Nasdaq

Nasdaq files Polkadot ETF on behalf of 21Shares

Published

2 days agoon

By

admin

Nasdaq officially asked the U.S. Securities and Exchange Commission for permission to list a 21Shares Polkadot ETF.

Nasdaq filed formal paperwork with the SEC to allow the trading of a Polkadot (DOT) exchange-traded fund issued by wealth manager 21Shares.

The 19b-4 document filed by Nasdaq, otherwise known as a proposal for rule change, represents the second half of a standard ETF filing with the SEC.

Earlier this year, 21Shares submitted a spot DOT ETF filing and updated its S-1 application on March 7. The S-1 form is called a registration of securities and is typically one of the first steps in bringing a new ETF to market.

Several issues have tested the waters with crypto ETF filings under President Donald Trump’s new pro-digital asset administration. 21Shares also filled for ETFs tracking other altcoins like Solana (SOL) and (XRP). Grayscale bid for a spot DOT product also, while Canary Capital is seeking a SUI ETF which could also be the first of its kind.

Source link

You may like

Trader Issues Urgent XRP Alert, Says the Top-Five Altcoin at Risk of Sharp Correction – Here’s His Target

This coin could see a $10b market cap and double-digit price before SHIB gains its 2021 mojo

Can a Meme Coin Fund the Future of Scientific Research?

Analyst Confirms XRP Price Is Still On Path To $130

Proof-of-Work Crypto Mining Doesn’t Trigger Securities Laws, SEC Says

Crypto campaign donations are democracy at work — former Kraken exec

Bitcoin

Nasdaq Proposes In-Kind Redemptions for BlackRock’s Bitcoin ETF

Published

1 month agoon

February 10, 2025By

admin

Nasdaq has submitted a groundbreaking proposal to the U.S. Securities and Exchange Commission (SEC) that could transform the operational framework of Bitcoin exchange-traded funds (ETFs). The proposal, focused on BlackRock’s iShares Bitcoin Trust (IBIT), seeks to introduce “in-kind” bitcoin redemptions, offering a streamlined and cost-effective alternative to the current cash redemption process.

JUST IN: BlackRock files to allow in-kind creations and redemptions for its spot Bitcoin ETF! pic.twitter.com/SSigX4utRG

— Bitcoin Magazine (@BitcoinMagazine) January 24, 2025

What Are In-Kind Redemptions?

Under the proposed system, institutional players known as authorized participants (APs) – responsible for creating and redeeming ETF shares – could opt to exchange ETF shares directly for bitcoin rather than cash. This innovation eliminates the need to sell bitcoin to generate cash for redemptions, simplifying the process while cutting operational costs.

While this option would only be available to institutional participants and not retail investors, experts suggest that the improved efficiency could indirectly benefit everyday investors. By reducing operational hurdles, in-kind redemptions have the potential to make Bitcoin ETFs more streamlined and cost-efficient for all market participants.

Related: BlackRock CEO Larry Fink Forecasts $700K Bitcoin Price Amid Inflation Worries

Why the Change?

The cash redemption model, implemented in January 2024 when spot Bitcoin ETFs were first approved by the SEC, was designed to keep financial institutions and brokers from handling bitcoin directly. This approach prioritized regulatory simplicity during the nascent stages of Bitcoin ETFs.

However, the rapid growth of the Bitcoin ETF market has created new opportunities to improve its infrastructure. With evolving regulations and a more mature digital asset ecosystem, Nasdaq and BlackRock now see a pathway to adopt a more efficient in-kind redemption model.

Benefits of In-Kind Redemptions

- Operational Efficiency:

- Reduces the complexity and number of steps in the redemption process.

- Streamlines ETF operations, saving both time and costs.

- Tax Advantages:

- Avoiding the sale of bitcoin minimizes capital gains distributions, making ETFs more tax-efficient for institutional investors.

- Market Stability:

- Reduces sell pressure on bitcoin during redemptions, potentially stabilizing the asset’s price.

Regulatory and Market Context

Nasdaq’s proposal coincides with significant regulatory developments under the pro-Bitcoin Trump administration. Recent policy shifts, such as the repeal of Staff Accounting Bulletin 121 (SAB 121), have paved the way for broader cryptocurrency adoption. The removal of SAB 121 eliminated barriers that previously discouraged banks from offering cryptocurrency custody services, creating a more favorable environment for innovations like Nasdaq’s in-kind redemption model.

BlackRock’s Bitcoin ETF: A Market Leader

Since its 2024 launch, BlackRock’s iShares Bitcoin ETF has emerged as a market leader, with over $60 billion in inflows. The fund’s consistent growth highlights institutional demand for Bitcoin investment products. Innovations like Nasdaq’s in-kind redemption model could further enhance IBIT’s appeal to institutional investors.

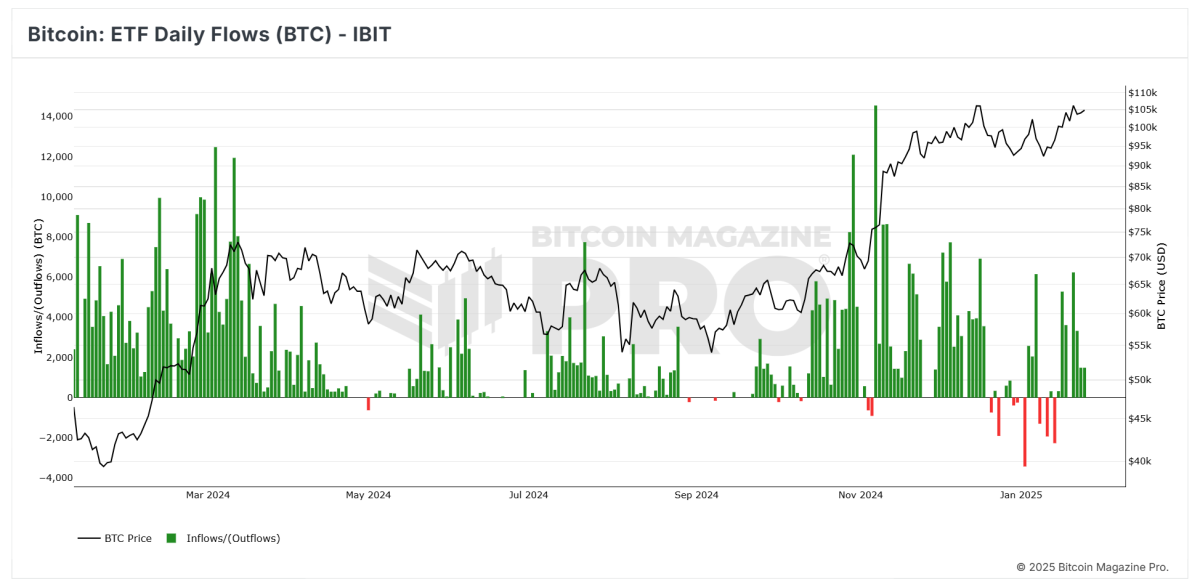

Note the consistent upward trend of green candles, reflecting strong and steady inflows.

Related: What Bitcoin Price History Predicts for February 2025

Conclusion

Nasdaq’s proposal to introduce in-kind redemptions for BlackRock’s Bitcoin ETF represents a pivotal moment for the Bitcoin ETF market. By simplifying redemption processes, offering tax efficiencies, and reducing sell pressure on bitcoin, the model stands to significantly enhance the appeal and performance of Bitcoin ETFs for institutional investors.

As the Bitcoin ETF market matures and regulatory support continues to grow, innovations like this are poised to drive further adoption. If approved, Nasdaq’s proposal could mark a critical step forward, solidifying Bitcoin ETFs as a cornerstone of institutional digital asset investment while indirectly benefiting retail participants.

With a favorable regulatory climate and growing institutional interest, the future of Bitcoin ETFs looks brighter than ever.

Source link

Bitcoin ETF

Nasdaq Files for In-Kind Redemptions for BlackRock Spot BTC ETF (IBIT): SEC Filing

Published

2 months agoon

January 25, 2025By

admin

Nasdaq has filed a proposed rule change to allow in-kind creation and redemption for the BlackRock iShares Bitcoin Trust (IBIT), according to a Friday filing to the U.S. Securities and Exchange Commission (SEC).

The process allows large institutional investors, called authorized participants (APs), to buy and redeem shares of the fund directly to bitcoin (BTC).

It is considered to be more efficient as it allows APs closely monitor the demand for the ETF and to act fast by buying or selling shares of the fund without cash being involved in the process. Retail investors are not eligible to participate.

When the SEC first approved spot bitcoin ETFs including IBIT last January, the agency allowed to launch the funds with cash redemption, instead of bitcoin.

“It should have been approved in the first place but Gensler/Crenshaw didn’t want to allow it for a whole host of reasons they gave,” Bloomberg Intelligence ETF analyst James Seyffart wrote on X. “Mainly [they] didn’t want brokers touching actual Bitcoin.”

BlackRock’s IBIT is the largest spot BTC ETF on the market, attracting nearly $40 billion of inflows in its first year, making it the most successful ETF debut ever.

Source link

Bitcoin

‘Very Dubious’ Speculation Suggests Bitcoin Could Follow Nasdaq ETF Rallies of 1999: Benjamin Cowen

Published

2 months agoon

January 8, 2025By

admin

Benjamin Cowen is saying that the price action of Bitcoin (BTC) could mirror that of the Nasdaq exchange-traded fund (ETF) Invesco QQQ during the first 13 months that followed its launch about 26 years ago.

In a new video, Cowen tells his 855,000 YouTube subscribers that the QQQ ETF hit a local top after going up by 150% in roughly one year following the launch of the ETF.

The QQQ ETF tracks the performance of the 100 largest non-financial firms listed on the Nasdaq stock exchange.

As the flagship digital asset approaches the first anniversary since the launch of the spot Bitcoin ETF, Cowen says the crypto king could replicate similar price action, though it’s unlikely to “play out the exact same way.”

“In 1999 the QQQ ETF launched in March and it rallied from around $48 to $120. And that Rally from $48 to $120 took about 54 weeks – $48 to $120…

…if you look at Bitcoin’s ETF, it launched at around $48,000… if you look at the launch of the spot ETF for Bitcoin it wicked up to $48,000 instead of down to it like it did with the QQQ [ETF]. But interestingly enough, 54 weeks later is January 20th – Inauguration Day [of President-elect Donald Trump], which is interesting because 54 weeks after this launch of the QQQ, it was 54 weeks later the QQQ went from like $48 to $120.

Now look at this, if you go to Bitcoin on the daily time frame and you connect these highs here [$99,600, $104,100 and $108,200] and you just extend that out what’s fascinating is if you grab the sort of a price label and you go over to January 20th and go up to this trend line it would put you at $120,000 which is exactly what the QQQ did – it went from $48 to $120, 54 weeks later.”

Cowen says that if Bitcoin’s price action closely follows that of the QQQ ETF in the first 13 months of its existence, a 48% drop is a possibility.

“Obviously this is very dubious and obviously, we know that QQQ got a large drop after that…

…what I would be interested in is if Bitcoin finds itself at $120,000 at some point in a few weeks, what is the reaction there? And one potential outcome… basically what happened with the QQQ is after it hit $120, it had a large drop down to $63, which is a pretty big drop.”

Bitcoin is trading at $101,484 at time of writing.

?

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

Trader Issues Urgent XRP Alert, Says the Top-Five Altcoin at Risk of Sharp Correction – Here’s His Target

This coin could see a $10b market cap and double-digit price before SHIB gains its 2021 mojo

Can a Meme Coin Fund the Future of Scientific Research?

Analyst Confirms XRP Price Is Still On Path To $130

Proof-of-Work Crypto Mining Doesn’t Trigger Securities Laws, SEC Says

Crypto campaign donations are democracy at work — former Kraken exec

1 Million Bitcoin In New Whale Hands—A Mega BTC Rally On The Horizon?

Argentina’s Senate Hosts First-Ever Conference On Bitcoin Regulation

Justin Sun Stakes $100,000,000 Worth of Ethereum Amid Calls for ‘Tron Meme Season’

Cardano wallet Lace adds Bitcoin support

Donald Trump Vows to Make America the ‘Undisputed Bitcoin Superpower’

Will Trump Announce Zero Tax Gains in Today’s Crypto Summit Talk?

Avalanche (AVAX) Drops 4.5%, Leading Index Lower

Tether’s US treasury holdings surpass Canada, Taiwan, ranks 7th globally

Here’s Where Support & Resistance Lies For Solana, Based On On-Chain Data

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Crypto’s Big Trump Gamble Is Risky

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

Trump’s Coin Is About As Revolutionary As OneCoin

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Is $200,000 a Realistic Bitcoin Price Target for This Cycle?

Trending

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin2 months ago

Bitcoin2 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News2 months ago

24/7 Cryptocurrency News2 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Altcoins2 months ago

Altcoins2 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin4 months ago

Bitcoin4 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Price analysis5 months ago

Price analysis5 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x