Altcoins

Layer-1 Project MultiversX Continues To Top the Crypto Gaming Sector in Terms of Development Activity: Santiment

Published

21 hours agoon

By

admin

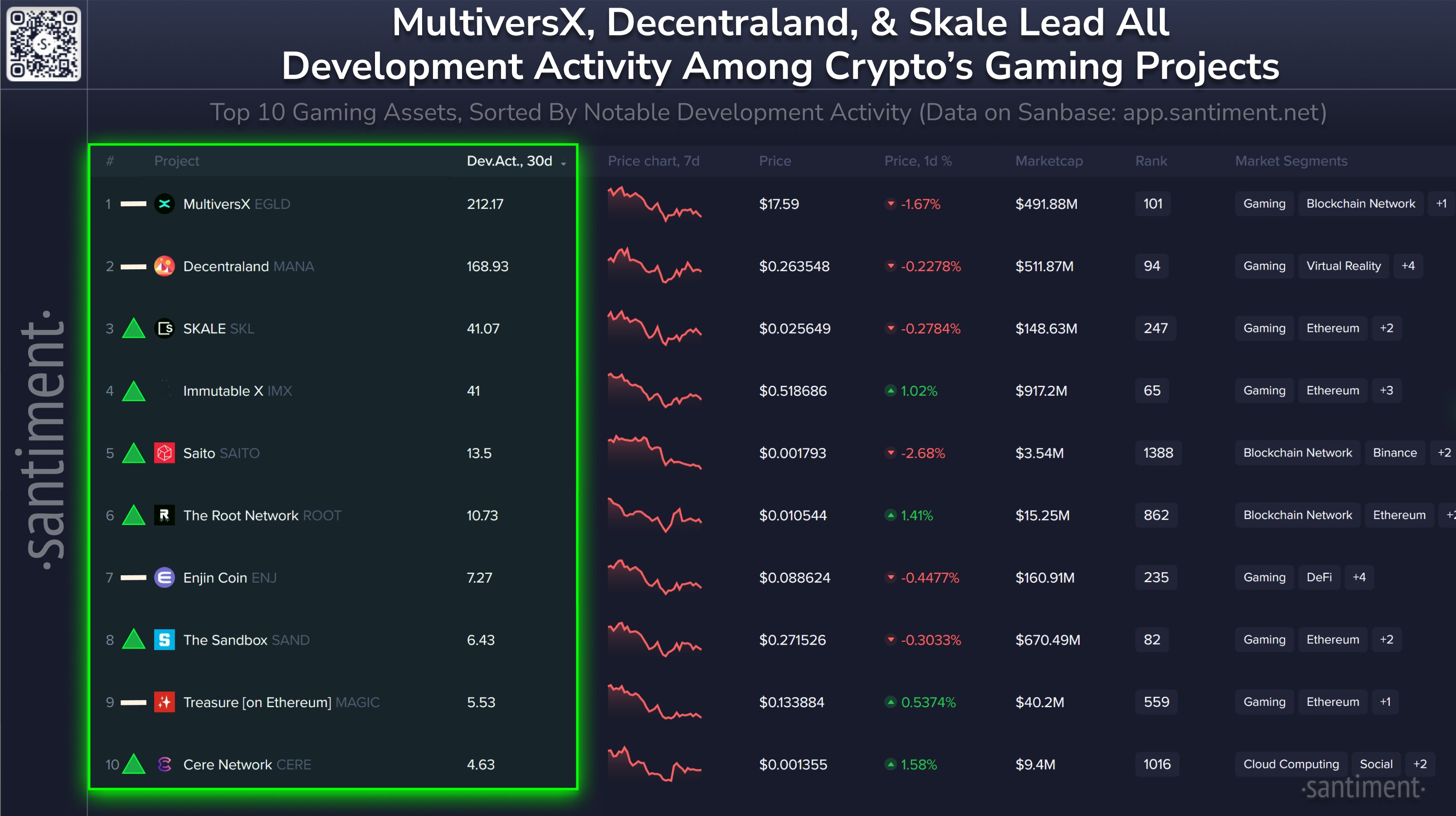

The layer-1 blockchain MultiversX (EGLD) continues to lead the digital asset gaming sector in the realm of development activity, according to the crypto analytics firm Santiment.

Santiment notes on the social media platform X that MultiversX, formerly known as Elrond, registered 212.17 notable GitHub events in the past 30 days.

The Ethereum (ETH)-based virtual reality platform Decentraland (MANA) ranks second, clocking 168.93 events, and the Ethereum layer-2 protocol Skale Network (SKL) is a distant third with 41.07.

MultiversX and Decentraland have occupied the number one and two spots in previous months as well, according to Santiment.

Santiment notes that it doesn’t count routine updates and uses a “better methodology” to collect data for GitHub events based on a “backtested process.”

The analytics firm has previously said that heavy development activity centered around a crypto project is a positive indication that could mean that the developers believe the protocol will be successful. It also indicates that the project is less likely to be an exit scam.

MultiversX is a distributed, proof-of-stake blockchain network that is decentralized via more than 3,500 nodes. The project aims to help developers build next-gen applications.

The project’s native token, EGLD, is trading at $18.10 at time of writing. The 139th-ranked crypto asset by market cap is up more than 3% in the past 24 hours.

Follow us on X, Facebook and Telegram

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

You may like

TON Token Surges 20% as Telegram Founder Recovers Passport From French Authorities

Can Bitcoin Reach $100K After the Upcoming US Fed Decision?

XRP Must Close Above This Level For Bullish Breakout: Analyst

Bitcoin reclaims $80K zone as BNB, TON, GT, ATOM hint at altcoin season

Stock Market To Witness Rallies in Next One to Two Weeks, Predicts Wall Street’s Cantor Fitzgerald – Here’s Why

Cryptocurrencies to watch this week: Binance Coin, Cronos, ZetaChain

Altcoin

XRP Must Close Above This Level For Bullish Breakout: Analyst

Published

3 hours agoon

March 16, 2025By

admin

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

XRP has struggled to gain momentum, with its price caught in a downtrend since the beginning of March. Although XRP has managed to push up in the past five days after reaching a low of $1.93 on March 11, it has yet to fully recoup its losses in the first week of the month.

Related Reading

The altcoin’s long-term prospects are still on bullish speculation, but its short-term price action has frustrated traders looking for signs of a breakout. Amid this stagnation, crypto analyst Egrag Crypto has outlined specific price levels that could determine whether XRP finally reverses its course.

Analyst Identifies $2.65 As Key Level Before XRP Can Challenge $3.00

Egrag Crypto, a long-time bullish advocate for XRP, recently took to social media platform X to outline key price levels that could determine the cryptocurrency’s next significant move. He identified $2.65 as the first critical threshold the coin must reclaim to sustain meaningful bullish momentum. However, the analyst expressed concern over XRP’s repeated tests of lower boundaries, which is in reference to the recent bottom at $1.93.

According to the analyst, the frequent retests of this support level are a double-edged sword. While multiple touches on resistance can eventually trigger a breakout, repeated tests of support weaken its integrity, increasing the likelihood of a breakdown. He likened this pattern to knocking on a door that would eventually open or break. He highlighted six instances of XRP retesting this zone since December 2024 on a 12-hour candlestick chart, warning that prolonged weakness could pave the way for further downside.

For the crypto to escape this cycle and shift into bullish territory, Egrag emphasized the importance of a strong close above $3.00, not just a brief move past it. This level has served as the upper resistance trendline for the past two weeks and has been a barrier to any sustained uptrend. Failure to break and hold above $3.00 could cause continued correction in the short term and keep XRP trapped in its current range.

However, the analyst believes XRP’s chances of reaching $3.00, considering the current price action, are slim without securing a close above $2.65.

Image From X: EGRAG CRYPTO

What’s Next For XRP After $3?

March has been particularly bearish for XRP, with sellers maintaining control as it failed to reclaim lost ground. However, if XRP bulls manage to close above $3 before the end of the month, it will open up the door for the resumption of a price rally. With this in mind, Egrag set an initial target of $4.80, placing XRP at new all-time highs.

Related Reading

Interestingly, this target is modest compared to the analyst’s more ambitious long-term projections. Egrag has previously predicted that XRP could surge to $110 in the long term. At the time of writing, XRP is trading at $2.37 and is still 26.5% away from reaching $3.

Featured image from Crypto Logos, chart from TradingView

Source link

Altcoin

XRP $15 Breakout? Not A Far-Fetched Idea—Analysis

Published

11 hours agoon

March 16, 2025By

admin

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

After dropping to less than $2 last March 11th, Ripple’s XRP springs back to life and it’s currently trading between $2.30 and $2.40. And with the US Securities and Exchange Commission vs Ripple case nearing its resolution, the market can expect more price volatility for this digital asset.

Related Reading

Within this context, market analyst Ali Martinez boldly claims that Ripple’s native coin still have the legs to hit a two-digit figure this cycle, using an extensive symmetrical triangle formation as a solid basis.

Martinez’s view runs opposite the bearish statements from other commentators. XRP has been on a slide lately, affected by the broader crypto fall, dipping by around 25% from its $3.40 high achieved mid-January.

XRP Gradually Builds Its Symmetrical Triangle

Like most cryptos, XRP continues to have a highly volatile market performance. The token attempted a recovery early this month but met resistance, leading to a steep decline on March 11th. Interestingly, a few commentators remain bullish on the altcoin, including Martinez, who sees the token on track to reach $15.

This is why $XRP can still reach $15! pic.twitter.com/vkIiR0rnpU

— Ali (@ali_charts) March 14, 2025

In his latest commentary, shared via a Twitter/X posting, Martinez highlighted the seven-year symmetrical triangle formed by this asset, which dates back to January 2018, when it dropped from its $3.80 high.

Even before Martinez shared this observation, several commentators reported the triangle’s formation, suggesting that a breakout could lead to a price run.

The Ascending Trendline

According to Martinez, XRP formed its lower highs in January 2018, extending the descending trendline on top. As the crypto witnessed higher lows during this time frame, it extended its ascending trendline below, creating a symmetrical triangle.

Interestingly, XRP exited the symmetrical triangle structure following the November US elections. Ripple’s native token surged by 280% for the month, marking the biggest 30-day increase for the asset in seven years.

Along with surprising traders, this breakout inspired fresh hope among XRP enthusiasts. While some experts noted that past breakouts do not automatically ensure continuous rallies, many saw this spike as evidence of possible long-term strength.

Still, the dramatic price fluctuation sparked conversations on XRP’s future, particularly in light of further government changes and more general market movements.

Ripple’s XRP is currently trading at $2.37, which is 2% up in the last seven days.

Related Reading

XRP Currently Retesting A Breakout

After two months of upside, Ripple’s XRP is on a downturn, reflecting the broader crypto market sentiment. According to Martinez, XRP’s price is currently retesting the triangle chart breakout. He also suggested that even if XRP slips below $2, it’s still on track for a breakout, as long as it stays above $1. Armed with the charts, Martinez believes that XRP hitting $15 is not a far-out idea.

Featured image from StormGain, chart from TradingView

Source link

Altcoins

‘Be on Guard’: Trader Says Altcoin Bounce May Be Temporary, Tracks Bitcoin’s Next Targets

Published

1 day agoon

March 15, 2025By

admin

A widely followed crypto analyst and trader is warning that an altcoin market bounce may end up being short-lived.

In a new post, pseudonymous crypto trader Altcoin Sherpa tells his 243,900 followers on the social media platform X that alts may give up gains after bouncing based on historical precedence.

He also says Bitcoin (BTC) may soon flip $84,000 into support and that the flagship crypto asset could maintain bullish momentum by breaking through the $89,000 level.

“BTC looks like $84,000 is the first test that is going to break (to the upside) and we’re ok in that department. $89,000 would be my next level of interest overall. Alts looking like they’ll give a temporary bounce but not sure how strong (yet). Be on guard.”

Looking at his chart, the analyst suggests that if Bitcoin can regain $98,703 as support, the flagship crypto asset may print new all-time highs.

However, he warns if $78,167 breaks down as support, Bitcoin may plummet into the $60,000 range.

Bitcoin is trading for $84,154 at time of writing, up 4.6% in the last 24 hours.

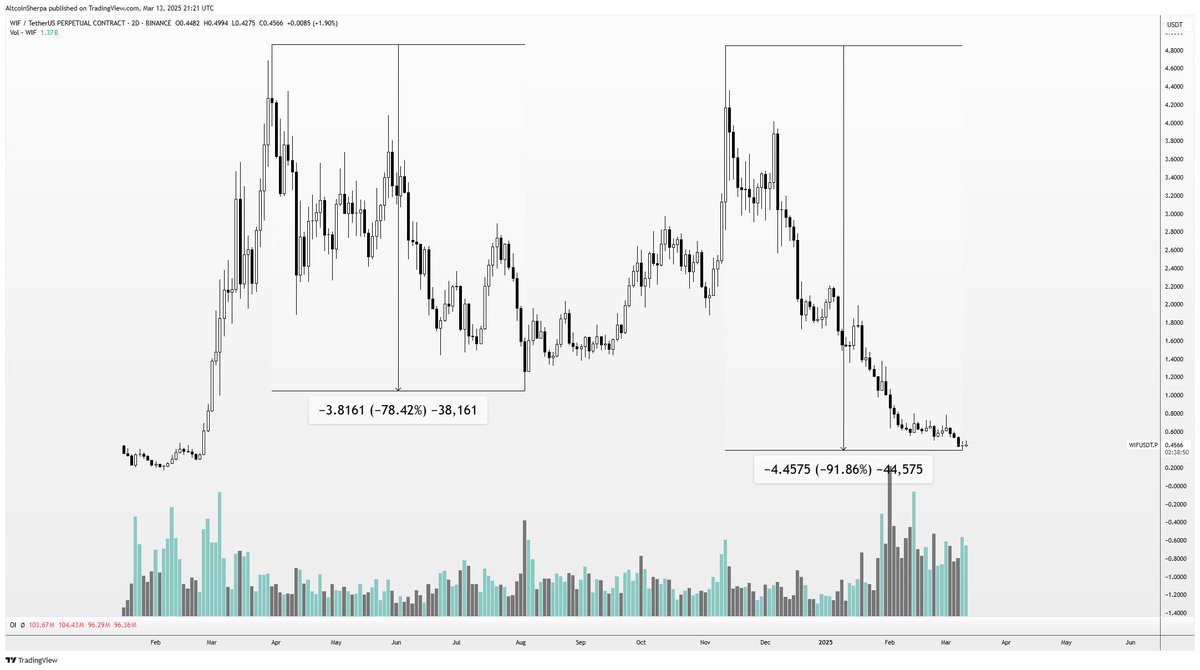

The analyst also warns that altcoins like the dogwifhat (WIF) memecoin may struggle for a long time to ever regain higher price targets if Bitcoin turns bearish.

“It’s a lot more concerning for sh**coins this go around because BTC might actually be dead for a bit. In the previous drawdown, we had a lot more hope because we assumed BTC still had more upside. If BTC dies to $50,000 or w/e (whatever), these aren’t coming back for a very long time. See WIF.”

WIF is trading for $0.50 at time of writing, up 9.7% in the last 24 hours.

He adds that altcoins may bounce even as they continue to print a bearish lower-high price structure.

“As much as everything is dead and we’re truly in a bear market for altcoins, it’s important to remember that a bounce will come and alts can still do a few x from current levels. Markets don’t move in a straight line down. Bounce coming within the next one to two months in my opinion.”

He shares the two-day chart of Ethereum (ETH) to illustrate the historical precedence of an altcoin bouncing amid a larger downtrend.

Follow us on X, Facebook and Telegram

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

TON Token Surges 20% as Telegram Founder Recovers Passport From French Authorities

Can Bitcoin Reach $100K After the Upcoming US Fed Decision?

XRP Must Close Above This Level For Bullish Breakout: Analyst

Bitcoin reclaims $80K zone as BNB, TON, GT, ATOM hint at altcoin season

Stock Market To Witness Rallies in Next One to Two Weeks, Predicts Wall Street’s Cantor Fitzgerald – Here’s Why

Cryptocurrencies to watch this week: Binance Coin, Cronos, ZetaChain

What is Milady? The Edgy Ethereum NFT Community With Vitalik Buterin’s Support

Can Pi Network Price Triple if Binance Listing is Approved Before March 2025 Ends?

Gold ETFs Inflow Takes Over BTC ETFs Amid Historic Rally

Toncoin in ‘great entry zone’ as Pavel Durov’s France exit fuels TON price rally

XRP $15 Breakout? Not A Far-Fetched Idea—Analysis

Here’s why the Toncoin price surge may be short-lived

Wells Fargo Sues JPMorgan Chase Over Soured $481,000,000 Loan, Says US Bank Aware Seller Had Inflated Income: Report

BTC Rebounds Ahead of FOMC, Macro Heat Over?

Solana Meme Coin Sent New JellyJelly App Off to a Sweet Start, Founder Says

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Crypto’s Big Trump Gamble Is Risky

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

Trump’s Coin Is About As Revolutionary As OneCoin

Is $200,000 a Realistic Bitcoin Price Target for This Cycle?

Ripple Vs. SEC, Shiba Inu, US Elections Steal Spotlight

Trending

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin2 months ago

Bitcoin2 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News2 months ago

24/7 Cryptocurrency News2 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin4 months ago

Bitcoin4 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Altcoins2 months ago

Altcoins2 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin4 months ago

Bitcoin4 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Opinion4 months ago

Opinion4 months agoCrypto’s Big Trump Gamble Is Risky

Price analysis4 months ago

Price analysis4 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x