Bitcoin ETF

Low Fees Are A Symptom Of Deeper Problems

Published

1 month agoon

By

admin

People tend to celebrate periods of low feerates. It’s time to clean house, consolidate any UTXOs you need to, open or close any Lightning channels you’ve been waiting on, and inscribe some stupid 8-bit jpeg into the blockchain. They’re perceived as a positive time.

They are not. We have seen explosive price appreciation the last few months, finally hitting the 100k USD benchmark that everyone took for granted as preordained during the last market cycle. That’s not normal.

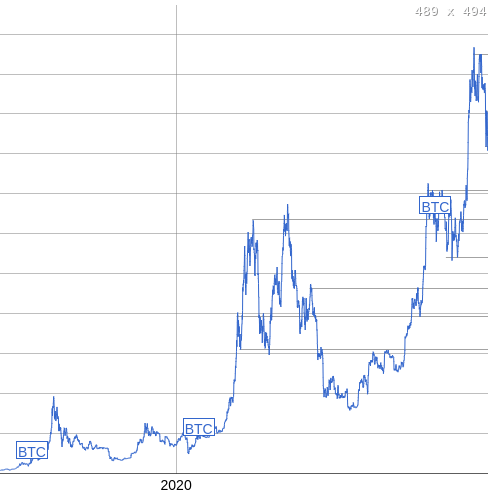

The picture on the left is the average feerate each day since 2017, the picture on the right is the average price each day since 2017. When the price was pumping, when it was highly volatile, historically we have seen feerates spike accordingly. Generally matching the growth and peaking when the price did. The people actually buying and selling transacted on-chain, people took custody of their own coins when they bought them.

This last leg up to over 100k does not seem at all to have had the same proportional affect on feerates that even moves earlier in this cycle have. Now, if you actually did look at both of those charts, I’m sure many people are going “What if this cycle is at the end?” It’s possible, but let’s say it’s not for a second.

What else could this be indicating? That the participants that are driving the market are changing. A group of people who used to be dominated by individuals who self custodied, who managed their counterparty risk by removing gains from exchanges, who generated time-sensitive on-chain activity, are transforming into a group of people simply passing around ETF shares that have no need of settling anything on-chain.

That is not a good thing. Bitcoin’s very nature is defined by the users who interact with the protocol directly. Those who have private keys to authorize transactions generating revenue for miners. Those who are sent funds, and verify transactions against consensus rules with software.

Both of those things being removed from the hands of users and placed behind the veil of custodians puts the very stability of Bitcoin’s nature at risk.

This is a serious existential issue that has to be solved. The entire stability of consensus around a specific set of rules is premised on the assumption that there are enough independent actors with separate interests that diverge, but align on a value gained from using that set of rules. The smaller the group of independent actors (and the larger the group of people “using” Bitcoin through those actors as intermediaries) the more practical it is for them to coordinate to fundamentally change them, and the more likely it is that their interests as a group will diverge in sync from the interests of the larger group of secondary users.

If things continue trending in that direction, Bitcoin very well could end up embodying nothing that those of us here today hope it can. This problem is both a technical one, in terms of scaling Bitcoin in a way that allows users to independently have control of their funds on-chain, even if only through worst-case recourse, but it is also a problem of incentive and risk management.

The system must not only scale, but it has to be able to provide ways to mitigate the risks of self custody to the degree that people are used to from the traditional financial world. Many of them actually need it.

This isn’t just a situation of “do the same thing I do because it’s the only correct way,” this is something that has implications for the foundational properties of Bitcoin itself in the long term.

This article is a Take. Opinions expressed are entirely the author’s and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Source link

You may like

Ethereum Price Fights for Momentum—Traders Watch Key Resistance

Corporate Bitcoin Holdings Hit Record High In Q1 2025 As Public Companies Accelerate Accumulation

‘Big Short’ Investor Steve Eisman Derisks, Says Stock Market Volatility Will Be Here for a While

Dow drops over 500 points as UnitedHealth tanks, Fed tensions weigh on markets

Gold Is Still the Safe-Haven King, While Bitcoin Loses Out: JP Morgan

Dogecoin Price Breakout in view as Analyst Predicts $5.6 high

Bitcoin

Bitcoin ETFs post $172m in weekly outflows amid market bloodbath

Published

2 weeks agoon

April 7, 2025By

admin

Spot Bitcoin exchange-traded funds in the U.S. recorded a negative week once again amid escalating trade tensions following President Donald Trump’s announcement of new tariffs, dubbed ‘Liberation Day’ duties.

According to data from SoSoValue, the 12 spot Bitcoin ETFs reported $172.89 million in net outflows over the past week, snapping a two-week inflow streak that drew in nearly $941 million into the funds.

Notably, these ETFs experienced outflows on four of the five days between March 31 and April 4. Monday saw $71.07 million in outflows, followed by $157.64 million on Tuesday, $99.86 million on Thursday, and $64.88 million on Friday. The only positive day was Wednesday, with $220.76 million in inflows.

The majority of outflows came from Grayscale GBTC, which lost $95.5 million over last week, followed by WisdomTree’s BTCW with $44.6 million per Faside data. Additionally, outflows came from IBIT, BITB, ARKB, and HODL funds that saw $35.5 million, $24.1 million, $22.2 million, and $4.9 million in net redemption, respectively.

However, it wasn’t entirely a bearish week across the board, as Grayscale’s spot Bitcoin Trust, Franklin Templeton’s EZBC, and Fidelity’s FBTC still saw combined inflows of $61.8 million. The remaining BTC ETFs remained flat over the five days.

The drop in investor demand wasn’t limited to Bitcoin ETFs. Ethereum ETFs recorded $49.93 million in outflows last week, marking six straight weeks of withdrawals totaling over $795 million.

These outflows come as Bitcoin posted its worst first-quarter performance since 2018, and investor sentiment weakened due to Trump’s new tariff plans, starting with a flat 10% on all imports and higher rates for certain key trading partners, raising fears of a new global trade war.

At press time, the crypto market was down nearly 10% over the past day. Bitcoin had dropped 9.3%, falling below the $76,500 mark, a level BitMEX co-founder Arthur Hayes previously warned must be held to avoid deeper losses.

Source link

Bitcoin ETF

Bitwise Debuts Option Income ETFs On Bitcoin Treasury Stocks: MSTR, MARA, COIN

Published

2 weeks agoon

April 5, 2025By

admin

Bitwise has introduced three new ETFs that provide yield-seeking investors with exposure to leading Bitcoin treasury companies, using a covered call strategy designed to capitalize on equity volatility while preserving Bitcoin-linked upside.

The funds include:

- $IMST, tracking Strategy (formerly MicroStrategy, ticker: MSTR), which currently holds 528,185 BTC.

- $IMRA, focused on MARA Holdings (MARA), a top-tier Bitcoin miner with 47,600 BTC in treasury.

- $ICOI, offering exposure to Coinbase (COIN), which holds 9,480 BTC and serves as a key on-ramp for institutional and retail Bitcoin adoption.

Each ETF employs an actively managed options overlay, writing out-of-the-money calls on the underlying equity while maintaining a long position. This approach is designed to deliver monthly income distributions—particularly attractive in today’s high-volatility environment—while retaining meaningful upside exposure to Bitcoin-linked companies.

While none of the funds directly hold Bitcoin, all three underlying equities are deeply intertwined with Bitcoin’s performance and trajectory. Strategy and Marathon are among the most prominent corporate holders of BTC, while Coinbase continues to serve as critical infrastructure for the broader ecosystem.

New Tools for Bitcoin-Aligned Capital Allocation

For corporate treasurers and institutional allocators who view Bitcoin as a long-term strategic asset, these new products represent a compelling way to gain indirect exposure while generating yield—especially in balance sheets that can’t yet directly hold BTC.

The rise of equity-based strategies like this is part of a broader shift. More public companies are actively integrating Bitcoin into their financial models, whether through direct holdings or through services and operations tied to Bitcoin mining, custody, or exchange infrastructure.

What Bitwise is offering is not just exposure, but a way to monetize volatility—something that Bitcoin-native companies experience more than most. Whether it’s MSTR stock reacting to Bitcoin’s price swings, MARA stock tracking mining difficulty and rewards, or Coinbase stock responding to changes in trading volume and regulatory sentiment, these equities are increasingly used as BTC proxies by sophisticated investors.

In recent months, institutional interest in Bitcoin ETFs, mining stocks, and companies with Bitcoin treasuries has intensified, and tools like IMST, IMRA, and ICOI provide a new angle on that demand. For companies already on a Bitcoin treasury path—or considering one—this evolution in capital markets infrastructure is notable.

What This Signals for Bitcoin Treasury Strategy

The launch of these ETFs reflects how Bitcoin is no longer just a spot asset—it’s now embedded in public equity strategy, yield generation, and portfolio construction.

Covered call structures won’t be right for every investor or treasury, but the signal is clear: the market is maturing around the idea that Bitcoin isn’t just to be held—it can be actively managed, structured, and monetized in new ways.

These new ETFs won’t replace direct holdings on a corporate balance sheet. But they may complement them—or offer a first step for firms exploring how to position around Bitcoin while still meeting traditional risk, yield, and reporting mandates.

Disclaimer: This content was written on behalf of Bitcoin For Corporations. This article is intended solely for informational purposes and should not be interpreted as an invitation or solicitation to acquire, purchase, or subscribe for securities.

Source link

Bitcoin

This Easy Bitcoin ETF Flow Strategy Beats Buy And Hold By 40%

Published

2 weeks agoon

April 5, 2025By

admin

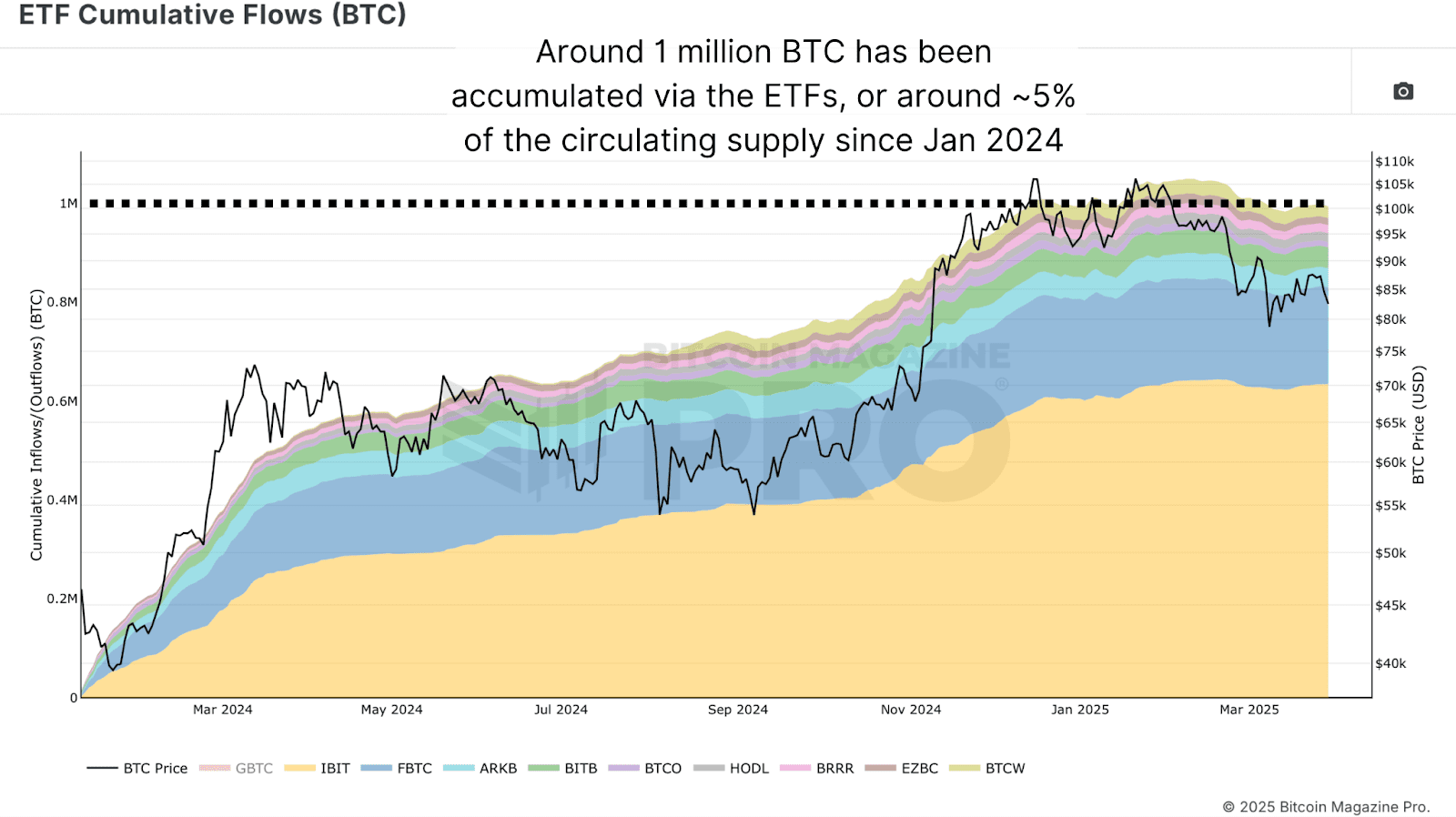

Bitcoin has seen an institutional capital influx on a scale previously unfathomable. Billions of dollars are flowing into Bitcoin ETFs, reshaping the liquidity landscape, inflow-outflow dynamics, and investor psychology. While many interpret this movement as smart money executing complex strategies backed by proprietary analytics, a surprising reality surfaces: outperforming the institutions might not be as difficult as it seems.

For a more in-depth look into this topic, check out a recent YouTube video here:

Outperforming Bitcoin – Invest Like Institutions

Canary In The Bitcoin Coal Mine

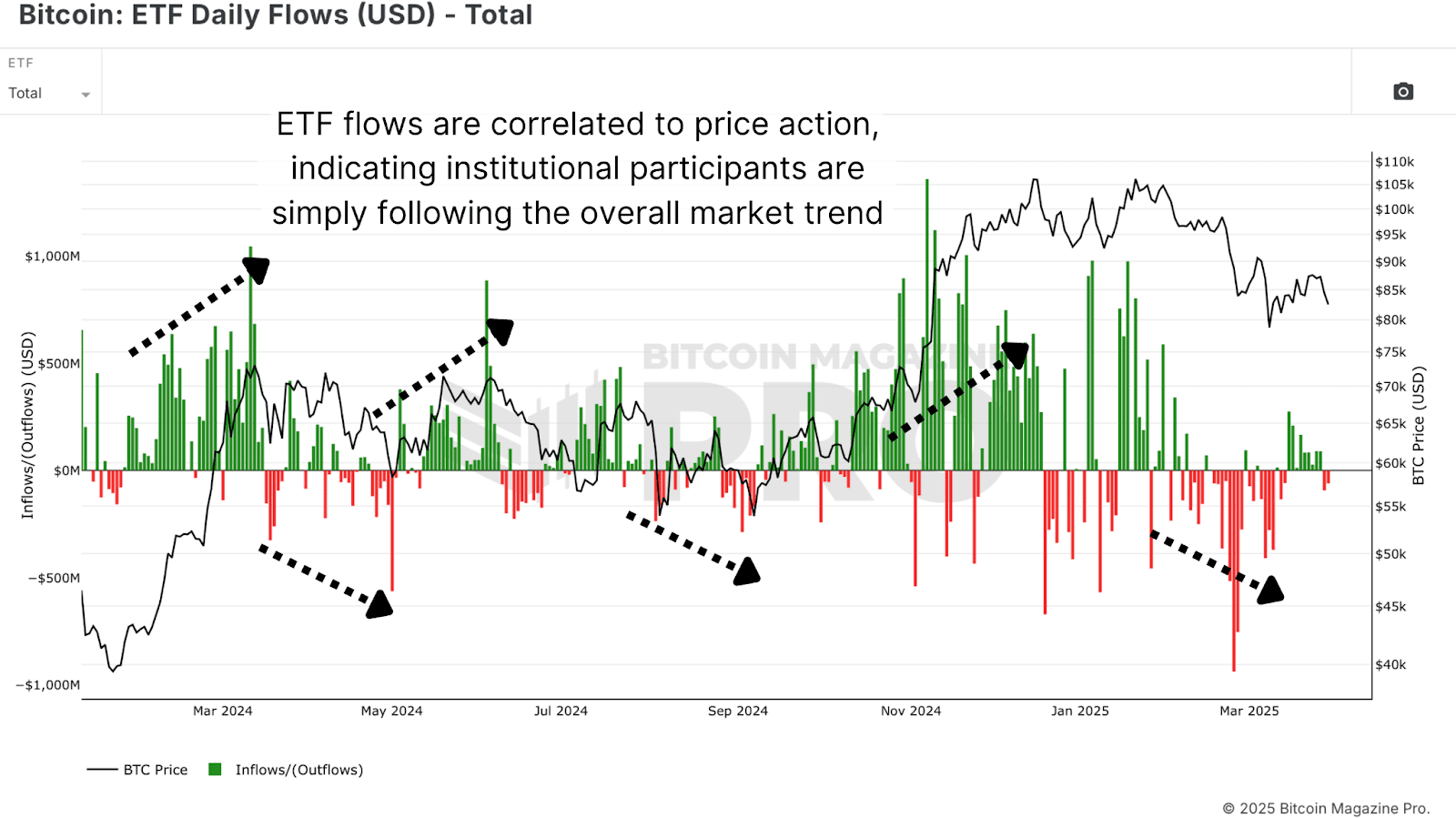

One of the most revealing datasets available today is daily Bitcoin ETF flow data. These flows, denoted in USD, offer direct insight into how much capital is entering or exiting the Bitcoin ETF ecosystem on any given day. This data has a startlingly consistent relationship with short to mid-term price action.

Importantly, while these flows do impact price, they are not the primary movers of a multi-trillion-dollar market. Instead, ETF activity functions more like a mirror for broad market sentiment, especially as retail traders dominate volume during trend inflections.

Surprisingly Simple

The average retail investor often feels outmatched, overwhelmed by the data, and disconnected from the tactical finesse institutions supposedly wield. But institutional strategies are often simple trend-following mechanisms that can be emulated and even surpassed with disciplined execution and proper risk framing:

Strategy Rules:

- Buy when ETF flows are positive for the day.

- Sell when ETF flows turn negative.

- Execute each trade at daily close, using 100% portfolio allocation for clarity.

- No complex TA, no trendlines, just follow the flows.

This system was tested using Bitcoin Magazine Pro’s ETF data starting from January 2024. The base assumption was a first entry on Jan 11, 2024, at ~$46,434 with subsequent trades dictated by flow changes.

Performance vs. Buy-and-Hold

Backtesting this basic ruleset yielded a return of 118.5% as of the end of March 2025. By contrast, a pure buy-and-hold position over the same period yielded 81.7%, a respectable return, but a near 40% underperformance relative to this proposed Bitcoin ETF strategy.

Importantly, this strategy limits drawdowns by reducing exposure during downtrends, days marked by institutional exits. The compounding benefit of avoiding steep losses, more than catching absolute tops or bottoms, is what drives outperformance.

Institutional Behavior

The prevailing myth is that institutional players operate on superior insight. In reality, the majority of Bitcoin ETF inflows and outflows are trend-confirming, not predictive. Institutions are risk-managed, highly regulated entities; they’re often the last to enter and the first to exit based on trend and compliance cycles.

What this means is that institutional trades tend to reinforce existing price momentum, not lead it. This reinforces the validity of using ETF flows as a proxy signal. When ETFs buy, they’re confirming a directional shift that is already unfolding, allowing the retail investor to “surf the wave” of their capital inflow.

Conclusion

The past year has proven that beating Bitcoin’s buy-and-hold strategy, one of the toughest benchmarks in financial history, is not impossible. It requires neither leverage nor complex modeling. Instead, by aligning oneself with institutional positioning, retail investors can benefit from market structure shifts without the burden of prediction.

This doesn’t mean the strategy will work forever. But as long as institutions continue to influence price through these large, visible flow mechanics, there is an edge to be gained in simply following the money.

If you’re interested in more in-depth analysis and real-time data, consider checking out Bitcoin Magazine Pro for valuable insights into the Bitcoin market.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment decisions.

Source link

Ethereum Price Fights for Momentum—Traders Watch Key Resistance

Corporate Bitcoin Holdings Hit Record High In Q1 2025 As Public Companies Accelerate Accumulation

‘Big Short’ Investor Steve Eisman Derisks, Says Stock Market Volatility Will Be Here for a While

Dow drops over 500 points as UnitedHealth tanks, Fed tensions weigh on markets

Gold Is Still the Safe-Haven King, While Bitcoin Loses Out: JP Morgan

Dogecoin Price Breakout in view as Analyst Predicts $5.6 high

Bitcoin (BTC) Price in Standstill at $85K as Trump Increases Pressure on Fed’s Powell

Ripple acquisition Hidden Road secures FINRA registration

Ethereum Whales Offload 143,000 ETH In One Week – More Selling Ahead?

How Do We Protect Bitcoin From Quantum Computers? Not With A Joke

OKX Goes Live In The US After Setting Up New Headquarters in San Jose, California

Stanford’s AI research lab to use Theta EdgeCloud for LLM model studies

Central African Republic Solana Meme Coin Jumps as President Fuels Rumors of Revival

Will Shiba Inu Price 3x?

Bitcoin Cash (BCH) Gains 4.2%, Leading Index Higher

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

Crypto’s Big Trump Gamble Is Risky

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

I’m Grateful for Trump’s Embrace of Bitcoin

Trending

24/7 Cryptocurrency News5 months ago

24/7 Cryptocurrency News5 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin3 months ago

Bitcoin3 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Ripple Price4 weeks ago

Ripple Price4 weeks ago3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Altcoins3 months ago

Altcoins3 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin5 months ago

Bitcoin5 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals