Airdrop

Meteora shares two proposals on MET token allocation

Published

1 day agoon

By

admin

Meteora, the popular decentralized exchange on Solana, has put forward two proposals for adjusting MET token allocation.

According to Meteora’s Mar. 20 post on X, these changes aim to make liquidity provider rewards fairer, support new token launches, and secure long-term incentives for the team. The first proposal suggests revising the LP Stimulus Plan.

Originally, 10% of the MET supply was set aside to reward liquidity providers, but since the program has been running longer than its expected December 2024 end date, Meteora wants to increase this to 15%. This adjustment ensures that early and new LPs receive rewards without devaluing tokens.

The first two proposals are live on https://t.co/OeTKWfH27W.

These proposals address key community concerns about the LP Stimulus Plan, M3M3 and more.

Watch the community call to see @0xSoju & @0xmiir go through these proposals live.

— Meteora (@MeteoraAG) March 20, 2025

Early contributors will receive 2% of MET under the updated plan, while all LPs will receive 8% equally. The original points multiplier system has been replaced by this. An extra 3% of MET will go to Launch Pools and Launch Pads in order to avoid reward dilution for retail LPs.

The second proposal focuses on the team. Meteora plans to allocate 20% of the MET supply to its team, with a six-year vesting period to maintain long-term commitment. Within this, 2% will go to M3M3 token holders. M3M3 is Meteora’s stake-to-earn platform, which lets users earn fee rewards from permanently locked liquidity pools.

This move follows the mismanagement of M3M3 by its original creators, which led to investor losses. To maintain fairness, the distribution will be based on two snapshots and wallets connected to questionable activity will be blocked.

Meteora has experienced rapid growth in the past few months. According to DeFiLlama data, the platform’s trading volume surged 33 times, from $990 million in December 2024 to $33 billion in January 2025.

Due to its rapid growth, Meteora now holds a 9% market share and is ranked fourth among DEXs by trading volume. While the broader DEX market was on a downturn, Meteora raked in $195 million in monthly fees in February.

Despite its achievements, Meteora is currently facing legal issues that may impact its future. Burwick Law, a New York law firm, filed a class-action lawsuit against Meteora, KIP Protocol, and Kelsier Ventures on Mar. 13. According to the lawsuit, they defrauded retail traders and misled investors by manipulating liquidity during the LIBRA token launch.

Source link

You may like

Bitcoin Primed for Major Moves As Macroeconomic Conditions Ease, Says Analyst Jamie Coutts – Here’s His Outlook

Themes ETFs exec on new 2X Coinbase fund: ‘We believe as the Bitcoin tide rises, it will lift all crypto boats’

Ethena’s USDe Stablecoin Sales Blocked by German Regulator Over ‘Serious Deficiencies’

Is Ethena Price At Risk? Market Maker Offloads $10M ENA Raising Concerns

Tether eyes Big Four firm for its first full financial audit: Report

US Treasury Removes Tornado Cash From OFAC Sanctions List

Airdrop

NFT Marketplace OpenSea Confirms Upcoming SEA Token Airdrop, Expands to Crypto Trading

Published

1 month agoon

February 13, 2025By

admin

Popular non-fungible token (NFT) marketplace OpenSea said Thursday that it is expanding its platform to crypto trading and confirmed it is planning to distribute SEA tokens to users.

The trading platform called OS2 has launched today, and aggregates marketplaces, allows cross-chain purchasing and offers lower fees in the beginning, according to the protocol’s press release.

“This represents an expansion of OpenSea from an NFT marketplace to a much broader platform for trading all types of digital assets,” said Devin Finzer, Co-founder and CEO of OpenSea. “We think tokens and NFTs belong together in a single, powerful, delightful experience.”

OpenSea Foundation, the Cayman Islands-based development organization behind the protocol, will also distribute SEA tokens offering utility on the OS2 platform.

While details and date of the airdrop remain undisclosed, OpenSea has confirmed that SEA will recognize both active users and those who have been part of the platform since its early days. US users will be included in the airdrop.

OpenSea has said that SEA’s utility will be focused on long-term engagement rather than short-term speculation.

The platform’s monthly trading volume is down significantly from a $5 billion peak in early 2021, having facilitated trading of $190 million worth of NFTs last month. The platform’s annualized revenue stands at $33 million, according to Dune Analytics data.

Source link

Airdrop

Story Protocol announces launch of public mainnet

Published

1 month agoon

February 13, 2025By

admin

Story Protocol has officially launched its public mainnet following a six month long testnet.

Story Protocol, a layer-1 blockchain, has announced the launched its public mainnet, marking the first-ever global, programmable market for IP. The platform aims to transform the $61 trillion IP asset class by giving IP holders and AI-driven products the tools to manage, trade, and monetize creative assets.

Story Protocol’s launch follows a six-month testnet phase that began with the “Iliad” testnet on August 27, 2024. Now live, its mainnet provides a decentralized platform where IP owners can set up licensing rules and transact without any middlemen.

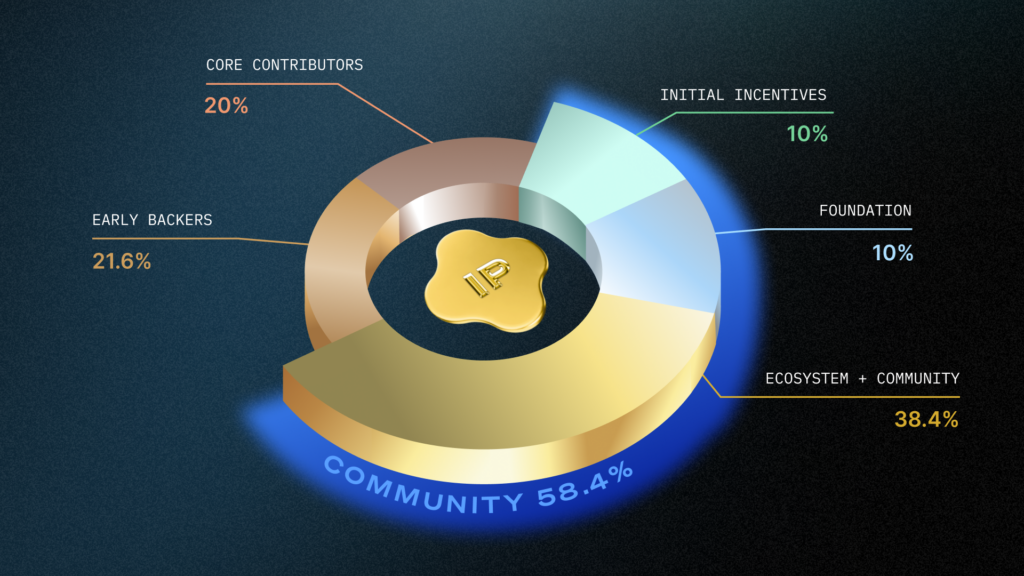

The network will be secured by the IP token. IP is used for transactions, governance, and creator rewards. IP owners can register and tokenize their work on the blockchain, setting rules for how it can be used, modified, or monetized. Developers can build apps on the network, creating new AI tools, licensing platforms, and IP marketplaces.

IP has debuted with an initial supply of 1 billion tokens. A 30-day rewards portal has been set up to allow testnet participants to claim IP tokens. Staking IP is an option for those who wish to promote network security. The staking phase for the IP, called “Singularity,” kicked off on Feb.1, but rewards will be distributed starting March 2.

Notably, tokens allocated to early backers and core contributors will be locked for one year. Major exchanges like Coinbase, OKX, KuCoin, Bybit, Bitget, and Bithumb have already announced the listing of IP.

Story Protocol raised $140 million from investors such as Samsung Next and a16z. Several IP-focused projects are already building on the network. Aria, one such project, raised $7 million to purchase the rights to Justin Bieber’s song “Peaches” and divide the proceeds among the IP asset’s fractional owners.

Source link

Airdrop

Jupiter Decentralized Exchange to Issue $612M JUP Tokens in Wednesday Airdrop

Published

2 months agoon

January 22, 2025By

admin

Jupiter, a Solana-based decentralized exchange, will airdrop 700 million JUP tokens to its community on Wednesday in what it is calling the “largest airdrop in history.”

The airdrop is a part of the project’s annual “Jupuary” event, which was voted into existence alongside another event in 2026 in a governance vote in December. It is scheduled to start at 15:30 UTC.

Initial concerns were raised about the sustainability of supply increase, prompting the proposal to be amended to include a token audit and burn schedule over the next month.

At the time of writing JUP is trading at $0.87 after sliding by 2% over the past 24 hours. The total value of the airdrop is set to be $612 million.

Source link

Bitcoin Primed for Major Moves As Macroeconomic Conditions Ease, Says Analyst Jamie Coutts – Here’s His Outlook

Themes ETFs exec on new 2X Coinbase fund: ‘We believe as the Bitcoin tide rises, it will lift all crypto boats’

Ethena’s USDe Stablecoin Sales Blocked by German Regulator Over ‘Serious Deficiencies’

Is Ethena Price At Risk? Market Maker Offloads $10M ENA Raising Concerns

Coinbase Could Be Near Multi-Billion Dollar Deal for Deribit: Bloomberg

Tether eyes Big Four firm for its first full financial audit: Report

Why Current ‘Boredom Phase’ Could Trigger Epic Rally

US Treasury Removes Tornado Cash From OFAC Sanctions List

21,899 Bank Customers Affected As US Lender Suffers Cybersecurity Breach, Hacker Taps Social Security Numbers and Other Sensitive Information

Tether eyeing ‘Big Four’ firm for reserve audit: CEO

Solo Bitcoin Miner Hits the Jackpot, Scoring $266K Reward

Is Bitcoin Price Bottom In? Key Metrics Show rally Is Likely

SEC ‘Earnest’ About Finding Workable Crypto Policy, Commissioners Say at Roundtable

John Reed Stark opposes regulatory reform at SEC crypto roundtable

Investors Withdraw 360,000 Ethereum From Exchanges In Just 48 Hours – Accumulation Trend?

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Crypto’s Big Trump Gamble Is Risky

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

Trump’s Coin Is About As Revolutionary As OneCoin

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Is $200,000 a Realistic Bitcoin Price Target for This Cycle?

Trending

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin2 months ago

Bitcoin2 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News2 months ago

24/7 Cryptocurrency News2 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Altcoins2 months ago

Altcoins2 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin4 months ago

Bitcoin4 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Price analysis5 months ago

Price analysis5 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x