Arkham

Man Burns $1,300,000 Worth of Ethereum (ETH) With Cryptic Messages About ‘Brain-Computer Weapons’: Arkham

Published

1 month agoon

By

admin

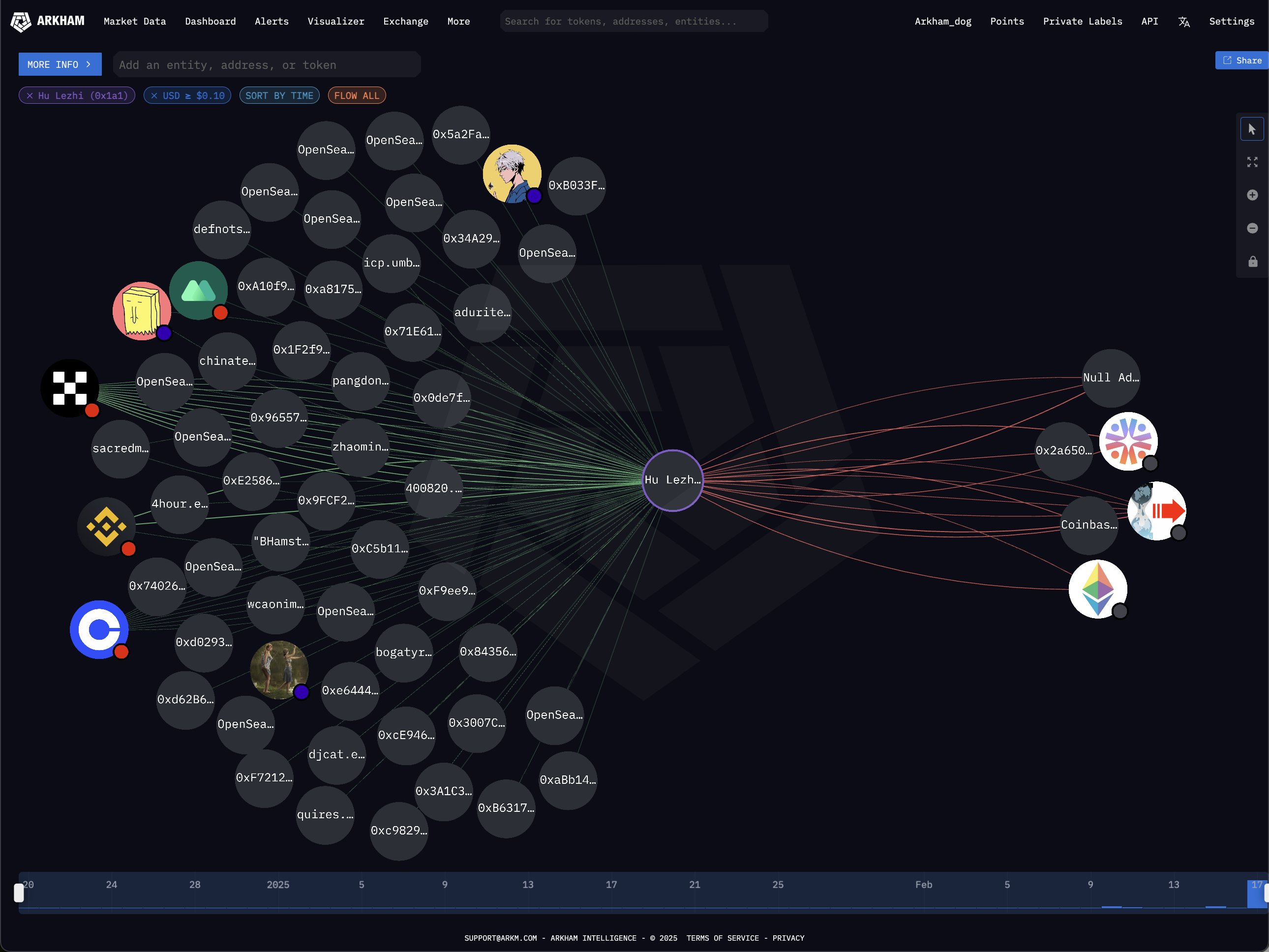

A Chinese crypto investor burned $1.3 million in Ethereum (ETH) for mysterious reasons, according to the blockchain analytics firm Arkham.

Someone calling themselves “Hu Lezhi” sent the ETH to a burn address and accused Xin Feng and Yuzhi Xu, executives at a Chinese quantitative hedge fund called WizardQuant, of using “brain-computer weapons to persecute all company employees and former employees.”

“CHINESE MAN BURNS $1.3 million [of] ETH CLAIMING ATTACK BY BRAIN-COMPUTER WEAPONS

This morning, an address sent $1.3 million of ETH to the burn address, accusing some Chinese investors of using ‘brain-computer weapons’. It is now completely unrecoverable.

Did the brain-computer weapons make him do this?”

Lezhi also claims that Feng and Xu “themselves were controlled.” WizardQuant also uses the name Kuande.

Lezhi refers to himself as an “ordinary programmer and entrepreneur” and claims that he has been “monitored and manipulated by the mind control organization” since he was born. His address has sent a total of $4.95 million to the burn address, Wikileaks and the Ethereum Foundation in the past week, and it has transferred $825,000 ETH to a Coinbase Deposit and $273,000 ETH to a fresh address.

ETH is trading at $2,669 at time of writing. The second-ranked crypto asset by market cap is down nearly 3% in the past 24 hours.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

You may like

Investors Withdraw 360,000 Ethereum From Exchanges In Just 48 Hours – Accumulation Trend?

The FAIR Act Would Protect Bitcoin Holders

Russian National Set To Forfeit Nearly $23,000,000 After Agreeing To Plead Guilty to Crypto Market Manipulation

German regulator prohibits sales of Ethena USDe

US Treasury Lifts Sanctions Against Ethereum Mixer Tornado Cash

What Would Pi Coin Price Look Like if Pi Network Reaches XRP Market Cap?

Arkham

Mt. Gox Stirs The Market With $1 Billion Bitcoin Transfer

Published

2 weeks agoon

March 6, 2025By

admin

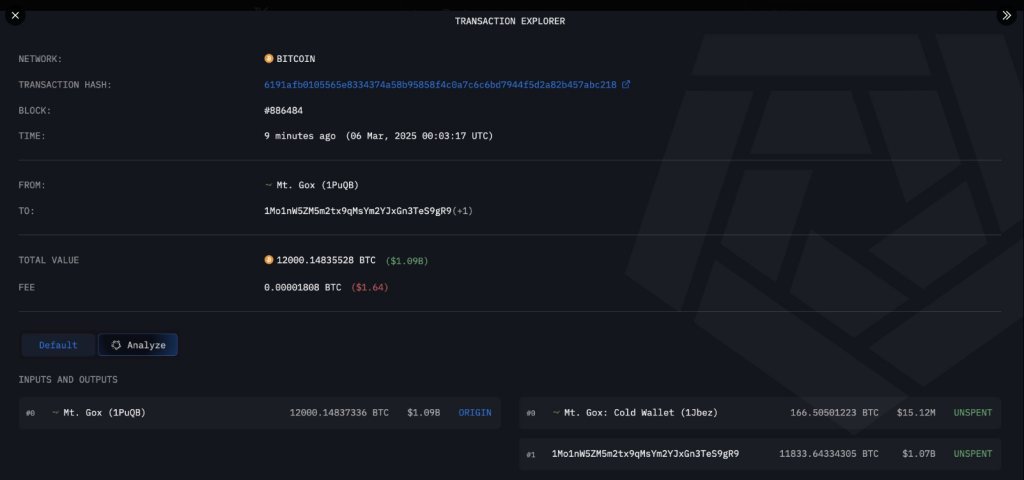

Bitcoin took center stage again as Mt. Gox moved 12,000 BTC, valued at over $1 billion, to an unknown wallet. This occurs at a time when Bitcoin is trading at approximately $92,000, a level that has caused market volatility. The actions of the defunct exchange have sparked debate regarding whether this movement indicates imminent creditor repayments or something else entirely.

Related Reading

Large Bitcoin Transfer Raises Eyebrows

Mt. Gox collapsed in 2014 following a major attack, and for years it has been in the process of reimbursing debtors. Regarding the trade, the movement of 12,000 BTC represents among the most important events in recent history. While some people think it may be a big step toward the much-needed repayments, others worry about the possible market pressure a big sell-off could generate.

On March 6, Arkham Intelligence reported that a Mt. Gox-linked wallet, “1PuQB,” moved 12,000 BTC, with 11,834 BTC (over $1 billion) sent to an unidentified wallet, “1Mo1n,” and 166.5 BTC ($15 million) transferred to Mt. Gox’s cold wallet, “1Jbez.”

ARKHAM ALERT: MT GOX MOVING $1B $BTC pic.twitter.com/VpIkHdJQkl

— Arkham (@arkham) March 6, 2025

This marks the first major transaction since January, when smaller amounts were shuffled between its cold wallets. Mt. Gox-linked wallets still hold approximately 36,080 BTC, valued at $3.26 billion, according to Arkham.

Such a large volume of Bitcoin movement historically has caused market volatility to rise. Investors are closely monitoring the possible sale in great numbers or redistribution of these monies to creditors. Although the recent surge in Bitcoin shows strong buying demand, this latest movement – if its a sell – could trigger a price dip,

Bitcoin Price Remains Stable At Or Above $90,000

Bitcoin is strong and is currently trading at about $91,680 despite the uncertainty. The market’s lackluster reaction to the transfer thus far may suggest that investors are “cool” about the most recent activity from the now-defunct exchange. Similar huge transactions have previously resulted in brief declines, but the price of Bitcoin has continued to rise.

Creditors Await Further Updates

Mt. Gox’s creditors have been waiting years for their money to come back. Payback has been slow and marked by delays. Although this most recent transaction shows that development is happening, it is still unknown when or how the creditors will get their Bitcoin.

Many hope that restitution will be handled smoothly so that it minimizes disturbance of the market. However, until official announcements are made, speculation will continue. The crypto community remains watchful for any updates that might clarify the exchange’s next steps.

Related Reading

What Next For Bitcoin

Meanwhile, any information regarding Mt. Gox’s forthcoming actions could potentially influence the coin’s short-term price action. Investors and analysts will be monitoring the transferred BTC for indications of heavy selling activity.

Featured image from Gemini Imagen, chart from TradingView

Source link

Investors Withdraw 360,000 Ethereum From Exchanges In Just 48 Hours – Accumulation Trend?

The FAIR Act Would Protect Bitcoin Holders

Russian National Set To Forfeit Nearly $23,000,000 After Agreeing To Plead Guilty to Crypto Market Manipulation

German regulator prohibits sales of Ethena USDe

US Treasury Lifts Sanctions Against Ethereum Mixer Tornado Cash

What Would Pi Coin Price Look Like if Pi Network Reaches XRP Market Cap?

SUI Drops 5.1% as Index Trades Lower From Thursday

South Korea to block non-compliant crypto exchanges

1.5M Holders, 10M Blocks on Shibarium

Pakistan Plans To Legalise Bitcoin And Crypto

‘This Is a Good Sign’: Crypto Analyst Says Bitcoin at a Key Inflection Point, Unveils Breakout Targets for BTC

Meteora shares two proposals on MET token allocation

Trump Aides Look To Reform USAID With Blockchain For ‘Transparency’: Report

Ethereum Price Eyes 50% Drop Amid Heavy ETH Whale Profit Booking

Polymarket is Over 90% Accurate in Predicting World Events: Research

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Crypto’s Big Trump Gamble Is Risky

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

Trump’s Coin Is About As Revolutionary As OneCoin

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Is $200,000 a Realistic Bitcoin Price Target for This Cycle?

Trending

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin2 months ago

Bitcoin2 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News2 months ago

24/7 Cryptocurrency News2 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Altcoins2 months ago

Altcoins2 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin4 months ago

Bitcoin4 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Price analysis5 months ago

Price analysis5 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x