Feature

Is USDT Losing to RLUSD and USDC?

Published

3 months agoon

By

admin

Is the EU’s MiCA framework forcing investors to rethink their allegiance to Tether’s USDT and explore alternatives like Circle’s USDC and Ripple’s RLUSD?

USDT under radar

For years, Tether’s USDT (USDT) has been the go-to stablecoin for traders and investors. Yet, as we step into 2025, its dominance is starting to waver, particularly in the European Union, where mounting regulatory scrutiny and growing competition are challenging its unshakable reputation.

The turning point came on December 30, 2024, with the full implementation of the European Union’s Markets in Crypto-Assets regulations.

Designed to bring order to the unpredictable crypto market, MiCA has imposed stringent compliance requirements on stablecoin issuers, including a mandate for major players like Tether to hold 60% of their reserves in EU banks.

As these regulations take effect, Tether is grappling with a wave of redemptions, new regulatory hurdles, and intensifying competition from rivals like Circle’s USDC (USDC) and Ripple’s RLUSD (RLUSD).

In the past, Tether’s CEO, Paolo Ardoino, raised concerns over the risks of “bank failures,” arguing that such requirements could expose stablecoin issuers to systemic vulnerabilities rather than reducing them.

Just to correct the statement: we’re still discussing with the regulator about our concerns that I expressed in our interview, that would pose severe risks to stablecoins regulated in EU.

Uninsured cash deposits are not a good idea.

We should learn from what happened with…

— Paolo Ardoino

(@paoloardoino) April 11, 2024

But the market seems less concerned with Tether’s reasoning and more with its actions — or lack thereof.

In the days leading up to MiCA’s implementation, nearly $4 billion worth of USDT was redeemed, marking the largest outflow since the 2022 crypto winter.

Back then, scandals like the collapse of FTX and revelations of fraud across the industry sent shockwaves through crypto, shrinking USDT’s market cap from $83 billion in May to $65 billion by November — a 21% drop.

The recent decline, while smaller, carries deeper implications. As of Jan. 9, Tether’s market cap stands at $137.5 billion, down from $141 billion just two weeks earlier.

The question now is not just whether Tether can adapt but whether the market will wait for it to do so. With USDC cementing its regulatory foothold and RLUSD rapidly gaining momentum, could this be the beginning of a sharp decline for the world’s largest stablecoin? Let’s try to decode.

Competitors closing In: USDC and RLUSD’s strategic advances

Tether’s reluctance to comply with its strict reserve requirements has raised red flags among investors, while its competitors are thriving under the new framework.

Even though EU member states have up to 18 months to fully enforce MiCA, the market isn’t waiting. Investors and exchanges are already repositioning, and USDT’s grip on the market appears to be slipping.

For context, exchanges like Coinbase and OKX have already delisted USDT for European users, citing non-compliance with MiCA.

Circle’s USDC stands out as a prime beneficiary of the regulatory shift. Having secured MiCA approval in mid-2024, USDC has positioned itself as the stablecoin of choice for exchanges looking to align with EU rules.

Binance’s partnership with Circle, aimed at accelerating USDC adoption globally, is a direct response to growing demand for transparency and compliance. This move has already begun to pay off; USDC’s market cap has grown by $2 billion since securing the license.

Meanwhile, Ripple’s RLUSD, launched on December 17, 2024, is also gaining traction as a regulatory-compliant alternative.

Designed to operate seamlessly on the XRP Ledger (XRP) and Ethereum (ETH), RLUSD processed 33,953 transactions on the XRP Ledger and 1,690 on Ethereum during its testing phase alone.

Ripple’s big Moment as RLUSD gains momentum in a changing era

The year 2025 could be a turning point for Ripple, as a convergence of legal victories, strategic partnerships, and a crypto-friendly administration in the U.S. creates ideal conditions for expanding its foothold in the stablecoin market.

With Donald Trump’s presidency expected to usher in crypto-friendly policies, Ripple may finally resolve its long-standing legal battle with the Securities and Exchange Commission, lifting a major obstacle to its growth.

Already, Ripple has scored key wins in the SEC case, including reducing a potential $2 billion penalty to just $125 million. This resolution provides the company with the breathing room needed to refocus on innovation and the rollout of RLUSD.

Monica Long, Ripple’s president, has hinted at ambitious plans for RLUSD, including imminent listings on major exchanges to broaden its reach and utility.

“We are continuing to expand distribution and availability of Ripple dollars on other exchanges. So, I think you can expect to see more availability, more announcements coming soon,” Long shared in a recent Bloomberg interview.

Ripple’s well-established payments business is also a crucial driver for RLUSD’s adoption. Over the past year, Ripple’s payment solutions have doubled their transaction volume, reflecting their value in facilitating seamless cross-border transactions.

Stablecoins like RLUSD could enhance this ecosystem by offering businesses an efficient alternative to traditional banking systems.

As Ripple expands RLUSD’s availability, businesses already relying on its payment solutions could likely adopt the stablecoin, further accelerating its growth.

Beyond payments, partnership with Chainlink, a leader in blockchain oracles, could propel it into the decentralized finance space.

Chainlink’s infrastructure, which has supported over $18 trillion in transaction value, positions RLUSD to integrate effectively with DeFi ecosystems, offering new opportunities for both traditional and DeFi users.

The stablecoin market, now valued at $206.2 billion, continues to remain dominated by USDT, which holds 66% of the market share.

What to expect next?

USDT’s struggles have been years in the making, marked by its unmatched dominance but shadowed by persistent questions about transparency.

While Tether has consistently maintained its peg to the U.S. dollar, its reluctance to provide full-scale audits and ongoing accusations of under-collateralization have fueled mistrust.

Amid this, USDC has positioned itself as the “safe” alternative, building its reputation on monthly attestations and a compliance-first approach. Its recent approval under Europe’s MiCA regulations has further strengthened its foothold in the region.

Meanwhile, Ripple’s RLUSD, though a newer entrant, is also gaining traction with Ripple’s strong payment infrastructure, rapid exchange listings, and seamless integration into DeFi markets.

As MiCA sets a clear regulatory benchmark in the EU, the U.S. would soon follow suit. Signals from the Trump administration suggest an acceleration of crypto-friendly policies, likely pushing the U.S. toward an accountable regulatory framework.

With these shifts, 2025 may mark the beginning of a power transition in the stablecoin market. While USDT remains the leader, for now, the momentum of its competitors signals that change is upcoming.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Source link

You may like

‘Big Short’ Investor Steve Eisman Derisks, Says Stock Market Volatility Will Be Here for a While

Dow drops over 500 points as UnitedHealth tanks, Fed tensions weigh on markets

Gold Is Still the Safe-Haven King, While Bitcoin Loses Out: JP Morgan

Dogecoin Price Breakout in view as Analyst Predicts $5.6 high

Bitcoin (BTC) Price in Standstill at $85K as Trump Increases Pressure on Fed’s Powell

Ripple acquisition Hidden Road secures FINRA registration

Feature

Janover climbs over 840% as Solana becomes its core treasury asset

Published

1 week agoon

April 9, 2025By

admin

How did Janover go from real estate loans to a Solana validator network — and what explains its 840% stock jump in less than 24 hours?

A tiny SaaS firm goes full crypto

Janover (JNVR), a relatively unknown software company that connects commercial real estate borrowers with lenders, has made an unexpected move into the crypto world.

On Apr. 7, the company announced that a group of former Kraken executives had acquired a controlling stake and raised $42 million in funding.

Alongside this, Janover revealed a new digital asset strategy focused on Solana (SOL), including plans to rebrand as DeFi Development Corporation.

While Janover will continue running its software operations, the company now intends to hold Solana’s SOL token as its core treasury asset.

Before the announcement, JNVR traded at $4.44, with limited trading activity. However, following the news, the stock opened at $10 in pre-market trading, surged to an intraday high of $48.47, marking a brief 1,000% jump, and ultimately closed at $40.25, reflecting an 842% gain on the day.

Trading volume also spiked from a few thousand shares to over 25 million, largely driven by retail interest after the crypto pivot.

Let’s take a closer look at what the company is doing and why the market responded the way it did.

A new owner, a new direction

Founded in 2018 by Blake Janover, Janover Inc. initially focused on financial technology in the commercial real estate space. Its core product was a software platform designed to connect real estate borrowers, such as those developing apartment complexes or shopping centers, with banks, credit unions, and other lenders.

The platform used AI tools to simplify loan discovery, aiming to streamline the borrowing process in a market that remains highly fragmented.

Janover operated as a software-as-a-service business, generating revenue through digital infrastructure that supported lending workflows.

The company went public on NASDAQ in July 2023 under the ticker JNVR, raising $5.6 million at $4 per share. Despite listing, Janover remained a small player in public markets, with low daily trading volume and a market capitalization below $5 million.

On Apr. 7, Janover announced a full strategic reorientation. The acquisition involved the purchase of 728,632 shares of common stock and all 10,000 shares of Series A preferred stock, granting the new group led by former Kraken executives controlling interest in the company.

To fund the shift, Janover raised $42 million through a mix of convertible notes and warrants. Crypto investors, including Pantera Capital, Kraken, Arrington Capital, and others, backed the raise.

The financial structure of the deal includes a few key components:

- Convertible notes: These carry a 2.5% annual interest rate and mature in April 2030. If Janover’s market cap hits $100 million, the notes can be converted into shares at $4.81 each.

- Warrants: These give investors the right to purchase additional shares in the future, priced at $120 or $150 per $1,000 invested, depending on the terms.

A crypto-focused overhaul

Janover’s new direction centers on holding Solana’s SOL token as its primary treasury asset, a strategy inspired by Strategy’s approach to Bitcoin (BTC), which it holds on its balance sheet.

But unlike Bitcoin, Solana operates on a proof-of-stake network, allowing holders to earn yield by running validator nodes.

Janover now plans to operate these validators directly. Validators are servers that confirm transactions and help maintain the security of the Solana blockchain. In return, they earn rewards, typically between 5% and 7% annually.

Running its own validators, instead of relying on third-party platforms, allows Janover to generate yield while also building stronger technical and operational alignment with the Solana network.

In parallel, the company has expressed interest in developing a deeper connection with the Solana ecosystem. While details remain limited, this could involve building software tools tailored to blockchain-based projects or integrating real estate finance with decentralized infrastructure.

For now, however, the focus is on asset acquisition and validator participation.

The transition is being led by a new executive team with strong crypto-native experience:

- Joseph Onorati, formerly Chief Strategy Officer at Kraken, has been named Chairman and CEO. He’s responsible for steering Janover’s shift to a digital asset treasury model. In remarks to CNBC, Onorati said the company would begin acquiring SOL and operating validators immediately.

- Parker White, now serving as CIO and COO, was previously Engineering Director at Kraken. He brings hands-on experience from managing a Solana validator with $75 million in delegated stake, along with overseeing a $2 billion bond portfolio in earlier roles. His combined background in blockchain operations and traditional finance will be key in managing both token holdings and staking infrastructure.

- Marco Santori, Kraken’s former Chief Legal Officer, has joined the board. Known for his work on crypto regulatory frameworks, Santori is expected to guide Janover’s compliance efforts as it enters the digital asset space.

Amid the market noise today, there is signal.

Please meet my new project, @defidevcorp. It’s a public crypto company with a new strategy going live today. I like to think of it as Microstrategy For Everything Else… and we’re starting with Solana.

It’s a team run by Kraken… pic.twitter.com/c3I176lx7h

— Marco Santori (@msantoriESQ) April 7, 2025

Importantly, Janover’s original leadership team remains in place. Founder Blake Janover and CFO Bruce Rosenbloom continue to oversee the company’s legacy real estate SaaS business, while William Caragol remains chair of the audit committee.

The new treasury paradigm

Janover’s shift toward a crypto-backed treasury model may seem unconventional, but it’s part of a growing trend. In recent years, several public companies have sought to replicate Strategy’s strategy of holding digital assets, initially Bitcoin, as core reserve assets.

Strategy itself holds over 500,000 BTC on its balance sheet. Its pivot was one of the earliest attempts to transform a public company into a direct proxy for exposure to a crypto asset.

More recently, GameStop, one of the U.S.-listed companies, have also adopted a crypto-focused capital strategy, although its approach has been more experimental and retail-driven.

Outside the U.S., Tokyo-listed Metaplanet has taken a similar route, positioning itself as a digital asset-aligned public company.

Janover’s move stands out as it appears to be the first U.S. company to adopt this kind of treasury model using Solana as the core asset, rather than Bitcoin.

In Canada, Sol Strategies is pursuing a similar vision, with its reserve holdings primarily allocated in SOL, instead of traditional cash or equity instruments.

While smaller in scale than Strategy’s holdings, these companies are helping to create a blueprint for aligning treasury management with blockchain ecosystems they believe in.

Amid this shift, SOL’s price has shown clear signs of volatility in the past 24 hours, though it’s followed an upward trajectory overall.

Starting from a low of $96.50, SOL steadily climbed throughout the day, reaching a high of $112.30 before settling around $111 at the time of writing, marking a gain of approximately 11% over the 24-hour period.

Much of this price movement seems to be influenced by broader market factors, particularly news related to trade tariffs, which have added short-term uncertainty across asset classes.

Source link

bybit

NFT industry in trouble as activity slows, market collapses

Published

2 weeks agoon

April 6, 2025By

admin

As the crypto market prepares for turbulence amid the tariff wars, the NFT market seems to be in a worse position.

Trading volumes are declining and marketplaces shutting down.

The once-hyped world of non-fungible tokens, which analysts once boldly projected could balloon to over $264 billion by 2032, now seems to be limping along. Weekly trading volumes have been falling like dominoes for weeks, scaring off capital and dragging the market back to levels not seen since its explosive 2020 debut.

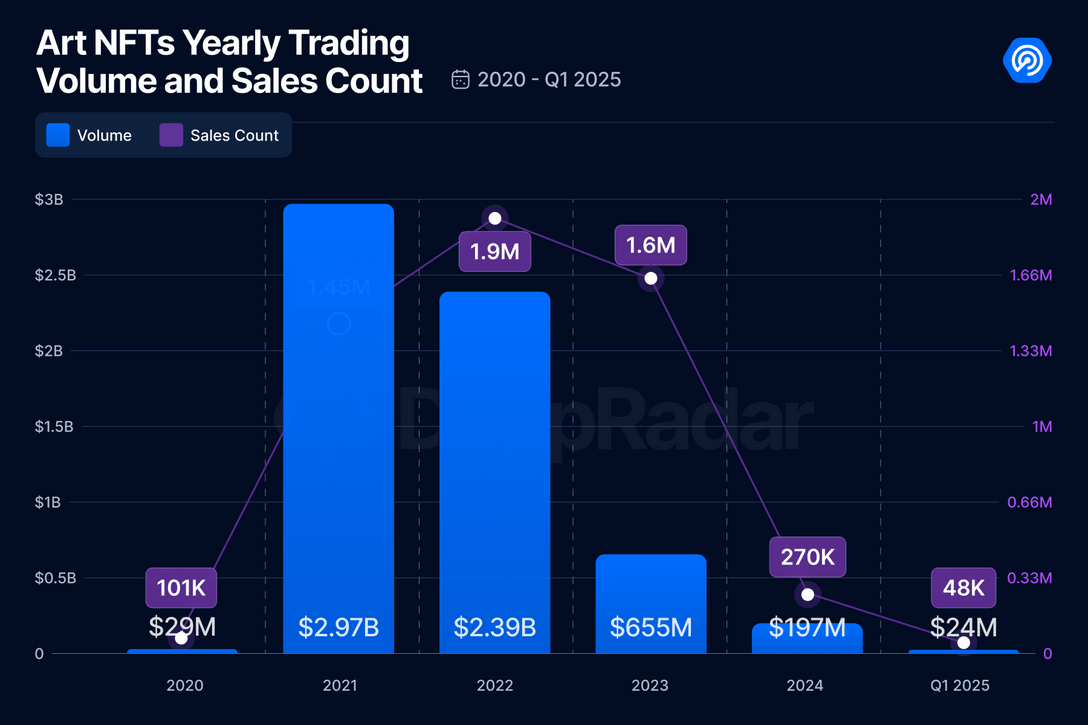

Blockchain analytics firm DappRadar shows that trading volumes in 2021 were riding high, hitting nearly $3 billion.

Fast-forward to the first quarter of 2025. That figure has nosedived 93% to just $23.8 million as “active traders have vanished,” blockchain analyst Sara Gherghelas noted.

“This rapid growth coincided with global shifts driven by the COVID-19 pandemic, accelerating the adoption of digital platforms and pushing artists to explore innovative methods of engaging with their audiences. However, three years later, the hype around Art NFTs has significantly decreased.”

Sara Gherghelas

The data backs her up. In 2024, trading volume dropped nearly 20% from the year prior, while total sales declined 18%. As Gherghelas put it in her 2025 research, it was “one of the worst-performing years since 2020.”

Still speculative assets

In an interview with crypto.news, OutsetPR’s legal officer Alice Frei implied that regulation is still a mess as “governments are still undecided on how to classify NFTs.”

In the U.S., they’re often treated like securities, meaning platforms must walk a legal tightrope. In the U.K., they’re seen more like collectibles under intellectual property law.

“These are examples of leading countries with clear cryptocurrency regulations; in many other countries, the situation is even more uncertain. This lack of regulatory clarity creates an environment that is ripe for fraud and erodes investor confidence. Until there is more consistency, NFT adoption will remain stagnant.”

Alice Frei

Frei also highlighted a deeper issue: beyond the worlds of cryptocurrency and gaming, NFTs are still “trying to prove that they offer real value.”

“In theory, they could revolutionize several industries — think concert tickets that prevent scalping, digital IDs for online verification, or property deeds stored on the blockchain. But in practice, most NFTs are still largely speculative assets.”

Alice Frei

Speaking of gaming, where NFTs have the most potential for mainstream use, their adoption is also struggling, Frei pointed out, recalling that Ubisoft’s Project Quartz, an attempt to integrate NFTs into AAA games, was met with “resistance from players, forcing the company to shut it down.”

Frei notes that gamers are “hesitant about digital assets that feel more like currency than a genuine addition to their experience.”

Revolving door

If the data wasn’t already bleak, March brought more bad news: a string of marketplace shutdowns added fuel to the fire. Among them, South Korean tech giant LG shut down its LG Art Lab, which was launched just three years ago at the height of the NFT mania. The company didn’t share detailed reasons, only saying that “it is the right time to shift our focus and explore new opportunities.”

Just a week later, X2Y2 — a former OpenSea rival that once boasted $5.6 billion in lifetime volume — also ceased its operations, citing a “90% shrinkage of NFT trading volume from its peak in 2021” and struggles to remain competitive in the space.

Then came Bybit. The crypto exchange, still reeling from a $1.46 billion theft linked to North Korea-affiliated hackers, quietly closed its platform.

Emily Bao, head of web3 at Bybit, said the decision would allow the company to “enhance the overall user experience while concentrating on the next generation of blockchain-powered solutions.”

Amid the wave of closures, Frei says the NFT market now “feels like a revolving door.”

“Take Bored Ape Yacht Club, for example – once the pinnacle of NFT status, its prices have dramatically dropped. At the peak, a single Bored Ape sold for $400,000, but now some are barely fetching $50,000. The problem lies in the fact that many NFT projects rely on hype rather than actual utility. If people cannot see long-term value, they are unlikely to return.”

Alice Frei

Last hope

Coinbase, too, seems to be pulling back. While it hasn’t officially shut down its NFT platform, all signs suggest it’s shifting focus. During an earnings call in early 2023, President and COO Emilie Choi indicated that the company sees “medium and long-term opportunities” in NFTs. But its real focus seems to be behind Base, its layer-2 blockchain network.

Coinbase declined to comment on its position as NFT activity continues to decline, despite multiple requests from crypto.news.

The OutsetPR legal officer thinks that with the market’s current trajectory, smaller platforms are unlikely to weather the storm. “Smaller platforms will continue to shut down, leaving only a few dominant players like OpenSea and Blur,” she said.

She explained that the shift is being driven by two major forces. First, tighter regulations are on the horizon, which will likely bring an end to the “Wild West days of NFTs.” Second, the gaming sector may offer NFTs a lifeline—but it’s still a narrow one. As Frei puts it, gaming may be NFTs’ “last hope,” though developers will still need to avoid “pay-to-win mechanics that could turn players away.”

“The hype is over. If NFTs are to survive, they will need to prove that they offer more than just expensive pictures on the blockchain,” Frei concluded.

Source link

Bitcoin

Trump pardons BitMEX, is ‘Bitcoin Jesus’ Roger Ver next?

Published

3 weeks agoon

March 30, 2025By

admin

Vitalik Buterin, Ross Ulbricht, and Tucker Carlson are among those urging President Donald Trump to pardon Roger Ver, aka Bitcoin Jesus.

Known as Bitcoin Jesus for his early advocacy of Bitcoin, Ver faces up to 109 years in prison on tax charges, including allegations of evading $48 million in taxes. Despite renouncing his U.S. citizenship in 2014 to avoid prosecution, Ver’s legal troubles resurfaced when he was arrested in Spain in 2024. But following the president’s earlier pardons of figures like Ulbricht and BitMEX co-founders, observers wonder whether Ver’s would catch a break. Is a pardon on the way, or will Ver’s legal troubles continue?

Read on for a closer look.

Crypto cronies

After Trump embraced cryptocurrency, many crypto leaders rallied to support him by donating funds to his inauguration and hobnobbing at galas.

Trump also , which industry brass celebrated.

In return, Trump signed an order to stockpile tokens and swiftly acted in favor of the industry. Under Trump-appointed SEC chair Mark Uyeda, investigations into several cryptocurrency companies, including Immutable, Crypto.com, Ripple, and Coinbase, were dismissed.

In a notable move on Thursday, March 27, Trump pardoned BitMEX co-founders Arthur Hayes, Benjamin Delo, and Samuel Reed, who had pleaded guilty to federal charges related to money laundering and regulatory violations. The trio was convicted for failing to implement anti-money laundering measures at BitMEX, which prosecutors had labeled a “money laundering platform.” Reed had also violated the Bank Secrecy Act and paid a $10 million fine. But under Trump, it seems all is forgiven.

This has sparked speculation on whether Ver, a prominent figure in the crypto world, could also receive the same courtesy.

Ver, a Silicon Valley native with a libertarian streak, was deeply involved in the early days of cryptocurrency, investing in companies like Kraken, Ripple, and Blockchain.com. In 2017, Ver hyped Bitcoin Cash (BCH) as more suitable for everyday payments.

Roger Ver was there for me when I was down and needed help. Now Roger needs our support.

No one should spend the rest of their life in prison over taxes. Let him pay the tax (if any) and be done with it. #FreeRoger pic.twitter.com/flP573hm0N

— Ross Ulbricht (@RealRossU) February 20, 2025

Ver’s past

In 2000, by the age of 20, Ver began to participate in libertarian party debates.

During these debates, he made critical statements about the agents of the Bureau of Alcohol, Tobacco, and Firearms, calling them “murderers” and referencing their involvement in the scandalous Waco Siege in which dozens of children were killed in a standoff between FBI and ATF agents and Branch Davidian cult followers. Ver didn’t know that ATF agents were present during these debates.

In the 2000s, Ver became involved in e-commerce. On top of tech enterprises, Ver was selling firecrackers on eBay. After selling unlicensed firecrackers in 2001, he was charged and spent 10 months in prison. The fact that he was locked in jail instead of being fined or notified about the necessity of obtaining a license led Ver to think that the case was politically motivated and that his criticism of ATF was the real reason behind his prosecution. Without fear of further persecution, Ver left the U.S. after his post-prison probation ended.

By 2011, Ver learned about Bitcoin and became one of its first investors. He also advocated for Bitcoin long before it went mainstream, with multi-million investments and national leaders talking about its importance for the future of their countries.

The key points of Ver’s advocacy for Bitcoin were the financial freedom of individuals and the stopping of government and banks from interfering in people’s lives.

The legal fight

Since February 2014, Ver has been a citizen of Saint Kitts and Nevis. He claims that he had to renounce his U.S. citizenship after long-lasting targeting from the U.S. government.

In April 2024, he was indicted and arrested in Spain on charges of U.S. tax evasion and mail fraud. Ver is accused of dodging $48 million in taxes after earning up to half a billion dollars through cryptocurrencies.

According to prosecutors, Ver failed to pay his “exit tax” on 131,000 BTC owned by his two companies when he left the U.S. and provided false info to the law firms filing Ver’s tax returns. Allegedly, he sold his bitcoins in 2017 without notifying the financial attorneys.

Ver clarifies that three charges of mail fraud (combined, punishable by 19 years behind bars) are based on the three letters with his tax returns he sent to the Internal Revenue Service (IRS).

Ver denies he committed crimes such as tax evasion and mail fraud. He insists he was doing his best to comply with the nascent Bitcoin taxation rules, and that his prosecution was politically motivated.

In December, he began his legal fight against the prosecution, denying all the charges. He filed a motion to dismiss charges, but the government rejected it in January.

Ver’s legal team challenged an exit tax as “an unconstitutional burden on the fundamental right to expatriate.” For people like Ver, who have substantial amounts of low-liquidity assets, the exit tax may be prohibitive. The government suggests Ver is a fugitive. He disagrees with this status as he doesn’t hide and didn’t commit crimes for which he is judged while living in the U.S.

On March 1, Ethereum’s Buterin published an X post arguing that the exit tax doesn’t exist in most other countries and called it the “tax-by-citizenship” and “extreme.”

In addition, Buterin mentioned that the IRS obtained some of the information by intimidating Ver’s lawyers. The Ethereum founder added:

“Genuine good faith mistakes should be treated by giving the actor the opportunity to pay back taxes if needed with interest and penalties, not with prosecution.”

Going to prison for the rest of your life over non-violent tax offenses is absurd. The case against Roger seems very politically motivated; like with @RealRossU, there have been plenty of people and corporations who have been accused of far worse and yet faced sentences far… https://t.co/7G3zDkn2F2

— vitalik.eth (@VitalikButerin) March 1, 2025

Will Bitcoin Jesus be pardoned?

Trump promised to pardon Ross Ulbricht if get elected. Ulbricht, the man behind the Silk Road marketplace charged for money laundering and drug trafficking, is an important figure in the history of Bitcoin as his marketplace drove Bitcoin’s adoption. After the inauguration, Trump indeed pardoned Ulbricht to much acclaim.

Soon, various crypto advocates began to urge Trump to pardon Roger Ver. On Jan. 21, 2025, following the pardon of Ross Ulbricht, an X influencer using the moniker Rothmus published a short post calling for the pardon of Ver to which Elon Musk replied: “will inquire.” This reply gave the community hope for the pardon of Bitcoin Jesus.

https://twitter.com/Rothmus/status/1881536312710402268

On March 17, Marla Maples, Trump’s ex-wife, took to X to share a touching video where people who met Ver tell their stories of his generosity.

It is not clear, though, if the POTUS paid attention to this post.

The hope for a pardon of Ver was seriously undermined on Jan. 26, when Elon Musk suddenly, via an X post, stated that Ver would not be pardoned because he gave up his U.S. citizenship.

Roger Ver gave up his US citizenship. No pardon for Ver. Membership has its privileges.

— Elon Musk (@elonmusk) January 26, 2025

The statement drew much criticism, as Musk is not an elected official and cannot decide who to pardon and who not to. He is, however, Trump’s advisor and was a major donor to his “MAGA” campaign.

More than that, the POTUS is not prohibited from pardoning non-U.S. citizens. Finally, many commented that Ver had to renounce his citizenship under pressure from ATF and a U.S. prison sentence.

I missed this tweet.

Another time I will publicly criticize Elon, hopefully for his own benefit. Because this is a terrible and wildly ignorant “hot take”.

1) You don’t need to be a citizen to get a pardon.

2) Ver was a citizen and specifically renounced his U.S. citizenship in…— Viva Frei (@thevivafrei) January 27, 2025

A few hours after Musk’s tweet, Ver took X to post a video in which he briefly explained why he was prosecuted and asked Trump for a pardon.

In the video, Ver stated that he is American and that renouncing his citizenship was one of the “hardest and saddest decisions [he] ever made.”

After Ulbricht, Hayes, Delo, and Reed received presidential pardons, others, including Angela McArdle, who currently serves as Chair of the national Libertarian Party, called for freeing Ver as well.

“Let’s pray Roger Ver is next!” she declared on Friday.

It remains to be seen whether Musk made skeptical comments over the possibility of Ver’s clemency on Trump’s behalf or if it was only his view of the situation.

At last check Saturday, Trump hasn’t commented on Ver’s situation.

Source link

‘Big Short’ Investor Steve Eisman Derisks, Says Stock Market Volatility Will Be Here for a While

Dow drops over 500 points as UnitedHealth tanks, Fed tensions weigh on markets

Gold Is Still the Safe-Haven King, While Bitcoin Loses Out: JP Morgan

Dogecoin Price Breakout in view as Analyst Predicts $5.6 high

Bitcoin (BTC) Price in Standstill at $85K as Trump Increases Pressure on Fed’s Powell

Ripple acquisition Hidden Road secures FINRA registration

Ethereum Whales Offload 143,000 ETH In One Week – More Selling Ahead?

How Do We Protect Bitcoin From Quantum Computers? Not With A Joke

OKX Goes Live In The US After Setting Up New Headquarters in San Jose, California

Stanford’s AI research lab to use Theta EdgeCloud for LLM model studies

Central African Republic Solana Meme Coin Jumps as President Fuels Rumors of Revival

Will Shiba Inu Price 3x?

Bitcoin Cash (BCH) Gains 4.2%, Leading Index Higher

Bybit shuts down four more Web3 services after axing NFT marketplace

Aptos To Continue Moving In ‘No Man’s Land’ – Can It Reclaim $5?

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

Crypto’s Big Trump Gamble Is Risky

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

I’m Grateful for Trump’s Embrace of Bitcoin

Trending

24/7 Cryptocurrency News5 months ago

24/7 Cryptocurrency News5 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin3 months ago

Bitcoin3 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Ripple Price4 weeks ago

Ripple Price4 weeks ago3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Altcoins3 months ago

Altcoins3 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin5 months ago

Bitcoin5 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals