cryptocurrency

Launchpads are the key to decoding crypto investment

Published

4 months agoon

By

admin

Disclosure: The views and opinions expressed here belong solely to the author and do not represent the views and opinions of crypto.news’ editorial.

When investors decide which stocks or ventures to invest in, they usually have a set of criteria to evaluate which options best align with their financial goals. One main factor to consider is risk appetite, which refers to investor willingness to take on risk in pursuit of potential returns.

Those with a lower risk appetite prefer more stable blue-chip stocks with steady but modest returns. On the other hand, investors with a higher risk tolerance may seek out more volatile stocks or emerging markets, enticed by the possibility of substantial returns. They are often willing to endure market fluctuations, believing the potential long-term rewards outweigh the risks.

However, when it comes to crypto, retail investors have remained conservative. Despite the industry’s notorious promises of high returns, many retail investors cautiously approach crypto. Their hesitation is due to crypto’s well-known volatility, the perception that frauds and scams are prevalent, and a general lack of technological understanding compounded by a complex user experience.

With 2025 on the horizon and Bitcoin (BTC) soaring amid bullish vibes, crypto has steadily gained traction as a legitimate investment class. While recent price jumps stem from Donald Trump’s election victory and his crypto-friendly appointees, the industry has been gaining traction for some time.

The industry has found a new product-market fit for stablecoins, DeFi is booming, and newly improved infrastructure has enabled a variety of new applications while also reducing transaction costs. As such, many retail and institutional investors are becoming enamoured with crypto’s investment potential and growing technological capabilities.

This begs the question: How can blockchain-based projects effectively convert conservative retail and institutional investors into active participants beyond their comfort zone?

Enter crypto launchpads

Crypto launchpads grant investors early access to tokens before they list on public exchanges. In practice, this offers investors enticing investment opportunities as they have the potential for higher ROIs.

Cryptocurrency uncertainty can be unsettling for those who prefer investing in safe stocks with steady growth. Launchpads address these concerns by helping make crypto approachable, challenging the perception that it is unsafe, and emphasizing transparency to foster trust among hesitant new investors.

The concept wasn’t always perfect. For one, ICOs became notorious during the 2017 bull run due to scammy token launches and straight-up fraud. However, the next generation of crypto launchpads incorporates stronger vetting practices to bolster safety and informed investment. This allows investors to engage with early-stage projects with a sense of security they might not get when exploring projects independently.

Investors gain here in two ways. They get to actively engage with projects with some level of protection and gain bragging rights to say they helped launch an innovation in a growing field. As crypto expands and matures, so do the launchpads that propel many of the industry’s most promising projects, even putting community-focused spins on the “auction house” vibe launchpads sometimes inhabit.

For instance, Gems’s launchpad emphasizes community and networking as it seeks to establish an exclusive ecosystem for crypto investing and fundraising. At the heart of Gems’s platform is a diverse network of “Leaders,” eager and discerning investor influencers who then rally their community around projects on the launchpad based on their interests and speciality.

Compared to other launchpads, Gems recognizes the unpredictability of crypto investments and offers an optional protection program through a trusted insurance provider. To make sure the projects utilizing their launchpad are the cream of the crop, Gems’s investment committee also conducts a thorough vetting process to pinpoint teams with the most disruptive potential.

It’s understandable why investors may be cautious about investing in unknown crypto projects. However, launchpads are an irreplaceable asset for an industry that is in the midst of expansion by helping demystify early-stage investing and broadening access to everyone.

Source link

You may like

Tariff Carnage Starting to Fulfill BTC’s ‘Store of Value’ Promise

The cost of innovation — Regulations are Web3’s greatest asset

Best Crypto to Buy as Derivatives Exchange CME Set to Launch XRP Futures

Metaplanet Buys Additional ¥1.92 Billion Worth Of Bitcoin

Here Are Four Signs the Stock Market Has Bottomed, According to Fundstrat’s Tom Lee

Bitcoin dips below $94,000 as ETFs record $3b weekly inflow

Disclosure: The views and opinions expressed here belong solely to the author and do not represent the views and opinions of crypto.news’ editorial.

Although some believe that crypto PR and communications efforts should slow down when the markets are cooling off, it couldn’t be further from the truth. Sure, during crypto winters, product development teams huddle together to work on building their solutions—and that’s great—but these are also the ideal times for brand building.

Indeed, when the market is going through a crypto slowdown, the strategic brands are seizing the opportunity to strengthen credibility while everyone else is hibernating. And when the market inevitably heats up, this strategy will position such players ahead of the competition.

Now, not all might agree with this point of view, arguing that pushing PR during a downturn is tone-deaf. Others might see slow market communications as unnecessary noise when product development should be the only priority. But visibility isn’t vanity—it’s strategy, and it’s easier to get noticed in calmer markets.

Slower news, hungrier journalists

As the movements in the crypto market slow down, so does everything else that relates to it, including newsrooms. In other words, journalists have more space (and patience) for stories that go beyond mere price action. There are no big stories of exploding digital assets. Bitcoin (BTC) is nowhere near reaching a new all-time high, and altcoins are taking the cue from the industry’s number one, sleeping it off themselves.

Thus, when the hype and the noise in the crypto sphere die down, media outlets are on the lookout for stories worth telling. In such moments, true innovation and strong projects get their chance to shine and get real editorial interest, instead of getting lost among drama-driven headlines.

Small news can be perceived as newsworthy in a bear market

Here’s a secret—during a bull run, not even a $10 million funding round might turn heads. It’s just too common when there’s money flowing everywhere across the board. To illustrate, an insider source at a crypto media powerhouse once said that their “funding news coverage threshold is a minimum of $10 million, with exceptions.”

This might sound counterintuitive at first, but in a more bearish market sentiment, that same outlet might just be interested in a mere $5 million, or even a $1.4 million seed round, like the one recently raised by crypto payment hub Lyzi to expand its Tezos-based service.

In other words, Lyzi has just told the world that it’s there and constantly working on building its product. Arguably, in a period of market pessimism, it would be one hell of a smart and well-timed PR move, and the best part—the likes of CoinDesk might pick it up.

Pick up the mic when no one else is talking

Providing expert commentary when the industry goes silent becomes even more valuable. Journalists still seek third-party sources and insights, and this is your chance to establish yourself as an authoritative figure in the sector, to whom journalists will come back when the bull market returns.

This means that when it’s all quiet on the crypto front and a journalist comes knocking at your door, be ready. Hiring a good PR firm that will lead you, shape your story, and provide the stage is certainly the right move, but it’s up to you to step up with confidence and claim the spotlight.

Execution still matters

With this in mind, don’t mindlessly drop news just for the sake of it. Be strategic about timing, like holidays, conferences, and other major events that might overshadow your news, as well as the tone—this isn’t the time to brag but display resilience and value.

Also, use the time of market bearishness to build your reputation and flesh out your digital footprint through earned media placements in trusted crypto outlets. Potential users, partners, and investors will look you up online, so make sure they have good things to read about you—that’s your PR working in the background.

The real bottom line

All things considered, crypto PR in times of market stagnation and bearish sentiment is not so much about creating hype as it is about demonstrating real substance. It’s about crafting a narrative that portrays you as the crypto player who can weather the blizzard, better positioning your brand.

So, the next time you’re considering staying silent during a crypto downturn, think again. You might miss out on the best PR opportunities of the cycle, as at this time, you could get more attention than usual.

Don’t wait for the bull to charge—make your mark when the field is clear.

Afik Rechler

Afik Rechler is the co-founder and co-CEO of Chainstory, a results-driven crypto PR agency. He specializes in crypto communications and search-driven content marketing. Afik has been in the crypto industry since late 2016, helping blockchain businesses meet their marketing and communications goals.

Source link

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

As Bitcoin (BTC) edges closer to the psychologically significant $100,000 milestone, several technical and on-chain indicators suggest that a major breakout could be on the horizon. One such metric – Bitcoin’s Apparent Demand – has shown a strong rebound, signalling renewed interest and sustained accumulation in the market.

Bitcoin Sees Sharp Rebound In Apparent Demand

According to a recent CryptoQuant Quicktake post, contributor IT Tech pointed to a significant rise in BTC’s Apparent Demand. Most notably, this key indicator has returned to positive territory after spending several consecutive weeks in the red.

Related Reading

For the uninitiated, Bitcoin’s Apparent Demand (30-day sum) measures the cumulative net demand for BTC over the past 30 days by tracking wallet accumulation and exchange outflows. A sharp increase in this metric suggests strong, sustained buying pressure, which can indicate bullish sentiment and potential for a price rally.

The following chart illustrates this rebound in BTC’s Apparent Demand, which essentially reflects net changes in one-year inactive supply adjusted by daily block rewards – a metric designed to better represent organic demand growth.

Previously, this metric had fallen deeply into negative territory – dipping below -200,000 (highlighted in red) – suggesting waning demand. However, its recent reversal into positive territory signals that long-dormant capital is flowing back into the market. As noted in the post:

The demand pivot is closely aligned with the recent price rebound above $87K, implying this recovery is underpinned by real on-chain behavior rather than purely speculative flows.

This marks the first positive Apparent Demand reading since February and aligns with rising inflows into spot Bitcoin exchange-traded funds (ETFs), as well as growing accumulation by long-term holders.

Data from SoSoValue shows that US-based spot BTC ETFs have recorded five consecutive days of net positive inflows, totalling more than $2.5 billion. The cumulative net inflow into spot BTC ETFs now stands at an impressive $38.05 billion.

Is A BTC Rally In Sight?

IT Tech noted that past reversals in Apparent Demand have historically preceded either significant rallies or periods of strong price support. If the current trend continues, BTC may have the momentum needed to challenge the $90,000 level in the near term.

Related Reading

However, analysts caution that Bitcoin must hold its current support around $91,500 to maintain upward momentum. This level is particularly important because it is close to the realized price of short-term BTC holders, according to CryptoQuant contributor Crazzyblockk.

Further adding to this outlook, prominent crypto analyst Rekt Capital emphasized that Bitcoin needs to secure a weekly close above $93,500 and reclaim it as support in order to establish a clear path to $100,000. At press time, BTC trades at $94,492, up 2% in the last 24 hours.

Featured image from Unsplash, charts from CryptoQuant and Tradingview.com

Source link

Bitcoin

Bitcoin Must Clear This Critical Cost Basis Level For Continued Upside, Analyst Says

Published

4 days agoon

April 23, 2025By

admin

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

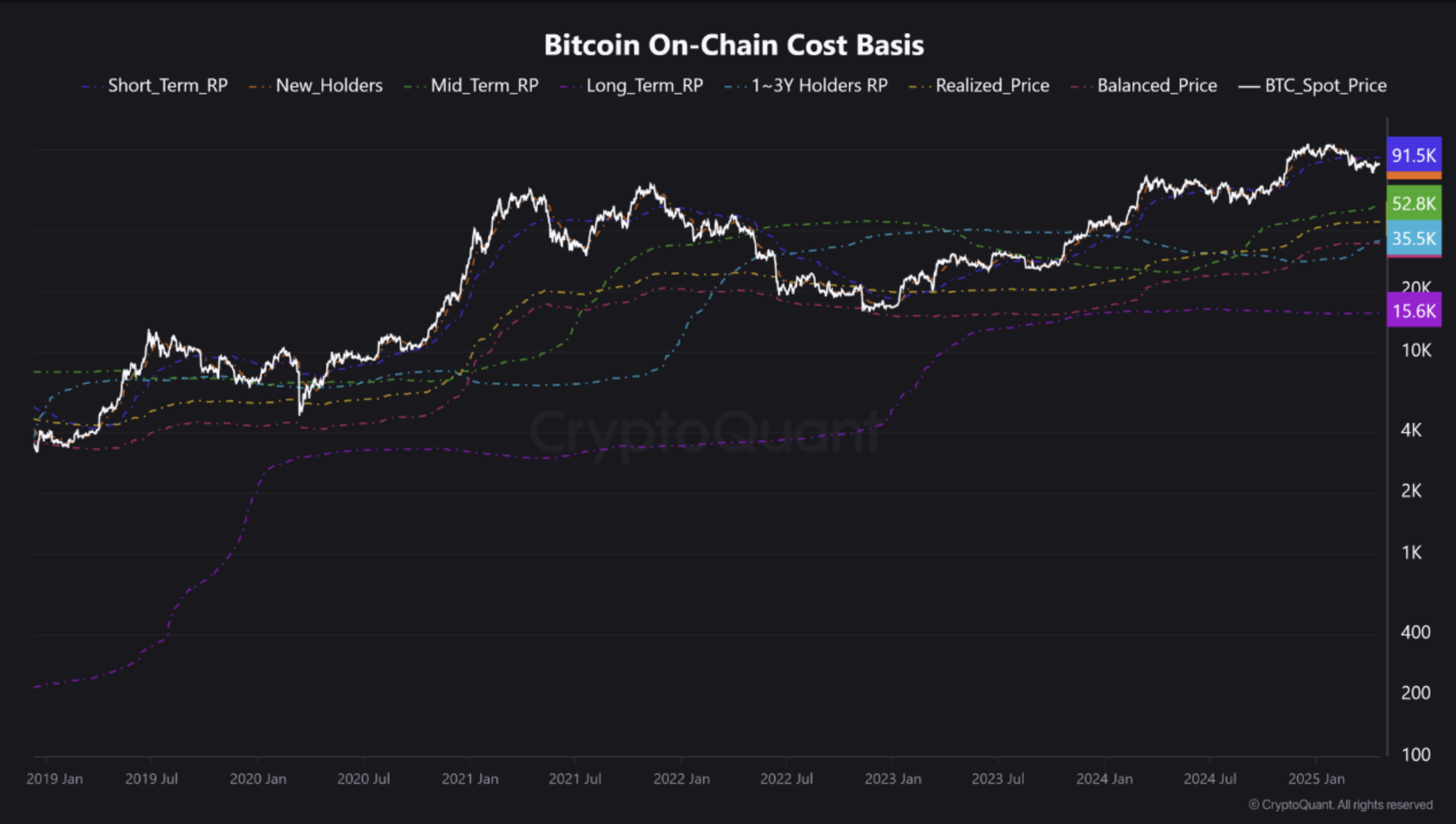

In a recent CryptoQuant Quicktake post, contributor Crazzyblockk highlighted key Bitcoin (BTC) cost basis zones that the leading cryptocurrency must clear – or avoid breaking below – to sustain its bullish momentum.

Analyst Highlights Key Bitcoin Cost Basis Zones

Bitcoin is beginning to show signs of newfound strength, with the top digital asset surging nearly 3.5% over the past week and trading in the high $80,000 range at the time of writing. BTC’s rise amid the global equity market downturn has reignited discussions about the cryptocurrency’s potential to ‘decouple’ from traditional markets.

Related Reading

In a recent Quicktake post, CryptoQuant contributor Crazzyblockk outlined Bitcoin’s various cost basis zones and realized price cohorts to identify key resistance and support levels.

The analyst noted that short-term holders – those who have held BTC for less than 155 days – currently have their realized price, or average cost, sitting at the $91,500 resistance level. Crazzyblockk added that this group tends to be the most price-sensitive.

On the other hand, the cost basis for new holders – those who have held the digital asset for one to three months – currently has its strongest support level around $83,700. The analyst pointed out that this level represents the cost basis of recent market participants, who often lead short-term trend changes.

To clarify, cost basis zones are price levels where a significant amount of BTC was last moved or acquired. A potential breakout above the short-term holders’ realized price would suggest new bullish momentum, as these holders would be back in profit and less likely to sell their holdings.

Conversely, a break below the new holders’ cost basis support level could signal potential downside movement, as recent buyers might begin incurring losses and be forced to capitulate.

Notably, each cost basis line highlighted in the chart below is calculated based on the realized price of Unspent Transaction Outputs (UTXOs) held within a specific age band. Similarly, realized price is determined by dividing the total value of all UTXOs by the number of coins.

Are Investors Expecting Further Upside?

Recent on-chain analysis suggests that BTC holders may be anticipating further upside. Short-term holders appear to be holding onto their BTC despite being in a loss position.

Related Reading

Additionally, crypto exchange net flow data hints that a BTC price rally may be imminent. Some analysts are also drawing parallels to gold’s recent historic price action and predicting that ‘digital gold’ may soon experience similar momentum.

That said, Bitcoin futures index sentiment is pointing toward rising pessimism surrounding BTC, driven by macroeconomic uncertainty. As of press time, BTC is trading at $88,759, up 1.7% in the last 24 hours.

Featured image created with Unsplash, charts from CryptoQuant and TradingView.com

Source link

Tariff Carnage Starting to Fulfill BTC’s ‘Store of Value’ Promise

The cost of innovation — Regulations are Web3’s greatest asset

Best Crypto to Buy as Derivatives Exchange CME Set to Launch XRP Futures

Metaplanet Buys Additional ¥1.92 Billion Worth Of Bitcoin

Here Are Four Signs the Stock Market Has Bottomed, According to Fundstrat’s Tom Lee

Bitcoin dips below $94,000 as ETFs record $3b weekly inflow

Bitcoin Post-Halving Price Performance Is the Worst on Record. Why?

Expert Predicts Start Date For Pi Network Price Pump

GameFi Tokens Show Signs of Life After Gala Games, White House Tie-Up

Bitcoin trades at ‘40% discount’ as spot BTC ETF buying soars to $3B in one week

Bitcoin Continues To Flow Out Of Major Exchanges — Supply Squeeze Soon?

BlackRock’s Bitcoin ETF Sees $643 Million Inflows

DePIN Altcoin Outpaces Crypto Market and Skyrockets by Nearly 44% Following High-Profile Exchange Listing

Solaxy, BTC bull token, and Pepeto gaining momentum as leading 2025 presale tokens

Australian Radio Station Used AI DJ For Months Before Being Discovered

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Crypto’s Big Trump Gamble Is Risky

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

I’m Grateful for Trump’s Embrace of Bitcoin

Trending

24/7 Cryptocurrency News6 months ago

24/7 Cryptocurrency News6 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin3 months ago

Bitcoin3 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Ripple Price1 month ago

Ripple Price1 month ago3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin6 months ago

Bitcoin6 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Opinion6 months ago

Opinion6 months agoCrypto’s Big Trump Gamble Is Risky

Altcoins3 months ago

Altcoins3 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin5 months ago

Bitcoin5 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals