Bitcoin ETF

Nasdaq Files for In-Kind Redemptions for BlackRock Spot BTC ETF (IBIT): SEC Filing

Published

2 months agoon

By

admin

Nasdaq has filed a proposed rule change to allow in-kind creation and redemption for the BlackRock iShares Bitcoin Trust (IBIT), according to a Friday filing to the U.S. Securities and Exchange Commission (SEC).

The process allows large institutional investors, called authorized participants (APs), to buy and redeem shares of the fund directly to bitcoin (BTC).

It is considered to be more efficient as it allows APs closely monitor the demand for the ETF and to act fast by buying or selling shares of the fund without cash being involved in the process. Retail investors are not eligible to participate.

When the SEC first approved spot bitcoin ETFs including IBIT last January, the agency allowed to launch the funds with cash redemption, instead of bitcoin.

“It should have been approved in the first place but Gensler/Crenshaw didn’t want to allow it for a whole host of reasons they gave,” Bloomberg Intelligence ETF analyst James Seyffart wrote on X. “Mainly [they] didn’t want brokers touching actual Bitcoin.”

BlackRock’s IBIT is the largest spot BTC ETF on the market, attracting nearly $40 billion of inflows in its first year, making it the most successful ETF debut ever.

Source link

You may like

Analyst Says Crypto Whales Loading Up on Ethereum, Accumulating $815,514,345 in ETH in Just Five Days

Bitcoin landfill man loses appeal, says he has one ‘last legal option’

Filmmakers Bet on Web3 to Fix Hollywood Film Financing

Mr. Wonderful says the crypto cowboy era is over. Really?

TON Token Surges 20% as Telegram Founder Recovers Passport From French Authorities

Can Bitcoin Reach $100K After the Upcoming US Fed Decision?

Bitcoin ETF

Gold ETFs Inflow Takes Over BTC ETFs Amid Historic Rally

Published

13 hours agoon

March 16, 2025By

admin

Gold exchange-traded funds (ETFs) have overtaken bitcoin ETFs in assets under management as investors shift toward the traditional safe-haven asset as BTC price tumbled more than 19% over the past three months, while the precious metal climbed 12.5%.

Bitcoin ETFs, which saw significant inflows following their U.S. launch in January last year, have experienced major outflows, losing about $3.8 billion since Feb. 24 of this year, according to Farside Investors data. Meanwhile, gold ETFs recorded their highest monthly inflows since March 2022 last month, according to the World Gold Council.

These flows have meant that gold ETFs have now “reclaimed the asset crown over bitcoin ETFs,” as Bloomberg Senior ETF analyst Eric Balchunas said on social media.

The Empire Strikes Back: Gold ETFs have reclaimed the asset crown over bitcoin ETFs thanks to 12% gain this year. https://t.co/ls67z5sIs5

— Eric Balchunas (@EricBalchunas) March 14, 2025

Spot bitcoin ETFs listed in the U.S. first surpassed gold ETFs in assets under management in December 2024 as the cryptocurrency market surged after Donald Trump’s victory in the U.S. presidential elections.

Meanwhile, gold has been seeing a significant run. This Friday, it exceeded the $3,000 per ounce mark for the first time ever, with gold futures for April delivery breaking through the same level earlier in the week.

Market volatility and geopolitical uncertainty have been helping the price of the precious metal rise as demand for a safe haven continues to grow.

Read more: Gold’s Historic Rally Leaves Bitcoin Behind, But the Trend May Reverse

Source link

People tend to celebrate periods of low feerates. It’s time to clean house, consolidate any UTXOs you need to, open or close any Lightning channels you’ve been waiting on, and inscribe some stupid 8-bit jpeg into the blockchain. They’re perceived as a positive time.

They are not. We have seen explosive price appreciation the last few months, finally hitting the 100k USD benchmark that everyone took for granted as preordained during the last market cycle. That’s not normal.

The picture on the left is the average feerate each day since 2017, the picture on the right is the average price each day since 2017. When the price was pumping, when it was highly volatile, historically we have seen feerates spike accordingly. Generally matching the growth and peaking when the price did. The people actually buying and selling transacted on-chain, people took custody of their own coins when they bought them.

This last leg up to over 100k does not seem at all to have had the same proportional affect on feerates that even moves earlier in this cycle have. Now, if you actually did look at both of those charts, I’m sure many people are going “What if this cycle is at the end?” It’s possible, but let’s say it’s not for a second.

What else could this be indicating? That the participants that are driving the market are changing. A group of people who used to be dominated by individuals who self custodied, who managed their counterparty risk by removing gains from exchanges, who generated time-sensitive on-chain activity, are transforming into a group of people simply passing around ETF shares that have no need of settling anything on-chain.

That is not a good thing. Bitcoin’s very nature is defined by the users who interact with the protocol directly. Those who have private keys to authorize transactions generating revenue for miners. Those who are sent funds, and verify transactions against consensus rules with software.

Both of those things being removed from the hands of users and placed behind the veil of custodians puts the very stability of Bitcoin’s nature at risk.

This is a serious existential issue that has to be solved. The entire stability of consensus around a specific set of rules is premised on the assumption that there are enough independent actors with separate interests that diverge, but align on a value gained from using that set of rules. The smaller the group of independent actors (and the larger the group of people “using” Bitcoin through those actors as intermediaries) the more practical it is for them to coordinate to fundamentally change them, and the more likely it is that their interests as a group will diverge in sync from the interests of the larger group of secondary users.

If things continue trending in that direction, Bitcoin very well could end up embodying nothing that those of us here today hope it can. This problem is both a technical one, in terms of scaling Bitcoin in a way that allows users to independently have control of their funds on-chain, even if only through worst-case recourse, but it is also a problem of incentive and risk management.

The system must not only scale, but it has to be able to provide ways to mitigate the risks of self custody to the degree that people are used to from the traditional financial world. Many of them actually need it.

This isn’t just a situation of “do the same thing I do because it’s the only correct way,” this is something that has implications for the foundational properties of Bitcoin itself in the long term.

This article is a Take. Opinions expressed are entirely the author’s and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Source link

Bitcoin

U.S. Bitcoin ETFs Post Year’s 2nd-Biggest Outflows, More May Be on the Way

Published

3 weeks agoon

February 25, 2025By

admin

U.S. spot-listed bitcoin (BTC) exchange-traded funds (ETFs) experienced the second-biggest outflows of the year on Monday, dropping $516.4 million, Farside data shows.

The withdrawals, the ninth net outflow in 10 days, reflect a growing discomfort with the largest cryptocurrency, which has traded in a narrow price range between $94,000 and $100,000 for most of this month.

On Tuesday, bitcoin broke out of its three-month channel, falling below $90,000 and sliding to as low as $88,250.

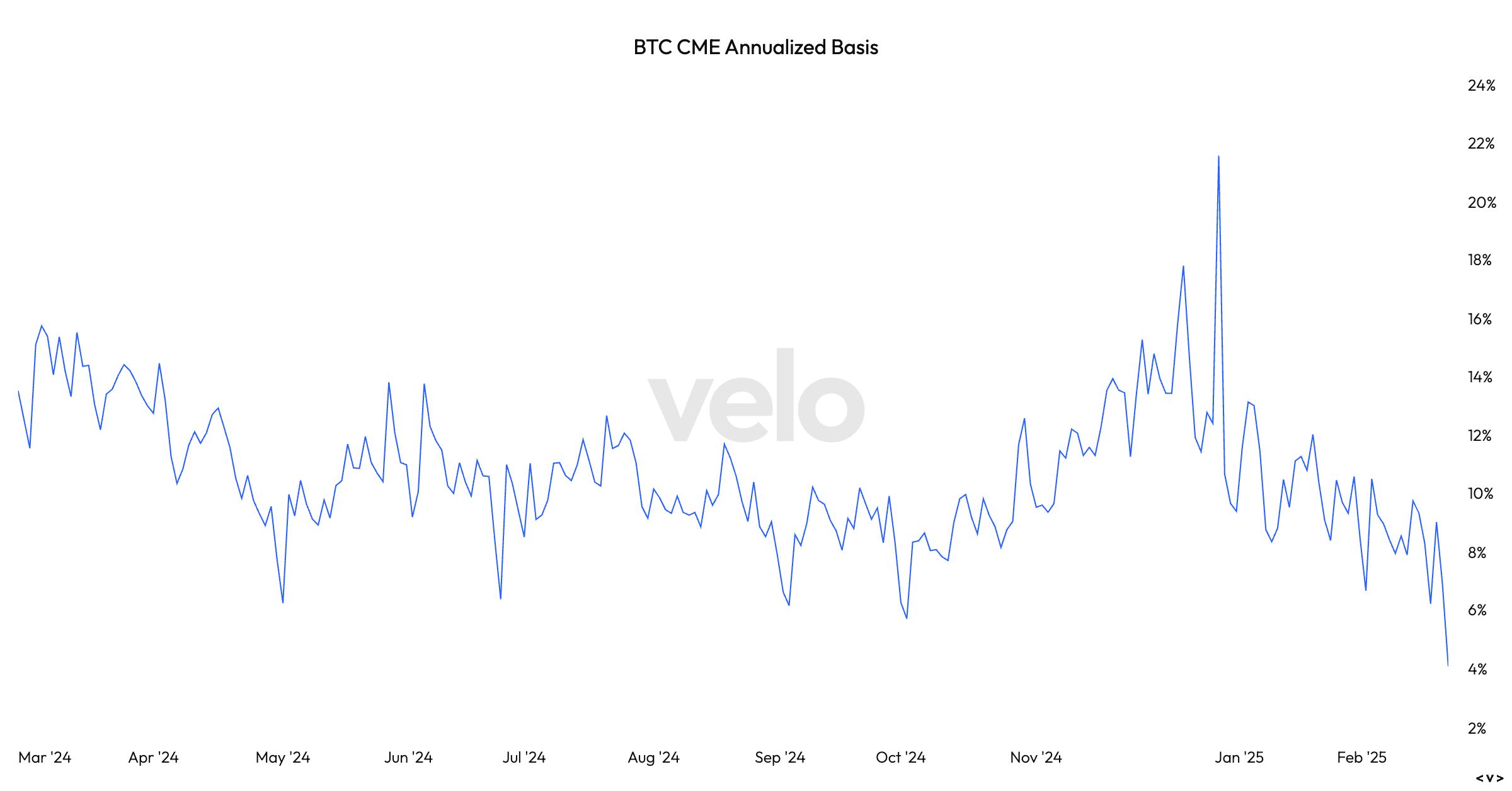

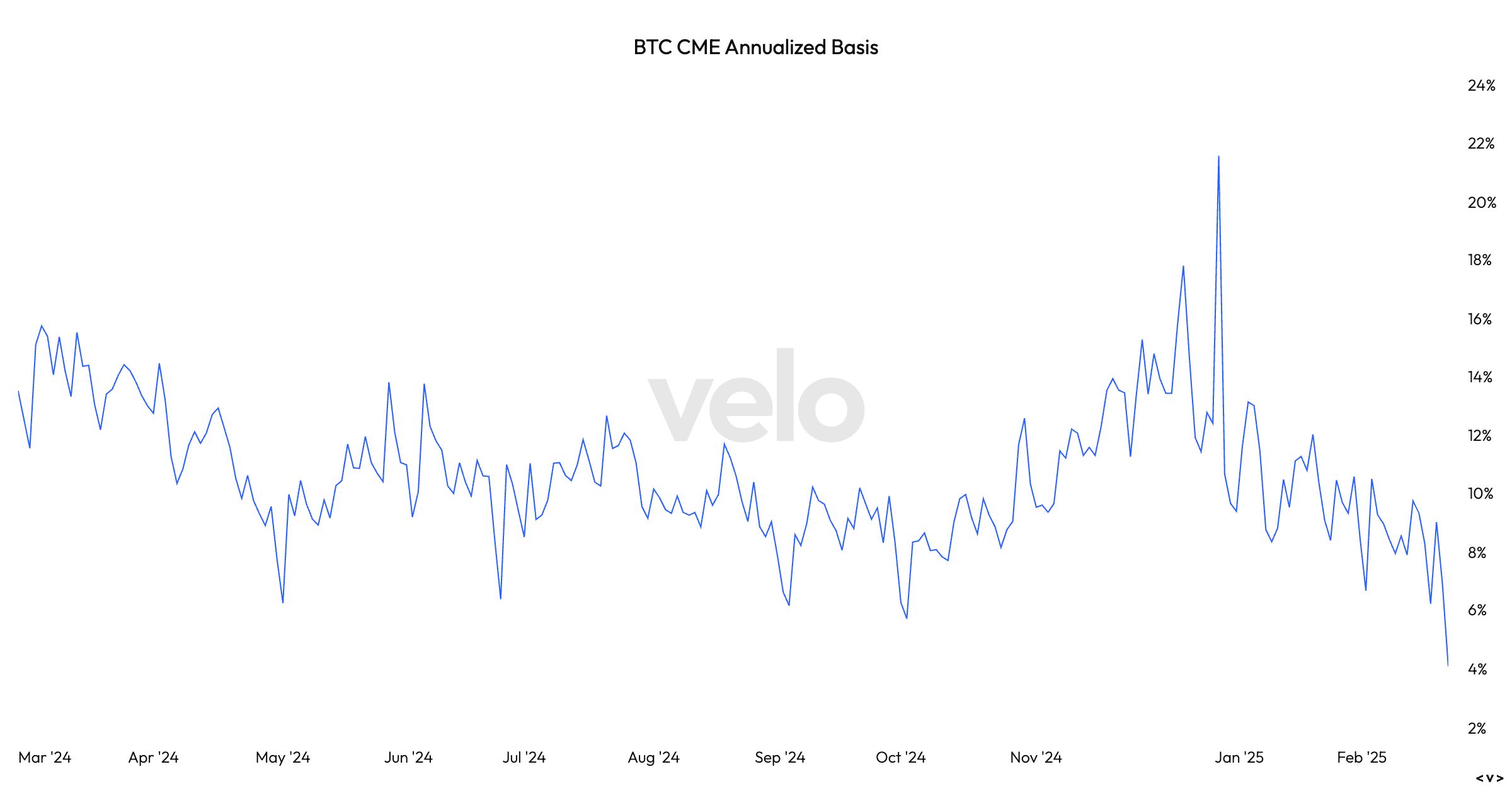

According to Velo data, the bitcoin CME annualized basis — the difference between the spot price and futures — has dropped to 4%. This is the lowest since the ETFs started trading in January 2024. This is also known as the cash-and-carry trade, which is a market-neutral strategy that seeks to profit from the mispricing between the two markets.

The strategy involves taking a long position in the spot market and a short position in the futures market. Velo data shows a one-month futures forward contract. Investors collect a premium between the spread of the spot and futures pricing until the futures contract expiry date closes.

At the current level, the basis trade is less than the so-called risk-free rate, the yield on the U.S. 10-year Treasury of 5%. The difference may persuade investors to close their positions in favor of the greater return. That could see further outflows from the ETFs. Because this is a neutral strategy, investors will also have to close their short position in the futures market.

Arthur Hayes, the co-founder of Bitmex, alludes to the basis trade unravelling in a post on X.

“Lots of IBIT holders are hedge funds that went long ETF short CME future to earn a yield greater than where they fund, short term US treasuries,” he wrote. “If that basis drops as bitcoin falls, then these funds will sell IBIT and buy back CME futures. These funds are in profit, and given basis is close to UST yields they will unwind during US hours and realise their profit. $70,000 I see you mofo!”

Source link

Analyst Says Crypto Whales Loading Up on Ethereum, Accumulating $815,514,345 in ETH in Just Five Days

Bitcoin landfill man loses appeal, says he has one ‘last legal option’

Filmmakers Bet on Web3 to Fix Hollywood Film Financing

Mr. Wonderful says the crypto cowboy era is over. Really?

TON Token Surges 20% as Telegram Founder Recovers Passport From French Authorities

Can Bitcoin Reach $100K After the Upcoming US Fed Decision?

XRP Must Close Above This Level For Bullish Breakout: Analyst

Bitcoin reclaims $80K zone as BNB, TON, GT, ATOM hint at altcoin season

Stock Market To Witness Rallies in Next One to Two Weeks, Predicts Wall Street’s Cantor Fitzgerald – Here’s Why

Cryptocurrencies to watch this week: Binance Coin, Cronos, ZetaChain

What is Milady? The Edgy Ethereum NFT Community With Vitalik Buterin’s Support

Can Pi Network Price Triple if Binance Listing is Approved Before March 2025 Ends?

Gold ETFs Inflow Takes Over BTC ETFs Amid Historic Rally

Toncoin in ‘great entry zone’ as Pavel Durov’s France exit fuels TON price rally

XRP $15 Breakout? Not A Far-Fetched Idea—Analysis

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Crypto’s Big Trump Gamble Is Risky

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

Trump’s Coin Is About As Revolutionary As OneCoin

Is $200,000 a Realistic Bitcoin Price Target for This Cycle?

Ripple Vs. SEC, Shiba Inu, US Elections Steal Spotlight

Trending

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin2 months ago

Bitcoin2 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News2 months ago

24/7 Cryptocurrency News2 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin4 months ago

Bitcoin4 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Altcoins2 months ago

Altcoins2 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin4 months ago

Bitcoin4 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Opinion4 months ago

Opinion4 months agoCrypto’s Big Trump Gamble Is Risky

Price analysis4 months ago

Price analysis4 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x