Altcoin

Lido Spikes 20% Following Kraken’s Staking Relaunch In Select US States

Published

1 month agoon

By

admin

Ash is a dedicated crypto researcher and blockchain enthusiast with a passion for diving deep into the evolving world of decentralized technologies. With a background in writing and a natural curiosity for how digital assets are shaping the future, he has immersed himself in various sectors of the cryptocurrency space, including decentralized finance (DeFi), NFTs, and liquidity mining. His journey into crypto started with a desire to fully understand the technology behind it, leading him to explore and engage with these systems firsthand.

Ash’s approach to DeFi goes beyond surface-level research as he actively participates in decentralized protocols, testing their functionality to gain a deeper understanding of how they operate. From experimenting with staking mechanisms to exploring liquidity mining strategies, he is hands-on in his exploration, which allows him to provide practical, real-world insights that go far beyond theoretical knowledge. This immersive experience has helped him develop a comprehensive grasp of smart contracts, token governance, and the broader implications of decentralized platforms on the future of finance.

In the NFT space, Ash’s interest is driven by the technology’s potential to reshape ownership and creativity in the digital age. He has explored various NFT projects, gaining insights into how these digital assets function within different ecosystems. His focus is on understanding the evolving relationship between creators and communities, as well as the innovative uses of blockchain technology to establish authenticity and provenance in the digital world. Ash’s research in this area often touches on the intersection of culture, technology, and community-driven projects.

A key area of his expertise lies in liquidity mining, where he has engaged with various decentralized platforms to understand how liquidity provision contributes to the functionality and security of DeFi ecosystems. Ash’s hands-on involvement has allowed him to analyze the risks, rewards, and broader implications of liquidity pools, giving him a well-rounded perspective on this integral part of DeFi. His understanding of risk management and protocol design allows him to provide insights into how these systems can be navigated effectively, with an emphasis on both opportunity and caution.

When it comes to communicating these complex topics, Ash’s writing is grounded in clarity and depth. He excels at breaking down intricate blockchain concepts into easily digestible information for a wide audience. Whether explaining the workings of decentralized exchanges or outlining the future potential of blockchain technology, Ash ensures that his content is accessible to both those new to the space and experienced participants looking for deeper insights.

Beyond DeFi and NFTs, Ash explores a wide array of emerging blockchain applications. His research spans areas like cross-chain technologies, decentralized governance, and blockchain’s potential to integrate with traditional finance. He is continuously learning and adapting to the latest developments, ensuring that his insights are both timely and relevant. His interest extends to how these technologies are creating new possibilities for decentralization, transparency, and trust in a variety of industries.

Ash’s commitment to engaging with the crypto space firsthand gives him a unique perspective that goes beyond what can be learned from research alone. His practical involvement allows him to stay ahead of the curve, offering readers and enthusiasts a clear and comprehensive understanding of the rapidly evolving world of blockchain. Whether delving into the technical mechanics of DeFi or exploring the cultural impact of NFTs, Ash’s approach is always rooted in curiosity, research, and a desire to make this technology accessible to all.

Source link

You may like

VanEck Registers AVAX ETF in Delaware

Why is Ethereum (ETH) price down today?

Key Support Level At $74,000 Determines Bitcoin Bull Or Bear Future

Deutsche Boerse-backed Clearstream to offer custody for Bitcoin, Ethereum

Analyst Who Nailed End of 2021 Bull Market Says Bitcoin May Have Seen Worst of Correction – Here’s Why

Crypto & Stock Market Crash as US Recession Odds Hit 40%

Altcoin

Monthly Close Below This Level Could Be Catastrophic

Published

1 day agoon

March 10, 2025By

admin

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Ethereum has struggled to gain momentum, remaining stuck below critical resistance for over a year. Despite multiple attempts, the second-largest cryptocurrency by market capitalization has been unable to break through key technical levels since the beginning of this year.

Related Reading

Ethereum’s price action over the past two weeks has shown more weakness. An interesting analysis from analyst Tony “The Bull” Severino shows that the cryptocurrency recently failed to break above a resistance indicator and is now at risk of more catastrophic price drops.

Ethereum Fails To Breach Long-Term Resistance

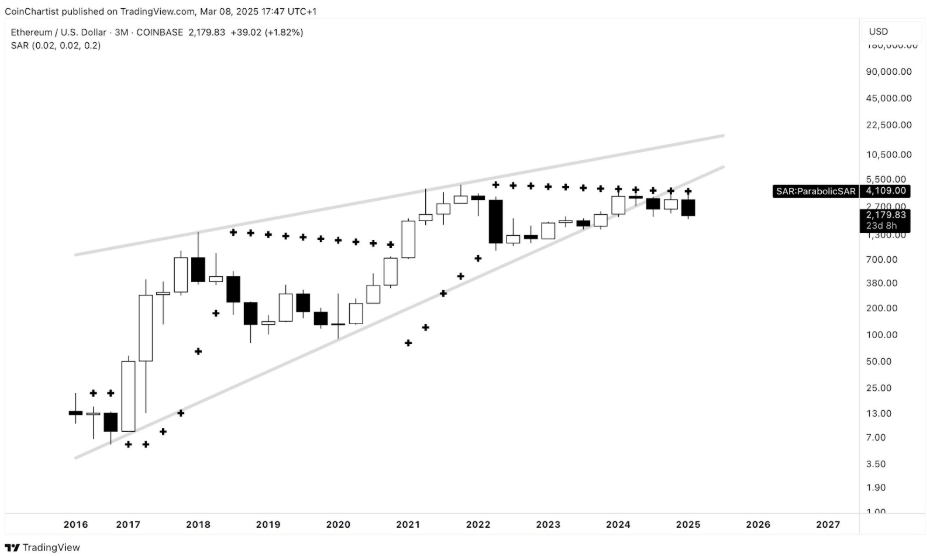

Tony “The Bull” Severino, in a technical analysis shared on social media platform X, highlighted Ethereum’s persistent failure to overcome major resistance levels. He pointed out that Ethereum has been unable to tag the quarterly (three-month) Parabolic SAR despite more than a year of attempts. This indicator, often used to determine the direction of an asset’s trend, shows that Ethereum is locked in a prolonged struggle against resistance on a larger downtrend.

“This feels like it sends a message — resistance won’t be broken,” the analyst said.

Image From X: Tony “The Bull” Severino

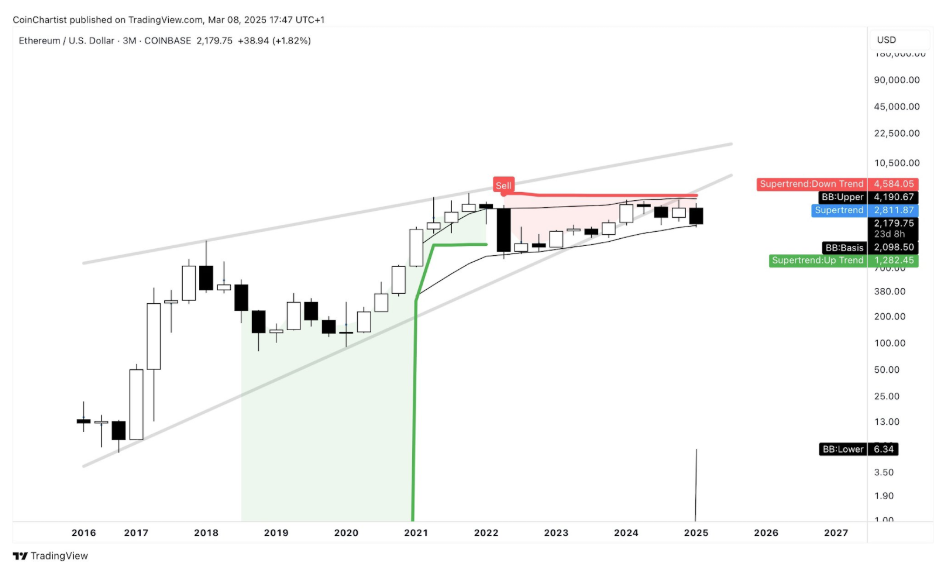

Adding to the failure to break resistance, Tony Severino also noted in another analysis that Ethereum has repeatedly faced rejection from the quarterly (3M) SuperTrend dynamic resistance, further solidifying the case that buyers have been unable to regain control.

Image From X: Tony “The Bull” Severino

A Monthly Close Below $2,100 Could Be Catastrophic

Ethereum’s inability to sustain key price levels has been a dominant theme in the past six months. Interestingly, this inability was shown further in the past two weeks. After failing to hold above $2,800, the cryptocurrency has seen a steady drop, losing multiple support zones along the way.

Currently, Ethereum is trading below $2,200, edging dangerously close to breaking below the crucial $2,100 threshold. A drop beneath this level is particularly concerning, not just because it signifies the loss of yet another psychological support but because technical indicators suggest that a monthly close below $2,100 could have severe consequences.

One of the most significant warning signs comes from the quarterly Bollinger Bands indicator, which has tracked Ethereum’s price action since February 2022. According to this indicator, Ethereum has remained within a defined range, with the upper Bollinger Band currently positioned at $4,190 and the lower band at $2,098. The worrying part is that a monthly close below $2,100 would effectively translate to breaking beneath the lower Bollinger Band and removing a long-standing support level.

Image From X: Tony “The Bull” Severino

Related Reading

At the time of writing, Ethereum is trading at $2,178, having gained 2.2% in the past 24 hours after starting the day at $2,120. Ethereum’s sentiment is now at its lowest level this year. The next few weeks will be crucial to see if Ethereum can reclaim lost ground and prevent a monthly close below $2,100.

Featured image from Tech Magazine, chart from TradingView

Source link

Bitcoin price volatility, shifting narratives in crypto and U.S. President Trump’s executive orders have shaken down the cryptocurrency ecosystem in less than 50 days of his administration. Crypto.news interviewed top women executives at blockchain and crypto firms to gather their insights, to unpack the recent developments with these leaders.

Rachel Conlan, Global CMO, Binance

Rachel Conlan opens with comments on Binance’s growth trajectory, fueled by increasing crypto adoption and institutional interest in the U.S. Conlan says that in Latin America alone, Binance recorded a 116% surge in crypto adoption in 2024 and reached 55 million users.

95% of these users plan to expand their holdings in 2025 as Binance surpasses 250 million registered users. With a mission of onboarding 1 billion users, the cryptocurrency exchange maintains optimism, expecting positive regulatory shifts and further institutional adoption in the U.S.

Conlan said in the interview:

“U.S. President Donald Trump’s pro-crypto stance has reignited global interest, potentially acting as a catalyst for increased adoption and regulatory clarity. With the approval of Bitcoin ETFs boosting investor confidence, Binance is poised to support the growing interest in the market, reinforcing its role as a preferred platform for both retail and institutional users.”

Discussing the ongoing Bitcoin price cycle’s top narrative, memecoins, Conlan says:

“Memecoins have definitely lowered the barrier to entry for new participants in crypto trading, attracting and engaging a diverse audience with their viral and trendy appeal and community-driven narratives. While some memecoins may fade with market cycles, the industry has progressed beyond a mere trend.”

The CMO highlights how few memecoin projects have expanded their ecosystems and offered features like staking and decentralized exchanges, signifying a shift toward sustainability. Along with growing institutional interest, they could soon be recognized as a legitimate asset class, according to Conlan.

“Memecoins may continue to play an important role in the crypto ecosystem, functioning as both an entry point for new investors and a driving force for greater crypto adoption.”

When asked about ETF approvals in 2025 and whether traders should prepare for Dogecoin, Cardano, XRP, Solana ETFs being approved in H1 this year, Conlan said that the industry remains optimistic.

“With increasing institutional interest and regulatory clarity, the industry is optimistic about the expansion of ETF offerings to include other major digital assets such as Dogecoin (DOGE), Solana (SOL), XRP, and Cardano (ADA). These potential ETF approvals would mark a significant step in the broader institutionalization of crypto, bringing increased liquidity and legitimacy to these assets. However, approvals may depend on evolving SEC policies and market conditions.”

Binance’s CMO believes that Trump’s Strategic Crypto Reserve, and related executive orders have sparked meaningful discussions about the role of digital assets in the future of finance. She further mentions that the initiative reflects growing recognition of cryptocurrencies as a strategic asset class, highlighting the need for the U.S. to remain at the forefront of innovation in blockchain technology.

“While the proposal to build a Strategic Crypto Reserve faces important discussions in Congress, we hope to see constructive dialogue between policymakers, regulators, and industry stakeholders. Constructive collaboration can help shape a framework that ensures security, stability, and economic benefits for all.

As global interest in digital assets continues to rise, countries are exploring regulatory approaches that best suit their markets. We look forward to policies that support technological innovation while balancing market needs and compliance requirements, fostering a more stable and healthy environment for the entire industry,” she said.

Adding to her thoughts on the Strategic Crypto Reserve, Rachel told Crypto.news:

“If implemented, such an initiative could lead to increased institutional and retail participation, further cementing crypto’s role as a mainstream financial asset. Binance is prepared to support this evolution by ensuring liquidity, security, and accessibility for traders globally.

This will represent a pivotal moment for the industry, and Binance looks forward to contributing its expertise and experience in driving crypto adoption forward. A clear regulatory path, government engagement, and increased institutional confidence will play a crucial role in shaping the future of digital assets and Binance is ready to support this transformation at a global scale.”

Chrissy Hill, Chief Counsel/Interim COO, Parity Technologies

Crypto.news interviewed Chrissy Hill of Parity.io, a core blockchain infrastructure company known for creating Polkadot. Hill shed light on the groundbreaking White House Crypto Summit event, the regulatory landscape in the U.S., Polkadot’s initiatives and what to make of the rising institutional adoption of crypto.

Hill considers Trump’s White House Crypto Summit to be “the highest level of political support for the crypto industry.” Commenting on the Strategic Crypto Reserve, Hill explains how centralization vs. decentralization play a key role in token selection and that the announcement has acted as a “Geopolitical driver.”

Hill is quoted as saying:

“The U.S. is positioning itself as a forward-thinking leader in digital world, and the initial token selection (e.g., Cardano, Solana) reflects the “Made in USA” concept. The discussion remains open for other tokens to join the strategic reserve.”

When asked about the upcoming SEC crypto roundtable and the financial regulator’s shifting stance on litigation against crypto firms and exchanges, Hill stresses the importance of all three branches, the executive, legislative and judicial, in shaping crypto policy.

“The timeline for crypto legislation (e.g., Genius Act, Fit 21) has been pushed back to year-end. There is a critical need for educating policymakers on digital assets fundamentals and the Polkadot Blockchain Academy is running a UK pilot in April, with plans to expand globally.”

Commenting on SEC guidance on memecoins, Parity’s Chief Counsel explains that it provides clarity but doesn’t address the speculative nature of the tokens. Hill recommends traders do their own research before investing in memecoins.

Hill concludes the interview with Polkadot’s technology and roadmap for 2025, stating that, “the focus is on a multi-chain world, interoperability, scalability, and security. The project’s long-term approach emphasizes innovation and Web3 principles, with an aim to attract diverse stakeholders: builders, users, institutions, and governments.”

Hill is confident that altcoins have the potential to see similar interest as institutions have shown in Bitcoin treasury holdings and ETF investments. Parity’s interim COO identifies Trump administration’s crypto-friendly appointments (e.g., Jonathan Gould to OCC) as the foundation to potentially setting global benchmarks in other jurisdictions like the EU, Japan, South Korea, Hong Kong, that are reviewing crypto regulations.”

Chrissy advises women in crypto to embrace curiosity and open-mindedness in exploring new areas. She quotes Sun Tzu in her chat with Crypto.news and says,

“Opportunities multiply as you seize them – Sun Tzu.”

Hill encourages women to recognize that the digital world (blockchain, AI, robotics, IoT) offers numerous opportunities and not be afraid to enter new spaces, as everyone is starting from a similar point.

Kyla Curley, Certified Cryptocurrency Forensic Investigator and Partner, StoneTurn

Kyla Curley, a leader in crypto forensic investigation, has over two decades of experience in financial investigations and business litigation. Curley discussed expectations from the upcoming SEC crypto roundtable, crypto regulation in the U.S., memecoins and institutional interest in crypto with Crypto.news.

Curley doesn’t expect a significant downturn in litigation against crypto firms, even as the SEC warms up to exchanges and drops lawsuits. She said,

“There is no doubt that the Trump Administration, and the SEC as an extension, has rolled out the welcome mat to the crypto industry from day one. The Administration has hit the pause button on certain enforcement actions and policies, but the bottom line is this: fraud is not good for business, and the industry wants to work with The Administration to ensure the business-side thrives. So, of course the SEC is going to support and encourage innovation so crypto can take the next step in their maturity in the financial world, but I don’t think there is going to be a significant downturn in litigation, if potential enforcement is merited.

At the end of the day, U.S. consumer and investor demand for crypto is driven in large part by confidence in the security of the market. An inadequately regulated market with few guardrails will drive consumers and investors to send their money to safer, more regulated markets.”

Sharing her thoughts on the pace of crypto regulation and litigation by the U.S. financial regulator, the StoneTurn partner says,

“The prior SEC Chair undertook a “regulation by enforcement” stance, which may have been intended to install guardrails around the industry, but led to a spike in litigation and ultimately drove some of the crypto investment out of the U.S. The Trump Administration is telling us they are looking to find a middle ground and find that balance in crypto regulation.

We’ve already seen action here through SEC guidance in January, Staff Accounting Bulletin (“SAB”) 122, which broke down one of the greatest barriers to widespread adoption of crypto and other digital assets. SAB 122 repealed a widely unpopular reporting requirement contained in SAB 121 which placed significant and largely infeasible requirements on any financial institution wanting to custody digital assets for their customers.”

Curley sees no intrinsic value in memecoins, guiding traders on the topic of meme tokens and the recent SEC guidance, the executive said:

“Generally speaking, memecoins have no intrinsic value, so those launching projects should be aware that they are entering a space that is highly sensitive to any change in public perception and therefore more susceptible to potential market manipulation. A single social media post can impact the price, and the greater the audience, the greater the impact on the token.”

As traditional financial institutions warm up to crypto, Curley says,

“As I said before, business doesn’t like fraud. I think the traditional financial “gatekeepers” realize the inherent value of the industry, but they were always weary of the prevalence of “bad” business.

As long as there is a balance between innovation and regulation, larger financial institutions will likely deepen their relationship with crypto in 2025 and beyond.”

Agne Linge, Head of Growth, WeFi

Linge observes the volatility in the crypto market and comments on the sentiment and unmet expectations of traders when referring to the U.S. Strategic Crypto Reserve. Linge tells Crypto.news,

“The tariff and trade war has continued to create headwinds for the US stock market and, by extension, risk assets like Bitcoin. Despite President Trump’s postponement of the tariff on Mexico, investors still considered the market too risky to bet on.

The subpar strategic Bitcoin reserve move triggered the uncertainty in the crypto market. With the Executive Order directing agencies to consolidate seized Bitcoin to form the reserve, crypto investors see the move as a trick, as no new BTC purchase was announced.”

Linge highlights how, despite the knee-jerk reaction from investors, the Bitcoin reserve mandate authorizes the acquisition of BTC through means that will not cost taxpayers’ money.

She explains,

“The available options in this regard include Bitcoin bonds and the sales of its gold reserve to fund more purchases. In the long term, the Bitcoin reserve shift might benefit the coin. This thesis hinges on a possible race it has triggered that may see other sovereign nations make similar moves.

Pricing in the long term prospect is hard for now, and in the short term, investors are focused on the non-farm payroll report. This report will serve as a major insight into the Federal Reserve’s next monetary actions, which can go a long way in pacifying investors.”

Linge is no outsider to the crypto market and has navigated previous cycles where the market faced intense volatility. The recent surge in crypto liquidations and Bitcoin flash crash highlighted the market’s uncertainty, she remarks.

“Amid this price action, the conviction for sustainable growth in the near term remains low as significant headwinds lie ahead. Despite the market’s long-term prospects, the headwinds from the events of the week, the tariff announcements, Crypto Summit and the FTX repayment scheduled cannot be ignored and may trigger more volatility in the coming days,” she says.

Disclosure: The views and opinions expressed here belong solely to the author and do not represent the views and opinions of crypto.news’ editorial.

Source link

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

In crypto, wild price swings are normal when policies and new regulations are announced. This market observation became evident this week, immediately after US President Donald Trump announced plans for a strategic crypto reserve that includes Ethereum, Solana, ADA, Ripple’s XRP, and of course, Bitcoin.

Related Reading

Cryptos’ reaction was immediate, with Ethereum as one of the top assets that surged and fell massively within days. On March 2nd, ETH was trading at $2,191, then climbed to as high as $2,542 on March 3rd, before dropping below $2,300 at the day’s close and settling at the $2,050 level again the next day.

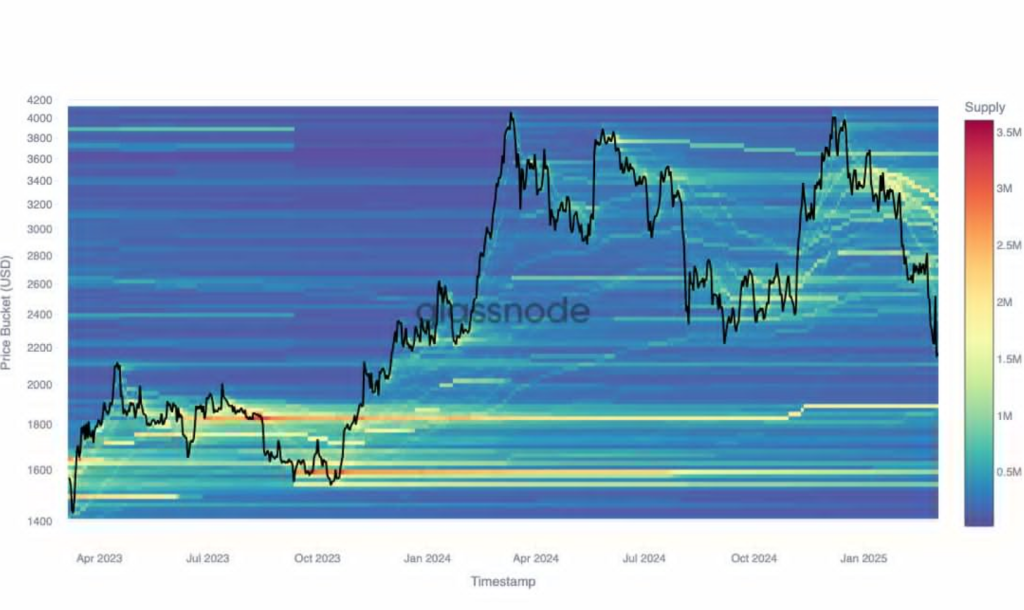

According to Glassnode, the recent crypto price movements unraveled some of the key strategies of ETH holders.

A Flurry Of Activities Among ETH Holders

Glassnode data shows ETH holders and investors moved and adjusted their holdings during the recent crypto price swings. Based on its three-month analysis, Ether holders who acquired their tokens at $3,500 adjusted their holdings in February.

#Ethereum investors actively managed their exposure through this volatile period. After a rally to $2.5K, $ETH retraced to $2.05K – levels last seen in Nov 2023. Cost Basis Distribution (CBD) shows how capital rotated across price levels and who took advantage of the dip.

pic.twitter.com/vl6AdghfRO

— glassnode (@glassnode) March 5, 2025

These investors started their positions at a peak price of $2,500, and remained on their positions when ETH revisited $2,050. Based on Glassnode figures, these investors own 1.75 million ETH with an average acquisition price of $3,200. This means that their holdings are now down 10% from their entry.

Glassnode also shares that on March 1st, investors bought 500k ETH at an average price of $2,200. However, this group quickly redistributed their holdings when ETH’s price hit $2,500.

Ethereum’s recent price action has revealed a new major price resistance at $2,800, where market traders accumulated 800k tokens. As such, crypto holders and investors are now looking at this level if ETH rebounds soon.

Growing Accumulation Among ETH Whales

Market analysts also highlight the growing trading activity and accumulation among crypto wallets. Crypto commentator Ted shared that a crypto whale investor recently bought 17,855 ETH worth roughly $36 million, with an average price of $2,054.

The whale’s ETH holdings are now valued at $2.5 billion. This transaction validates the current accumulation trend, suggesting that today’s price is a “buy opportunity”.

Is It Time To Buy ETH?

Currently, ETH is trading between $2,100 and $2,300, which is still below its Monday price of $3,500. According to a CryptoQuant analyst, Ethereum is most likely in favorable condition after its recent price swings. The analyst added that Ethereum’s MVRV ratio drops below 1, meaning the asset is undervalued.

Related Reading

This level often sets the tone for a price surge in previous bull markets. He also noted that an increasing number of ETH addresses are buying more tokens. These wallets hold ETH without selling, suggesting that institutional players are building their holdings.

Still, the CryptoQuant analyst remains cautious on ETH, pointing out that macroeconomic conditions can still sway crypto prices. He then noted the possible impact of tariff measures and monetary strategies on ETH and altcoin prices.

Featured image from Reuters, chart from TradingView

Source link

VanEck Registers AVAX ETF in Delaware

Why is Ethereum (ETH) price down today?

Key Support Level At $74,000 Determines Bitcoin Bull Or Bear Future

Deutsche Boerse-backed Clearstream to offer custody for Bitcoin, Ethereum

Analyst Who Nailed End of 2021 Bull Market Says Bitcoin May Have Seen Worst of Correction – Here’s Why

Crypto & Stock Market Crash as US Recession Odds Hit 40%

ChatGPT Maker OpenAI Inks $12B Deal With CoreWeave Ahead of Planned IPO

Mt. Gox makes second $900M+ move in a week as Bitcoin taps $76K

Bitcoin’s Downtrend Continues, But Analyst Predicts $180K Target—Is It Possible?

Why is Bitcoin price down 30% from its all time high?

Market Cap of Top Five Stablecoins Surges to New All-Time High of $204,700,000,000, According to Analyst

3 Top Factors That Can Fuel Massive Bitcoin Price Rebound

Rex Shares, Osprey Seek Movement ETF Approval as Ethereum Layer-2 Mainnet Launches

4 things must happen before Ethereum can reclaim $2,600

Recent SEC Guidance On Memecoins Suggests Broader Policy Change

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Crypto’s Big Trump Gamble Is Risky

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

A16z-backed Espresso announces mainnet launch of core product

Has The Bitcoin Price Already Peaked?

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

Trump’s Coin Is About As Revolutionary As OneCoin

Ripple Vs. SEC, Shiba Inu, US Elections Steal Spotlight

Is $200,000 a Realistic Bitcoin Price Target for This Cycle?

Trending

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin2 months ago

Bitcoin2 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News2 months ago

24/7 Cryptocurrency News2 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin4 months ago

Bitcoin4 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Bitcoin4 months ago

Bitcoin4 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Altcoins1 month ago

Altcoins1 month agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Opinion4 months ago

Opinion4 months agoCrypto’s Big Trump Gamble Is Risky

Price analysis4 months ago

Price analysis4 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x