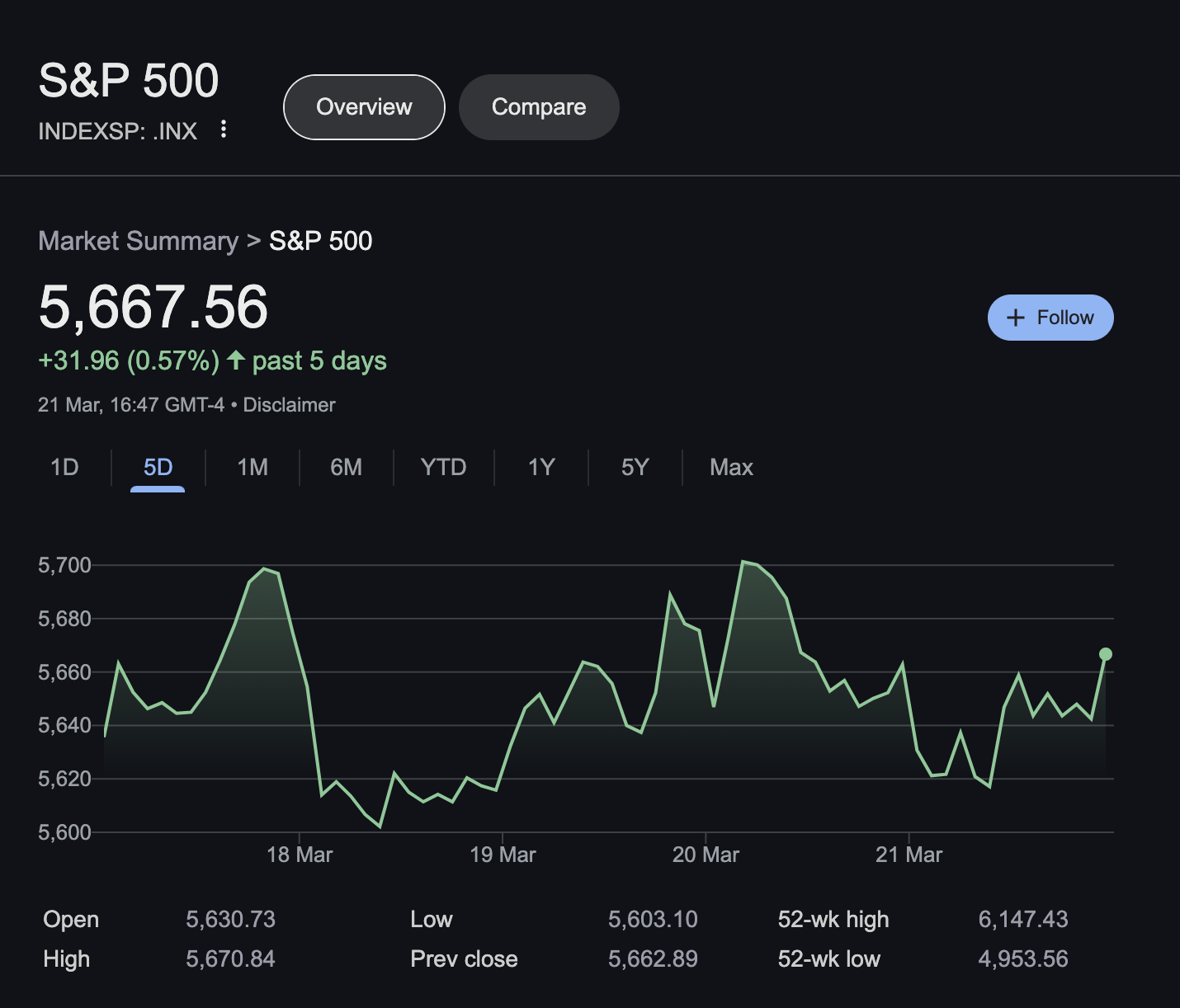

This shift in sentiment is reflected in broader financial markets. The S&P 500 surged by 32 points following the Fed rate pause, signalling renewed risk appetite. As Bitcoin mirrors this trend, it has seen a sharp uptick in speculative trading activity from large investors.

Validating this stance, Coinglass derivatives market data shows BTC’s options trading volume skyrocketed 24% in the last 24 hours, pushing total volume above $793 million.

What Does 24% Options Trading Surge Mean for Bitcoin Price Action This Week?

Options trading is a derivatives market strategy that allows traders to bet on the future price movements of an asset without directly purchasing it. This technique is particularly popular among institutional investors and whales because leverage enables traders to control large positions with relatively small capital, amplifying returns, especially during periods of market volatility.

Given that options trading volume surged 24% over the last day, it suggests that whales and institutional investors are taking bullish positions on BTC’s near-term price movements.

Why is BTC Options Volume Rising?

The renewed interest in BTC options trading aligns with key macroeconomic narratives:

- Fed Rate Pause Fuels Risk Appetite – With the Fed pausing rate hikes, liquidity-sensitive assets like Bitcoin become more attractive.

- S&P 500 Rally Indicates Broader Market Confidence – TradFi investors reallocating capital to stocks may also be expanding exposure to BTC.

- Altcoin Season Rotation – With BTC holding steady above $85,000, traders are betting on volatility to capture short-term gains.

Bitcoin Price Forecast: Data Supports Bullish Outlook, But $90K Flip Unlikely

Beyond options trading, other key metrics reinforce a positive BTC outlook for the week ahead:

- Open Interest Rose 3.88% to $54.04B – A sign that new capital is entering the derivatives market.

- Long/Short Ratio at 1.28 on OKX & 1.2217 on Binance – Indicates more traders are placing long bets.

- Liquidations Favor Shorts – Over the last 12 hours, $14.2M in short positions were wiped out, compared to just $2.82M in longs.

With Bitcoin showing strong demand above $86,000 and institutional investors actively positioning through options, a bullish breakout toward $90,000 remains a distinct possibility. However, signals on the daily Bitcoin price forecast charts below suggest the rally could face significant resistance below the $90,000 mark.

Despite these bullish signals, the technical chart presents a nuanced picture. While Bitcoin has reclaimed $85,600, the looming death cross—where the 50-day moving average trends below the 200-day moving average—remains a cause for concern. This bearish formation suggests that unless BTC can decisively break above $87,200, a retracement toward the $80,000 region remains plausible.

Bulls must clear this key resistance zone to sustain momentum toward $90,000. If BTC fails to establish support above $87,200, bears could regain control, triggering a potential pullback.

Frequently Asked Questions (FAQs)

Bitcoin’s bullish momentum suggests it could approach $90,000, but resistance around $87,200 and technical signals indicate potential pullbacks.

Institutional investors and whales are increasing leverage after the Fed rate pause, betting on Bitcoin’s near-term price movement.

The Fed rate pause, stock market trends, and increased institutional activity in options trading are driving Bitcoin’s recent price movements.

ibrahim

Crypto analyst covering derivatives markets, macro trends, technical analysis, and DeFi. His works feature in-depth market insights, price forecasts, and institutional-grade research on digital assets.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

Altcoins have been attracting investor attention this weekend, with Bitcoin and Ethereum prices stagnating around $85,000 and $2,000, respectively, since Friday. Prominent crypto analysts have published data insights showing investors are increasingly rotating capital toward altcoins after recent U.S. macroeconomic updates.

Analysts Predict Altcoin Season as Fed Rate Pause Triggers Risk-On Appetite

The altcoin market had a rough start to March 2025 when U.S. President Donald Trump announced new tariffs on Canada and Mexico. However, the macroeconomic landscape has since improved. The Trump administration made adjustments to the tariffs, while U.S. CPI and PPI data indicated that inflation risks from the tariffs were overestimated.

This shift in sentiment was further reinforced after the latest Federal Open Market Committee (FOMC) meeting on Wednesday, where the U.S. Federal Reserve announced a pause in interest rate hikes.

Traditional finance (TradFi) investors reacted by moving capital out of safe-haven assets like gold and into stocks, pushing the S&P 500 up by 31.7 points last week.

Crypto markets appear to be following suit, with traders increasingly rotating funds from Bitcoin and Ethereum into altcoins.

Crypto Analysts Signal Imminent Altcoin Breakout

Adding to the growing optimism around altcoins, two major crypto analysts took to social media to highlight technical indicators pointing to an incoming “Alt Season”—a market phase where altcoins significantly outperform Bitcoin.

“2025 #ALTSEASON starts in less than 3 days now,” alongside a chart illustrating past cycles of altcoin dominance relative to Bitcoin.

Crypto analyst Sensei (@SenseiBR_btc) made a bold declaration, March 21, 2025 ,

The accompanying chart showed clear historical patterns where altcoins surged against Bitcoin, with a third major rally seemingly about to begin.

In response, OBI Real Estate (@Obirealestate) weighed in on the discussion, adding, “Markets are buzzing, timing will be everything.”

Key Takeaways: Why This Weekend Matters for Altcoins

Capital Rotation: With Bitcoin and Ethereum trading sideways, traders are diverting funds toward altcoins, anticipating stronger returns.

Macro Trends: Improved inflation outlook and the Fed’s rate pause have boosted risk-on sentiment across global markets.

Technical Indicators: Historical charts from top analysts suggest that the long-awaited Alt Season could be days away from starting.

As traders look ahead, this weekend may present a critical window of opportunity to accumulate promising altcoins before a broader market breakout.

3 Top Trending Altcoins to Watch in the Week Ahead

Bitcoin (BTC) has surged past the $85,000 mark, signaling strong market sentiment despite a slight 0.9% decline in global crypto market cap over the past 24 hours. While BTC’s resilience suggests growing confidence, a look at broader market trends reveals that large-cap altcoins remain stagnant, while smaller-cap assets are seeing significant moves.

Ethereum (ETH) remains subdued at $2,000, showing only a 0.5% gain in 24 hours. Similarly, Cardano (ADA) and Binance Coin (BNB) also moved sideways, conslidating at the $0.70, $620 respectively, while Solana (SOL), trading at $132 leads the top 10 assets with a 2.4% gain.

However a closer look at the Coinmarketcap above shows low-cap altcoins, are attracting significant search traffic, a move that could attract further capital inflows in the coming trading seesions.

1. Trump Memecoin (Official Trump) – Political optimism fuels rally

The Trump-themed memecoin is trading at $11.81, up 5.9% in the last 24 hours, making it one of the most notable gainers. This rally alligns with improved sentiment surrounding recent U.S. policy discussions and Trump’s appearance at the Blockwork’s Digital Assets Summit, last week.

With increasing political relevance and heightened social media buzz, this token is one to watch closely. A break above key resistance levels in the coming days could drive further gains.

2. Pi Network (PI) – Struggling to Break $1, But Buzz is Growing

Last week, PI endured major sell-offs as the network migration trigger mixed reactions among investors. However, Pi Network is now flashing recovery signals. At press time on Sunday, March 23, PI network price is facing strong resistance at the $1 mark, struggling to establish a breakout. However, with the token has become one of the most discussed assets in the last 24 hours, investor interest is evident.

If buying pressure continues and $1 resistance caves, a significant breakout could follow, making this an asset to monitor for a potential price explosion.

3. Wormhole (W) – Cross-Chain Demand Fuels Buying Activity

Ethereum’s native cross-chain bridge token, Wormhole (W) price, has surged 23.9%, driven by increased demand as investors rotate funds across chains.

The boost in market optimism, combined with the Fed’s recent decision to pause interest rate hikes, has further supported capital flows into decentralized finance (DeFi).

With more activity on cross-chain protocols, Wormhole’s demand could continue to rise, making it a strong candidate for further upside in the days ahead.

In Summary:

While Bitcoin’s dominance remains strong above $85,000, altcoins, particularly low-cap assets, are gaining momentum. The surge in Trump memecoin, Pi Network’s rising popularity, and Wormhole’s DeFi-driven gains all signal that the altcoin market could be gearing up for major moves. Traders should watch for key breakout levels as these assets continue to gain traction

Frequently Asked Questions (FAQs)

Altcoin Season refers to a market phase where altcoins outperform Bitcoin, often driven by capital rotation and favorable macroeconomic conditions.

Analysts predict an Altcoin Season due to Bitcoin’s stagnation, improving inflation data, and the Federal Reserve’s decision to pause rate hikes.

Trump memecoin, Pi Network, and Wormhole are gaining traction due to political sentiment, technical setups, and cross-chain DeFi demand.

ibrahim

Crypto analyst covering derivatives markets, macro trends, technical analysis, and DeFi. His works feature in-depth market insights, price forecasts, and institutional-grade research on digital assets.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

Pi coin price

What Would Pi Coin Price Look Like if Pi Network Reaches XRP Market Cap?

Published

3 days agoon

March 21, 2025By

admin

Pi Network price price has dropped by more than 23% today, March 21, and fallen below $1 for the first time in one month. However, despite this decrease, the Pi Coin community remains bullish that the price will recover, leading to a significant growth in market cap. In this article, we look at how high Pi Network token could go if it reaches the XRP market cap.

Pi Network Price If It Reaches XRP Market Cap

Today’s steep decline in Pi Network price has pushed its market cap to $6.24 billion. In contrast, XRP has the second-largest market cap among altcoins of $138 billion. This means that Pi Coin would have to undergo a parabolic rally to compete against XRP.

The market cap of crypto assets is measured using the price and supply. For context, Pi Coin has a total supply of 10 billion coins. Therefore, if Pi Network price were to reach a $138 billion market cap, it would have to surge to $13.80.

Pi Coin has a history of making independent rallies when the rest of the crypto market stalls. Therefore, attaining the $13.8 price target when the XRP market cap remains constant at $138 billion is likely. However, if XRP also hits an ATH market cap of $186 billion, Pi Network price would reach $18.6 to equal Ripple’s market cap.

Can Pi Coin Rally to $13?

There are multiple reasons why Pi Coin price can rally to $13 and reach the XRP market cap. Speculation is rife that Pi Network is currently working on launching a cryptocurrency exchange. According to reports, the launch is likely in its final stages.

If these reports are true and the Pi Coin exchange debuts, a rally to the $13-$18 price range is realistic. This launch will boost utility for the Pi Network token and help in increasing investor confidence.

The other catalyst for such a rally is a possible listing of Pi Network on major exchanges like Binance, Coinbase, and Kraken.

Lastly, a Coingape analysis revealed that a Pi Coin ETF might debut in the US, considering that it is a US-based coin. If any asset manager were to file for this product, Pi Network price is likely to surge past $13.

Pi Network Technical Analysis

The possible Pi exchange launch, upcoming exchange listing, and the likelihood of a Pi Coin ETF filing support a bullish Pi Network price prediction. However, for a parabolic rally to occur, Pi Coin would have to defy the bearish outlook on its 4-hour price chart.

Pi Coin dropped to an oversold region after the over 20% drop in the last 24 hours. The RSI is reversing to the upside, which is an indication that the altcoin may have reached a local bottom, and is now making an uptrend.

If traders start accumulating, the immediate resistance is at $1.17. Flipping this level decisively could cause a strong uptrend past $1.80 and later $3.

Therefore, if Pi Network price were to rally amid bullish factors like rising utility and institutional interest, it is likely that its market cap could balloon past $100 billion. However, to flip the XRP market cap, it has to rally to between $13 and $18.

Frequently Asked Questions (FAQs)

Pi Network price would have to surge to between $13 and $18 to reach the XRP market cap.

Several catalysts like the launch of a Pi Network exchange and the possible launch of a Pi Coin ETF could drive the price to $13.

Speculation is rife that Pi Network is working on launching its own exchange, amid reports that this platform could be on its final stages.

muthoni

Muthoni Mary is a seasoned crypto market analyst and writer with over three years of experience dissecting blockchain trends, price movements, and market dynamics. With a sharp eye for technical analysis and an in-depth understanding of on-chain metrics, she delivers insightful, data-driven content that helps investors navigate the fast-paced world of digital assets.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

Crypto Braces For April 2 — The Most Crucial Day Of The Year

DYDX shoots up 10% as buybacks get a quarter of protocol revenue

$7,000,000 Up for Grabs As Feds Tell Crypto Fraud Victims To Come Recover Their Money

Berachain rolls out next phase of proof-of-liquidity system

White House to Scale Back Tariffs, Bitcoin Gains on Eased Economic Jitters

More is Less: Feature Fatigue is Driving Web3 Users Away

Trump-Linked WLFI Snaps Up 3.54M MNT After Last Week’s Hard Fork

Tokenized US gold could ultimately benefit Bitcoin: NYDIG

XRP Price Reclaims Ground—Is a Bigger Push Just Getting Started?

First meta-DEX aggregator Titan launches on Solana

Crypto Trader Sees Memecoin Resurgence After Sector Got ‘Smashed’ – Here Are His Top Picks

$90K Target Ahead as BTC Options Volume nears $800M

This Week in Crypto Games: Jurassic World in ‘The Sandbox’, Telegram Gets ‘Not Games’

Fidelity files for Ethereum-based US Treasury fund ‘OnChain’

German Regulator BaFin Identifies ‘Deficiencies’ in Ethena’s USDe Stablecoin, Orders Immediate Issuance Halt

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Crypto’s Big Trump Gamble Is Risky

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

Trump’s Coin Is About As Revolutionary As OneCoin

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Is $200,000 a Realistic Bitcoin Price Target for This Cycle?

Trending

24/7 Cryptocurrency News5 months ago

24/7 Cryptocurrency News5 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin2 months ago

Bitcoin2 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News2 months ago

24/7 Cryptocurrency News2 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Bitcoin4 months ago

Bitcoin4 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Altcoins2 months ago

Altcoins2 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Price analysis5 months ago

Price analysis5 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x

✓ Share: