FTX

Kraken is gearing up for the next round of FTX payouts, including claims about $50K

Published

2 months agoon

By

admin

Kraken confirmed it will begin the next round of FTX payouts on May 30, covering claims both below and above $50,000.

According to FTX creditor representative Sunil’s recent post on X, Kraken has begun sending emails to FTX users, confirming that the next round of FTX payout distribution will take place on May 30. This distribution, which marks the second round of FTX repayments, will cover claims both below and above $50,000.

FTX Claims Distribution

Distributor: Kraken@krakenfx has started sending out emails

to FTX customers confirming theNext FTX distribution

30th May 2025Claims <$50k and Claims> $50k

are included in this distribution pic.twitter.com/nVjF4YPI94— Sunil (FTX Creditor Champion) (@sunil_trades) March 6, 2025

The now defunct crypto exchange FTX announced on Feb. 7 that initial distributions to holders of allowed claims in the Plan’s Convenience Classes would begin on Feb. 18, with repayments facilitated through BitGo and Kraken. Kraken even provided trading fee credits alongside the payouts to avoid profiting from the distribution process.

The first repayment round, which started on Feb.18, covered approved Convenience Class claims valued at $50,000 or less. Small claimants will receive full repayment plus post-petition interest of 9% per annum by April 11. Larger claimants (with claims valued above $50,000), including institutional investors and VC firms, have been not been issued any repayments as of yet.

Complex legal disputes and asset recovery efforts have delayed the distribution to larger investors. But with the next repayment round slated for May 30, larger investors will start receiving their funds (+9% interest accrued per annum), with roughly $16 billion earmarked for total distributions.

FTX, once valued at $32 billion, collapsed in Nov. 2022 after it was revealed that Alameda Research had misused customer funds to cover its own losses. A wave of withdrawal requests followed, but FTX could not meet them. The exchange halted withdrawals and filed for bankruptcy. FTX’s founder, Sam Bankman-Fried, was convicted on fraud and conspiracy charges in Nov. 2023. Other former executives, including Caroline Ellison and Gary Wang, pleaded guilty and cooperated with authorities. John J. Ray III took over as CEO in Nov. 2022 and has led efforts to locate and recover FTX’s lost assets through lawsuits, real estate purchases, and liquidations of FTX’s remaining assets.

Source link

You may like

Here’s How Bitcoin Could Boost Demand for US Treasuries, According to Macro Guru Luke Gromen

Experts Predict US Recession in 2025 if Trump-China Trade War Tariffs Stay

Monero Jumps 51% After ‘Suspicious Transfer’ of $333M in Bitcoin

ZachXBT flags suspicious $330M Bitcoin transfer triggering Monero surge

Monero’s XMR Rockets 40% as XRP Leads Crypto Majors Gains

The 5 top crypto loan platforms of 2025

Bankruptcy

FTX to Begin $11.4B Creditor Payouts in May After Years-Long Bankruptcy Battle

Published

4 weeks agoon

March 29, 2025By

admin

FTX, the collapsed cryptocurrency exchange once helmed by Sam Bankman-Fried, plans to begin paying its main creditors at the end of May, Bloomberg reported based on court proceedings in Delaware this week.

The company has gathered $11.4 billion in cash to distribute to thousands of parties affected by its 2022 bankruptcy, with the first payments to major creditors set for May 30.

These include institutional investors and firms that held crypto on FTX’s platform. Smaller creditors with claims below the $50,000 mark have already begun receiving distributions.

FTX’s collapse left a financial crater and a trail of frustrated creditors—many of whom expected to be repaid in crypto, not dollars. Since the bankruptcy, the price of bitcoin has more than quadrupled, intensifying frustrations among those waiting for their assets back.

The task of unwinding FTX’s balance sheet has been slowed by a large number of claims, many of them reportedly questionable. Andrew Dietderich, a bankruptcy attorney for the firm, told the court that FTX has received “27 quintillion” claims, Blloomberg reported, many of which are duplicates or outright fraudulent.

Interest payments are compounding the urgency. While FTX earns only a modest return on its cash, legitimate creditors are entitled to 9% interest annually on unpaid claims. The longer it takes to pay, the more the company could owe.

Read more: Nearly All FTX Creditors Will Get 118% of Their Funds Back in Cash, Estate Says in New Plan

Source link

crypto liquidations

US court permits Three Arrows Capital to expand claim against FTX, rejects FTX’s objections

Published

2 months agoon

March 14, 2025By

admin

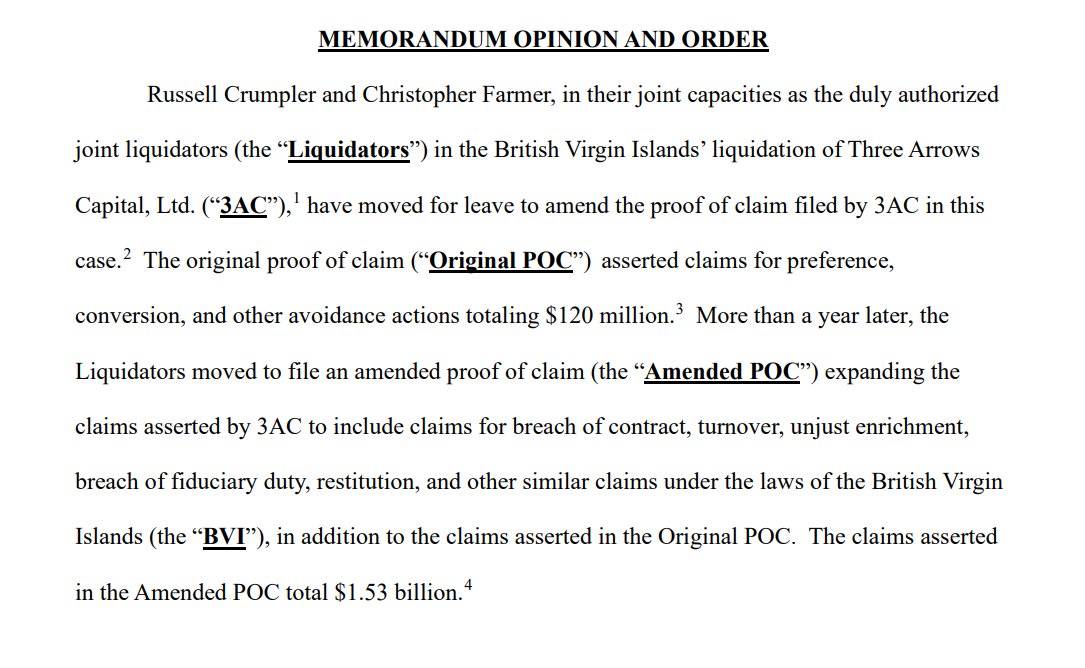

A U.S. bankruptcy court has allowed the liquidators of the defunct crypto hedge fund Three Arrows Capital to substantially increase its claim against the collapsed crypto exchange FTX from $120 million to $1.53 billion.

In a March 13 ruling by the US Bankruptcy Court for the District of Delaware, the judge ruled that FTX is to pay out $1.53 billion to Three Arrows Capital, increasing the claim from the original $120 million filed in June 2023. FTX objected to the decision, arguing it was too late and would slow down their bankruptcy process. However, the judge sided with 3AC’s liquidators, opining that they had provided sufficient notice of their claim. The judge determined that the delay in filing the larger claim was mainly due to FTX not promptly sharing relevant records with 3AC’s liquidators. 3AC liquidators needed that information to properly assess and detail their claim.

The 3AC’s liquidators are claiming that FTX held $1.53 billion in 3AC’s assets, which were then liquidated to pay off 3AC’s debts. Furthermore, 3AC liquidators argued that those transactions were avoidable and that FTX didn’t provide the information that would’ve uncovered the liquidation.

Both 3AC and FTX were once major players in the crypto world, but both are no defunct. Three Arrows Capital was one of the largest crypto hedge funds that collapsed in June 2022 due to forced liquidation of overleveraged positions in Bitcoin (BTC), Ethereum (ETH), and other altcoins. They filed for bankruptcy in July 2022. Its liquidators are now trying to recover funds by selling their remaining assets and through various lawsuits, most notably against FTX and Terraform Labs to repay its creditors.

FTX crypto exchange declared bankruptcy in Nov. 2022 and has also seen been trying to recoup funds through various lawsuits, including one against Binance and Changpeng Zhao. FTX recently started their repayment process facilitated through BitGo and Kraken exchanges.

Source link

cryptocurrency

Crypto exchange Backpack, founded by former FTX execs, acquires FTX EU

Published

4 months agoon

January 7, 2025By

admin

FTX alumni’s Backpack Exchange completes acquisition of FTX EU, set to launch MiFID II-regulated crypto products.

Backpack, a crypto exchange founded by former FTX executives, has acquired FTX EU, the former European arm of FTX, as part of its expansion into the European market. The acquisition, approved by the FTX bankruptcy court and the Cyprus Securities and Exchange Commission, will allow Backpack to offer regulated crypto derivatives and other financial products to European users, the company said in a blog announcement.

The new European branch will provide a range of crypto derivatives, including perpetual futures. This comes as other exchanges exit Europe, leaving a gap in the regulated crypto derivatives market. Backpack chief executive Armani Ferrante says becoming a MiFID II-licensed entity “demonstrates our dedication to meeting the highest regulatory standards and is a significant step to bringing transparent, secure, and regulated crypto trading to an underserved European market.”

In addition to offering new products, Backpack EU will handle the distribution of FTX bankruptcy claims to FTX EU customers. Backpack EU will also integrate traditional payment systems, allowing users to make payments across Europe via SEPA and wire transfers, the announcement reads.

The company plans to reactivate its EU license and launch Backpack EU in Q1 2025, though no exact timeframe has been provided for the launch.

Founded in 2022 by Armani Ferrante, an early employee of Alameda Research, Backpack was initially launched as the non-custodial Backpack Wallet. In November 2022, during the collapse of FTX, Backpack lost $14.5 million, which was 88% of its operating funds. Despite that setback, the team chose to continue building with minimal funding.

Source link

Here’s How Bitcoin Could Boost Demand for US Treasuries, According to Macro Guru Luke Gromen

Experts Predict US Recession in 2025 if Trump-China Trade War Tariffs Stay

Monero Jumps 51% After ‘Suspicious Transfer’ of $333M in Bitcoin

ZachXBT flags suspicious $330M Bitcoin transfer triggering Monero surge

Monero’s XMR Rockets 40% as XRP Leads Crypto Majors Gains

The 5 top crypto loan platforms of 2025

XRP Price Shows Strength — Breakout Above Key Levels Possible?

Expert Reveals Why The Ethereum-To-Bitcoin Ratio Is Falling

Analyst Says Solana-Based Memecoin Going Much Higher, Sees PENGU Facing ‘True Test’ After April Surge

Nike sued for $5 million over its shutdown of NFT platform RTFKT

Biological Age vs. Chronological Age: Redefining Age in the Digital Era

TRUMP whale regrets sale, pays double to buy back meme coins

Stripe Tests New Stablecoin Project as $3.7T Market Looms

Falling Wedge Pattern Confirms $264 target

Dogecoin Confirms Daily Trend Reversal With Breakout, Retest, And New Uptrend

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Crypto’s Big Trump Gamble Is Risky

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

I’m Grateful for Trump’s Embrace of Bitcoin

Trending

24/7 Cryptocurrency News6 months ago

24/7 Cryptocurrency News6 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin3 months ago

Bitcoin3 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Ripple Price1 month ago

Ripple Price1 month ago3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin6 months ago

Bitcoin6 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Opinion6 months ago

Opinion6 months agoCrypto’s Big Trump Gamble Is Risky

Bitcoin6 months ago

Bitcoin6 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Bitcoin3 months ago

Bitcoin3 months agoThe Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines