Bitcoin

Ledn Remains Bitcoin’s Premier Borrowing And Lending Platform

Published

2 months agoon

By

admin

Company Name: Ledn

Founders: Mauricio Di Bartolomeo and Adam Reeds

Date Founded: September 2018

Location of Headquarters: N/A (Fully remote)

Number of Employees: 51

Website: https://ledn.io/

Public or Private? Private

“Lending is the type of relationship where you value the return of your assets more than the return on your assets.”

This was Di Bartolomeo’s answer when I asked him what has set Ledn, a bitcoin and crypto borrowing and lending platform, apart from its competitors, including now defunct companies that offered similar services like BlockFi, Celsius and Voyager.

“There’s no company in this space that has a better track record of returning your assets than Ledn,” Di Bartolomeo told Bitcoin Magazine.

Since its founding, Ledn has prioritized security and reliability. Di Bartolomeo and his co-founder, Adam Reeds, have not only wanted to win the trust of the traditional financial institutions with which Ledn interfaces but that of Ledn’s global user base, some of whom are accessing financial services for the first time thanks to the company.

And Di Bartolomeo’s work is quite personal to him in part because he understands the importance of Bitcoin thanks to his firsthand experience with it in his home country of Venezuela.

Di Bartolomeo’s Bitcoin Journey

“My family found Bitcoin and started mining it in Venezuela in late 2014/early 2015 in the middle of hyperinflation where basically it was illegal for them to buy or hold U.S. dollars or anything that would preserve value,” recounted Di Bartolomeo.

“When I saw how they and other Venezuelans were using Bitcoin to opt out of their broken system, I thought to myself “How many people in the world live like this and how many people in the world are going to need this?” And my answer was a number that I couldn’t compute in my head,” he added.

Di Bartolomeo decided to begin working in the Bitcoin space soon after. He moved to Canada where he and Reeds began helping miners grow their operations. Di Bartolomeo recalled that these miners wanted to expand but didn’t want to sell their bitcoin to do so.

“They had bitcoin revenues and fiat expenses, and there was no real place for them to get any type of financing,” said Di Bartolomeo.

“We sought financing, but nobody would give us a loan. So, we decided to solve our own problem,” he added.

“That was the genesis of Ledn.”

How Ledn Differentiated Itself

When Ledn was founded in 2018, only a few other services like it existed. However, there was a notable difference between Ledn and its competitors.

“There were other bitcoin-backed lenders in the market, but they required tokens,” said Di Bartolomeo.

“This was around the ICO era and we saw Nexo and Celsius come into the space with tokens. My view was that they were only using them to raise cash without selling off equity,” he added.

Di Bartolomeo and Reeds didn’t want to issue a token, as they saw it as a questionable practice from a regulatory perspective.

“When you look at finance at scale, immediately you think about compliance and regulation,” said Di Bartolomeo. “We wanted to build a company that was able to sit in front of BlackRock or Goldman Sachs, heavily regulated banks, and say, ‘Hey, I want to interact with you guys.’”

What is more, Ledn also prioritized transparency. In 2021, it became one of the first major Bitcoin companies to issue a proof of reserves, a system that allows anyone to audit Ledn’s bitcoin holdings.

“We’re still the only lender operating in the U.S. or other highly-regulated markets that has this proof of reserves where every six months our clients can come and check it out,” said Di Bartolomeo. “We’ve been doing this since before it was cool.”

Ledn also publishes a monthly Open Book Report that breaks down Ledn’s lending strategies.

From early on, Di Bartolomeo believed that taking a buttoned-up and transparent approach would foster trust amongst Bitcoin enthusiasts, a group that lives by the “don’t trust, verify” mantra, and his thesis has played out.

Reducing Risks

Of the many products Ledn offers, one is yield generation on bitcoin — the same type of product that caused the demise of BlockFi.

However, Ledn approaches its version of this product differently than its former competitor did.

“We generate Bitcoin yield on bitcoin primarily by lending it to market makers that arbitrage the BlockRock IBIT ETF and units of Coinbase spot,” said Di Bartolomeo.

“These groups are price neutral. They don’t have directional exposure. They’re just closing price gaps and benefitting from volatility,” he added.

BlockFi’s approach was far riskier.

“With BlockFi, there was a duration mismatch,” explained Di Bartolomeo.

“They were taking open-term deposits, and they were deploying them into mining infrastructure that had five-year payback. What do you think is going to happen when somebody shows up before the five years are done?” he added, alluding to the notion that what happened to BlockFi seemed inevitable.

What is more, Ledn only deals in highly liquid assets like bitcoin (and ether, which they added in 2023), which helps alleviate asset liability mismatch risk.

“With bitcoin, you always have people on both sides of the house with demand,” said Di Bartolomeo.

“When you start supporting things like Shiba Inu or Dogecoin and people want to earn interest on those, you then have to turn that Dogecoin into something else, and you create asset liability mismatch in the process,” he added.

Di Bartolomeo also noted that all of Ledn’s products are ring-fenced from one another.

“When you’re paying for a custody loan, you are not exposed to the credit risk of our other products,” he said. “This is very similar to how traditional finance works, and it’s something we do very differently as compared to our now defunct peers.”

Growing Competition

As more people begin to view bitcoin as “pristine collateral,” more bitcoin borrowing and lending platforms are destined to pop up. Many already have.

Centralized bitcoin borrowing and lending services like Salt and Nexo remain competitors to Ledn, while institutional bitcoin financing services like Newmarket Capital’s Battery Finance are also poised to cut into Ledn’s business. And services that enable users to borrow against their bitcoin in a non-custodial manner, including Debifi and Lava, may also increase their market share.

Di Bartolomeo is aware of the competition but doesn’t seem concerned. In fact, he believes that in such a market, the biggest winner will be the consumer, and he doesn’t have any plans to change Ledn’s strategy. Instead, he’s looking to double down on what Ledn does best.

“Our sweet spot is going to be individuals or people who prioritize transparency, security of funds and compliance,” said Di Bartolomeo.

“Safety, trust and transparency are what makes Ledn stand out. There is no other operator like us in this space with an equivalent track record as far as loans processed, years in the business and cycles survived,” he added.

“This industry is volatile. You have to have the right expertise and the right set of values powering your team, and I think other companies would be hard pressed to demonstrate what we have over the time that we have. Will you be able to find something cheaper? Yes. Will that be riskier? Absolutely.”

Fostering Financial Inclusion

One of the primary ways in which Ledn differs from traditional borrowing and lending platforms is that its rates don’t differ based on the jurisdiction in which the lender or borrower is located.

“This makes people feel very empowered because they know that whether they’re in Madrid or Medellín, they’re getting the same rate,” said Di Bartolomeo.

And Di Bartolomeo smiled from ear to ear as he discussed this point, as it seemed to remind him of why he got involved with Bitcoin in the first place.

“This is one of the things that makes me proudest about this business,” he said.

“We have people back in Latin America who’ve come to us to say we are the first loan they’ve ever been approved for. This is because all we look at is ‘Did you complete KYC?’; ‘Are you a compliant citizen?’; ‘Do you have Bitcoin?,’” he added.

“It’s not ‘Where do you live?’; ‘Who are your parents?’; What’s your skin color?’ I love this aspect of Bitcoin and what we do.”

Source link

You may like

This Week in Bitcoin: Strategy Stalls, But White House Plans to Buy More BTC

Layer3 (L3) Price Prediction March 2025, 2026, 2030, 2040

Ripple Token Zooms 5% Higher as Bitcoin Grapples With $84K Level

Bitcoin’s megaphone pattern, explained: How to trade it

This Rare Bitcoin Buy Signal Could Ignite Next BTC Rally

There’s a Good Chance the Bull Cycle’s Over if Bitcoin Plunges to This Level, Warns Analyst Benjamin Cowen

BasicTradingTV

Is Bitcoin Price Headed For $70,000 Or $300,000? What The Charts Are Saying

Published

4 hours agoon

March 15, 2025By

adminReason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bitcoin’s price trajectory has become a significant point of interest in light of the recent downtrend, which has disappointed many bullish traders. According to on-chain analytics platform IntoTheBlock, the recent price crash up to the current price has seen over 6.5 million BTC addresses falling into losses. Still, technical analysis suggests Bitcoin could experience further drops.

The question is whether Bitcoin will test the $70,000 mark before regaining strength or can rebound from here toward a $300,000 price target. Insights from price structure and historical patterns help provide a clearer picture of what’s next.

Bitcoin Price Decline: A Normal Cycle Within Uptrends

Despite concerns over Bitcoin’s recent price swings, crypto analyst Philip (BasicTradingTV) maintains that the market is behaving normally within a long-term bullish structure. He highlights that on the higher monthly timeframe, Bitcoin continues to create higher highs and higher lows and maintains a solid uptrend that dates back to 2017.

Related Reading

This technical outlook, which was noted on the TradingView platform, comes as a response to concerns about whether BTC is still bullish after the ongoing 25% correction from its recent all-time high.

Traders have been unsettled following the recent drop, but historical trends suggest this kind of movement is part of the market’s natural cycle. According to the analyst, Bitcoin is still forming a bullish market structure, and while short-term fluctuations may continue, the broader uptrend channel from 2017 is still in place. Furthermore, the analyst noted previous instances of 25% and 40% corrections during Bitcoin’s rallies from the lower trendline of this uptrend channel.

What’s Next For BTC? Possible Retest Of Resistance Before Rally To $300,000

With the notion of a long-term uptrend still intact, the analyst noted, however, that Bitcoin could continue its downtrend until it reaches $70,000. This level holds significant importance, as it previously marked Bitcoin’s all-time high before turning into resistance around mid-2024. After multiple attempts, Bitcoin eventually broke through this resistance toward the end of the year, leading to its new all-time high of $108,786 in January 2025.

Related Reading

As such, this $70,000 level is now a major psychological support zone, making it a key area to watch amidst the ongoing Bitcoin price correction. From here, the analyst predicted a rebound that would send BTC to reach as high as $300,000. “Levels to watch: 70.000, $300.000,” the analyst said.

At the time of writing, Bitcoin is trading at $82,555, having spent the majority of the past 24 hours trading between $79,947 and $83,436. This leaves Bitcoin still about 14% away from testing the $70,000 support level.

However, there is also the possibility that BTC may not drop as low as $70,000 before bullish sentiment takes over once again. If Bitcoin continues to follow the trajectory of past cycles, Fibonacci extensions point to price targets between $150,000 and $300,000.

Featured image from Unsplash, chart from Tradingview.com

Source link

Bitcoin

This Rare Bitcoin Buy Signal Could Ignite Next BTC Rally

Published

5 hours agoon

March 15, 2025By

admin

Bitcoin has been struggling with lower lows in recent weeks, leaving many investors questioning whether the asset is on the brink of a major bear cycle. However, a rare data point tied to the US Dollar Strength Index (DXY) suggests that a significant shift in market dynamics may be imminent. This bitcoin buy signal, which has only appeared three times in BTC’s history, could point to a bullish reversal despite the current bearish sentiment.

For a more in-depth look into this topic, check out a recent YouTube video here:

Bitcoin: This Had Only Ever Happened 3x Before

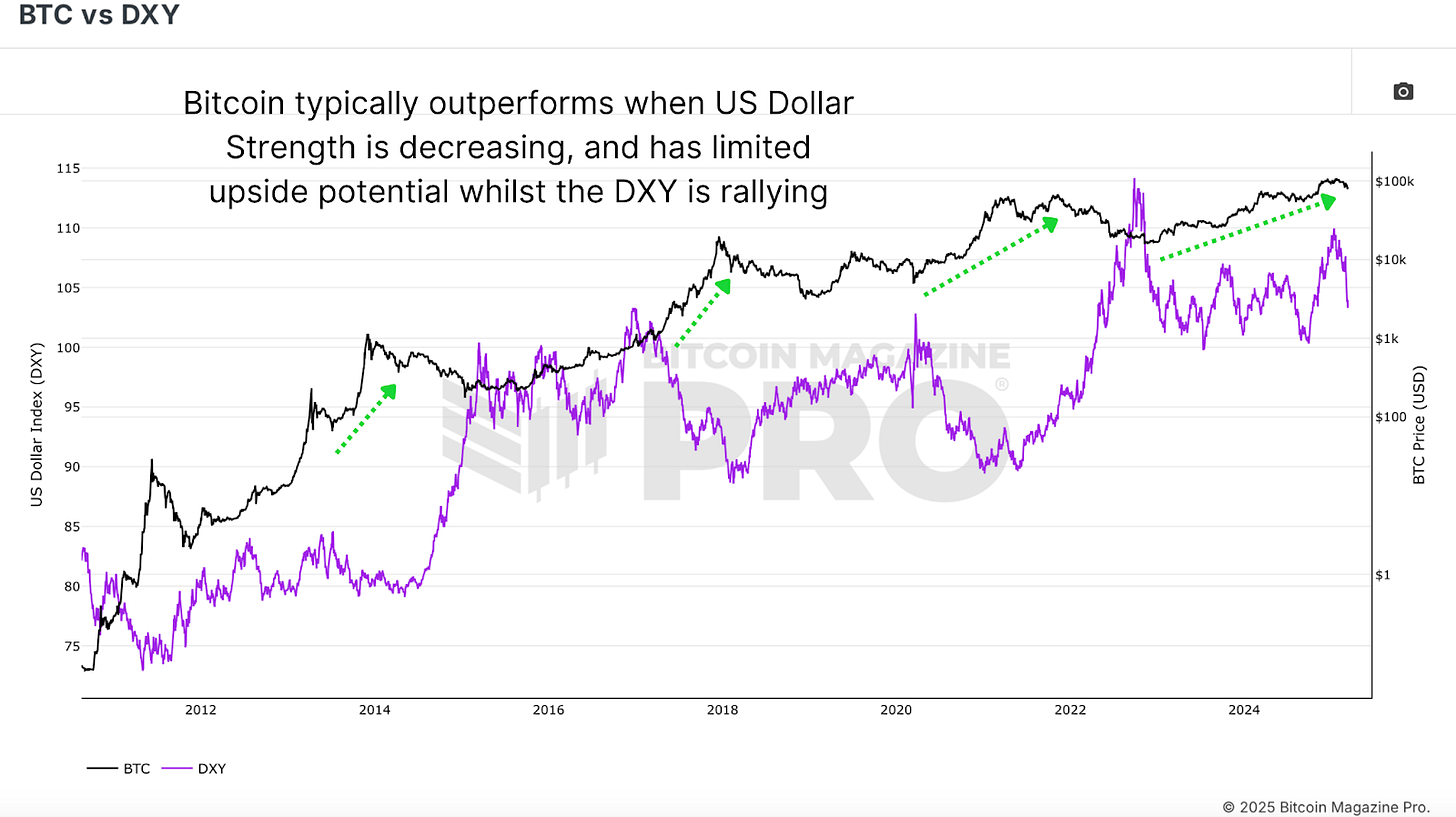

BTC vs DXY Inverse Relationship

Bitcoin’s price action has long been inversely correlated with the US Dollar Strength Index (DXY). Historically, when the DXY strengthens, BTC tends to struggle, while a declining DXY often creates favorable macroeconomic conditions for Bitcoin price appreciation.

Despite this historically bullish influence, Bitcoin’s price has continued to retreat, recently dropping from over $100,000 to below $80,000. However, past occurrences of this rare DXY retracement suggest that a delayed but meaningful BTC rebound could still be in play.

Bitcoin Buy Signal Historic Occurrences

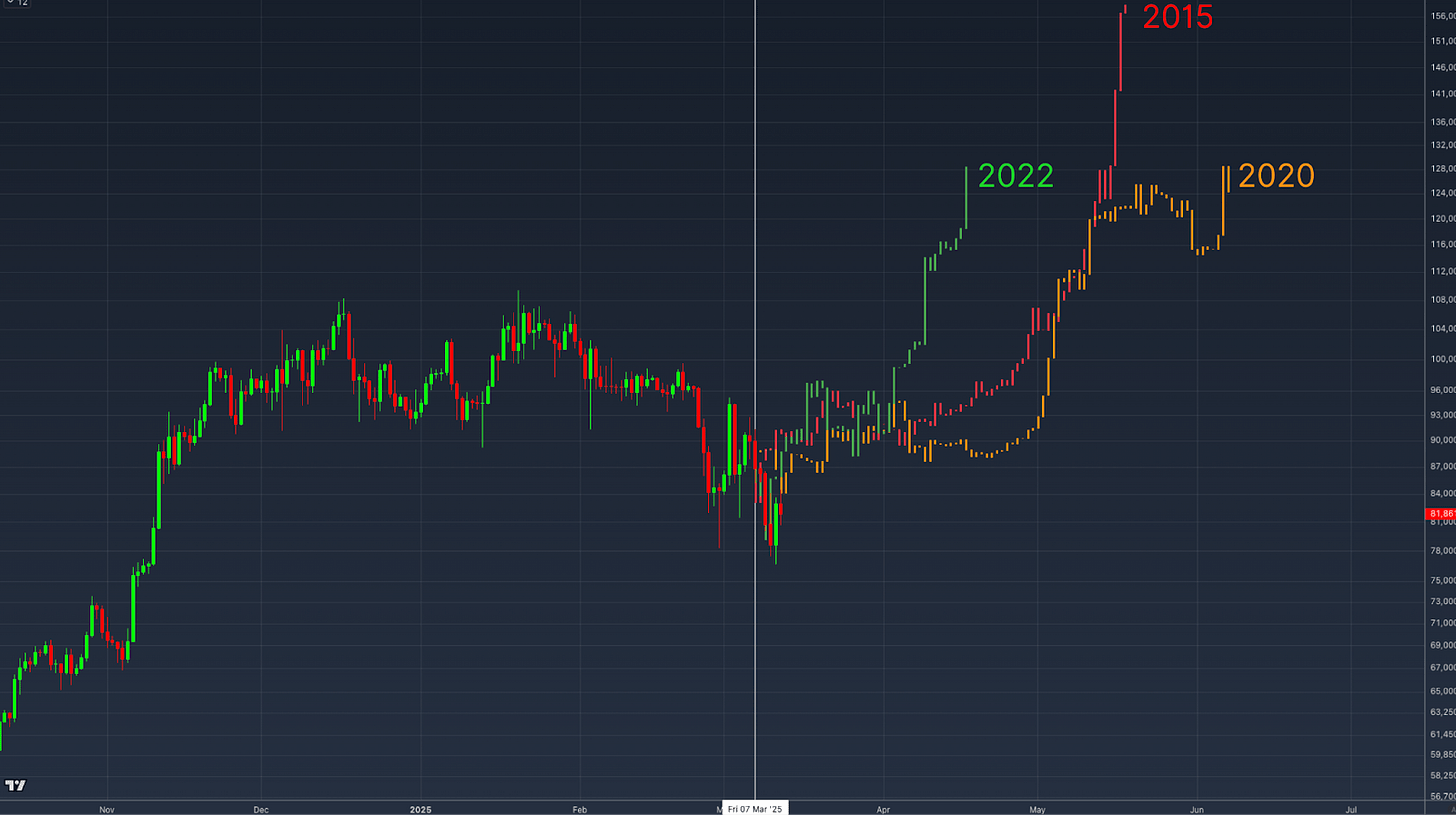

Currently, the DXY has been in a sharp decline, a decrease of over 3.4% within a single week, a rate of change that has only been observed three times in Bitcoin’s entire trading history.

To understand the potential impact of this DXY signal, let’s examine the three prior instances when this sharp decline in the US dollar strength index occurred:

- 2015 Post-Bear Market Bottom

The first occurrence was after BTC’s price had bottomed out in 2015. Following a period of sideways consolidation, BTC’s price experienced a significant upward surge, gaining over 200% within months.

The second instance occurred in early 2020, following the sharp market collapse triggered by the COVID-19 pandemic. Similar to the 2015 case, BTC initially experienced choppy price action before a rapid upward trend emerged, culminating in a multi-month rally.

- 2022 Bear Market Recovery

The most recent instance happened at the end of the 2022 bear market. After an initial period of price stabilization, BTC followed with a sustained recovery, climbing to substantially higher prices and kicking off the current bull cycle over the following months.

In each case, the sharp decline in the DXY was followed by a consolidation phase before BTC embarked on a significant bullish run. Overlaying the price action of these three instances onto our current price action we get an idea of how things could play out in the near future.

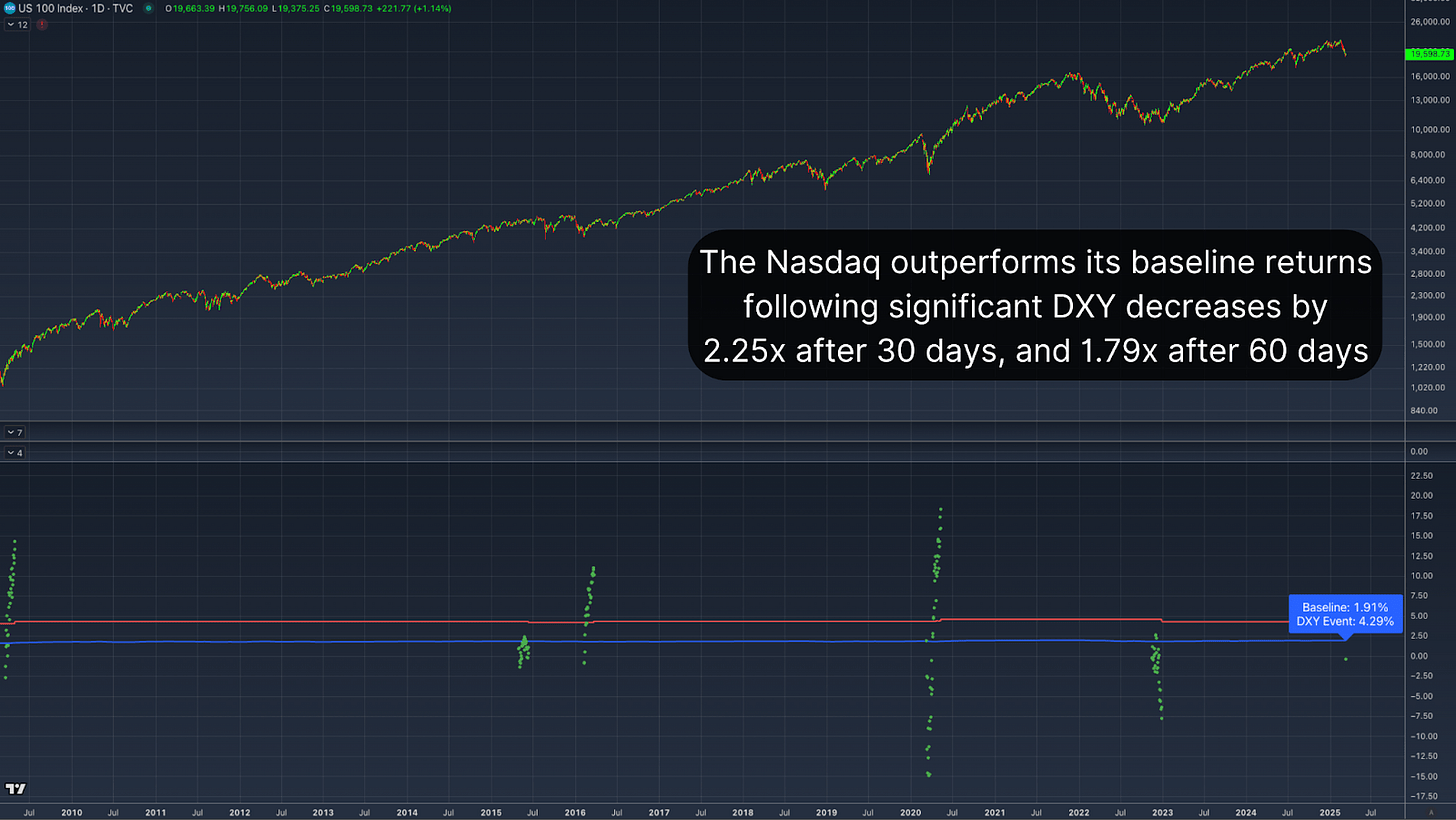

Equity Markets Correlation

Interestingly, this pattern isn’t limited to Bitcoin. A similar relationship can be observed in traditional markets, particularly in the Nasdaq and the S&P 500. When the DXY retraces sharply, equity markets have historically outperformed their baseline returns.

The all-time average 30-day return for the Nasdaq following a similar DXY decline stands at 4.29%, well above the standard 30-day return of 1.91%. Extending the window to 60 days, the Nasdaq’s average return increases to nearly 7%, nearly doubling the typical performance of 3.88%. This correlation suggests that Bitcoin’s performance following a sharp DXY retracement aligns with historical broader market trends, reinforcing the argument for a delayed but inevitable positive response.

Conclusion

The current decline in the US Dollar Strength Index represents a rare and historically bullish Bitcoin buy signal. Although BTC’s immediate price action remains weak, historical precedents suggest that a period of consolidation will likely be followed by a significant rally. Especially when reinforced by observing the same response in indexes such as the Nasdaq and S&P 500, the broader macroeconomic environment is setting up favorably for BTC.

Explore live data, charts, indicators, and in-depth research to stay ahead of Bitcoin’s price action at Bitcoin Magazine Pro.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment decisions.

Source link

Bitcoin

There’s a Good Chance the Bull Cycle’s Over if Bitcoin Plunges to This Level, Warns Analyst Benjamin Cowen

Published

6 hours agoon

March 15, 2025By

admin

The widely followed cryptocurrency analyst Benjamin Cowen says Bitcoin’s (BTC) bull cycle would likely be over if it enters one key level.

In a new video, Cowen tells his 886,000 YouTube subscribers that Bitcoin may be repeating a similar pattern from 2017, when it tested the prior year high.

However, he warns that if Bitcoin drops below the 2024 low of about $71,000 and enters the $60,000 range, the bull cycle may be over.

“In 2017 Bitcoin had a drop in early 2017 where it tested the 2016 high. And it happened, by the way, fairly early on. I would argue that’s very much an outcome to consider for this cycle, testing the 2024 high, which is in the lower $70,000s…

If we get closes, and especially if there’s a wick in the low $60,000s, then there’s a good chance the cycle is over. If it stays above the 2024 high, then the party could easily go on.”

He also says that if Bitcoin maintains the $70,000 range, a bull cycle will probably remain intact, whereas anything lower may result in a bearish price pattern of lower highs later in the year on the weekly chart.

“If it holds support above $70,000, $73,000, [the] structure of the market is fine. If it goes into the $60,000s, then I would argue that the more likely outcome would be a macro lower high in Q2, Q3, potentially around like the August timeframe.”

Bitcoin is trading for $84,059 at time of writing, up 3.8% in the last 24 hours.

Follow us on X, Facebook and Telegram

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

This Week in Bitcoin: Strategy Stalls, But White House Plans to Buy More BTC

Layer3 (L3) Price Prediction March 2025, 2026, 2030, 2040

Ripple Token Zooms 5% Higher as Bitcoin Grapples With $84K Level

Bitcoin’s megaphone pattern, explained: How to trade it

Is Bitcoin Price Headed For $70,000 Or $300,000? What The Charts Are Saying

This Rare Bitcoin Buy Signal Could Ignite Next BTC Rally

There’s a Good Chance the Bull Cycle’s Over if Bitcoin Plunges to This Level, Warns Analyst Benjamin Cowen

Ethena overtakes PancakeSwap and Jupiter with $3.28m daily revenue

Gold ETFs Winning the Asset Race With Bitcoin Funds–for Now

BTC Regains $84K; ETH, XRP, SOL Pump

Court Approves 3AC’s $1.53B Claim Against FTX, Setting Up Major Creditor Battle

Sacks and his VC firm sold over $200M in crypto and stocks before WH role

Polkadot (DOT) Price Stability Fuels Hopes For Short-Term Recovery

Bitcoin Is A Strategic Asset, Not XRP

Bank of America Insider Helps Criminals and Illicit Businesses Launder Funds in Massive Global Conspiracy: US Department of Justice

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Crypto’s Big Trump Gamble Is Risky

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

A16z-backed Espresso announces mainnet launch of core product

Has The Bitcoin Price Already Peaked?

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

Trump’s Coin Is About As Revolutionary As OneCoin

Ripple Vs. SEC, Shiba Inu, US Elections Steal Spotlight

Is $200,000 a Realistic Bitcoin Price Target for This Cycle?

Trending

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin2 months ago

Bitcoin2 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News2 months ago

24/7 Cryptocurrency News2 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin4 months ago

Bitcoin4 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Bitcoin4 months ago

Bitcoin4 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Altcoins1 month ago

Altcoins1 month agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Opinion4 months ago

Opinion4 months agoCrypto’s Big Trump Gamble Is Risky

Price analysis4 months ago

Price analysis4 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x