Altcoins

Litecoin Price Upsurge Cools Off – What’s Next After The $97.8 Drop?

Published

2 months agoon

By

admin

Litecoin’s bullish momentum has cooled off, with the price sliding back to $97.8 after struggling to sustain its recent uptrend. The pullback comes amid increasing selling pressure, raising concerns about whether this is a temporary correction or the start of a deeper decline. While LTC previously showed strength, the inability to maintain higher levels suggests that market sentiment is shifting, leaving traders questioning the coin’s next move.

As the price approaches key support levels, traders are closely monitoring market signals to determine the next move. Will buyers step in to defend LTC and spark a rebound, or will bearish pressure push the price even lower?

Litecoin Drop To $97.8: What Triggered The Pullback?

Litecoin’s retreat to $97.8 comes after failing to sustain its recent uptrend, as increasing selling pressure drove the price lower. After an initial push higher, LTC encountered strong resistance at the $113 key level, preventing further gains and triggering a pullback. This resistance rejection prompted profit-taking among traders, as many opted to secure gains rather than hold through potential volatility.

Moreover, the decline in buying momentum played a crucial role in the price drop. As bullish enthusiasm faded, buyers struggled to maintain control, allowing sellers to take over. The weakening demand led to increased downward pressure, accelerating Litecoin’s descent toward the $97.8 support level.

Broader market uncertainty also contributed to the downturn. A combination of external factors, including macroeconomic conditions and Bitcoin’s price action, likely influenced traders’ risk appetite, leading to a cautious approach toward altcoins like LTC.

Technical indicators also experienced a drop below average, prompting a correction as traders reassessed their positions. If Litecoin fails to hold above $97.8, further downside could be expected. However, a possible recovery may be on the horizon if buyers step in at this level.

Potential Scenarios: Rebound Or Further Decline?

The Litecoin price movement around the $97.8 level will be crucial in determining its next direction. Two possible scenarios could unfold—a strong rebound if buyers regain control or a deeper decline if selling pressure persists.

In a bullish scenario where LTC manages to hold above $97.8, buyers could step in, driving the price toward immediate resistance levels. A successful rebound might push Litecoin back above $113, with the next target being $131.6. After this, bullish momentum may grow, paving the way for a rally to $146.

However, in a bearish scenario where Litecoin fails to hold above $97.8, the price could face additional downside pressure. Breaking below this key support hints at a decline toward $89.7 and $76.8, and even lower support zones, making it critical for bulls to defend key levels.

Source link

You may like

Stripe Tests New Stablecoin Project as $3.7T Market Looms

Falling Wedge Pattern Confirms $264 target

Ethereum community members propose new fee structure for the app layer

Crypto Investors Sue Nike, Accuse Apparel Giant of Rug Pull After Abrupt Closure of Metaverse Business: Report

Top cryptocurrencies to watch: Pi Network, XRP, Sui

This Week in Crypto Games: Ubisoft’s ‘Might & Magic’, ‘Peaky Blinders’ in Development

Altcoin

Dogecoin Confirms Daily Trend Reversal With Breakout, Retest, And New Uptrend

Published

3 hours agoon

April 27, 2025By

adminReason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Dogecoin’s price is entering a new bullish phase after months of decline. Technical analysis of the daily candlestick timeframe chart shows that the popular meme cryptocurrency is flashing a trend reversal, hinting at a significant shift from bearish to bullish momentum.

Analyst Flags Daily Trend Reversal On Dogecoin Chart

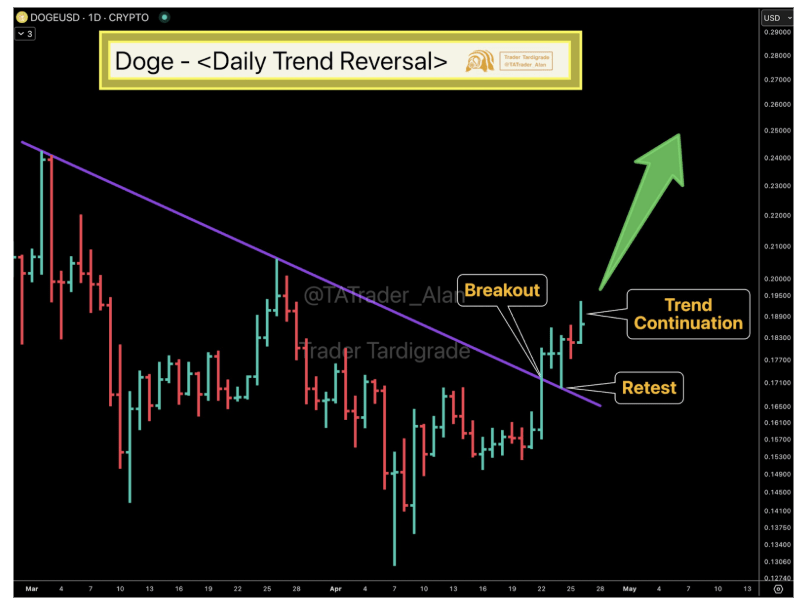

A prominent crypto analyst known as Trader Tardigrade has highlighted a confirmed trend reversal for Dogecoin. In a post on X (formerly Twitter) this week, he pointed out that DOGE’s daily chart has flipped from a downtrend to an uptrend. This claim is reinforced by a technical analysis of Dogecoin’s price action.

Related Reading

Dogecoin’s price recently broke above a descending trendline that had defined its downtrend for several weeks. This breakout occurred on April 22, when Dogecoin closed above $0.165 on the daily candlestick timeframe. This breakout was the first step indicating the coin was escaping its bearish trajectory.

Shortly after breaching the downward sloping resistance line, Dogecoin’s price pulled back between April 23 and April 24 to retest the same trendline, but this time from above. Importantly, the former resistance trendline held strong as a new support level during the retest. Following that successful test, Dogecoin resumed its upward climb, marking the continuation of the new uptrend.

This pattern of breakout, retest, continuation is a classic technical confirmation of a trend reversal. The successful retest of this trendline gives more confidence that the bullish shift is real and not a false signal.

Image From X: Trader Tardigrade

Bullish Target: $0.25 By Early May

With the daily trend now pointing upward, the focus is now on how far this new uptrend could carry Dogecoin. According to Trader Tardigrade’s analysis, Dogecoin could continue climbing in the coming days, potentially crossing the quarter-dollar mark very soon. As indicated on the chart he shared by Trader Tardigrade, the next Dogecoin price target is around $0.25 by the first week of May.

If achieved, a rise to $0.25 would be a significant milestone, considering Dogecoin has been stuck in a downtrend for over 10 weeks. As such, a break to $0.25 would mark Dogecoin’s highest price since late February and a robust recovery from its recent lows around the $0.14 to $0.15 range. Such a move would also represent roughly a 51% gain from the breakout level of $0.165.

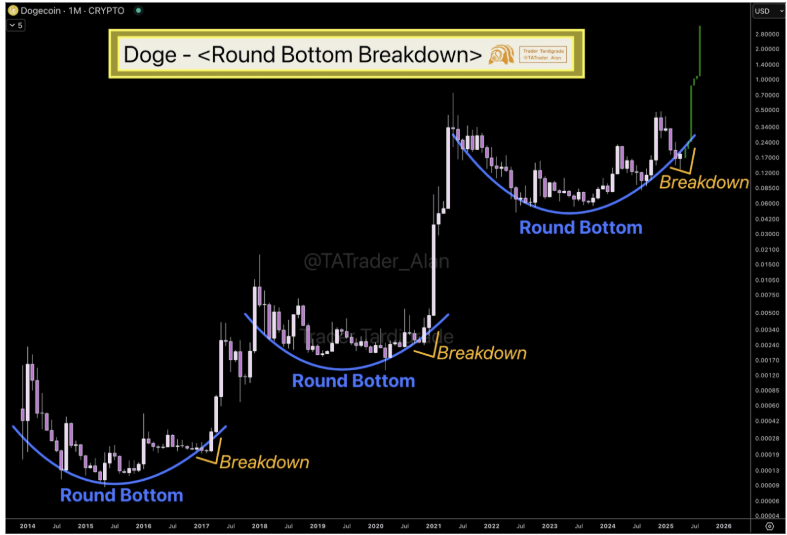

However, $0.25 is only the target in the short term. In a separate analysis, Trader Tardigrade pointed to Dogecoin’s long-term chart, highlighting a round bottom formation. The accompanying chart shows that in previous cycles, Dogecoin’s price formed a rounded bottom before entering explosive upward trends. This repeated pattern, now visible again on the monthly timeframe, signals that Dogecoin may be on the verge of another significant breakout. The long-term price target in this case is $2.8.

Image From X: Trader Tardigrade

Related Reading

At the time of writing, Dogecoin is trading at $0.18.

Featured image from Unsplash, chart from TradingView

Source link

Altcoins

DePIN Altcoin Outpaces Crypto Market and Skyrockets by Nearly 44% Following High-Profile Exchange Listing

Published

21 hours agoon

April 27, 2025By

admin

An altcoin associated with a decentralized physical infrastructure network (DePIN) project surged by nearly 44% on Friday after receiving a prominent exchange listing.

On Thursday, the South Korean crypto exchange giant Bithumb announced it was listing XYO, the native token of the XYO Network.

The XYO Network aims to process any type of decentralized data.

Explains the project’s website,

“Encompassing both a network and protocol, XYO can be used for aggregating, verifying, organizing, and utilizing decentralized data from any hardware node capable of running XYO-enabled software or firmware.

XYO’s defining premise is decentralized verification, allowing network devices to verify the data flowing into the network’s databases by acting as witnesses for one another, strengthening the veracity of data received. Simple, accessible organization then allows this data to be put to use quickly and efficiently.”

Earlier this month, the project announced it would be migrating its network to a new layer-1 chain focused on DePIN. To help facilitate that move, the XYO Network is also rolling out a new layer-1 native token, XL1, and will operate with a dual-token model going forward.

The original XYO token will stay on Ethereum (ETH) and act “as an anchor to regulate the flow of XL1 into its native blockchain,” according to the project.

XYO is trading at $0.0154 at time of writing. The 278th-ranked crypto asset by market cap is also up by more than 71% in the past week.

Follow us on X, Facebook and Telegram

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: DALLE3

Source link

Altcoins

XRP, Solana, DOGE and Others Among 72 Different ETF Applications Waiting for SEC Approval: Report

Published

4 days agoon

April 24, 2025By

admin

Crypto firms are now waiting to hear back on 72 active applications for new crypto-related exchange-traded funds (ETFs).

James Seyffart, an ETF analyst at Bloomberg Intelligence, compiled the list of submissions to the U.S. Securities and Exchange Commission (SEC).

ETFs awaiting approval include funds tied to Solana (SOL), XRP (XRP), Sui (SUI), Litecoin (LTC), Axelar (AXL) Hedera (HBAR), BNB, Cardano (ADA), Avalanche (AVAX), Dogecoin (DOGE), Polkadot (DOT), Aptos (APT), Chainlink (LINK), Pudgy Penguins (PENGU), Official Trump (TRUMP), Melania (MELANIA) and Bonk (BONK).

Other potential new ETFs are tied to a basket of currencies, and a few are based on Bitcoin (BTC) and/or Ethereum (ETH), assets that have already been approved for inclusion in other spot ETFs.

Eric Balchunas, a senior ETF analyst at Bloomberg Intelligence, predicts that BTC ETFs will remain dominant regardless of the number of altcoin funds that are approved.

“No Second Best? Bitcoin ETFs command 90% of all the crypto fund assets globally. While a TON of alt/meme coin ETFs are likely going to hit market this year, they will only make a minor dent, Bitcoin likely to retain at least 80-85% share long-term.”

The SEC greenlit the first spot market Bitcoin ETFs in January 2024, bringing in billions of dollars worth of inflows to the top digital asset by market cap, and the regulator subsequently approved Ethereum ETFs for trading last July.

Follow us on X, Facebook and Telegram

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Don White – Art Dreamer/Vladimir Sazonov

Source link

Stripe Tests New Stablecoin Project as $3.7T Market Looms

Falling Wedge Pattern Confirms $264 target

Dogecoin Confirms Daily Trend Reversal With Breakout, Retest, And New Uptrend

Ethereum community members propose new fee structure for the app layer

Crypto Investors Sue Nike, Accuse Apparel Giant of Rug Pull After Abrupt Closure of Metaverse Business: Report

Top cryptocurrencies to watch: Pi Network, XRP, Sui

This Week in Crypto Games: Ubisoft’s ‘Might & Magic’, ‘Peaky Blinders’ in Development

Why Arbitrum-Nvidia Partnership Collapsed – And What It Means for Web3

Tariff Carnage Starting to Fulfill BTC’s ‘Store of Value’ Promise

The cost of innovation — Regulations are Web3’s greatest asset

Best Crypto to Buy as Derivatives Exchange CME Set to Launch XRP Futures

Metaplanet Buys Additional ¥1.92 Billion Worth Of Bitcoin

Here Are Four Signs the Stock Market Has Bottomed, According to Fundstrat’s Tom Lee

Bitcoin dips below $94,000 as ETFs record $3b weekly inflow

Bitcoin Post-Halving Price Performance Is the Worst on Record. Why?

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Crypto’s Big Trump Gamble Is Risky

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

I’m Grateful for Trump’s Embrace of Bitcoin

Trending

24/7 Cryptocurrency News6 months ago

24/7 Cryptocurrency News6 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin3 months ago

Bitcoin3 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Ripple Price1 month ago

Ripple Price1 month ago3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin6 months ago

Bitcoin6 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Opinion6 months ago

Opinion6 months agoCrypto’s Big Trump Gamble Is Risky

Bitcoin5 months ago

Bitcoin5 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Bitcoin2 months ago

Bitcoin2 months agoThe Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines