Markets

Monochrome Brings First Aussie Bitcoin, Ethereum ETFs to Singapore Market

Published

1 month agoon

By

admin

Australian crypto-asset firm Monochrome Group has registered its Bitcoin and Ethereum ETFs with Singapore’s Monetary Authority, marking a strategic expansion into Southeast Asian markets amid growing institutional demand for regulated digital asset products.

“We’re bringing Monochrome to South East Asia, starting with getting the first Australian Bitcoin ETF registered with the Monetary Authority of Singapore,” CEO Jeff Yew told Decrypt.

The firm’s Bitcoin ETF (IBTC) and Ethereum ETF (IETH) secured registration as restricted schemes, enabling access for accredited or institutional investors through Singapore’s regulated financial framework, which places a minimum of S$200,000 per transaction.

These new products allow both Bitcoin and cash subscriptions and redemptions, addressing varied institutional requirements in the region.

“It’s not about chasing price moves—it’s about building real infrastructure and giving institutions, investors, and even governments better access to Bitcoin,” Yew said, reflecting on Sunday’s market rout which triggered over $2 billion in liquidations.

Monochrome’s expansion includes a strategic partnership with Anadara Capital to strengthen institutional services. The company enhanced its infrastructure by onboarding BitGo Trust Company for custody services on both ETF products, addressing security concerns common among institutional investors.

The Australian firm plans to build out regional offices within the year 2025 as it focuses on ironing out regulatory compliance and its engagements with institutions.

In October last year, the firm worked on launching Australia’s first “true” spot Ethereum ETF on Cboe.

Cutting through the noise

Monochrome’s expansion into Southeast Asia with regulated crypto ETFs from Singapore arrives amid broader market turbulence, including trade tensions impacting traditional assets like equities and currencies.

Institutions are increasingly viewing regulated digital asset products as portfolio hedges against geopolitical and macroeconomic instability, driving demand for compliant offerings like IBTC/IETH.

The crypto market bloodbath over the weekend saw roughly 11.4% of its market cap wiped over the last 24 hours, according to data from CoinGecko.

“We’ve seen Bitcoin go through every kind of macro cycle over the years—it’s built for this,” Yew said. “Institutional investors don’t get caught in short-term noise, that’s why we’re focused on fundamentals and expanding access to the asset where it’s needed most.”

The move aligns with Asia’s growing role as a crypto regulatory hub while Western markets face political uncertainty over digital asset policies.

Monochrome’s MAS-approved ETFs provide a blueprint for integrating crypto into mainstream finance through rigorous compliance frameworks, contrasting with ad-hoc approaches in volatile jurisdictions.

Yew describes Bitcoin as a “unique commodity” whose “short-term volatility” is “purely caused by fluctuations in demand.”

In effect, Yew sees the recent macro market movements as having “no cause or impact to the underlying supply or protocol rigidity.”

Edited by Sebastian Sinclair

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.

Source link

You may like

Traders eye $2.80 Rally As Ripple Files New Trademark

Analyst Says Crypto Whales Loading Up on Ethereum, Accumulating $815,514,345 in ETH in Just Five Days

Bitcoin landfill man loses appeal, says he has one ‘last legal option’

Filmmakers Bet on Web3 to Fix Hollywood Film Financing

Mr. Wonderful says the crypto cowboy era is over. Really?

TON Token Surges 20% as Telegram Founder Recovers Passport From French Authorities

Markets

TON Token Surges 20% as Telegram Founder Recovers Passport From French Authorities

Published

6 hours agoon

March 16, 2025By

admin

The price of TON has surged more than 20% over the last 24 hours to now trade above $3.45 and have a $8.14 billion market capitalization after French authorities returned Telegram founder Pavel Durov’s passport.

The move restores Durov’s ability to travel freely and marks the end of a situation that had drawn concerns from privacy and free speech advocates. Durov, who co-founded Telegram, a messaging platform with nearly a billion users, has long been an outspoken advocate for privacy and secure communication.

Read more: TON Down 14% as Telegram CEO Pavel Durov Arrested in France

The TON Foundation, which supports the Telegram Open Network (TON), celebrated the moment on social media. “As part of the decentralized TON community, we have stood in solidarity with Pavel, supporting his unwavering dedication to defending the right to free speech and privacy online.“

TON has also benefited from new features introduced to the Wallet app on Telegram, which include multiple assets, a yield program, an updated user interface, and more.

Read more: Telegram’s Pivot to TON Payments for Ads Boosts Toncoin

Source link

layer 1

Cryptocurrencies to watch this week: Binance Coin, Cronos, ZetaChain

Published

10 hours agoon

March 16, 2025By

admin

Cryptocurrency prices rose modestly during the weekend as investors embraced a risk-on sentiment following Friday’s surge in the US stock market.

Bitcoin (BTC) held steady above $84,000, while the market cap of all coins rose to over $2.8 trillion.

The crypto market will have two main catalysts this week: President Donald Trump’s tariffs and the Federal Reserve’s interest rate decisions. A sign of Trump easing his stand on tariffs and a more dovish Fed will be bullish for cryptocurrencies and other risky assets.

The top cryptocurrencies to watch this week will be Binance Coin (BNB), Cronos (CRO), and ZetaChain (ZETA).

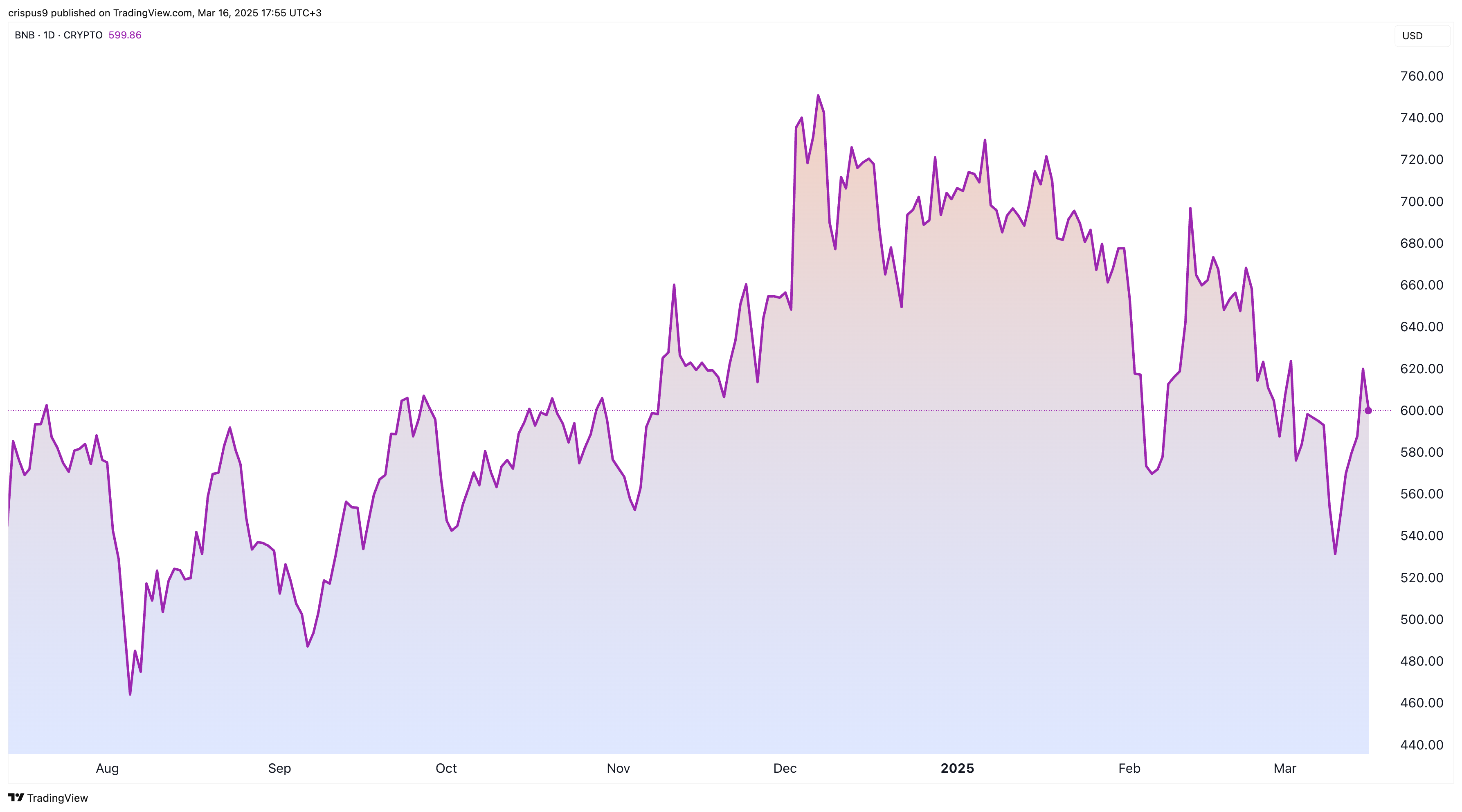

BNB

BNB price will be in the spotlight this week as the developers activate the Pascal hard fork on March 20. This is one of the three upgrades scheduled for the year’s first half. It is set to introduce newer features, including more Ethereum compatibility, native smart contract wallets, and more security.

The other two upgrades will improve BNB Chain’s speed and security. This is happening as the BSC Chain becomes one of the best alternatives to Ethereum (ETH) and Solana (SOL). Ethereum has higher fees and is slow, while the Solana network is highly associated with meme coins.

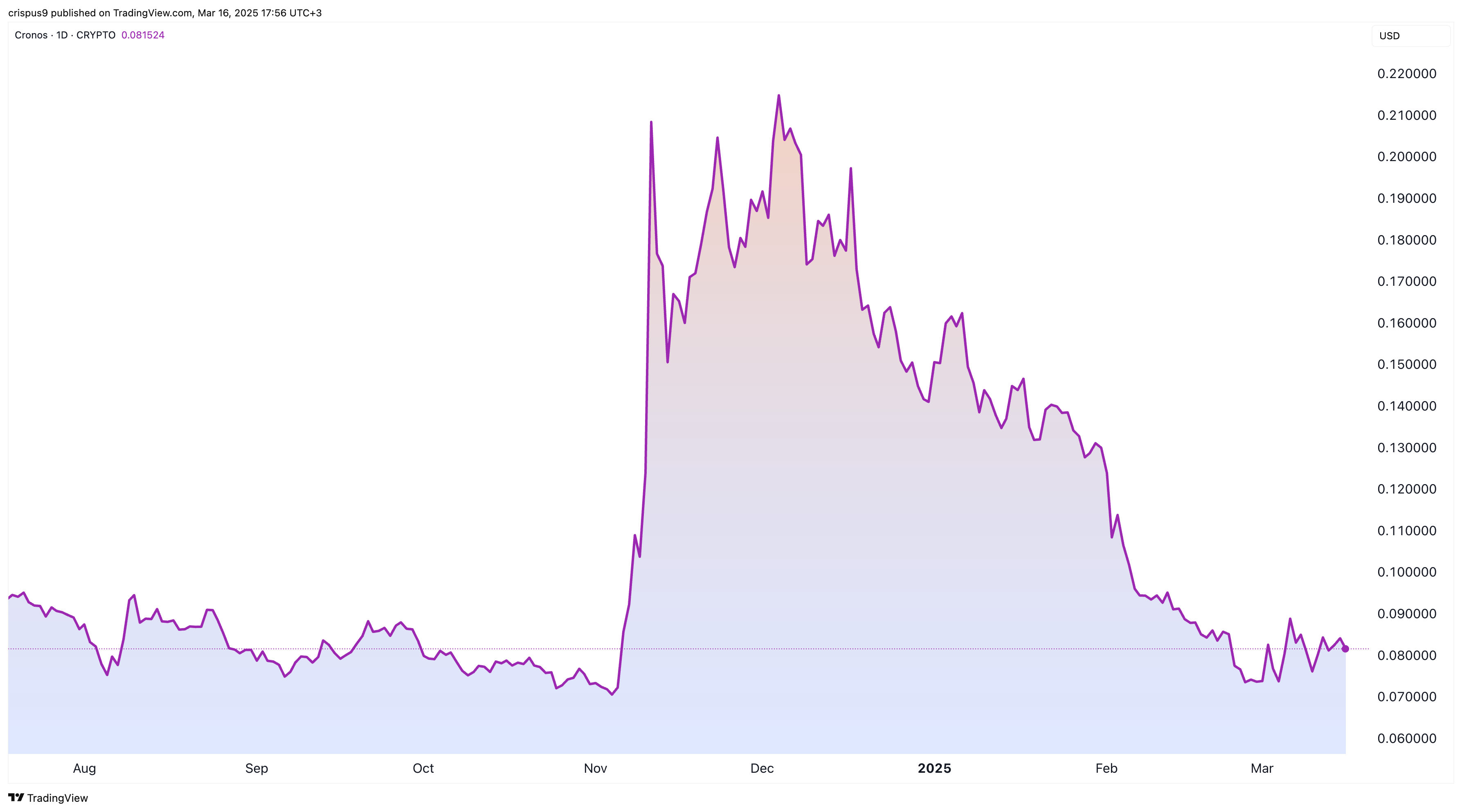

Cronos

A key Cronos vote will conclude on March 17. This crucial vote seeks to determine the creation of the Cronos Strategic Reserve. It aims to do that by undoing a 70 billion token burn that happened in 2021.

If the vote passes, Cronos will create 70 billion tokens and use them to create a reserve that will be used to support the ecosystem. Critics argue that creating these new tokens will dilute existing investors by adding to the supply.

Voting data shows that 45.8% of users have voted in support of the proposal, while 44.4% have rejected it. 9.27% have abstained. If the vote ends like this, the proposal will be rejected as the turnout is less than the quorum.

ZetaChain

ZetaChain is another top cryptocurrency to watch after its price crashed to a record low of $0.2070. It has dropped by over 92% from its all-time high, bringing its market cap to $151 million.

One reason for the ZETA price crash is that the total value locked in its ecosystem has crashed to $13 million from its all-time high of near $20 million.

The other reason is that Zetachain is highly dilutive as it has a circulating supply of 731 million against a total supply of 2.1 billion.

The network will unlock tokens worth over $6.6 million, representing 4.29% of the float this week. Cryptocurrencies are often highly volatile when there is a major unlock.

Source link

Bitcoin ETF

Gold ETFs Inflow Takes Over BTC ETFs Amid Historic Rally

Published

14 hours agoon

March 16, 2025By

admin

Gold exchange-traded funds (ETFs) have overtaken bitcoin ETFs in assets under management as investors shift toward the traditional safe-haven asset as BTC price tumbled more than 19% over the past three months, while the precious metal climbed 12.5%.

Bitcoin ETFs, which saw significant inflows following their U.S. launch in January last year, have experienced major outflows, losing about $3.8 billion since Feb. 24 of this year, according to Farside Investors data. Meanwhile, gold ETFs recorded their highest monthly inflows since March 2022 last month, according to the World Gold Council.

These flows have meant that gold ETFs have now “reclaimed the asset crown over bitcoin ETFs,” as Bloomberg Senior ETF analyst Eric Balchunas said on social media.

The Empire Strikes Back: Gold ETFs have reclaimed the asset crown over bitcoin ETFs thanks to 12% gain this year. https://t.co/ls67z5sIs5

— Eric Balchunas (@EricBalchunas) March 14, 2025

Spot bitcoin ETFs listed in the U.S. first surpassed gold ETFs in assets under management in December 2024 as the cryptocurrency market surged after Donald Trump’s victory in the U.S. presidential elections.

Meanwhile, gold has been seeing a significant run. This Friday, it exceeded the $3,000 per ounce mark for the first time ever, with gold futures for April delivery breaking through the same level earlier in the week.

Market volatility and geopolitical uncertainty have been helping the price of the precious metal rise as demand for a safe haven continues to grow.

Read more: Gold’s Historic Rally Leaves Bitcoin Behind, But the Trend May Reverse

Source link

Traders eye $2.80 Rally As Ripple Files New Trademark

Analyst Says Crypto Whales Loading Up on Ethereum, Accumulating $815,514,345 in ETH in Just Five Days

Bitcoin landfill man loses appeal, says he has one ‘last legal option’

Filmmakers Bet on Web3 to Fix Hollywood Film Financing

Mr. Wonderful says the crypto cowboy era is over. Really?

TON Token Surges 20% as Telegram Founder Recovers Passport From French Authorities

Can Bitcoin Reach $100K After the Upcoming US Fed Decision?

XRP Must Close Above This Level For Bullish Breakout: Analyst

Bitcoin reclaims $80K zone as BNB, TON, GT, ATOM hint at altcoin season

Stock Market To Witness Rallies in Next One to Two Weeks, Predicts Wall Street’s Cantor Fitzgerald – Here’s Why

Cryptocurrencies to watch this week: Binance Coin, Cronos, ZetaChain

What is Milady? The Edgy Ethereum NFT Community With Vitalik Buterin’s Support

Can Pi Network Price Triple if Binance Listing is Approved Before March 2025 Ends?

Gold ETFs Inflow Takes Over BTC ETFs Amid Historic Rally

Toncoin in ‘great entry zone’ as Pavel Durov’s France exit fuels TON price rally

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Crypto’s Big Trump Gamble Is Risky

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

Trump’s Coin Is About As Revolutionary As OneCoin

Is $200,000 a Realistic Bitcoin Price Target for This Cycle?

Ripple Vs. SEC, Shiba Inu, US Elections Steal Spotlight

Trending

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin2 months ago

Bitcoin2 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News2 months ago

24/7 Cryptocurrency News2 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin4 months ago

Bitcoin4 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Altcoins2 months ago

Altcoins2 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin4 months ago

Bitcoin4 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Opinion4 months ago

Opinion4 months agoCrypto’s Big Trump Gamble Is Risky

Price analysis4 months ago

Price analysis4 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x