Breez

More Nodeless Non-custodial Bitcoin Lightning Wallets, Por Favor

Published

5 months agoon

By

admin

On Tuesday, Breez announced its latest partner, Yopaki, a Mexican neobank. Yopaki has integrated with Breez’s free and open-source SDK, which enables its users to have a non-custodial Lightning wallet without having to run their own Lightning node. (More on how this works here.)

Before continuing, I have to say that I get a little bit jealous whenever Breez makes such announcements, because they make me wish that Breez could partner with neobanks or Bitcoin apps accessible to residents in New York State, like myself.

The thing is though, we can’t have nice Lightning things here in the Empire State because regulation in New York — a state that seems to almost pride itself on its soul-crushing levels of red tape and bureaucracy — prohibits companies from offering Lightning services.

But anyway, where was I?

Welcoming Yopaki to (Nodeless) Lightning

We're thrilled to announce @yopaki_ as our latest SDK partner. The bitcoin neobank is reimagining banking while sharing

culture with the world.

Powered by Breez SDK – Nodeless (@Liquid_BTC)

— Breez

(@Breez_Tech) November 12, 2024

In the Bitcoin space, we frequently hear about the challenges Bitcoin faces in scaling and how Lightning isn’t a sufficient solution. Oddly enough, though, we never hear this complaint from Roy Sheinfeld, co-founder and CEO of Breez, because he’s too busy building things that prove the Lightning naysayers wrong.

Sheinfeld and the team at Breez, who are on a mission to bring Lightning to every app, have been on a hot streak when it comes to helping Lightning users around the world gain access to non-custodial Lightning services. Earlier this year, they announced partnerships with Volt in Nigeria and Diamond Hands in Japan.

We're excited to announce the beta release of Diamond Wallet, a self-custodial Lightning wallet that enables users to earn sats by viewing ads.

It's also the first self-custodial wallet from Japan, built using the Breez SDK and its Greenlight implementation.

Demo video↓ pic.twitter.com/kpsgfh3RGZ

— Diamond Hands

(@DiamondHandsLN) October 1, 2024

Sometimes, when I’m alone, I look up at the sky and say to myself, “Why, God, why do Nigerians, the Japanese and Mexicans get access to such sweet monetary tech while my once great state — home to a city that refers to itself as the ‘financial capital of the world,’ but ironically doesn’t allow its residents to use cutting edge Lightning services — fades into obscurity?”

While I never get an answer, I do take comfort in the fact that the likes of Sheinfeld and the team at Breez are out there ensuring that nodeless non-custodial Lightning wallets are proliferating, enabling people to more easily use bitcoin as it was intended to be used — peer-to-peer.

I look forward to seeing Breez partner with even more apps and neobanks in 2025.

This article is a Take. Opinions expressed are entirely the author’s and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Source link

You may like

Stripe Tests New Stablecoin Project as $3.7T Market Looms

Falling Wedge Pattern Confirms $264 target

Ethereum community members propose new fee structure for the app layer

Crypto Investors Sue Nike, Accuse Apparel Giant of Rug Pull After Abrupt Closure of Metaverse Business: Report

Top cryptocurrencies to watch: Pi Network, XRP, Sui

This Week in Crypto Games: Ubisoft’s ‘Might & Magic’, ‘Peaky Blinders’ in Development

Breez

Breez Announces Launch Of New Wallet, Misty Breez

Published

4 weeks agoon

April 2, 2025By

admin

Today, Breez launches Misty Breez, their latest application built using the Breez SDK. The Breez SDK was initially developed to simplify the process of integrating Lightning Network support into different consumer applications. Dozens of existing projects and companies currently build on Lightning using the SDK.

The SDK supports two methods of Lightning integration. Native, which allows app developers to integrate a Lightning wallet or functionality utilizing the Greenlight service offered by Blockstream, which allows the wallet provider to host a cloud based Lightning node for users while keeping private keys solely in the users control, and Nodeless, which allows Liquid support to seamlessly integrate with the Lightning Network. Both models supported in the SDK give full support to the range of features available on the Lightning Network, as well as Liquid, without the complexity of having to build support from scratch.

Misty Breez is built on the Nodeless SDK tooling. This means that users’ coins are self-custodied on the Liquid sidechain, giving users the ability to fully control their own funds but also requiring the trust trade-offs involved in using the Liquid Network (i.e. that the majority Federation signers will remain honest and trustworthy).

The wallet supports BOLT 11 and BOLT 12 invoices, LNURL-Pay, Lightning Addresses, on-chain BTC addresses, and even Matt Corrallo’s BIP 353 using DNS to fetch payment details for another user’s wallet. It also supports offline payments based on mobile notifications in the phone’s operating system.

Breez SDK’s goal is to provide developers with the tooling to build a seamless and use-case specific user experience with as little effort as possible. In that vein Misty Breez aims to set a benchmark for a simplified user experience that other developers can use as a reference for Lightning integration into their own applications, or even to build on top of Misty Breez itself. If you want, feel free to simply integrate the functionality you seek to build into Misty Breez itself and rebrand it however you want (it is 100% opensource).

Documentation for the Breez SDK Nodeless configuration used by Misty Breez is available here. The Github for the Misty Breez implementation is available here. Lastly, for users who wish to play around with the application, early access release is available here for Android, and here for iOS.

All the tooling for developers to build a new UX experience for users is here today.

Source link

1a1z

Bitcoin Payments Aren't The Future, They're Here Already

Published

3 months agoon

February 6, 2025By

admin

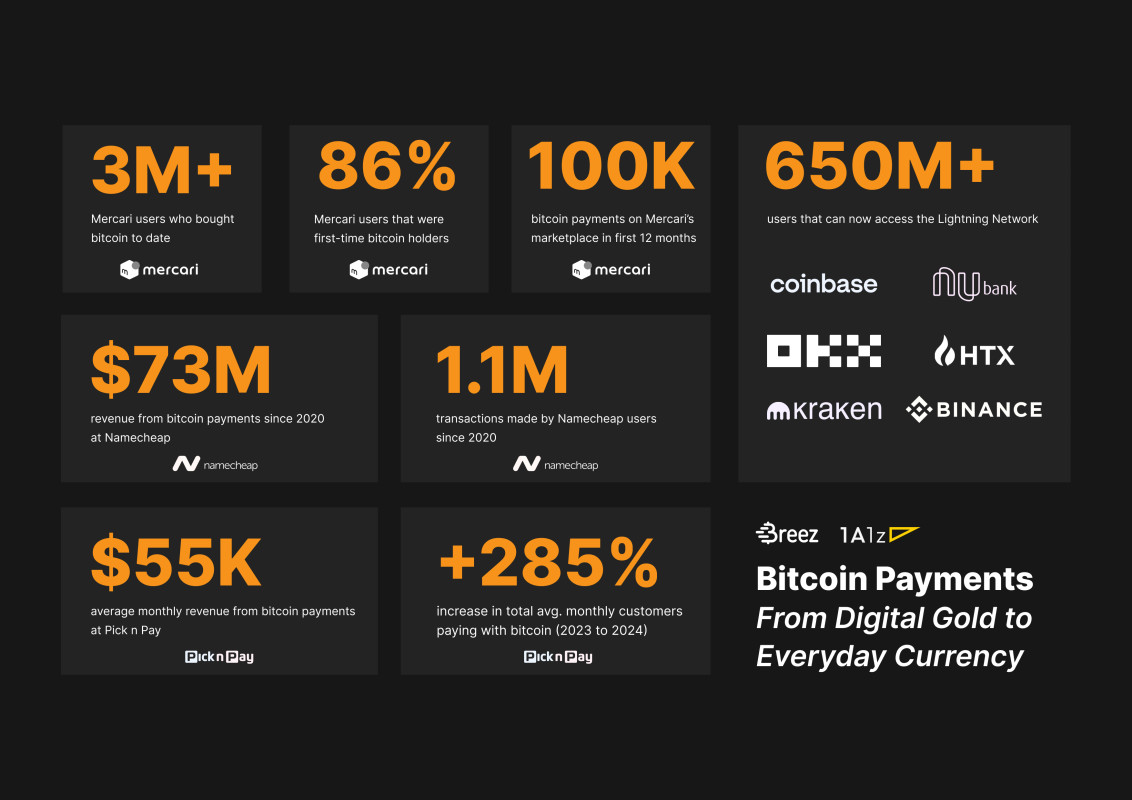

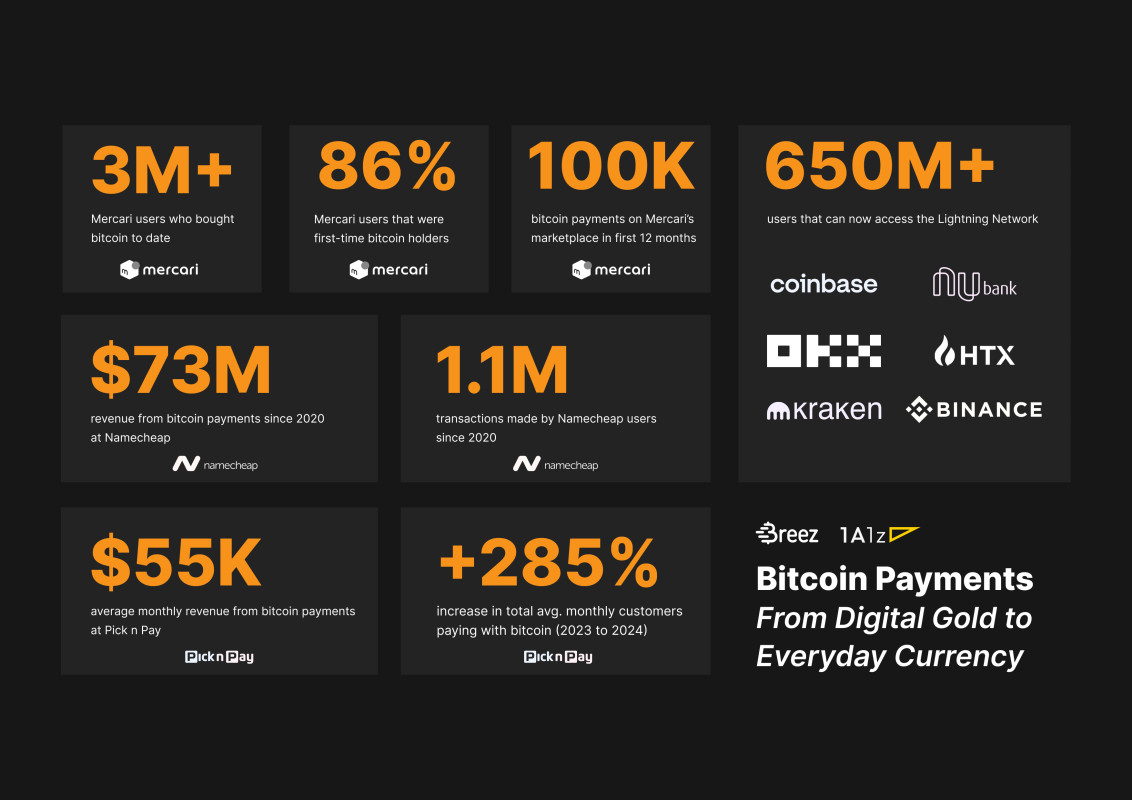

Breez, in partnership with 1A1z, has released a new report investigating the use of Bitcoin as a payments system and transactional currency. Bitcoin has always been painted as digital gold, that is one of the longest running narratives at this point in terms of what Bitcoin actually is. It does capture the use as a long-term investment or speculative asset, and has been a very helpful aid in getting people over the first hump of basic understanding, but it is by no means a comprehensive explanation of what Bitcoin is.

The report dives into multiple factors of Bitcoin’s use as a payment mechanism. It dissects different use cases, regulatory treatments received in different jurisdictions, services and platforms with existing integration of Lightning payments, etc.

Case studies are included looking at specific businesses and the volume of transactions or userbase they have provided access to Bitcoin for. Mercari, a major Japanese marketplace similar to Amazon, accepts bitcoin. Mullvad VPN, Namecheap, and Protonmail are all instances of digital businesses benefiting from bitcoin payments.

While the Bitcoin digital gold narrative is running strong, Bitcoin’s use as a payment mechanism is growing quietly in the background. Storing value may be a necessary component of Bitcoin’s use in commerce, but the ultimate purpose it was created for was to transact with.

Read the report here for more details on how Bitcoin’s transactional use is going through a quiet renaissance.

Source link

Bitcoin education

Neobank Yopaki Aims To Make Every Mexican A Bitcoiner

Published

4 months agoon

December 31, 2024By

admin

Company Name: Yopaki

Founders: Francisco Chavarria (CEO) and Carlos Chida (CTO)

Date Founded: March 2023

Location of Headquarters: Austin, TX

Number of Employees: Four full time; one part time

Website: https://www.yopaki.com/

Public or Private? Private

In 2021, Francisco Chavarria stood in the audience at Bitcoin 2021 and watched as Strike CEO Jack Mallers passionately delivered his now famous keynote speech during which he revealed that El Salvador planned to make bitcoin legal tender.

That moment sparked something within Chavarria.

“It was unlike anything I’d experienced in my professional career,” Chavarria told Bitcoin Magazine.

“I knew I had to do something in the Bitcoin space after that. It was the seed,” he added.

First-forward ahead two years, and Chavarria found himself putting his career as a Software as a Service (SaaS) consultant on hold to draw up the blueprints for Yopaki, a neobank and investment app with a Bitcoin-focus, aimed at serving the people of his home country, Mexico. (Users outside of Mexico can also use Yopaki’s non-custodial Lighting wallet.)

Since then, he and his co-founder, Carlos Chida, have been hard at work bringing Yopaki to life, including taking part in Wolf’s Bitcoin Accelerator program in efforts to make Yopaki as cutting-edge and dynamic as possible.

But before getting to that part of the story, let’s start with the cultural origin of the platform’s name.

What’s In A Name?

“The name Yopaki comes from the ancient language Nahuatl, the language spoken by the Aztecs,” explained Chavarria.

“The Aztecs lived in the center region of what today is Mexico, and they’re the ones responsible for some of the biggest pyramids in all of Latin America. The center of this historical place is called Teotihuacán, ‘the place of the gods,’” he added.

“The name itself, if I were to translate it into English, most closely means “the pursuit of happiness.’”

Judging by the name alone, it’s clear that Chavarria views Yopaki as more than just another business endeavor — he wants it to have a profound impact on those who use it.

And he’ll need the app to have such an impact if he and his team are to succeed in their mission: to turn every Mexican into a Bitcoiner.

2025 Dream Predictions for Bitcoin in Mexico

1. Bitcoin adoption in Mexico surges.

2. Mexican Bitcoin startups attract global investors. With El Salvador’s influence, Mexico becomes the Latin American leader for Bitcoin innovation.

3. Peso-Bitcoin integration deepens.…

— Francisco Chavarria (@FranciscoBTC) December 31, 2024

Bitcoin In The Mexican Context

When Bitcoin is brought up in the context of Latin America and other developing regions, it’s often referenced as a tool to “bank the unbanked.”

However, Mexico’s banking system is “quite advanced,” according to Chavarria.

“The infrastructure has been built for people to have access to banking,” he explained.

“It may not be the same banking that we have in the U.S. (where Chavarria currently resides), but, for example, in Mexico, there are stores like 7/11s called OXXOs, and they’re everywhere. Any person can walk into an OXXO with an ID, and within 20 minutes, they can walk out with a Visa card and an app,” he added.

“It’s not exactly a bank, but it provides access to payment rails,” he added.

Chavarria went on to share that these Visa cards charge high fees, though.

“They’re very predatory in that sense,” he said.

So, Yopaki provides its Mexican users with access to three different monetary accounts: a Mexican peso account, a U.S. dollar account and a (non-custodial) bitcoin Lightning wallet. Each of these accounts lets their users transact at lower rates than said Visa cards. (In 2025, Yopaki will also enable its Mexican users to buy stocks, ETFs and other securities, as well.)

By offering a bitcoin wallet alongside accounts for traditional currencies, Chavarria hopes to legitimize bitcoin in the eyes of its users. However, he also feels that Yopaki has some work to do as far as helping Mexicans to get comfortable using bitcoin, which is why he and his team are doing what they can to make the process enjoyable.

Making Bitcoin Fun With Lotería

Lotería is a favorite pastime of the Mexican people. It’s comparable to Bingo but with images instead of numbers.

Chavarria and the Yopaki team included it into the app with a Bitcoin slant — concepts and characters like the Lightning Network and Max Keiser appear in the Yopaki version of the game.

“When it comes to Mexico, people think tequila, tacos, mariachi, and Lotería,” said Chavarria.

“There’s no negative connotation to the game. Because of this, the feedback we’ve received over the last couple of months has been, ‘Man, I didn’t realize that Bitcoin was fun,’” he added.

Users earn sats as they play Lotería within the app. When they’ve earned 1,000 sats or more, they can learn through the app how to transfer those sats from Yopaki’s custody into their own, all within the Yopaki app.

Yopaki teamed up with Breez to bring its users a non-custodial Lightning wallet that doesn’t require its users to to deal with the hassle of Lightning channel management.

Yopaki + Breez

“One of the main reasons we decided to go with Breez is that we knew about their implementation of the Nodeless SDK through Liquid before it was public,” said Chavarria.

“We know channel management is a fundamental roadblock for a lot of people in using an application like this. The second you introduce roadblocks the experience becomes scary. It’s just too much,” he added.

“So, in offering a product in which users can do an immediate transaction, that magic that we’ve all had as Bitcoiners can be brought to the masses.”

Chavarria went on to share that Yopaki’s Lightning wallet is so easy to use that even his mother-in-law is now using (and enjoying) the product.

He’s excited to bring such a product to the Mexican market, because, as he put it, Mexicans “have been rugged” by custodial solutions in the past.

“It’s important that we let users know that we don’t hold their funds,” said Chavarria.

Prioritizing Bitcoin Education

Not only does the Yopaki team encourage and prioritize self-sovereignty, but it also educates its users about Bitcoin, as it doesn’t underestimate their curiosity and ability to learn.

“We have curated content including lessons on broad topics like ‘What is money?’ — not just Bitcoin, but money,” explained Chavarria.

“They’re micro lessons that take anywhere from one to two minutes to complete. At the end of the day, it’s about creating a curiosity that I feel and I think a lot of us feel the legacy system has not really cared about,” he added.

The educational component within the app also sets it apart from its competitors in the region.

“Bitso is the largest player not just in Mexico but all of Latin America, and we have a lot of respect for what they’ve done, but they have turned into a casino with tokens and NFTs and all of that,” shared Chavarria. “We believe they have really underestimated the curiosity of their users and just triggered the degenerate gambling addiction side of things instead.”

Guidance From Wolf

Given how cool, calm and collected Chavarria was when I spoke with him, I got the impression that the now fleshed out vision for Yopaki came to him with relative ease, maybe even in a flash of light.

But he told me otherwise.

Apparently, he and Chida’s experience at Wolf’s Bitcoin startup incubator pushed them out of their comfort zone and into a state of mind that helped them to make Yopaki as unique as it is.

“It was one of the most important and meaningful experiences we could have gone through,” said Chavarria of his time at Wolf. “The type of feedback we received and the type of strategy sessions we had were, to say it nicely, brutal in a good way.”

Chavarria explained how he and Chida did, in fact, enter the Wolf program thinking they’d already crafted a solid vision for Yopaki, but that the guidance they received in the program is what pushed them to create many of the features that differentiate the apps for others like it.

“Having people like Kelly Brewster (Wolf’s CEO), who has years of experience at Goldman Sachs, and Ross Stevens (Wolf’s founder) really sit down and ask the tough questions and push you to the limit was powerful,” said Chavarria. “They made us really consider ‘Do you understand that what you’re doing is difficult?’ and made us articulate how we were going to execute our plan.”

The Year Ahead

As mentioned, Yopaki will enable its Mexican users to begin investing in traditional assets in the coming year and, starting next month, it will offer users a bitcoin exchange, as well.

What is more, it will issue its users debit cards that they can use to spend their pesos, dollars or bitcoin. And Chavarria says it plans to offer sats back rewards when users purchase either traditional assets or bitcoin via the app.

With so much coming down the pike, Chavarria is in good spirits.

“I’m just grateful that we’re doing this,” he said.

“It’s been really fun to build in the bear — now the good times are coming.”

Source link

Stripe Tests New Stablecoin Project as $3.7T Market Looms

Falling Wedge Pattern Confirms $264 target

Dogecoin Confirms Daily Trend Reversal With Breakout, Retest, And New Uptrend

Ethereum community members propose new fee structure for the app layer

Crypto Investors Sue Nike, Accuse Apparel Giant of Rug Pull After Abrupt Closure of Metaverse Business: Report

Top cryptocurrencies to watch: Pi Network, XRP, Sui

This Week in Crypto Games: Ubisoft’s ‘Might & Magic’, ‘Peaky Blinders’ in Development

Why Arbitrum-Nvidia Partnership Collapsed – And What It Means for Web3

Tariff Carnage Starting to Fulfill BTC’s ‘Store of Value’ Promise

The cost of innovation — Regulations are Web3’s greatest asset

Best Crypto to Buy as Derivatives Exchange CME Set to Launch XRP Futures

Metaplanet Buys Additional ¥1.92 Billion Worth Of Bitcoin

Here Are Four Signs the Stock Market Has Bottomed, According to Fundstrat’s Tom Lee

Bitcoin dips below $94,000 as ETFs record $3b weekly inflow

Bitcoin Post-Halving Price Performance Is the Worst on Record. Why?

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Crypto’s Big Trump Gamble Is Risky

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

I’m Grateful for Trump’s Embrace of Bitcoin

Trending

24/7 Cryptocurrency News6 months ago

24/7 Cryptocurrency News6 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin3 months ago

Bitcoin3 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Ripple Price1 month ago

Ripple Price1 month ago3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin6 months ago

Bitcoin6 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Opinion6 months ago

Opinion6 months agoCrypto’s Big Trump Gamble Is Risky

Bitcoin5 months ago

Bitcoin5 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Altcoins3 months ago

Altcoins3 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje