Argentina

Libra Token’s Hayden Davis Bragged of Influence Over Argentina’s Milei

Published

4 weeks agoon

By

admin

A key player behind the Libra token bragged about buying access to Argentine President Javier Milei’s inner circle months before the memecoin’s scandalous launch and crash.

In text messages reviewed by CoinDesk, Hayden Davis, CEO of Kelsier Ventures, claimed he could “control” Milei because of payments he had been making to Karina Milei, a powerful figure in Milei’s government, not to mention the president’s sister.

“I control that n****,” Davis claimed in text messages from mid-December, adding, “I send $$ to his sister and he signs whatever I say and does what I want.”

Karina Milei’s office did not respond to a request for comment. Davis did not respond to multiple requests for comment.

It was unclear if any money was exchanged between Davis and Milei’s inner circle in advance of Libra’s launch.

Davis’ December claims add a new dimension to an anti-corruption probe that Argentina’s presidential office has opened into Javier Milei, who, on Feb. 15, brought attention to the doomed Libra crypto as a novel way to fund small businesses in that country.

But the biggest winner from the Solana-based memecoin’s launch was Davis and Kelsier Ventures. Wallets controlled by the entities netted over $100 million in Libra’s early hours, when it soared to $5 and then crashed over 95%, wiping out millions of dollars of speculative investments.

Opposition leaders in Argentina have threatened to call for an impeachment trial over the incident, which the local press has coined, “critpogate.” The scandal is weighing on Argentina’s stock market and pushed Milei into “damage control,” said one observer of the country’s crypto space.

In the December text messages, Davis claimed he could get Milei to promote ventures on social media. Milei’s tweet about Libra two months later fueled its rise. When he deleted the tweet after just five hours – and after on-chain sleuths had discovered evidence of shady dealings – Libra’s price had already crashed.

Source link

You may like

TON Token Surges 20% as Telegram Founder Recovers Passport From French Authorities

Can Bitcoin Reach $100K After the Upcoming US Fed Decision?

XRP Must Close Above This Level For Bullish Breakout: Analyst

Bitcoin reclaims $80K zone as BNB, TON, GT, ATOM hint at altcoin season

Stock Market To Witness Rallies in Next One to Two Weeks, Predicts Wall Street’s Cantor Fitzgerald – Here’s Why

Cryptocurrencies to watch this week: Binance Coin, Cronos, ZetaChain

Adoption

Coinbase Rolled Out the Newest State of Crypto Report

Published

2 months agoon

January 24, 2025By

admin

Coinbase rolled out the newest State of Crypto report. The study was conducted by Ipsos. It observes how crypto and blockchain technology are viewed in Argentina, Kenya, the Philippines, and Switzerland and how it impacts the lives of people in these countries.

For most of the part, the study is based on surveys with 4,000 adults (not specifying the age rates) in Argentina, Kenya, the Philippines, and Switzerland conducted on behalf of Coinbase. The choice of countries aims to give an outlook of societies living in markedly different socioeconomic conditions in different parts of the world (none of these countries belong to the same continent, with the Philippines being an archipelago-based country).

The similarities between these countries are the mostly Christian populations and the government systems revolving around the republic model. Nevertheless, the countries have strikingly different areas, positions on the map, historical experiences, cultures, languages, climates, economic states, etc.

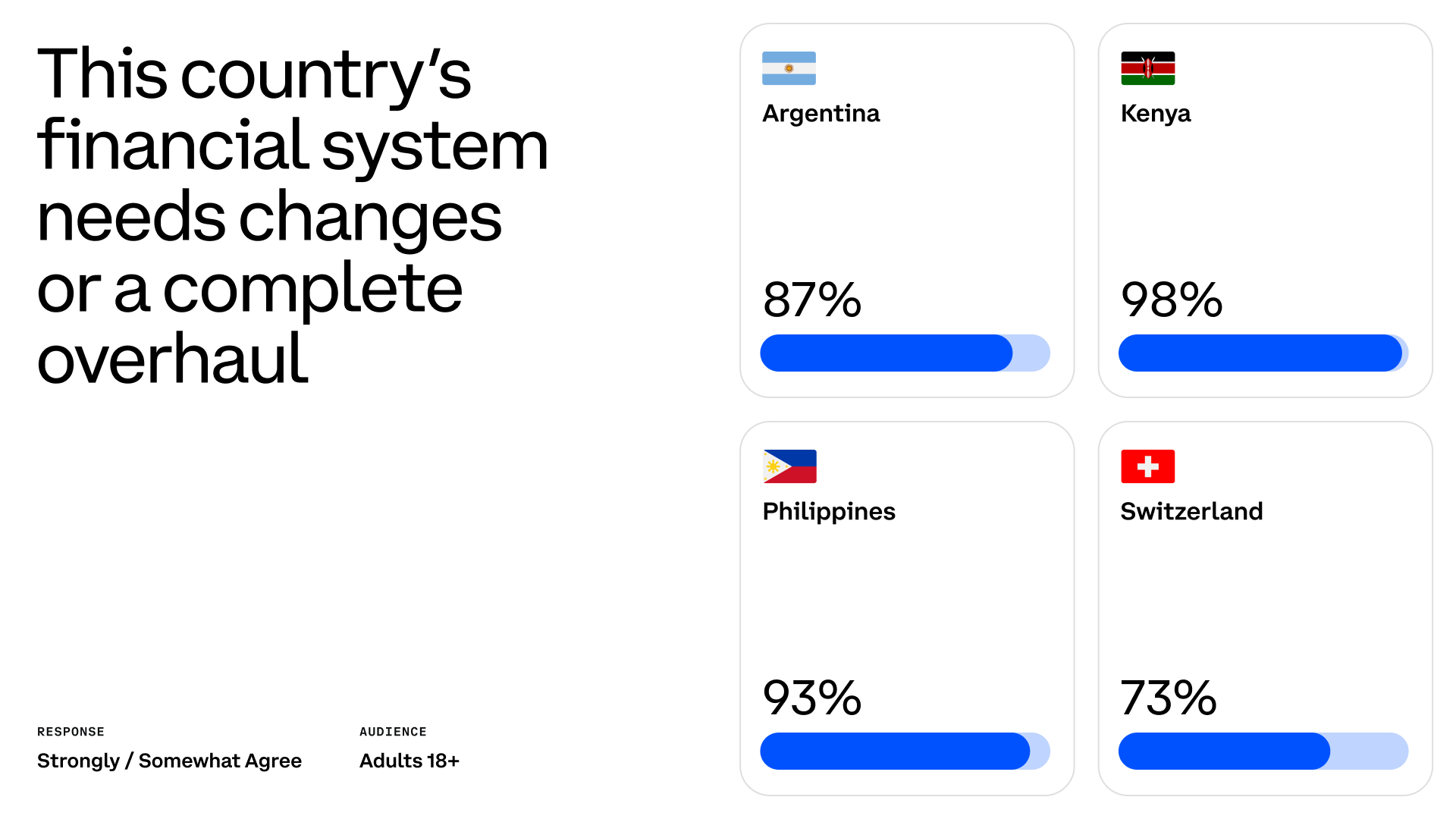

Coinbase, however, outlines another similarity between Argentina, Kenya, the Philippines, and Switzerland: according to the exchange team, the residents of these countries feel that the local financial systems need to be improved. More than that, generally, the polled residents see cryptocurrencies and blockchain as tools that may enhance their lives in terms of financial wealth and overall give more freedom and independence.

The state of economy in these countries

The report starts with the statistics demonstrating that in each country, less than a half of all respondents believe that the current financial direction in their country will make them live better than the previous generation. However, even fewer people believe that they will live worse than their parents in Argentina and the Philippines.

So it’s fair to say that in Kenya and Switzerland, people don’t approve of the current financial politics in contrast to the past years, while Argentina and the Philippines rather dislike both the current and the previous efforts, believing that nowadays things are a bit better than before. Respondents in all these countries agree that the local financial system should be changed or overhauled completely. They refer to the financial systems of their countries as “slow,” “expensive,” and “unstable.” They also cited a lack of innovation as one of the problems.

The study reveals four main concerns of the respondents named in the surveys: lack of fairness (discrimination), centralization, decreasing value of the national currency, and too much hard work to earn enough or save money.

The distribution of concerns varies from country to country, with Kenya and the Philippines being most critical towards centralization, discrimination, and wage slavery. Switzerland is least concerned about many of these issues while being cautious towards the government’s dependency on banks. Argentinians have the biggest trust issues with their financial institutions and a problem with saving money.

Crypto as a remedy

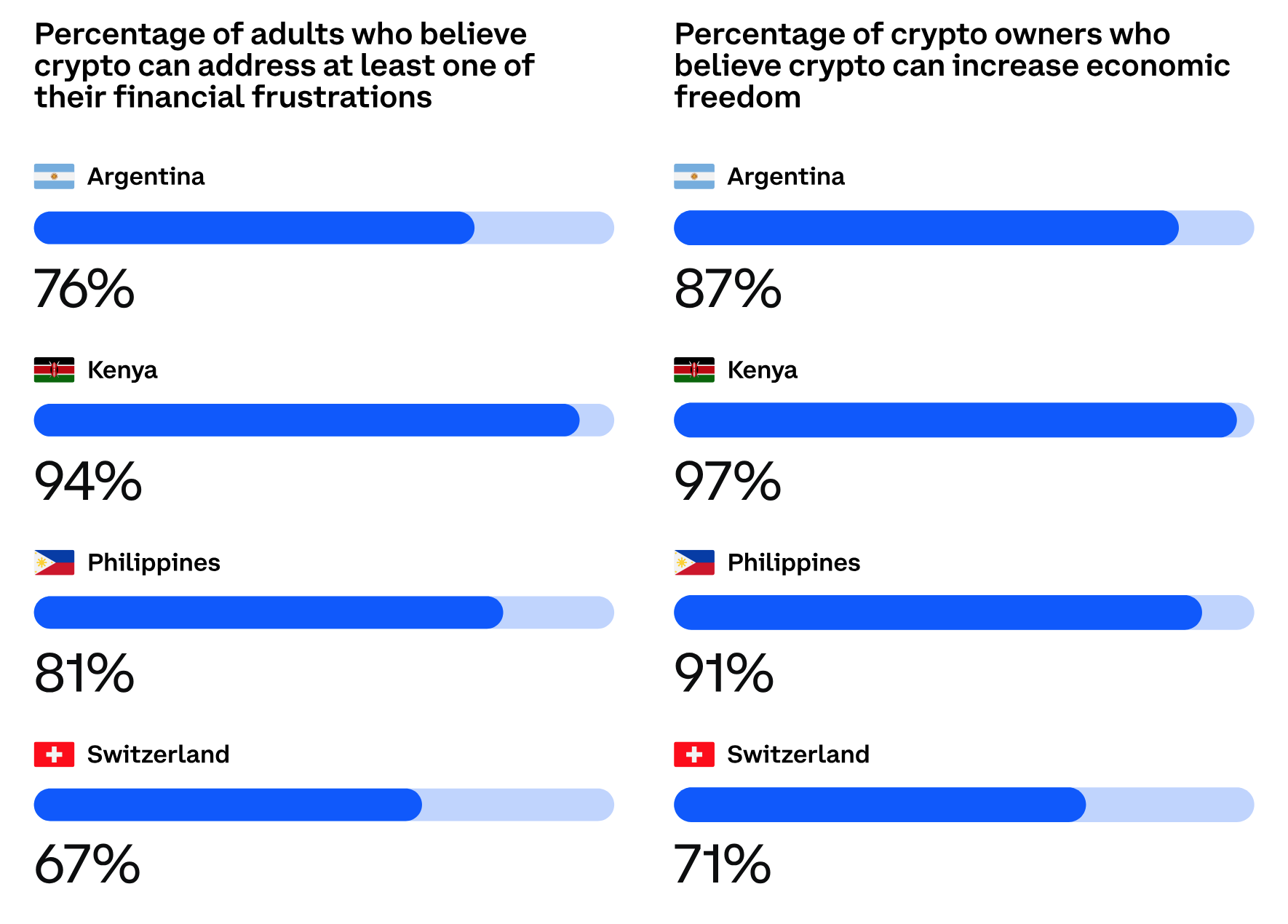

Most people polled by Ipsos for the study want to be in charge of their financial state and gain more freedom and control over their money. 7 in 10 respondents see cryptocurrency and blockchain as the way to achieve these goals. More than that, both crypto owners and those who don’t have crypto agree that digital currencies can help them gain more freedom and control over their wealth.

Switzerlanders are markedly less interested in crypto than respondents from other countries. However, over 70% of crypto owners in Switzerland believe that crypto offers them more control and freedom. Less than half of the surveyed Switzerlanders with no crypto believe that they need it.

Wider blockchain adoption is also viewed as a favorable factor that may improve the local financial systems and individual wealth. Most respondents believe that blockchain promotes innovation and facilitates control over individual finances. Respondents hope that blockchain will make the system faster and more accessible.

In all polls, Switzerland is presented with lower numbers. It reflects the lower expectations associated with Bitcoin and blockchain and the lower level of dissatisfaction with the financial status quo.

Looking into this study, you may notice a strong connection between the level of satisfaction with the country’s financial direction and the level of support for cryptocurrencies and blockchain. The residents of Switzerland and Argentina are less concerned with the current financial state of their countries, and they are less into crypto than Kenya and the Philippines. Probably, that’s one of the reasons why not only Kenya but Africa in general, where the population has little to no access to banking services but has smartphones, are usually seen as the driver of the mass adoption of cryptocurrency and blockchain-based solutions as the substitute of traditional banks.

Source link

Argentina

How a $115M Crypto Fund With Big Ambitions Plans to Invest In Latin America

Published

4 months agoon

November 13, 2024By

admin

One of the biggest roadblocks in converting Latin American investors to concept of crypto, is education about the sector. Cryptocurrencies, which don’t have a physical existence like gold or cash, can be a difficult concept for investors to grasp. “Latin American investors are still very traditional,” she added. “They tell me they only invest in things that they can stand on, or things they can touch. We’re trying to change that mentality… we need to prove to them that these technologies actually work.”

Source link

TON Token Surges 20% as Telegram Founder Recovers Passport From French Authorities

Can Bitcoin Reach $100K After the Upcoming US Fed Decision?

XRP Must Close Above This Level For Bullish Breakout: Analyst

Bitcoin reclaims $80K zone as BNB, TON, GT, ATOM hint at altcoin season

Stock Market To Witness Rallies in Next One to Two Weeks, Predicts Wall Street’s Cantor Fitzgerald – Here’s Why

Cryptocurrencies to watch this week: Binance Coin, Cronos, ZetaChain

What is Milady? The Edgy Ethereum NFT Community With Vitalik Buterin’s Support

Can Pi Network Price Triple if Binance Listing is Approved Before March 2025 Ends?

Gold ETFs Inflow Takes Over BTC ETFs Amid Historic Rally

Toncoin in ‘great entry zone’ as Pavel Durov’s France exit fuels TON price rally

XRP $15 Breakout? Not A Far-Fetched Idea—Analysis

Here’s why the Toncoin price surge may be short-lived

Wells Fargo Sues JPMorgan Chase Over Soured $481,000,000 Loan, Says US Bank Aware Seller Had Inflated Income: Report

BTC Rebounds Ahead of FOMC, Macro Heat Over?

Solana Meme Coin Sent New JellyJelly App Off to a Sweet Start, Founder Says

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Crypto’s Big Trump Gamble Is Risky

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

Trump’s Coin Is About As Revolutionary As OneCoin

Ripple Vs. SEC, Shiba Inu, US Elections Steal Spotlight

Is $200,000 a Realistic Bitcoin Price Target for This Cycle?

Trending

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin2 months ago

Bitcoin2 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News2 months ago

24/7 Cryptocurrency News2 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin4 months ago

Bitcoin4 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Altcoins2 months ago

Altcoins2 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin4 months ago

Bitcoin4 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Opinion4 months ago

Opinion4 months agoCrypto’s Big Trump Gamble Is Risky

Price analysis4 months ago

Price analysis4 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x